RNS No 6893b

KENWOOD APPLIANCES PLC

1 July 1999

KENWOOD APPLIANCES PLC

Preliminary results for the year ended 2nd April 1999

# million 1998/99 1997/98

Restated

*

Sales 154.1 170.3

Gross margins** 35.1% 35.2%

Operating Profit** 4.1 10.3

Profit before exceptionals and tax 0.1 5.6

Exceptional items operating (1.0) -

non operating (8.9) (3.1)

(Loss)/Profit before tax (9.8) 2.5

Net borrowings 29.2 35.5

(Loss)/Earnings per share (24.6)p 0.6p

*Restated for FRS 12

**Before exceptional charges

David Nash, Chairman said today: -

"Difficult trading conditions, in both the UK and a

number of export markets, led to sales declining from

#170.3m to #154.1m and pre-tax profits before

exceptionals declining from #5.6m to #0.1m. At this

stage, the Board is not recommending the payment of a

dividend.

"In response to these conditions, we have accelerated the

restructuring programme, initiated in 1997, to transform

Kenwood from a vertically integrated, predominantly UK,

manufacturing company into an agile brand led business.

This programme, which is nearing completion, has led to

exceptional restructuring charges in the year of #9.9m

primarily in connection with asset write-downs.

"Tight cash control resulted in borrowings reducing by

#6.3m to #29.2m after spending #2.8m on restructuring

charges."

Colin Gordon, Chief Executive said today: -

"This has been a year of significant progress in

reshaping the underlying structure of the business,

against a background of difficult trading conditions in a

number of key markets and the short term impact of that

radical restructuring.

In the year to 2nd April 1999: -

Our product range has been dramatically improved with the

launch of 28 new Kenwood products and the complete

redesign of the Ariete kitchen range;

The transfer of sourcing to achieve the optimum mix of

cost and quality is well underway;

The gains made last year on gross margins were

maintained;

The international sales structure was reorganised with

the closure of the New Zealand subsidiary and cost

reduction programmes implemented in a number of markets;

Year-end borrowings were reduced from #35.5m to #29.2m.

"Since the year-end, we have announced further major

moves including the proposed sale and closure of the

Havant site with the transfer of more products to lower

cost areas and the sale, to the management, of a non core

engineering business.

"Given the continuing depressed state of consumer sales

in key markets and the high level of the pound, the Board

anticipates that the first half will show a loss after

interest. In the second half, the benefit from the new

products and reduced costs will show through and a profit

before tax and exceptional charges is anticipated for the

full year. The restructuring moves, which the Company has

announced, are not scheduled to be completed until

December 2000. These will progressively benefit profits

over the next two years and are projected to add

approximately #4m annually to profits before tax once

fully implemented."

For further information:

Colin Gordon Tel: 0171 638 9571 (today)

Chief Executive,

Kenwood Appliances Tel: 01705 476 000

(thereafter)

Simon Rigby, Alex Brown Tel: 0171 638 9571

Citigate Dewe Rogerson

KENWOOD APPLIANCES Plc

PRELIMINARY RESULTS FOR YEAR ENDED 2ND APRIL 1999

FINANCIAL RESULTS

Sales were #154.1m compared to #170.3m, in the previous

year. After stripping out discontinued activities, sales

were #148.0m compared to #160.7m in 1997/98, a decline of

8%. Sales were weak in both the UK and a number of export

markets, particularly those affected by the economic

crises in Asia and Eastern Europe.

The progress made on margins was maintained and gross

margin stabilised at 35.1% compared to 35.2% last year.

Profit before exceptionals and tax was #0.1m compared to

#5.6m in 1997/98.

Exceptional charges of #9.9m have been provided. As

announced on 7th June 1999, the restructuring of UK

operations resulted in an exceptional charge of #8.8m in

1998/99. #7.8m was non cash asset write downs principally

affecting the value of UK properties and the balance of

#1.0m cash was in respect of redundancy and associated

restructuring costs. A further #1.1m was provided in

respect of redundancy and other cash restructuring costs

for the overseas sales operations.

The loss after exceptionals and before tax was #9.8m

compared to a profit of #2.5m in 1997/8. The loss per

share was 24.6p (1997/8 earnings per share 0.6p).

Net borrowings were reduced by #6.3m to #29.2m despite

spending #2.8m on the restructuring charges. Although

borrowings were significantly lower, gearing increased

from 103% to 125% reflecting the effect of the asset

write-downs on the net asset base. The positive cash flow

was generated by tight working capital controls; in

particular stocks were #10.5m lower at the year-end at

21.7m.

The net interest charge fell from #4.7m to #4.0m. Pre

exceptional interest cover was 1.0 times.

The Board is not recommending a dividend payment for the

year 1998/99.

TRADING REPORT

UK

Turnover from continuing businesses fell by 7.7%

reflecting poor consumer confidence and a weak

performance in core Kenwood categories such as food

processors where the market declined by 8.1%. Total

Kenwood market share declined from 12.1% to 10.4% but

share gains were posted in some important categories

including kettles. Kenwood remains the clear brand leader

in food preparation products. Once again significant

margin improvement was achieved principally from new

products and improved purchasing benefits.

Italy

Overall Ariete grew turnover by 15.0% to 111.8bn lire

(#39.6m) largely as a result of strong export sales. In

Italy, Ariete has achieved a 5% market share and in the

year saw growth in its market shares in coffee makers and

ironing systems. The relaunch of its core Grati cheese

grater was very encouraging and the Vapori steam broom

performed well in its launch in the USA.

For Mizushi the strategy is to manage the business for

cash whilst trading at break even. This was achieved.

Debtors reduced by two thirds to 5.5bn lire (#1.9m) and

stocks were cut by over one third to 9.6bn lire (#3.3m).

Overseas Sales Subsidiaries (IKBs)

During the year a full review of each subsidiary was

conducted. This resulted in the decision to close the IKB

in New Zealand and aggressively to reduce costs in

Germany, Austria, Poland, Ireland, Malaysia and South

Africa. An agreement has been signed with UPS Worldwide

Logistics to outsource the warehousing and transport for

our continental European IKBs. After a difficult period

our businesses in both Germany and France improved

performance and posted share growth in the core stand

mixer category.

Third Party Distributors

Export sales to third party distributors fell by 17% to

#24.3m. Half of the decline occurred in Australia, our

largest export market, where there was a change of

distributor. These sales should be recovered in the

current year. Sales to Eastern Europe fell by over #1m

reflecting the region's financial crisis. The strength of

sterling continues to impact this business.

Manufacturing and Sourcing

This has been another year of major change for the UK

manufacturing team. Over 60% of the Group's manufacturing

is now outsourced and over 40% of our products are

produced in China. Whilst we clearly regret the loss of

UK jobs that these moves have entailed, this development

is absolutely essential if Kenwood is to remain

competitive in the market place.

Tricom, Kenwood's 100% owned Chinese facility, has also

seen considerable change. In future it will focus on the

production of motors and components for the Chef and a

number of our products formerly produced in Tricom are

being transferred to a Chinese partner company.

As these two manufacturing sites are reshaped, there has

been a negative impact on profits as a result of the

lower levels of overhead recovery. The recently announced

restructuring programmes are addressing this.

In Italy, where only 5% of production is now in house, a

25% reduction in the labour force was achieved.

As a result of the Asian crisis there have been

significant deflationary pressures on products sourced

from the Far East. Prices now are showing signs of

firming.

KENWOOD RESTRUCTURING PROGRAMME

A strategy was initiated in 1997 to transform Kenwood

from a vertically integrated predominantly UK

manufacturing company into an agile brand led business.

To achieve this a number of programmes were introduced: -

To focus the business on small domestic appliances;

To revitalise the product range

To cut the cost base;

To reduce borrowings; and

To deliver low cost flexible manufacturing.

Despite the disappointing trading performance,

significant progress has been made against all of these

objectives: -

Focus

Following the sale in 1997/8 of the UK printing business,

in June 1999, a UK engineering business, where 60% of the

output was unconnected to our products, was sold to the

management. The unprofitable sales subsidiary in New

Zealand was closed.

Refreshed Product Ranges

A complete review of the Kenwood product range has been

undertaken. This had led to the introduction of new

models in all of the key categories such as kettles,

irons, toasters and food processors. In 1998/99 28 new

products were introduced and it is planned to match that

number in the current year. The processes are now in

place to deliver a continuing programme of new products.

Ariete continues to lead the way in innovation and has

launched a completely new kitchen essentials range, a new

coffee machine range, which has captured a 5% share of

the Italian market and a new range of irons.

Cost Reduction

Since the start of the Kenwood restructuring programme,

the Group has reduced its workforce by almost one-third

(917) to 1955. The effect of the moves announced in

February and June 1999 will reduce this by approximately

a further 450 jobs. The full benefit of the cost savings

will occur in 2000/01.

Borrowings Reduction

A major management programme to focus on cash led to a

33% reduction in stock levels and an 11% reduction in

debtors at the year-end. As a result borrowings fell 18%

to #29.2m. At the same time the Group increased

investment in tooling for new products and spent #2.8m on

the cash costs of restructuring.

Flexible Low Cost Manufacturing

During the year, the Company sold its UK plastic moulding

operations and this transfer will be completed by March

2000. The programme to transfer the balance of production

to China except for the Kenwood Chef and water filter

business is underway. This development was only initiated

once rigorous testing of the quality of the new products

had been undertaken.

Restructuring Costs

The UK restructuring programme involving the transfer of

production to China and the relocation of the Head office

and remaining UK manufacturing will result in exceptional

charges of approximately #11.6m. The sale of Freshwater,

a non-core engineering business, will result in a book

loss of #2.3m. A further #1.1m restructuring charge has

been incurred in the reorganisation of the overseas sales

companies.

Of this total of #15m of exceptional charges, #9.9m has

been incurred in 1998/9 and has been recognised in that

year's accounts in accordance with current accounting

standards. This comprises #8.0m in respect of the UK

reorganisation, #0.8m for the write down of property at

Freshwater and #1.1m for overseas sales companies.

In 1999/2000, a further #4.0m of restructuring costs is

anticipated: #1.5m being the balance of the loss on

disposal of Freshwater and #2.5m in respect of redundancy

and associated costs. The balance of the exceptional

charges will be incurred in 2000/01.

FUTURE PROSPECTS

Given the continuing depressed state of consumer sales in

key markets and the high level of the pound, the Board

anticipates that the first half will show a loss after

interest. In the second half, the benefit from the new

products and reduced costs will show through and a profit

before tax and exceptional charges is anticipated for the

full year. The restructuring moves, which the Company has

announced, are not scheduled to be completed until

December 2000. These will progressively benefit profits

over the next two years and are projected to add

approximately #4m annually to profits before tax once

fully implemented.

Group Profit & Loss Account

For the year ended 2nd April 1999

1999 1999 1999 1998

Before Excep-

Exceptional tional Total Restated

Items Items Total

#000 #000 #000 #000

Turnover:

Continuing operations 148,028 - 148,028 160,659

Discontinued operations 6,093 - 6,093 9,678

----- ----- ----- -----

154,121 154,121 170,337

Cost of sales (100,072) (1,005) (101,077)(110,465)

----- ----- ----- -----

Gross profit 54,049 (1,005) 53,044 59,872

----- ----- ----- -----

Distribution costs (35,721) - (35,721) (36,201)

Administrative expenses(14,248) - (14,248) (13,314)

----- ----- ----- -----

(49,969) - (49,969) (49,515)

----- ----- ----- -----

4,080 (1,005) 3,075 10,357

Other operating

expenditure 59 - 59 (62)

----- ----- ----- -----

Operating profit:

Continuing operations 4,589 (1,005) 3,584 9,673

Discontinued operations (450) - (450) 622

----- ----- ----- -----

4,139 (1,005) 3,134 10,295

Exceptional items:

Continuing operations - - - (3,713)

Discontinued operations - (8,884) (8,884) 569

Bank interest receivable 704 - 704 603

Interest payable (4,708) - (4,708) (5,297)

----- ----- ----- -----

(4,004) - (4,004) (4,694)

(Loss)/Profit on

ordinary activities

before taxation 135 (9,889) (9,754) 2,457

Tax on profit

on ordinary

activities (1,519) - (1,519) (2,191)

----- ----- ----- -----

(Loss)/Profit attributable

to members of

the parent company (1,384) (9,889) (11,273) 266

(Loss)/Retained

profit for the year (1,384) (9,889) (11,273) 266

===== ===== ===== =====

(Loss)/Earnings

per share (24.6)p 0.6p

Diluted (loss)/

earnings per share (24.6)p 0.6p

Group Balance Sheet

Restated

2nd April 3rd April

1999 1998

#000 #000

Fixed assets

Tangible fixed assets 27,467 37,058

Investments 1,927 1,927

----- -----

29,394 38,985

----- -----

Current assets

Stocks 21,698 32,203

Debtors 40,658 45,776

Cash at bank and in hand 9,670 20,470

----- -----

72,026 98,449

Creditors: amounts falling

due within one year (76,489)(100,368)

----- -----

Net current (liabilities)/assets (4,463) (1,919)

----- -----

Total assets less

current liabilities 24,931 37,066

----- -----

Creditors: amounts falling

due after more

than one year (602) (1,328)

Provisions for

liabilities and charges (1,005) (1,153)

----- -----

23,324 34,585

=== ===

Capital and reserves

Called up share capital 4,586 4,586

Share premium 25,101 25,101

Special reserve 2,180 2,180

Capital reserve - -

Profit and loss account (8,543) 2,718

----- -----

Shareholders' funds-equity interest 23,324 34,585

=== ===

Group Statement of Cash Flows

Year to Year to

2nd April 3rd April

1999 1998

#000 #000

Cash flow from

operating activities 15,997 16,253

Returns on investments

and servicing of finance (4,004) (4,686)

Taxation (763) (3,477)

Capital expenditure (4,666) (4,539)

Acquisitions and disposals - 646

Equity dividends paid - -

Financing (21,402) 33,446

----- -----

(Decrease)/increase

in cash in the period (14,838) 37,643

==== ====

Reconciliation of net cash flow to movement in net debt

(Decrease)/increase in

cash in the period (14,838) 37,643

Cash outflow/(inflow)

from decrease/(increase)

in debt and lease financing 21,402 (33,446)

----- -----

Change in net debt

resulting from

cash flows 6,564 4,197

Translation difference (324) 1,987

----- -----

Movement in net

debt in the period 6,240 6,184

Net debt brought forward (35,456) (41,640)

----- -----

Net debt carried forward (29,216) (35,456)

==== ====

The above accounts do not constitute full accounts within

the meaning of the Companies Act. Full accounts for the

year to 2nd April 1999, which have not yet been delivered

to the Registrar of Companies, will be sent to

shareholders.

The auditors have issued an unqualified audit report.

Copies of this announcement are available to members of

the public at the Company's registered office, New Lane

Havant Hants PO9 2NH.

END

FR ARSBKKKKNOAR

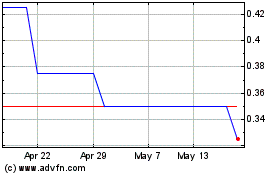

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

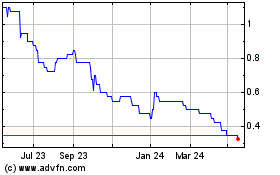

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024