TIDMOSB

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN,

INTO OR FROM ANY RESTRICTED JURISDICTIONS OR JURISDICTION WHERE TO DO SO

WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION.

THE FOLLOWING ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR A

PROSPECTUS EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY

INVESTMENT DECISION IN RELATION TO THE NEW SHARES EXCEPT ON THE BASIS OF

THE INFORMATION IN THE SCHEME DOCUMENT, THE PROSPECTUS AND THE CIRCULAR

WHICH ARE BEING PUBLISHED TODAY.

CAPITALISED TERMS DEFINED IN THE CIRCULAR HAVE THE SAME MEANING WHEN

USED IN THIS ANNOUNCEMENT, UNLESS OTHERWISE DEFINED IN THIS

ANNOUNCEMENT.

FOR IMMEDIATE RELEASE

15 May 2019

Recommended all-share combination of OneSavings Bank plc ("OSB") and

Charter Court Financial Services Group plc ("Charter Court")

Publication of Prospectus and Circular (this "Announcement")

On 14 March 2019, the OSB Board and the Charter Court Board jointly

announced that they had reached agreement on the terms of a recommended

all-share combination pursuant to which OSB will acquire the entire

issued and to be issued ordinary share capital of Charter Court to form

the Combined Group (the "Combination").

Under the terms of the Combination, completion of which is subject to

the satisfaction (or, where applicable, waiver) of the Conditions, each

Charter Court Shareholder (other than Restricted Overseas Persons) will

be entitled to receive 0.8253 New OSB Shares for each Charter Court

Share held.

Today, OSB published a Circular containing a notice convening a general

meeting of OSB Shareholders to be held at the offices of Slaughter and

May, One Bunhill Row, London EC1Y 8YY at 10.00 a.m. on 6 June 2019 (the

"OSB General Meeting") to consider and, if thought fit, approve the

Combination as a "Class 1 transaction" under the Listing Rules and to

grant authority to the OSB Directors to allot the new shares to be

issued to Charter Court Shareholders by OSB in connection with the

Combination (the "New OSB Shares").

OSB has also published a Prospectus today relating to the New OSB Shares

and the application for admitting new shares to the premium segment of

the Official List and to trading on the London Stock Exchange's Main

Market for listed securities.

The Circular and the Prospectus have each been approved by the FCA and

are now available at www.osb.co.uk. A copy of each of the Circular and

the Prospectus has been submitted to the National Storage Mechanism and

will shortly be available for viewing at www.morningstar.co.uk/uk/nsm.

OSB also notes that a Scheme Document in relation to the Combination is

being sent or made available by Charter Court to Charter Court

Shareholders today. The Scheme Document contains, amongst other things,

notices convening a meeting of the Charter Court Shareholders convened

at the direction of the Court (the "Court Meeting") and a general

meeting of Charter Court Shareholders (the "Charter Court General

Meeting"). The Court Meeting and the Charter Court General Meeting will

take place on the same day as the OSB General Meeting. The Scheme

Document will be made available on the Charter Court website:

www.chartercourtfs.co.uk.

Action to be taken by OSB Shareholders

OSB Shareholders are encouraged to vote on the OSB Resolution contained

in the Circular, but should carefully read the Circular in its entirety

before making any decision. The notes to the Notice of General Meeting

at pages 63 and 64 of the Circular provide an explanation of how to

attend and vote at the OSB General Meeting, including how to appoint a

proxy.

Expected timetable

Subject to the approval of the OSB Shareholders and Charter Court

Shareholders, as well as the satisfactory or, where permitted, waiver of

the Conditions set out in the Scheme Document and the approval of the

Court, completion of the Combination is expected to occur in the third

quarter of 2019.

The expected timetable of principal events for the implementation of the

Combination is set out below.

All references to time in this announcement are to London time unless

otherwise stated.

Principal events Time and/or date(1)

Publication of the Prospectus, the Circular and the 15 May 2019

Scheme Document

OSB General Meeting 10.00 a.m. on 6 June 2019

Court Meeting 10.30 a.m. on 6 June 2019

Charter Court General Meeting 10.45 a.m. on 6 June 2019(2)

Scheme Court Hearing to sanction the Scheme "D" (a date expected to be in the third quarter of

2019, subject to the Conditions)(3)

Effective Date D+1

Admission of New OSB Shares on London Stock By 8.00 a.m. on D+2

Exchange

(1) All dates by reference to "D+1" and "D+2" will be to the

date falling the number of indicated Business Days immediately after

date D, as indicated above.

(2) To commence at the time fixed or, if later, immediately

after the conclusion or adjournment of the Court Meeting.

(3) The Court Order is expected to be delivered to Companies

House following the suspension of trading in Charter Court Shares and

the Scheme Record Time on D+1, which date will then become the Effective

Date. The events which are stated as occurring on subsequent dates are

conditional on the Effective Date and operate by reference to this time.

Enquiries

OneSavings Bank plc

Alastair Pate, Group Head of Investor Relations:

Tel: +44 (0) 16 3483 8973

Rothschild & Co (Financial Adviser and Sponsor to OSB)

Stephen Fox Tel: +44 (0) 20 7280 5000

Toby Ross

Guy Luff

James Ford

Barclays (Financial Adviser and Corporate Broker to OSB)

Kunal Gandhi Tel: +44 (0) 20 7623 2323

Francesco Ceccato

Derek Shakespeare

Brunswick (Financial PR Adviser to OSB)

Robin Wrench Tel: +44 (0) 20 7404 5959

Simone Selzer

Slaughter and May are retained as legal adviser to OSB.

Notes to Editors

OSB began trading as a bank on 1 February 2011 and was admitted to the

Main Market of the London Stock Exchange in June 2014. OSB joined the

FTSE 250 index in June 2015. OSB is a specialist lending and retail

savings group authorised by the PRA and regulated by the FCA and the

PRA.

Based in Chatham, Kent, the OSB Group trades under the Kent Reliance,

InterBay Commercial, Prestige Finance, and Heritable Development Finance

brands in the UK. The OSB Group also has a presence in the Channel

Islands under the Jersey Home Loans and Guernsey Home Loans brands.

OSB primarily targets underserved market sub-sectors that offer high

growth potential, attractive risk-adjusted returns and where it has

established expertise, platforms and capabilities. These include private

rented sector / professional buy-to-let, commercial and semi-commercial

mortgages, residential development finance, bespoke and specialist

residential lending and secured funding lines and asset finance. OSB

targets its customers through specialist brokers and independent

financial advisers, and is differentiated through its use of high

skilled, bespoke underwriting and its efficient operating model.

Important notice related to financial advisers

N. M. Rothschild & Sons Limited, which is authorised and regulated by

the Financial Conduct Authority in the United Kingdom, is acting

exclusively for OSB and no one else in relation to the contents of this

Announcement, the Combination, Admission or any other matters referred

to in this Announcement and will not regard any other person (whether or

not a recipient of this Announcement) as a client in relation to the

Combination, Admission or any other matters referred to in this

Announcement and will not be responsible to anyone other than OSB for

providing the protections afforded to clients of Rothschild & Co nor for

providing advice in relation to the contents of this Announcement, the

Combination, Admission or any other matters referred to in this

Announcement. Apart from the responsibilities and liabilities, if any,

which may be imposed on Rothschild & Co under FSMA or the regulatory

regime established thereunder, neither Rothschild & Co nor any of its

affiliates accept any responsibility or liability whatsoever for, nor

make any representation or warranty, express or implied, concerning the

contents of this Announcement, including its accuracy, completeness or

verification, or for any other statement made or purported to be made by

OSB or on OSB's behalf, or by Rothschild & Co, or on Rothschild & Co's

behalf in connection with the Combination, the New OSB Shares or

Admission and nothing in this Announcement is, or shall be relied upon

as, a promise or representation in this respect, whether as to the past

or future. To the fullest extent permitted by law, Rothschild & Co and

its affiliates disclaim all and any duty, liability or responsibility

whatsoever (whether direct or indirect and whether in contract, in tort,

under statute or otherwise) which it might otherwise have in respect of

this Announcement or any such statement.

Barclays Bank PLC, acting through its Investment Bank, ("Barclays")

which is authorised by the Prudential Regulatory Authority and regulated

in the United Kingdom by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting exclusively for OSB and no

one else in relation to the Combination and will not be responsible to

anyone other than OSB for providing the protections afforded to its

clients nor for providing advice in connection with the Combination or

any other matter referred to in this Announcement.

Cautionary Note Regarding Forward-Looking Statements

This Announcement contains certain statements about OSB and Charter

Court that are or may be forward looking statements, including with

respect to the Combination involving OSB and Charter Court. Forward

looking statements are prospective in nature and are not based on

historical facts, but rather on assumptions, expectations, valuations,

targets, estimates, forecasts and projections of OSB and Charter Court

about future events, and are therefore subject to risks and

uncertainties which could cause actual results, performance or events to

differ materially from those expressed or implied by the forward looking

statements. All statements other than statements of historical facts

included in this Announcement may be forward looking statements. Without

limitation, forward looking statements often include words such as

"targets", "plans", "believes", "hopes", "continues", "expects", "aims",

"intends", "will", "may", "should", "would", "could", "anticipates",

"estimates", "will look to", "budget", "strategy", "would look to",

"scheduled", "goal", "prepares", "forecasts", "cost-saving", "is subject

to", "synergy", "projects" or words or terms of similar substance or the

negative thereof.

By their nature, forward looking statements involve risk and uncertainty,

because they relate to events and depend on circumstances that will

occur in the future and the factors described in the context of such

forward looking statements in this Announcement could cause actual

results and developments to differ materially from those expressed in or

implied by such forward looking statements. Such risks and uncertainties

include, but are not limited to, the possibility that the Combination

will not be pursued or consummated, failure to obtain necessary

regulatory approvals or to satisfy any of the other conditions to the

Combination if it is pursued, adverse effects on the market price of

OSB's or Charter Court's ordinary shares and on OSB's or Charter Court's

operating results because of a failure to complete the Combination,

failure to realise the expected benefits of the Combination, negative

effects relating to the announcement of the Combination or any further

announcements relating to the Combination or the consummation of the

Combination on the market price of OSB's or Charter Court's ordinary

shares, significant transaction costs and/or unknown liabilities, the

Combined Group incurring and/or experiencing unanticipated costs and/or

delays (including IT system failures, cyber-crime, fraud and pension

scheme liabilities), general economic and business conditions that

affect the combined companies following the consummation of the

Combination, changes in global, political, economic, business,

competitive, market and regulatory forces (including exposures to

terrorist activities, the repercussions of the UK's referendum vote to

leave the European Union, the UK's exit from the EU and Eurozone

instability), future exchange and interest rates, changes in tax laws,

regulations, rates and policies, future business combinations or

disposals and competitive developments. Although it is believed that the

expectations reflected in such forward looking statements are reasonable,

no assurance can be given that such expectations will prove to have been

correct and you are therefore cautioned not to place undue reliance on

these forward looking statements which speak only as at the date of this

Announcement.

Each forward looking statement speaks only as of the date of this

Announcement. Neither OSB nor Charter Court, nor any of their respective

associates or directors, officers or advisers, provides any

representation, warranty, assurance or guarantee that the occurrence of

the events expressed or implied in any forward looking statements in

this Announcement will actually occur. Other than in accordance with

their legal or regulatory obligations (including under the City Code,

the Prospectus Rules, the Listing Rules and the Disclosure Guidance and

Transparency Rules), neither the OSB Group nor the Charter Court Group

is under, or undertakes, any obligation, and each of the foregoing

expressly disclaims any intention or obligation, to update or revise any

forward looking statements, whether as a result of new information,

future events or otherwise.

No forecasts or estimates

Nothing in this Announcement (including any statement of estimated costs

savings or synergies) is intended as a profit forecast or estimate for

any period and no statement in this Announcement should be interpreted

to mean that earnings or earnings per share or dividend per share for

OSB or Charter Court, as appropriate, for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share or dividend per share for OSB

or Charter Court, as appropriate.

Accretion statements or statements as to the effect of the Combination

on free cash flow per share, earnings per share, cash flow from

operations per share, or return on average capital employed are not

intended to be and should not be construed as profit forecasts and are,

therefore, not subject to the requirements of Rule 28 of the City Code.

No statement in this Announcement should be interpreted to mean that

free cash flow per share, earnings, earnings per share or income, cash

flow from operations per share or return on average capital employed for

the OSB Group, the Charter Court Group and/or the Combined Group, as

appropriate, for the current or future financial years would necessarily

match or exceed the historical published earnings, earnings per share or

income, cash flow from operations, free cash flow or return on average

capital employed for the OSB Group or the Charter Court Group, as

appropriate.

Further Information

This Announcement is for information purposes only and is not intended

to and does not constitute or form part of any offer to sell or

subscribe for or any invitation to purchase or subscribe for or

otherwise acquire or dispose of any securities or the solicitation of

any vote or approval in any jurisdiction pursuant to the Combination or

otherwise, nor will there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law. The

Combination will be made solely pursuant to the terms of the Scheme

Document setting out the particulars of the proposed Scheme between

Charter Court and the Charter Court Shareholders to implement the

Combination with or subject to any modification, addition or condition

approved or imposed by the Court and agreed by Charter Court and OSB (or,

in the event that the Combination is to be implemented by means of an

Offer, the Offer Document), which, together with the forms of proxy that

will accompany the Scheme Document, contain the full terms and

conditions of the Scheme, including details of how to vote in respect of

the Combination. Any decision in respect of, or other response to, the

Combination by Charter Court Shareholders should be made only on the

basis of the information contained in the Scheme Document.

Charter Court has prepared the Scheme Document to be distributed to

Charter Court Shareholders. OSB has prepared the Circular and has made

available the Prospectus containing information on the New OSB Shares

and the Combined Group. OSB urges OSB Shareholders to read the

Prospectus to be published by OSB and the Circular carefully when they

become available because they contain important information in relation

to the Scheme, the New OSB Shares and the Combined Group. Charter Court

urges Charter Court Shareholders to read the Scheme Document and the

Prospectus carefully because they contain important information in

relation to the Scheme, the New OSB Shares and the Combined Group. Any

vote in respect of resolutions to be proposed at the OSB General Meeting

to approve the Combination, the Scheme or related matters, should be

made only on the basis of the information contained in the Scheme

Document, the Prospectus and, the Circular.

This Announcement does not constitute a prospectus or prospectus

equivalent document.

The Combination will be subject to the applicable requirements of the

City Code, the UK Panel on Takeovers and Mergers, the London Stock

Exchange and the FCA.

Overseas jurisdictions

The release, publication or distribution of this Announcement in

jurisdictions other than the United Kingdom may be restricted by law and

therefore any persons who are subject to the laws of any jurisdiction

other than the United Kingdom should inform themselves about, and

observe any applicable requirements. In particular, the ability of

persons who are not resident in the United Kingdom to vote their Charter

Court shares with respect to the Scheme at the Court Meeting, or to

execute and deliver Forms of Proxy appointing another to vote at the

Court Meeting on their behalf, may be affected by the laws of the

relevant jurisdictions in which they are located. Any failure to comply

with such requirements may constitute a violation of the securities laws

of any such jurisdiction. To the fullest extent permitted by applicable

law, the companies and other persons involved in the Combination

disclaim any responsibility or liability for any violation of such

restrictions by any person. This Announcement has been prepared for the

purpose of complying with English law and the City Code and the

information disclosed may not be the same as that which would have been

disclosed if this Announcement had been prepared in accordance with the

laws of jurisdictions outside the United Kingdom. Unless otherwise

determined by OSB or required by the City Code, and permitted by

applicable law and regulation, the Combination will not be made

available directly or indirectly in, into or from any Restricted

Jurisdiction or where to do so would violate the laws of a jurisdiction,

and the Combination will not be capable of acceptance from or within a

Restricted Jurisdiction.

Copies of this Announcement and any documentation relating to the

Combination are not being, and must not be, directly or indirectly,

mailed, transmitted or otherwise forwarded, distributed or sent in or

into or from any Restricted Jurisdiction and persons receiving such

documents (including custodians, nominees and trustees) must not mail or

otherwise forward, distribute or send it in or into or from any

Restricted Jurisdiction where to do so would violate the laws in that

jurisdiction, and persons receiving this Announcement and any documents

relating to the Combination (including custodians, nominees and

trustees) must not mail or otherwise distribute or send them in, into or

from such jurisdictions where to do so would violate the laws in that

jurisdiction.

If the Combination is implemented by way of an Offer (unless otherwise

permitted by applicable law and regulation), the Offer may not be made

directly or indirectly, in or into, or by the use of mails or any means

or instrumentality (including, but not limited to, facsimile, e-mail or

other electronic transmission, telex or telephone) of interstate or

foreign commerce of, or of any facility of a national, state or other

securities exchange of any Restricted Jurisdiction and the Offer may not

be capable of acceptance by any such use, means, instrumentality or

facilities.

The availability of New OSB Shares under the Combination to Charter

Court Shareholders who are not resident in the United Kingdom or the

ability of those persons to hold such shares may be affected by the laws

or regulatory requirements of the jurisdiction in which they are

resident. Persons who are not resident in the United Kingdom should

inform themselves of, and observe, any applicable legal or regulatory

requirements.

The New OSB Shares may not be offered, sold or delivered, directly or

indirectly, in, into or from any Restricted Jurisdiction or to, or for

the account or benefit of, any restricted overseas persons (being any

Charter Court Shareholders resident in, or nationals or citizens of,

Restricted Jurisdictions or who are nominees or custodians, trustees or

guardians for, citizens, residents or nationals of such Restricted

Jurisdictions) except pursuant to an applicable exemption from, or in a

transaction not subject to, applicable securities laws of those

jurisdictions. Further details in relation to any Charter Court

Shareholders who are resident in, ordinarily resident in, or citizens of,

jurisdictions outside the United Kingdom, are contained in the Scheme

Document.

Additional information for US shareholders

The New OSB Shares have not been, and will not be, registered under the

US Securities Act, or with any securities regulatory authority of any

state, district or any other jurisdiction of the United States.

Accordingly, the New OSB Shares may not be offered, sold or otherwise

transferred, directly or indirectly, in or into the United States absent

registration under the US Securities Act and any applicable state

securities law or an exemption therefrom. The New OSB Shares to be

issued to existing Charter Court Shareholders pursuant to the Scheme are

expected to be issued in reliance upon an exemption from the

registration requirements of the US Securities Act afforded by section

3(a)(10) thereof and exemptions from registration and qualification

under applicable state securities laws. Charter Court Shareholders

(whether or not US persons) who are or will be affiliates (within the

meaning of the US Securities Act) of Charter Court or OSB before, or of

OSB after, the Effective Date will be subject to certain US transfer

restrictions relating to the New OSB Shares received pursuant to the

Scheme.

None of the securities referred to in this Announcement has been

approved or disapproved by the US Securities and Exchange Commission,

any state securities commission in the United States or any other US

regulatory authority, nor have such authorities passed upon or

determined the adequacy or accuracy of this Announcement. Any

representation to the contrary is a criminal offence in the United

States.

Disclosure requirements of the City Code

Under Rule 8.3(a) of the City Code, any person who is interested in 1%

or more of any class of relevant securities of an offeree company or of

any securities exchange offeror (being any offeror other than an offeror

in respect of which it has been announced that its offer is, or is

likely to be, solely in cash) must make an Opening Position Disclosure

following the commencement of the offer period and, if later, following

the announcement in which any securities exchange offeror is first

identified. An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe for,

any relevant securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than 3.30

p.m. (London time) on the 10th business day following the commencement

of the offer period and, if appropriate, by no later than 3.30 p.m.

(London time) on the 10th business day following the announcement in

which any securities exchange offeror is first identified. Relevant

persons who deal in the relevant securities of the offeree company or of

a securities exchange offeror prior to the deadline for making an

Opening Position Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the City Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities of the

offeree company or of any securities exchange offeror. A Dealing

Disclosure must contain details of the dealing concerned and of the

person's interests and short positions in, and rights to subscribe for,

any relevant securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s), save to the extent that these details

have previously been disclosed under Rule 8. A Dealing Disclosure by a

person to whom Rule 8.3(b) applies must be made by no later than 3.30

p.m. (London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a securities

exchange offeror, they will be deemed to be a single person for the

purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company

and by any offeror and Dealing Disclosures must also be made by the

offeree company, by any offeror and by any persons acting in concert

with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing Disclosures

must be made can be found in the Disclosure Table on the Takeover

Panel's website at www.thetakeoverpanel.org.uk, including details of the

number of relevant securities in issue, when the offer period commenced

and when any offeror was first identified. You should contact the

Panel's Market Surveillance Unit on +44 (0)20 7638 0129 if you are in

any doubt as to whether you are required to make an Opening Position

Disclosure or a Dealing Disclosure.

Publication on website

A copy of this Announcement and the documents required to be published

by Rule 26 of the City Code will be made available, subject to certain

restrictions relating to persons resident in Restricted Jurisdictions,

on OSB's website at www.osb.com by no later than 12 noon (London time)

on the Business Day following this Announcement. For the avoidance of

doubt, the contents of those websites are not incorporated into and do

not form part of this Announcement.

If you are in any doubt about the contents of this Announcement or the

action you should take, you are recommended to seek your own independent

financial advice immediately from your stockbroker, bank manager,

solicitor, accountant or independent financial adviser duly authorised

under the Financial Services and Markets Act 2000 (as amended) if you

are resident in the United Kingdom or, if not, from another

appropriately authorised independent financial adviser.

This announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: OneSavings Bank plc via Globenewswire

http://www.osb.co.uk/

(END) Dow Jones Newswires

May 15, 2019 06:47 ET (10:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

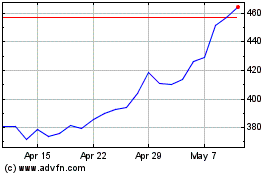

Osb (LSE:OSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

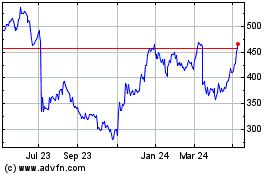

Osb (LSE:OSB)

Historical Stock Chart

From Jul 2023 to Jul 2024