Picton Prop Inc Ltd Picton upsizes Lidl into former Homebase unit

January 07 2019 - 2:00AM

UK Regulatory

TIDMPCTN

7 January 2019

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Picton upsizes Lidl into former Homebase unit

Picton has completed an Agreement to Lease with Lidl on its former Homebase

unit at Parc Tawe North, Swansea.It will move Lidl from its existing premises

on the retail park, making it the anchor occupier, alongside JD Sports, Pets at

Home, Home Bargains and Poundstretcher.

Lidl currently occupies a 10,000 sq ft unit on a lease expiring in 2023. It

will increase its footprint by 255%, taking the entire 35,500 sq ft previously

occupied by Homebase. Following enabling works by Picton, Lidl will take a 20

year lease, with a break after 15 years, at an annual rent of GBP0.39 million, in

line with ERV. The lease is subject to five yearly Retail Price Index (RPI)

based rent reviews capped at 2% per annum. Homebase was paying a rent of GBP0.44

million per annum on a lease expiring in 2022.

Lidl will continue to trade from its existing unit, paying GBP0.14 million per

annum until the enabling works and fit out have been completed, which is

expected to be in the second quarter of 2019. The current lease will then be

surrendered.

Homebase, which undertook a Company Voluntary Arrangement (CVA) in August 2018,

had proposed to reduce the passing rent by 90% if they remained in occupation.

Rather than agree the proposed terms, Picton decided to serve notice to secure

vacant possession of the unit. At the same time, Picton negotiated the release

of a restrictive covenant to allow additional food retailing on the park to

facilitate this letting transaction.

With the Lidl agreement completed, Picton will pursue the second stage of its

strategy at Parc Tawe North by focusing on letting the 15,000 sq ft of space

that became vacant following the insolvency of Poundworld in 2018 and, when

vacated, the former Lidl unit.

Michael Morris, Chief Executive of Picton, commented:

'By executing a bold strategy of securing vacant possession, releasing a

restrictive covenant and working with one of our existing occupiers, we have

been able to secure a high quality anchor for the largest unit on the park on a

long lease.'

For further information please contact:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980

Note to Editors

Picton is a UK REIT established in 2005. It owns and actively manages a GBP683

million diversified UK commercial property portfolio, invested across 49 assets

and with around 350 occupiers (as at 30 September 2018). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

www.picton.co.uk

ENDS

END

(END) Dow Jones Newswires

January 07, 2019 02:00 ET (07:00 GMT)

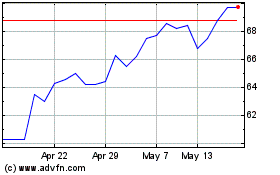

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Picton Property Income Ld (LSE:PCTN)

Historical Stock Chart

From Apr 2023 to Apr 2024