TIDMKEN

RNS Number : 3541Y

Kenetics Group Limited

22 December 2010

22 December 2010

Kenetics Group Limited

("Kenetics" or "the Company")

Proposed Cancellation of Admission to Trading on AIM

Kenetics, the Radio Frequency Identification ("RFID") group

focussed on security and RFID systems and products, today announces

that it is seeking Shareholder approval for the cancellation of

admission to trading on AIM of its Ordinary Shares.

Introduction

Kenetics' ordinary shares were admitted to trading on AIM on 18

August 2006 and for some time now the Board has been concerned that

trading in the Company's shares has become progressively more

limited. The reasons for the limited trading in Kenetics' shares,

and those of many other small cap companies, have been widely

discussed in the press and elsewhere.

The Board believes that the Company's share price does not

reflect the value of the underlying business and that the Company

is prevented from raising the funds required to develop its current

and planned activities. As a result, the Board now announces its

intention to seek the authority of Shareholders to obtain a

cancellation of the Company's Ordinary Shares from trading on

AIM.

A General Meeting has been convened at the offices of Stephenson

Harwood One St. Paul's Churchyard, London, EC4M 8SH for 8.30 a.m.

on 18 January 2011, at which Shareholders will be asked to

consider, and if thought fit, to approve a Resolution in order to

implement the Delisting.

Rationale for the Delisting

The Directors have concluded that a resolution should be put to

Shareholders to approve a Delisting for the following reasons:

-- there is a clear lack of liquidity in the Ordinary Shares of

the Company which, in the Directors' view, has contributed to the

Company being undervalued on AIM;

-- the bid/offer spread at which a market is made in the

Company's Ordinary Shares has perpetuated the lack of liquidity and

the Directors believe this is unlikely to be resolved, given the

size of the Company and its lack of appeal to institutional

investors;

-- the ability to secure new equity participation at levels

which fairly reflect the existing equity value is significantly

undermined by the low share price at a time when the Company has a

pressing need to raise funds; and

-- the costs associated with maintaining a listing on AIM are

now disproportionate to value provided by the listing, and

management expects savings arising from the Delisting will amount

to approximately GBP125,000 per annum.

Progress since admission to AIM

The Company has made significant progress since being admitted

to trading on AIM in August 2006. A new range of GEN2 products have

been developed and improvements have been made to its existing

industrial product range, including the Ultra High Frequency (UHF)

RFID readers. These products are currently being sold in the USA,

Europe and Japan.

In addition to continuing to enhance its UHF technology platform

and developing a new generation of RFID products, in early 2008 the

Company began investing in the development of Advanced Fare

Collection (AFC) technologies. Strategically, Kenetics has

identified a growing market towards automation in the public mass

transport sector, particularly through the use of AFC in rail and

bus systems. Since 2009, Kenetics has focused mainly on developing

Contactless Smart Card (CSC) readers and On Board Bus Equipment

(OBE), which form the backbone for entry into the AFC systems

market. Since it first began to invest in the development of AFC

technologies, the Company has made significant progress in its

R&D efforts and has developed what the Directors believe to be

some technologically advanced innovations for the rail and bus

systems.

The development work for the CSC readers and the OBE systems is

now completed and both are currently undergoing commercial trials

in both the rail and bus systems under two contracts for the

Singapore Land Transport Authority (LTA).

Board deliberations

Against this background, the Board, some of whom are also major

Shareholders, has spent significant time evaluating different

strategic alternatives for the Company. These deliberations have

taken into account the current financial position of the Company,

the Company's growth strategy, the current financial climate and

the relative benefits compared to the ongoing costs of maintaining

a listing on AIM. The Board has also taken into account the views

of the Company's large shareholders, as well as assessing the

position of the Company's shareholders as a whole.

Following careful consideration of these factors with its

advisers, the Board has decided that the disadvantages and the

ongoing costs of maintaining a listing on AIM far outweigh the

benefits that the listing on AIM provides to the Company

Irrevocable Undertakings

Each Director who holds Ordinary Shares and certain other

significant Shareholders have confirmed to the Company that they

will be voting in favour of the Resolution in respect of the

Ordinary Shares held by them. The total number of Ordinary Shares

covered by these irrevocable undertakings is 32,215,480 Ordinary

Shares representing 78.86 per cent. of the Company's issued share

capital.

Future Opportunity

The Board's objective is to realise an exit for Shareholders

within a three to five year period following cancellation of it

Ordinary Shares from trading on AIM. The Board will consider all

forms of exit for its Shareholders, including a trade sale, private

equity buyout or public market listing with the aim to maximize

Shareholder value.

Share dealing following the Delisting

Whilst the Board believes that the Delisting is in the interests

of Shareholders as a whole, it recognises that Delisting will make

it more difficult for Shareholders to buy and sell Ordinary Shares

should they so wish. Accordingly, the Board intends to set up a

matched bargain arrangement, provided by SVS Securities, to enable

Shareholders to trade the Ordinary Shares. Under this facility, it

is intended that Shareholders or persons wishing to trade Ordinary

Shares will be able to leave an indication with SVS Securities that

they are prepared to buy or sell at an agreed price. In the event

that the matched bargain settlement facility is able to match that

indication with an opposite sell or buy instruction, SVS Securities

will contact both parties to effect the bargain. Shareholders who

do not have their own broker may need to register with SVS

Securities as a new client. This can take some time to process and

therefore Shareholders who consider they are likely to use this

facility are encouraged to commence it at the earliest opportunity.

Once the facility has been arranged, details will be made available

to Shareholders on the Company's website at

www.kenetics-group.com.

Recommendation

The Directors believe that the cancellation from admission to

AIM is in the best interests of Shareholders as a whole. The

Directors therefore unanimously recommend that Shareholders vote in

favour of the Resolution as they intend to do in respect of their

own interests in 27,410,575 Ordinary Shares in aggregate,

representing approximately 67.10 per cent. of the Ordinary Shares

currently in issue.

Circular

A circular is today being posted to Shareholders with a Notice

of General Meeting to approve the Delisting and is available on the

Company's website www.kenetics-group.com.

For further information, please

contact:

Ken Wong, Chairman and CEO Dominique Doussot

Kenetics Group Limited ZAI Corporate Finance

Tel: +65 6749 0083 (Nominated Advisor)

Website:www.kenetics-group.com Tel: +44 207 060 1760

Alex Mattey / Ian Callaway Jeremy Carey / Andrew Dunn

SVS Securities Tavistock Communications

(Broker)

Tel: +44 207 638 5600 Tel: +44 207 920 3150

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Announcement of cancellation of admission 22 December 2011

to AIM

Latest time and date for receipt of Forms 8.30 a.m. on 17 January

of Proxy for the General Meeting 2011

General Meeting of Kenetics Group Ltd 8.30 a.m. on 18 January

2011

Cancellation of the admission to trading 28 January 2011

on AIM of the Ordinary Shares

DEFINITIONS

The following definitions apply throughout the document unless

the context requires otherwise:

"1985 Act" the Companies Act 1985 (as amended)

"2006 Act" the Companies Act 2006

"Act" the 1985 Act and the 2006 Act

"Admission" the admission of the Ordinary

Shares to trading on AIM in accordance

with the AIM Rules

"AIM" the market of that name, operated

by the London Stock Exchange

plc

"AIM Rules" the AIM Rules for Companies published

by the London Stock Exchange

plc from time to time

"Board" or "Directors" the directors of the Company,

whose names appear on page 3

of this document

"Business Day" any day, other than a Saturday,

Sunday or UK Bank Holiday

"Company" or "Kenetics" Kenetics Group Ltd

"CREST" the computer based system for

the transfer of uncertificated

securities operated by Euroclear

"Delisting" the proposed cancellation of

Admission

"Euroclear" Euroclear UK and Ireland Limited

"Form of Proxy" the form of proxy accompanying

this document for use by Shareholders

at the General Meeting

"General Meeting" the general meeting of the Company

to be held at the offices of

Stephenson Harwood, One St. Paul's

Churchyard, London, EC4M 8SH

at 10.00 a.m. on [18] January

2011 (notice of which is set

out at the end of this document)

"Notice" the notice of the General Meeting

which is set out at the end of

this document

"Ordinary Shares" the ordinary shares of 1p each

in the share capital of the Company

"Registrars" Computershare Investor Services

(Jersey) Limited of Queensway

House, Hilgrove Street, St Helier,

Jersey JE1 1ES

"Resolution" the resolution to be proposed

at the General Meeting, as set

out in the Notice

"Restricted Jurisdictions" the United States, Canada, Australia,

New Zealand, South Africa or

Japan or any other jurisdiction

where the mailing of this document

into such jurisdiction would

constitute a violation of the

laws of such jurisdiction

"Shareholders" holders of Ordinary Shares and

the term "Shareholder" shall

mean any one of them

"United Kingdom" or "UK" the United Kingdom of Great Britain

and Northern Ireland

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFEDFSFFSSELE

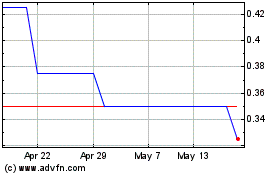

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

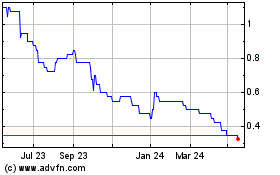

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024