RNS Number:6213I

London Finance & Investment Grp.PLC

17 August 2001

London Finance & Investment Group P.L.C.

Preliminary announcement of unaudited results for the year ended 30th June

2001

This year was definitely one of two halves. In the first half growth in net

asset value per share, taking listed investments at market value, was very

strong. Net assets rose from 50.0p per share at 30th June 2000 to 61.1p at

31st December, an increase of 22% in a period in which the FTSE 100 index fell

by 1%. However we were not able to avoid the turbulence in the markets in the

second half of the year and net assets declined to 54.3p per share at 30th

June 2001. This increase in net assets of 9% over the year to #13.9 million

compares to falls in the FTSE 100 and FTSE All Share indices of 11% and 10%

respectively over the same period.

The profit before tax for the year ended 30th June 2001 was #1,060,000 an

increase of 66% from #638,000 reported last year. Earnings per share increased

by 68% from 2.4p last year to 4.1p in the year to 30th June 2001. These

results have been significantly influenced by exceptional profits recorded by

our associated company, Western Selection P.L.C., which are explained below.

Excluding exceptional items, our profit before tax has fallen from #444,000

last year to #255,000 and earnings per share have fallen from 1.67p to 0.94p.

This decrease is mainly due to a reduction in the sale of General Portfolio

investments with correspondingly lower profits.

Your directors propose to raise the dividend this year to 1.2p per share, an

increase of 9% (2000 - 1.1p)

Strategic Investments

Western Selection P.L.C. ("Western")

The Company owns 17,611,745 shares, being 40.48% of the issued share capital,

and 3,238,255 warrants, of Western. On 2nd August 2001 Western announced a

profit after tax and exceptional items of #2 million for its year to 30th June

2001, an increase in earnings to 4.56p from 1.96p, and a 15% increase in

dividend to 0.46p (2000 - 0.40p). Western's net assets at market value were #

13.1 million, equivalent to 30.2p per share, an increase of 2% over the 29.6p

recorded at 30th June 2000.

The market value of the Company's investment in Western at 30th June 2000 was

#3.4 million and the book value was #4.0 million. At market value this

represents 25% of the net assets of the Company. The underlying value of the

Company's investment in Western, valuing Western's own investments at market

value, was #5.3 million (2000- #5.2 million).

I am the Chairman of Western and Mr. Robotham is a non-executive director.

Western has strategic investments in The Sanctuary Group PLC and Creston plc

and has recently committed to make a Strategic Investment in Doctors Direct

plc prior to its introduction to Ofex and has reported on them as follows:

The Sanctuary Group PLC

At 30th June 2001, Western owned 4,000,000 shares (1.46% of the issued

share capital) and 3,131,801 warrants in Sanctuary. The market value

of Western's holding in shares and warrants on 30th June 2001 was #4.5

million, being 34% of Western's net assets, and the cost was #593,100.

On 24th August 2000, Western sold 2,725,000 shares in Sanctuary at a

price of 73p each realising a profit of #1,575,300. This was Western's

first sale of Sanctuary shares since its transformation from

Burlington Group plc in 1998. The cash received of almost #2 million

has more than recouped the total investment in the company of #1

million. Since the year end, Western has sold a further 1,131,801

shares and exercised the holding of 3,131,801 warrants at 25p each and

now holds 6,000,000 shares representing 2.0% of the issued share

capital.

On 5th June 2001 Sanctuary announced its results for the half-year to

31st March 2001. Turnover increased by 174% over the equivalent period

in 2000; operating profits before interest, taxation, depreciation and

amortisation increased by 140%. Profit before tax, after amortisation

of the catalogues rose 76%. Basic earnings per share were 0.88p for

the half-year compared with 0.81p for the same period a year earlier,

an increase of 8%.

On 19th June 2001 Sanctuary announced agreement in principle to

acquire the Trojan catalogue of over 10,000 tracks for #10.3 million,

which will extend its presence in the Reggae segment of the market. In

addition, Sanctuary announced that it had raised #20.5 million, by a

placing of 27.35 million shares at 75p each, which will be used to

finance the acquisition of Trojan, repay some existing debt and

provide additional working capital.

Creston plc

Western owns 1,600,000 shares and 308,264 warrants, being 14% of the

issued share capital and 16% of the warrants of Creston. The market

value of Western's holding in Creston on 30th June 2001 was #1.3

million, being 10% of the Company's net assets, and the book value was

#1.6 million.

On 20th December 2000, Creston disposed of its remaining property

interests and on 29th January 2001 it completed its transformation

from a UK property company, to a marketing services company by

acquiring Synergie Consulting Limited and a well established

quantitative research company with a blue chip client list, Marketing

Sciences Limited. Synergie Consulting was established by Don Elgie,

Creston's new Chief Executive, for the purpose of developing a "buy

and build" concept within the marketing services sector.

Doctors Direct plc

On 31st July 2001, Western entered into an agreement providing for the

investment of a sum totalling #500,000 in Doctors Direct. Ten per

cent. of this total will be allocated at cost to a co-investor.

Western will therefore hold 4.5 million shares and 4.5 million

warrants (which will be 15% of their issued share capital and 41.7% of

their issued warrants). These shares will be part of an offer for

subscription of 10 million new shares being conducted by way of a

prospectus and admission to trading on Ofex. On completion of the

offer, assuming maximum subscription, Doctors Direct will have 30

million shares in issue and be capitalised at #3 million at the offer

price of 10p. In recognition of Western's significant investment, Mr.

D.C. Marshall (Chairman of both Western and London Finance) has agreed

to act as non-executive chairman of Doctors Direct upon completion of

this fund raising.

Doctors Direct provides a visiting GP service direct to individuals

and organisations at their home, hotel or workplace 24 hours a day,

365 days a year. Visits are made at the patient's request and

convenience. Doctors can attend patients throughout the central London

area. The new shares are being issued to raise working capital to

expand the business both within London and in other areas with

suitable population densities and profiles.

Unlike many Ofex stocks, Doctors Direct is an established company that

is trading profitably and made profits before tax of #126,000 on

turnover of #683,600 in the nine month period ended 31st March 2001.

It had annualised earnings per share of 0.8p on a pre-funding basis.

The company believes it will be able to substantially boost turnover

over the next few years, as it plans to emulate the success of SOS

Medecins, which provides a similar service in Paris and has proved

extremely successful.

Marylebone Warwick Balfour Group Plc ("MWB")

The Company owns 3,000,000 shares in MWB, being 2.59% of the issued share

capital of MWB. The market value of the Company's holding in shares of MWB on

30th June 2001 was #5.2 million and the book value was #2.5 million. At market

value this represents 37% of the net assets of the Company.

MWB has six main operating divisions: serviced business space, hotels, fund

management, asset management, project management and retail operations. The

first four of these are structured as long term businesses producing recurring

income and cash flow, the project management division produces profits and

fees over fixed timetables and the retail operations encompass the Liberty

retail store operations in London. I am the Chairman of MWB and Mr. Robotham

is a non-executive director.

MWB's European serviced business space operations have nearly doubled in

capacity over the last year. The focus is on Europe's major business cities

with London and Paris representing 50% of workstations and operating at 80%

capacity. 75% of the London centres have a relatively low cost base as they

are either owned or have been refurbished by MWB.

The hotels business is underpinned by long term operating and management

agreements with internationally renowned hotel groups. These agreements are

signed before commencing any new development, usually for 20 years and

including a minimum annual income guarantee. Planning consent has recently

been granted to add another two floors to The Howard, a five-star hotel on

London's Victoria Embankment, which will increase the number of rooms by

almost a third. The Malmaison chain was acquired last November and is operated

in conjunction with Scandanavian Airlines System. Construction work continues

on a 157 room luxury hotel on Park Lane, London to be operated by Marriott

International and at Argyll Street, Glasgow which will be operated by Radisson

SAS Hotels.

The first two leisure funds operated by MWB's fund management division are

fully invested and the third fund has invested #110 million of the total

capability of #250 million. The life of the MWB Leisure Fund 1 has been

increased by a further two years until December 2003, providing MWB with

continuing management fees.

On 6th July 2001, MWB announced that approval had been received for its 70%

owned development at the Royal Victoria Docks. This development valued at

approaching #300m will include 750 hotel rooms and detailed planning consent

has been received for two hotels with a total of 413 rooms which are being

constructed on behalf of Accor.

Retail Stores, which owns Liberty, has disposed of surplus property, is

refurbishing the store and has converted part of the space into serviced

offices. It has a new management team to revitalise the Liberty brand and

return the retail operations to profitability.

MWB announced earnings of 5.3p per share for its half-year ended 31st December

2000, up from 4.8p for the half-year ended 31st December 1999, and an interim

dividend of 1.4p per share (1.4p last year). At 31st December 2000 MWB had net

assets #303 million which represent net assets per share of 204p (up from 202p

at 30th June 2000).

Megalomedia plc ("Megalomedia")

At 30th June 2001 the Company owned 4,300,000 shares in Megalomedia,

representing 5.74% of Megalomedia's issued share capital. The market value of

our holding was #1.2 million on 30th June 2001 compared to a cost of #0.6

million.

Megalomedia sold its post production film services business to management in

the year for #12 million and has agreed in principle to sell its recruitment

business to management for #0.4 million. Shareholder and court approval has

been granted for a tender scheme under which Megalomedia has repurchased 77%

of its shares at a price of 29p each on 7 August. We have not tendered any of

our shares and as a result now own 25% of Megalomedia following the share

repurchase. Megalomedia has net assets of #5 million and two other major

shareholders: Landau Enterprises Inc. and Robert Fleming & Co Ltd who own 28%

and 26% of the company respectively. Mr. Barclay is a director of our

associated company Western, and he and I are both non-executive directors of

Megalomedia.

Megalomedia has outsourced all of its day-to-day activities to our management

services subsidiary City Group Ltd who will be working with the board of

Megalomedia to identify suitable businesses for acquisition.

Merrydown plc ("Merrydown")

In June, we acquired 1,100,000 shares in Merrydown plc at a cost of #432,000.

This represents 4.15% of Merrydown's issued share capital.

Merrydown is a leading cider producer and also manufactures the Schloer range

of soft drinks, which is widely distributed through supermarkets. Sales of

Schloer increased by 47% to #8.5 million in the year ended 31st March 2001.

This is almost 50% of the total sales for the year of #17.6 million and

reflects the continuing shift in emphasis of the company from cider to soft

drinks. The Merrydown cider brand maintained its market share in a difficult

year.

Merrydown's profit before tax for the year ended 31st March 2001 was #1.0

million compared to #742,000 for the previous year and earnings per share were

2.9p, up from 1.6p in the previous year. At 31 March 2001, Merrydown had no

borrowings and #2.8 million in cash. It also had #865,000 of property held for

resale. Shareholders funds were 50p per share at 31st March 2001, which

compares favourably with our average purchase price of 39.3p

General Portfolio

The General Portfolio is dominated by three sectors: banking and insurance;

food, beverages and consumer goods; support services, transport and logistics.

These three sectors accounted for 64% of the portfolio by value at 30th June

2001. We believe that the companies in these sectors in which we have invested

have the potential to outperform the market in the medium to long term.

We are taking a cautious view of the stock markets in the short term and the

General Portfolio has therefore been reduced in size over the year from a cost

of #3.7 million to #3.4 million. This has allowed a reduction in bank

borrowings from #1.5 million to #0.9 million and with the bank facility of #2

million gives us flexibility to take advantage of any bargains arising from

the current volatility in world stock markets.

The year ahead

Our long standing strategy is to achieve increasing value for shareholders

from a number of Strategic Investments, which may well be volatile, and a

General Portfolio of leading shares in companies which operate on a global

basis.

Every day the newspapers seem to provide more bad news about the performance

or the outlook for world economies, in view of which we maintain a cautious

view for the shorter term.

Our strategy has been successful in recent years and will enable us to take

advantage, where appropriate, of new opportunities.

D.C. MARSHALL

Chairman

------------------------------------------------------------------------------

Unaudited Consolidated Profit and Loss Account

For the year ended 30th June 2001 2000

#000 #000

Operating Income

Investment operations 620 660

Management services 425 433

Administrative expenses

Investment operations (273) (271)

Management services (416) (430)

Operating profit 356 392

Share of result of associated undertaking- normal 16 175

- exceptional 805 194

Interest payable (117) (123)

Profit on ordinary activities before taxation 1,060 638

Tax on result of ordinary activities (12) (16)

Profit on ordinary activities after taxation 1,048 622

Minority interest (3) (1)

Profit attributable to members of the holding company 1,045 621

Proposed dividend 1 (307) (281)

Retained profit for the period 738 340

Earnings per share 2 4.09 p 2.43 p

Earnings per share excluding exceptionals 2 0.94 p 1.67 p

Fully diluted earnings per share 2 3.93 p 2.35 p

There are no recognised gains or losses other than the above profits and

accordingly no separate statement of recognised gains and losses is shown.

All profits and losses are on continuing activities.

There is no difference in either year between the above profit and the profit

on an historical cost basis.

Unaudited Balance Sheets

at 30th June Group Company

2001 2000 2001 2000

#000 #000 #000 #000

Fixed Assets

Tangible assets 493 517 467 477

Investments in Group companies - - 6,154 6,087

Investments 7,607 6,499 - -

8,100 7,016 6,621 6,564

Current Assets

Listed investments 3,443 3,710 3,443 3,710

Unlisted investments 43 55 43 55

Debtors 157 146 44 41

Bank balance and deposits 32 53 17 35

3,675 3,964 3,547 3,841

Current Liabilities

Creditors: falling due within one year (2,010) (1,962) (1,972) (1,906)

Net Current Assets 1,665 2,002 1,575 1,935

Total Assets less Current Liabilities 9,765 9,018 8,196 8,499

Capital and Reserves

Called up share capital 1,277 1,276 1,277 1,276

Share premium account 962 957 962 957

Reserves 361 361 480 480

Profit and loss account 7,109 6,371 5,477 5,786

Equity shareholders' funds 9,709 8,965 8,196 8,499

Minority equity interests 56 53 - -

9,765 9,018 8,196 8,499

Analysis of Net Assets

at 30th June 2001 2000

#000 #000

Principal investments at market value:

Western Selection P.L.C. 3,418 2,604

Megalomedia plc 1,161 867

Marylebone Warwick Balfour Group Plc 5,160 4,830

Creston plc - sold 30 January 2001 - 238

Merrydown PLC - acquired 27 June 2001 429 -

10,168 8,539

General equity portfolio at market value 5,040 5,479

Tangible fixed assets 493 517

Cash, bank balances and deposits 32 53

Bank Loan (900) (1,500)

Other net liabilities (910) (261)

Minority interests (55) (53)

Net assets, including investments at market value 13,868 12,774

Net assets per share, including investments at market 54.28 p 50.05p

values

The market value of net assets is stated before any taxation which may arise

on disposal.

Consolidated Cash Flow Statement

For the year ended 30th June 2001 2000

#000 #000

Cash outflow on operating activities 888 (18)

Returns on investments and servicing of finance

Dividends received 374 369

Interest paid (105) (104)

Net cash inflow from returns on investments and servicing of 269 265

finance

Taxation (6) (10)

Investing activities

Tangible fixed assets - purchased (3) (31)

Fixed asset investments - purchased (532) (511)

- proceeds on disposal 238 167

Net cash outflow from investment activities (297) (375)

Equity dividend paid - Company (281) (255)

Financing

Share capital issued 6 1

Net (repayment)/drawdown of loan facility (600) 350

Net cash (outflow)/inflow from financing (594) 351

Decrease in cash (21) (42)

Notes

1 The dividend for the year of 1.20p per share (2000 - 1.10p) will

be paid on 12th October 2001 to shareholders on the register on 21st

September 2001.

2 Earnings per share are based on the result of ordinary

activities after taxation and minority interests and on 25,540,767

(2000 - 25,523,710) being the weighted average of the number of shares

in issue during the year.

3 The net assets attributable to shareholders, taking investments

at market value, are before providing for any tax that may arise on

realisation

4. The financial information in this preliminary announcement of unaudited

group results, which has been reviewed and agreed by the auditors, does

not constitute statutory accounts within the meaning of section 240(5) of

the Companies Act 1985. The audited accounts of the group for the year

ended 30th June 2000 have been reported on with an unqualified audit

report in accordance with section 235 of the Companies Act 1985 and have

been delivered to the Registrar of Companies.

General Equity Portfolio

Anglo American PLC

AstraZeneca PLC

Avocet Mining PLC

BAA PLC

BOC Group PLC

Cable & Wireless PLC

CGNU PLC

Credit Suisse Group AG

Diageo PLC

Fortis (NL) NV

Fuller, Smith & Turner PLC

GlaxoSmithKline PLC

HSBC Holdings plc

ING Groep NV

J. Sainsbury plc

Johnson Matthey PLC

Lavendon Group PLC

Lloyds TSB Group PLC

Marconi PLC

Nestle SA

Novartis AG

Pearson PLC

Prudential PLC

Reuters Group PLC

Roche Holdings AG

Rolls-Royce PLC

Schweiz-Ruckversicherungs-G

The Shell Transport & Trading Company PLC

Somerfield PLC

Tibbett & Britten Group PLC

UBS AG

Unilever PLC

UTi Worldwide Inc.

Vodafone Group PLC

Wyndeham Press Group PLC

Zurich Financial Services AG

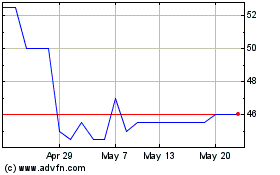

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Sep 2024 to Oct 2024

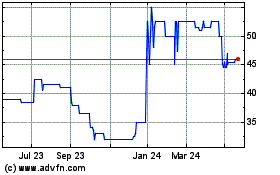

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Oct 2023 to Oct 2024