TIDMLLAI

RNS Number : 3593Q

LungLife AI, INC

20 February 2023

LungLife AI, Inc.

(the "Company" or "LungLife")

Preliminary audited results for year ended 31 December 2022

LungLife to report financial results for full-year 2022

LungLife AI (AIM: LLAI), a developer of clinical diagnostic

solutions for lung cancer, announces its audited preliminary

results for the year ended 31 December 2022.

Summary and Highlights for the year:

-- Cash as of 31 December 2022 of $8.01m (2021: $14.62m)

-- Loss before tax of $7.60m (2021: $7.43m)

-- Adjusted EBITDA(1) loss of $6.84m (2021: $5.40m)

-- Enrolled first participant into multi-centre clinical

validation study in February 2022, and on track to complete study

enrolment in the next 2-3 months. Total of 14 sites enrolled in the

study, including seven from Veterans Affairs Hospitals(2)

-- Centers for Medicare & Medicaid Services ("CMS") granted

a national price of $2,030 per test for the LungLB(R),

November 2022

-- LungLB(R) test approved and Clinical Laboratory Evaluation

Programme ("CLEP") permit awarded by the New York State Department

of Health, allowing the Company to perform clinical utility studies

and offer LungLB(R) commercially in New York state, September

2022

-- Selected to participate in the US National Cancer Institute's

Early Detection Research Network ("EDRN") as part of Boston

University-University of California Los Angeles Lung Cancer

Biomarker Development Laboratory

-- CPT(R) Proprietary Laboratory Analyses (PLA code), a key

component towards reimbursement in the US market, awarded and

became effective on 1 April 2022

-- Appointment of Dr Drew Moghanaki, an internationally

recognised lung cancer specialist, to the Company's Scientific

Advisory Board, March 2022

(1) Earnings before interest, tax, depreciation and

amortisation, adjusted to exclude exceptional items, share based

payments and other operating income

(2) Federal government charged with providing life-long

healthcare services to eligible veterans

Commenting, Paul Pagano, Chief Executive Officer of LungLife,

said : "2022 was a significant year for LungLife and I'm proud of

the team for the accomplishments made in fulfilment of our

milestones. We initiated our multi-centre validation study in

February, expanded the number of participating sites throughout the

year and is on track to complete participant enrolment in the next

2-3 months. We ended the year with CMS confirming a price of $2,030

for LungLB(R) under crosswalk - avoiding a year long process of

gapfill price determination and accelerating progress on

reimbursement.

"We also received two independent reviews of LungLB(R) with the

New York CLEP permit and selection to participate in the US

National Cancer Institute's Early Detection Research Network. These

have provided external evaluation of our technology's analytical

and clinical data and are important steps in increasing awareness

of LungLB(R) and moving towards the Company's commercialisation

plan.

"We remain focused on completing our clinical validation study,

commencing our clinical utility study later this year and expanding

patient access to LungLB(R) through implementation of our

commercial reimbursement plan. We are very excited by the

opportunities ahead and the potential for LungLB(R) to transform

the early detection of lung cancer".

For further information please contact:

LungLife AI, Inc. www.lunglifeai.com

Paul Pagano, CEO Via Walbrook PR

David Anderson, CFO

Investec Bank plc (Nominated Adviser Tel: +44 (0)20 7597 5970

& Broker)

Virginia Bull / Cameron MacRitchie

/ Lydia Zychowska

Walbrook PR Limited Tel: +44 (0)20 7933 8780 or LungLifeAI@walbrookpr.com

Stephanie Cuthbert / Alice Woodings Mob: 07980 541 893 / 07407 804 654 /

/ Phillip Marriage 07867 984 082

About LungLife

LungLife AI is a developer of clinical diagnostic solutions

designed to make a significant impact in the early detection of

lung cancer, the deadliest cancer globally. Using a minimally

invasive blood draw, the Company's LungLB(R) test is designed to

deliver additional information to clinicians who are evaluating

indeterminate lung nodules. For more information visit

www.lunglifeai.com

Our Purpose is to be a driving force in the early detection to

lung cancer. And our Vision is to invert the 20:80 ratio such that

in years to come at least 80% of lung cancer is detected early.

Chairman's Statement

I am delighted to report on the Company's results for the year

ended 31 December 2022. We have continued to deliver on the

Company's objectives and remain committed to creating shareholder

value as we proceed with the aim of being a driving force in the

early detection of lung cancer through the completion of our

LungLB(R) test multi-centre clinical validation study.

LungLB(R) test

According to the World Health Organization, over 2.2 million new

cases of lung cancer were diagnosed in 2020 and approximately 1.8

million deaths from lung cancer were recorded in 2020 globally.

Nearly 80% of all lung cancers in the United States are diagnosed

in later stages when survival rates are low because the options for

curative treatment are then limited. This is in part due to the

lack of effective early detection solutions and the fact that lung

cancer largely develops asymptomatically.

LungLB(R) is a blood-based test that uses circulating tumour

cells ("CTC") to stratify indeterminant lung nodules as either

cancerous or benign following their identification by CT scan.

Biopsy is currently part of the standard care pathway for lung

nodules and the LungLB(R) test is designed to support the

physician's decision to biopsy only when necessary, or to monitor

non-invasively using additional imaging. There are estimated to be

over 1.5 million indeterminant lung nodules identified each year in

the United States(1) and LungLife's estimated one week turnaround

from receipt of the blood sample to results can save a significant

amount of stressful waiting time for the participant as well as

unnecessary costly and often dangerous procedures.

(1) Gould MK et al. Am J Respir Crit Care Med. 2015 PMID:

26214244 .

Progress

Our focus this year has been on our clinical validation study

and charting a course to subsequent commercialisation.

We enrolled our first participant in February 2022 in our

multi-centre clinical validation study. Currently we have activated

14 sites in our clinical validation study, which include seven from

the Veterans Affairs hospitals. Our study currently requires us to

enrol 425 participants.

As we collect more data on enrolment trends from various sites,

we become more able to precisely estimate timing of completion,

which we forecast to be completed in the next 2-3 months.

Hand-in-hand with enrolment, the Clinical Research Organization

(CRO) monitors the usable sample rate (unusable samples may result

from a failed biopsy, or insufficient blood draw, for example) and

distribution of the study arms (cancer vs benign nodules) to ensure

we are still in-line with our initial projections; so that we can

make adjustments to final enrolment numbers, should it be

necessary, which is standard practise for clinical studies.

While COVID, nursing and research strikes impacted sites at

times from reaching their full enrolment rates, our actions,

including activating additional sites across the country, have

helped keep us broadly on track with our initial estimates. Within

approximately three months following the enrolment of the last

participant we anticipate the data will be available for analysis

and subsequent study readout. These timelines are well-accounted

for within our current cash runway, which we continue to expect

will take us through to mid-2024.

We received two important, independent evaluations of our test

this year.

In September the New York State Department of Health ("NYSDOH")

awarded LungLife a Clinical Laboratory Evaluation Program ("CLEP")

permit following their on-site audit, during which there were no

deficiencies found.

The CLEP permit allows LungLife to perform clinical utility

studies and offer the LungLB(R) test commercially in New York

state, in addition to 46 other states permitted by the Company's

existing Clinical Laboratory Improvement Amendments ("CLIA")

certification.

This is an important step in LungLife's commercialisation plan,

given its relationship with the Icahn School of Medicine at Mount

Sinai in New York, a key site in the ongoing pivotal validation

trial, and from which the Company is now able to accept study

participants in future utility studies. Securing a CLEP permit is a

requirement to consider participants from New York state in the

utility studies planned for 2023, from which the Company expects

first nominal revenues.

The audit was performed to ensure that the premises, laboratory

practice, equipment, personnel, and record-keeping methods meet

state requirements. Issuance of the CLEP permit follows a rigorous,

independent scientific review of both analytical and clinical data

for LungLB(R) , as well as evaluation of adherence to the Company's

quality management system.

In October we announced we will be one of two industry partners

to participate in the Boston University ("BU") -University of

California Los Angeles ("UCLA") Lung Cancer Biomarker Development

Laboratory of the US National Cancer Institute's Early Detection

Research Network ("EDRN").

The EDRN is a division of the US National Cancer Institute, the

federal government's principal agency for cancer research and

training. The EDRN's mission is to discover, develop, and validate

new biomarkers and medical imaging technologies to detect

early-stage cancers, and to translate them into clinical tests. It

is comprised of over 300 investigators from academic institutions

and industry partners working collaboratively to bring new

diagnostic biomarkers to clinical use.

LungLife's clinical laboratory will operate as a Biomarker

Reference Laboratory, processing blood samples from the

participating academic centres at UCLA and BU where the LungLB(R)

test will be combined with imaging to assist their early detection

research, as well as validate combined test performance in patients

with indeterminate lung nodules. It is expected the blood samples

will be collected over a number of years with progress and results

presented to EDRN members at annual meetings, representing the

first independent study of LungLB(R) . These activities are

independent of LungLife's ongoing pivotal validation study and do

not impact on the progress of this study.

The work of the EDRN closely aligns with LungLife's mission to

increase the early detection of lung cancer and will provide

further clinical evidence for the LungLB(R) technology as well as

widen awareness of our technology with leading US investigators. It

also affords LungLife the potential to offer novel cell-based

diagnostic biomarkers discovered at UCLA and BU to physicians from

its clinical laboratory, thereby potentially expanding its lung

cancer testing capabilities.

We were pleased to conclude the year with the announcement in

November that the Centers for Medicare & Medicaid Services

("CMS") has granted a price at $2,030 per test for the LungLB(R)

early lung cancer detection diagnostic. This final CMS payment

determination is listed in the Calendar Year 2023 Clinical

Laboratory Fee Schedule (CLFS) and will apply to all eligible

Medicare patients tested by LungLB(R) .

Medicare, a national health insurance program in the US, covers

63.9 million people and indeterminate lung nodules are often found

in patients of an age typically covered by Medicare. Securing a

favourable crosswalk* decision means Medicare beneficiaries now

have a national price for the LungLB(R) test effective since 1

January 2023. This represents completion of a key Company milestone

as it supports the plan to seek comprehensive reimbursement for the

test.

* Crosswalk applies if the new test is comparable to an existing

test (that may use a similar technology but for a different

indication, for example), in which case it is assigned the

market-based payment rate of that comparable existing test.

People

The team currently comprises of 14 full time and 2 part time

employees, having hired our Director of Quality Assurance in the

year.

In March we announced the appointment of Dr Drew Moghanaki, MD,

MPH, an internationally recognised lung cancer specialist, to our

Scientific Advisory Board. Dr Moghanaki is Professor and Chief of

Thoracic Oncology at the UCLA Department of Radiation Oncology. He

has brought extensive leadership to our Scientific Advisory Board

as the Director of the VA Partnership to increase Access to Lung

Cancer Screening programme (VA-PALS), and the co-chair of the VA

Lung Cancer Surgery or Stereotactic Radiotherapy (VALOR) Phase III

study, investigating treatment options for Stage I lung cancer.

On behalf of the Board, I would like to thank our employees,

clinical partners, study participants, professional advisors,

suppliers and shareholders for their support, and we look forward

to providing further updates on progress throughout the current

year.

Outlook

Our focus is the conclusion of our clinical validation study

and, while optional, subsequent submission to FDA, and planning for

the clinical utility study as part of our commercialisation

pathway. We were delighted to have received confirmation of our

price; our focus is now on securing coverage.

The next two years are incredibly exciting for LungLife and we

look forward to updating shareholders on our progress during that

time.

Roy Davis

Chairman

20 February 2023

Financial Review

The financial performance of the Company in the year to 31

December 2022 reflects the first full year of activity post our IPO

in July 2021.

Statement of Comprehensive Income

The Company generated revenues of US$24,000 in the year (2021 -

US$195,000) comprising wholly of royalty income from its sub

licensee in China. In 2021 royalty income accounted for US$88,000

with the balance of US$107,000 being consumable sales of

fluorescent in situ hybridisation (FISH) probes. The royalty income

is calculated at 6% of underlying net sales, and the Company pays a

3% royalty on this income to MD Anderson Cancer Center.

The largest cost incurred in the year was employee expenses of

US$3,264,000 (2021 - $1,760,000) followed by research and

development costs US$1,981,000 (2021 - US$1,343,00), being those

external costs incurred on our clinical validation trial and in the

continued development of our LungLB(R) test and AI algorithm. In

the year we increased headcount by one additional full-time member

of the team, one intern and hired a new member of the team as

replacement for a leaver. At the end of December 2022, and at the

date of this report, we have 14 full time and 2 part time

employees.

Other operating income of US$102,000 (2021 - US$206,000) relates

to claims made under the US Government Employee Retention Credits

scheme, designed as COVID related support for businesses, whilst in

2021 other operating income related to payment received under the

US Government Paycheck Protection Program, akin to the UK furlough

scheme. Finance income of US$88,000 (2021 - US$12,000) was

generated from funds held on deposit, and we incurred finance

expense of US$52,000 (2021 - US$417,000). Finance expense in the

year related to that arising on lease liabilities for certain

tangible assets and the leasehold premises occupied by the Company,

whereas last year $309,000 related to interest charged on the

Convertible Loan Notes, which formed part of the balance on the

Notes subsequently converted into new common shares at the time of

the IPO.

Total loss for the year was US$7,606,000, the loss of 2021 was

US$7,444,000 but included exceptional costs of the IPO of

US$1,101,000, so a true comparable loss of US$6,343,000. EBITDA

loss for 2022 excluding share-based payments was $6,841,000 and a

comparable EBITDA for 2021, excluding the exceptional costs, of

US$5,396,000.

Statement of Financial Position

Cash and cash equivalents at the end of the year was

US$3,088,000 (2021 - US$9,217,000). In addition, the Company holds

money on short term deposit, on which notice is 95 days with the

balance at year end US$4,922,000 (2021 - US$5,411,000). We continue

to hold the cost of acquiring the option under the License

Agreement with the Icahn School of Medicine of Mount Sinai ("Mount

Sinai") at its original purchase cost, without amortisation. The

option fee gives the Company access in the future to the

de-identified participant records held by Mount Sinai to assist in

the development of future products. As this asset is therefore not

currently being utilised no amortisation has been charged to

date.

Statement of Cash Flows

The net outflow from operating activities was US$5,845,000 (2021

- US$7,540,000), with minimal outflows for investing and financing

activities such that net cash outflow for the year was US$6,129,000

(2021 - inflow of $9,089,000). The prior year benefited from the

gross proceeds from the AIM admission of $23,444,000.

David Anderson

Chief Financial Officer

20 February 2023

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2022

Year to Year to

31 December 31 December

Note 2022 2021

US$'000 US$'000

Revenue 4 24 195

Cost of sales (-) (96)

_________ _________

Gross margin 24 99

Administrative expenses 6 (6,865) (5,495)

Share-based payments 6 (614) (409)

Depreciation 6 (285) (323)

Exceptional expense - costs of listing - (1,101)

_________ _________

Loss from operations (7,740) (7,229)

Other operating income 6 102 206

Finance income 9 88 12

Finance expense 9 (52) (417)

_________ _________

Loss before tax (7,602) (7,428)

Tax expense 10 (4) (16)

_________ _________

Loss from continuing operations (7,606) (7,444)

Other comprehensive income - -

_________ _________

Loss and total comprehensive income attributable

to the owners of the Company (7,606) (7,444)

_________ _________

Earnings per share attributable to the

ordinary equity holders of the parent 11

Loss per share

Basic and diluted (US$ cents) ($0.298) ($0.469)

_________ _________

The results reflected above relate to continuing operations

STATEMENT OF FINANCIAL POSITION

As at 31 December 2022

Note 2022 2021

US$'000 US$'000

Assets

Current assets

Trade and other receivables 14 613 741

Short term deposits 5 4,922 5,411

Cash and cash equivalents 5 3,088 9,217

_________ _________

8,623 15,369

_________ _________

Non-current assets

Property, plant and equipment 12 566 766

Intangible assets 13 5,818 5,818

Other receivables 14 13 13

_________ _________

6,397 6,597

_________ _________

Total assets 15,020 21,966

_________ _________

Liabilities

Current liabilities

Trade and other payables 15 1,055 804

Lease liabilities 16 255 207

Discontinued operations 174 174

_________ _________

1,484 1,185

Non-current liabilities

Lease liabilities 16 346 601

Provisions 17 50 50

_________ _________

Total liabilities 1,880 1,836

_________ _________

NET ASSETS 13,140 20,130

_________ _________

Issued capital and reserves attributable

to

owners of the parent

Share capital 19 3 3

Share premium reserve 20 91,266 91,264

Share based payment reserve 1,574 960

Accumulated losses (79,703) (72,097)

_________ _________

TOTAL EQUITY 13,140 20,130

_________ _________

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022

Total

attributable

to equity

Share-based holders

Share Share payment Accumulated of Total

capital premium reserve Other equity losses parent equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

1 January 2021 9 52,194 551 843 (64,903) (11,306) (11,306)

Comprehensive

income

for the year

Loss - - - - (7,444) (7,444) (7,444)

Other comprehensive

Income - - - - - - -

_________ _________ _________ _________ _________ _________ _________

Total comprehensive

Income

for the year - - - - (7,444) (7,444) (7,444)

_________ _________ _________ _________ _________ _________ _________

Contributions by

and

distributions to

owners

Issue of Convertible

Loan

Notes - - - 99 - 99 99

Reverse split (8) 8 - - - - -

Issue of common

shares

on conversion of

preference

shares and

Convertible

Loan Notes 1 12,601 - - - 12,602 12,602

Issue of share

capital 1 27,461 - - - 27,462 27,462

Transfer of balance

following

conversion of

Convertible

Loan Notes - - - (942) 250 (692) (692)

Share issue costs - (1,000) - - - (1,000) (1,000)

Share-based payment - - 409 - - 409 409

_________ _________ _________ _________ _________ _________ _________

Total contributions

by

and

distributions to

owners (6) 39,070 409 (843) 250 38,880 38,880

_________ _________ _________ _________ _________ _________ _________

31 December 2021 3 91,264 960 - (72,097) 20,130 20,130

_________ _________ _________ _________ _________ _________ _________

STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022 (continued)

Total

attributable

to equity

Share-based holders

Share Share payment Accumulated of Total

capital premium reserve Other equity losses parent equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

1 January 2022 3 91,264 960 - (72,097) 20,130 20,130

Comprehensive

income

for the year

Loss - - - - (7,606) (7,606) (7,606)

Other comprehensive

Income - - - -

_________ _________ _________ _________ _________ _________ _________

Total comprehensive

Income

for the year - - - - (7,606) (7,606) (7,606)

_________ _________ _________ _________ _________ _________ _________

Contributions by

and

distributions to

owners

Exercise of share

options - 2 - - - 2 2

Share-based payments - - 614 - - 614 614

_________ _________ _________ _________ _________ _________ _________

Total contributions

by

and

distributions to

owners - 2 614 - 616 616

_________ _________ _________ _________ _________ _________ _________

31 December 2022 3 91,266 1,574 - (79,703) 13,140 13,140

_________ _________ _________ _________ _________ _________ _________

STATEMENT OF CASH FLOWS

For the year ended 31 December 2022

Year to Year to

31 December 31 December

Note 2022 2021

US$'000 US$'000

Cash flows from operating activities

Loss for the year (7,606) (7,444)

Adjustments for:

Depreciation of property, plant and equipment 285 323

Forgiveness of Paycheck Protection Program

Loan (206)

Gain on sale of tangible assets (43) (36)

Foreign exchange loss on short term deposit 562 -

Finance income (88) (12)

Finance expense 52 417

Taxation 4 16

Share-based payments expense 614 409

_________ _________

(6,220) (6,533)

(Increase) / decrease in trade and other

receivables 128 (569)

(Decrease) / increase in trade and other

payables 251 (422)

Income taxes paid (4) (16)

_________ _________

Net cash outflow from operating activities (5,845) (7,540)

_________ _________

Cash flows from investing activities

Purchases of tangible assets (85) (47)

Proceeds from sale of tangible assets 43 36

Short term deposits (73) (5,411)

Landlord improvement contribution - 15

Purchase of intangibles - (1,800)

_________ _________

Net cash used in investing activities (115) (7,207)

_________ _________

Cash flows from financing activities

Issue of Convertible Notes - 1,612

Issue of Common Stock 2 23,444

Expenses of issue of Common Stock - (1,000)

Interest received 88 10

Interest paid (52) (107)

Repayment of lease liabilities (207) (123)

_________ _________

Net cash (used in) / from financing activities (169) 23,836

Net (decrease) / increase in cash and cash

equivalents (6,129) 9,089

Cash and cash equivalents at beginning

of year 9,217 128

_________ _________

Cash and cash equivalents at end of year 5 3,088 9,217

_________ _________

Notes forming part of the financial statements

For the year ended 31 December 2022

General Information

1

LungLife AI, Inc, (the "Company") is a company based in Thousand

Oaks, California which is developing a diagnostic test for the

early detection of lung cancer. The Company was incorporated under

the laws of the state of Delaware, USA, on 30 December 2009.

The Company's costs associated with developing and

commercialising its test include costs associated with the

development of intellectual property optimising the technology, and

obtaining regulatory approval. To complete clinical trials the

Company will continue to require additional operating funds. The

Company has raised funds through offerings of debt, common stock

and Series A Preferred Shares.

There are no restrictions on the Company's ability to access or

use its assets and settle its liabilities.

Basis of preparation

2

Information in this preliminary announcement does not constitute

statutory accounts of the company. The financial information

presented in this preliminary announcement is based on, and is

consistent with, that in the company's audited financial statements

for the year ended 31 December 2022, which will be delivered to

shareholders for approval at the Company's Annual General Meeting.

The independent auditors have reported on those financial

statements and their report is unqualified and unmodified.

The financial statements have been prepared in accordance with

UK adopted International Accounting Standards ("UK IFRS").

These financial statements are prepared in accordance with UK

IFRS under the historical cost convention, as modified by the use

of fair value for financial instruments measured at fair value. The

historical financial information is presented in United States

Dollars ("US$") except where otherwise indicated.

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

(a) Going concern

These financial statements have been prepared on the going

concern basis.

The directors of the Company have a reasonable expectation that

the Company has adequate resources to continue in operational

existence for the foreseeable future and for at least one year from

the date of approval of the financial statements. As of 31 December

2022 the Company had total available cash resources of

US$8,010,000, split between cash and cash equivalents of

US$3,088,000 and monies of short term deposit (with notice of 95

days) of US$4,922,000. The Company will be concluding its clinical

trial in early 2023 and together with other operational impacts our

expenditure levels are expected to be reduced. For that reason,

they continue to adopt the going concern basis in preparing the

Company's financial statements.

(b) New standards, amendments and interpretations

New standards are not expected to impact the Company as they are

either not relevant to the Company's activities or require

accounting which is consistent with the Company's current

accounting policies.

The Directors have considered those standards and

interpretations which have not been applied in these financial

statements but which are relevant to the Company's operations that

are in issue but not yet effective and do not consider that they

will have a material effect on the future results of the

Company.

(c) Revenue recognition

Sale of goods

Revenue comprises the fair value of the sale of FISH probes used

to identify the properties of blood samples under the terms of a

sub license agreement with a third party, net of applicable sales

taxes. Revenue is recognised on the sale of goods when the

significant risks and rewards of ownership of the goods have passed

to the buyer and the amount of revenue can be measured reliably.

Revenue on goods delivered is recognised when the customer accepts

delivery and on services when those services have been

rendered.

Royalty income

Under the terms of a patent and technology sub license agreement

the company is entitled to receive royalty income at 6% of the

quarterly net sales invoiced by the sub licensee in the relevant

quarter. Income is recognised in the period in which the underlying

net sales are generated.

Cash is received from revenues recognised according to terms of

trade within the relevant contractual relationship, usually in

accordance with agreed events such as placing of order, fulfilment

of order and delivery.

(d) Intangible assets

Research expenditure is recognised as an expense when incurred.

Development expenditure is recognised as an expense except those

costs incurred on development projects are capitalised as long term

assets to the extent that such expenditure is expected to generate

future economic benefits. Development expenditure is capitalised

only if it meets the criteria for capitalisation under IAS 38.

Capitalised development expenditure is measured at cost less

accumulated amortisation and impairment losses, if any. Development

expenditure initially recognised as an expense is not recognised as

an asset in future years. Capitalised development expenditure is

amortised on a straight-line basis over the estimated useful life

of the asset when the asset is available for use.

(e) Property, plant and equipment

Owned assets

Items of property, plant and equipment are stated at cost less

accumulated depreciation and impairment losses. Cost includes the

original purchase price of the asset and the costs attributable to

bringing the asset to its working condition for its intended use.

When parts of an item of property, plant and equipment have

different useful lives, those components are accounted for as

separate items of property, plant and equipment.

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Company and the cost of the item can be measured

reliably.

(e) Property, plant and equipment (continued)

Depreciation

Depreciation is charged to profit or loss on a straight-line

basis over the estimated useful lives of each part of an item of

property, plant and equipment. The estimated useful lives are as

follows:

-- computer and IT equipment - 33 per cent. straight line

-- leasehold improvements - shorter of lease term and useful life

-- plant and machinery - 20 per cent. straight line

-- laboratory equipment - 20 per cent. straight line

The residual values, useful lives and depreciation methods are

reviewed, and adjusted if appropriate, or if there is an indication

of a significant change since the last reporting date.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised within "other

operating income" in the statement of income.

(f) Impairment of non-financial assets

Non-financial assets are reviewed for impairment annually in the

case of not being available for use, and whenever events or changes

in circumstances indicate that the carrying amount may not be

recoverable. An impairment loss is recognised for the amount by

which the asset's carrying amount exceeds its recoverable amount.

The recoverable amount is the higher of an asset's fair value less

costs to sell and value in use. For the purposes of assessing

impairment, assets are considered at the lowest levels for which

there are separately identifiable cash flows (cash- generating

units).

Non-financial assets other than goodwill that suffered

impairment are reviewed for possible reversal of the impairment at

each reporting date.

Basis of preparation (continued)

2

(g) Financial assets

Classification

The Company classifies its financial assets as loans and

receivables. The classification depends on the purpose for which

the investments were acquired. Management determines the

classification of its investments at initial recognition.

Loans and receivables

Loans and receivables are non-derivative financial assets with

fixed or determinable payments. They are initially recognised at

fair value and are subsequently stated at amortised cost using the

effective interest method.

Impairment of financial assets

Impairment provisions are recognised when there is objective

evidence (such as significant financial difficulties on the part of

the counterparty or default or significant delay in payment) that

the Company will be unable to collect all of the amounts due under

the term's receivable, the amount of such a provision being the

difference between the net carrying amount and the present value of

the future expected cash flows associated with the impaired

asset.

(h) Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits with an original maturity of three months or less.

Basis of preparation (continued)

2

(i) Financial liabilities

Trade and other payables

Trade and other payables are initially recognised at fair value

and subsequently measured at amortised cost. Accounts payable are

classified as current liabilities if payment is due within one year

or less. If not, they are presented as non-current liabilities.

Convertible debt

The proceeds received on issue of the Company's convertible debt

are allocated into their liability and equity components. The

amount initially attributed to the debt component equals the

discounted cash flows using a market rate of interest that would be

payable on a similar debt instrument that does not include an

option to convert. Subsequently, the debt component is accounted

for as a financial liability measured at amortised cost until

extinguished on conversion or maturity of the bond. The remainder

of the proceeds is allocated to the conversion option and is

recognised in the "Other equity" within shareholders' equity, net

of income tax effects.

(j) Borrowings

Borrowings are recognised initially at fair value, net of

transaction costs incurred. Borrowings are subsequently carried at

amortised cost; any difference between the proceeds (net of

transaction costs) and the redemption value is recognised in the

income statement over the period of the borrowings using the

effective interest method.

Borrowings are de-recognised from the statement of financial

position when the obligation specified in the contract is

discharged, is cancelled or expires. The difference between the

carrying amount of a financial liability that has been extinguished

or transferred to another party and the consideration paid,

including any non-cash assets transferred or liabilities assumed,

is recognised in the income statement as other operating income or

finance costs.

Borrowings are classified as current liabilities unless the

Company has an unconditional right to defer settlement of the

liability for at least 12 months after the reporting period.

(k) Provisions

A provision is recognised in the statement of financial position

when the Company has a present legal or constructive obligation as

a result of a past event, and it is probable that an outflow of

economic benefits will be required to settle the obligation. If the

effect is material, provisions are determined by discounting the

expected future cash flows at a pre- tax rate that reflects current

market assessments of the time value of money and, when

appropriate, the risks specific to the liability. The increase in

the provision due to the passage of time is recognised in finance

costs.

(l) Share capital

Ordinary shares are classified as equity. There are various

classes of ordinary shares in issue, as detailed in note 19.

Incremental costs directly attributable to the issue of new shares

are shown in share premium as a deduction from the proceeds.

Basis of preparation (continued)

2

(m) Net finance costs

Finance costs

Finance costs comprise interest payable on borrowings, direct

issue costs and dividends on preference shares, and are expensed in

the period in which they are incurred.

Finance income

Finance income comprises interest receivable on funds invested,

and foreign exchange gains.

Interest income is recognised in the income statement as it

accrues using the effective interest method.

(n) Leases

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

-- Leases of low value assets; and

-- Leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the Company's incremental borrowing

rate on commencement of the lease is used. Variable lease payments

are only included in the measurement of the lease liability if they

depend on an index or rate. In such cases, the initial measurement

of the lease liability assumes the variable element will remain

unchanged throughout the lease term. Other variable lease payments

are expensed in the period to which they relate.

On initial recognition, the carrying value of the lease

liability also includes:

-- amounts expected to be payable under any residual value guarantee

-- the exercise price of any purchase option granted in favour

of the Company if it is reasonably certain to assess that

option

-- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of termination option

being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

-- lease payments made at or before commencement of the lease

-- initial direct costs incurred; and

-- the amount of any provision recognised where the Company is

contractually required to dismantle, remove or restore the leased

asset (typically leasehold dilapidations - see note 19).

Subsequent to initial measurement lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term.

Basis of preparation (continued)

2

(n) Leases (continued)

When the company revises its estimate of the term of any lease

(because, for example, it re-assesses the probability of a lessee

extension or termination option being exercised) it adjusts the

carrying amount of the lease liability to reflect the payments to

make over the revised term, which are discounted using a revised

discount rate. The carrying value of lease liabilities is similarly

revised when the variable element of future lease payments

dependent on a rate or index is revised, except the discount rate

remains unchanged. In both cases an equivalent adjustment is made

to the carrying value of the right-of-use asset, with the revised

carrying amount being amortised over the remaining (revised) lease

term. If the carrying amount of the right-of-use asset is adjusted

to zero, any further reduction is recognised in profit or loss.

(o) Income tax

Income tax for the years presented comprises current and

deferred tax. Income tax is recognised in the income statement

except to the extent that it relates to items recognised directly

in equity, in which case it is recognised in equity. Current tax is

the expected tax payable on the taxable income for the year, using

tax rates enacted or substantively enacted at the statement of

financial position date, and any adjustment to tax payable in

respect of previous years.

Deferred tax is recognised on temporary differences arising

between the tax bases of assets and liabilities and their carrying

amounts.

The following temporary differences are not recognised if they

arise from (a) the initial recognition of goodwill; and (b) for the

initial recognition of other assets or liabilities in a transaction

other than a business combination that at the time of the

transaction affects neither accounting nor taxable profit or loss.

The amount of deferred tax provided is based on the expected manner

of realisation or settlement of the carrying amount of assets and

liabilities, using tax rates enacted or substantively enacted at

the statement of financial position date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilised. Deferred tax assets are reduced to

the extent that it is no longer probable that the related tax

benefit will be realised.

Deferred income tax assets and liabilities are offset when there

is a legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred income taxes assets

and liabilities relate to income taxes levied by the same taxation

authority on either the taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

(p) Foreign currency translation

i) Function and presentational currency

Items included in the financial statements of the Company are

measured using USD, the currency of the primary economic

environment in which the entity operates ('the functional

currency'), which is also the Company's presentation currency.

ii) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from the

settlement of such transactions and from the translation at

year-end exchange rates, of monetary assets and liabilities

denominated in foreign currencies to USD, are recognised in the

income statement.

Critical accounting judgements and estimates

3

The preparation of the Company's historical financial

information under UK IFRS requires the directors to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and

liabilities. Estimates and judgements are continually evaluated and

are based on historical experience and other factors including

expectations of future events that are believed to be reasonable

under the circumstances. Actual results may differ from these

estimates.

The Directors consider that the following estimates and

judgements are likely to have the most significant effect on the

amounts recognised in the financial information.

Carrying value of intangible assets, property, plant and

equipment

In determining whether there are indicators of impairment of the

Company's assets, the directors make a number of estimates in

relation to assets including the economic viability and expected

future financial performance of the asset and when it relates to

the intangible assets arising on a business combination, the

expected future performance of the business acquired.

Classification of the Mount Sinai License as an intangible

asset

As set out in note 13, o n 18 June 2021, the Company entered

into the Mount Sinai License Agreement, pursuant to which Mount

Sinai granted an option to the Company to obtain a licence, on a

non-exclusive basis, to use certain information held by Mount

Sinai. After considering the criteria in IAS38 the directors have

judged that the recognition criteria therein have been met and

classified the Mount Sinai license as an intangible asset.

Segment analysis

4

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Company that are

regularly reviewed by the chief operating decision maker (which

takes the form of the Board of Directors) as defined in IFRS 8, in

order to allocate resources to the segment and to assess its

performance.

The chief operating decision maker has determined that the

Company has one operating segment, the development and

commercialisation of its lung cancer early detection test. Revenues

are reviewed based on the products and services provided.

The Company operates in the United States of America. Revenue by

origin of geographical segment is as follows:

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Revenue

People's Republic of China 24 195

________ ________

24 195

________ ________

Segment analysis (continued)

4

2022 2021

US$'000 US$'000

Non-current assets

United States of America 6,397 6,597

________ ________

6,397 6,597

________ ________

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Product and service revenue

Royalty income 24 88

Consumable items - 107

________ ________

24 195

________ ________

Financial instruments - Risk management

5

The Company is exposed through its operations to the following

financial risks:

- Credit risk

- Foreign exchange risk and

- Liquidity risk

The Company is exposed to risks that arise from its use of

financial instruments. This note describes the Company's

objectives, policies and processes for managing those risks and the

methods used to measure them. Further quantitative information in

respect of these risks is presented throughout these financial

statements.

(i) Principal financial instruments

The principal financial instruments used by the Company, from

which financial instrument risk arises, are as follows:

- Cash and cash equivalents

- Short term cash deposits

- Trade and other payables

Financial instruments - Risk management (continued)

5

(ii) Financial instruments by category

Financial asset

Amortised Amortised

cost cost

2022 2021

US$'000 US$'000

Cash and cash equivalents* 3,088 9,217

Short term cash deposits* 4,922 5,411

Trade and other receivables 607 741

_________ _________

Total financial assets 8,617 15,369

_________ _________

* Comparative amounts at 31 December 2021 have been re-presented

to reflect the reclassification of fixed term deposits of

$5,411,000 with a maturity date of greater than three months at

inception. There were no fixed term deposits at 31 December

2020.

Financial liabilities

Amortised Amortised

cost cost

2022 2021

US$'000 US$'000

Trade and other payables 1,055 804

_________ _________

Total financial liabilities 1,055 804

_________ _________

(iii) Financial instruments not measured at fair value

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, and trade and

other payables.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, and trade and other

payables approximates their fair value.

See note 16 for information on lease liabilities.

Financial instruments - Risk management (continued)

5

(iv) Financial instruments

General objectives, policies and processes

The Board has overall responsibility for the determination of

the Company's risk management objectives and policies and, whilst

retaining ultimate responsibility for them, it has delegated the

authority for designing and operating processes that ensure the

effective implementation of the objectives and policies to the

Company's finance function.

The overall objective of the Board is to set policies that seek

to reduce risk as far as possible without unduly affecting the

Company's competitiveness and flexibility. Further details

regarding these policies are set out below:

Credit risk

Credit risk is the risk of financial loss to the Company if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations. Due to the current low level of

revenue, the Company's exposure to credit risk is on cash at bank.

The Company only deposits cash with major banks with high quality

credit standing.

Cash in bank and short-term deposits

The credit quality of cash has been assessed by reference to

external credit rating, based on Standard and Poor's long-term /

senior issuer rating:

2022 2022 2021 2021

Cash in bank Cash Cash

Rating at bank Rating at bank

US$'000 US$'000

Bank A A+ 981 A+ 8,140

Bank B BBB+ 2,002 BBB+ 1,015

Bank C A+ 105 A+ 62

_________ _________

3,088 9,217

_________ _________

2022 2022 2021 2021

Short term deposits

Rating Rating

US$'000 US$'000

Bank B BBB+ 4,922 BBB+ 5,411

_________ _________

4,922 5,411

_________ _________

Financial instruments - Risk management (continued)

5

Foreign exchange risk

Foreign exchange risk arises when the Company enters into

transactions denominated in a currency other than its functional

currency. The Company's policy is, where possible, to settle

liabilities denominated in its functional currency. Currently the

Company's liabilities are either US dollar or UK sterling. No

forward contracts or other financial instruments are entered into

to hedge foreign exchange movements, with funds raised in the UK

being transferred to fund US operations using spot rates.

As at 31 December 2022 assets held in Sterling amounted to

US$5,275,000 (2021 - US$6,488,000) and liabilities held in Sterling

amounted to US$65,000 (2021 - US$66,000).

The effect of a 5% strengthening of the Sterling against US

dollar at the reporting date on the Sterling denominated net assets

carried at that date would, all other variables held constant, have

resulted in a decrease in post-tax loss for the year and increase

of net assets of US$260,000 (2021 - US$321,000). A 5% weakening in

the exchange rate would, on the same basis, have increased post-tax

loss and decreased net assets by US$260,000 (2021 -

US$321,000).

Liquidity risk

Liquidity risk is the risk that the Company will encounter

difficulty in meeting its financial obligations as they fall due.

This risk is managed by the production of annual cash flow

projections. The Company's continued future operations depend on

its ability to raise sufficient working capital through the issue

of share capital and generating revenue.

The following table sets out the contractual maturities

(representing undiscounted contractual cash-flows) of financial

liabilities which can all be met from the cash resources currently

available:

Between

Up to 3 3 and 12

months months

At 31 December 2022 US$'000 US$'000

Trade and other payables 371 -

_________ _________

Total 371 -

_________ _________

Between

Up to 3 3 and 12

months months

At 31 December 2021 US$'000 US$'000

Trade and other payables 275 -

_________ _________

Total 275 -

_________ _________

Financial instruments - Risk management (continued)

5

Capital Disclosures

The Company monitors its capital which comprises all components

of equity (i.e., share capital, share premium, and accumulated

losses).

The Company's objectives when maintaining capital are to

safeguard the entity's ability to continue as a going concern.

Expenses by nature

6

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Employee benefit expenses (see note 8) 3,264 1,760

Share-based payments charge - non-employee and

directors 37 87

Depreciation of property, plant and equipment 285 323

Gain on disposal of equipment (43) (36)

Research and development expenditure 1,981 1,343

Professional costs 643 720

Legal settlement - 687

Foreign exchange losses 659 97

Other costs 938 1,210

Other operating income is claims made for Employee Retention

Credits. Other operating income for the prior year represented

forgiveness of the Paycheck Protection Program Loan.

Auditors' remuneration

7

During the year the Company obtained the following services from

the Company's auditor:

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Fees payable to the Company's auditor for the

audit of the Company 48 48

Fees payable to the Company's auditor for other

services:

Services in connection with listing - 108

_________ _________

Total 48 156

_________ _________

Employee benefit expenses

8

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Employee benefit expenses (including Directors)

comprise:

Wages and salaries 2,262 1,304

Benefits 164 75

Share-based payments expense 577 323

Social security contributions and similar taxes 177 53

Pension 84 5

_________ _________

3,264 1,760

_________ _________

Key management personnel compensation

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities of the Company, including the Directors of the

Company.

Year to Year to

31 December 31 December

2022 2021

US$ US$

Salary 696 599

Share based payment expense 495 313

_________ _________

1,191 912

_________ _________

The average number of employees (including Directors) in the

Company in the year was 18 (2021 - 14).

Net finance costs

9

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Finance expense

Interest expense on lease liabilities 52 108

Interest expense on liabilities measured at amortised

cost - 309

_________ _________

Total finance expense 52 417

_________ _________

Net finance costs (continued)

9

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Finance income

Bank interest 88 12

_________ _________

Total finance income 88 12

_________ _________

Tax expense

10

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Current tax expense

Current tax on loss for the year - -

Withholding tax on royalties 4 16

_________ _________

Total current tax 4 16

Deferred tax asset

On losses generated in the year - -

_________ _________

4 16

_________ _________

Tax expense (continued)

10

There were no charges to current corporation taxation due to the

losses incurred by the Company in the year. The reasons for the

difference between the actual tax charge for the year and the US

federal income tax rate of 21% and state of California income tax

rate of 8.84% are as follows:

Year to Year to

31 December 31 December

2022 2021

US$'000 US$'000

Loss for the year (7,606) (7,428)

_________ _________

Tax using 29.84% (2,270) (2,217)

Expenses not deductible for tax purposes 34 689

Unrecognised deferred tax assets for losses

carried forward 2,236 1,528

_________ _________

Total tax expense - -

_________ _________

The unrecognised deferred tax is based on Federal taxable losses

carried forward of US$53,485,000 (2021 - US$49,393,000) and a

Federal capital loss of US$4,583,333 (2021 - US$4,583,333). No

deferred tax asset is recognised for these losses due to early

stage in the development of the Company's activities. Of the total

Federal losses carried forward US$35,281,000 (2021 - US$35,281,000)

expire in 2030 and can only be used against trading profits from

the same trade. Losses of US$18,204,000 (2021 - US$14,112,000) do

not expire but can only offset against 80% of taxable profits from

the same trade.

Loss per share

11

Year to Year to

31 December 31 December

2022 2021

Total Total

Numerator US$ US$

Loss for the year used in basic EPS (7,605,585) (7,444,188)

Denominator

Weighted average number of ordinary shares used

in basic EPS 25,481,800 15,870,143

Resulting loss per share (US$0.298) (US$0.469)

The Company has one category of dilutive potential ordinary

share, being share options (see note 21). The potential shares were

not dilutive in the year as the Company made a loss per share in

line with IAS 33. As described in note 19, between 2 July 2021 and

7 July 2021 the Company implemented a pre-Admission reorganisation

of its capital which included the conversion of Series A and B

Preferred Shares into Common Shares and a reverse share split by

way of the issue of one new Common Share and Preferred Share for

every 18 old Common Shares and Preferred Shares held.

As required by IAS33, the number of shares presented as the

denominator in calculating loss per share has been adjusted from 1

January 2020, the beginning of the earliest period for which loss

per share information is presented in order to maintain

comparability.

Tangible assets

12

Furniture Computers

Leasehold and and IT Plant &

improvements equipment equipment machinery Total

US$'000 US$'000 US$'000 US$'000 US$

Cost or valuation

At 1 January 2021 982 56 50 1,051 2,139

Landlord contribution (15) - - - (15)

Additions 349 - 35 258 642

________ ________ ________ _________ _________

At 31 December 2021 1,316 56 85 1,309 2,766

Additions - - 31 54 85

________ ________ ________ ________ ________

At 31 December 2022 1,316 56 116 1,363 2,851

________ ________ ________ ________ ________

Accumulated depreciation

and impairment

At 1 January 2021 712 56 50 859 1,677

Depreciation 233 - 3 87 323

________ ________ ________ ________ ________

At 31 December 2021 945 56 53 946 2,000

Depreciation 140 - 19 126 285

________ ________ ________ ________ ________

At 31 December 2022 1,085 56 72 1,072 2,285

________ ________ ________ ________ ________

Net book value

At 31 December 2022 231 - 44 291 566

________ ________ ________ ________ ________

At 31 December 2021 371 - 32 363 766

________ ________ ________ ________ ________

Included in leasehold improvements at 31 December 2022 are right

of use assets with a cost of $1,282,052 (2021 - $1,282,052) and

accumulated depreciation of $1,042,261 (2021 - $911,119).

Intangible assets

13

License Total

US$'000 US$'000

Cost

_________ _________

At 31 December 2021 and 2022 5,818 5,818

_________ _________

Accumulated amortisation and impairment

At 1 January 2021 - -

Amortisation charge - -

_________ _________

At 31 December 2021 - -

Amortisation charge

_________ _________

At 31 December 2022 - -

_________ _________

Net book value

At 31 December 2022 5,818 5,818

_________ _________

At 31 December 2021 5,818 5,818

_________ _________

On 18 June 2021, the Company entered into the Mount Sinai

Licence Agreement, pursuant to which the Icahn School of Medicine

at Mount Sinai ("Mount Sinai") granted an option to the Company to

obtain a licence, on a non-exclusive basis, to use certain

information held by Mount Sinai. The Mount Sinai Licence Agreement

automatically became effective on Admission. Exercise of the option

contained in the Mount Sinai Licence Agreement is conditional on:

(i) Admission; (ii) clearance by Mount Sinai's information security

team; and (iii) IRB, data security and data use approvals. Mount

Sinai is under an obligation to use commercially reasonable efforts

to obtain such clearances and approvals (other than Admission).

Pursuant to the Mount Sinai Licence Agreement, Mount Sinai has

granted the Company an option to obtain a licence, on a

non-exclusive basis, to use certain information held by Mount Sinai

to be able to develop future products.

Trade and other receivables

14

2022 2021

US$'000 US$'000

Amounts falling due within one year

Prepayments and accrued income 463 692

Other debtors 150 49

_________ _________

613 741

_________ _________

2022 2021

US$'000 US$'000

Amounts falling due after one year

Rent deposit 13 13

_________ _________

13 13

_________ _________

Trade and other payables

15

2022 2021

US$'000 US$'000

Trade payables 358 212

Accruals and other payables 684 571

_________ _________

Total financial liabilities classified as financial

liabilities measured at amortised cost 1,042 783

Other payables - tax and social security payments 13 21

_________ _________

Total trade and other payables 1,055 804

_________ _________

The carrying value of trade and other payables classified as

financial liabilities measured at amortised cost approximates fair

value.

Lease Liabilities

16

Land and Plant and

buildings machinery Total

US$'000 US$'000 US$'000

At 1 January 2021 571 360 931

Interest expense 89 18 107

Repayments (156) (74) (230)

________ ________ ________

At 31 December 2021 504 304 808

________ ________ ________

Additions - - -

Repayments (134) (125) (259)

Interest expense 37 15 52

________ ________ ________

At 31 December 2022 407 194 601

________ ________ ________

2022 2021

US$'000 US$'000

Maturity of lease liabilities

Within 3 months 62 57

Between 3 - 12 months 193 150

Between 1 - 2 years 233 255

Between 2 - 5 years 113 346

________ ________

601 808

________ ________

Provisions

17

Dilapidations Total

US$'000 US$'000

At 1 January 2021 50 50

Movement - -

_________ _________

At 31 December 2021 50 50

_________ _________

Movement - -

_________ _________

At 31 December 2022 50 50

_________ _________

Provision is made for the anticipated cost of returning the

Company's premises to their prior state on termination of the

lease.

Net cash /(debt) reconciliation

18

2022 2021

US$'000 US$'000

Cash and cash equivalents 3,088 9,217

Lease liabilities (601) (808)

_________ _________

Net cash / (debt) 2,487 8,409

_________ _________

Cash and Borrowings

cash equivalents and loans Net Debt

US$'000 US$'000 US$'000

Net debt at 1 January 2021 128 (10,630) (10,502)

Cash flows 9,089 - 9,089

Other non-cash movements:

Conversion of Convertible Loan Notes - 10,396 10,396

Forgiveness of Payroll Protection

Program loan - 206 206

Lease liabilities - (471) (471)

Accretion of interest on convertible

notes - (309) (309)

_________ _________ _________

Net debt at 31 December 2021 9,217 (808) 8,409

_________ _________ _________

Cash flows (6,129) - (6,129)

Other non-cash movements:

Lease liabilities 207 207

_________ _________ _________

Net debt at 31 December 2022 3,088 (601) 2,487

_________ _________ _________

Share capital

19

Issued and fully paid

Number US$

Shares of US$0.0001 par value each

At 1 January 2020

Common shares 5,092,839 510

Preference shares, Series A and B 79,738,560 7,973

Issue of common shares in the year 1,820,407 182

_________ _________

Total at 31 December 2020 86,651,806 8,665

Reverse stock split, at ratio of 1 new common

share (81,837,883) (8,184)

Issue of common shares on conversion of the

Convertible Loan Notes and Warrants 9,350,888 935

Issue of common shares for cash 9,659,091 966

Issue of common shares for non-cash consideration 1,656,888 166

_________ _________

Total issued share capital at 31 December

2021 25,480,790 2,548

Exercise of 5,192 options in the year 5,192 5

_________ _________

Total issued share capital at 31 December

2022 25,485,982 2,553

_________ _________

Between 2 July 2021 and 7 July 2021 the Company implemented a

pre-Admission reorganisation of its capital which included, inter

alia, the following:

-- A reverse share split by way of the issue of one new Common

or Preferred Share for every 18 old Common or Preferred Shares

held

-- Conversion of Series A-1 and Series A-2 Convertible Notes and

related Warrants into Common Shares

-- Conversion of Series A Preferred Shares and Series B Preferred Shares into Common Shares

Reserves

20

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Share premium Amount subscribed for share capital in

excess of nominal value.

Share based payment reserve Amount charged to date in respect of share

based payment expense

Retained earnings All other net gains and losses and transactions

with owners (e.g., dividends) not recognised

elsewhere.

Share-based payment

21

Prior to Admission to AIM the Company operated two share option

plans: the 2010 Stock Incentive Plan and approved by the Board on 1

January 2010 and the 2020 Stock Incentive Plan was approved on 14

May 2020:

(a) options granted under the 2010 Stock Incentive Plan fall into two groups:

(i) options granted in or before 2016 over a total of 2,183,634

shares, with exercise prices ranging from $0.10 to $0.16 per share,

these options are now fully vested; and

(ii) options granted in 2019 over a total of 6,951,463 shares,

with an exercise price of $0.025 per share: these options generally

vest on a monthly basis over three or four years from the date of

grant. However, those granted to current employees of the Company

were amended so that they became exercisable in full on

Admission.

(b) Options were granted in 2020 and 2021 under the 2020 Stock

Incentive Plan over a total of 5,364,385 shares with an exercise

price of $0.0044 per share. These options vest over four years from

the date of grant on a monthly basis, but certain of these options

accelerated immediately before Admission, and became fully

exercisable at Admission.

On 14 May 2021 the Board approved the Company's 2021 Omnibus

Long-Term Incentive Plan ("LTIP") and it was approved by

shareholders on 27 May 2021 to become effective approximately three

days prior to Admission. The LTIP provides for the grant of both

EMI Options and non-tax favoured options. Options granted under the

LTIP are subject to exercise conditions as summarised below.

The LTIP has a non-employee sub-plan for the grant of Options to

the Company's advisors, consultants, non-executive directors, and

entities providing, through an individual, such advisory,

consultancy, or office holder services and a US sub-plan for the

grant of Options to eligible participants in the LTIP and the

Non-Employee Sub-Plan who are US residents and US taxpayers.

With the exception of options over 384,924 shares, which vested

immediately on Admission, the options issued under the LTIP vest

25% on the first anniversary of the vesting commencement date and

an additional one forty-eighth of the total number of options after

each subsequent calendar month for employees. For consultants

options issued under the LTIP vest 25% on the first anniversary of

the vesting commencement date and an additional one sixteenth of

the total number of options after each subsequent quarter. If

options remain unexercised after the date one day before the tenth

anniversary of grant such options expire. Vesting shall accelerate

in full in the event of a change of control of the Company.

As described in note 19, between 2 July 2021 and 7 July 2021 the

Company implemented a pre-Admission reorganisation of its capital

which included a reverse share split by way of the issue of one new

Common or Preferred Share for every 18 old Common or Preferred

Shares held.

At the date of the reorganisation there were 14,499,482

pre-Admission options outstanding to 32 option holders comprising

Directors, former Directors and employees with exercise prices

between $0.0044 and $0.16 per share. Those options were varied to

reflect the reverse share split so that they were replaced with

805,492 options with exercise prices of between $0.0792 and $2.88

per share. The directors consider that this was a mechanical

variation modification of the awards and not a modification for the

purposes of IFRS2. Comparative figures have been adjusted to

restate numbers and values of share options issued as if the

reverse share split had been in effect from 1 January 2020.

On Admission on 8 July 2021 the Board approved grants of 769,707

to Paul Pagano and 386,703 options to David Anderson and on 23

November 2021 and 27 December 2021 the Board approved further

grants, of 112,500 and 5,000 options respectively, to employees and

consultants.

Share-based payment (continued)

21

Weighted

average

exercise

price US$ Number

Outstanding at 1 January 2020 - 12,230,198

Granted during the year - 2,345,845

Cancelled - (25,000)

Exercised during the year - (51,561)

_________ _________

Outstanding at 31 December 2020 and 1 January

2021 - 14,499,482

Reverse share split - (13,693,990)

_________ _________

Revised balance outstanding at 31 December 2020 0.74 805,492

Granted during the year 2.19 1,260,035

Exercised or expired during the year 0.74 (13,913)

_________ _________

Outstanding at 31 December 2021 1.74 2,065,527

_________

Granted during the year 2.37 75,000

Exercised during the period 0.45 (5,192)

Expired during the year 1.80 (18,356)

_________ _________

Outstanding at 31 December 2022 1.76 2,116,979

_________ _________

Exerciseable at 31 December 2022 1.62 1,506,180

_ _

The exercise price of options outstanding at 31 December 2022

ranged between US$0.08 and US$2.70 and their weighted average

contractual life was 5.03 years and weighted average expected life

was 3.55 years. The fair value of each share option granted has

been estimated using a Black-Scholes model. The weighted average

inputs into the model for the 2022 grants are a share price of

$2.37, exercise price of $2.37, expected volatility of 55.21%,

expected dividend yield of 0%, expected life of 5.03 years and a

risk-free interest rate of 1.26%. In the absence of historic

volatility data available at the grant date the expected volatility

of 55.21% was estimated based on comparable companies.

The Company recognised total expenses of US$614,000 (2021:

US$409,000) within administrative expenses relating to

equity-settled share-based payment transactions during the

year.

Related party transactions

22

During the year an amount of US$130,000 (2021 - US$2,190,000)

was invoiced by The Icahn School of Medicine at Mount Sinai for

services rendered in the year. As of 31 December 2022 no amounts

were owed to The Icahn School of Medicine at Mount Sinai (2021 -

Nil).

During the year Paul Pagano and David Anderson, both directors

of the Company, each purchased 5,000 shares in the Company using

their own funds.

Events after the reporting date

23

There have been no events subsequent to the year-end that

require disclosure in these financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKCBQBBKDFBD

(END) Dow Jones Newswires

February 20, 2023 02:00 ET (07:00 GMT)

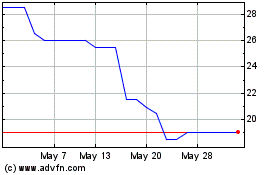

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From May 2024 to Jun 2024

Lunglife Ai (LSE:LLAI)

Historical Stock Chart

From Jun 2023 to Jun 2024