TIDMLWDB

The Law Debenture Corporation p.l.c. and its subsidiaries

HALF YEARLY REPORT FOR THE SIX MONTHS TO 30 JUNE 2012 (unaudited)

The Directors recommend an interim dividend of 4.5p on the ordinary shares for

the six months to 30 June 2012. The report including the unaudited results for

the period was as follows:

Group summary

From its origins in 1889, Law Debenture has diversified to become a group with

a unique range of activities in the financial and professional services

sectors. The group divides into two distinct complementary areas of business.

Investment trust

We are a global investment trust, listed on the London Stock Exchange.

Our portfolio of investments is managed by Henderson Global Investors Limited

under a contract terminable by either side on six months' notice.

Our objective is to achieve long term capital growth in real terms and steadily

increasing income. The aim is to achieve a higher rate of total return than the

FTSE Actuaries All-Share Index through investing in a portfolio diversified

both geographically and by industry.

Independent fiduciary services

We are a leading provider of independent fiduciary services. Our activities are

corporate trusts, treasury and agency solutions, pension trusts, corporate

services (including agent for service of process) whistle blowing services and

board effectiveness services. We have offices in London, Sunderland, New York,

Delaware, Hong Kong, the Channel Islands and the Cayman Islands.

Companies, agencies, organisations and individuals throughout the world rely

upon Law Debenture to carry out its duties with the independence and

professionalism upon which its reputation is built.

Registered office

Fifth Floor

100 Wood Street

London EC2V 7EX

Telephone: 020 7606 5451

Facsimile: 020 7606 0643

Email: enquiries@lawdeb.com

(Registered in England No 30397)

Financial summary

Highlights

30 June 30 June 31 December

2012 2011 2011

Pence Pence Pence

Share price 376.00 372.80 333.50

NAV per share after proposed 348.31 361.86 323.75

dividend

Net revenue return per share:

- Investment trust 4.78 5.03 8.27

- Independent fiduciary services 3.45 3.55 7.25

Group net revenue return per share 8.23 8.58 15.52

Capital return per share 21.22 15.05 (19.07)

Dividends per share 4.50 4.50 13.50

Performance to 30 June 2012

6 months 12 months

% %

Share price total return 1 15.5 4.6

NAV total return 1 8.7 0.1

FTSE All-Share Index total return 3.3 (3.1)

1 Including reinvestment of

dividends

Basis of preparation

The results for the period have been prepared in accordance with International

Financial Reporting Standards (IAS 34 - Interim financial reporting).

There have been no changes to the group's accounting policies during the

period.

Half yearly management report

Performance

Our net asset value total return for the six months to 30 June 2012 was 8.7%,

compared to a total return of 3.3% for the FTSE Actuaries All-Share Index. Net

revenue per share was 8.23p, a decrease of 4.1% over the corresponding period

last year, as a result of a 5.0% decrease in the investment trust and a 2.8%

decrease in independent fiduciary services.

Dividend

The board has declared an interim dividend of 4.5p (2011: 4.5p). The dividend

will be paid on 13 September 2012 to holders on the record date of 10 August

2012. The current expectation of the directors is that the final dividend will

be maintained.

Investment trust

Equity markets have been volatile but ultimately changed little during the

first six months of the year. The debate still rages between investors who

focus on the macro economic worries and those who look at the reasonable

valuations of companies that are producing good results.

In these market conditions, there are opportunities to be taken. Among the best

relative contributors to the portfolio in the first six months of the year were

two technology based companies, IP Group and BTG. Part of the attraction for

investors in these stocks is that they are not closely connected with the

economic cycle. It has been stocks that are perceived to have cyclical risk

that have detracted from performance. Weir Group would be an example.

Good industrial companies producing competitive products will come through the

economic turbulence. Global trade is set to keep growing in spite of a slowing

in world economic growth and the strong companies will benefit.

Outlook

Dividend cover in the stocks held in the portfolio is at historically high

levels and further dividend growth is anticipated. The gearing in the companies

is low as they continue to be cash generative. We are not using gearing in the

investment trust as uncertainties about the Eurozone and debt problems continue

to persist. The resolution of these difficulties is not in sight. However, when

appropriate, we will consider increasing our exposure to equities.

Independent fiduciary services

Revenues, net of cost of sales, which represent legal costs recharged to

clients, increased by 2.0% and while costs continued to be tightly controlled,

profit before taxation decreased by 0.2%. New appointments in financial

wholesale markets remain at relatively low levels with no sign of any

improvement in the corporate bond and securitisation markets. The outlook in

global financial markets remains uncertain, particularly in Europe, but we

continue to look for new opportunities and control our costs.

Group income statement

For the six months ended 30 June 2012 (unaudited)

30 June 2012 30 June 2011

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

UK dividends 6,104 - 6,104 6,580 - 6,580

UK special dividends 181 - 181 - - -

Overseas dividends 1,221 - 1,221 1,185 - 1,185

Overseas special dividends 48 - 48 51 - 51

Interest from securities 334 - 334 222 - 222

7,888 - 7,888 8,038 - 8,038

Interest income 42 - 42 52 - 52

Independent fiduciary 14,904 - 14,904 14,416 - 14,416

services fees

Other income 58 - 58 175 - 175

Total income 22,892 - 22,892 22,681 - 22,681

Net gain on investments - 25,031 25,031 - 17,744 17,744

held at fair value through

profit or loss

Gross income and capital 22,892 25,031 47,923 22,681 17,744 40,425

gains

Cost of sales (1,800) - (1,800) (1,615) - (1,615)

Administrative expenses (9,314) (83) (9,397) (8,874) (64) (8,938)

Operating profit 11,778 24,948 36,726 12,192 17,680 29,872

Finance costs

Interest payable (1,225) - (1,225) (1,225) - (1,225)

Profit before taxation 10,553 24,948 35,501 10,967 17,680 28,647

Taxation (876) - (876) (894) - (894)

Profit for period 9,677 24,948 34,625 10,073 17,680 27,753

Return per ordinary share 8.23 21.22 29.45 8.58 15.05 23.63

(pence)

Diluted return per ordinary 8.23 21.21 29.44 8.57 15.04 23.61

share (pence)

Statement of comprehensive income

For the six months ended 30 June 2012 (unaudited)

30 June 2012 30 June 2011

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Profit for the period 9,677 24,948 34,625 10,073 17,680 27,753

Other comprehensive

income:

Foreign exchange - (29) (29) - (109) (109)

Total comprehensive income 9,677 24,919 34,596 10,073 17,571 27,644

for the period

Group statement of financial position

30 June 201 30 June 2011 31 December

2 2011

(unaudited)

(unaudited) (audited)

GBP000

GBP000 GBP000

Assets

Non current assets

Goodwill 2,210 2,191 2,218

Property, plant and equipment 300 214 320

Other intangible assets 429 85 199

Investments held at fair value 446,857 459,133 423,044

through profit or loss

Deferred tax assets 1,223 662 1,416

Total non current assets 451,019 462,285 427,197

Current assets

Trade and other receivables 5,113 4,989 4,940

Other accrued income and prepaid 6,473 5,502 6,246

expenses

Cash and cash equivalents 16,381 19,300 18,063

Total current assets 27,967 29,791 29,249

Total assets 478,986 492,076 456,446

Current liabilities

Trade and other payables 10,585 10,818 11,674

Corporation tax payable 783 1,109 1,293

Other taxation including social 623 622 559

security

Deferred income 4,184 3,848 3,902

Total current liabilities 16,175 16,397 17,428

Non current liabilities and

deferred income

Long term borrowings 39,404 39,378 39,391

Retirement benefit obligations 2,823 561 3,138

Deferred income 5,765 5,433 5,563

Total non current liabilities 47,992 45,372 48,092

Total net assets 414,819 430,307 390,926

Equity

Called up share capital 5,905 5,904 5,905

Share premium 8,106 8,070 8,106

Capital redemption 8 8 8

Share based payments 201 201 201

Own shares (1,805) (1,717) (1,684)

Capital reserves 371,216 386,346 346,268

Retained earnings 30,704 31,082 31,609

Translation reserve 484 413 513

Total equity 414,819 430,307 390,926

Group statement of cash flows

For the six months ended 30 June 2012

30 June 30 June 31 December

2012 2011 2011

(unaudited) (unaudited)

(audited)

GBP000 GBP000 GBP000

Operating activities

Operating profit before interest 36,726 29,872 260

payable and taxation

(Gains)/losses on investments (24,948) (17,680) 22,398

Foreign exchange 8 20 (12)

Depreciation of property, plant and 56 63 164

equipment

Amortisation of intangible assets 109 33 76

(Increase)/decrease in receivables (400) 37 (658)

(Decrease)/increase in payables (528) (548) 442

Transfer to/(from) capital reserves 529 (40) 126

Normal pension contributions in (315) (315) (883)

excess of cost

Cash generated from operating 11,237 11,442 21,913

activities

Taxation (1,193) (695) (1,548)

Interest paid (1,225) (1,225) (2,450)

Operating cash flow 8,819 9,522 17,915

Investing activities

Acquisition of property, plant and (36) (87) (289)

equipment

Expenditure on intangible assets (339) - (157)

Purchase of investments (20,504) (20,403) (96,508)

Sale of investments 21,120 20,272 92,275

Cash flow from investing activities 241 (218) (4,679)

Financing activities

Dividends paid (10,582) (9,984) (15,270)

Proceeds of increase in share capital - 4 41

Purchase of own shares (121) 77 110

Net cash flow from financing (10,703) (9,903) (15,119)

activities

Net (decrease) in cash and cash (1,643) (599) (1,883)

equivalents

Cash and cash equivalents at 18,063 19,953 19,953

beginning of period

Foreign exchange (losses) on cash and (39) (54) (7)

cash equivalents

Cash and cash equivalents at end of 16,381 19,300 18,063

period

Cash and cash equivalents comprise

Cash and cash equivalents 16,381 19,300 18,063

Group statement of changes in equity

Share Share Own Capital Share Translation Capital Retained Total

capital premium shares redemption based reserve reserves earnings

payments

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Equity at 1 5,905 8,106 (1,684) 8 201 513 346,268 31,609 390,926

January 2012

Net profit - - - - - - 24,948 9,677 34,625

Other

comprehensive

income:

Foreign exchange - - - - - (29) - - (29)

Total - - - - - (29) 24,948 9,677 34,596

comprehensive

income for the

period

Issue of shares - - - - - - - - -

Movement in own - - (121) - - - - - (121)

shares

Dividend relating - - - - - - - (10,582) (10,582)

to 2011

Total equity at 5,905 8,106 (1,805) 8 201 484 371,216 30,704 414,819

30 June 2012

Group segmental analysis

Investment trust Independent fiduciary Total

services

30 June 30 June 31 Dec 30 June 30 June 31 Dec 30 June 30 June 31 Dec

2012 2011 2011 2012 2011 2011 2012 2011 2011

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Segment income 7,888 8,038 14,126 14,904 14,416 30,948 22,792 22,454 45,074

Other income - 71 76 58 104 18 58 175 94

Cost of sales - - - (1,800) (1,615) (4,313) (1,800) (1,615) (4,313)

Administration costs (993) (958) (1,915) (8,321) (7,916) (16,728) (9,314) (8,874) (18,643)

6,895 7,151 12,287 4,841 4,989 9,925 11,736 12,140 22,212

Interest (net) (1,279) (1,245) (2,566) 96 72 562 (1,183) (1,173) (2,004)

Return, including 5,616 5,906 9,721 4,937 5,061 10,487 10,553 10,967 20,208

profit on ordinary

activities before

taxation

Taxation - - - (876) (894) (1,977) (876) (894) (1,977)

Return, including 5,616 5,906 9,721 4,061 4,167 8,510 9,677 10,073 18,231

profit attributable

to shareholders

Revenue return per 4.78 5.03 8.27 3.45 3.55 7.25 8.23 8.58 15.52

ordinary share

(pence)

Assets 454,766 468,162 434,325 24,220 23,914 22,121 478,986 492,076 456,446

Liabilities (55,424) (53,635) (57,233) (8,743) (8,134) (8,287) (64,167) (61,769) (65,520)

Total net assets 399,342 414,527 377,092 15,477 15,780 13,834 414,819 430,307 390,926

The capital element of the income statement is wholly attributable to the

investment trust.

Analysis of the investment portfolio

By geographical location

Valuation Purchases Costs of Sales Appreciation/ Valuation %

acquisition proceeds 30 June

31 GBP000 (depreciation) 2012

December GBP000 GBP000

2011 GBP000 GBP000

GBP000

United 274,705 14,641 (65) (7,737) 18,983 300,527 67.2

Kingdom

North America 27,859 4,639 (7) - 1,697 34,188 7.7

Europe 31,263 1,224 (1) (1,774) 1,303 32,015 7.2

Japan 12,753 - - - 643 13,396 3.0

Other Pacific 31,973 - - (2,807) 2,528 31,694 7.1

UK Gilts 44,491 - - (8,802) (652) 35,037 7.8

423,044 20,504 (73) (21,120) 24,502 446,857 100.0

By Sector (excluding cash)

As at As at

30 June 31 December

2012 2011

% %

Oil & gas 10.2 10.2

Basic materials 3.8 3.8

Industrials 22.0 21.5

Consumer goods 10.9 10.8

Health care 8.3 7.8

Consumer services 5.9 6.2

Telecommunications 1.9 2.5

Utilities 4.6 4.6

Financials 11.3 9.6

Technology 2.7 1.4

Pooled equity investments 10.6 11.1

UK Gilts 7.8 10.5

100.0 100.0

Investment portfolio valuation

as at 30 June 2012

UK unless otherwise

stated.

Holdings in italics were acquired

after 31 December 2011

GBP000 %

Oil & gas

Oil & gas producers

BP 11,180 2.50

Royal Dutch Shell 11,125 2.49

BG 4,550 1.02

Total (Fra) 1,764 0.39

Premier Oil 1,690 0.38

30,309 6.78

Oil equipment &

services

Gibson Energy (Can) 4,076 0.91

Cape 3,686 0.82

Schlumberger (USA) 3,311 0.74

National Oilwell 2,054 0.46

Varco (USA)

Saipem (Ita) 1,096 0.25

AMEC 1,002 0.22

15,225 3.40

Basic materials

Chemicals

Croda 3,958 0.89

Brenntag (Ger) 864 0.19

4,822 1.08

Forestry & paper

Mondi 2,720 0.61

2,720 0.61

Mining 6,793 1.52

Rio Tinto

BHP Billiton 2,709 0.61

9,502 2.13

Industrials

Construction &

materials

Balfour Beatty 3,619 0.81

Marshalls 557 0.12

4,176 0.93

Aerospace & defence

Senior 15,107 3.38

Meggitt 5,393 1.21

BAE Systems 5,195 1.16

Rolls Royce 5,145 1.15

Hampson Industries 3 -

30,843 6.90

GBP000 %

General industrials

Smith (DS) 6,578 1.47

6,578 1.47

Electronic &

electrical

equipment

Morgan Crucible 5,564 1.25

Spectris 4,587 1.03

Applied Materials 3,648 0.81

(USA)

TT Electronics 2,193 0.49

Legrand (Fra) 706 0.16

16,698 3.74

Industrial

engineering

Hill & Smith 5,872 1.31

Cummins (USA) 4,324 0.97

Weir Group 3,825 0.86

Caterpillar (USA) 2,165 0.48

Renold 1,463 0.33

IMI 831 0.19

Severfield-Rowen 375 0.08

18,855 4.22

Industrial

transportation

Kuehne & Nagel 929 0.21

(Swi)

Goldenport 469 0.11

Autologic 304 0.07

Wincanton 196 0.04

1,898 0.43

Support services

Interserve 5,959 1.33

Carillion 3,446 0.77

Babcock 2,132 0.48

SGS (Swi) 1,853 0.41

Deutsche Post (Ger) 1,635 0.37

Sodexho (Fra) 1,191 0.27

Johnson Service 1,058 0.24

Adecco (Swi) 857 0.19

DKSH (Swi) 605 0.14

Augean 351 0.08

19,087 4.28

GBP000 %

Consumer goods

Automobiles & parts

GKN 8,342 1.87

Toyota Motor (Jap) 1,748 0.39

10,090 2.26

Beverages

Diageo 6,236 1.40

Pernod-Ricard (Fra) 870 0.19

7,106 1.59

Food producers

Unilever 3,752 0.84

Associated British Foods 3,202 0.72

Nestlé (Swi) 3,033 0.68

9,987 2.24

Household goods & home

construction

Bellway 3,744 0.84

Redrow 2,673 0.60

Reckitt Benckiser 2,524 0.56

Essilor (Fra) 1,035 0.23

L'Oreal (Fra) 821 0.18

10,797 2.41

Tobacco

British American Tobacco 5,673 1.27

Imperial Tobacco 3,682 0.82

Swedish Match (Swe) 1,269 0.28

10,624 2.37

Health care

Health care equipment &

services

Becton Dickinson (USA) 3,573 0.80

Fresenius (Ger) 3,049 0.68

Smith & Nephew 2,994 0.67

Fresenius Medical Care (Ger) 1,758 0.39

11,374 2.54

GBP000 %

Pharmaceuticals &

biotechnology

GlaxoSmithKline 10,853 2.43

BTG 7,544 1.69

Novartis (Swi) 2,474 0.55

AstraZeneca 2,138 0.48

Pfizer (USA) 1,465 0.33

Roche (Swi) 1,433 0.32

25,907 5.80

Consumer services

Food & drug retailers

Tesco 2,325 0.52

2,325 0.52

General retailers

Dunelm 4,382 0.98

Inditex (Spa) 1,307 0.29

Findel 477 0.11

Topps Tiles 291 0.07

6,457 1.45

Media

Reed Elsevier 3,836 0.86

Pearson 3,479 0.78

British Sky Broadcasting 1,741 0.39

Daily Mail & General Trust 1,480 0.33

Yell 19 -

10,555 2.36

Travel & leisure

Greene King 3,468 0.77

Marstons 2,128 0.48

International Consolidated 1,315 0.29

Airlines

6,911 1.54

GBP000 %

Telecommunications

Fixed line

telecommunications

BT 2,536 0.57

2,536 0.57

Mobile telecommunications

Vodafone 3,585 0.80

Inmarsat 1,783 0.40

Ericsson (Swe) 778 0.17

6,146 1.37

Utilities

Electricity

Scottish & Southern Energy 4,173 0.93

Scottish & Southern Energy 2,491 0.56

5.75% 5/2/14

Iberdrola (Spa) 489 0.11

7,153 1.60

Gas water & multiutilities

National Grid 6.125% 15/4/ 5,745 1.29

14

National Grid 4,120 0.92

Severn Trent 3,359 0.75

Centrica 318 0.07

13,542 3.03

Financials

Banks

HSBC 7,294 1.63

7,294 1.63

Nonlife insurance

Amlin 7,779 1.74

Hiscox 5,769 1.29

Hardy Underwriting Bermuda 510 0.11

14,058 3.14

Life insurance / assurance

Prudential 2,212 0.50

Aviva 2,140 0.48

Chesnara 1,715 0.38

Irish Life & Permanent 8 -

(Ire)

6,075 1.36

Real estate investments &

services

St Modwen Properties 1,685 0.38

1,685 0.38

Real estate investment

trusts

Mucklow (A&J) Group 2,940 0.66

Land securities 2,375 0.53

5,315 1.19

GBP000 %

Financial services

IP Group 7,485 1.68

Provident Financial 3,341 0.75

International Personal 2,989 0.67

Finance

3i 986 0.22

Deutsche Borse (Ger) 826 0.18

15,627 3.50

Equity investment

instruments

Henderson Japan Capital 11,648 2.61

Growth

Henderson Asia Pacific 10,717 2.40

Capital Growth

Baillie Gifford Pacific 9,344 2.09

First State Asia Pacific 8,391 1.88

Herald Investment Trust 4,071 0.91

Scottish Oriental Smaller 3,242 0.73

Company Trust

47,413 10.62

Technology

Software & computer

services

Microsoft (USA) 5,849 1.31

Amadeus IT (Spa) 1,322 0.30

Sage 971 0.22

8,142 1.83

Technology hardware &

equipment

Apple (USA) 3,723 0.83

3,723 0.83

UK Gilts

UK Treasury 4.5% 07/03/13 20,059 4.49

UK Treasury 2.25% 07/03/14 14,978 3.35

35,037 7.84

Principal risks and uncertainties

The principal risks of the Corporation relate to the investment activities and

include market price risk, foreign currency risk, liquidity risk, interest rate

risk and credit risk. These are explained in the notes to the annual accounts.

In the view of the board these risks are as applicable to the remaining six

months of the financial year as they were to the period under review.

The principal risks of the independent fiduciary services business arise during

the course of defaults, potential defaults and restructurings where we have

been appointed to provide services. To mitigate these risks we work closely

with our legal advisers and, where appropriate, financial advisers, both in the

set up phase to ensure that we have as many protections as practicable, and at

all other stages whether or not there is a danger of default.

Related party transactions

There have been no related party transactions during the period which have

materially affected the financial position or performance of the group. During

the period transactions between the Corporation and its subsidiaries have been

eliminated on consolidation. Details of related party transactions are given in

the notes to the annual accounts.

Directors' responsibility statement

We confirm that to the best of our knowledge:

* the condensed set of financial statements has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU;

* the half yearly report includes a fair review of the information required

by:

a. DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of

important events that have occurred during the first six months of the

financial year and their impact on the condensed set of financial

statements; and a description of the principal risks and uncertainties for

the remaining six months of the year; and

b. DTR 4.2.8R of the Disclosure and Transparency Rules, being related party

transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the entity during that period.

On behalf of the board

Douglas McDougall

24 July 2012

Notes

1. The financial information presented herein does not amount to full

statutory accounts within the meaning of Section 435 of the Companies Act

2006 and has neither been audited nor reviewed pursuant to guidance issued

by the Auditing Practices Board. The annual report and financial statement

for 2011 have been filed with the Registrar of Companies.

The independent auditors' report on the annual report

and financial statements for 2011 was unqualified, did not include a

reference to any matters to which the auditor drew attention by way of

emphasis without qualifying the report, and did not contain a statement

under section 498(2) or (3) of the Companies Act 2006.

2. The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 117,575,226 (30 June 2011: 117,454,638) (31

December 2011: 117,482,050).

Income: average shares during the period 117,565,430 (30 June 2011:

117,449,590) (31 December 2011: 117,459,408).

END

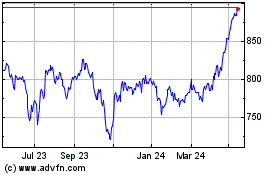

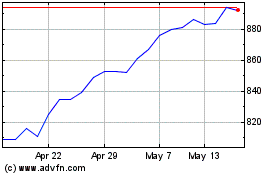

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024