RNS Number:2716N

Kenwood Appliances PLC

4 July 2000

KENWOOD APPLIANCES PLC

Preliminary Results for the Year ended 31st March 2000

Strong Second Half Performance at Kenwood

# Million

1999/2000 1998/99

Sales

from

continuing

business 143.4 145.0

Gross

Margins*

36.6% 35.6%

Operating

Profit* 5.8 4.1

Profit

before

exceptionals

& tax 2.9 0.1

Exceptional

items -

operating 0.3 (1.0)

- non-operating (4.3) (8.9)

(Loss)

before Tax (1.1) (9.8)

Net Borrowings 24.0 29.2

Earnings/

(Loss) per

Share

before exceptionals 3.3p (3.0)p

after exceptionals (3.0)p (24.6)p

* before exceptional charges

David Nash, Chairman said today: -

"Profit before tax and exceptionals moved strongly ahead from

#0.1m to #2.9m fuelled by a particularly robust second half

sales performance in the UK, and in a number of export

markets. Profits before tax and exceptionals in the second

half were #3.1m compared to a loss of #0.8m in 1998/99. These

results were achieved despite the adverse impact of currency

movements and on a constant currency basis, full year PBT

would have been approximately #1.5m higher.

"The restructuring programme resulted in the Group's committed

cost base being reduced by #7.6m. The associated exceptional

charges were in line with previous forecasts at #4.0m.

"Tight cash controls resulted in net borrowings reducing by a

further #5.2m to #24.0m after spending #3.5m cash on

restructuring charges."

Colin Gordon, Chief Executive said today: -

"The benefits from the programme to transform Kenwood from a

vertically integrated manufacturing company to an agile brand

led business are now beginning to show through.

In the year to 31st March 2000: -

- 67 new products were launched, the most successful being

the Kenwood fryers and food processors and the Ariete

steam gun;

- Over 20% of sales were generated by new products;

- These new products fuelled growth in our core markets

with, for example, Kenwood sales in the UK, our largest

market, increasing by 13%;

- Despite the further strengthening of sterling, gross

margins improved 1.0% to 36.6% as more product was

sourced from the Far East;

- The programme to reduce UK manufacturing content was

implemented successfully and the number of UK employees

fell by almost half from 691 to 361;

- The Group is now outsourcing both its international

warehousing and 66% of manufacturing;

- The long-standing arbitration proceedings arising from

the acquisition of Ariete in 1994 were finally resolved.

"Since the year-end, the 12 acre site in Havant has been sold

for #5.4m with an agreement to lease back warehousing and

refurbished office space. Net proceeds are anticipated to be

#4.5m. In addition a freehold property in Florence, Italy has

been sold for #2.0m. These two disposals were slightly above

book value and the net proceeds will be used to reduce

borrowings.

"In the absence of unforeseen circumstances, the Board

anticipates continued progress as the restructuring programme

is completed. Sales momentum has continued in the first

quarter, although there is increased pressure on margins

arising from currency and retail price deflation. The final

outcome will, of course, be dependent upon the level of

sterling relative to the Euro and the US dollar."

For further information contact:

Colin Gordon Kenwood Appliances plc 0239 247 6000

Simon Rigby Citigate Dewe Rogerson 020 7638 9571

Alex Brown Citigate Dewe Rogerson 020 7638 9571

FINANCIAL RESULTS

Sales were #145.4m compared to #154.1m in the previous year.

After stripping out discontinued activities, sales were

#143.4m compared to #145.0m.

The first half had been difficult in a number of markets and

sales from continuing business declined by 9%. However, the

second half recovered strongly and sales were up by 6%

compared to the previous year. Sales growth was good in the

UK, the Far East and a number of export markets.

Continuing progress was made on gross margins, which increased

to 36.6% compared to 35.6% last year, as more product was

sourced from China. Tight controls resulted in distribution

and administration costs falling by 7.6% to #47.1m. Total

fixed costs including manufacturing fell by #7.6m.

Profit before exceptionals and tax increased strongly from

#0.1m to #2.9m. In the second half profits before tax and

exceptionals were #3.1m compared to a loss of #0.8m in

1998/99.

In line with other UK exporters, the Group was hampered by the

strength of Sterling, and at constant exchange rates PBT would

have been approximately #1.5m higher.

Exceptional charges of #4.0m were booked, which was in line

with previous forecasts and, as a result, the loss after

exceptionals was #1.1m compared to a loss of #9.8m in 1998/99.

Earnings per share before exceptionals were 3.3p (loss 3.0p in

1998/99). After exceptionals losses per share were 5.4p (24.6p

in 1998/99).

Net borrowings were reduced by #5.2m to #24.0m. Despite

spending #3.5m on exceptional charges, #3.4m of cash was

generated.

The net interest charge fell from #4.0m to #3.0m. Pre-

exceptional interest cover was 2.0 times (1.0 times in

1998/99).

The Board is not recommending a dividend payment for the year

1999/2000.

TRADING REPORT

UK

Building upon a successful first half, sales of Kenwood

products rose by 13% to #41.6m. The market grew 8% and Kenwood

gained share overall. Particularly strong performances were

recorded on deep fryers, kettles and food processors - one in

every two food processors sold in the UK last Christmas was

branded Kenwood. Margins were higher and as a result

profitability increased significantly. Kenwood is strongly

positioned as the clear brand leader in food preparation with

a market share over twice that of its nearest competitor.

Italy

Ariete achieved record profits, despite difficult conditions

in the Italian market where a number of the categories in

which Ariete is strong showed significant declines. After a

first half decline of 16%, sales in the second half were up

12% against the previous year. The strongest performance was

recorded in the export markets, which grew 26% to 47.2bn lire

(#15.4m). For the full year, sales were marginally ahead at

112.2bn lire (#36.5m). Ariete's second half sales growth was

generated by the continuing success of its new product

development programme which contributed 34% of the total sales

and the Vapori steam cleaning gun sold 146,000 units in the

first six months following its launch. Mizushi, the air

conditioning business, had a good season and as a result its

working capital declined by 13.3bn lire (#4.1m).

Overseas Subsidiaries

In Europe, turnover fell by #4.5m to #25.0m (-15%) as the

Group focused on more profitable products and sales channels.

Consequently profits increased in France and losses were

reduced in Germany. The loss making Polish sales subsidiary

was closed at the end of March 2000. Ireland, which had been

reorganised at the end of the last financial year, showed

improved sales and significantly enhanced profitability.

In the rest of the world, all the Kenwood sales companies

showed progress. Sales in aggregate were up 16% at #11.9m.

After a difficult start, the strength of the new product

programme delivered a significant profit improvement in South

Africa and the Asian subsidiaries - Malaysia, Singapore and

Hong Kong - all reported profits that were sharply higher.

Third Party Distributors

After a difficult first half in which sales declined by 21% to

#9.5m, there was a significant recovery in the second half

resulting in a sales increase of 24%. For the full year,

therefore, sales were in line with those achieved in 1998/99.

There were strong performances from a number of markets

including Greece, Belgium and the Middle East, but overall

this sector of business was impacted by the high sterling

exchange rate.

Manufacturing and Sourcing

The transformation of the Group's manufacturing facilities was

largely completed in the year. The final products were

successfully transferred to China leaving the UK to focus on

the manufacture of the Kenwood Chef and of water filter

cartridges. The number of employees in UK manufacturing fell

by two thirds to 174.

In China, from where the Group is now sourcing over half its

products, the strategic alliance with Allan International has

been developed following their acquisition of the majority of

the UK manufacturing plant and machinery.

In Italy there has been a further consolidation of

manufacturing activity following the merger of the Mizushi and

Ariete production facilities. As a result it was possible to

reduce the labour force by 17%.

KENWOOD RESTRUCTURING PROGRAMME

In 1997 a strategy was initiated to transform Kenwood from a

vertically integrated, predominantly UK manufacturing company,

into an agile brand led business. The target date for the

completion of this programme was identified as December 2000.

The Board indicated that profits would improve by #4m per year

in the first full year following the completion of the

programme.

In the year to the 31st March 2000, and particularly in the

second half, those benefits have started to materialise.

Revitalised Products

New products are the lifeblood of this business. In the year,

there were 54 new products launched under the Kenwood brand.

The most successful of these included our patented dishwasher

safe fryer and the updated food processors. A comprehensive

range of chromium finished products has also been successfully

launched.

In the core categories, the number of Kenwood Chefs sold

increased by 4%.

Ariete has a consistent track record of innovation; last year

13 new products were launched including the Vapori steam gun

which has sold 146,000 units since it was introduced in

September 1999. Sales of ironing systems and coffee makers in

Italy were encouraging with Ariete enjoying third and fourth

positions respectively in the market in these two important

categories.

Cost Reduction Programmes

Since the start of the Kenwood restructuring programme the

Group has reduced its workforce by over 40 % to 1626. In the

year to 31st March 2000, headcount was reduced by 329 and with

the closure of the UK motor winding facility during July, the

Group is a long way to delivering its target employment level

of approximately 260 staff in the UK.

In total, the fixed cost base of the Group was further reduced

by #7.6m.

Reductions in Borrowings

Borrowings fell by a further #5.2m to #24.0m having peaked at

over #50m in 1996/97. Interest charges fell by #1.0m to

#3.0m. Interest cover is now 2.0 times compared to 1.0 times

in the last financial year.

Since the year end there have been two developments which will

impact borrowings in the current year: -

- Two property sales have been finalised. On 30 June the

12 acre site in Havant in the UK was sold for #5.4m. A

lease back arrangement has been agreed for part of the

site which will be comprehensively refurbished to provide

new offices, distribution and manufacturing facilities in

line with the current scope of the UK Group's operations.

Net proceeds will be #4.5m. Also in June, the former

Ariete site in Calenzano, Florence was sold for 6.1bn

lire (#2.0m). The Italian operations have been

consolidated on to the Mizushi site in Prato, Florence.

These sales were achieved at slightly above book value

and the proceeds will be used to reduce borrowings.

- The litigation on the purchase price of Ariete was

resolved resulting in a settlement of #4.5m to the

Vendor.

Restructuring Costs

In July 1999 the Board forecast that restructuring charges of

#4.0m would be incurred in 1999/2000, with a further #1.1m in

2000/01.

Exceptional charges of #4.0m were incurred in 1999/2000 of

which #2.6m were cash items largely representing redundancy

payments. For the current year the bulk of the exceptionals

will again be for redundancies which have already been

announced.

Future Prospects

In the absence of unforeseen circumstances, the Board

anticipates continued progress as the restructuring programme

is completed. Sales momentum has continued in the first

quarter, although there is increased pressure on margins

arising from currency and retail price deflation. The final

outcome will, of course, be dependent upon the level of

sterling relative to the Euro and the US dollar.

Group Profit & Loss Account

Year to Year to

31 March 2000 2 Apr

1999

Before

Except- Except-

ional ional Total Total

#000 #000 #000 #000

Turnover:

Continuing

operations 143,359 - 143,359 145,016

Discontinued

operations 2,021 - 2,021 9,105

---- ---- ---- ----

145,380 - 145,380 154,121

Cost

of sales (92,203) - (92,203) (100,206)

---- ---- ---- ----

Gross profit 53,177 - 53,177 53,915

Distribution

costs (34,568) - (34,568) (37,181)

Administrative

expenses (12,490) 267 (12,223) (13,766)

---- ---- ---- ----

(47,058) 267 (46,791) (50,947)

---- ---- ---- ----

6,119 267 6,386 2,968

Other

operating

expenditure (271) - (271) 166

Operating

profit:

Continuing

operations 6,146 267 6,413 3,680

Discontinued

operations (298) - (298) (546)

5,848 267 6,115 3,134

Exceptional

items:

Continuing -

fundamental

reorganisation - (2,765) (2,765) (8,884)

Discontinued -

loss on

sale of

operation - (1,483) (1,483) -

Bank

interest

receivable 282 - 282 704

Interest

payable (3,269) - (3,269) (4,708)

---- ---- ---- ----

(2,987) - (2,987) (4,004)

---- ---- ---- ----

(Loss)/

Profit on

ordinary

activities

before

taxation 2,861 (3,981) (1,120) (9,754)

Tax on

ordinary

activities (1,366) - (1,366) (1,519)

---- ---- ---- ----

(Loss)/

Profit

attributable

to members

of the

parent

company 1,495 (3,981) (2,486) (11,273)

Earnings /

(loss) per

share 3.3p (5.4)p (24.6)p

Adjusted

earnings /

(loss) per

share (3.0)p

Fully

diluted

earnings /

(loss) per

share 3.3p (5.4)p (24.6)p

Group Balance Sheet

31 March 2 April

2000 1999

#000 #000

Fixed

assets

Tangible

fixed

assets 20,588 27,467

Investments 1,927 1,927

---- ----

22,515 29,394

---- ----

Current

assets

Stocks 25,760 21,698

Debtors 36,839 40,658

Cash at

bank and

in hand 10,773 9,670

---- ----

73,372 72,026

---- ----

Creditors:

amounts

falling due

within

one year (72,550) (76,489)

---- ----

Net current

assets /

(liabilities) 822 (4,463)

---- ----

Total assets

less current

liabilities 23,337 24,931

Creditors:

amounts

falling due

after more

than one year (3,635) (602)

Provision

for liabilities

and charges (506) (1,005)

---- ----

19,196 23,324

====== ======

Capital

& reserves

Called up

share capital 4,586 4,586

Share

premium 25,101 25,101

Special

reserve 2,180 2,180

Profit

and loss

account (12,671) (8,543)

---- ----

19,196 23,324

====== ======

Group Statement of Cash Flows

Audited Audited

31 March 2 April

2000 1999

#000 #000

Net cash

inflow from

operating

activities 7,037 15,997

Returns

on investments

and servicing

of finance (2,987) (4,004)

Taxation (716) (763)

Capital

expenditure

- net (930) (4,666)

Acquisitions

& disposals 990 -

Financing -

loans repaid (1,521) (21,402)

---- ----

Increase /

(Decrease)

in cash

in the

period 1,873 (14,838)

---- ----

Reconciliation

to net debt:

Increase /

(Decrease)

in cash

in the period 1,873 (14,838)

Cash outflow

from decrease

in debt and

lease financing 1,521 21,402

---- ----

Change in

net debt

resulting

from cash

flows 3,394 6,564

Translation

difference 1,815 (324)

---- ----

Movement in

net debt

in the period 5,209 6,240

Opening

net debt (29,216) (35,456)

---- ----

Closing

net debt (24,007) (29,216)

---- ----

The above accounts do not constitute full accounts within the

meaning of the Companies Act. Full accounts for the year to

31st March 2000, which have not yet been delivered to the

Registrar of Companies, will be sent to shareholders.

The auditors have issued an unqualified audit report.

Copies of this announcement are available to members of the

public at the Company's registered office. New Lane Havant

Hants PO9 2NH.

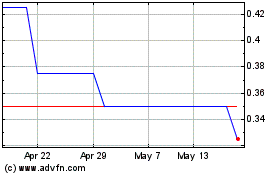

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

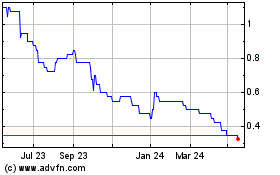

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024