TIDMJDW

RNS Number : 0679A

Wetherspoon (JD) PLC

14 March 2013

15 March 2013 PRESS RELEASE

J D WETHERSPOON PLC

INTERIM RESULTS

(For the 26 weeks ended 27 January 2013)

FINANCIAL HIGHLIGHTS

Revenue GBP626.4m (2012: GBP569.4m) +10.0%

Like-for-like sales +6.9%

Operating profit GBP52.1m (2012: GBP53.1m) -2.0%

Profit before tax & exceptional items GBP34.8m

(2012: GBP35.8m) -2.7%

Earnings per share 20.8p (2012: 20.2p) +3.0%

Interim dividend 4.0p (2012: 4.0p) Maintained

Commenting on the results, Tim Martin, the Chairman of J D

Wetherspoon plc, said:

"The outcome for the first half of the financial year was

reasonable, given the pressures on the UK consumer.

As previously stated, the biggest danger to the pub industry, is

the VAT disparity between supermarkets and pubs and the continuing

imposition of stealth taxes, such as the late-night levy, and the

increase in fruit/slot machine taxes.

In the six weeks to 10 March 2013, like-for-like sales increased

by 7.3%, with total sales increasing by 9.9%.

Taxation and input costs will continue to rise, but, overall,

the company continues to aim for a reasonable outcome in the

current financial year."

Enquiries:

John Hutson Chief Executive Officer 01923 477777

Kirk Davis Finance Director 01923 477777

Eddie Gershon Company spokesman 07956 392234

Photographs are available at: www.newscast.co.uk

Notes to editors

1. JD Wetherspoon owns and operates pubs throughout the UK. The

Company aims to provide customers with good-quality food and drink,

served by well-trained and friendly staff, at reasonable prices.

The pubs are individually designed and the Company aims to maintain

them in excellent condition.

2. Visit our website www.jdwetherspoon.co.uk

3. This announcement has been prepared solely to provide

additional information to the shareholders of JD Wetherspoon, in

order to meet the requirements of the UK Listing Authority's

Disclosure and Transparency Rules. It should not be relied on by

any other party, for other purposes. Forward-looking statements

have been made by the directors in good faith using information

available up until the date that they approved this statement.

Forward-looking statements should be regarded with caution because

of inherent uncertainties in economic trends and business

risks.

4. The next Interim Management Statement will be issued on 8 May 2013

CHAIRMAN'S STATEMENT AND OPERATING REVIEW

In the 26 weeks ended 27 January 2013, like-for-like sales

increased by 6.9%, with total sales, including new pubs, increasing

by 10.0% to GBP626.4 million (2012: GBP569.4 million).

Like-for-like bar sales increased by 4.1% (2012: 3.4%),

like-for-like food sales were up 13.4% (2012: 0.1%) and machine

sales increased by 4.4% (2012: decreased by 3.8%).

Operating profit before exceptional items decreased by 2.0% to

GBP52.1 million (2012: GBP53.1 million) and after exceptional items

increased by 3.1% to GBP52.1 million (2012: GBP50.5 million). The

operating margin before exceptional items was lower, at 8.3% (2012:

9.3%). As previously highlighted, there was considerable inflation

in costs during the period. The largest increase was GBP23.4

million in taxation, with further increases in labour costs,

utilities and bar and food supplies. The operating margin after

exceptional items was 8.3% (2012: 8.9%).

Profit before tax and exceptional items decreased by 2.7% to

GBP34.8 million (2012: GBP35.8 million) and after exceptional items

increased by 4.9% to GBP34.8 million (2012: GBP33.2 million).

Earnings per share before exceptional items increased by 3.0% to

20.8p (2012: 20.2p), despite the fall in adjusted earnings, owing

to fewer shares in issue and a reduced corporation tax charge.

Basic earnings per share after exceptional items increased by 13.7%

to 20.8p (2012: 18.3p).

As illustrated in the table in the tax section below, the

company paid taxes of GBP273.5 million in the period under review,

43.7% of sales, compared with GBP250.1 million in the same period

last year - 43.9% of sales. Taxes amounted to a multiple of 10.9

times profit after tax, compared with 10.7 times last year.

Net interest was covered 3.0 times by operating profit before

exceptional items (2012: 3.1 times). There were no exceptional

items in the period under review (2012: GBP2.6 million). Total

capital investment was GBP36.3 million in the period (2012: GBP60.5

million), with GBP19.1 million on new pub openings (2012: GBP41.7

million) and GBP17.2 million on existing pubs (2012: GBP18.8

million).

Free cash flow, after capital investment of GBP17.2 million in

existing pubs and payments of tax and interest, decreased to

GBP22.6 million (2012: GBP34.9 million), owing primarily to an

expected reversal of a working capital benefit of approximately

GBP15.0 million at the previous year end. Free cash flow per share

was 18.7p (2012: 27.5p).

Dividends

The board declared an interim dividend of 4.0p per share for the

current interim financial period ending 27 January 2013 (2012: 4.0p

per share). The interim dividend will be paid on 30 May 2013 to

those shareholders on the register at 3 May 2013. The dividend was

covered 5.2 times by profit.

Corporation tax

We expect the overall corporation tax charge for the financial

year, including current and deferred taxation, to reduce to

approximately 27.7% before exceptional items (July 2012: 28.5%

before exceptional items and after excluding the effect of the

tax-rate change). This is due to a reduction in the UK standard

weighted average tax rate for the period of 1.7% to 23.7%. As in

previous years, the company's tax rate is higher than the standard

UK tax rate, owing mainly to depreciation which is not eligible for

tax relief.

Financing

As at 27 January 2013, the company's net bank borrowings

(including finance leases) were GBP469.9 million, an increase of

GBP7.3 million, compared with those of the previous year end (29

July 2012: GBP462.6 million). Our net-debt-to-EBITDA ratio was 2.99

times at the period end, in line with the financial year end.

Property

In the period, we opened five new pubs, bringing the number of

pubs open at the period's end to 865. We now expect to open around

30 pubs in this financial year.

Also in the period, Wetherspoon agreed on an out-of-court

settlement with developer Anthony Lyons, formerly of property

leisure agent Davis Coffer Lyons. Wetherspoon will receive

approximately GBP1.25 million from Mr Lyons.

The payment relates to litigation in which Wetherspoon claimed

that Mr Lyons had been an accessory to frauds committed by

Wetherspoon's former retained agent Van de Berg and its directors

Christian Braun, George Aldridge and Richard Harvey. Mr Lyons

denied the claim and the litigation was contested.

The claim related to properties in Portsmouth, Leytonstone and

Newbury. The Portsmouth property was involved in the 2008/9 Van de

Berg case itself. In that case, Mr Justice Peter Smith found that

Van de Berg, but not Mr Lyons, who was not a party to the case,

fraudulently diverted the freehold from Wetherspoon to Moorstown

Properties Limited, a company owned by Simon Conway. Moorstown

leased the premises to Wetherspoon. Wetherspoon is still a

leaseholder of this property - a pub called The Isambard Kingdom

Brunel.

The properties in Leytonstone and Newbury (the other properties

in the case against Mr Lyons) were not pleaded in the 2008/9 Van de

Berg case. Leytonstone was leased to Wetherspoon and trades today

as The Walnut Tree public house. Newbury was leased to Pelican plc

and became a Café Rouge.

In the last financial year, Wetherspoon also agreed on a

settlement with Paul Ferrari, of London estate agent, Ferrari, Dewe

& Co, in respect of properties referred to as the 'Ferrari

Five' by Mr Justice Peter Smith, in the Van de Berg case.

Taxes and regulation

The company paid total taxes of GBP273.5 million in the

six-month period, a GBP23.4 million increase on the previous year.

If we were taxed on the same basis as supermarkets, we would have

paid GBP40.7 million less, since supermarkets pay virtually no VAT

in respect of food sales.

We believe there to be an overwhelmingly strong case for tax

parity between pubs and supermarkets, since lower supermarket taxes

help them to sell alcoholic drinks at extremely low prices,

compared with those of pubs.

The government and medical profession hope to combat low

supermarket prices by 'minimum pricing' legislation. However, if

the government were to use the tax system to encourage, rather than

discourage, consumption in pubs, it would greatly increase the

average price per unit of alcohol paid by consumers, helping to

meet government and medical health objectives, while increasing

employment and tax revenues at the same time.

At the current time, approximately 50% of beer is consumed in

pubs, and 50% in the 'off-trade'. For illustrative purposes, if the

average price of a pint from a supermarket is GBP1 and that of a

pint in a pub GBP3, increasing the number of pub pints from 50% to

75% would increase the average price paid in the country as a whole

from about GBP2 to GBP2.50. Instead, successive governments have

'cracked down' on pubs by increasing taxes and regulations,

resulting in on-trade consumption of beer dropping from about 90%

to about 50% in the last 30 years and, perversely, reducing the

average price per pint paid by consumers.

As well as paying far higher taxes per pint or per meal than

supermarkets, pubs generate far more jobs. The campaign by the 'VAT

Club', headed by respected restaurateur Jacques Borel (supported

by: Heineken; the family brewers such as Young's and Fuller's;

Wetherspoon; many others), has comprehensively explained the

financial and employment benefits for the economy of tax parity

with supermarkets.

2013 2012

First First

half half

GBPm GBPm

VAT 126.1 115.6

Alcohol duty 74.6 65.6

PAYE and NIC 34.7 32.8

Business rates 23.4 21.0

Corporation tax 8.6 9.0

Machine duty 1.8 1.6

Fuel duty 1.0 1.3

Carbon tax 1.3 1.2

Climate change levy 0.8 0.6

Stamp duty 0.3 0.6

Landfill tax 0.6 0.6

Premise licence and

TV licences 0.3 0.2

------------------------ ------- -------

TOTAL TAX 273.5 250.1

------------------------ ------- -------

TAX AS % OF SALES 43.7% 43.9%

------------------------ ------- -------

PROFIT AFTER TAX (PAT) 25.2 23.3

------------------------ ------- -------

PAT AS % OF SALES 4.0% 4.1%

------------------------ ------- -------

Further progress

As in the past, the company has endeavoured to improve as many

areas of the business as possible. For example, we have introduced

a system for faster credit card payments, as well as contactless

payment.

We have continued our heavy investment in the business, having

spent GBP22.8 million on repairs (2012: GBP20.1 million) and

GBP17.2 million on refurbishments and improvements (2012: GBP18.8

million).

We have continued to make significant investments in training

programmes and also paid GBP13.0 million (2012: GBP10.9 million) in

bonuses and free shares to employees, 99% of which was paid to

those below board level and 88% paid to those working in our

pubs.

Once again, the company has received a record number of

recommendations in CAMRA's Good Beer Guide. We were also named 'the

nation's favourite pub brand' at the Eat Out Magazine Awards, in

London, in January 2013. As regards hygiene, the company has

received an average score of 4.8 out of 5, in respect of the

local-authority-run scheme Scores on the Doors. We believe this to

be higher than any other substantial pub company, including

well-run competitors.

Current trading and outlook

The outcome for the first half of the financial year was

reasonable, given the pressures on the UK consumer.

The biggest danger to the pub industry, as indicated above and

previously, is the VAT disparity between supermarkets and pubs and

the continuing imposition of stealth taxes, such as the late-night

levy, and the increase in fruit/slot machine taxes.

In the six weeks to 10 March 2013, like-for-like sales increased

by 7.3%, with total sales increasing by 9.9%.

As previously indicated, taxation and input costs will continue

to rise, but, overall, the company continues to aim for a

reasonable outcome in the current financial year.

INCOME STATEMENT for the 26 weeks ended 27 January 2013

Notes Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

------------------------------------- --------- ------------ ------------ ------------

Revenue 4 626,397 569,375 1,197,129

Operating costs (574,321) (516,259) (1,089,811)

------------------------------------- --------- ------------ ------------ ------------

Operating profit before exceptional

items 6 52,076 53,116 107,318

Exceptional items 5 - (2,599) (13,481)

Operating profit 52,076 50,517 93,837

Finance income 61 27 55

Finance costs (17,300) (17,334) (35,010)

Profit before tax 34,837 33,210 58,882

Income tax expense 7 (9,636) (9,926) (14,315)

Profit for the period 25,201 23,284 44,567

------------------------------------- --------- ------------ ------------ ------------

Basic earnings per share 8 20.8 18.3 35.6

STATEMENT OF COMPREHENSIVE INCOME for the 26 weeks ended 27

January 2013

Notes Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

---------------------------------- ------ ------------ ------------ ----------

Interest-rate swaps: gain/(loss)

taken to equity 13 9,274 (6,638) (8,149)

Tax on items taken directly

to equity (2,133) 1,660 717

---------------------------------- ------ ------------ ------------ ----------

Net gain/(loss) recognised

directly in equity 7,141 (4,978) (7,432)

Profit for the period 25,201 23,284 44,567

---------------------------------- ------ ------------ ------------ ----------

Total comprehensive income

for the period 32,342 18,306 37,135

---------------------------------- ------ ------------ ------------ ----------

CASH FLOW STATEMENT for the 26 weeks ended 27 January 2013

Notes Unaudited Unaudited Unaudited Unaudited Audited Audited

26 weeks 26 weeks 26 weeks 26 weeks 53 weeks 53 weeks

ended ended ended ended ended ended

27 January 27 January 22 January 22 January 29 July 29 July

2013 2013 2012 2012 2012 2012

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Cash flows from operating

activities

Cash generated from operations 9 64,360 64,360 79,173 79,173 196,733 196,733

Interest received 62 62 17 17 49 49

Interest paid (15,398) (15,398) (16,478) (16,478) (36,091) (36,091)

Corporation tax paid (8,615) (8,615) (8,968) (8,968) (18,168) (18,168)

Purchase of own shares for

share-based payments (628) (628) - - (5,756) (5,756)

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Net cash inflow from operating

activities 39,781 39,781 53,744 53,744 136,767 136,767

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Cash flows from investing

activities

Purchase of property, plant

and equipment (14,905) (14,905) (14,986) (14,986) (36,578) (36,578)

Purchase of intangible assets (2,293) (2,293) (3,838) (3,838) (8,647) (8,647)

Purchase of lease premiums (21) - (489) -

Proceeds of sale of property,

plant and equipment - 250 887 -

Investment in new pubs and

pub extensions (19,033) (41,666) (74,859) -

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Net cash outflow from investing

activities (36,252) (17,198) (60,240) (18,824) (119,686) (45,225)

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Cash flows from financing

activities

Equity dividends paid 14 (10,021) (10,475) (15,544)

Proceeds from issue of ordinary

shares - 46 95

Purchase of own shares - - (22,711)

Advances under bank loans 13 7,509 18,199 18,059

Advances under finance leases - - 10,474

Finance costs on new loan 13 - (2,711) (2,731)

Finance lease principal

payments 13 (2,921) (2,038) (4,373)

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Net cash (outflow)/inflow

from financing activities (5,433) 3,021 (16,731)

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Net change in cash and cash

equivalents 13 (1,904) (3,475) 350

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Opening cash and cash equivalents 28,040 27,690 27,690

Closing cash and cash equivalents 26,136 24,215 28,040

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Free cash flow 22,583 34,920 91,542

---------------------------------- ----- ----------- ----------- ----------- ----------- --------- ---------

Free cash flow per ordinary

share 8 18.7p 27.5p 73.2p

BALANCE SHEET as at 27 January 2013

Notes Unaudited Unaudited Audited

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

---------------------------------- ------ ------------ ------------ ----------

Assets

Non-current assets

Property, plant and equipment 10 932,063 907,800 924,341

Intangible assets 11 17,995 12,908 16,936

Deferred tax assets 14,073 17,229 16,198

Other non-current assets 12 10,537 10,350 10,682

Total non-current assets 974,668 948,287 968,157

Current assets

Inventories 20,655 20,282 20,975

Other receivables 26,866 25,597 18,685

Assets held for sale 2,076 145 2,055

Cash and cash equivalents 13 26,136 24,215 28,040

Total current assets 75,733 70,239 69,755

Total assets 1,050,401 1,018,526 1,037,912

---------------------------------- ------ ------------ ------------ ----------

Liabilities

Current liabilities

Trade and other payables (197,094) (185,143) (207,114)

Financial liabilities due

in one year 13 (5,660) (3,545) (5,880)

Current income tax liabilities (9,845) (10,505) (9,103)

Total current liabilities (212,599) (199,193) (222,097)

Non-current liabilities

Financial liabilities (490,406) (477,300) (484,771)

Derivative financial instruments 13 (56,755) (64,518) (66,029)

Deferred tax liabilities (68,147) (71,358) (67,860)

Provisions and other liabilities (28,621) (25,067) (27,511)

---------------------------------- ------ ------------ ------------ ----------

Total non-current liabilities (643,929) (638,243) (646,171)

Net assets 193,873 181,090 169,644

---------------------------------- ------ ------------ ------------ ----------

Shareholders' equity

Ordinary shares 15 2,521 2,632 2,521

Share premium account 143,294 143,245 143,294

Capital redemption reserve 1,910 1,798 1,910

Hedging reserve (43,701) (48,388) (50,842)

Retained earnings 89,849 81,803 72,761

---------------------------------- ------ ------------ ------------ ----------

Total shareholders' equity 193,873 181,090 169,644

---------------------------------- ------ ------------ ------------ ----------

STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

Called-up Share Capital

share premium redemption Hedging Retained

capital account reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- ---------- --------- ------------ ---------- ---------- ---------

At 24 July 2011 2,632 143,199 1,798 (43,410) 66,826 171,045

Profit for the period 23,284 23,284

Interest-rate swaps

- loss taken to equity (6,638) (6,638)

Tax on items taken directly

to equity 1,660 1,660

----------------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive (loss)/

income (4,978) 23,284 18,306

Exercise of options 46 46

Share-based payment charges 2,168 2,168

Dividends (10,475) (10,475)

At 22 January 2012 2,632 143,245 1,798 (48,388) 81,803 181,090

Profit for the period 21,283 21,283

Interest-rate swaps

- loss taken to equity (1,511) (1,511)

Tax on items taken directly

to equity (943) (943)

----------------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive (loss)/income (2,454) 21,283 18,829

Exercise of options 1 49 50

Repurchase of shares (112) 112 (22,598) (22,598)

Tax on repurchase of

shares (113) (113)

Share-based payment charges 3,211 3,211

Purchase of shares held

in trust (5,727) (5,727)

Tax on purchase of shares

held in trust (29) (29)

Dividends (5,069) (5,069)

At 29 July 2012 2,521 143,294 1,910 (50,842) 72,761 169,644

Profit for the period 25,201 25,201

Interest-rate swaps

- profit taken to equity 9,274 9,274

Tax on items taken directly

to equity (2,133) (2,133)

----------------------------------- ---------- --------- ------------ ---------- ---------- ---------

Total comprehensive (loss)/income 7,141 25,201 32,342

Share-based payment charges 2,536 2,536

Purchase of shares held

in trust (624) (624)

Tax on purchase of shares

held in trust (4) (4)

Dividends (10,021) (10,021)

At 27 January 2013 2,521 143,294 1,910 (43,701) 89,849 193,873

----------------------------------- ---------- --------- ------------ ---------- ---------- ---------

Notes

1. General information

J D Wetherspoon plc is a public limited company, incorporated

and domiciled in England and Wales. Its registered office address

is: Wetherspoon House, Central Park, Reeds Crescent, Watford, WD24

4QL

The company is listed on the London Stock Exchange.

This condensed half-yearly financial information was approved

for issue by the board on 15 March 2013.

This interim report does not comprise statutory accounts within

the meaning of Sections 434 and 435 of the Companies Act 2006.

Statutory accounts for the year ended 29 July 2012 were approved by

the board of directors on 14 September 2012 and delivered to the

Registrar of Companies. The report of the auditors, on those

accounts, was unqualified, did not contain an emphasis-of-matter

paragraph or any statement under Sections 498 to 502 of the

Companies Act 2006.

There are no changes to the principal risks and uncertainties as

set out in the financial statements for the 53 weeks ended 29 July

2012, which may affect the company's performance in the next six

months. The most significant risks and uncertainties relate to the

taxation on, and regulation of, the sale of alcohol, cost increases

and UK disposable consumer incomes. For a detailed discussion of

the risks and uncertainties facing the company, refer to the annual

report for 2012, pages 40 and 41.

2. Basis of preparation

This condensed half-yearly financial information of J D

Wetherspoon plc (the 'Company'), which is abridged and unaudited,

has been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Services Authority and with

International Accounting Standards (IAS) 34, Interim Financial

Reporting, as adopted by the European Union. This interim report

should be read in conjunction with the annual financial statements

for the 53 weeks ended 29 July 2012 which were prepared in

accordance with IFRSs, as adopted by the European Union.

The directors have made enquiries into the adequacy of the

Company's financial resources, through a review of the Company's

budget and medium-term financial plan,including capital expenditure

plans and cash flow forecasts; they have satisfied themselves that

the Company will continue in operational existence for the

foreseeable future. For this reason, they continue to adopt the

going-concern basis in preparing the Company's financial

statements.

The financial information for the 53 weeks ended 29 July 2012 is

extracted from the statutory accounts of the Company for that

year.

The interim results for the 26 weeks ended 27 January 2013 and

the comparatives for 22 January 2012 are unaudited, but have been

reviewed by the independent auditors. A copy of the review report

is included at the end of this report.

3. Accounting policies

Taxes on income in the interim periods are accrued using the tax

rate which would be applicable to expected total annual

earnings.

With the exception of tax, the accounting policies adopted in

the preparation of the interim report are consistent with those

applied in the preparation of the Company's annual report for the

year ended 29 July 2012.

The following new standards, amendments to standards or

interpretations are mandatory for the first time for the financial

year beginning 30 July 2012, but are not relevant for the

Company:

-- Amendment to IAS12 'Income taxes' on deferred tax

-- Amendment to IAS 1 'Presentation of financial statements on other comprehensive income'

4. Revenue

Revenue disclosed in the income statement Unaudited Unaudited Audited

is analysed as follows: 26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

--------------------------------------------- ------------ ------------ ----------

Sales of food, beverages and machine income 626,397 569,375 1,197,129

--------------------------------------------- ------------ ------------ ----------

The Company trades in one business segment (that of operating

managed public houses) and one geographical segment (being the

United Kingdom).

5. Exceptional Items

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

Operating items

Property impairment - - 7,823

Onerous lease provision - - 2,229

Restructuring costs - - 625

Loss on disposal of property, plant and

equipment - 666 1,062

Write-off of IT-related assets and other

software costs - 1,933 1,742

----------------------------------------- ----------- ----------- ---------

2,599 13,481

----------------------------------------- ----------- ----------- ---------

The IT related assets written off in the previous period relate

primarily to the development cost of software which was not

implemented.

6. Operating profit before exceptional items

This is stated after charging/(crediting): Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

----------------------------------------------- ------------ ------------ ----------

Concession rental payments 7,405 6,940 14,831

Operating lease payments 26,803 25,965 53,230

Repairs and maintenance 22,794 20,073 44,575

Rent receivable (259) (251) (540)

Depreciation of property, plant and equipment 24,273 23,010 47,416

Amortisation of intangible assets 1,234 620 1,423

Amortisation of non-current assets 166 159 327

Share-based payment charges 2,536 2,168 5,379

----------------------------------------------- ------------ ------------ ----------

7. Income tax expense

The taxation charge for the period ended 27 January 2013 is

based on the estimated effective tax rate for the year ending 28

July 2013 of 27.7% (2012: 28.5%, based on a pre-exceptional profit

before tax of GBP35.8m). This comprises a current tax rate of 26.9%

(2012: 28.7% pre-exceptional) and a deferred tax rate of 0.8%

(2012: -0.2% pre-exceptional). The UK standard weighted average tax

rate for the year is 23.7%. The current tax rate is higher than the

UK standard weighted average tax rate, owing mainly to depreciation

which is not eligible for tax relief.

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

---------------------------------------------- ----------- ----------- ---------

Current tax 9,357 10,288 18,538

Current tax on exceptional items - intangible

asset write-off - (272) (723)

Deferred tax

Origination and reversal of temporary

differences 279 (90) 2,127

Impact of change in UK tax rate - (5,627)

Tax charge in the income statement 9,636 9,926 14,315

---------------------------------------------- ----------- ----------- ---------

8. Earnings and free cash flow per share

Basic earnings per share has been calculated by dividing the

profit attributable to equity holders of

GBP25,201,000 (January 2012: GBP23,284,000; July 2012:

GBP44,567,000) by the weighted average number of shares in issue

during the period of 120,890,250 (January 2012: 127,004,632; July

2012: 125,079,021).

The weighted average number of shares has been adjusted to

exclude shares held in respect of the employee Share Incentive

Plan.

Earnings before exceptional items per share has been calculated

before exceptional items detailed in note 5. There are no shares

remaining under option.

Adjusted earnings for the 53 weeks ended 29 July 2012 excludes

an adjustment of GBP5,627,000, in respect of the corporation

tax-rate change in that year.

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

------------------------------------------------ ------------ ------------ ----------

Earnings (profit after tax) 25,201 23,284 44,567

Exclude one-off tax benefit (rate change) - - (5,627)

Adjusted earnings after exceptional items 25,201 23,284 38,940

Exclude effect of exceptional items net

of tax - 2,327 12,758

Adjusted earnings before exceptional

items 25,201 25,611 51,698

------------------------------------------------ ------------ ------------ ----------

Basic/diluted earnings per share 20.8p 18.3p 35.6p

Adjusted earnings per share before exceptional

items 20.8p 20.2p 41.3p

Adjusted earnings per share after exceptional

items 20.8p 18.3p 31.1p

Free cash flow per share

The calculation of free cash flow per share is based on the net

cash generated by business activities and available for investment

in new pub developments and extensions to current pubs, after

funding interest, tax, all other reinvestment in pubs open at the

start of the period and the purchase of own shares under the

employee share-based schemes ('free cash flow'). It is calculated

before taking account of proceeds from property disposals, inflows

and outflows of financing from outside sources and dividend

payments and is based on the same number of shares in issue as that

for the calculation of basic earnings per share.

9. Cash generated from operations

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

------------------------------------------- ------------ ------------ ----------

Operating profit 52,076 50,517 93,212

Operating exceptional Items - 2,599 13,481

------------------------------------------- ------------ ------------ ----------

Operating profit before exceptional items 52,076 53,116 106,693

Depreciation and amortisation 25,673 23,789 49,166

Share-based payment charges 2,536 2,168 5,379

80,285 79,073 161,238

Change in inventories 320 1,207 514

Change in receivables (8,181) (3,677) 2,598

Change in payables (8,064) 2,570 32,383

------------------------------------------- ------------ ------------ ----------

Net cash inflow from operating activities 64,360 79,173 196,733

------------------------------------------- ------------ ------------ ----------

10. Property, plant and equipment

GBP000

------------------------------------------------ ----------

Net book amount at 24 July 2011 881,271

Additions 50,653

Disposals (1,114)

Depreciation (23,010)

------------------------------------------------ ----------

Net book amount at 22 January 2012 907,800

Additions 51,486

Disposals and transfer to assets held for sale (12,856)

Depreciation, impairment and other movements (22,089)

Net book amount at 29 July 2012 924,341

Additions 32,140

Disposals (145)

Depreciation (24,273)

------------------------------------------------ ----------

Net book amount at 27 January 2013 932,063

------------------------------------------------ ----------

11. Intangible assets

GBP000

---------------------------------------------- ---------

Net book amount at 24 July 2011 11,525

Additions 3,745

Write-off of IT-related assets (1,742)

Amortisation, impairment and other movements (620)

---------------------------------------------- ---------

Net book amount at 22 January 2012 12,908

Additions 4,902

Amortisation, impairment and other movements (874)

Net book amount at 29 July 2012 16,936

Additions 2,293

Amortisation, impairment and other movements (1,234)

---------------------------------------------- ---------

Net book amount at 27 January 2013 17,995

---------------------------------------------- ---------

Intangible assets all relate to computer software and

development.

12. Other non-current assets

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

-------------------- ------------ ------------ ----------

Leasehold premiums 10,537 10,350 10,682

-------------------- ------------ ------------ ----------

13. Analysis of changes in net debt

Non-cash 27 January

29 July Cash flows movement 2013

2012 GBP000 GBP000 GBP000

GBP000

------------------------------ ---------- ------------- ---------- -----------

Cash at bank 28,040 (1,904) - 26,136

Debt due after one year (474,559) (7,509) (827) (482,895)

(446,519) (9,413) (827) (456,759)

Finance lease creditor (16,092) 2,921 - (13,171)

------------------------------ ---------- ------------- ---------- -----------

Net borrowings (462,611) (6,492) (827) (469,930)

Derivative - cash flow hedge (66,029) - 9,274 (56,755)

Net debt (528,640) (6,492) 8,447 (526,685)

------------------------------ ---------- ------------- ---------- -----------

During the period under review, the company entered into

additional forward-starting interest-rate swap agreements,

totalling GBP150 million, in addition to the existing swaps which

expire in 2014 and 2016, respectively. The weighted average

interest rate of the new swaps is 1.78%, from July 2016 to July

2018. Swap agreements totalling GBP400 million are now in place

until July 2018.

The GBP9.3-million non-cash movement on the interest-rate swap

arises from the movement in fair value of the swaps.

14. Dividends paid and proposed

Unaudited Unaudited Audited

26 weeks 26 weeks 53 weeks

ended ended ended

27 January 22 January 29 July

2013 2012 2012

GBP000 GBP000 GBP000

Paid in the period

2012 interim dividend - - 5,069

2012 final dividend 10,021 10,475 10,475

10,021 10,475 15,544

----------------------------------- ----------- ----------- ---------

Dividends in respect of the period

Interim dividend 4,835 5,069

Final dividend - 10,021

----------------------------------- ----------- ----------- ---------

4,835 5,069 10,021

Dividend per share 4p 4p 8p

----------------------------------- ----------- ----------- ---------

15. Share capital

Number Share

of capital

shares GBP000

000s

-------------------------------------- ---------- ---------

Opening balance at 24 July 2011 131,608 2,632

Allotments 14 -

Closing balance at 22 January 2012 131,622 2,632

Allotments 16 1

Repurchase of shares (5,602) (112)

-------------------------------------- ---------- ---------

Closing balance at 29 July 2012 126,036 2,521

Closing balance at 27 January 2013 126,036 2,521

-------------------------------------- ---------- ---------

All issued shares are fully paid.

16. Related-party disclosure

There were no material changes to related party transactions

described in the last annual financial statements. There have been

no related-party transactions having a material effect on the

Company's financial position or performance in the first half of

the current financial year.

17. Capital commitments

The Company had GBPnil capital commitments for which no

provision had been made, in respect of property, plant and

equipment, at 27 January 2013 (2012: GBPnil).

Independent review report to J D Wetherspoon plc

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 27 January 2013, which comprises the Income

Statement, the Statement of Comprehensive Income, the Cash Flow

Statement, the Balance Sheet, the Statement of Changes in

Shareholders' Equity and related notes. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Services Authority.

As disclosed in note 2, the annual financial statements of the

Company are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review. This report, including the

conclusion, has been prepared for and only for the Company for the

purpose of the Disclosure and Transparency Rules of the Financial

Services Authority and for no other purpose. We do not, in

producing this report, accept or assume responsibility for any

other purpose or to any other person to whom this report is shown

or into whose hands it may come save where expressly agreed by our

prior consent in writing.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 27

January 2013 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Services Authority.

PricewaterhouseCoopers LLP

Chartered Accountants

15 March 2013

1 Embankment Place

London

WC2N 6RH

Notes:

(a) The maintenance and integrity of the J D Wetherspoon plc

website is the responsibility of the directors; the work carried

out by the auditors does not involve consideration of these matters

and, accordingly, the auditors accept no responsibility for any

changes that may have occurred to the financial statements since

they were initially presented on the website.

(b) Legislation in the United Kingdom governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGURUWUPWGBC

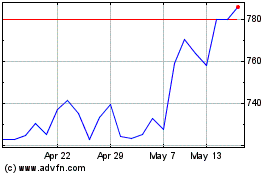

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Jun 2024 to Jul 2024

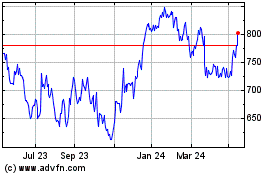

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Jul 2023 to Jul 2024