McCormick Confirms Premier Foods Approach

March 23 2016 - 11:50AM

Dow Jones News

LONDON—U. S. based spice maker McCormick & Co. Wednesday

confirmed it had made a takeover approach of roughly $670 million

for British food manufacture Premier Foods PLC, which was

subsequently rejected.

The confirmation came after Premier broke the news earlier in

the day, saying it had received a total of two approaches from

McCormick. The first offer, Premier said, came on Feb. 12 and was

pitched at 52 pence a share in cash, valuing Premier at 462 million

pounds ($653 million). The second offer arrived on March 14 and

represented an increase of 15%, valuing Premier at 60 pence a

share.

Premier said both offers undervalued its growth prospects.

However McCormick said in its response that the second offer

represented a 90% premium on Premier's closing share price of 31.5

pence on Tuesday, and believes that, even though the bid has been

rejected at board level, it should be well-received by Premier's

shareholders.

McCormick, which already sells spices and flavorings in the U.K.

under the Schwartz brand, said the acquisition of Premier is

consistent with its long-term strategy and, if completed, will

increase its presence in the U.K. grocery market.

The Maryland-based company also said the sweetened offer

provides Premier shareholders with an attractive premium, combined

with the certainty of a cash value. But this was refuted by

Premier, which said the increased offer represented an insufficient

premium on its total value, which includes allowances for debt and

pension obligations.

"McCormick's proposal represents an attempt to capture the

upside value embedded in Premier's business that rightfully belongs

to Premier's shareholders," Premier Chairman David Beever said.

"The proposal fails to recognize the value of Premier's

performance to date and prospects for the future, including the

strategic plans we have to accelerate growth," Mr. Beever

added.

McCormick didn't reveal its next move, and cautioned that no

firm offer is certain. Under U.K. takeover rules, McCormick is

required to make a firm bid for Premier by April 20 or withdraw its

offer.

The U.S. firm is being advised by Goldman Sachs and Rothschild,

while Premier is being advised by HSBC, Jefferies, Credit Suisse

and Ondra Partners.

Premier shares soared on the takeover approach and are currently

trading around 52 pence each, up 65.9%.

In an effort to protect its independence, Premier also said

Wednesday it is making new investments to accelerate growth and has

signed a cooperation agreement with Japanese noodle maker Nissin

Foods Holdings Co. Ltd. (2897.TO).

Premier, based in the county of Hertfordshire in southern

England, said it is investing to introduce new twin packs of cake

slices, and expand its cake brands in the U.S. and other parts of

the world.

The company, best known for its Mr. Kipling cup cakes and Loyd

Grossman sauces, said it plans to extend its brands into

premium-food categories.

The company's tie-up with Nissin is conditional upon no takeover

bid for the company succeeding. Under the deal, Premier would be

able to distribute Nissin's products in the U.K., while making its

own products available in overseas markets.

Write to Tapan Panchal at Tapan.Panchal@wsj.com

(END) Dow Jones Newswires

March 23, 2016 11:35 ET (15:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

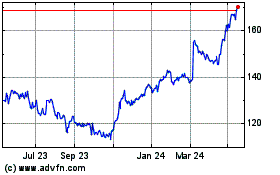

Premier Foods (LSE:PFD)

Historical Stock Chart

From Jul 2024 to Aug 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Aug 2023 to Aug 2024