TIDMITM

RNS Number : 3324O

ITM Power PLC

31 January 2023

31 January 2023

ITM Power PLC

("ITM" or the "Company")

Interim Results for the Six Months to 31 October 2022 and

Strategic Update

Interim results summary

-- Revenue GBP2.0m (H122: GBP4.2m)

-- Adjusted EBITDA loss GBP54.1m (H122: GBP12.9m) *

-- Net cash at the end of the H123 of GBP317.7m (H122: GBP164.2m)

-- Majority of Leuna project revenue deferred due to delays and changed delivery model

* Adjusted EBITDA is a non-statutory measure. The calculation

methodology is set out in the Note 3

Two 100 MW contracts signed with Linde Engineering

-- Largest PEM electrolyser under execution in the world today

-- Deploying the new Linde / ITM Power 10 MW standard modules

based on state-of-the-art 3MEP 30bar stacks

-- To be installed at RWE's site in Lingen, Germany

Strategic update: 12-month priorities to solidify our

foundations for growth

-- Concentrating our portfolio on a core product suite, with

robust product validation, and preparing for manufacturing at

scale

-- A rigorous approach to capital allocation and cost

management, including a headcount reduction equating to a 30%

(GBP9m) annualised saving on personnel cost, professionalising

engineering and manufacturing, and increasing control over

spend

-- Plans for future testing capacity and incremental automation,

improving cycle times, volume output and build quality

Agreement with Vitol to review strategic options for their joint

venture Motive Fuels Ltd

-- Options to be considered by the shareholders range from the

sale of the business to discontinuing activities, and are subject

to appropriate consultation

-- This is intended to save ITM Power c.GBP28m to be rerouted to our core business

Financial guidance for FY23

-- As previously announced, materially changing earlier guidance

-- Full-year revenue now expected to be c.GBP2m with further

revenue deferred into the next financial year

-- Adjusted EBITDA loss expected to be in the range of GBP85m to GBP95m

-- Net cash at year-end expected to be in the range of GBP245m to GBP270m

Board change

-- Dr Rachel Smith to step down from the Board of Directors from

1 February 2023 and assume a new role in the Company

Sir Roger Bone, Chairman, said: "We raised capital to pursue an

expansion strategy and in doing so underestimated the competencies

and capabilities required to scale up and to transition from an

R&D company to a volume manufacturer. As a consequence, we set

unrealistic targets for project completion. This has produced an

unacceptable financial performance.

"We have acted swiftly by appointing Dennis as our new CEO.

During his 2 months at ITM, Dennis has developed a 12-month plan

which lays out the underlying challenges of the business as well as

the solutions which we will put into place. I have no doubt that

the immediate actions being taken will provide strong foundations

for the future which will enable ITM to move into its next phase of

development and to play a leading role in the journey to net

zero.

"On a separate note, Dr Rachel Smith will step down from the

Board on 1 February. With her knowledge, expertise and passion for

the Company, Rachel has been pivotal in the delivery of several key

strategic projects for a number of years. On behalf of the Board, I

would like to thank Rachel for her continued commitment to ITM as

she works with the Company in her new role."

Dennis Schulz, CEO, said: "As a former customer of ITM, I had a

good understanding of the company's situation before I took on the

challenge of leading its transformation. Prior to committing

myself, I questioned:

1. Does ITM have a cutting-edge electrolyser technology with the

potential to outperform its competitors?

2. Does ITM have a strong enough balance sheet to support the

necessary strategic and operational changes required to strengthen

the company's foundations?

3. Does the market give us the time window needed to solve the

growing pains ITM is encountering?

"In answer, I am confident these crucial preconditions are

met.

"Having worked in close partnership with ITM, and selectively

with competitors, I am convinced that ITM's technology can

outperform the competition. However, product focus must be narrowed

significantly. Our balance sheet is robust, but we need a much more

rigorous approach to managing cost. This requires scrutinising

every aspect of the business for cost saving potential, and it will

make difficult decisions necessary. One of those is the need to

streamline our organisation via a headcount reduction

programme.

"We need to transform ITM from an R&D culture company to a

professional and credible delivery organisation ready for volume

manufacturing - sustainably growing into a profitable business.

Most issues today arise from immature engineering processes, which

materialise during manufacturing and lead to project delays and

cost overruns. As one key priority, we will change the way we

engineer our products and control design changes.

"The market for green hydrogen is real, driven by climate

change, and decarbonisation imperatives. Increasing carbon taxation

in combination with green funding programmes make previously

unattractive business cases viable. Recent energy independence

considerations are further fuelling demand growth. However, peak

electricity prices and inflation have temporarily slowed down

customer investment decisions. This gives ITM time to have the

breathing space required to focus on getting the fundamentals of

the business in order, while delivering on our contractual customer

commitments.

"Our detailed 12-month plan will make ITM a stronger, more

focused and more capable company. The large-scale opportunities in

the market are yet to come, and by putting these foundations in

place ITM will be ready for the significant market demand ahead of

us."

A presentation for analysts and investors by Dennis Schulz, CEO,

and Andy Allen, CFO, will be held at 9.00am GMT.

The presentation will be via the Investor Meet Company platform.

Questions can be submitted pre-event via the Investor Meet Company

dashboard at any time during the live presentation. Analysts and

investors can sign up to Investor Meet Company for free via:

https://www.investormeetcompany.com/itm-power-plc/register-investor.

Those who already follow the Company on the Investor Meet Company

platform will automatically be invited.

A recording will be made available on the Investor Relations

section of the ITM website after the event.

For further information please visit www.itm-power.com or

contact:

ITM Power PLC

James Collins, Investor Relations +44 (0)114 551 1205

Justin Scarborough, Investor Relations +44 (0)114 551 1080

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

James Rudd / Chris Sim / Ben Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / Tim Pearson / Charlie

Baister

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR

About ITM Power PLC:

ITM Power was founded in 2000 and ITM Power PLC was admitted to

the AIM market of the London Stock Exchange in 2004. Headquartered

in Sheffield, England, ITM Power designs and manufactures

electrolysers based on proton exchange membrane (PEM) technology to

produce green hydrogen, the only net zero energy gas, using

renewable electricity and water.

Interim results

The results for the period to 31 October 2022 reflect the impact

of provisions taken for project cost overruns and inventory losses.

The causes are discussed below.

Revenue

Revenue for the period was GBP2.0m (H122: GBP4.2m). The Leuna

project consists of 12 x 2 MW Cube modules and GBP1.8m was

recognised in the first half following completion of the Factory

Acceptance Test (FAT) for 2 Cube modules. In order to mitigate on

site delays, our customer Linde requested split delivery of Cubes

and Stacks for the remaining 10 Cubes meaning revenue will be

recognised upon successful Site Acceptance Test (SAT). All Cubes

have now been delivered to site. The project now awaits the

upgraded MEP 30 bar stacks to be delivered to site for SAT by

Linde.

Gross margin

The gross loss was GBP45.6m (H122: GBP2.6m) reflecting increased

losses on inventory and customer contracts, and a prudent

assessment of warranty commitments.

Costs recognised in the period relating to inventory were

GBP15.7m, constituting a GBP1.6m write-off and a provision of

GBP14.1m. The losses originate from continued iterations of product

designs during manufacturing, together with some manufactured

products being considered obsolete or in need of rework.

Contract loss provisions relate to a number of factors including

changes of scope to projects, additional on-site engineering works,

increased energy and labour costs due to extended stack testing

times and future costings updated for inflation. Net contract loss

provisions increased by GBP18.0m, with GBP27.3m created and GBP9.3m

utilised in the period. The total contract loss provision at the

period end stood at GBP30.4m.

The warranty provision increased by a net GBP2.3m in the period

with a GBP2.8m increase in provision offset by the utilisation of

GBP0.5m. The balance at period end was GBP5.3m. This includes all

projects contracted at period end. We expect to continue to review

product performance in the field and for future products to reflect

the benefits of the manufacturing we are making.

Adjusted EBITDA

The company posted an adjusted EBITDA loss of GBP54.1m

(GBP12.9m) for the period. Adjusted EBITDA is a non-statutory

measure and is detailed in Note 3.

Capital expenditure

Capital expenditure totalled GBP7.2m in the period, with GBP3.5m

invested on capital projects, namely Bessemer Park improvements and

machinery, and GBP3.7m on intangible assets.

Working capital

The working capital outflow in the first half was GBP6.9m, with

inventories and receivables increasing by GBP14.8m and GBP7.6m

respectively, partly offset by an increase in payables of

GBP15.5m.

Cash

Net cash at the period end was GBP318m (H122: GBP164m),

benefiting from the net GBP242m raised in November 2021.

Two 100 MW contracts signed with Linde Engineering

ITM Power has signed two contracts, each for the sale of 100 MW

of PEM electrolysers to Linde Engineering. Both plants will be

installed at a site operated by RWE in Lingen, Germany, and are the

largest PEM electrolysers under execution worldwide today.

The plants will be the first deployment of the Linde Engineering

/ ITM Power 10 MW standard module skids for large-scale

installations, utilising state-of-the-art MEP 30 bar electrolyser

stacks. Whilst we do not expect the project to contribute to our

margin, delivery for these two projects will represent a key

milestone on ITM Power's journey towards high volume manufacturing

of an industrialised product.

As part of its "Growing Green" strategy, RWE announced in

November 2021 that it aimed to create electrolyser capacity of at

least 2 GW to generate green hydrogen by 2030. The two 100 MW

electrolyser plants at Lingen are part of this ambition. In

December 2021, Linde Engineering and ITM Power were preselected by

RWE as technical provider for the first two 100 MW installations of

the so-called GET H2 Nukleus project in Lingen.

Products

Our core electrochemical technology works well. At this stage,

we are testing and verifying the latest iteration of our

state-of-the-art MEP 30 bar stack which we expect to deploy into

existing projects.

Today our product suite is too wide. The services we provide to

support older generation technologies are disruptive to our

manufacturing process and have become too costly.

Historically, we have started to develop the second generation

of an existing product in advance of the first generation having

been fully verified for field deployment. This will no longer be

the case.

Our portfolio will be rationalised and our focus in the future

will be on two core products, our MEP 30 bar stack platform and our

Plug and Play containers. The MEP stack platform will benefit from

design, manufacture and assembly improvements, thereby reducing

production costs, assembly time and delivery lead times. For

large-scale installations we are looking forward to deploying Stack

& Skid Modules. With regards to Plug and Play containers, some

of our engineering processes have been immature and at times

disruptive. Remedial actions to address these issues are being put

into place from design, to piloting, and validation.

Capital discipline and cost reduction

It is common for a growing technology company developing

first-of-a-kind products which need to be manufactured at scale, to

be loss making. However, our cost discipline has not been rigorous

enough. Constant design changes led to unwelcomed inventory

write-downs. In addition, delays in project deliveries caused

excessive consumption of working hours. Finally, an

overly-optimistic recruitment programme has led to organisational

overcapacity. We will address the underlying causes of these issues

as three parts of a 12-month priorities plan.

First, we are in the process of reshaping our organisational

structure to be leaner and flatter, where accountability is clear

and which will create an environment for effective engineering,

manufacturing and project delivery. Today we have announced an

anticipated 25% headcount reduction in full-time equivalents

(FTEs), subject to employee consultation, leading to a GBP9m (30%)

cost reduction on an annualised basis. The benefits will start to

be recognised in FY24.

Second, to address the causes of the inventory losses for FY23,

we will bring in new capabilities in design to professionalise

engineering, including enhanced simulation tools as well as a

strengthening of the compliance and validation function. We will

improve supplier audits on quality and will develop inspection and

test planning to reflect our supplier capability risk. A new

process for enhanced parts traceability from incoming goods to

shipping will be introduced into our warehousing and a new

Enterprise Resource Planning (ERP) system will ensure seamless

tracking of warehouse stock to work orders.

Lastly, to avoid future project losses, there will be enhanced

discipline around the sale of standard products as opposed to

customised solutions with a strengthening of sales governance from

the initial bid phase through to project execution and covering

areas such as costings, scheduling and risk estimations. Our

project management requires the strengthening of capabilities and

accountability. Controls will be strengthened with the introduction

of a clear phase gate process which will be strictly adhered

to.

Agreement with Vitol to review strategic options for their joint

venture Motive Fuels Ltd

Today the Company also announces it has agreed with Vitol to

review the strategic options for Motive Fuels Ltd. Options to be

considered by the shareholders range from the sale of the business

to discontinuing activities, subject to appropriate

consultation.

The vision of the JV partners was one of building a significant

UK refuelling business, with GBP30m committed by each party as seed

funding to be geared to create a refuelling network. However, the

landscape has changed since the establishment of the joint venture,

with lower availability of heavy-duty hydrogen vehicles than

originally anticipated adversely affecting fuelling asset

utilisation.

ITM expects to save GBP28m of the original committed sum, which

will support the core business of electrolyser manufacturing.

De-bottlenecking

One of the challenges over the past year has been managing our

testing capacity alongside our expected manufacturing output. It is

our intention to locate increased testing capacity as near to

manufacturing as possible with a phased approach in order to

satisfy project delivery needs.

Looking ahead, automation will play an important role in

optimising build quality, reducing manufacturing costs,

accelerating output and reducing delivery lead times. We will

incrementally introduce automation into Bessemer Park in a

controlled way and only after new equipment and new processes have

been validated.

Financial Guidance for FY23

The main factors which will impact the outcome for the financial

year are expected losses on customer contracts, legacy commitments

for earlier product generations causing on-site support costs,

warranty provisions, and inventory write-downs and provisions

originating from iterations of product designs during

manufacturing. Another important factor affecting guidance is the

revenue recognition timing for contracted projects.

The guidance for FY23 is:

-- Full year product revenue of c.GBP2.0m

-- Adjusted EBITDA loss of GBP85m to GBP95m

-- Net cash of GBP245m to GBP270m

Revenue

Design, manufacturing and testing bottlenecks have affected our

original plan to fully recognise the revenues associated with

notable projects such as Leuna and Yara. For Leuna, whilst we

anticipate delivering all elements of the project to site before

year end, we do not expect that customer-led SAT will be completed

for ITM to recognise revenue in the current financial year. SAT and

therefore revenue recognition for the Yara project will also occur

after year end in April.

Based on the products revenue recognised in the first half, we

therefore expect revenue for the full year to be c.GBP2.0m.

As set out in the strategic update, decisive actions have been

identified to limit the recurrence of these predominantly

process-based factors on our future product delivery

capabilities.

EBITDA

EBITDA guidance includes the contract loss provisions taken in

the first half which are expected to unwind with project progress.

Further details are in Note 5. All contracted warranty obligations

including those relating to the Lingen project announced today are

reflected in the full year guidance. The warranty provisions will

be included within contract loss provisions prior to

deployment.

We expect inventory write-downs for the full-year of GBP18-23m.

The majority of write-down, consisting of GBP15.7m, was recognised

in H1, with the balance projected against production volumes in

H2.

Net cash

Our balance sheet remains strong, with net cash at the year-end

expected to be in the range of GBP245m to GBP270m. Capital

discipline and rigour will be at the heart of every spending

decision that we take.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Results for the six months ended 31 October 2022

Six months Year ended

Six months to 31 October 2022 to 31 October 30 April

(unaudited) 2021 (unaudited) 2022 (audited)

Note GBP'000 GBP'000 GBP'000

Revenue 2 2,031 4,156 5,627

Cost of sales (47,590) (6,766) (29,104)

Gross loss (45,559) (2,610) (23,477)

Operating costs

Staff and employment costs (4,284) (7,662) (4,316)

Consultancy and consumables (3,699) (1,902) (11,225)

Building overheads (871) (1,276) (2,564)

Depreciation and amortisation (877) (1,538) (3,189)

Impairment of obsolete assets (1,193) - -

Other 158 (241) (609)

Expected credit risk (11) 18 84

Other income - government grants 175 172 560

------------------------------------ -----------------

Loss from operations (56,161) (15,039) (44,736)

Share of loss of associate companies

and joint ventures (1,384) (82) (10)

Finance income 1,282 38 325

Finance costs (270) (259) (532)

Loss on deemed disposal of subsidiary - - (1,710)

------------------------------------ -----------------

Loss before tax (56,533) (15,342) (46,663)

Tax (15) (21) (31)

Loss for the period (56,548) (15,363) (46,694)

------------------------------------ ----------------- ---------------

Other total comprehensive income:

Foreign currency translation differences

on foreign operations (260) (141) (71)

Total comprehensive loss for

the period (56,808) (15,504) (46,765)

==================================== ================= ===============

Basic and diluted loss per share (9.2p) (2.8p) (8.1p)

==================================== ================= ===============

Weighted average number of shares 613,658,155 550,658,155 576,699,822

==================================== ================= ===============

All results presented above are derived from continuing

operations. The loss per ordinary share and diluted loss per share

are equal because share options are only included in the

calculation of diluted earnings per share if their issue would

decrease the net profit per share. The number of potentially

dilutive shares not included in the calculation above due to being

anti-dilutive at 31 October 2022 were 7,991,625 (31 October 2021:

7,460,734; 30 April 2022: 45,064,658).

CONSOLIDATED BALANCE SHEET

As at 31 October 2022

Note As at 31 October 2022 As at 31 October 2021 As at 30

(unaudited) (unaudited) April 2022

(audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Investment in associate 720 155 1,662

Loan notes 1,577 - 1,548

Intangible assets 11,916 3,856 9,081

Right of use assets 6,095 6,203 6,454

Property, plant and equipment 17,400 13,732 15,637

Financial asset at amortised

cost 168 155 161

--------------------- --------------------- -----------

Total non-current assets 37,876 24,101 34,543

--------------------- --------------------- -----------

Current assets

Inventories 4 47,003 11,742 32,198

Trade and other receivables 33,073 21,481 25,542

Cash and cash equivalents 317,738 164,235 365,882

--------------------- --------------------- -----------

Total current assets 397,814 197,458 423,622

Current liabilities

Trade and other payables (49,785) (22,487) (34,296)

Provisions 5 (19,702) (10,237) (15,207)

Lease liability (755) (512) (626)

-----------

Total current liabilities (70,242) (33,236) (50,129)

Net current assets 327,572 164,222 373,493

--------------------- --------------------- -----------

Non-current liabilities

Lease liability (6,271) (6,033) (6,522)

Provisions 5 (20,034) - (6,561)

--------------------- --------------------- -----------

Total non-current liabilities (26,305) (6,033) (13,083)

--------------------- --------------------- -----------

Net assets 339,143 182,290 394,953

===================== =====================

Equity

Called up share capital 30,808 27,533 30,658

Share premium account 542,461 302,248 542,323

Merger reserve (1,973) (1,973) (1,973)

Foreign exchange reserve (248) (58) 12

Retained loss (231,905) (145,460) (176,067)

--------------------- --------------------- -----------

Total Equity 339,143 182,290 394,953

===================== ===================== ===========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Results for the six months ended 31 October 2022

Foreign

Share Exchange Retained Total

capital Share premium Merger reserve reserve loss Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2022 30,658 542,323 (1,973) 12 (176,067) 394,953

Transactions with Owners

Issue of shares 150 138 - - - 288

Credit to equity for

share based payment - - - - 710 710

-------- ------------- -------------- --------- --------- ---------

Total Transactions with

Owners 150 138 - - 710 998

Loss for the period - - - - (56,548) (56,548)

Other comprehensive income - - - (260) - (260)

-------- ------------- -------------- --------- --------- ---------

Total comprehensive

income - - - (260) (56,548) (56,808)

At 31 October 2022 (unaudited) 30,808 542,461 (1,973) (248) (231,905) (339,143)

======== ============= ============== ========= ========= =========

At 1 May 2021 27,533 302,248 (1,973) 83 (130,444) 197,447

Transactions with Owners

Issue of shares - - - - - -

Credit to equity for

share based payment - - - - 347 347

-------- ------------- -------------- --------- --------- ---------

Total Transactions with

Owners - - - - 347 347

Loss for the period - - - - (15,363) (15,363)

Other comprehensive income - - - (141) - (141)

-------- ------------- -------------- --------- --------- ---------

Total comprehensive

income - - - (141) (15,363) (15,504)

At 31 October 2021 (unaudited) 27,533 302,248 (1,973) (58) (145,807) 182,285

======== ============= ============== ========= ========= =========

At 1 May 2021 27,533 302,248 (1,973) 83 (130,444) 197,447

Transactions with Owners

Issue of shares 3,125 240,075 - - - 243,200

Credit to equity for

share based payment - - - - 1,071 1,071

-------- ------------- -------------- --------- --------- ---------

Total Transactions with

Owners 3,125 240,075 - - 1,071 244,271

Loss for the year - - - - (46,694) (46,694)

Other comprehensive income - - - (71) (71)

-------- ------------- -------------- --------- --------- ---------

Total comprehensive

income - - - (71) (46,694) (46,765)

At 30 April 2022 (audited) 30,658 542,323 (1,973) 12 (176,067) 394,953

======== ============= ============== ========= ========= =========

CONSOLIDATED CASH FLOW STATEMENT

Results for the six months ended 31 October 2022

Note Six months Year ended

Six months to 31 October 2022 to 31 October 30 April

(unaudited) 2021 (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

Net cash used in operating activities 6 (41,818) (9,800) (38,155)

Investing activities

Investment in associate (428) - (1,838)

Cashflows arising from loss of control of

subsidiary - - (993)

Loan notes (loan to joint venture) - - (1,899)

Purchases of property, plant and equipment (3,549) (1,064) (4,119)

Capital Grants received against purchases of

non-current assets 4 97 150

Proceeds on disposal of plant & equipment - - 352

Payments for intangible assets (3,667) (1,059) (7,036)

Interest received 1,247 32 304

------------------------------------ ----------------- ---------------

Net cash used in investing activities (6,393) (1,994) (15,079)

------------------------------------ ----------------- ---------------

Financing activities

Issue of ordinary share capital 900 - 250,000

Costs associated with fund raise (612) - (6,800)

Payment of lease liabilities (165) (65) (69)

Net cash from financing activities 123 (65) 243,131

------------------------------------ ----------------- ---------------

(Decrease)/ increase in cash and cash

equivalents (48,088) (11,859) 189,897

Cash and cash equivalents at the beginning

of period 365,882 176,078 176,078

Effect of foreign exchange rate changes (56) 15 (93)

------------------------------------ ----------------- ---------------

Cash and cash equivalents at the end of

period 317,738 164,234 365,882

==================================== ================= ===============

The interim summary accounts were approved by the board of

Directors on 30 January 2023.

Notes to the interim summary accounts

1. Basis of preparation of interim figures

These interim summary accounts have been prepared using

accounting policies consistent with UK-adopted international

accounting standards, in conformity with the requirements of the

Companies Act 2006. Whilst the financial information has been

compiled in accordance with the recognition and measurement

principles of UK-adopted international accounting standards

(IFRSs), it does not contain sufficient information to comply with

IFRSs. This interim financial information does not constitute

statutory financial statements within the meaning of section 435 of

the Companies Act 2006.

The financial information has been prepared on the historical

cost basis. The principal accounting policies adopted by the Group

are as applied in the Group's latest audited financial

statements.

The information relating to the year ended 30 April 2022 has

been extracted from the Group's published financial statements for

that year, which contain an unqualified audit report that does not

draw attention to any matters of emphasis, and did not contain

statements under section 498(2) and 498(3) of the Companies Act

2006 and which have been filed with the Registrar of Companies.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial position and performance of the Group since

the last annual consolidated financial statements as at the year

ended 30 April 2022.

Going Concern

The Directors have prepared a cash flow forecast for the period

ending 31 January 2024. This forecast indicates that the Company

would expect to remain cash positive without the requirement for

further fund raising based on delivering the existing pipeline, for

a period of at least 12 months from the date of approval of these

summary accounts.

This cash flow forecast has also been stress tested. As a

worst-case scenario, if all payments had to continue as forecast

while receipts were not received at all, the business would remain

cash positive for the full twelve months from the date of approval

of these summary accounts.

The interim summary accounts have therefore been prepared on a

going concern basis.

2. Revenue and other operating income

An analysis of the Group's revenue is as follows:

Six months Year ended

Six months to 31 October 2022 to 31 October 30 April

(unaudited) 2021 (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

Revenue from product sales recognised

over time - 510 808

Revenue from product sales recognised

at point in time 1,751 670 1,231

Consulting contracts recognised over

time - 2,840 2,948

Maintenance contracts recognised at

point in time 169 32 43

Fuel sales 111 104 229

Other - - 368

---------------------------------------- ----------------- ---------------

Revenue in the Consolidated Income

Statement 2,031 4,156 5,627

Grant income (claims made for projects) 52 61 271

Other government grants (R&D claims) 123 111 289

Grant income in the Consolidated Income

Statement 175 172 560

2,206 4,328 6,187

======================================== ================= ===============

Revenues from major products and services

The Group's revenues from its major products and services were

as follows:

Six months Year ended

to 31 October 30 April

Six months to 31 October 2022 (unaudited) 2021 (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

Power-to gas 107 16 207

Refuelling 173 859 1,704

Industrial 1,751 412 507

Other - 2,869 3,209

----------------------------------------- ----------------- ---------------

2,031 4,156 5,627

========================================= ================= ===============

GEOGRAPHIC ANALYSIS OF REVENUE

A geographical analysis of the Group's revenue is set out

below:

Year ended

30 April

2022

(audited)

Six months

to 31 October

2021 (unaudited)

Six months to 31 October 2022 (unaudited) GBP'000 GBP'000 GBP'000

United Kingdom 45 2,976 3,359

Germany 1,751 425 770

Rest of Europe 124 85 246

United States 111 - 22

Australia - 670 1,230

------------------------------------------------- ----------------- ----------

2,031 4,156 5,627

================================================= ================= ==========

The following accounted for more than 10% of total revenue:

Six months to 31 October 2022 Six months to 31 October 2021 Year ended

(unaudited) GBP'000 (unaudited) GBP'000 30 April 2022 (audited) GBP'000

Customer A 1,751 N/A N/A

Customer B N/A 2,840 2,840

Customer C N/A 670 673

================================== ================================= =================================

3. Calculation of Adjusted EBITDA

In reporting EBITDA, management use the metric of adjusted

EBITDA, to better reflect underlying performance and remove the

effect of the following items:

Six months Year ended

to 31 October 30 April

Six months to 31 October 2022 2021 (unaudited) 2022 (audited)

(unaudited) GBP'000 GBP'000 GBP'000

Loss from operations (56,161) (15,039) (44,736)

Add back:

Depreciation 1,318 1,149 2,340

Impairment 1,193 - -

Amortisation 482 396 849

Loss on disposal 35 - -

Fair value loss on loan notes - - 344

Share based payment (credit) / charge (952) 552 1,429

-------------------------------------- ------------------ ----------------

(54,085) (12,942) (39,774)

====================================== ================== ================

4. Inventories

October October April

2022 2021 2022

GBP000 GBP000 GBP000

Raw Materials 36,013 9,486 24,311

Work in progress 10,990 2,256 7,887

------- ------- -------

47,003 11,742 32,198

======= ======= =======

Inventories are stated after a provision for impairment of

GBP18.1 million (October 2021: GBP1.5 million; April 2022: GBP2.7

million).

5. Provisions

Leasehold

Half year to October Property Provision Employers' National Total

2022 Provision Warranty for contract losses Other Provisions Insurance Provision Provisions

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May

2022 (854) (2,938) (12,493) (1,330) (4,153) (21,768)

Provision created

in the period (21) (2,842) (27,255) (1,454) - (31,572)

Use of the provision - 496 9,304 - 376 10,176

Release in the period - - - - 3,428 3,428

---------- -------- -------------------- ---------------- -------------------- -----------

Balance at 31 October

2022 (875) (5,284) (30,444) (2,784) (349) (39,736)

---------- -------- -------------------- ---------------- -------------------- -----------

In the balance sheet:

Expected within

12 months

(current) - (534) (16,954) (2,214) - (19,702)

Expected after 12

months

(non-current) (875) (4,750) (13,490) (570) (349) (20,034)

========== ======== ==================== ================ ==================== ===========

Employers'

Leasehold Provision National

Full year to April Property for contract Insurance Total

2022 Provision Warranty losses Other Provisions Provision Provisions

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May

2021 (1,024) (797) (4,820) (677) (4,958) (12,276)

Provision created

in the year (36) (2,163) (15,052) (1,330) - (18,581)

Use of the provision 206 18 7,379 509 - 8,112

Release in the year - 4 - 168 805 977

---------- -------- ------------- ---------------- ---------- -----------

Balance at 30 April

2022 (854) (2,938) (12,493) (1,330) (4,153) (21,768)

---------- -------- ------------- ---------------- ---------- -----------

In the balance sheet:

Expected within

12 months

(current) - (1,145) (9,453) (456) (4,153) (15,207)

Expected after 12

months

(non-current) (854) (1,793) (3,040) (874) - (6,561)

========== ======== ============= ================ ========== ===========

Employers'

Leasehold Provision National

Half year to October Property for contract Insurance Total

2021 Provision Warranty losses Other Provisions Provision Provisions

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 May

2021 (1,024) (797) (4,820) (677) (4,958) (12,276)

Provision created

in the year (20) (569) (1,344) (313) (7) (2,253)

Use of the provision 142 18 4,065 67 - 4,292

Balance at 31 October

2021 (902) (1,348) (2,099) (923) (4,965) (10,237)

---------- -------- ------------- ---------------- ---------- -----------

The leasehold property provision represents management's best

estimate of the present value of the dilapidations work that may be

required to return our leased buildings to the landlords at the end

of the lease term. The discount applied to this is amortising over

the lease term.

The warranty provision is recognised in line with revenue

recognition on contracts and represents management's best estimate

of the Group's liability under warranties granted on products. It

is based on historical knowledge of the products or their

components and adjusted for any new knowledge that becomes

available. As with any product warranty, there is an inherent

uncertainty around the likelihood and timing of a fault occurring

that would trigger further work or part replacement.

The provision for contract losses is created when it becomes

known that a commercial contract has become onerous. Project

Managers provide rolling spend forecasts, updating these as quotes

are obtained. The provision is therefore based on best estimates

and information known at the time to ensure the expected losses are

recognised immediately through the statement of comprehensive

income. This provision will be used to offset the costs of the

project as it reaches completion in future periods.

Provision is also made at the point when project forecasts

suggest that the contractual clauses for liquidated damages might

be triggered. The other provisions category relates to potential

liquidated damages for overruns on contracts with customers.

There is a provision for Employer's NIC due on share options as

they exercise.

6. Notes to the Cashflow Statement

Six months Six months Year ended

to 31 October to 31 October 30 April

2022 (unaudited) 2021 (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

Loss from operations (56,161) (15,039) (44,736)

Adjustments:

Depreciation of property, plant and equipment 1,318 1,149 2,340

Loss on disposal 35 - -

Impairment 1,193 - -

Amortisation 482 396 849

Share based payment (as seen through

equity) 710 347 1,071

Foreign exchange on intercompany transactions (270) - (43)

Fair value adjustment and expected credit

loss on loan notes - - 359

-----------------

Operating cash flows before movements

in working capital (52,693) (13,147) (40,160)

Increase in inventories (14,805) (5,324) (25,780)

(Increase)/ decrease in receivables (7,548) 1,377 (2,550)

Increase in payables 15,488 9,630 21,437

Increase/ (decrease) in provisions 17,989 (2,039) 9,492

----------------- ----------------- ---------------

Cash used in operations (41,569) (9,503) (37,561)

Interest paid (249) (235) (532)

Income taxes received - (62) (62)

----------------- ----------------- ---------------

Net cash used in operating activities (41,818) (9,800) (38,155)

----------------- ----------------- ---------------

Cash Burn

Cash burn is a measure used by key management personnel to

monitor the performance of the business.

Six months to Year ended

31 October Six months to 31 October 2021 30 April

2022 (unaudited) (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

(Decrease)/ increase in Cash and Cash

equivalents per the cash flow statement (48,088) (11,859) 189,897

Effect of foreign exchange rates (56) 15 (93)

Less share issue proceeds (net) (288) - (243,200)

-----------------

Cash Burn (48,432) (11,844) (53,396)

================= ======================================= ===============

7. Related Parties

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. All related party transactions which were

not intra-group have been conducted at arms' length.

During the period purchases from Linde/BOC Group, represented on

the Board by J Nowicki, totalled GBP0.3m (H1 2022: GBP0.4m; YE

2022: GBP0.5m) with GBP0.1m outstanding for payment at period-end

(H1 2022: GBP0.1m; YE 2022 GBP0.1m). Furthermore, an amount of

GBP0.6m brought forward from the year-end relates to stage payments

made for goods not yet received (H1 2022 & YE 2022: GBP0.6m).

Sales invoices raised to Linde/BOC group in the period totalled

GBP9.4m (H1 2022: GBPnil; YE 2022: GBP7.0m) with GBP5.3m

outstanding (H1 2022: GBPnil; YE 2022: GBP1.7m).

There were also stage payments of GBPnil (H1 2022: GBP4.1m; YE

2022: GBP5.4m), and GBPnil remained outstanding from ITM Linde

Electrolysis GmbH at period end (H1 2022: GBP0.2m; YE 2022:

GBP1.0m). Purchases from ILE in the period equated to GBPnil (H1

2022: GBP0.2m; YE 2022: GBP0.2m, which was paid immediately and

therefore settled by both period ends). Sales to ILE in the period

were GBP1.8m (H1 2022 and YE 2022: GBPnil). The Group also

continued to pay for the hosting of ILE's website.

Transactions with Motive Fuels Limited amounted to GBP0.1m in

the period with GBP0.3m remaining outstanding at period end (YE

2022: total transactions of GBP0.2m that remained outstanding at

year end).

8. Subsequent events

The Company announced the appointment of Dennis Schulz and the

official resignation of Dr Graham Cooley as Chief Executive Officer

with effect from 1 December 2022.

The Company today announced the official resignation of Dr

Rachel Smith from the Board of Directors with effect from 1

February 2023.

The Company today announced an agreement with Vitol to seek exit

from their joint venture Motive Fuels Ltd.

The Company today announced it has signed two contracts, each

for the sale of 100 MW of PEM electrolysers to Linde Engineering.

Both plants will be installed at a site operated by RWE in Lingen,

Germany.

Independent review report to ITM Power PLC

Conclusion

We have reviewed the summary set of financial statements in the

half-yearly financial report for the six months ended 31 October

2022 which comprises the Consolidated Statement of Comprehensive

Income, the Consolidated Balance Sheet, the Consolidated Statement

of Changes in Equity, the Consolidated Cash Flow Statement and the

related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the summary set of financial statements

in the half-yearly financial report for the six months ended 31

October 2022 is not prepared, in all material respects, in

accordance with the recognition and measurement principles of UK

adopted International Accounting Standards.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (ISRE) 2410 (UK), "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" (ISRE (UK) 2410). A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

As disclosed in Note 3, the annual financial statements of the

group are prepared in accordance with UK-adopted international

accounting standards. The financial information in the half-yearly

financial report has been prepared in accordance with the basis of

preparation in Note 1.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the summary set of financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of Conclusion

section of this report, nothing has come to our attention to

suggest that management have inappropriately adopted the going

concern basis of accounting or that management have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with this ISRE, however future events or conditions may

cause the entity to cease to continue as a going concern.

In our evaluation of the directors' conclusions, we considered

the inherent risks associated with the group's business model

including effects arising from macro-economic uncertainties, we

assessed and challenged the reasonableness of estimates made by the

directors and the related disclosures and analysed how those risks

might affect the group's financial resources or ability to continue

operations over the going concern period.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The AIM rules of the London

Stock Exchange require that the accounting policies and

presentation applied to the financial information in the

half-yearly financial report are consistent with those which will

be adopted in the annual accounts having regard to the accounting

standards applicable for such accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Our responsibility

Our responsibility is to express to the company a conclusion on

the financial information in the half-yearly financial report based

on our review.

Our conclusion, including our Conclusions relating to going

concern, are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report.

Use of our report

This report is made solely to the company in accordance with

guidance contained in ISRE (UK) 2410. Our review work has been

undertaken so that we might state to the company those matters we

are required to state to it in a review report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusion we have

formed.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Sheffield

30 January 2023

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAEFFDALDEEA

(END) Dow Jones Newswires

January 31, 2023 02:00 ET (07:00 GMT)

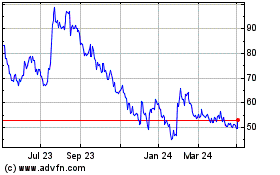

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

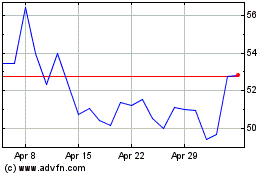

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024