TIDMPEG

RNS Number : 6747V

Petards Group PLC

10 April 2019

10 April 2019

Petards Group plc

("Petards", "the Group" or "the Company")

Final results for the year ended 31 December 2018

Petards Group plc (AIM: PEG), the AIM quoted developer of

advanced security and surveillance systems, is pleased to report

its final results for the year ended 31 December 2018.

Key Highlights:

-- Operational

o Order book at 31 December 2018 over GBP19 million (31 Dec

2017: over GBP18 million)

o Order coverage for 2019 in excess of GBP13 million

o Acquired RTS Solutions software business focused on UK rail

infrastructure

o Significant orders of over GBP6.5 million for eyeTrain

received in H2 2018

o QRO generated over GBP1 million of revenues from two new UK

police framework agreements of 3 and 4 years respectively, with 3

year extension options

o Significant investment in our eyeTrain automated software

applications has created new orders and opened up new business

opportunities

-- Financial

o Total revenues increased to GBP20.0 million (2017: GBP15.6

million)

o Gross margins 34.5% (2017: 38.6%)

o Adjusted EBITDA* GBP2,057,000 (2017: GBP1,619,000)

o Operating profit GBP1,156,000 (2017: GBP1,245,000 including

GBP362,000 exceptional income)

o Pre-tax profit GBP1,126,000 (2017: GBP1,205,000 including

GBP491,000 net exceptional income)

o Net funds (cash less debt) GBP969,000 (31 Dec 2017:

GBP1,286,000)

o Basic EPS 2.01p (2017: 3.31p)

o Diluted EPS 1.95p (2017: 2.32p)

*Adjusted EBITDA comprises operating profit adjusted to remove

the impact of depreciation, amortisation, exceptional items,

acquisition costs and share based payments. A reconciliation of

Adjusted EBITDA to operating profit is included on the face of the

consolidated income statement.

Commenting on the current outlook, Raschid Abdullah, Chairman,

said:

"The Group continues to enjoy a strong order book that provides

the Board with good visibility to plan for the future. The order

book at 31 December 2018 was over GBP19 million, of which over

GBP13 million is scheduled for revenue during 2019. Due to customer

delivery schedules these are weighted towards the second half of

the year. The Group has a strong pipeline of new contracts under

negotiation which it is anticipated will add to the orders for

delivery in the second half of 2019 and for 2020. These together

with the Group's strong market position provides the board with

confidence in its prospects for the year ahead.

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

Contacts:

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

WH Ireland Limited, Nomad and www.whirelandcb.com

Joint Broker

Mike Coe, Chris Savidge Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3764 2341

claire.noyce@hybridan.com

Square 1 Consulting, Financial

PR

David Bick Mb: 07831 381 201

Tel: 020 7929 5599

david.bick@square1consulting.co.uk

Chairman's statement

I am pleased to report on the Group's annual results for 2018

together with the progress made in meeting our strategic growth

objectives. While the development of our new eyeTrain software

solutions presented some technical challenges, it is gratifying

that Petards' market position has been strengthened and that the

Group is well positioned to continue to win significant new

projects.

Group revenues increased to GBP20.0 million (2017: GBP15.6

million) with Adjusted EBITDA* of GBP2,057,000 (2017: GBP1,619,000)

and profits before tax of GBP1,126,000 (2017: GBP1,205,000 that

included GBP491,000 of net exceptional profit). The Group closed

2018 with net funds of GBP969,000 (2017: GBP1,286,000). As I

reported at the half year stage, the 2018 results reflect the

adoption of IFRS 15, the new revenue recognition standard, details

of which are set out in note 3 to the financial statements.

Rail products continued to provide the majority of the Group's

revenues with around 60% relating to eyeTrain in 2018. The majority

of the Group's overseas sales also derive from the rail sector with

overall Group exports accounting for 23% of revenues. Over the past

few years the Group has placed considerable emphasis on

establishing a strong position in its home rail market, which is

expected to provide good growth prospects over the coming years for

train new build and retrofit applications as the train operators

continue to increase network capacity. Significant investment was

made in 2018 in developing Driver Controlled Operation ("DCO") and

Automatic Selective Door Opening ("ASDO") safety critical software

systems. ASDO forms a key part of the overall solution to help

train operators increase passenger carrying capacity particularly

on rail lines with shorter platforms.

QRO's traffic products had an excellent 2018 in its second full

year as part of the Group. Following its success in winning two

long-term framework agreements with UK police forces, QRO is well

positioned to achieve continued growth for its ANPR products and

new service agreements. In April 2019 it is moving to larger nearby

facilities in Northamptonshire to manage this new business, with

plans to expand the product range.

Defence products had a mixed year. Following a strong first half

year with a number of good contract wins and related revenues, the

second half year proved to be more difficult. The MOD has not

presently sought to re-tender the radio catalogue framework

agreement previously held by the Group for the past 5 years, which

expired in September 2018. While we understand that the MOD will

re-tender in due course, this delay means that the large orders

received in 2018 are not expected to be repeated in 2019.

RTS Solutions made a maiden contribution to Petards' results

following its acquisition in May 2018. I would like to welcome the

team at RTS to the Group and look forward to supporting them in the

future development of the business. The acquisition affirmed the

Board's strategy to pursue ownership of a broader portfolio of

products and RTS provides the Group with its first exposure to rail

infrastructure. Leeds based RTS supplies real-time software

solutions and services that support the operational, maintenance

and safety functions of the UK's rail infrastructure. Since its

acquisition we have created a business development function to

market the software products on a wider basis while at the same

time pursuing business with existing customers where we believe

there is potential for the provision of additional services.

The importance and contribution that the staff within the Group

make cannot be underestimated and 2018 was certainly a challenging

year. On behalf of the Board and shareholders I would like to

express thanks to all of our management and staff at all levels for

their hard work and professionalism and their contribution to the

success of the Group. We look forward to their continued support in

2019.

In line with its strategy the Board is reviewing opportunities

to increase the Group's market presence which will either be in the

form of strategic alliances or the acquisition of complementary

organisations, which is its preferred route.

The Group continues to enjoy a strong order book that provides

the Board with good visibility to plan for the future. The order

book at 31 December 2018 was over GBP19 million, of which over

GBP13 million is scheduled for revenue during 2019, with customer

delivery schedules weighted towards the second half of the year.

The Group has a strong pipeline of new contracts under negotiation

which it is anticipated will add to the orders for delivery in the

second half of 2019 and for 2020. These together with the Group's

strong market position provides the Board with confidence in its

prospects for the year ahead.

Raschid Abdullah

Chairman

*See Alternative Performance Measures Glossary at the end of

this document.

Strategic Report

Business review

Petards' operations continue to be focused upon the development,

supply and maintenance of technologies used in advanced

security, surveillance and ruggedized electronic applications,

the main markets for which are:

-- Rail -software driven video and other sensing systems for

on-train applications sold under the eyeTrain brand to global train

builders, integrators and rail operators, and web-based real-time

safety critical integrated software applications supporting the UK

rail network infrastructure sold under the RTS brand;

-- Traffic -Automatic Number Plate Recognition ("ANPR") systems

for lane and speed enforcement and commercial applications, and UK

Home Office approved mobile speed enforcement systems, sold under

the QRO and ProVida brands to UK and overseas law enforcement

agencies and commercial customers; and

-- Defence - electronic countermeasure protection systems,

mobile radio systems and related engineering services sold

predominantly to the UK Ministry of Defence ("MOD").

Operating review

2018 saw the Group continue to secure the majority of orders

available for its products placed by new train builders for the UK

market. Order intake for eyeTrain products was similar to the prior

year with recurring revenues for spares and repairs continuing to

grow. The acquisition of RTS during the year added to the Group's

rail-related software solutions. The Group also secured

year-on-year increases in both order intake and revenues for its

Traffic and Defence products.

At an operational level the year presented a number of

challenges, particularly in respect of the delivery of some complex

eyeTrain projects. The Group addressed these head-on and it is

pleasing that these have been overcome to the satisfaction of our

customers, albeit at some higher than anticipated cost.

Order intake for eyeTrain products was weighted towards the

second half of the year with significant orders being received for

delivery in 2019 and 2020 from Bombardier Transportation and

Siemens Mobility worth in the region of GBP6.5 million. The Group's

industry experience, the growing number of train types on which

eyeTrain is installed, our willingness to innovate, and the strong

customer relationships built over time, all play a significant role

in continuing to secure such projects.

The Group has invested heavily in developing software that

provides Automatic Selective Door Operation (ASDO), Driver

Controlled Operation (DCO) and Automatic Passenger Counting (APC)

systems that integrate with its other eyeTrain video systems. The

programme required a significant scaling up of our software team

with both permanent and contract staff. It has taken longer than

originally envisaged, however, the core system is now operational

and provides a further differentiator for Petards. It is well

suited to retrofit applications and we have been presented with new

sales opportunities, some of which we expect to be converted in the

coming 12 months.

As more eyeTrain projects go into service, revenues from spares

and service support are expected to continue to grow. This is a key

long-term objective to enhance our customer and product support and

we are seeking to reach agreement on service contracts as warranty

periods expire.

The UK's demand for new and upgraded rolling stock remains

strong and there are a number of major projects for which orders

are scheduled to be placed by customers over the course of the next

year. If Petards is selected then the majority of these are

expected to utilise our existing proven eyeTrain software systems

developed over the past two years. While the development of new

on-board product applications for eyeTrain remains core to the

Group's strategy, the quantum of spend is presently expected to be

much lower in 2019.

Defence products had a strong first half year with the receipt

and delivery of GBP1.5 million in radio equipment orders and the

delivery of the GBP1 million emulator tool for the MOD's transport

aircraft. The MOD also extended Petards post design services

contract for another two years to the end of 2021, worth an

additional GBP1.1 million. However, regretfully that level of

performance was not carried through to the second half of the year.

While Petards continues to win some radio business, at the present

time the MOD has not as yet re-tendered its radio catalogue

framework agreement, previously held by the Group, which expired in

September 2018. While we understand that the MOD will re-tender in

due course, this delay means that the large orders received in 2018

are not expected to be repeated in 2019. Other than the provision

of specialist engineering services, the Group's current defence

activities are mainly as a value-added re-seller of radio

communications and electronic countermeasures equipment.

Strategic report (continued)

Operating review (continued)

The strong order and revenue performance of Traffic products

continued into the second half buoyed by QRO's success in securing

two framework agreements with UK police forces; one with the

Cheshire force and a joint one with Thames Valley and Hampshire.

While Cheshire has been a longstanding customer, the growth in

revenues over the prior year can be attributed to the second

agreement. This has been utilised by other forces in England with

deliveries worth over GBP1 million being made during 2018.

Commercial sales also increased and customer service support

contracts continued to be an important aspect of the business. In

April 2019 QRO will be relocating to new premises in

Northamptonshire to support its anticipated future growth. The

Board is very satisfied with the return on its investment in QRO

over the past two years and looks forward to further growth.

The RTS acquisition in May 2018 was the first since QRO joined

the Group back in April 2016. The initial and contingent

consideration of GBP1.85 million was paid during the year,

including GBP0.6 million paid on a pound for pound basis for

surplus cash in RTS's acquired balance sheet. The consideration was

satisfied in cash from the Group's existing cash reserves and a new

GBP1.25 million five year bank term loan. No further consideration

is expected to be payable.

RTS adds to Petards' existing capabilities in the rail sector

providing the Group with an entry into the UK rail infrastructure

market. It brings with it a portfolio of software solutions and

recurring revenues. In June 2018 it added significantly to its

recurring revenues order book with the renewal of a contract that

related to software licences, maintenance and third line support in

respect of Network Rail's real time failure and incident management

system. The contract will generate annual revenues in excess of

GBP250,000 and runs until June 2023. The final two years are at

Network Rail's option which would add to the order book when

exercised.

Since its acquisition RTS has made steady progress and

contributed GBP0.2 million to Group profits in the period to 31

December 2018 on revenues of GBP0.5 million. Investment of GBP0.1

million was also made in developing a new core module for its

software portfolio, the first revenues on which were realised in

the period. While customer related project delays had an impact on

its financial performance in 2018, those projects remain live and

the revenues are expected to be realised during the course of 2019.

The Board remains confident that RTS will prove to be a good

contributor to Group profits going forward.

Following 2018's positive order intake performance, the Group

closed the year with an order book of over GBP19 million (2017:

over GBP18 million). This provides good coverage of the Group's

forward revenues with over GBP13 million scheduled for recognition

during 2019 and a further GBP5 million for 2020.

Financial review

Operating performance

The year ended 31 December 2018 is the first year that the Group

has reported under IFRS 15 "Revenue from contracts with customers"

and its implementation has not altered the revenue recognition

policy for the majority of the Group's revenue streams. The one

area of the Group's business in which the adoption of IFRS 15 has

resulted in a change, is that of the work performed relating to the

delivery of customer specific development projects.

Prior to the adoption of IFRS 15, the Group recognised such

revenue upon achievement of specific pre-agreed, customer-set

milestones (other than advance payments) and for which the Group

could invoice the customer for payment. Under IFRS 15, work of this

nature results in later recognition of the related revenue and

predominantly affects eyeTrain revenues. The Group has adopted IFRS

15 using the "cumulative effect" method under which comparative

information is not restated. The cumulative effect of revising the

revenue and profit previously recognised up to 31 December 2017 is

shown as an adjustment to brought forward retained earnings,

details of which are set out in note 3 to the financial statements,

as is the effect of the deferral of revenues that would have been

recognised in 2018 had IFRS 15 not been adopted.

Revenues for the year were GBP20.0 million (2017: GBP15.6

million) including exports of GBP4.7 million (2017: GBP5.3

million). The majority of exports related to shipments of eyeTrain

system to customers in Germany, Switzerland and Poland, most of

which are destined for rail vehicles that will be operated in the

UK.

Strategic report (continued)

Financial review (continued)

Operating performance (continued)

Gross margins for the year remained in line with those reported

in the first half year at 34.5%, with the reduction over those

achieved in 2017 (38.6%) reflecting both product mix and higher

than anticipated project costs. With regards to mix, Defence

products comprised almost a third of 2018 total revenues. The

increase over the prior year related to additional bought-in lower

margin product and this had a dilutive effect on the overall

margin. In addition, higher non-recurring project costs were

incurred in the implementation of eyeTrain projects on two new

train platforms, and this work has been completed in the first

quarter of 2019. While the benefits will be seen on future new

orders, these costs had an effect on the gross margin in 2018.

While those higher specific project costs are one-off in nature,

the Group has embarked on a programme of margin improvement across

its supply chain, which it is expected will drive better

returns.

Overall administrative expenses were up to GBP5,728,000 (2017:

GBP4,770,000). The main increases related to higher amortisation

and depreciation charges, the effect of the RTS acquisition and

exceptional income of GBP362,000 netted off against 2017

administrative expenses. Other administrative expenses increased by

4% over the prior year primarily due to higher indirect staff costs

and one-off Defence product tendering costs.

Earnings before interest, tax, depreciation, amortisation,

exceptional items, acquisition costs and share based payment

charges ("Adjusted EBITDA") totalled GBP2,057,000 up from

GBP1,619,000 in 2017. Operating profits were GBP1,156,000 against

GBP1,245,000 in 2017 (2017 included GBP362,000 exceptional

income).

Net financial expenses totalled GBP30,000 (2017: GBP40,000)

albeit that its composition was very different than the prior year

which included interest relating to loan notes converted in 2017 of

GBP131,000, and net exceptional financial income of GBP129,000.

A tax credit of GBP17,000 for the year (2017: GBP32,000 credit)

included the benefit of research and development tax credits

relating to prior years.

Profit after tax was GBP1,143,000 (2017: GBP1,237,000) and basic

earnings per share 2.01p (2017: 3.31p). The equity issued as a

result of the conversion of loan notes in December 2017 had little

effect on 2017's basic earnings per share as they were only in

issue for two weeks but impacted that of 2018 as they were in issue

for the whole year. Fully diluted earnings per share were not

affected to the same extent and were 1.95p (2017: 2.32p).

Research and development

The Group continues to invest in its product offering and during

2018 made a significant investment in its rail products. This

investment totalled GBP1,608,000 (2017: GBP1,290,000) of which

GBP1,444,000 was capitalised (2017: GBP1,043,000). The capitalised

costs relate predominantly to the Group's next generation of

eyeTrain software products which will sit alongside its existing

software portfolio. These new products will support future sales to

the Group's most recent new customers as well as those for all ASDO

systems, retrofitted DCO systems and integrated APC systems. In

addition to eyeTrain, the Group invested to support RTS's software

development roadmap.

Cash and cash flow

Net cash inflows from operating activities for the year were

GBP2,515,000 (2017: GBP539,000).

Net cash outflows from investing activities were GBP3 million

comprising the acquisition of RTS, investment in new product

development and equipment. Net financing inflows were GBP1.3

million of which a net GBP1.1 million concerned the term loan

financing of the RTS acquisition.

At 31 December 2018 the Group's net cash and cash equivalents

were GBP2,117,000 up by GBP793,000 over the year (2017:

GBP1,324,000). The Group also has available to it a GBP0.75 million

2-year revolving credit facility secured in June 2018.

Strategic report (continued)

Brexit

In common with most UK companies, Petards would not be immune to

any potential adverse impact that a disorderly Brexit might have on

the wider economy. However, the Board's current assessment is that

the specific sectors in which the Group operates are not

significantly exposed to particular Brexit risk, although some

impact may be felt in the days immediately following any disorderly

Brexit.

Rail products are the main contributor to Group revenues and

while almost a quarter of the Group's revenues for 2018 were

exported to the EU, the majority related to UK rail projects. The

market sectors to which Petards supplies tend to be highly

regulated and the Group does not anticipate Brexit will change

existing regulations significantly. Like most businesses it can be

affected by any inflationary pressures in the supply chain but

again these are not considered to be specific to the sectors in

which the Group operates. Neither the Group's current order book

nor the orders it expects to receive during 2019 contain

significant foreign currency exposures. The Group has also been

monitoring its major suppliers within its supply chain and they

have indicated that they have taken additional measures, such as

stocking, to ensure continuity of supply.

The UK Long Term Passenger Rolling Stock Strategy for the Rail

Industry published in 2018 continued to express the view that while

Brexit impacts remain unknown, the scenarios covered by the "worst

case" industry modelling already cater for impacts much worse than

the Office of Budgetary Responsibility predictions for Brexit. The

overall long term rolling stock outlook remained unchanged from the

prior year's report and forecasts a national rail fleet increase of

between 40% (5,500 vehicles) and 85% (12,000 vehicles) over the

next 30 years. The investment decisions for new rolling stock

require long term planning and those relating to orders which

Petards expects to receive in the coming year were completed some

time ago.

The Group's other sector exposure, defence and traffic, is also

largely dependent upon UK government expenditure but those for

Petards' products and services are generally subject to shorter

planning cycles. The current indications are that the Group's

forecast revenues take into account any likely adverse impact that

Brexit might have, although Petards may possibly be a beneficiary

of any boost in government spending that may follow Brexit.

Osman Abdullah

Group Chief Executive

Consolidated income statement

for year ended 31 December 2018

Note 2018 2017

GBP000 GBP000

Revenue 4 19,973 15,581

Cost of sales (13,089) (9,566)

Gross profit 6,884 6,015

Administrative expenses (5,728) (4,770)

Adjusted EBITDA* 2,057 1,619

Amortisation of intangibles (590) (547)

Depreciation (209) (162)

Exceptional income 5 - 362

Acquisition costs (77) -

Share based payment charges (25) (27)

----------------------------------------------- ---- -------- -------

Operating profit 1,156 1,245

Financial income (2017 included GBP340,000

exceptional income) 6 3 340

Financial expenses (2017 included GBP211,000

exceptional expense) 6 (33) (380)

Profit before tax 1,126 1,205

Income tax 7 17 32

Profit for the year attributable to

equity shareholders of the parent 1,143 1,237

Earnings per ordinary share (pence)

Basic 11 2.01 3.31

Diluted 11 1.95 2.32

* Earnings before financial income and expenses, tax,

depreciation, amortisation, exceptional items, acquisition costs

and share based payment charges. See Alternative Performance

Measures Glossary at the end of this document.

Consolidated statement of comprehensive income

for year ended 31 December 2018

Note 2018 2017

GBP000 GBP000

Profit for the year 1,143 1,237

Other comprehensive income

Items that may be reclassified to

profit:

Release of foreign currency reserve

on abandonment of US subsidiary 5,

(included in financial expenses) 6 - 211

Total comprehensive income

for the year 1,143 1,448

Statements of changes in equity

for year ended 31 December 2018

Share Share Retained Currency Total

capital premium Equity earnings translation equity

reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2017 357 68 200 3,768 (211) 4,182

Profit for the year - - - 1,237 - 1,237

Other comprehensive

income - - - - 211 211

Total comprehensive

income for the year - - - 1,237 211 1,448

Equity-settled share

based payments - - - 27 - 27

Conversion of

convertible loan

notes 198 1,383 (169) 142 - 1,554

Exercise of share

options 3 22 (6) - - 19

At 31 December 2017 558 1,473 25 5,174 - 7,230

At 1 January 2018 558 1,473 25 5,174 - 7,230

Adjustment on initial

application of IFRS

15 (net of tax)

* - - - (468) - (468)

Adjusted balance

at

1 January 2018 558 1,473 25 4,706 - 6,762

Profit for the year - - - 1,143 - 1,143

Total comprehensive

income for the year - - - 1,143 - 1,143

Equity-settled share

based payments - - - 25 - 25

Exercise of share

options 17 144 (11) 11 - 161

At 31 December 2018 575 1,617 14 5,885 - 8,091

* The Group has adopted IFRS 15 using the cumulative effect

method, under which the comparative information is not restated

(note 3). The cumulative effect of adopting IFRS 15 is recognised

in equity at the date of first adoption on 1 January 2018.

Consolidated balance sheet

at 31 December 2018

Note

2018 2017

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 943 825

Intangible assets 4,676 2,488

Investments in subsidiary - -

undertakings

Deferred tax assets 284 344

5,903 3,657

Current assets

Inventories 4,104 3,403

Trade and other receivables 2,553 3,743

Cash and cash equivalents 2,117 1,324

8,774 8,470

Total assets 14,677 12,127

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Share capital 10 575 558

Share premium 1,617 1,473

Equity reserve 14 25

Currency translation reserve - -

Retained earnings 5,885 5,174

Total equity 8,091 7,230

Non-current liabilities

Interest-bearing loans

and borrowings 9 883 23

Trade and other payables - -

883 23

Current liabilities

Interest-bearing loans

and borrowings 9 265 15

Trade and other payables 5,438 4,859

5,703 4,874

Total liabilities 6,586 4,897

Total equity and liabilities 14,677 12,127

Consolidated statement of cash flows

for year ended 31 December 2018

Note

2018 2017

GBP000 GBP000

Cash flows from operating activities

Profit for the year 1,143 1,237

Adjustments for:

Depreciation 209 162

Amortisation of intangible assets 590 547

Financial income 6 (3) (340)

Financial expenses 6 33 380

Equity settled share-based payment

expenses 25 27

Income tax (credit)/charge 7 (17) (32)

Operating cash flows before

movement in

working capital 1,980 1,981

Change in inventories 1,024 (1,450)

Change in trade and other receivables 1,344 (1,003)

Change in trade and other payables (1,834) 1,057

Cash generated from operations 2,514 585

Interest received 3 -

Interest paid (58) (107)

Tax received 56 61

Net cash from operating activities 2,515 539

Cash flows from investing activities

Acquisition of property, plant

and equipment (325) (509)

Capitalised development expenditure (1,444) (1,043)

Acquisition of subsidiary 8 (1,224) -

Net cash outflow from investing

activities (2,993) (1,552)

Cash flows from financing activities

Bank loan received 9 1,250 -

Bank loan repaid 9 (125)

Finance lease repayments (15) (10)

Proceeds from exercise of share

options 161 25

Net cash inflow from financing

activities 1,271 15

Net increase/(decrease) in cash

and cash equivalents 793 (998)

Total movement in cash and cash equivalents

in the year 793 (998)

Cash and cash equivalents at

1 January 1,324 2,322

Cash and cash equivalents at

31 December 2,117 1,324

Notes

1 Basis of preparation

The financial information set out in this statement has been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards as

adopted by the EU ("adopted IFRSs"), IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS. It

does not include all the information required for full annual

accounts.

The financial information does not constitute the Company's

statutory accounts for the years ended 31 December 2018 or 31

December 2017 but is derived from those accounts. Statutory

accounts for 2017 have been delivered to the registrar of companies

and those for 2018 will be delivered in due course. The auditor has

reported on those accounts; his reports (i) were unqualified, (ii)

did not include a reference to any matters to which the auditor

drew attention by way of emphasis without qualifying his report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

2 Changes in significant accounting policies

IFRS 9 Financial instruments (effective 1 January 2018)

IFRS 9 addresses the classification and measurement of financial

assets and liabilities and replaces IAS 39. Among other things, the

standard introduces a forward-looking credit loss impairment model

whereby entities need to consider and recognise impairment triggers

that might occur in the future (an 'expected loss' model). The

Board has considered the impact of the introduction of IFRS 9 and

determined that it does not have a significant impact on the

numbers reported or as previously reported.

IFRS 15 Revenue from contracts with customers (effective 1

January 2018)

IFRS 15 sets out a single and comprehensive framework for

revenue recognition. The guidance in IFRS 15 is considerably more

detailed than previous IFRSs for revenue recognition (IAS 11

Construction Contracts and IAS 18 Revenue and associated

interpretations).

The Group has adopted IFRS 15 retrospectively from 1 January

2018 and has chosen to apply the cumulative effect approach. As a

result, the Group has restated its opening equity position as at 1

January 2018 to reflect the impact of transitioning to IFRS 15. A

summary of the effect of the impact of the adoption of IFRS 15 is

set out at note 3 below.

In line with the requirements of the standard with regards to

the transition option adopted, the Group has not restated its

comparative information which continues to be reported under

previous revenue standards, IAS 11 and IAS 18.

3 Impact of the adoption of IFRS 15

Impact in respect of the position on adoption at 1 January

2018

As reported Reclassification Remeasurement IFRS 15

31 December as adopted

2017 1 January

2018

Balance sheet headings GBP000 GBP000 GBP000 GBP000

Work in progress

within inventories 2,211 - 1,707 3,918

Payments on account

within current trade

and other payables (382) 382 - -

Deferred revenue

within current trade

and other payables - (382) (2,271) (2,653)

Deferred tax assets 344 - 96 440

---------------------------------------- ------------- ----------------- -------------- -------------

As reported

1 January

2018

Retained earnings as previously reported 5,174

Adjustment to earnings from adoption of IFRS 15 -

profit before tax (564)

Adjustment to earnings from adoption of IFRS 15 -

deferred tax 96

Retained earnings on adoption of IFRS 15 - at 1 January

2018 4,706

Impact on the result for the year to 31 December 2018

Result before Impact of Result after

the adoption change the adoption

of IFRS 15 in GAAP of IFRS 15

GBP000 GBP000 GBP000

Consolidated income statement

Revenue 18,198 1,775 19,973

Cost of sales (11,719) (1,370) (13,089)

Gross profit 6,479 405 6,884

Administrative expenses (5,728) - (5,728)

Operating profit 751 405 1,156

Financial income 3 - 3

Financial expense (33) - (33)

Profit before tax 721 405 1,126

Income tax 103 (86) 17

Profit for the year 824 319 1,143

Revenue before the adoption of IFRS 15 were accounted for under

IAS 11 and IAS 18.

An assessment of the impact of IFRS 15 was completed during the

year across the Group's revenue streams, including a comprehensive

review of contracts that were not completed contracts at the date

of initial application.

This review ascertained that under IFRS 15, GBP2,271,000 of

revenue and GBP564,000 of profit recognised in previous accounting

periods up to and including 31 December 2017 would be deferred to

future periods. The effect of this assessment based on the progress

of these contracts during the current year, has been to recognise

revenue of GBP1,961,000 and profit of GBP451,000 in 2018, leaving

revenue of GBP310,000 and profit of GBP113,000 to be recognised in

accounting periods after 31 December 2018.

The impact of IFRS 15 on contracts commencing during the year

and which are incomplete at 31 December 2018 has been to defer

revenue of GBP186,000 and estimated profit of GBP46,000 to future

accounting periods.

4 Segmental information

The analysis by geographic segment below is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to make

strategic decisions, to monitor performance and allocate

resources.

The Board regularly reviews the Group's performance and balance

sheet position for its entire operations as a whole. The Board

receives financial information, assesses performance and makes

resource allocation decisions for its UK based business as a whole,

therefore the Directors consider the Group to have only one segment

in terms of products and services, being the development, supply

and maintenance of technologies used in advanced security,

surveillance and ruggedized electronic applications.

As the Board of Directors receives revenue, Adjusted EBITDA and

operating profit on the same basis as set out in the consolidated

income statement no further reconciliation or disclosure is

considered necessary.

Revenue by geographical destination can be analysed as

follows:

2018 2017

GBP000 GBP000

United Kingdom 15,285 10,227

Continental Europe 4,250 4,930

Rest of World 438 424

19,973 15,581

The timing of revenue recognition can be analysed as

follows:

2018 2017

GBP000 GBP000

Products and services transferred at a point

in time -IFRS 15 19,058 -

Products and services transferred over time

- IFRS 15 915 -

Products and services - IAS 11 and IAS 18 - 5,921

Construction contract revenue - IAS 11 - 9,660

19,973 15,581

5 Exceptional items

2018 2017

GBP000 GBP000

Exceptional income included in administrative

expenses - 362

Exceptional interest received included in

financial income - 340

Exceptional loss on currency translation reserve - (211)

The 2017 results included two exceptional items. First, the

Group accepted an offer to settle a historic matter, unrelated to

the current trading activities of the Group, which arose over ten

years ago. Under the settlement, on 9 January 2018, the Group

received a total of GBP702,000 in cash comprising an amount of

GBP362,000 plus compensatory interest of GBP340,000.

The second exceptional item was also unrelated to the current

trading activities of the Group. During 2017 the Board decided that

the US subsidiary that had been dormant for several years should be

abandoned, and any future activities that the Group may undertake

in the US would not be conducted through the subsidiary. The

GBP211,000 deficit on the Group's currency translation reserve was

reclassified from equity to income and shown as an expense.

6 Financial income and expenses

2018 2017

GBP000 GBP000

Recognised in profit or loss

Exceptional item - interest receivable on

settlement (note 5) - 340

Interest on bank deposits 1 -

Other exchange gain 2 -

Financial income 3 340

2018 2017

GBP000 GBP000

Interest expense on financial liabilities

at amortised cost 33 133

Exceptional item - foreign exchange loss (note

5) - 211

Other exchange loss - 36

Financial expenses 33 380

7 Taxation

Recognised in the income statement

2018 2018 2017 2017

GBP000 GBP000 GBP000 GBP000

Current tax (credit)/expense

Current tax charge 34 5

Adjustments in respect of

prior years (113) (57)

Total current tax (79) (52)

Deferred tax (credit)/expense

Origination and reversal

of temporary differences 105 5

Derecognition of previously

recognised tax losses 73 -

Recognition of previously

unrecognised tax losses (56) (148)

Utilisation of recognised

tax losses 75 303

Adjustment in respect of

prior years (145) (162)

Effect of differential tax

rate for deferred tax 10 22

Total deferred tax 62 20

Total tax credit in income

statement (17) (32)

7 Taxation (continued)

Reconciliation of effective tax rate

2018 2017

GBP000 GBP000

Profit before tax 1,126 1,205

Tax using the UK corporation tax rate of 19%

(2017: 19.25%) 214 232

Non-deductible expenses 42 81

Non taxable income (21) -

Derecognition of previously recognised tax

losses 73 -

Recognition of previously unrecognised tax

losses (56) (148)

Adjustments in respect of prior years (258) (219)

Effect of differential tax rate for deferred

tax 10 22

Other reconciling items (21) -

Total tax credit (17) (32)

8 Acquisitions

On 11 May 2018, the Group acquired the entire issued share

capital of RTS Solutions (Holdings) Limited which was the sole

shareholder of RTS Solutions (UK) Limited (RTS) for GBP1.8 million,

comprising GBP1.2 million for the business and GBP0.6 million for

surplus cash. This consideration was settled by an initial cash

consideration of GBP1 million, funded by a 5 year bank loan and

GBP547,000 paid from internal cash reserves. Further deferred

consideration of GBP250,000 was paid in June 2018, funded by an

additional drawdown on the 5 year bank loan and a further GBP55,000

was paid in July, funded from cash reserves. The terms of the

acquisition provided for a further amount of up to GBP250,000 to be

payable in the event that the financial performance of RTS for the

year ended 31 March 2019 met certain targets. The fair value of

this element of consideration has been determined to be GBPnil on

the basis that the forecast results were expected to be below the

target amounts.

During the period from acquisition to 31 December 2018, RTS

contributed GBP511,000 of revenue and GBP183,000 of profit to the

Group. Had the results been consolidated from 1 January 2018, Group

revenue would have been GBP20,165,000 and net profit would have

been GBP1,167,000. In determining these amounts, management has

assumed that the fair value adjustments that arose on the date of

acquisition would have been the same if the acquisition occurred on

1 January 2018.

Pre-acquisition carrying amounts were determined based on

applicable IFRSs, immediately prior to the acquisition. The values

of assets and liabilities recognised on acquisition are the

estimated fair values. The goodwill arising on acquisition can be

attributed to a multitude of assets that cannot be readily

separately identified for the purposes of fair value accounting.

None of the goodwill is expected to be deductible for tax

purposes.

The fair value adjustments arise in accordance with the

requirements of IFRSs to recognise intangible assets acquired. In

determining the fair value of intangible assets, the Group has used

discounted cash flow forecasts and these are being amortised over

their estimated useful life.

The Group incurred acquisition related costs of GBP77,000 that

are included within administrative expenses.

8 Acquisition (continued)

The acquisition had the following effect on the Group's assets

and liabilities on the acquisition date:

Provisional

fair values

recognised

on acquisition

GBP000

Net assets acquired

Intangible assets

Technology related assets 407

Customer related assets 146

Property, plant and equipment 2

Inventories 18

Trade and other receivables 131

Cash and cash equivalents 628

Trade and other payables (167)

Deferred tax (94)

Net identified assets and

liabilities 1,071

Goodwill on acquisition 781

Total consideration 1,852

Cash flow

Consideration paid in cash 1,852

Cash and cash equivalents

acquired (628)

Net cash flow 1,224

9 Interest-bearing loans and borrowings

This note provides information about the contractual terms of

the Group's and Company's interest-bearing loans and borrowings,

which are measured at amortised cost.

Group Company

2018 2017 2018 2017

GBP000 GBP000 GBP000 GBP000

Non-current liabilities

Bank loan 875 - 875 -

Finance lease liabilities 8 23 - -

883 23 875 -

Current liabilities

Bank loan 250 - 250 -

Current portion of finance

lease liabilities 15 15 - -

265 15 250 -

During the year the Company entered into a term loan facility

of GBP1.25 million repayable by equal quarterly instalments over

60 months. The interest rate is set at LIBOR plus 3.19% and the

loan is secured by a fixed and floating charge over the assets

of the Group.

During the year the Company was also provided a revolving credit

facility of up to GBP750,000 which was undrawn at 31 December

2018. The interest rate on amounts drawn is set at LIBOR plus

3.19% and there is a commitment fee of 1.85% on the undrawn facility.

9 Interest-bearing loans and borrowings (continued)

Changes in liabilities from financing activities

Loans and borrowings Finance lease liabilities

GBP000 GBP000

Balance at 1 January 2018 - 38

New bank loan 1,250 -

Repayment of bank loan (125) -

Payment of finance lease liabilities - (15)

Total changes from financing cash flows 1,125 (15)

Balance at 31 December 2018 1,125 23

10 Share capital

At 31 December At 31 December

2018 2017

Number Number

Number of shares in issue - allotted,

called up and fully paid

Ordinary shares of 1p each 57,468,229 55,768,229

GBP000 GBP000

Value of shares in issue - allotted, called up

and fully paid

Ordinary shares of 1p each 575 558

The Company's issued share capital comprises 57,468,229 ordinary

shares of 1p each, all of which have equal voting rights.

On 22 May 2018 the Company issued 700,000 ordinary 1p shares at

a price of 11.625p each and on 11 June 2018 the Company issued

a further 1,000,000 ordinary 1p shares at a price of 8p each,

on the exercise of options.

11 Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to the shareholders by the weighted

average number of shares in issue.

2018 2017

Earnings

Profit for the year (GBP000) 1,143 1,237

Number of shares

Weighted average number of ordinary shares ('000) 56,752 37,418

Basic earnings per share (pence) 2.01 3.31

11 Earnings per share (continued)

Diluted earnings per share

Diluted earnings per share assumes conversion of all potentially

dilutive ordinary shares, which arise from share options, and is

calculated by dividing the adjusted profit for the year

attributable to the shareholders by the assumed weighted average

number of shares in issue. The adjusted profit for 2017 comprised

the profit for the year attributable to the shareholders after

adding back the interest on convertible loan notes amounting to

GBP131,000.

2018 2017

Adjusted earnings

Profit for the year (GBP000) 1,143 1,368

Number of shares

Weighted average number of ordinary shares ('000) 58,627 58,844

Diluted earnings per share (pence) 1.95 2.32

12 Annual Report and Accounts

The Annual Report and Accounts will be sent to shareholders

shortly and will be available to download on the Company's website

www.petards.com.

Alternative Performance Measures Glossary

This report provides alternative performance measures ("APMs"),

which are not defined or specified under the requirements of

International Financial Reporting Standards. The Board believes

that these APMs provide management with useful performance

measurement indicators and readers with important additional

information on the business.

Adjusted EBITDA

Adjusted EBITDA is earnings before financial income and

expenses, tax, depreciation, amortisation, exceptional items,

acquisition costs and share based payment charges. Adjusted EBITDA

is considered useful by the Board since by removing exceptional

items, acquisition costs and share based payments, the year on year

operational performance comparison is more comparable.

Order intake

The value of contractual orders received from customers during

any period for the delivery of performance obligations. This allows

management to monitor the performance of the business.

Order book

The value of contractual orders received from customers yet to

be recognised as revenue. This allows management to monitor the

performance of the business and provides forward visibility of

potential earnings.

Net funds

Total net funds comprises cash and cash equivalents less

interest bearing loans and borrowings. This allows management to

monitor the indebtedness of the Group.

Current net funds

Current net funds comprises cash and cash equivalents less

current liabilities in respect of interest bearing loans and

borrowings. This allows management to monitor the short term

indebtedness of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR ILMATMBAMBRL

(END) Dow Jones Newswires

April 10, 2019 02:00 ET (06:00 GMT)

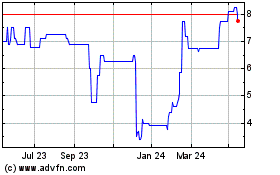

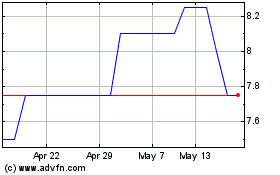

Petards (LSE:PEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petards (LSE:PEG)

Historical Stock Chart

From Apr 2023 to Apr 2024