RNS Number:7404B

Kenwood Appliances PLC

1 December 1999

Interim results: half year ended 1st October 1999

Kenwood results in line with expectations plus further

progress on borrowings

#m

6 mths to 6 mths to

1.10.99 2.10.99

Sales

from

continuing

business 63.1 69.2

Gross

Margins 35.0% 36.5%

Operating

Profit 1.1 3.2

(Loss)/

Profit

Before

Exceptionals

& tax (0.2) 0.9

Exceptional

items (3.1) (0.1)

(Loss)

Profit

before tax (3.3) 0.8

Net

Borrowings 30.5 39.7

(Loss)/

Earnings

per share

- before

exceptionals (0.6p) 1.3p

- after

exceptionals (7.3p) 1.1p

David Nash, Chairman said today: -

"Despite the strength of sterling, the Group traded in line

with expectations in the first half.

Tight control of capital expenditure and working capital, in

the period, resulted in a further #9.2m reduction in

borrowings, compared to September 1998, after spending #1.7m

on restructuring charges. Net interest payable fell from

#2.3m to #1.4m."

Colin Gordon, Chief Executive said today: -

"Whilst sales for continuing operations fell 9% from #69.2m to

#63.1m, due to sterling's impact on exports and a difficult

Italian market, we have seen considerable progress elsewhere

during this period. Sales in the rest of the world have

stabilised and in the UK Kenwood's new products have generated

an encouraging 9% growth in revenues in a market which grew by

less than 1%."

"The decline in gross margins was almost wholly the result of

the continuing weakness of the Euro."

"There was considerable progress with our strategy to

transform Kenwood into an agile brand led company with the

restructuring programme continuing on plan. Fixed costs were

reduced by #2.7m and the number of employees fell from 2,346

to 1,821."

"As always, the full year result will be dependent upon the

Christmas season. Despite the continuing strength of sterling,

trading in October and November has been encouraging, with

continuing growth in the UK, recovery in Asia and a positive

response to the new products launched in Italy. The Board

therefore anticipates, in the absence of unforeseen

circumstances, that the benefits from new products and cost

reductions will result in a profit before tax and exceptional

charges for the full year."

For further information:

Colin Gordon

Tel: 0171 638 9571 (today)

Chief Executive, Kenwood Appliances

Tel: 01705 476 000 (thereafter)

Simon Rigby, Alex Brown

Tel: 0171 638 9571

Citigate Dewe Rogerson

KENWOOD APPLIANCES PLC

INTERIM RESULTS: HALF YEAR ENDED 1ST OCTOBER 1999

FINANCIAL RESULTS

Total sales in the half-year were #64.2m compared to #73.4m.

Sales from continuing operations were #63.1m compared to

#69.2m last year. This represents a fall of 8.9% and is due

to sterling's impact on exports and a difficult Italian

market.

Gross margins fell from 36.5% to 35.0%, almost all of which is

accounted for by currency.

Distribution and administration costs were reduced by #1.7m to

#21.3m as the benefits from the restructuring programme are

being realised.

Net interest charges fell #0.9m to #1.4m.

The loss before tax and exceptionals was #0.2m compared to a

profit of #0.9m in 1998/9. This was in line with the position

anticipated by the Board in the preliminary announcement made

on the 1st July 1999.

Exceptional charges of #3.1m have been incurred principally to

cover the loss on disposal of the specialist engineering

business and the cost of the continuing restructuring

programme in the UK. These costs were in line with the

forecast made in July.

The loss after exceptionals and before tax was #3.3m compared

to a profit of #0.8m in 1998/99. At this stage the Directors

are not recommending an interim dividend.

Tight controls on capital expenditure and reduced working

capital resulted in borrowings reducing by #9.2m, in the past

twelve months, to #30.5m.

TRADING REVIEW

UK

Turnover of Kenwood products rose by 9% to #20.1m in a

market which grew by less than 1%. Kenwood grew share in

categories where its new product programme had a

significant impact including deep fat fryers and kettles.

Margins were also significantly better than last year.

Italy

Difficult market conditions in Italy had a

disproportionate effect in certain niche categories,

where Ariete is strongest. Consequently its domestic

turnover fell 23% to 20.6 bn lire (#6.9m). This is being

addressed in the second half by an aggressive programme

of new product launches. Export sales were 6% lower at

18.2 bn lire (#6.1m). Vapori exports to the USA and

Australia were very encouraging.

For Mizushi the strategy remains unchanged, namely to

reduce borrowings whilst trading at breakeven. Turnover

stabilised at 9.4bn lire (#3.2m). Working capital fell by

67% to 5.5 bn lire (#1.8m) compared to 16.8 bn lire

(#6.1m) at 2nd October 1998.

Overseas Subsidiaries

All of the overseas subsidiaries showed an improvement in

contribution with the exception of Poland and South

Africa. The closure of the Polish sales company is

planned for the fourth quarter and new product launches

are anticipated to address the issues in South Africa.

The Asian businesses of Malaysia, Singapore and Hong Kong

saw strong growth.

Export Markets - Kenwood Distributors

Sales continue to be difficult to many export markets and

as a result turnover fell 19% to #10.2m.

Manufacturing and Sourcing

The changes in Havant manufacturing are nearing

completion. In the half year production of food

processors and deep fat fryers commenced in China. The

only activity still to be transferred from the UK is the

production of motors which is currently being piloted in

the Company's Chinese factory. Manufacturing headcount in

the UK fell by 286 to 244 during the six months.

The proportion of third party manufacture rose to 65%

from 61% in line with the strategic refocusing of the

business.

Kenwood Transformation Programme

Significant progress has been made in executing the

programme to transform Kenwood into an agile brand led

business. A number of further steps have been taken In

the last six months: -

* The specialist engineering business on the Isle of

Wight was sold for #1.1m;

* The European distribution of Kenwood product was

outsourced to UPS World-wide Logistics;

* Total headcount fell to 1,821 compared to 2,346 in

September 1998 and of this total the Group employed 399

personnel in the UK compared to 843 a year ago.

FUTURE PROSPECTS

As always, the full year result will be dependent upon the

Christmas season. Despite the continuing strength of sterling,

trading in October and November has been encouraging with

continuing growth in the UK, recovery in Asia and a positive

response to the new products launched in Italy. The Board

therefore anticipates, in the absence of unforeseen

circumstances, that the benefits from new products and cost

reductions will result in a profit before tax and exceptional

charges for the full year.

Consolidated Profit & Loss Account

Un- Un- Un- Un- Audited

audited audited audited audited yr to

6 mths 6 mths 6 mths 6 mths 2 April

1 Oct 1 Oct 1 Oct 2 Oct 1999

1999 1999 1999 1998

#000's #000's #000's #000's #000's

Before

Excep- Excep Total

tional tional

Turnover:

Continuing

operations 63,061 - 63,061 69,236 145,016

Discontinuing

operations 1,111 - 1,111 4,126 9,105

---- ---- ---- ---- ----

64,172 - 64,172 73,362 154,121

Cost

of

sales (41,691) -(41,691)(46,569)(101,077)

---- ---- ---- ---- ----

Gross

profit 22,481 - 22,481 26,793 53,044

Distribution

costs (15,081) -(15,081)(15,340)(35,721)

Administrative

expenses (6,234) - (6,234) (7,686)(14,248)

---- ---- ---- ---- ----

(21,315) -(21,315)(23,026)(49,969)

---- ---- ---- ---- ----

1,166 - 1,166 3,767 3,075

Other

operating

expenditure (51) - (51) (578) 59

Operating

profit:

Continuing

operations 1,233 - 1,233 3,299 3,689

Discontinued

operations (118) - (118) (110) (555)

1,115 - 1,115 3,189 3,134

Exceptional

items:

Continuing

fundamental

reorganisation - (1,589) (1,589) (105) (8,884)

Discontinued

loss on

sale of

operation - (1,483) (1,483) - -

Bank

Interest

receivable 192 - 192 37 704

Interest

payable (1,545) - (1,545) (2,308) (4,708)

---- ---- ---- ---- ----

(1,353) - (1,353) (2,271) (4,004)

---- ---- ---- ---- ----

(Loss)/

profit on

ordinary

activities

before

taxation (238) (3,072) (3,310) 813 (9,754)

Tax on

Ordinary

activities (37) - (37) (317) (1,519)

---- ---- ---- ---- ----

(Loss)/

profit

attributable

to

members of

the

parent

company (275) (3,072) (3,347) 496(11,273)

Earnings

per share -0.6p -6.7p -7.3p 1.1p -24.6p

Fully

diluted

earnings

per share -0.6p -6.7p -7.3p 1.1p -24.6p

Balance sheet

Unaudited Unaudited Audited

1 Oct 2 Oct 2 Apr

1999 1998 1999

#000's #000's #000's

Fixed

assets

Tangible

Fixed

assets 23,182 36,261 27,467

Investments 1,927 1,927 1,927

---- ---- ----

25,109 38,188 29,394

---- ---- ----

Current

assets

Stocks 24,270 31,860 21,698

Debtors 40,384 48,416 40,658

Cash at

bank and

in hand 7,509 12,898 9,670

---- ---- ----

72,163 93,174 72,026

---- ---- ----

Creditors :

Amounts

falling

due

within

1 year

Borrowings (37,764) (51,991) (38,284)

Trade and

Other

creditors (38,981) (43,760) (38,205)

---- ---- ----

Net

Current

liabilities (4,582) (2,577) (4,463)

---- ---- ----

Total

Assets

Less

Current

liabilities 20,527 35,611 24,931

Creditors :

Amounts

falling

due

after

more

than 1 year (287) (645) (602)

Provision

for

liabilities

and charges (712) (119) (1,005)

---- ---- ----

19,528 34,847 23,324

---- ---- ----

Capital

& reserves

Called up

share

capital 4,586 4,586 4,586

Share

premium 25,101 25,101 25,101

Special

reserve 2,180 2,180 2,180

Profit

& loss

account (12,339) 2,980 (8,543)

---- ---- ----

19,528 34,847 23,324

---- ---- ----

Group Statement of Cash Flows

Unaudited Unaudited Audited

1 Oct 2 Oct 2 Apr

1999 1998 1999

#000's #000's #000's

Operating

profit 1,115 3,189 3,134

Depreciation 2,767 3,565 7,207

Loss/

(profit)

on disposal

of fixed

assets - 133 -

(Increase)/

decrease

in stock (3,624) 1,126 10,455

(Increase)/

decrease

in debtors (665) (1,675) 2,574

Increase/

(decrease)

in creditors 1,197 (1,890) (4,596)

---- ---- ----

790 4,448 18,774

Cash

outflow

from

exceptional

items (1,656) (1,203) (2,777)

---- ---- ----

Net

cash

(outflow)/

inflow

from

operating

activities (866) 3,245 15,997

Returns

on

investments

& servicing

of finance (1,353) (2,315) (4,004)

Taxation (37) (644) (763)

Capital

expenditure (218) (2,525) (4,666)

Acquisitions

& disposals 990 (244) -

Financing

- loans

repaid (9,118) (3,736) (21,402)

---- ---- ----

(Decrease)

in cash

in the

period (10,602) (6,219) (14,838)

---- ---- ----

Reconciliation

to net

debt:

(Decrease)

in cash

in the

period (10,602) (6,219) (14,838)

Cash

outflow

from

decrease

in debt

and lease

financing 9,118 3,736 21,402

---- ---- ----

Change in

net debt

resulting

from cash

flows (1,484) (2,483) 6,564

Translation

difference 158 (1,799) (324)

---- ---- ----

Movement

in net

debt in

the period (1,326) (4,282) 6,240

Opening

net

debt (29,216) (35,456) (35,456)

---- ---- ----

Closing

net

debt (30,542) (39,738) (29,216)

---- ---- ----

Turnover & Segmental Analysis

Unaudited Unaudited Audited

1 Oct 2 Oct 2 Apr

1999 1998 1999

#000's #000's #000's

Turnover

by

destination:

Sales

to

third

parties

UK 20,298 20,889 40,939

Continental

Europe 28,651 36,725 80,563

Rest

of the

world 15,223 15,748 32,619

---- ---- ----

64,172 73,362 154,121

---- ---- ----

Turnover

by origin:

Total

sales

UK 33,611 35,348 71,039

Continental

Europe 29,931 37,864 82,842

Rest of

the

world 17,734 19,302 37,714

---- ---- ----

81,276 92,514 191,595

---- ---- ----

Inter-

segment

sales

UK 6,105 6,506 14,056

Continental

Europe 3,406 4,176 8,386

Rest of

the world 7,593 8,470 15,032

---- ---- ----

17,104 19,152 37,474

---- ---- ----

Sales to

third

parties

UK 27,506 28,842 56,983

Continental

Europe 26,525 33,688 74,456

Rest of

the world 10,141 10,832 22,682

---- ---- ----

64,172 73,362 154,121

---- ---- ----

Notes

1. The interim financial statements are unaudited and do not

constitute full accounts within the meaning of the Companies

Act 1985. Figures for the financial year to 2nd April 1999

have been extracted from the financial statements which have

been delivered to the Registrar of Companies on which the

Auditors have given an unqualified report.

2. The financial statements have been prepared on the basis

of the accounting policies set out in the group's 1999

statutory accounts.

3. A copy of the announcement will be sent to shareholders,

additional copies can be obtained from the Company Secretary,

Kenwood Appliances Plc, New Lane Havant Hants PO9 2NH

END

IR FDDFUSUUUFLF

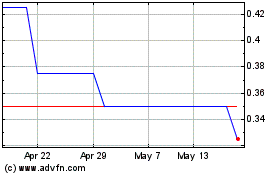

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

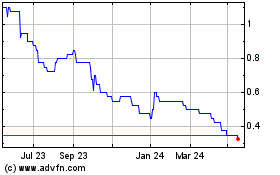

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024