TIDMMXC

RNS Number : 6878R

MGC Pharmaceuticals Limited

30 October 2023

MGC Pharmaceuticals Ltd.

September 2023 Quarter Activity Report and

Cash Flow Statement

30 October 2023

ASX, LSE: MXC

Key Highlights:

-- MGC received an order for US$1m from AMC Pharma ("AMC") to

produce ArtemiC(TM) (the Over the Counter ("OTC") version of

CimetrA(R)). This order comes alongside AMC's new supply agreement

to distribute to over 100 Holistic and Wellness Chiropractic

offices in California, and Florida

-- Positive results from Pre-clinical Chronic Toxicology

Evaluation of 14 days oral dose of CimetrA(R)

-- New regulation in Australia was passed making it the first

country to allow psychiatrists to prescribe psilocybin psychedelics

to treat depression or post-traumatic stress disorder (PTSD)

-- MGC was granted its first permit to import 200g of Psilocybin

Raw Mushroom material to its Slovenian research facility

-- The Company conditionally raised A$1.24 million by way of a placing and subscription

-- MGC successfully completed a Share Purchaser Plan raising A$834,000

MGC Pharmaceuticals Ltd (MGC Pharma, MGC or the Company) a

European based pharmaceutical company specialising in the

production and development of plant derived medicines, is pleased

to provide its Quarterly Activity Report for the three months

ending 30(th) September 2023.

Roby Zomer, Managing Director and CEO of MGC Pharma, commented:

"We are pleased to report on a productive September quarter for the

business. MGC has received an order for US$1m from AMC Pharma to

produce ArtemiC(TM) . This order comes alongside AMC's new supply

agreement to distribute to over 100 Holistic and Wellness

Chiropractic offices in California, and Florida. The Company has

also been granted its first import permit to its Slovenian research

facility."

Key Company Activities

US$1M Order of ArtemiC(TM) Placed by AMC

MGC received an order for US$1m from AMC Pharma to produce

ArtemiC(TM) (the Over the Counter ("OTC") version of CimetrA(R)).

This order came alongside AMC's own separate supply agreement to

distribute to over 100 Holistic and Wellness Chiropractic offices

in California, and Florida. This represents the start of a

substantial ramp up of sales for ArtemiC(TM) with increasing

distribution across the US. To date, the Company has received total

orders of over 100,000 units of ArtemiC(TM) By AMC.

Positive Pre-clinical Trial Results for CimetrA(R)

On 14 August 2023 MGC announced positive pre-clinical trial

results from the completed Pre-clinical Chronic Toxicology

Evaluation of 14 days oral dose of CimetrA(R).

The recently completed study was undertaken on 32 domestic

swine, that received a study treatment (three dosages groups of

CimetrA(R) and Placebo) for 14 days. During this period, the

clinical parameters were recorded, blood (hematology, coagulation

and chemistry) and urine tests were collected and sent to the

histopathological evaluation.

The study demonstrated that following the full chronic safety

and toxicology analysis of CimetrA(R) in large animals - the drug

was found to be safe. The histopathological analysis of the full

organs spectrum demonstrated all tissues of all animals were normal

and unaffected. It was concluded that the test article at the

dosage administered did not induce toxicological changes. No

changes in the blood and urine samples were reported.

The study was performed under animal EC approval in the GLP

certified Lab Science in Action, Ness Ziona, Israel, and is an

important step in the Investigational New Drug ("IND") submission

preparation for the US Food and Drug Administration ("FDA"). The

study was designed and managed according to industry guidelines and

the IND submission is planned for Q1 2024.

MGC Welcomes Australia's Reclassification of Psychedelic

Compounds

During the quarter, MGC welcomed new regulation in Australia to

prescribe psychedelics to patients with depression or

post-traumatic stress disorder (PTSD). Effective from 1st July

2023, MDMA and Psilocybin were reclassified as medicines for some

complex mental health conditions. Authorities in Australia placed

the two drugs on the list of approved medicines by the Therapeutic

Goods Administration, allowing patients suffering from depression

and PTSD to access them under the care of authorised Australian

physicians.

Following the latest regulatory advancements, MGC is able to

position itself as a key player in pioneering psychedelic research

and development and as a result, the Company can now offer

accurate, pharmaceutical-grade products. MGC will look to expand

sales in Australia through the Company's existing channels to

provide Psilocybin to those in need of treatment.

MGC Pharma Received Permission to Import Psilocybin

On 31 July 2023 MGC announced they had been granted its first

import permit of Psilocybin Raw Mushroom material to its Slovenian

research facility from Psyence Group Inc's (Psyence) Southern

Africa production site as part of the raw material transfer

agreement (transfer agreement) signed between the two

companies.

Under the transfer agreement, MGC Pharma will perform an

analysis on the materials with a view to assist Psyence in the

development of new psilocybin products to take to market, through

its GMP-certified research facility in Slovenia that was recently

approved for psilocybin compounding.

September Quarter Sales Update

September Quarter Sales Update MGC Pharma revenue in the June

quarter were in line with the quarterly average sales.

Activities Post Quarter End

The Company held a general meeting on 25 October 2023. The

subsequent approval of all resolutions has allowed MGC to conduct a

consolidation of the Company's capital on a 1,000:1 basis as well

as provide approval for a capital raise to give the company

sufficient funding for the following 12 months. Additionally, the

Company will hold its annual general meeting on 30 November

2023.

Corporate and Commercial News

Funding and Cashflow Reporting

During the quarter, the Company conditionally raised GBP0.65

million (A$1.24 million) (before expenses) by way of a placing and

subscription of 541,666,667 new ordinary shares of no-par value

(Ordinary Shares) in the capital of the Company (Fundraising

Shares) at a price of 0.12 pence (0.23 cents) per Fundraising Share

("Issue Price"). The Company also agreed to issue one free

attaching option exercisable at 0.12 pence (0.23 cents) with an

expiry date of 14 July 2026 for every one Fundraising Share

subscribed for under the Placement and Subscription.

Additionally, the Company launched a Share Purchase Plan to its

Australian shareholders to raise up to $2,685,728. The Company

received applications from eligible shareholders totalling

A$834,000 to subscribe for 362,608,570 new fully paid ordinary

shares in the capital of the Company at A$0.0023 (0.23 cents) per

Share, with A$1,851,728 to be placed under a Shortfall Offer.

Subject to shareholder approval to be sought at the Company's

upcoming general meeting on 5 September 2023, applicants will

receive one free attaching option exercisable at A$0.003 (0.3

cents) each on or before 31 July 2026 (Options) for every two (2)

Shares subscribed for under the SPP, being 181,304,269 Options.

At the end of the September, the Company has A$417k of cash on

hand.

Accompanying this Activity Report is a Cash Flow Report for the

Quarter ending 30 September 2023.

In accordance with ASX Listing Rule 4.7C.3 the Company advises

that during the September 2023 quarter, payments to related parties

totalled A$129k, which consisted of fees paid to executive and

non-executive directors of the Company.

As detailed in the accompanying Appendix 4C (Quarterly Cashflow

Report), cashflows during the quarter included A$285k cash outflows

associated with inventory production, A$1.015 million for

administration costs (including product registration costs), and

cash inflows of A$2.5m including funding received from the

Placement conducted in July and the Share Purchase Plan in

August.

Personnel Changes

On 28 July 2023 Mr Arron Canicais resigned as Joint Company

Secretary, with Mr Rowan Harland remaining as the sole Company

Secretary. The Company thanked Mr Canicais for his contributions to

the Company and wished him the very best for the next stage of his

career.

Change of Registry Address

In accordance with ASX Listing Rule 3.15.1 and effect from

Monday, 18 September 2023, the Perth office of Computershare

Investor Services Pty Limited moved to Level 17, 221 St Georges

Terrace, Perth WA 6000.

Telephone numbers and postal address remained unchanged.

Lodgement of documentation by member organisations, securityholders

and other parties must be made at the new address.

-S-

Authorised for release by the board of directors, for further

information please contact:

MGC Pharmaceuticals Ltd MGC Pharmaceuticals Ltd

Roby Zomer Rowan Harland

CEO & Managing Director Company Secretary

+61 8 6555 2950 +61 8 6555 2950

info@mgcpharma.co.uk info@mgcpharma.co.uk

UK IR/PR Advisers UK Brokers

IFC Advisory Oberon Capital

Graham Herring / Tim Metcalfe Aimee McCusker / Adam Pollock

/ Zach Cohen +44 203 179 5300

+44 203 934 6630 aimeemccusker@oberoninvestments.com

mgcpharma@investor-focus.co.uk adampollock@oberoninvestments.com

About MGC Pharma

MGC Pharmaceuticals Ltd (LSE: MXC, ASX: MXC) is a European based

pharmaceutical company, focused on developing and supplying

accessible and ethically produced medicines, combining in-house

research with innovative technologies, with the goal of finding or

producing treatments for unmet medical conditions.

The Company's founders and executives are key figures in the

global pharmaceuticals industry and the core business strategy is

to develop and supply innovative medicines.

MGC Pharma has a robust development pipeline targeting two

widespread medical conditions and has further products under

development.

MGC Pharma has partnered with renowned institutions and academia

to optimise the development of targeted medicines, to be produced

in the Company's EU-GMP Certified manufacturing facilities.

MGC Pharma has a growing patient base in Australia, the UK,

Brazil and Ireland and has a global distribution footprint via an

extensive network of commercial partners meaning that it is poised

to supply the global market.

Follow us through our social media channels:

LinkedIn: MGC Pharmaceuticals Ltd.

Twitter: @MGC_Pharma

Facebook: @mgcpharmaceuticals

Instagram: @mgc_pharma

Appendix 4C

Quarterly cash flow report for entities

subject to Listing Rule 4.7B

Name of entity

------------------------------------------------------

MGC PHARMACEUTICALS LTD

ABN Quarter ended ("current quarter")

---------------- ----------------------------------

30 116 800 269 30 September 2023

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows $A'000 (3 months)

$A'000

1. Cash flows from operating

activities

------------------------------------------- ----------------------------- ---------------

1.1 Receipts from customers 511 511

1.2 Payments for

(a) research and development (97) (97)

(b) product manufacturing -

and operating costs

i) cost of sales / inventory (285) (285)

ii) operating costs - -

(c) advertising and marketing (118) (118)

(d) leased assets - -

(e) staff costs (1,375) (1,375)

(f) administration and corporate

costs (including product registrations) (1,015) (1,015)

1.3 Dividends received (see note - -

3)

1.4 Interest received - -

1.5 Interest and other costs of - -

finance paid

1.6 Income taxes paid - -

Government grants and tax

1.7 incentives 2 2

1.8 Other (GST/VAT refund) - -

------------------------------------------- ----------------------------- ---------------

Net cash from / (used in)

1.9 operating activities (2,377) (2,377)

------------------------------------------- ----------------------------- ---------------

2. Cash flows from investing

activities

----------------------------------------- ----------------------------- ---------------

2.1 Payments to acquire: - -

(a) entities - -

(b) businesses - -

(c) property, plant and equipment (14) (14)

(d) investments - -

(e) intellectual property - -

(f) other non-current assets - -

2.2 Proceeds from disposal of:

(a) entities - -

(b) businesses - -

(c) property, plant and equipment - -

(d) investments - -

(e) intellectual property - -

- -

(f) other non-current assets

2.3 Cash flows from loans to - -

other entities

2.4 Dividends received (see note - -

3)

2.5 Other (cash acquired through - -

assets acquisition)

----------------------------------------- ----------------------------- ---------------

Net cash from / (used in)

2.6 investing activities (14) (14)

----------------------------------------- ----------------------------- ---------------

3. Cash flows from financing

activities

----------------------------------------- ----------------------------- ---------------

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) 1,986 1,986

3.2 Proceeds from issue of convertible - -

debt securities

3.3 Proceeds from exercise of - -

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities (210) (210)

3.5 Proceeds from borrowings 777 777

3.6 Repayment of borrowings - -

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

3.9 Other (loan entity which - -

where control was gained

after quarter-end)

----------------------------------------- ----------------------------- ---------------

Net cash from / (used in)

3.10 financing activities 2,553 2,553

----------------------------------------- ----------------------------- ---------------

4. Net increase / (decrease) Current quarter Year to date

in cash and cash equivalents (3 months)

for the period

$A'000 $A'000

------------------------------- ----------------- --------------

Cash and cash equivalents

4.1 at beginning of period 259 259

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (2,377) (2,377)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (14) (14)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) 2,553 2,553

Effect of movement in exchange

4.5 rates on cash held (4) (4)

------------------------------- ----------------- --------------

Cash and cash equivalents

4.6 at end of quarter 417 417

------------------------------- ----------------- --------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 391 233

5.2 Call deposits 26 26

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

----------------------------------- ---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 417 259

----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 129

6.2 Aggregate amount of payments to related -

parties and their associates included in

item 2

------------------------------------------- ----------------

Note: if any amounts are shown in items 6.1 or 6.2, your

quarterly activity report must include a description of,

and an explanation for, such payments.

-------------------------------------------------------------------

The payments in 6.1 are payments to directors of the company for

their service during the quarter and to related party Graft

Polymer.

7. Financing facilities available Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity.

Add notes as necessary for

an understanding of the sources

of finance available to the

entity.

7.1 Loan facilities - -

7.2 Credit standby arrangements - -

7.3 Other (please specify) 14,600 6,948

7.4 Total financing facilities 14,600 6,948

--------------------------------- ------------------- ----------------

Unused financing facilities

available at quarter

7.5 end - 7,652

--------------------------------- ------------------- ----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

------------------------------------------------------------------------

$14.6M Convertible note facility with Mercer Street Opportunity

Fund LLC. Refer to ASX announcement on 29 July 2022 for further

information.

8. Estimated cash available for future $A'000

operating activities

Net cash from / (used in) operating

8.1 activities (Item 1.9) (2,377)

Cash and cash equivalents at quarter

8.2 end (Item 4.6) 417

Unused finance facilities available

8.3 at quarter end (Item 7.5) 7,652

Total available funding (Item 8.2

8.4 + Item 8.3) 8,069

------------------------------------------------------- ----------

Estimated quarters of funding available

8.5 (Item 8.4 divided by Item 8.1) 3.4

------------------------------------------------------- ----------

Note: if the entity has reported positive net operating

cash flows in item 1.9, answer item 8.5 as "N/A". Otherwise,

a figure for the estimated quarters of funding available

must be included in item 8.5.

-------------------------------------------------------------------

8.6 If Item 8.5 is less than 2 quarters, please provide answers

to the following questions:

-------------------------------------------------------------------

1. Does the entity expect that it will continue to have

the current level of net operating cash flows for the

time being and, if not, why not?

Answer: N/A

-------------------------------------------------------------------

2. Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

Answer: N/A

-------------------------------------------------------------------

3. Does the entity expect to be able to continue its operations

and to meet its business objectives and, if so, on what

basis?

Answer: N/A

-------------------------------------------------------------------

Note: where item 8.5 is less than 2 quarters, all of

questions 8.6.1, 8.6.2 and 8.6.3 above must be answered.

-------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

27 October 2023

Date:

...................................................................................

[lodge electronically without signature]

Authorised by:

...................................................................................

Roby Zomer - Managing Director

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standard applies to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAXEEDFLDFEA

(END) Dow Jones Newswires

October 30, 2023 03:16 ET (07:16 GMT)

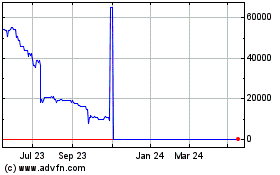

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Mgc Pharmaceuticals (LSE:MXC)

Historical Stock Chart

From Feb 2024 to Feb 2025