TIDMMCM

RNS Number : 2480U

MC Mining Limited

29 July 2022

ANNOUNCEMENT 29 July 2022

ACTIVITIES REPORT FOR THE QUARTERED 30 JUNE 2022

FOR

MC Mining Limited (" MC Mining" or the "Company")

and its subsidiary companies

HIGHLIGHTS

Operations

-- Health and safety remain a top priority and no lost-time

injuries (LTIs) were recorded during the quarter (FY2022 Q3: three

LTIs);

-- Measures previously implemented to restrict the spread of the

COVID-19 virus at the various group workplaces remain in place

pending formal confirmation of the relaxation of requirements by

the relevant regulatory authorities. During the quarter, one

employee (FY2022 Q3: one employee) at the high grade Uitkomst

metallurgical and thermal coal mine (Uitkomst Colliery or Uitkomst)

contracted the virus;

-- Run-of-mine (ROM) coal production at Uitkomst was 7% lower

than the June 2021 quarter at 119,005 tonnes (t) (FY2021 Q4:

127,927t);

-- 22,169t (FY2021 Q4: 0t) of coal were at the Durban port at

the end of June 2022 for exporting in July/August 2022 on the terms

of the Coal Sales & Marketing Agreement (Marketing Agreement)

with Overlooked (Proprietary) Limited (Overlooked), announced by

the Company on 28 July 2022;

-- The Company recorded 34,126t of coal sales during the quarter

(FY2021 Q4: 90,858t), comprising 28,360t (FY2021 Q4: 84,834t) of

high grade metallurgical and thermal coal and 5,766t (FY2021 Q4:

6,024t) of lower grade middlings coal;

-- Revenue per tonne decreased to $80/t (FY2021 Q4: $85/t) with

high quality coal stockpiled for sales into the forecasted higher

pricing API4 market, achievable through the Marketing Agreement in

the September quarter (product stockpiles at site: FY2022 Q4:

15,534t vs. FY2021 Q4: 4,553t);

-- The Integrated Water Use Licence (IWUL) applications were

granted by the Department of Water & Sanitation (DWS) for the

Uitkomst Colliery and nearby Wykom siding were granted in April

2022;

-- Completion of the Makhado hard coking coal project (Makhado

Project or Makhado) Bankable Feasibility Study (BFS) 'base case'

scenario confirming the project's robust economic fundamentals, a

key input in the due diligence process for potential funders;

and

-- Limited activities undertaken at the Company's Vele semi-soft

coking and thermal coal colliery (Vele Colliery or Vele) and

Greater Soutpansberg Projects (GSP), which remains on care and

maintenance.

Corporate

-- Appointment of Mr Nhlanhla Nene as Non-Executive Director and Chairman of MC Mining;

-- Appointment of Mr Godfrey Gomwe as Managing Director and

Chief Executive Officer (CEO) of the Company and resignation of Sam

Randazzo as director and interim CEO;

-- Appointment of Mr Matthews Senosi of Senosi Group Investment

Holdings Pty Ltd (SGIH) (the Company's 19.9% shareholder) as a

Non-Executive Director of the Company;

-- Issue of 38,363,909 new ordinary shares in the capital of the

Company (Ordinary Shares) to SGIH under the terms of the

Convertible Advance and Subscription Agreement (the Agreement),

raising ZAR46 million and resulting in SGIH owning 19.9% of the

Company;

-- Completion of an independent fair and reasonableness report

by BDO Corporate Finance (WA) Pty Ltd in terms of the Agreement for

the issue of an additional 33,333,333 new Ordinary Shares to SGIH,

subject to shareholder approval, for ZAR40 million (approximately

$2.4 million);

-- Securing of a R60 million (approximately $3.5 million)

Standby Loan Facility (the Facility) from Dendocept (Pty) Ltd

(Dendocept), a 1.5% shareholder in MC Mining; and

-- Available cash and facilities at quarter-end of $3.1 million

($3.0 million at 31 March 2022) and restricted cash of $0.03

million.

Events subsequent to the end of the quarter

-- MC Mining shareholders voted against the issue of the

33,333,333 new Ordinary Shares to SGIH and the Company will repay

the R20 million ($1.2 million) already advanced by SGIH prior to

the shareholder meeting, during August 2022; and

-- Marketing Agreement entered into with Overlooked, expiring on

31 December 2022, facilitates the export of at least 20,000t of

API4 coal from Uitkomst on a monthly basis, allowing the Company to

take advantage of international coal prices.

COMMENTARY

MC Mining's flagship Makhado Project's favourable economics were

confirmed in the BFS completed by Minxcon (Pty) Ltd (Minxcon)

during the quarter. The development of Makhado is expected to

deliver positive returns for shareholders and could position the

Company as South Africa's pre-eminent hard coking coal (HCC)

producer. The BFS confirms the project's robust economics and is a

key milestone in the funding process. The Company is progressing

several alternative strategies to raise the required funding with a

target date to conclude the requisite financing during Q3

CY2022

The BFS is based on the project plan with the lowest capital

cost options and results in Makhado's ROM coal being transported to

the Vele Colliery for processing for the entire life of mine. The

project has an estimated capital cost (including contingencies) of

R625 million (approximately $41.7 million), a peak funding

requirement of R727 million (approximately $48.5 million), and is

expected to create an estimated 650 permanent employment positions

(including contractors) when at steady state production. The BFS

confirmed that Makhado has a short expected construction period of

12 months, positioning the project to take advantage of the

short-term forecasted higher global coal prices.

Uitkomst Colliery - Utrecht Coalfields (70% owned)

No LTIs were recorded during the quarter (FY2022 Q3: one

LTI).

The invasion of Ukraine in February 2022 and subsequent

sanctions against Russia exacerbated the global energy shortage

leading to international thermal coal prices attaining record

highs. The increase in coal prices were not accepted by the South

African domestic coal market. As a result of ongoing major

maintenance and the high coal prices, Uitkomst did not receive any

orders during the quarter from its largest customer.

The Company continued its assessment of alternative coal

marketing strategies for Uitkomst during the quarter, including the

trial production of a higher quality, low ash coal for the smaller

but more stable international pulverized coal injection (PCI)

market. However, the continued demand for API4 coal indicated that

this is currently the most lucrative market for Uitkomst's coal and

the colliery concluded the Marketing Agreement in July 2022, with

this route to market secured until December 2022. As a result, the

colliery will sell the majority of its coal at higher international

coal prices rather than floating and fixed price domestic

prices.

The Uitkomst Colliery generated 119,005t of ROM coal during the

quarter, a decline of 7% (Q4 FY2021: 127,929t) resulting from

challenging geological conditions experienced. Sales of high-grade

peas and duff of 28,360t (Q4 FY2021: 84,834t) with sales volumes in

the comparative Q4 FY2021 were augmented by the sale of coal

carried over from the preceding quarter. Uitkomst had 22,169t (Q4

FY2021: 0t) of API4 quality coal at the Durban port at the end of

the quarter, and a further 15,534t (FY2021 Q4: 4,553t) of at the

colliery, compared to 8,373t at the beginning of the quarter. In

addition, the colliery also sold 5,766t of high ash middlings coal

during the quarter (FY2021 Q4: 6,024t).

The average API4 prices for the three months to 30 June 2022

were $315/t compared to $105/t in Q4 FY2021. Uitkomst's sales

include lower value middlings coal as well as sales under fixed

price arrangements and the volumes of these sales were reduced in

July 2022 when the offtakes were renegotiated. The stockpiling of

high grade export coal adversely affected the composition of

Uitkomst's sales mix resulting in revenue per tonne being

marginally higher than the comparative period in South African rand

terms (R1,238/t vs. R1,201/t). However, exchange rate movements

resulted in average revenue per tonne decreasing in US dollar terms

($80/t vs. $85/t in Q4 FY2021). The 67% decline in sales of premium

quality ROM coal products as well as increased maintenance,

particularly underground mining equipment, resulted in production

costs per saleable tonne being higher than the comparative period

(FY2022 Q4: $108/t vs. FY2021 Q4: $57/t) and the decision to

stockpile coal for sale on international markets.

Quarter to end-Jun 2022 Quarter to end-Jun 2021 %

Production volues

Uitkomst ROM (t) 119,005 127,927 (7%)

Inventory volumes

High quality duff and peas at site (t) 15,534 4,553 241%

High quality duff and peas at port (t) 22,169 - 100%

37,703 4,553 728%

Sales tonnages

High quality duff and peas (t) 28,360 84,834 (67%)

Middlings sales (t) 5,766 6,024 (4%)

34,126 90,858 (62%)

Quarter financial metrics

Revenue/t ($) 80 85 (6%)

Revenue/t (ZAR) 1,238 1,201 3%

Production cost/saleable tonnes ($)^ 108 57 91%

---------------------------------------- ------------------------- ------------------------- -------

^ costs are all South African Rand based

Makhado Hard Coking Coal Project - Soutpansberg Coalfield (67%

owned)

The favourable economics of MC Mining's flagship Makhado Project

were confirmed in the BFS completed by Minxcon. The development of

Makhado is expected to deliver positive returns for shareholders

and could position the Company as South Africa's pre-eminent HCC

producer. The Company subsequently mandated Minxcon to expand the

BFS to include alternative development plans to enhance value.

These include, amongst others, the moving of the Vele coal

processing plant (CPP) to Makhado or the construction of a new CPP

at Makhado, and this additional work on the BFS is ongoing. A

further announcement is expected to be made in the coming weeks

.

Vele Semi-Soft Coking and Thermal Coal Colliery - Limpopo (Tuli)

Coalfield (100% owned)

The Vele Colliery remained on care and maintenance during the

quarter and recorded no LTIs during the period (FY2022 Q3: two

LTIs). The base case assessed in the Makhado BFS assumes the Vele

processing plant will be refurbished and recommissioned as part of

the development of the Makhado Project. Depending on the outcome of

the work Minxcon is doing on alternative development plans for

Makhado, the construction of a CPP at Makhado would allow

alternative development opportunities at Vele which the Company is

also investigating.

Greater Soutpansberg Project (GSP) - Soutpansberg Coalfield (74%

owned)

GSP recorded no LTIs (FY2022 Q3: nil) during the quarter and no

reportable activities occurred during the period.

Standby facility

The Company secured a R60 million Standby Facility from

Dendocept and proceeds from this were utilised to enhance the

Makhado BFS, geotechnical and confirmatory drilling programmes at

Makhado, as well as fund group working capital. These funds

assisted the Group during the quarter as inventory levels rose to

cater for volumes required for the export market.

The Facility is guaranteed by MC Mining, is unsecured and is

available for a period of 12 months, to June 2023 . Interest is

paid monthly calculated using the prevailing South African prime

interest rate (currently 9.0%) plus a margin of 3%, similar to that

levied on the current bank financing in the Group. Any outstanding

balance on the final maturity date is payable in cash or

convertible to MC Mining equity at a 15% discount to the prevailing

30-day Volume Weighted Average Price. Payment in MC Mining equity

is at the sole discretion of the Company and is subject to all

required shareholder and regulatory requirements, including South

African exchange control approval.

Appendix 5B - Quarterly Cash Flow Report

The Company's cash balance as at 30 June 2022 was $3.1 million

with available facilities of $0.3 million. The aggregate amount of

payments to related parties and their associates, as disclosed as

item 6.1 of the March quarter Appendix 5B was $106k, comprising

executive director remuneration.

To meet its working capital requirements, the Group is exploring

and progressing several alternative strategies to raise additional

funding including, but not limited to:

-- the issue of new equity for cash in the Company to current

and new shareholders, of which the MC Mining Group has a

demonstrated history of success;

-- the issue of new equity for cash in subsidiary companies which own the Makhado Project;

-- further debt funding;

-- further contractor BOOT (build, own, operate, transfer) funding arrangements; and

-- the sale of a minority stake in the subsidiary companies holding the Makhado Project.

The Group also has the capacity if necessary to reduce its

operating cost structure to minimise its working capital

requirements and defer the timing of any future capital raising.

The conclusion of the debt and equity raise is by its nature an

involved process and is subject to successful negotiations with the

external funders and shareholders. Any equity raise is likely to be

subject to a due diligence process. The Group has a history of

successful capital raisings to meet the Group's funding

requirements.

Godfrey Gomwe

Managing Director and Chief Executive Officer

This announcement has been approved by the Company's Disclosure

Committee.

All figures are in South African rand or United States dollars

unless otherwise stated.

For more information contact:

Tony Bevan Company Secretary Endeavour Corporate Services +61 08 9316 9100

Company advisors:

James Harris / James

Dance Nominated Adviser Strand Hanson Limited +44 20 7409 3494

Rory Scott Broker (AIM) Tennyson Securities +44 20 7186 9031

James Duncan Financial PR (South Africa) R&A Strategic Communications +27 11 880 3924

Investec Bank Limited is the nominated JSE Sponsor

About MC Mining Limited:

MC Mining is an AIM/ASX/JSE-listed coal exploration, development

and mining company operating in South Africa. MC Mining's key

projects include the Uitkomst Colliery (metallurgical and thermal

coal), Makhado Project (hard coking coal), Vele Colliery (semi-soft

coking and thermal coal), and the Greater Soutpansberg Projects

(coking and thermal coal).

All figures are denominated in United States dollars unless

otherwise stated. Safety metrics are compared to the preceding

quarter while financial and operational metrics are measured

against the comparable period in the previous financial year. A

copy of this report is available on the Company's website,

www.mcmining.co.za .

Forward-looking statements

This Announcement, including information included or

incorporated by reference in this Announcement, may contain

"forward-looking statements" concerning MC Mining that are subject

to risks and uncertainties. Generally, the words "will", "may",

"should", "continue", "believes", "expects", "intends",

"anticipates" or similar expressions identify forward-looking

statements. These forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those expressed in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond MC

Mining's ability to control or estimate precisely, such as future

market conditions, changes in regulatory environment and the

behaviour of other market participants. MC Mining cannot give any

assurance that such forward-looking statements will prove to have

been correct. The reader is cautioned not to place undue reliance

on these forward-looking statements. MC Mining assumes no

obligation and does not undertake any obligation to update or

revise publicly any of the forward-looking statements set out

herein, whether as a result of new information, future events or

otherwise, except to the extent legally required.

Statements of intention

Statements of intention are statements of current intentions

only, which may change as new information becomes available or

circumstances change.

Tenements held by MC Mining and its Controlled Entities

Project Name Tenement Number Location Interest Change during quarter

---------------------------- ---------------------------------- ---------------- ---------- ----------------------

Chapudi Project* Albert 686 MS Limpopo 74%

Bergwater 712 MS 74%

Remaining Extent and Portion 2 of

Bergwater 697 MS 74%

Blackstone Edge 705 MS 74%

Remaining Extent & Portion 1 of

Bluebell 480 MS 74%

Remaining Extent & Portion 1 of

Bushy Rise 702 MS 74%

Castle Koppies 652 MS 74%

Chapudi 752 MS 74%

Remaining Extent, Portions 1, 3 &

4 of Coniston 699 MS 74%

Driehoek 631 MS 74%

Remaining Extent of Dorps-rivier

696 MS 74%

Enfield 512 MS (consolidation of

Remaining Extent of Enfield 474

MS, Brosdoorn 682 MS & Remaining

Extent of Grootvlei 684 MS) 74%

Remaining Extent and Portion 1 of 74%

Grootboomen 476 MS 74%

Grootvlei 684 MS 74%

Kalkbult 709 MS 74%

Remaining Extent, Remaining

Extent of Portion 2, Remaining

Extent of Portion 3, Portions 1,

4, 5, 6, 7 & 8 of Kliprivier 692

MS 74%

Remaining Extent of Koodoobult

664 MS 74%

Koschade 657 MS (Was Mapani Kop

656 MS) 74%

Malapchani 659 MS 74%

Mapani Ridge 660 MS 74%

Melrose 469 MS 74%

Middelfontein 683 MS 74%

Mountain View 706 MS 74%

M'tamba Vlei 654 MS 74%

Remaining Extent & Portion 1 of

Pienaar 635 MS 74%

Remaining Extent & Portion 1 of

Prince's Hill 704 MS 74%

Qualipan 655 MS 74%

Queensdale 707 MS 74%

Remaining Extent & Portion 1 of

Ridge End 662 MS 74%

Remaining Extent & Portion 1 of

Rochdale 700 MS 74%

Sandilands 708 MS 74%

Portions 1 & 2 of Sandpan 687 MS 74%

Sandstone Edge 658 MS 74%

Remaining Extent of Portions 2 &

3 of Sterkstroom 689 MS 74%

Sutherland 693 MS 74%

Remaining Extent & Portion 1 of

Varkfontein 671 MS 74%

Remaining Extent, Portion 2,

Remaining Extent of Portion 1 of

Vastval 477 MS 74%

Vleifontein 691 MS 74%

Ptn 3, 4, 5 & 6 of Waterpoort 695

MS 74%

Wildebeesthoek 661 MS 74%

Woodlands 701 MS 74%

---------------------------------- --------------------------------------------- ---------- ----------------------

Kanowna West & Kalbara M27/41 Coolgardie^ Royalty<>

----------------

M27/47 Royalty<>

----------------

M27/59 Royalty<>

M27/72,27/73 Royalty<>

M27/114 Royalty<>

M27/196 Royalty<>

M27/181 6.79%

M27/414,27/415 Royalty<>

P27/1826-1829 Royalty<>

P27/1830-1842 Royalty<>

P27/1887 Royalty<>

---------------------------- ---------------------------------- ---------------- ---------- ----------------------

Abbotshall Royalty ML63/409,410 Norseman^ Royalty

---------------------------- ---------------------------------- ---------------- ---------- ----------------------

Kookynie Royalty ML40/061 Leonora^ Royalty

----------------------------

ML40/135,136 Royalty

---------------------------- ---------------------------------- ---------------- ---------- ----------------------

Makhado Project Fripp 645 MS Limpopo 67%(#)

Lukin 643 MS 67%(#)

Mutamba 668 MS 67%(#)

Salaita 188 MT 67%(#)

Tanga 849 MS 67%(#)

Daru 889 MS 67%(#)

Windhoek 900 MS 67%(#)

Generaal Project* Beck 568 MS Limpopo 74%

Bekaf 650 MS 74%

Remaining Extent & Portion 1 of

Boas 642 MS- 74%

Chase 576 MS 74%

Coen Britz 646 MS 74%

Fanie 578 MS 74%

Portions 1, 2 and Remaining

Extent of Generaal 587 MS 74%

Joffre 584 MS 74%

Juliana 647 MS 74%

Kleinenberg 636 MS 74%

Remaining Extent of Maseri Pan

520 MS 74%

Remaining Extent and Portion 2 of

Mount Stuart 153 MT 100%

Nakab 184 MT 100%

Phantom 640 MS 74%

Riet 182 MT 100%

Rissik 637 MS 100%

Schuitdrift 179 MT 100%

Septimus 156 MT 100%

Solitude 111 MT 74%

Stayt 183 MT 100%

Remaining Extent & Portion 1 of

Terblanche 155 MT 100%

Van Deventer 641 MS 74%

Wildgoose 577 MS 74%

---------------------------------- --------------------------------------------- ---------- ----------------------

Mopane Project* Ancaster 501 MS Limpopo 100%

Banff 502 MS 74%

Bierman 599 MS 74%

Cavan 508 MS 100%

Cohen 591 MS 100%

Remaining Extent, Portions 1 & 2

of Delft 499 MS 74%

Dreyer 526 MS 74%

Remaining Extent of Du Toit 563

MS 74%

Faure 562 MS 74%

Remaining Extent and Portion 1 of

Goosen 530 MS 74%

Hermanus 533 MS 74%

Jutland 536 MS 100%

Krige 495 MS 74%

Mons 557 MS 100%

Remaining Extent of Otto 560 MS

(Now Honeymoon) 74%

Remaining Extent & Portion 1 of

Pretorius 531 MS 74%

Schalk 542 MS 74%

Stubbs 558 MS 100%

Ursa Minor 551 MS 74%

Van Heerden 519 MS 74%

Portions 1, 3, 4, 5, 6, 7, 8, 9,

Remaining Extent of Portion 10,

Portions 13, 14, 15, 16,

17, 18, 19, 20, 21, 22, 23, 24,

26, 27, 29, 30, 35, 36, 37, 38,

39, 40, 41, 44, 45, 46, 48,

49, 50, 51, 52 & 54 of Vera 815

MS 74%

Remaining Extent of Verdun 535 MS 74%

Voorburg 503 MS 100%

Scheveningen 500 MS 74%

Uitkomst Colliery and Portion 3 (of 2) of Kweekspruit

prospects No. 22 KwaZulu-Natal 70%

Portion 8 (of 1) of Kweekspruit

No. 22 70%

Remainder of Portion 1 of

Uitkomst No. 95 70%

Portion 5 (of 2) of Uitkomst No.

95 70%

Remainder Portion1 of Vaalbank

No. 103 70%

Portion 4 (of 1) of Vaalbank No.

103 70%

Portion 5 (of 1) of Vaalbank No.

103 70%

Remainder of Portion 1 of

Rustverwacht No. 151 70%

Remainder of Portion 2 of

Rustverwacht No. 151 70%

Remainder of Portion 3 (of 1) of

Rustverwacht No. 151 70%

Portion 4 (of 1) Rustverwacht

No.151 70%

Portion 5 (of 1) Rustverwacht No.

151 70%

Remainder of Portion 6 (of 1) of

Rustverwacht No. 151 70%

Portion 7 (of 1) of Rustverwacht

No. 151 70%

Portion 8 (of 2) of Rustverwacht

No. 151 70%

Remainder of Portion 9 (of 2) of

Rustverwacht No. 151 70%

Portion 11 (of 6) of Rustverwacht

No. 151 70%

Portion 12 (of 9) of Rustverwacht

No. 151 70%

Portion 13 (of 2) of Rustverwacht

No. 151 70%

Portion 14 (of 2) of Rustverwacht

No. 151 70%

Portion 15 (of 3) of Rustverwacht

No. 151 70%

Portion 16 (of 3) of Rustverwacht

No. 151 70%

Portion 17 (of 2) of Rustverwacht

No. 151 70%

Portion 18 (of 3) of Waterval No.

157 70%

Remainder of Portion 1 of

Klipspruit No. 178 70%

Remainder of Portion 4 of

Klipspruit No. 178 70%

Remainder of Portion 5 of

Klipspruit No. 178 70%

Portion 6 of Klipspruit No. 178 70%

Portion 7 (of 1) of Klipspruit

No. 178 70%

Portion 8 (of 1 )of Klipspruit

No. 178 70%

Portion 9 of Klipspruit No. 178 70%

Remainder of Portion 10 (of 5) of

Klipspruit No. 178 70%

Portion 11 (of 5) of Klipspruit

No. 178 70%

Portion 13 (of 4) of Klipspruit

No. 178 70%

Remainder of Portion 14 of

Klipspruit No. 178 70%

Portion 16 (of 14) of Klipspruit

No. 178 70%

Portion 18 of Klipspruit No. 178 70%

Portion 23 of Klipspruit No. 178 70%

Remainder of Portion 1 of

Jackalsdraai No. 299 70%

Remainder of Jericho B No. 400 70%

Portion 1 of Jericho B No. 400 70%

Portion 2 of Jericho B No. 400 70%

Portion 3 of Jericho B No. 400 70%

Remainder of Jericho C No. 413 70%

Portion 1 of Jericho C No. 413 70%

Remainder of Portion 1 of Jericho

A No. 414 70%

Remainder of Portion 2 (of 1) of

Jericho A No. 414 70%

Portion 3 (of 1) of Jericho A No.

414 70%

Portion 4 (of 1) of Jericho A No.

414 70%

Portion 5 (of 2) of Jericho A No.

414 70%

Portion 6 (of 1) of Jericho A No.

414 70%

Margin No. 420 70%

Portions of Overvlakte 125 MS

Vele Colliery and (Remaining Extent, 3, 4, 5, 6,

prospects 13, 14) Limpopo 100%

Bergen Op Zoom 124 MS 100%

Semple 155 MS 100%

Voorspoed 836 MS 100%

Alyth 837 MS 100%

---------------------------------- --------------------------------------------- ---------- ----------------------

Certain portions of Unsurveyed

Tshikunda(1) State Land known as Mutale Limpopo 60% (60%)

---------------------------- ---------------------------------- ---------------- ---------- ----------------------

* Form part of the Greater Soutpansberg Projects

Tenement located in the Republic of South Africa

^ Tenement located in Australia

(#) MC Mining's interest will reduce to 67% on completion of the

26% Broad Based Black Economic Empowerment (BBBEE) transaction

<> net smelter royalty of 0.5%

(1) The Tshikunda prospecting right has lapsed

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGIGDRSSDDGDC

(END) Dow Jones Newswires

July 29, 2022 05:00 ET (09:00 GMT)

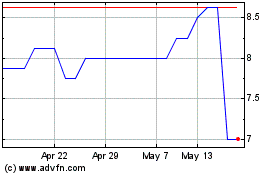

Mc Mining (LSE:MCM)

Historical Stock Chart

From May 2024 to Jun 2024

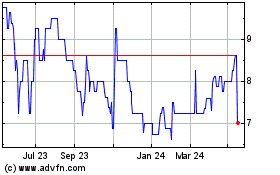

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2023 to Jun 2024