Pre-Close Statement

January 20 2009 - 2:00AM

UK Regulatory

TIDMJDW

RNS Number : 9068L

Wetherspoon (JD) PLC

20 January 2009

JD WETHERSPOON PLC

20 January 2009

PRE-CLOSE STATEMENT

JD Wetherspoon plc ("JD Wetherspoon" or the "Company") announces an update on

current trading prior to entering its close period for its interim results for

the six months ending 25 January 2009, which are expected to be announced on 13

March 2009.

Current Trading

For the first 12 weeks of the second quarter (to 18 January 2009), like for like

sales increased by 2.6%, compared to 1.5% growth in the first quarter (to 26

October 2008). In the year to date (25 weeks to 18 January 2009), like for like

sales have increased by 2.0% and total Company sales, including recently opened

pubs, increased by 6.5%. For the 6 week Christmas trading period (from 1

December 2008 to 11 January 2009), like for like sales growth was 3.7%. Sales

in the last two weeks of trading to 18 January 2009 have shown LFL increases of

6.4%

We expect operating margins for the half year ending 25 January 2009 to be

approximately 1% lower than the same period last year and in line with those in

the second half of last year.

Financing

The Company remains in a sound financial position. The strength of our cashflow

is demonstrated by a reduction in our borrowings of approximately GBP20m over

the last twelve months, after accounting for the opening of 34 new pubs, paying

dividends of GBP17m, and funding GBP6m of share buybacks.

The Company's US$140m private placement is due for renewal in September 2009. In

the light of current uncertainty in the credit markets, the Board has decided to

reduce substantially capital expenditure on new openings and to cancel future

dividend payments in order to ensure the repayment of the private placement from

cash flow and existing facilities. In normal conditions, a refinancing of the

private placement on attractive terms could be relied upon, given our financial

performance. However, in the present economic climate, a refinancing cannot be

taken for granted and the Board therefore feels that the measures described

above are prudent in the circumstances. We will continue to monitor the

situation.

Property

We have opened 21 new pubs so far this financial year and disposed of one pub,

bringing the current number of pubs to 714. We anticipate opening a further 12

pubs by July 2009. A considerable number of new openings this year have been

purchased from receivers and both rents and development costs are substantially

lower than historic trends.

Outlook

Our sales performance and cash flow have proved to be extremely resilient in the

current economic environment and a number of cost increases experienced during

2008 are starting to abate. For example, the Company has recently agreed a new

electricity supply contract from February to September 2009, which is

approximately half the rate per megawatt of the previous contract from October

2008 to January 2009. As a result of these encouraging circumstances, we remain

confident of the Company's prospects for the financial year ending July 2009.

Enquiries:

Keith Down Finance Director 01923 477777

John Hutson Chief Executive 01923 477777

Eddie Gershon Company Spokesman 0208 352 5012/07956 392234

Visit our web site at www.jdwetherspoon.co.uk

Notes to editors

1. JD Wetherspoon owns and operates pubs throughout the UK. The Company aims to

provide customers with good-quality food and drink, served by well-trained and

friendly staff, at reasonable prices. The pubs are individually designed and the

Company aims to maintain them in excellent condition.

2. Visit our website www.jdwetherspoon.co.uk

3. This announcement has been prepared solely to provide additional information to

the shareholders of JD Wetherspoon, in order to meet the requirements of the UK

Listing Authority's Disclosure and Transparency Rules. It should not be relied

on by any other party, for other purposes. Forward-looking statements have been

made by the directors in good faith using information available up until the

date that they approved this statement. Forward-looking statements should be

regarded with caution because of inherent uncertainties in economic trends and

business risks.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTEAPFNFSLNEFE

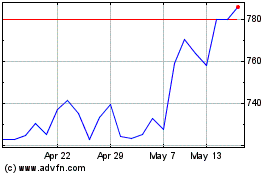

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Sep 2024 to Oct 2024

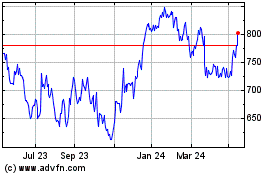

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Oct 2023 to Oct 2024