TIDMMDZ

("MediaZest", the "Company" or "Group"; AIM: MDZ)

Unaudited results for the six months ended 30 September 2018

MediaZest, the creative audio-visual company, is pleased to provide

shareholders with unaudited interim results for the six months ended 30

September 2018.

CHAIRMAN'S STATEMENT

Introduction

The Board presents the consolidated unaudited results for the six months ended

30 September 2018 for MediaZest plc and its wholly owned subsidiary company

MediaZest International Ltd (together the "Group").

Financial Review

* Revenue for the period was GBP1,819,000, up 36% (2017: GBP1,339,000).

* Gross profit was GBP932,000, up 45% (2017: GBP643,000).

* Gross margins improved to 51% (2017: 48%).

* EBITDA was a profit of GBP156,000 (2017: loss GBP87,000).

* Net profit for the period after taxation of GBP90,000 (2017: loss of GBP

149,000).

* The basic and fully diluted earnings per share was 0.0001 pence (2017: loss

per share 0.01 pence).

* Cash in hand at period end was GBP12,000 (2017: GBP103,000), although following

period end additional monies were received/are expected shortly from a

material overdue debtor.

Operational Review

Results for the six months to 30 September 2018 were considerably better than

for the comparable prior period with improvement in both revenue and

profitability. The Group reported a net profit after tax and at the EBITDA

level for the first time.

Revenue improved by GBP480,000 reflecting prestigious projects for clients

including HP, the European Bank for Reconstruction and Development (EBRD),

Ford, Mitsubishi, Kuoni, Ted Baker and Tiffany & Co. Revenues for three of

these projects included amounts delayed from the previous period, although in

addition the six months also showed growth in client business outside those

mentioned above, with several roll out opportunities beginning to develop.

Recurring revenues also continued to grow in the period and the current run

rate for these is over GBP700,000 per annum (2017: approximately GBP600,000). The

Board is targeting a run rate of GBP800,000 worth of recurring revenues by the

end of the financial year, which would cover almost 50% of the cost base.

Profit margins were enhanced by the growth in the recurring revenues generated

by the Company. The Board continues to view this as an important focal point

which enables management to have greater clarity on future revenues and to plan

operational capabilities from a position of strength. This wider focus on

managed services instead of on low margin hardware supply continues to reap

benefits, both in gross margin percentage and market positioning.

Administrative costs remained largely unchanged with reduced amortisation and

depreciation costs being offset by a small increase in engineering resources to

meet the additional workload generated by recurring contract growth. The

Company continues to run a very lean team of dedicated in house staff with

resources maximised to meet client and stakeholder demands.

Financing

The statement of financial position was improved by way of a reduction in trade

and other payables, whilst financial liabilities have been maintained at a

consistent level to the prior period. Cash in hand was, however, lower than the

comparable prior year due to late receipts from one client of EUR130,000 which

was overdue at the period end date. The majority of this money has now been

received and the balance is expected shortly. No bad debt provision is

required, however the delay in payment has adversely affected cashflow during

the period and the closing cash balance. Despite this late payment, and the

growth in Revenue, trade debtors have remained consistent with the prior

period.

Corporate Governance

The Company adopted the QCA Corporate Governance code in September 2018 and has

strengthened the Board by adding James Abdool as a non-executive director.

Outlook

As highlighted in previous statements, the Group is having considerable success

with overseas deployments, primarily in Europe, but also on a global basis.

Clients such as HP, Ted Baker, Nokia, Lululemon and Opel have all engaged the

Group's services outside of the UK in the six month period, representing

approximately 30% of gross profit.

The Group continues to target these opportunities, particularly during a time

when the domestic UK retail market is under pressure, leading to uncertainty,

which can result in the postponement of or delay in retail investment from some

UK participants. Notwithstanding, the Group is developing, currently, several

roll out / substantial deployment opportunities which would enable the Company

to show further progress both in the current and future reporting periods.

Lance O'Neill

Chairman

5 November 2018

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2018

Unaudited Unaudited Audited

Six months Six months 12 months

Notes 30-Sep-18 30-Sep-17 31-Mar-18

GBP'000 GBP'000 GBP'000

Continuing Operations

Revenue 1,819 1,339 2,819

Cost of sales (887) (696) (1,458)

------------ ------------ ------------

Gross profit 932 643 1,361

Administrative expenses (776) (730) (1,474)

------------ ------------ ------------

EBITDA 156 (87) (113)

Administrative expenses - depreciation & (10) (28) (41)

amortisation

------------ ------------ ------------

Operating Profit/(Loss) 146 (115) (154)

Finance Costs (56) (34) (102)

------------ ------------ ------------

Profit/(Loss) before taxation 90 (149) (256)

Taxation - - -

======== ======== ========

Profit/(Loss) for the period and total 90 (149) (256)

comprehensive income/loss for the period

attributable to the owners of the parent ======== ======== ========

Earnings/(Loss) per ordinary 0.1p share

Basic 2 0.0001p (0.01p) (0.02p)

Diluted 2 0.0001p (0.01p) (0.02p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2018

Unaudited Unaudited Audited

As at 30-Sep-18 As at 30-Sep-17 As at 31-Mar-18

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 2,772 2,772 2,772

Property, plant and equipment 58 43 51

Intellectual property 2 5 3

------------ ------------ ------------

Total non-current assets 2,832 2,820 2,826

Current assets

Inventories 97 92 217

Trade and other receivables 596 585 897

Cash and cash equivalents 12 103 38

------------ ------------ ------------

Total current assets 705 780 1,152

Current liabilities

Trade and other payables (1,175) (1,284) (1,664)

Financial liabilities (434) (447) (471)

------------ ------------ ------------

Total current liabilities (1,609) (1,731) (2,135)

Net current liabilities (904) (951) (983)

Non-current liabilities

Financial liabilities (17) (11) (22)

------------ ------------ ------------

Total non-current liabilities (17) (11) (22)

======== ======== ========

Net assets 1,911 1,858 1,821

======== ======== ========

Equity

Share Capital 3,546 3,499 3,546

Share premium account 5,244 5,221 5,244

Other reserves 146 146 146

Retained earnings (7,025) (7,008) (7,115)

======== ======== ========

Total equity 1,911 1,858 1,821

======== ======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2018

Share Share Share Options Retained Total

Capital Premium Reserves Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March 2017 3,499 5,221 146 (6,859) 2,007

Loss for the period - - - (149) (149)

----------- ------------ ------------------ ------------ ------------

Total comprehensive loss for - - - (149) (149)

the period

======= ======= ======== ======= =======

Balance at 30 September 2017 3,499 5,221 146 (7,008) 1,858

======= ======= ======== ======= =======

Loss for the period - - - (107) (107)

------------ ------------ ------------------ ------------ ------------

Total comprehensive loss for - - - (107) (107)

the period

Issue of share capital 47 24 - - 71

Share issue costs - (1) - - (1)

======= ======== ========= ======= =======

Balance at 31 March 2018 3,546 5,244 146 (7,115) 1,821

======= ======== ========= ======= =======

Profit for the period - - - 90 90

------------ ------------- ---------------- ------------ -----------

Total comprehensive income for - - - 90 90

the period

======= ======== ========= ======= =======

Balance at 30 September 2018 3,546 5,244 146 (7,025) 1,911

======= ======== ========= ======= =======

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2018

Unaudited Unaudited Audited

Six months Six months 12 months

Note 30-Sep-18 30-Sep-17 31-Mar-18

GBP'000 GBP'000 GBP'000

Net cash generated from/(used in) operating 3 143 (195) (434)

activities

Taxation - - -

Cash flows used in investing activities

Purchase of plant and machinery (13) (10) (5)

Purchase of intellectual property - (2) (2)

Purchase of leasehold improvements (3) - -

---------- ---------- ----------

Net cash used in investing activities (16) (12) (7)

Cash flow from financing activities

Other loan repayments (13) (10) (40)

Shareholder loan receipts - 32 233

Shareholder loan repayments (68) - (213)

Interest paid (17) (40) (54)

Proceeds of share issue - - 70

---------- ---------- ----------

Net cash used in financing activities (98) (18) (4)

---------- --------- ----------

Net increase/(decrease) in cash and cash 29 (225) (445)

equivalents

---------- ---------- ----------

Cash and cash equivalents at beginning of (353) 92 92

period / year

======= ======= =======

Cash and cash equivalents at end of period / 4 (324) (133) (353)

year

======= ======= =======

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The Group's annual financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted for use in the EU

applied in accordance with the provisions of the Companies Act 2006 applicable

to companies preparing financial statements under IFRS.

Accordingly, the consolidated half-yearly financial information in this report

has been prepared using accounting policies consistent with IFRS. IFRS is

subject to amendment and interpretation by the International Accounting

Standards Board (IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the European Commission. The

financial information has been prepared on the basis of IFRS that the Directors

expect to be applicable as at 31 March 2019.

The Board has considered the impact of IFRS9 and IFRS15 when drawing up these

financial statements, and deems no adjustments necessary.

This interim report does not comply with IAS 34 "Interim Financial Reporting"

(as adopted by the European Union), as permissible under the AIM Rules for

Companies.

Going Concern

The Directors have considered financial projections based upon known future

invoicing, existing contracts, pipeline of new business and the number of

opportunities it is currently working on, particularly in the Retail sector. In

addition, these forecasts have been considered in the light of the ongoing

challenges in the global economy, previous experience of the markets in which

the Group operates and the seasonal nature of those markets, as well as the

likely impact of ongoing reductions to public sector spending. These forecasts

indicate that the Group will generate sufficient cash resources to meet its

liabilities as they fall due over the next 12 month period from the date of

this interim announcement.

As a result the Directors consider that it is appropriate to draw up the

financial information on a going concern basis. Accordingly, no adjustments

have been made to reflect any write downs or provisions that would be necessary

should the Group prove not to be a going concern, including further provisions

for impairment to goodwill and investments in Group companies.

Non-statutory accounts

The financial information contained in this document does not constitute

statutory accounts within the meaning of Section 434 of the Companies Act 2006

("the Act").

The statutory accounts for the year ended 31 March 2018 have been filed with

the Registrar of Companies. The report of the auditors on those statutory

accounts was unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under Section 498(2) or (3) of the

Act. The financial information for the six months ended 30 September 2018 and

30 September 2017 is not audited.

2. Earnings per share

Basic earnings per share is calculated by dividing the profit attributed to

ordinary shareholders of GBP90,000 (2017: loss of GBP149,000) by the weighted

average number of shares during the period of 1,286,425,774 (2017:

1,239,757,641). The diluted earnings per share is identical to that used for

basic earnings per share as the warrants or share options are anti-dilutive.

3. Cash generated from/(used

in) operations

Unaudited Unaudited Audited

Six months Six months 12 months

30-Sep-18 30-Sep-17 31-Mar-18

GBP'000 GBP'000 GBP'000

Operating profit / (loss) 146 (115) (256)

Depreciation of tangible assets 9 18 -

Finance Costs 56 34 102

Amortisation of intangible assets 1 10 41

Decrease / (increase) in inventories 118 (23) (148)

(Decrease) / increase in payables (488) 223 481

Decrease / (increase) in receivables 301 (342) (654)

======== ======== ========

Net cash outflow from operating activities 143 (195) (434)

======== ======== ========

4. Cash and cash equivalents

Unaudited Unaudited Audited

Six months Six months 12 months

30-Sep-18 30-Sep-17 31-Mar-18

GBP'000 GBP'000 GBP'000

Cash held at bank 12 103 38

Invoice discounting facility (336) (236) (391)

======== ======== ========

(324) (133) (353)

======== ======== ========

5. Subsequent events

GBP47,000 of cash was received from a major client post 30 September 2018 in

payment of long-overdue invoices. Another payment of GBP53,000 is expected from

the same client in early November relating to further invoices currently over

due by 120 days or more. Had this cash been received within payment terms, the

bank balance at 30 September 2018 would have been significantly improved.

6. Distribution of the

Half-Yearly Report

Copies of the Half-yearly Report will be available to the public from the

Company's website, www.mediazest.com, and from the Company Secretary at the

Company's registered address at Unit 9, Woking Business Park, Albert Drive,

Woking, Surrey, GU21 5JY.

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) 596/2014.

Enquiries:

Geoff Robertson

Chief Executive Officer

MediaZest Plc 0845 207 9378

David Hignell / Edward Hutton

Nominated Adviser

Northland Capital Partners Limited 020 3861 6625

Claire Noyce

Broker

Hybridan LLP 020 3764 2341

END

(END) Dow Jones Newswires

November 05, 2018 02:00 ET (07:00 GMT)

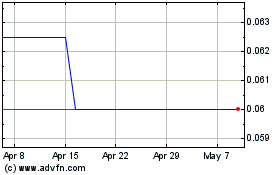

Mediazest (LSE:MDZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mediazest (LSE:MDZ)

Historical Stock Chart

From Apr 2023 to Apr 2024