TIDMNWG

RNS Number : 1775F

NatWest Group plc

12 November 2020

12 November 2020

NatWest Group plc

INITIAL NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING

MANAGERIAL RESPONSIBILITY (PDMRs) in accordance with Article 19 of

the EU Market Abuse Regulation 596/2014

1. NatWest Group plc (the Company) announces that ordinary

shares of GBP1 each in the Company (Shares) (ISIN: GB00B7T77214)

were delivered to PDMRs on 10 November 2020, under the NatWest

Group 2014 Employee Share Plan (the Plan) as set out below.

Unless otherwise stated, the Shares delivered represent payment

of a fixed share allowance (FSA) for the three month period ending

31 December 2020 and have been calculated using a Share price of

GBP1.2499.

The number of Shares delivered, the number of Shares withheld to

meet associated tax liabilities and the number of Shares retained

by each PDMR is as follows:-

Name of PDMR Position of PDMR No. of No. of Shares No. of

Shares withheld to Shares

delivered satisfy associated retained

tax liability

Robert Begbie CEO, NatWest Markets 65,006 31,250 33,756

------------------------ ----------- -------------------- ----------

Helen Cook Chief HR Officer 24,502 11,534 12,968

------------------------ ----------- -------------------- ----------

Chief Risk Officer,

Bruce Fletcher NatWest Group 60,005 28,245 31,760

------------------------ ----------- -------------------- ----------

Peter Flavel CEO, Wealth Businesses 45,032 21,197 23,835

------------------------ ----------- -------------------- ----------

David Lindberg

(1) CEO, Retail Banking 75,841 35,700 40,141

------------------------ ----------- -------------------- ----------

Andrew McLaughlin

(2) CEO, RBS International 30,003 - 30,003

------------------------ ----------- -------------------- ----------

Chief Administrative

Simon McNamara Officer 65,006 31,250 33,756

------------------------ ----------- -------------------- ----------

Chief Financial

Katie Murray Officer 150,013 70,613 79,400

------------------------ ----------- -------------------- ----------

Chief Executive

Alison Rose(3) Officer 220,018 103,564 116,454

------------------------ ----------- -------------------- ----------

CEO, Commercial

John Paul Thwaite Banking 45,004 21,184 23,820

------------------------ ----------- -------------------- ----------

Chief Transformation

Jen Tippin(4) Officer 125,725 59,180 66,545

------------------------ ----------- -------------------- ----------

1. David Lindberg received a FSA for the period 16 September

to 31 December 2020.

2. The FSA was delivered when Andrew McLaughlin was resident

in Jersey and therefore is taxable in Jersey only and

not in the UK. No employer tax withholding is required

under Jersey law. The Jersey income tax payable in respect

of the vesting of the award will be paid by the PDMR directly

to the Jersey tax authority.

3. Alison Rose has waived her entitlement to 25% of her

total fixed pay for the period 9 April 2020 to 31 December

2020 and this is being effected through a reduction in

the number of Shares she receives by way of FSA.

4. Jen Tippin received a FSA for the period 14 August

to 31 December 2020.

The market price used to determine the number of Shares withheld

to meet associated tax liabilities was GBP1.4019. Shares retained

after payment of associated tax liabilities will be held on behalf

of PDMRs in the Computershare Retained Share Nominee account and

will be released in instalments over a three year period.

2. The Company also announces that on 10 November 2020,

conditional Buy-out awards (Awards) were granted under the Plan to

the PDMRs set out below in order to replace awards forfeited by

such individuals on leaving their previous employer.

Name of PDMR Position of PDMR Award price No. of Shares

granted

David Lindberg CEO, Retail Banking 1.0284 (1) 1,085,957(2)

---------------------- ------------ --------------

129,830

--------------------------------------- ------------ --------------

Chief Transformation

Jen Tippin Officer 1.1563(3) 1,133,682

---------------------- ------------ --------------

1.3775(4) 28,119

--------------------------------------- ------------ --------------

1. The Award price has been calculated using a 5 day

average Share price taken immediately prior to the PDMR

joining the Group.

2. The vesting level will mirror the final performance

outcome applicable to the PDMR's original Westpac awards,

as disclosed in the future annual report and accounts

of Westpac, subject to a maximum of 1,085,957 Shares.

3. The Award price has been calculated using a 5 day

average Share price taken immediately prior to the PDMR

joining the Group.

4. The Award price has been calculated using the closing

Share price on 9 November 2020 and was granted in respect

of a forfeited cash award.

Mr Lindberg's Awards are eligible to vest between 2020 and 2023

and Ms Tippin's Awards are eligible to vest between 2020 and 2027.

The Awards are subject to malus and clawback provisions, where

applicable.

3. The Company announces that on 10 November 2020, buy-outs over

Shares vested to the PDMR set out below. The number of Shares

withheld to meet associated tax liabilities arising on vesting and

the number of vested Shares retained by the PDMR is set out

below:-

Name of PDMR Position Award No. of No. of Shares No. of

of PDMR Shares withheld to vested

vested satisfy associated Shares

tax liability retained

Chief Transformation

Jen Tippin Officer Buy-out 213,612 100,550 113,062

---------------------- --------- -------- -------------------- ----------

Buy-out 28,119 13,236 14,883

----------------------------------------------- -------- -------------------- ----------

The market p rice used to determine the number of Shares

withheld to meet associated tax liabilities was GBP1.4019.

Vested Shares retained after payment of associated tax

liabilities will, where applicable, be subject to retention periods

which mirror the retention periods applicable to the PDMR's

original Lloyds Banking Group awards.

The above transactions took place on the London Stock Exchange

(XLON) .

Legal Entity Identifier: 2138005O9XJIJN4JPN90

For further information contact:-

NatWest Group Investor Relations

Alexander Holcroft

Head of Investor Relations

+44(0)20 7672 1758

NatWest Group Media Relations

+44(0)131 523 4205

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHFFIFIEESSEEF

(END) Dow Jones Newswires

November 12, 2020 10:28 ET (15:28 GMT)

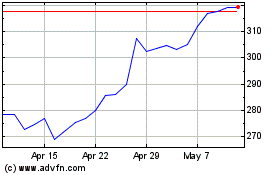

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024