TIDMIPX

RNS Number : 3547H

Impax Asset Management Group plc

03 December 2020

Impax Asset Management Group plc

Results for the year ended 30 September 2020

London 3 December 2020 - Impax Asset Management Group plc

("Impax" or the "Company"), the specialist investor focused on the

transition to a more sustainable global economy, today announces

final audited results for the year ending 30 September 2020 (the

"Period").

Business highlights

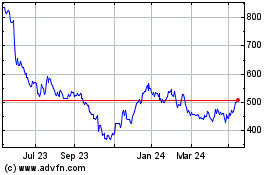

-- Assets under management ("AUM") increased 34% to GBP20.2 billion (2019: GBP15.1 billion)

-- Net inflows of GBP3.5 billion (2019: GBP1.4 billion)

-- Major investment strategies have continued to outperform global and regional markets

-- Net inflows of over GBP1.9 billion in the first two months of

the new financial year contributed to AUM rising to GBP23.4 billion

by 30 November

Financial highlights

-- Revenue increased 19% to GBP87.5 million (2019: GBP73.7 million)

-- Adjusted operating profit grew by 29% to GBP23.3 million (2019: GBP18.0 million)

-- Profit before tax of GBP16.7 million (2019: GBP18.9 million)

-- Shareholders' equity increased 13% to GBP71.5 million (2019: GBP63.2 million)

-- Proposed final dividend of 6.8 pence per share (2019: 4.0

pence) which together with the interim dividend of 1.8 pence per

share (2019: 1.5 pence) gives a total for the year of 8.6 pence per

share (2019: 5.5 pence), up 56%.

-- Cash reserves of GBP37.4 million (2019: GBP26.2 million)

Keith Falconer, Chairman, commented:

"Impax has proven highly resilient throughout the COVID-19

crisis to deliver outstanding success. Over the Period we expanded

our headcount by 12% and I am also very pleased that the functional

integration of the New Hampshire-based Pax World Management

business, which Impax acquired in January 2018, is largely

complete. Furthermore, we signed an updated distribution agreement

with BNP Paribas Asset Management that cements our long-term

relationship with this important partner."

Ian Simm, Chief Executive, added:

"I would like to thank all my colleagues who have worked

extremely hard and effectively to deliver Impax's excellent set of

results, marked by multiple industry awards and significant growth

across key performance indicators.

"Over the 12 months to 30 September 2020, our AUM increased by

34% to GBP20.2 billion and has expanded further in the first two

months of the new financial year, reaching GBP23.4bn on 30 November

2020. Year-on-year, our revenue was up 19%, driven by annual net

inflows of GBP3.5 billion into the funds and accounts that we

manage (up from GBP1.4 billion in the prior year). We have

sustained strong investment performance across major investment

strategies and currently have a solid pipeline of potential new

business.

"Impax's investment thesis is based on our belief that companies

that are benefiting from the transition to a more sustainable

economy should, on average, out-perform their peers in other

markets. Over the past 12 months we have seen further evidence

supporting this view. There are strong reasons to believe that

governments, investors and consumers are seeking to steer capital

towards markets that offer inherent resilience to environmental and

social problems."

Enquiries:

Impax Asset Management Group plc

Ian Simm, Chief Executive +44 (0)20 7434 1122 (switchboard)

Paul French, Corporate Communications Director

Montfort Communications

Gay Collins +44(0)77 9862 6282

Louis Supple +44(0)77 3943 0102

impax@montfort.london

Peel Hunt LLP, Nominated Adviser

James Britton or Rishi Shah +44 (0)20 7418 8900

LEI number: 213800AJDNW4S2B7E680

CHAIRMAN'S INTRODUCTION

COVID-19 has affected all our lives. During what has been a very

difficult time for businesses around the world, the Board has been

impressed that Impax has not only proven highly resilient

throughout the crisis but has gone beyond just "business as usual"

to deliver outstanding success. On behalf of my fellow Directors, I

would like to pay tribute to the management team for leading the

further expansion of the Company and to all our staff for their

continued commitment and diligence while working away from the

office.

During the 12 months to 30 September 2020 (the "Period"),

Impax's assets under management and advice ("AUM") grew by 34% to

GBP20.2 billion. Investment performance has been strong across all

our major strategies. These results are reflected in the many

prestigious industry awards that Impax won last year.

Over the Period we expanded our headcount by 18 (12%) to ensure

we had sufficient resources in investment management, client

service and in each of the support teams. I am also very pleased

that the functional integration of the business in New Hampshire,

which Impax acquired in January 2018, is largely complete.

Furthermore, we signed an updated distribution agreement with BNP

Paribas Asset Management that cements our long-term relationship

with this important partner.

In addition to highlighting the Company's successful growth in

AUM and profitability I would also like to draw attention to a

number of important non-financial developments, as you would expect

from an investment manager which focuses beyond the short-term

financial results. Achieving our vision and business goals requires

a culture where Impax colleagues can deliver their best, adapt and

learn continuously, and stay ahead in an increasingly competitive

arena. To this end, the senior management team has refreshed our

objectives in the management of talent and has introduced a

structured programme of leadership training.

We have also made good progress in the area of equality,

diversity and inclusion, in particular with the formation of a

Company-wide group to coordinate our initiatives in this area;

Lindsey Brace Martinez regularly attends the meetings of this group

as the Board sponsor of this work. We remain focused on increasing

the number of women in our business, especially at senior levels,

which over time will continue to reduce the senior management

gender pay gap.

We also continue to make strides with our sustainability

initiatives, including a new commitment to retain our "net carbon

positive" status across our operations and corporate

investments.

These important developments and our strong long-term investment

performance have been recognised and applauded by the investment

industry again this year. In addition to the numerous awards we

have won, I congratulate Ian Simm on his recognition from Financial

News as "Industry Leader of the Year (male)".

Keith Falconer

2 December 2020

CHIEF EXECUTIVE'S REPORT

I am pleased to report that Impax has had an outstanding year.

During the 12 months ending 30 September 2020 (the "Period"), the

Company's assets under discretionary and advisory management

("AUM") increased by 34% to GBP20.2 billion, which included GBP3.5

billion of net inflows into the funds and accounts that we manage.

By 30 November 2020, AUM had reached GBP23.4 billion.

Impax has remained fully operational since the start of the

pandemic. We have focused on protecting the health and safety of

our colleagues, while continuing to provide a seamless service to

clients and fulfilling obligations to our shareholders and other

stakeholders. We have sustained strong investment performance while

we have also been able to expand our operations and team in line

with the needs of the business.

Highly attractive investment opportunities

Government policies around the world continue to support our

investment thesis, and this year we have witnessed more debate than

ever before on what a sustainable economy will look like.

Impax's investment thesis is based on our belief that companies

that are benefiting from the transition to a more sustainable

economy should, on average, out-perform their peers in other

markets. Over the past 12 months we have seen further evidence

supporting this view.

While global health care and related social issues have

dominated the policy and media agendas in recent months, the impact

of climate change has never been more keenly felt. This year has

seen the worst wildfires in US history, and summer in the northern

hemisphere has been the hottest since records began, with the

coverage of Arctic sea-ice reaching another historical low. The

impacts of climate change have been largely in line with scientific

models, but the human and social cost appears to be much greater

than expected.

Against this backdrop, there are many compelling reasons for

optimism, with large flows of private capital into

climate-mitigating technologies and business models, shareholder

activism against the worst polluters, rapidly rising consumer

interest, and ever more robust environmental regulation.

Investment performance

The listed equity strategies managed by our London-centred team

have performed well. The two largest strategies, Water and Leaders,

posted increases of 9.6% and 14.8% respectively for the Period,

against their global comparator index, the MSCI All Country World

("ACWI") which returned 5.3%. The Specialists strategy, which is

the basis for our UK investment trust, Impax Environmental Markets

plc, returned 13.9%, and in March, this trust joined the FTSE 250

index.

The Asia-Pacific strategy was the standout performer with

returns of 19.3% reflecting the strong recovery in most regional

stock markets, while our fastest-growing strategy, Global

Opportunities, returned 12.9%, outperforming the ACWI by 7.6%. The

Sustainable Food strategy, which has a relatively defensive

investment approach, returned 3.3%, 2% below ACWI but outperforming

its specialist benchmark by 5.6%.

Performance from the Pax World Funds managed by our US-based

team has improved considerably, with more than half of the funds

significantly outperforming their benchmarks, and three funds

ranked in the top decile of their respective peer groups. This fund

range has had positive net inflows of over USD380 million over the

Period, with allocations focused on the Pax Global Environmental

Markets Fund, Pax Global Women's Leadership Fund and the Pax Large

Cap fund.

Real Assets

Our team investing in markets linked to renewable power

generation made good progress in investing our third fund, Impax

New Energy Investors III ("NEF III"), committing additional capital

in Norway, France and Germany and making its first commitments in

Spain. We expect this fund to be fully invested by the end of 2021

and are advancing our plans to raise additional capital in this

area.

Client Service and Business Development

Impax experienced another year of strong net inflows from

investors around the world.

This year our business development in the UK has been

particularly successful. The Global Opportunities mandate that we

manage on behalf of St James's Place recorded net inflows of GBP877

million, while our Irish UCITS fund range received GBP269 million

on a net basis. In Continental Europe total net inflows were GBP1.1

billion, with contributions from direct sales to institutional

investors and from our distribution partners, particularly

Formuepleje in Denmark, ASN Bank in the Netherlands, and BNP

Paribas Asset Management ("BNPP") across multiple countries in the

region.

In November 2020, we announced that BNPP had executed its plan

to reduce its holding in the Company from c.24.5% to c.14.0%,

having seen a very positive return on their original investment

made in 2007. BNPP remains Impax's largest shareholder and a key

distribution partner. The relationship was cemented with a new

distribution agreement on very similar terms to the Memorandum of

Understanding covering distribution that has been in place since

2007.

Although the pandemic delayed some institutional mandate

searches, we expect these to catch up in 2021. Our North American

business had another strong year, with positive net inflows of USD

778 million. We are seeing an increasing number of buy

recommendations from investment consultants and are continuing to

build our relationships with leading asset owners in the US. We

also extended our work in Canada, with new sub-advisory mandates

for NEI Investments and Desjardins.

Beyond investment returns

In addition to the pursuit of excellent investment returns, we

focus on four broader areas. First, our corporate engagement aims

to enhance our understanding of investment risk. In 2019 we engaged

with over 100 companies, or close to half of all those in which we

invest.

Second, as pioneers in the calibration of the positive

environmental impact of our investments, we have issued our sixth

annual Impact Report which covers listed equities and also

describes how we have applied our methodology to the fixed income

portfolios that we manage.

Third, we have strengthened our connections to the environmental

science community with the aim of augmenting our work on climate

risk and, more recently, biodiversity. In October we published a

white paper on physical climate risk and have also become a core

member of the Coalition for Climate Resilient Investment and joined

efforts to set up a new Task Force on Nature-related Financial

Disclosures.

And finally, this year we also have expanded our specialist

policy team in order to deepen our policy insights as well as our

contributions to the development of effective future laws and

regulations. Over the year, we have joined a number of

organisations and initiatives, including the Confederation of

British Industry's Energy & Climate Change Board, the Climate

Financial Risk Forum and the Energy Transitions Commission.

Developing Impax's talent

We have continued to recruit through the pandemic, and our team

now comprises 175 individuals, an increase in headcount of 12%

since the start of the Period.

As our volume of business has grown, we have also taken several

important steps to expand and strengthen our HR operations and

talent management systems. This has included refreshing our

objectives to ensure that our colleagues can thrive in their

current roles and also look forward to attractive career prospects.

This year we have focused on developing the leadership skills of

our managers, mapping out plans to enhance equality, diversity and

inclusion, and, in these challenging times, are devoting particular

attention to supporting our colleagues' well-being and mental

health.

We have accelerated the integration of our New Hampshire-based

team, who joined us in 2018 following the acquisition of Pax World

Management LLC. We have now completed the formation of global teams

in several areas, including actively managed listed equities,

trading, finance, compliance and HR, and have undertaken additional

integration projects in marketing and the definition of a common

corporate culture.

Awards and industry recognition

In April Impax was honoured to receive the Queen's Award for

Enterprise in the Sustainable Development category for a second

time. This represents a significant endorsement of the team's hard

work over the past two decades in encouraging companies to improve

their sustainability as well as supporting the growth of pioneering

new sustainable businesses.

The Company's expertise has also been acknowledged through

numerous prestigious industry awards again this year. These include

the Global Investor Investment Excellence awards 2020 (Boutique

Manager of the year), FT Pensions Expert PIPA Awards (highly

commended in the ESG/SRI Manager of the Year category) and Impax

was named one of the Corporate Knights' "Green 50 Top Business

Moves for the Planet" list. Furthermore, after Period end we were

proud to announce three further award wins: "Ambition Nation Listed

50" award (from Finncap), "Boutique of the Year - Equities" from

Financial News, and "European Specialist Investment Firm of the

Year" from Funds Europe.

In the United States Pax World Funds was recognised by Bloomberg

and the United Nations as one of "50 Climate Leaders" and Ethical

Corporation assigned a coveted "Highly Commended" designation to

the Pax Ellevate Global Women's Leadership Fund. Joe Keefe,

President, was acknowledged as one of the "10 leaders of ESG and

Impact Investing" in the US by Investment News and Impax joined the

"Best Companies to Work for in New Hampshire" Hall of Fame.

For the seventh consecutive year, Impax has been awarded A+ and

A scores across all applicable categories in the UN-backed

Principles for Responsible Investment (PRI) assessment report of

Environmental, Social and Governance (ESG) integration efforts.

Finally, in November 2020, Morningstar described Impax as a

"Leader" for its ESG Commitment, one of only six asset managers

globally to be awarded the highest grade.

Brexit

Given the political uncertainties and the current perceived lack

of provision for financial services, we are planning for our Dublin

office to be fully operational in December 2020. We only expect to

transfer a small number of clients, representing less than 2% of

current AUM. The required associated activities, including some

limited recruitment, are advancing in line with our plans.

Outlook

Since the late 1990s Impax has argued that many of those

companies that are tackling the environmental problems arising from

human activity are set to out-perform their peers in other sectors.

More recently, we have extended our analysis and argued that the

transition to a more sustainable global economy is accelerating,

and that companies whose business models address social issues are

providing additional investment opportunities.

We also consider the recent result of the US election to be

positive for the markets in which Impax invests. In addition to his

commitment to bring the US back into the Paris Climate agreement,

President-elect Biden appears determined to address the profound

sustainability challenges facing the country, including a climate

plan to invest $2 trillion over four years with targeted

zero-emissions power generation by 2035 and a net-zero economy by

2050. Investors are also hopeful that the Democrats will improve

ESG integration and disclosure.

This year the effects of COVID-19 have amplified many of the

issues associated with investing in the transition to a more

sustainable economy, but recent events have also reinforced our

investment case. There are strong reasons to believe that

governments, investors and consumers are seeking to steer capital

towards markets that offer inherent resilience to environmental and

social problems.

Nevertheless, the contours of the post pandemic landscape are

not yet clear and the timing of the economic recovery remains

uncertain. Corporate balance sheets have been severely impacted,

some dividends cancelled or reduced, and we can expect to see many

more companies looking to raise capital. Until the roadmap out of

the pandemic becomes clearer, we are likely to see considerable

volatility across financial markets.

We continue to invest in order to grow the Company and are well

positioned for further expansion that should enhance value for all

our stakeholders.

Ian Simm

2 December 2020

FINANCIAL REVIEW

I am pleased to report very strong financial results and strong

growth for all our financial KPIs.

As in previous periods, in order to facilitate comparison of

performance with past periods, and to provide an appropriate

comparison with our peers, the Board encourages shareholders to

focus on financial measures after adjustment for accounting charges

or credits arising from the acquisition accounting for Impax NH,

and adjustments arising from the accounting treatment of National

Insurance costs on share-based payment awards.

Financial highlights for financial year 2020 versus financial

year 2019

2020 2019

--------------------------- ------------ -------------

AUM(1) GBP20.2bn GBP15.1bn

============ =============

Revenue GBP87.5m GBP73.7m

============ =============

Adjusted operating profit GBP23.3m GBP18.0m

============ =============

Adjusted profit before tax GBP22.2m GBP18.1m

============ =============

Adjusted diluted earnings

per share 14.5p 11.5p

============ =============

Cash reserves GBP37.4m GBP26.2m

============ =============

Seed investments GBP4.3m GBP4.6m

============ =============

Dividend per share 1.8p interim 1.5p interim

+6.8p final + 4.0p final

============ =============

2020 2019

-------------------------- -------- --------

IFRS operating profit GBP17.6m GBP18.8m

======== ========

IFRS profit before tax GBP16.7m GBP18.9m

======== ========

IFRS diluted earnings per

share 10.5p 12.1p

======== ========

Revenue

Revenue for the Period grew by GBP13.8 million to GBP87.5

million (2019: GBP73.7 million). Growth was driven by continued

strong net inflows across the business and robust performance,

offset to some extent by the market falls seen in February and

March.

Our run-rate revenue at the end of the Period was GBP96.5

million (2019: GBP78.3 million), giving a weighted average run rate

revenue margin of 48 basis points (2019: 52 basis points) on the

GBP20.2 billion of AUM.

Operating costs

Adjusted operating costs increased to GBP64.3 million (2019:

GBP55.7 million), mainly reflecting planned increases in headcount

and higher profit-related pay due to the rising profitability. We

continue to invest selectively in the business to take advantage of

strong growth opportunities so we expect that there will be some

cost increases in the near term.

IFRS operating costs include additional charges and credits,

principally the amortisation of intangible assets arising on the

Impax NH acquisition, National Insurance charges on share options

and restricted shares and in 2019 a credit for the release of a

contingent consideration provision related to the NH acquisition.

Employer's National Insurance is payable based on the share price

when an option is exercised or restricted shares vest and

accordingly the charge has increased significantly as our share

price has risen over the year. This is offset by a tax credit which

is recorded in equity.

Profits

Adjusted operating profit increased to GBP23.3 million (2019:

GBP18.0 million), driven by the revenue growth described above.

Run-rate adjusted operating profits at the end of the Period grew

further to GBP28.3 million (2019: GBP20.5 million), in line with

business expansion. IFRS operating profit in 2020 fell to GBP17.6

million (2019: GBP18.8 million), as 2019 benefited from the credit

for the release of contingent consideration described above. Fair

value gains and losses and other financial income partially offset

interest expense and finance costs to give adjusted profit before

tax of GBP22.2 million (2019: GBP18.1 million).

Tax

Tax rates were lower than last year as the Group benefited from

a GBP1.0 million credit in relation to taxation of the prior years'

private equity income.

Earnings per Share

Adjusted diluted earnings per share grew to 14.5 pence (2019:

11.5 pence) as a result of the growth in profits. IFRS diluted

earnings per share however fell to 10.5 pence (2019: 12.1 pence) as

2019 benefited from the contingent consideration credit described

above.

Financial management

At the Period end the Company held GBP37.4 million of cash

reserves, an increase of GBP11.2 million on 2019. The Company had

no debt (2019: no debt) but retains access to a US$13 million

revolving facility (the "RCF") (LIBOR plus 3.3%), which was put in

place at the time of the acquisition of Impax NH.

The Company continues to make seed investments and to invest in

its private equity funds. These investments were valued at GBP4.3

million at the Period end. During the Period we redeemed GBP2.0

million by exiting the seed investment in our successful US mutual

fund which is managed under the Global Opportunities strategy. The

cash realised is planned to be re-invested after the year end into

a segregated account investing in our new Asian Opportunities

Strategy. We also invested GBP0.8 million into our third private

equity fund.

We adopted the new accounting standard IFRS 16 which covers

accounting for leases during the Period. This has required us to

recognise new assets, representing the leases on our office

buildings, and a corresponding lease liability.

Share management

The Board intends that the Company will continue to purchase its

own shares from time to time after due consideration of attractive

alternatives for the use of the Company's cash resources. Shares

purchased may be used to satisfy obligations linked to share

incentive awards for employees. Share purchases are usually made by

funding the Company's Employee Benefit Trusts ("EBTs") which will

then settle option exercises or hold shares for Restricted Share

awards until they vest.

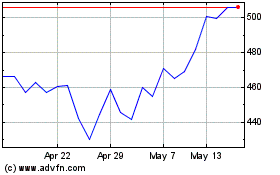

During the Period, the EBTs spent GBP4.2 million buying 1.3

million of the Company's shares at an average price of 332 pence.

At the Period end, the EBTs held a total of 5.2 million shares, 4.8

million of which were held for Restricted Shares leaving up to 0.4

million shares available for option exercises and future share

incentive awards. Net options outstanding at the Period end were

2.5 million of which 0.1 million were exercisable.

The Company did not issue any shares in the Period. Equity

issuance may arise in respect of staff option exercises or

restricted share awards that have not been previously matched by

share purchase into the EBTs, and in January 2021, conversion at

the Company's discretion into Impax shares of Impax NH management's

remaining 16.7% interest in Impax NH.

Dividends

The Company paid an interim dividend of 1.8 pence per share in

July 2020. Last year we announced a new policy of paying, in normal

circumstances, an annual dividend within a range of 55% and 80% of

adjusted profit after tax. Despite the unforeseen challenges of

COVID-19, Impax has reported strong growth in revenue and profits

and is in robust financial health. The Board is therefore

recommending a final dividend of 6.8 pence. This would be an

increase in the total dividend for the year of 3.1 pence or 56%,

while still being at the lower end of our stated range.

This dividend proposal will be submitted for formal approval by

shareholders at the Annual General Meeting on 18 March 2021. If

approved, the dividend will be paid on, or around, 26 March 2021.

The record date for the payment of the proposed dividend will be 19

February 2021 and the ex-dividend date will be 18 February

2021.

The Company operates a dividend reinvestment plan ("DRIP"). The

final date for receipt of elections under the DRIP will be 5 March

2021. For further information and to register and elect for this

facility, please visit www.signalshares.com and search for

information related to the Company.

Going concern

The Financial Reporting Council requires all companies to

perform a rigorous assessment of all the factors affecting the

business when deciding to adopt a "going concern" basis for the

preparation of the accounts.

The Board has made an assessment covering a period of at least

12 months from the date of approval of this report which indicates

that, taking account of a reasonably possible downside in relation

to asset inflows, market performance and costs, the Group will have

sufficient funds, to meet its liabilities as they fall due for that

period. In making this assessment the Board has considered the

potential evolving impacts of COVID-19. The Group has appropriate

cash balances and no debt and, at the Period end market levels, is

profitable. A significant part of the Group's cost basis is profit

related pay. The Group can also preserve cash through dividend

reduction and through issuance of shares to cover share option

exercises/restricted share awards (rather than purchasing shares).

The Group has operated without disruption during the lockdown

periods to date and expects to continue to do so. Consequently, the

Directors are confident that the Group will have sufficient funds

to continue to meet its liabilities as they fall due for at least

12 months from the date of approval of the financial statements and

therefore have prepared the financial statements on a going concern

basis.

Charlie Ridge

2 December 2020

Consolidated Income Statement

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

-------------------------------------------------- -------- --------

Revenue 87,511 73,695

Operating costs (69,928) (54,883)

Finance income 1,020 1,055

Finance expense (1,921) (1,125)

Non-controlling interest - 156

--------------------------------------------------- -------- --------

Profit before taxation 16,682 18,898

Taxation (2,944) (3,028)

--------------------------------------------------- -------- --------

Profit after taxation 13,738 15,870

--------------------------------------------------- -------- --------

Earnings per share

Basic 10.6p 12.2p

Diluted 10.5p 12.1p

--------------------------------------------------- -------- --------

Dividends per share

-------------------------------------------------- -------- --------

Interim dividend paid and final dividend declared

for the year 8.6p 5.5p

--------------------------------------------------- -------- --------

Adjusted results are provided in note 4.

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

-------------------------------------------------------- ------- -------

Profit for the year 13,738 15,870

Change in value of cash flow hedges (70) (12)

Tax on change in value of cash flow hedges 13 2

Exchange differences on translation of foreign

operations (487) 922

--------------------------------------------------------- ------- -------

Total other comprehensive income (544) 912

--------------------------------------------------------- ------- -------

Total comprehensive income for the year attributable to

equity holders of the Parent 13,194 16,782

--------------------------------------------------------- ------- -------

All amounts in other comprehensive income may be reclassified to

income in the future.

The statement has been prepared on the basis that all operations

are continuing operations.

Consolidated Statement of Financial Position

As at 30 September 2020

2020 2019

---------------------------------------- --------------- --------------

GBP000 GBP000 GBP000 GBP000

---------------------------------------- ------ ------- ------ ------

Assets

Goodwill 12,306 12,804

Intangible assets 20,871 24,518

Property, plant and equipment 10,857 1,779

Deferred tax assets 5,492 3,757

----------------------------------------- ------ ------- ------ ------

Total non-current assets 49,526 42,858

Trade and other receivables 20,735 16,740

Investments 4,387 4,626

Current tax asset 224 239

Cash invested in money market funds and

long-term deposit accounts 18,516 15,235

Cash and cash equivalents 20,245 11,939

----------------------------------------- ------ ------- ------ ------

Total current assets 64,107 48,779

----------------------------------------- ------ ------- ------ ------

Total assets 113,633 91,637

----------------------------------------- ------ ------- ------ ------

Equity and liabilities

Ordinary shares 1,304 1,304

Share premium 9,291 9,291

Exchange translation reserve 1,449 1,936

Hedging reserve (111) (54)

Retained earnings 59,515 50,751

----------------------------------------- ------ ------- ------ ------

Total equity 71,448 63,228

Trade and other payables 27,984 23,581

Lease liabilities 1,410 -

Current tax liability 190 124

----------------------------------------- ------ ------- ------ ------

Total current liabilities 29,584 23,705

Trade and other payables - 704

Lease liabilities 9,261 -

Deferred tax liability 3,340 4,000

----------------------------------------- ------ ------- ------ ------

Total non-current liabilities 12,601 4,704

Total equity and liabilities 113,633 91,637

----------------------------------------- ------ ------- ------ ------

Consolidated Statement of Changes in Equity

For the year ended 30 September 2020

Exchange

translation

Share capital Share premium reserve Hedging reserve Retained earnings Total Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------------- ------------- ---------------- --------------- ----------------- ------------

1 October 2018 1,304 9,291 1,014 (44) 41,054 52,619

Transactions with

owners of the

Company:

Dividends paid - - - - (5,792) (5,792)

Acquisition of own

shares - - - - (2,505) (2,505)

Cash received on

option exercises - - - - 111 111

Tax credit on

long-term

incentive schemes - - - - 251 251

Share-based

payment charges - - - - 1,160 1,160

Fair value of put

option over

non-controlling

interest - - - - (328) (328)

Acquisition of NCI

without a change

in control - - - - 930 930

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Total transactions

with owners of

the Company - - - - (6,173) (6,173)

Profit for the

year - - - - 15,870 15,870

Other

comprehensive

income:

Change in value of

cashflow hedges - - - (12) - (12)

Tax on change in

value of cashflow

hedges - - - 2 - 2

Exchange

differences on

translation of

foreign

operations - - 922 - - 922

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Total other

comprehensive

Income - - 922 (10) 912

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

30 September 2019 1,304 9,291 1,936 (54) 50,751 63,228

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Impact of adoption

of IFRS 16 - - - - (247) (247)

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Adjusted balance

at 1 October 2019 1,304 9,291 1,936 (54) 50,504 62,981

Transactions with

owners of the

Company:

Dividends paid - - - - (7,442) (7,442)

Acquisition of own

shares - - - - (4,223) (4,223)

Cash received on

option exercises - - - - 489 489

Tax credit on

long-term

incentive schemes - - - - 4,636 4,636

Share-based

payment charges - - - - 1,813 1,813

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Total transactions

with owners of

the Company - - - - (4,727) (4,727)

Profit for the

year - - - - 13,738 13,738

Other

comprehensive

income:

Change in value of

cash flow hedge - - - (70) - (70)

Tax on change in

value of cashflow

hedges - - - 13 - 13

Exchange

differences on

translation of

foreign

operations - - (487) - - (487)

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Total other

comprehensive

Income - - (487) (57) - (544)

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

30 September 2020 1,304 9,291 1,449 (111) 59,515 71,448

------------------ ------------- ------------- ---------------- --------------- ----------------- ------------

Consolidated Cash Flow Statement

For the year ended 30 September 2020

2020 2019

GBP000 GBP000

----------------------------------------------------- -------- --------

Operating activities

Cash generated from operations 24,382 20,848

Corporation tax paid (607) (580)

------------------------------------------------------ -------- --------

Net cash generated from operating activities 23,775 20,268

------------------------------------------------------ -------- --------

Investing activities

Deconsolidation of investment fund - (67)

Net acquisitions of property plant and equipment

and intangible assets (182) (402)

Net redemptions/investments from/into unconsolidated

Impax funds 1,191 (485)

Settlement of investment related hedges (156) 258

Investment income received 222 236

Increase in cash held in money market funds and

long-term deposit accounts (3,281) (4,024)

------------------------------------------------------ -------- --------

Net cash used by investing activities (2,206) (4,484)

------------------------------------------------------ -------- --------

Financing activities

Acquisition of non-controlling interest (201) (201)

Repayment of bank borrowings - (10,371)

Interest paid on bank borrowings (136) (670)

Payment of lease liabilities (1,699) -

Acquisition of own shares (4,223) (2,505)

Cash received on exercise of Impax staff share

options 489 111

Dividends paid (7,442) (5,792)

------------------------------------------------------ -------- --------

Net cash used by financing activities (13,212) (19,428)

------------------------------------------------------ -------- --------

Net increase/(decrease) in cash and cash equivalents 8,357 (3,644)

Cash and cash equivalents at beginning of year 11,939 15,529

Effect of foreign exchange rate changes (51) 54

------------------------------------------------------ -------- --------

Cash and cash equivalents at end of year 20,245 11,939

------------------------------------------------------ -------- --------

Cash and cash equivalents under IFRS does not include deposits

in money market funds and cash held in deposits with more than an

original maturity of three months. The Group however considers its

total cash reserves to include these amounts. Cash held in RPA

accounts are not included in cash reserves.

Movements on cash reserves are shown in the table below:

At the

beginning At the

of the Foreign end of

year Cashflow exchange the year

GBP000 GBP000 GBP000 GBP000

---------------------------------------- ---------- -------- --------- ---------

Cash and cash equivalents 11,939 8,357 (51) 20,245

Cash invested in money market funds and

long-term deposit accounts 15,235 3,281 - 18,516

Cash in RPAs (968) (395) - (1,363)

---------------------------------------- ---------- -------- --------- ---------

Total Group cash reserves 26,206 11,243 (51) 37,398

---------------------------------------- ---------- -------- --------- ---------

NOTES TO THE FINANCIAL STATEMENTS

1 REPORTING ENTITY

Impax Asset Management Group plc (the "Company") is incorporated

and domiciled in the UK and is listed on the Alternative Investment

Market ("AIM"). These consolidated financial statements comprise

the Company and its subsidiaries (together referred to as the

"Group").

2 BASIS OF PREPARATION

These financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRSs") adopted for

use by the European Union.

The financial statements have been prepared under the historical

cost convention, with the exception of the revaluation of certain

investments and derivatives being measured at fair value.

The financial statements are presented in Sterling. All amounts

have been rounded to the nearest thousand unless otherwise

indicated.

Going concern

The Board has made an assessment covering a period of 12 months

from the date of approval of these financial statements which

indicates that, taking account of a reasonably possible downside

assumptions in relation to asset inflows, market performance and

costs, the Group will have sufficient funds to meet its liabilities

as they fall due and regulatory capital requirements for that

period. In making this assessment the Board has considered the

potential ongoing impact of Covid-19. The Group has sufficient cash

balances and no debt and, at the year- end market levels, is

profitable. A significant part of the Group's cost basis is

variable as bonuses are linked to profitability. The Group can also

preserve cash through dividend reduction and through issuance of

shares to cover share option exercises/restricted share awards

(rather than purchasing shares). The Group has operated without

disruption during the lockdown periods to date and expects to

continue to do so. Consequently, the Directors are confident that

the Group will have sufficient funds to continue to meet its

liabilities as they fall due for at least 12 months from the date

of approval of the financial statements and therefore have prepared

the financial statements on a going concern basis.

3 USE OF JUDGEMENTS AND ESTIMATES

In preparing these financial statements management has made

estimates that affect the reported amounts of assets, liabilities,

income and expenses. Actual results may differ from estimates.

Revisions to estimates are recognised prospectively.

The significant key source of estimation uncertainty were

estimates made in determining if intangible assets, acquired on

acquisition of NH were impaired. The intangible assets acquired

represent investment management contracts. These are amortised over

an 11 year life which is considered reasonable given the nature of

the investors into these Funds. If there are any indications of

impairment they are tested for impairment at each reporting date.

The fair value at the date of acquisition was calculated using the

discounted cash flow methodology and represented the valuation of

the profits expected to be earned from the management contracts in

place at the date of acquisition. The impairment test completed

this year showed no impairment was required and used the following

key assumptions - future subscription of new assets of US$0.34bn

per annum on average (2019: USD$0.34bn), future equity fund

performance of 5 per cent (2019: 5 per cent), an average operating

margin of 20 per cent (2019: 23 per cent) and a discounted cost of

capital of 13.5 per cent (2019: 13.5 per cent).

Changes in the assumptions would give rise to impairments as

follows: a consistent ten per cent decrease in inflows - no

impairment; a 100 basis point annual reduction in performance each

year - impairment of GBP0.4 million; a one per cent annual

reduction in operating margin - no impairment.

4 ADJUSTED PROFITS AND EARNINGS

The reported operating earnings, profit before tax and earnings

per share are substantially affected by business combination

effects and other items. The Directors have therefore decided to

report an Adjusted operating profit, Adjusted profit before tax and

Adjusted earnings per share which exclude these items in order to

enable comparison with peers and provide consistent measures of

performance over time. A reconciliation of the adjusted amounts to

the IFRS reported amounts is shown below.

Year ended 30 September 2020

-------------------------------------------- -----------------------------------------

Adjustments

-------- --------------------- --------

Business

Reported combination

- IFRS effects Other Adjusted

GBP000 GBP000 GBP000 GBP000

-------------------------------------------- -------- ------------ ------- --------

Revenue 87,511 87,511

Operating costs (69,928) (64,261)

Amortisation of intangibles arising on

acquisition 2,535

Acquisition equity incentive scheme charges 135

Mark to market charge on equity awards* 2,997

-------------------------------------------- -------- ------------ ------- --------

Operating profit 17,583 2,670 2,997 23,250

Finance income 1,020 (124) 896

Finance expense (1,921) (1,921)

-------------------------------------------- -------- ------------ ------- --------

Profit before taxation 16,682 2,670 2,873 22,225

Taxation (2,944) (3,490)

Tax credit on adjustments (546)

-------------------------------------------- -------- ------------ ------- --------

Profit after taxation 13,738 2,670 2,327 18,735

-------------------------------------------- -------- ------------ ------- --------

Diluted earnings per share 10.5p 2.1p 1.8p 14.5p

-------------------------------------------- -------- ------------ ------- --------

* The charge is mitigated by GBP4,636,000 of tax credits shown

in the statement of changes in equity

Year ended 30 September 2019

----------------------------------------------- -----------------------------------------

Adjustments

-------- --------------------- --------

Business

Reported combination

- IFRS effects Other Adjusted

GBP000 GBP000 GBP000 GBP000

----------------------------------------------- -------- ------------ ------- --------

Revenue 73,695 73,695

Operating costs (54,883) (55,717)

Amortisation of intangibles arising on

acquisition 2,528

Credit from contingent consideration

adjustment (3,543)

Acquisition equity incentive scheme charges (21)

Mark to market charge on equity awards 202

----------------------------------------------- -------- ------------ ------- --------

Operating profit 18,812 (1,036) 202 17,978

Finance income 1,055 (154) 901

Finance expense (1,125) 209 (916)

Non-controlling interest 156 156

Change in third-party interest in consolidated

funds - -

----------------------------------------------- -------- ------------ ------- --------

Profit before taxation 18,898 (827) 48 18,119

Taxation (3,028) (3,037)

Tax credit on adjustments (9)

Profit after taxation 15,870 (827) 39 15,082

----------------------------------------------- -------- ------------ ------- --------

Diluted earnings per share 12.1p (0.6p) 0.0p 11.5p

----------------------------------------------- -------- ------------ ------- --------

The adjusted diluted earnings per share is calculated using the

adjusted profit after taxation shown above less the IFRS adjustment

for profit attributable to owners of restricted shares of

GBP503,000 (2019: GBP867,000). The diluted number of shares is the

same as used for the IFRS calculation of earnings per share.

Mark to market charge on equity incentive awards

The Group has in prior years and the current period awarded

employees options over the Group's shares, some of which are either

unvested or unexercised at the balance sheet date. The Group has

also made awards of restricted shares ("RSS awards") some of which

have not vested at the balance sheet date. Employers National

Insurance Contributions ("NIC") are payable on the option awards

when they are exercised and on the RSS awards when they vest, based

on the valuation of the underlying shares at that point. The Group

does however receive a corporation tax credit equal to the value of

the awards at the date they are exercised (options) or vest (RSS

awards). A charge is accrued for the NIC within IFRS operating

profit based on the share price at the balance sheet date.

Similarly, a credit for the corporation tax is accrued within

equity.

An additional retention payment is made to holders of legacy

Long-Term Incentive Plan ("LTIP") awards when they are exercised,

all of which are fully vested at the balance sheet date. The

payment will be equal to the corporation tax benefit the Group

receives on the exercise of the options minus the amount of NIC

payable on exercise. For unexercised options this charge is accrued

based on the share price at the balance sheet date.

These two charges vary based on the Group's share price

(together referred to as mark to market charge on equity incentive

schemes) and are not linked to the operating performance of the

Group. They are therefore eliminated when reporting adjusted

profit.

Contingent consideration

We are required to review and adjust our estimate of the

contingent consideration payable in respect of the Impax NH

acquisition. Any adjustment is recorded through income but is

excluded from adjusted profit. This is not linked to the operating

performance of the Impax NH business and is therefore eliminated

from operating costs.

Amortisation of intangibles

Intangible management contracts were acquired as part of the

acquisition of Impax NH acquisition and are amortised over their 11

year life. This is not linked to the operating performance of the

Impax NH business and is therefore eliminated from operating

costs.

Finance income/expense

The adjustments represent the removal of charges in respect of

unwinding the discount of the contingent consideration payable (see

above) and of legacy royalty income.

5 SEGMENTAL REPORTING

(a) Operating segments

In January 2018, Pax World Management LLC was acquired by Impax

and has been re-named Impax Asset Management LLC. This company is

based in Portsmouth, New Hampshire and we refer to it as "Impax

NH". Impax NH is the manager of Pax World Funds. Impax Asset

Management Ltd and Impax Asset Management (AIFM) Ltd manage or

advise listed equity funds and accounts, and the Real Assets

division. The majority of this business is based in London so we

refer to it as "Impax LN". Impax LN itself has two operating

segments: "Listed Equity" and "Private Equity". The results of

these segments have been aggregated into a single reportable

segment for the purposes of these financial statements because they

have characteristics so similar that they can be expected to have

essentially the same future prospects. These segments have common

investors, operate under the same regulatory regimes and their

distribution channels are substantially the same. Additionally

management allocates the resources of Impax LN as though there is

one operating unit.

Segment information is presented on the same basis as that

provided for internal reporting purposes to the Group's chief

operating decision maker, the Chief Executive.

Year ended 30 September 2020

Impax LN Impax NH Adjustments Total

GBP000 GBP000 GBP000 GBP000

------------------------------------------- -------- -------- ----------- -------

Revenue

External customers 61,906 25,605 - 87,511

Inter-segment 3,147 - (3,147) -

------------------------------------------- -------- -------- ----------- -------

Total revenue 65,053 25,605 (3,147) 87,511

------------------------------------------- -------- -------- ----------- -------

Segment profit - adjusted operating profit 22,176 1,074 - 23,250

------------------------------------------- -------- -------- ----------- -------

Year ended 30 September 2019

Impax LN Impax NH Adjustments Total

GBP000 GBP000 GBP000 GBP000

Revenue

External customers 50,030 23,665 - 73,695

Inter-segment 2,349 - (2,349) -

------------------------------------------- -------- -------- ----------- -------

Total revenue 52,379 23,665 (2,349) 73,695

------------------------------------------- -------- -------- ----------- -------

Segment profit - adjusted operating profit 16,630 1,348 - 17,978

------------------------------------------- -------- -------- ----------- -------

(b) Geographical analysis

An analysis of revenue by the location of client is presented

below:

Revenue

----------------

2020 2019

GBP000 GBP000

-------------- ------- -------

UK 15,104 13,221

North America 34,705 30,007

France 9,478 8,523

Luxembourg 19,066 14,580

Netherlands 2,912 3,087

Ireland 3,553 2,478

Other 2,693 1,799

-------------- ------- -------

87,511 73,695

-------------- ------- -------

6 OPERATING COSTS

The Group's largest operating cost is staff costs. Other

significant costs include direct fund costs, premises costs

(depreciation of office building lease right of use assets, rates

and service charge), amortisation of intangible assets, mark to

market charges on share awards and acquisition costs.

2020 2019

GBP000 GBP000

--------------------------------------- ------- -------

Staff costs (note 7) 44,728 36,657

Direct fund expenses 5,570 5,488

Premises costs 1,062 2,496

Research costs 570 322

Professional fees 2,555 2,596

IT and communications 4,017 3,458

Depreciation and amortisation 4,260 2,952

Mark to market charges on share awards 3,243 202

Other costs 3,923 4,255

--------------------------------------- ------- -------

Sub-total 69,928 58,426

--------------------------------------- ------- -------

Contingent Consideration - (3,543)

--------------------------------------- ------- -------

Total 69,928 54,883

--------------------------------------- ------- -------

Operating costs include GBP774,000 (2019: GBP791,000) in respect

of placing agent fees paid to related parties.

7 STAFF COSTS AND EMPLOYEES

Staff costs include salaries, a variable bonus, social security

cost (principally UK Employers' National Insurance on salary, bonus

and share awards), the cost of contributions made to employees'

pension schemes and share-based payment charges. Further details of

the Group's remuneration policies, including how the total variable

bonus pool is determined, are provided in the Remuneration Report.

Share-based payment charges are offset against the total cash bonus

pool paid to employees. NIC charges on share-based payments are

accrued based on the share price at the balance sheet date or at

the date of exercise.

2020 2019

GBP000 GBP000

---------------------------------------- ------- -------

Salaries and variable bonuses 34,081 29,290

Social security costs 3,702 1,661

Pensions 948 834

Share-based payment charge (see note 8) 1,813 1,160

Other staff costs 4,184 3,712

---------------------------------------- ------- -------

44,728 36,657

---------------------------------------- ------- -------

Employees

The average number of persons (excluding Non-Executive Directors

and including temporary staff), employed during the year was 171

(2019: 151).

2020 2019

No. No.

---------------------------------------- ---- ----

Listed Equity 57 55

Private Equity 12 11

Client Service and Business Development 53 43

Group 49 42

---------------------------------------- ---- ----

171 151

---------------------------------------- ---- ----

8 SHARE-BASED PAYMENT CHARGES

The total expense recognised for the year arising from

share-based payment transactions was GBP1,813,000 (2019:

GBP1,160,000). The charges arose in respect of the Group's

Restricted Share Scheme ("RSS"), the Group's Employee Share Option

Plan ("ESOP") and the Group's Restricted Share Units scheme ("RSU")

which are described below. Share-based payment charges also arose

in respect of the put and call arrangement made with Impax NH

management to acquire their shares in Impax NH. Details of all

outstanding options are provided at the end of this note. The

charges for each scheme are:

2020 2019

GBP000 GBP000

------------------------- ------- -------

RSS 1,253 1,099

ESOP 426 123

RSU - (41)

Put and call arrangement 134 (21)

------------------------- ------- -------

1,813 1,160

------------------------- ------- -------

Restricted Share Scheme

Restricted shares have been granted to employees in prior years

under the 2014, 2015, 2017, 2018 and 2019 plans which are not

wholly vested. Post year end the Board approved the grant of a

further 331,500 restricted shares under the 2020 plan. Details of

the awards granted along with their valuation and the inputs used

in the valuation are described in the table below. The valuations

were determined using the Black-Scholes-Merton model with an

adjustment to reflect dividends received by employees during the

vesting period. Following grant, the shares are held by a nominee

for employees - who are then immediately entitled to receive

dividends. After a period of three years' continuous employment the

employees will receive unfettered access to one third of the

shares, after four years a further third and after five years the

final third. The employees are not required to make any payment for

the shares on grant or when the restrictions lapse.

2014 RSS 2015 RSS 2017 RSS 2018 RSS 2019 RSS 2020 RSS

-------------------------------- --------- ----------- -------------- ---------- ---------- ----------

2,550,000/

3,140,000/ 500,000/

Awards originally granted 1,250,000 1,000,000 675,000 478,250 67,250 331,500

In respect of services provided 1 Oct 1 Oct 2014/ 14 Dec 2016/ 1 Oct 2017 1 Oct 2018 1 Oct 2019

for period from 2013 9 Feb 2016 11 May 2017/

1 Oct 2016

42.1p/ 52.2p/87.7p/

Option award value 49.9p 41.5p 161.6p 201.3p 236.8p 506.2p

Weighted average share price

on grant 52.5p 41.4p 77.4p 202.8p 239.0p 510.0p

Expected volatility 32% 32%/31% 29%/29%/29% 30% 31% 32%

Weighted average option life 5.3yrs 4.9yrs 4.3yrs 5.3yrs 5.3yrs 5.3yrs

on grant

Expected dividend rate 3% 3% 4%/2%/2% 1% 2% 1%

Risk free interest rate 1.2% 1.2%/0.8% 0.6%/0.6%/0.7% 1.2% 0.3% 0.0%

-------------------------------- --------- ----------- -------------- ---------- ---------- ----------

The expected volatility was determined by reviewing the

historical volatility of the Company and that of comparator

companies. The expected dividend rate is determined using the

Company share price and most recent full year dividend to grant

date.

Restricted shares outstanding

--------------------------------- -----------

Outstanding at 1 October 2019 7,185,479

Granted during the year 67,250

Vested during the year (2,480,007)

Forfeited during the year (25,000)

--------------------------------- -----------

Outstanding at 30 September 2020 4,747,722

--------------------------------- -----------

Employee share option plan

Options granted between 2014 and 2017

The strike price of these options was set at a 10 per cent

premium to the average market price of the Company's shares for the

five business days (ESOP 2014: 30 days) following the announcement

of the results for each of the respective preceding financial

years. The 2014 - 2015 ESOP options have vested. The 2017 options

do not have performance conditions but do have a time vesting

condition such that they vest subject to continued employment on 31

December 2020.

The valuation was determined using the Black-Scholes-Merton

model.

Options granted in 2018 and 2019

The strike price of these options was set at GBP1. The options

do not have performance conditions but do have a time vesting

condition such that the options vest subject to continued

employment five years following grant. Vested shares are restricted

from being sold until after a further five year period (other than

to settle any resulting tax liability).

Post year end the Board approved the grant of 610,000 options

under the 2020 plan. The options have a strike price of GBP3 but

otherwise have the same conditions as the other options.

The valuation was determined using the binomial model.

Share options are equity settled.

Options outstanding

An analysis of the outstanding options arising from Company's

ESOP and LTIP plans is provided below:

Weighted

average exercise

Number price p

----------------------------------------- ----------- -----------------

Options outstanding at 1 October 2019 4,525,500 74.4

Options granted 650,000 100.0

Forfeited during the year (100,000) 100.0

Options exercised (2,625,500) 18.0

Options outstanding at 30 September 2020 2,450,000 140.7

Options exercisable at 30 September 2020 100,000 53.6

----------------------------------------- ----------- -----------------

Exercise prices for the options outstanding at the end of the

period were 56.9p for the ESOP 2014, 180.2p for the ESOP 2017 and

100.0p for the ESOP 2018 and 2019. The weighted average remaining

contractual life was 5.5 years.

The Group continues to plan that future options exercises will

primarily be satisfied by the Group's Employee Benefit Trusts (the

"EBT"). The Group funds the EBT to acquire shares or issues shares

to the EBT to cover the grant of RSS awards and option

exercises.

Restricted stock units

The Group awarded Restricted Stock Units ("RSUs") to Impax NH

staff and management on 18 January 2018. The RSUs entitle holders

to receive Impax shares with a total value equal to 10 per cent of

the Contingent Consideration paid for the Impax NH acquisition. The

number of shares that each individual will receive under the RSUs

is determined on 15 January 2021 after the amount of Contingent

Consideration payable is finalised using the average Impax share

price for the 20 consecutive trading days ending 15 January 2021.

There is a further two-year restriction on the holders' ability to

sell the shares. The shares are forfeited if the individual leaves

at any time before the restricted period ends.

The charge to the income statement for these awards is

determined each year by estimating the total value of shares that

will be awarded (using the estimate of Contingent consideration)

and spreading this over the five year period until the restrictions

cease. The estimates are updated each year and the charge adjusted

accordingly.

Based on the current estimate of Contingent Consideration no

shares will be issued.

Impax NH put and call arrangement

The Group has a put and call arrangement which will require it

to purchase shares held in Impax NH by its management. The shares

held by Impax NH management were originally acquired as part of a

share-based payment arrangement and are subject to certain

restrictions. The original share-based payment agreement and the

put and call arrangement together represent a new share-based

payment. The charge is spread over a three year period from the

date of acquisition.

9 FINANCE INCOME

2020 2019

GBP000 GBP000

------------------------ ------- -------

Fair value gains 798 103

Interest income 98 82

Other investment income 124 154

Foreign exchange gains - 716

------------------------ ------- -------

1,020 1,055

------------------------ ------- -------

Fair value gains represent those arising on the revaluation of

listed and unlisted investments held by the Group and any gains or

losses arising on related hedge instruments held by the Group.

The fair value gain comprises realised losses of GBP53,000 and

unrealised gains of GBP851,000 (2019: GBP149,000 of realised losses

and GBP252,000 of unrealised gains).

10 FINANCE EXPENSE

2020 2019

GBP000 GBP000

-------------------------------------------------- ------- -------

Interest on lease liabilities 514 -

Finance costs on bank loans 295 912

Unwinding of discount on contingent consideration - 213

Foreign exchange losses 1,112 -

-------------------------------------------------- ------- -------

1,921 1,125

-------------------------------------------------- ------- -------

Finance costs on bank loans for 2020 mainly represent commitment

fees payable on the Group's revolving credit facility.

11 TAXATION

The Group is subject to taxation in the countries in which it

operates (the UK, the US and Hong Kong) at the rates applicable in

those countries. The total tax charge includes taxes payable for

the reporting period (current tax) and also charges relating to

taxes that will be payable in future years due to income or

expenses being recognised in different periods for tax and

accounting periods (deferred tax).

(a) Analysis of charge for the year

2020 2019

GBP000 GBP000

------------------------------------- ------- -------

Current tax expense:

UK corporation tax 124 831

Foreign taxes 219 227

Adjustment in respect of prior years 342 185

------------------------------------- ------- -------

Total current tax 685 1,243

------------------------------------- ------- -------

Deferred tax expense/(credit):

Charge for the year 3,388 2,165

Adjustment in respect of prior years (1,129) (380)

------------------------------------- ------- -------

Total deferred tax 2,259 1,785

------------------------------------- ------- -------

Total income tax expense 2,944 3,028

------------------------------------- ------- -------

Tax credits are also recorded in equity in respect of tax

deduction on share awards arising due to share prices increases of

GBP4,636,000 (2019: GBP251,000) and tax credits on cash flow hedges

of GBP13,000. This includes a credit of GBP175,000 to reflect the

cancellation of the planned reduction in the UK tax from 19 per

cent to 17 per cent that was due to come in to effect from 1 April

2020. The adjustment in respect of prior years in 2020 mainly

reflects reductions in the tax expected to be payable on private

equity income, recorded in prior years, as result of transactions

which took place in the year.

(b) Factors affecting the tax charge for the year

The UK tax rate for the year is 19 per cent. The tax assessment

for the period is lower than this rate (2019: lower). The

differences are explained below:

2020 2019

GBP000 GBP000

--------------------------------------------------------- ------- -------

Profit before tax 16,682 18,898

--------------------------------------------------------- ------- -------

Tax charge at 19% (2019: 19%) 3,170 3,591

Effects of:

Non-taxable income - contingent consideration adjustment - (863)

Non-deductible expense and charges 13 20

Adjustment in respect of historical tax charges (787) (195)

Effect of higher tax rates in foreign jurisdictions 85 95

Tax losses not recognised 463 380

--------------------------------------------------------- ------- -------

Total income tax expense 2,944 3,028

--------------------------------------------------------- ------- -------

The Group has tax losses of GBP4,467,000 available for offset

against future taxable profits in the USA which have not been

recognised as deferred tax assets on the basis that, based on

current profitability of the USA business we will not be able to

utilise them in the next 2 years.

(c) Deferred tax

The deferred tax asset/(liability) included in the consolidated

statement of financial position is as follows:

Share-based Income

payment not yet

scheme Other assets Total assets taxable Other liabilities Total liabilities

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------- ----------- ------------ ------------ -------- ----------------- -----------------

As at 1 October 2018 3,613 837 4,450 (2,851) (313) (3,164)

Credit to equity 251 2 253 - - -

Exchange differences on

consolidation - 2 2 1 - 1

Credit/(charge) to the income

statement (345) (603) (948) (983) 146 (837)

----------------------------- ----------- ------------ ------------ -------- ----------------- -----------------

As at 30 September 2019 3,519 238 3,757 (3,833) (167) (4,000)

Credit to equity 4,636 13 4,649 - - -

Exchange differences on

consolidation - - - 6 - 6

Credit/(charge) to the income

statement (2,953) 40 (2,913) 697 (43) 654

----------------------------- ----------- ------------ ------------ -------- ----------------- -----------------

As at 30 September 2020 5,202 291 5,492 (3,130) (210) (3,340)

----------------------------- ----------- ------------ ------------ -------- ----------------- -----------------

12 EARNINGS PER SHARE

Basic earnings per share ("EPS") is calculated by dividing the

profit for the year attributable to ordinary equity holders of the

Parent Company (the "Earnings") by the weighted average number of

Ordinary Shares outstanding during the year, less the weighted

average number of own shares held. Own shares are held in Employee

Benefit Trusts ("EBTs").

Diluted EPS includes an adjustment to reflect the dilutive

impact of share awards.

The number of shares to be issued under the Restricted Share

Units is based on the Impax NH assets under management at the

vesting date. Assets under management are currently below the

threshold for shares to be issued so the RSUs are currently not

dilutive. The put and call arrangement to acquire Impax NH

management shares is also currently not dilutive.

Earnings

for the

year Shares Earnings

GBP000 000s per share

-------- -------- ------- ----------

2020

Basic 13,235 124,572 10.6p

-------- -------- ------- ----------

Diluted 13,235 125,825 10.5p

-------- -------- ------- ----------

2019

-------- -------- ------- ----------

Basic 15,003 122,887 12.2p

-------- -------- ------- ----------

Diluted 15,003 124,056 12.1p

-------- -------- ------- ----------

Earnings are reduced by GBP503,000 for the year ended 30

September 2020 (2019: GBP867,000) to reflect holders of restricted

shares receiving dividends during the vesting period.

The weighted average number of shares is calculated as shown in

the table below:

2020 2019

000's 000's

---------------------------------------------------------- ------- -------

Weighted average issued share capital 130,415 130,415

Less own shares held not allocated to vested LTIP options (5,843) (7,528)

---------------------------------------------------------- ------- -------

Weighted average number of Ordinary Shares used in the

calculation of basic EPS 124,572 122,887

Additional dilutive shares regarding share schemes 2,451 2,800

Adjustment to reflect option exercise proceeds and future

service

from employees receiving share awards (1,198) (1,631)

---------------------------------------------------------- ------- -------

Weighted average number of Ordinary Shares used in the

calculation of diluted EPS 125,825 124,056

---------------------------------------------------------- ------- -------

The basic and diluted number of shares includes vested LTIP

option shares on the basis that these have an inconsequential

exercise price (1p or 0p).

13 DIVIDS

Dividends are recognised as a reduction in equity in the period

in which they are paid or in the case of final dividends when they

are approved by shareholders. The reduction in equity in the year

therefore comprises the prior year final dividend and the current

year interim.

Dividends declared/proposed in respect of the year

2020 2019

pence pence

------------------------------------ ------ ------

Interim dividend declared per share 1.8 1.5

Final dividend proposed per share 6.8 4.0

------------------------------------ ------ ------

Total 8.6 5.5

------------------------------------ ------ ------

The proposed final dividend of 6.8p will be submitted for formal

approval at the Annual General Meeting to be held on 18 March 2021.

Based on the number of shares in issue at the date of this report

and excluding own shares held the total amount payable for the

final dividend would be GBP8,838,000.

Dividends paid in the year

2020 2019

GBP000 GBP000

--------------------------------------- ------- -------

Prior year final dividend - 4.0p, 3.0p 5,140 3,864

Interim dividend - 1.8p, 1.5p 2,302 1,928

--------------------------------------- ------- -------

7,442 5,792

--------------------------------------- ------- -------

14 GOODWILL

The goodwill balance within the Group at 30 September 2020 arose

from the acquisition of Impax Capital Limited on 18 June 2001

(Listed Equity and Private Equity operating segment) and the

acquisition of Impax NH in January 2018.

Goodwill

GBP000

--------------------- --------

Cost

At 1 October 2018 12,171

Foreign exchange 633

--------------------- --------

At 30 September 2019 12,804

--------------------- --------

Foreign exchange (498)

--------------------- --------

At 30 September 2020 12,306

--------------------- --------

Impax NH consists of only one cash-generating unit ("CGU").

Goodwill is allocated between CGUs at 30 September 2020 as follows

- GBP10,677,000 to Impax NH and GBP1,629,000 to the Listed Equity

and Private Equity CGU's.

The Group has determined the recoverable amount of its CGUs by

calculating their value in use using a discounted cash flow model.

The cash flow forecasts were derived taking into account the budget

for the year ended 30 September 2021, which was approved by the

Directors in October 2020.

The goodwill on the Listed Equity and Private Equity CGUs arose

over 15 years ago and the business has grown significantly in size

and profitability since that date. There is accordingly significant

headroom before an impairment is required. The main assumptions

used to calculate the cash flows in the impairment test for these

CGUs were that asset under management would continue at current

levels and margins would continue at current levels, that fund

performance for the Listed Equity business would be 5 per cent per

year and a discount rate of 12.5 per cent. The discount rate was