TIDMPFD TIDMMKC TIDMIRSH TIDMTTM

RNS Number : 9965S

Premier Foods plc

23 March 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART), IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

THAT JURISDICTION. THIS ANNOUNCEMENT DOES NOT CONSTITUTE A TAKEOVER

OFFER OR AN OFFER OF SECURITIES.

23 March 2016

For immediate release

Premier Foods plc

Premier Foods plc rejects approach from McCormick & Company,

Inc. and announces Cooperation Agreement with Nissin Foods Holdings

Co., Ltd.

-- McCormick approach significantly undervalues Premier's growth

prospects and represents an insufficient premium to Premier's

enterprise value

-- Investment-led strategy starting to deliver results

-- New strategic initiatives expected to accelerate growth trajectory

-- Cooperation Agreement with Nissin to create long-term value

through strategic partnership of brands, markets and technology

-- Update on Hovis Holdings Ltd and Knighton Foods Ltd joint ventures

-- Board's expectations of Trading Profit for full year remain unchanged

The Board of Premier Foods plc ("Premier" or the "Company")

confirms that it received an unsolicited, non-binding and highly

conditional approach from McCormick & Company, Inc.

("McCormick") on 12 February 2016 regarding a possible offer for

the entire issued, and to be issued, ordinary share capital of the

Company at an indicative price of 52 pence in cash per Premier

share. This approach was rejected on the basis that it

significantly undervalued the Company and its prospects. The Board

received a subsequent approach on 14 March 2016 with a revised

possible offer for the entire issued, and to be issued, ordinary

share capital of the Company at an indicative price of 60 pence in

cash (the "Indicative Price") per Premier share (the "Proposal").

This approach has also been rejected on the basis that it

significantly undervalues the Company and its prospects, and

therefore the Board does not consider that the Proposal would be in

the best interests of Premier and its shareholders.

Commenting on the approach David Beever, Chairman of Premier,

said:

"McCormick's Proposal represents an attempt to capture the

upside value embedded in Premier's business that rightfully belongs

to Premier's shareholders. The Proposal fails to recognise the

value of Premier's performance to date and prospects for the

future, including the strategic plans we have to accelerate

growth.

McCormick's Proposal significantly undervalues the business and

the Board has unanimously decided to reject it."

McCormick's Proposal represents an insufficient premium to

Premier's enterprise value

Whilst the price per share indicated in McCormick's Proposal is

significantly above the current share price, due to Premier's

specific capital structure, the Board considers that shareholders

should evaluate the premium implicit in McCormick's Proposal with

reference to Premier's enterprise value (which includes allowances

for financial debt and ongoing pension obligations). On this basis,

the offer represents an insufficient premium which, in the Board's

view, does not fairly reflect the benefit to McCormick of gaining

control of Premier.

Furthermore, the Board does not believe that the multiple of

enterprise value to EBITDA implied in McCormick's Proposal fairly

reflects the Company's growth prospects. The Board considers that

the Net Present Value of the future cash flows expected to arise

from the Company's growth plans outlined below would imply a price

per share significantly above the Indicative Price.

In accordance with Rule 2.6(a) of Takeover Code (the "Code"),

McCormick is required, by not later than 5.00 p.m. on 20 April

2016, either to announce a firm intention to make an offer for the

Company in accordance with Rule 2.7 of the Code or announce that it

does not intend to make an offer, in which case the announcement

will be treated as a statement to which Rule 2.8 of the Code

applies. This deadline can be extended with the consent of the

Takeover Panel in accordance with Rule 2.6(c) of the Code.

There can be no certainty that any offer will be made nor the

terms on which any such offer might be made. Premier shareholders

are strongly advised to take no action in respect of the

Proposal.

This announcement is being made by Premier without the prior

agreement or approval of McCormick.

Investment-led strategy starting to deliver results

The Board sees a strong future for an independent Premier and

believes that the foundations have been laid for significant growth

and shareholder value creation.

Premier has a strong and valuable portfolio of market leading

brands, extensive distribution across key retail channels, a

well-invested manufacturing base and strong operational cash

flows.

Under the strong leadership of CEO, Gavin Darby, Premier has

assembled a highly experienced management team that has

successfully restructured the business and put in place an

investment-led growth strategy that is already starting to deliver

results.

-- Since 2014, the Company has more than doubled its rate of new

product innovation, launching a wide range of new products,

packaging formats and line extensions to meet changing consumer

trends.

-- Premier expects to increase significantly its investment in

consumer marketing from approximately GBP25 million in the 2013/14

financial year to approximately GBP36 million in the 2015/16

financial year.

-- The investments behind some of the biggest brands including

Mr. Kipling, Cadbury cakes, Oxo and Bisto, delivered gains in

volume, value, market share and household penetration in 2015(1)

.

-- The Company is driving growth in channels beyond the

supermarkets, including discounters, online and international.

The Board believes that, by extending this strategy to its other

brands, the Company will deliver further growth in the future. The

Board further considers that the step-up over the last two years of

the Company's investment in brand marketing and product innovation,

against the background of a challenging UK food retail environment,

means that the Company is at an inflection point in terms of its

longer-term growth prospects.

New strategic initiatives to accelerate growth

The Company has additionally identified a number of new

strategic initiatives to help accelerate growth across its three

Business Units of Grocery, Sweet Treats and International. Whilst

these initiatives are expected to incur initial upfront investment

of GBP2-4 million in the full year 2016/17, the Company is now

raising its sales growth guidance for the medium term from 1-2% to

2-4%.

The new initiatives will leverage the Company's existing

platforms, infrastructure and brand presence to expand further into

new formats, channels and markets:

-- In Sweet Treats, we plan to build on the successful trial of

our Cake-To-Go range of Mr. Kipling twin pack slices and Cadbury

mini roll twin pack by accelerating growth of our brands in broader

convenience channels; to do so, we will capitalise on our

manufacturing investments, innovation expertise and dedicated new

team.

-- In Grocery, we intend to extend our strong brands into

premium areas within the chilled grocery sector in the sweet and

savoury segments, including product ranges to meet consumers'

growing health-consciousness.

-- In International, we plan to leverage the investment we have

already made in hiring an experienced team to step-change the size

of our international business. Our focus will be on accelerating

the expansion of our cake brands in the US and other geographies

using our differentiated offering, unique formats and packaging.

Initial store trials have demonstrated the potential for future

growth in these markets.

Cooperation agreement with Nissin Foods Holdings Co., Ltd.

("Nissin")

Over recent years, Premier has discussed a number of potential

strategic opportunities with Nissin. The Board has now agreed to

enter into a cooperation agreement with Nissin (the "Cooperation

Agreement"), conditional upon: (i) Premier no longer being subject

to an offer period under the Code; and (ii) no third party having,

by the date on which such offer period expires, announced that any

offer for Premier has become or been declared unconditional as to

acceptances or that a scheme of arrangement has become

effective.

With annual revenues of around USD3.8 billion and operating

profit of around USD216 million, Nissin, which invented the world's

first instant noodles in 1958, operates in 19 different countries,

spanning Asia Pacific, the Americas, Europe, Middle East and

Africa. It is a global leader in instant noodles holding the number

one or two positions in key markets, including Japan, the United

States and Brazil and has a growing presence in chilled and frozen

foods, cereal-based confectionery and yoghurt beverages in Japan.

Nissin's presence in Europe includes Hungary, Germany and Spain,

with brands such as Cup Noodles, Soba and Top Ramen. It also

benefits from a state-of-the-art global research and innovation

centre in Japan that develops more than a thousand new products

that are distributed around the globe every year and has

significant expertise in starch technologies, sodium reduction and

production techniques.

The new strategic partnership has the potential for significant

long-term value creation for both organisations through strategic

cooperation in areas which may include:

-- Providing Premier with access to Nissin's innovative products

and formats to distribute in the UK market under either Nissin's or

Premier's brands, such as Batchelors.

-- Enabling Premier to benefit from Nissin's international scale

to accelerate the distribution of Premier's products in key

overseas markets.

-- Sharing of Nissin's significant intellectual property,

innovation and technical know-how to develop new products.

March 23, 2016 04:00 ET (08:00 GMT)

Ondra Partners, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting as financial adviser exclusively for Premier and for no-one

else in connection to the matters in this announcement and will not

be responsible to anyone other than Premier for providing the

protections afforded to its clients nor for providing advice in

connection with the Offer or any matter referred to herein.

Jefferies International Limited ("Jefferies"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting exclusively for Premier as financial

adviser and corporate broker and no-one else in connection with the

Proposal and Jefferies will not regard any other person as its

client(s) of Jefferies in connection to the matters in this

announcement and will not be responsible to anyone other than

Premier Foods for providing the protections afforded to its clients

or for providing advice in connection to the matters in this

announcement, the contents of this announcement or any transaction,

arrangement or other matter referred to in this announcement.

Credit Suisse International (Credit Suisse), which is authorised

by the Prudential Regulation Authority and regulated in the United

Kingdom by the Financial Conduct Authority and the Prudential

Regulation Authority, is acting exclusively for Premier Foods and

no one else in connection with the matters in this announcement and

will not be responsible to anyone other than Premier Foods for

providing the protections afforded to clients of Credit Suisse nor

for providing advice in relation to the Offer , the content of this

announcement or any other matter referred to herein. Neither Credit

Suisse nor any of its subsidiaries, branches or affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Credit Suisse in

connection with this announcement, any statement contained herein

or otherwise.

Rule 2.10 of the Code

In accordance with Rule 2.10 of the Code, Premier confirms that,

as at close of business on 22 March 2016, it had in issue

826,567,063 ordinary shares of 10 pence each. Premier does not hold

any shares in treasury. The International Securities Identification

Number for Premier ordinary shares is GB00B7N0K053.

Publication on websites

A copy of this announcement will be made available, subject to

certain restrictions relating to persons resided in restricted

jurisdictions on Premier's website at www.premierfoods.co.uk by no

later than 12 noon (GMT) on 23 March 2016.

The content of the website referred to in this announcement is

not incorporated into and does not form part of this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRLIFEDVLIVFIR

(END) Dow Jones Newswires

March 23, 2016 04:00 ET (08:00 GMT)

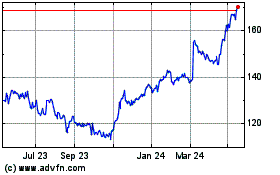

Premier Foods (LSE:PFD)

Historical Stock Chart

From Jul 2024 to Aug 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Aug 2023 to Aug 2024