LondonMetric Property PLC DISPOSAL OF TWO RETAIL PARKS FOR £55 MILLION (4492L)

October 03 2016 - 2:00AM

UK Regulatory

TIDMLMP

RNS Number : 4492L

LondonMetric Property PLC

03 October 2016

3 October 2016

LONDONMETRIC PROPERTY PLC

LONDONMETRIC SELLS TWO RETAIL PARKS FOR GBP55 MILLION

LondonMetric Property Plc ("LondonMetric") announces that it has

sold Pierpoint Retail Park in Kings Lynn for GBP24.0 million and

Damolly Retail Park in Newry, Northern Ireland, for GBP30.7

million.

At Kings Lynn, the Tritax Property Income Fund ("Tritax") has

purchased the 74,000 sq. ft. retail park reflecting a NIY of 5.77%;

which is in line with the March 2016 valuation. The property was

purchased in 2011 for GBP15.1 million and has undergone complete

refurbishment with six new lettings to Next, B&M, DFS, Tapi,

Poundland and Greggs. Since purchase, the rental income has

increased by 47% and the WAULT has risen from 4.3 years to 13.3

years.

At Newry, Northern Ireland a local investor has purchased the

165,000 sq. ft. Damolly Retail Park reflecting a NIY of 7.4%; which

is 3% below March 2016 book value. LondonMetric purchased the

retail park in 2010 and has undertaken numerous asset management

initiatives with new lettings to Lidl, Pets at Home, Home Bargains

and Costa. The WAULT to first break is now 7.6 years.

LondonMetric was advised by CBRE on Newry. Wilkinson Williams

advised Tritax on Kings Lynn.

Andrew Jones, Chief Executive of LondonMetric, commented:

"These sales represent the opportunity to monetise two of our

larger retail park investments following an intense period of asset

management activity.

"The investments have delivered positive returns over their

period of ownership but it is now opportune to reinvest the monies

into investment and development opportunities within our favoured

logistics sectors where rental growth prospects look more

attractive."

-Ends-

For further information, please contact:

LondonMetric Property Plc

Andrew Jones / Martin McGann

Tel: +44 (0) 20 7484 9000

FTI Consulting

Dido Laurimore / Tom Gough / Clare Glynn

Tel: +44 (0)20 3727 1000

About LondonMetric Property Plc

LondonMetric (ticker: LMP) aims to deliver attractive returns

for shareholders through a strategy of increasing income and

improving capital values. It invests across the UK in retail led

distribution, out of town and convenience retail properties. It

employs an occupier-led approach to property with a focus on strong

income, asset management initiatives and short cycle development.

Its portfolio is broadly split between distribution and retail with

a total of 12 million sq. ft. under management. LondonMetric works

closely with retailers, logistics providers and leisure operators

to help meet their evolving real estate requirements.

Further information on LondonMetric is available at

www.londonmetric.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISBBBDGSDGBGLD

(END) Dow Jones Newswires

October 03, 2016 02:00 ET (06:00 GMT)

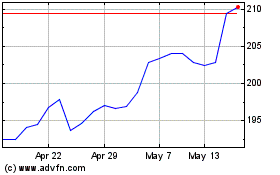

Londonmetric Property (LSE:LMP)

Historical Stock Chart

From Apr 2024 to May 2024

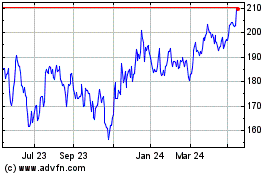

Londonmetric Property (LSE:LMP)

Historical Stock Chart

From May 2023 to May 2024