TIDMIGG

RNS Number : 9084H

IG Group Holdings plc

09 August 2021

IG Group Holdings plc

LEI No: 2 1 3 8 0 0 3A5Q1 M7 A NOUD 76

9 August 2021

Publication of Annual Report and Notice of Annual General

Meeting

IG Group Holdings plc ('the Company'), a global leader in online

trading, has today distributed to shareholders the following

documents:

-- Annual Report and Accounts for the year ended 31 May 2021 ('Annual Report');

-- Notice of the 2021 Annual General Meeting ('AGM'); and

-- Form of Proxy for the AGM

In accordance with Listing Rule 9.6.1, copies of the documents

listed above have been submitted to the Financial Conduct Authority

via the National Storage Mechanism and will shortly be available

for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The Annual Report and Notice of the AGM are available to view on

the Company's website at www.iggroup.com

The Company announces that its 2021 AGM Annual General Meeting

(the 'AGM') will be held at 14:00 on Wednesday 22 September 2021 at

the Company's offices located at Cannon Bridge House, 25 Dowgate

Hill, London, EC4R 2YA.

In accordance with the UK Government's roadmap to ease COVID-19

restrictions across England at the time of writing it has been

possible for the Company to offer an in-person meeting. The

Company's priority is to safeguard the health and safety of its

shareholders and employees and accordingly shareholders will need

to register their intention to attend the AGM in advance of the

meeting at www.investorcentre.co.uk/eproxy (this link can also be

used to vote their shares). Given the health and safety

restrictions for a COVID-19 secure meeting, shareholders are

advised to consider if they are able to safely attend the meeting

in person and are strongly urged to appoint the Chair of the AGM as

their proxy and give voting instructions. This will ensure that

votes will be counted even if attendance at the meeting in person

is restricted for shareholders (or any other proxy otherwise

appointed).

There is also the possibility that the AGM arrangements may need

to be adapted to respond to the UK Government guidelines on short

notice. The Company will keep under review the AGM format and any

changes to the AGM will be communicated to shareholders before the

meeting on the Company's website at www.iggroup.com and, where

appropriate, by an announcement via the Regulatory Information

Service.

Additional information

The Appendix to this announcement contains information extracted

from the Annual Report for the year ended 31 May 2021 for the

purposes of compliance with the FCA's Disclosure Guidance and

Transparency Rules and should be read in conjunction with the

Company's Full Year 2021 results announcement issued on 22 July

2021 which can be found at www.iggroup.com . Together these

constitute the information required by DTR 6.3.5 to be communicated

to the media in unedited full text through a Regulatory Information

Service. This information is not a substitute for reading the

Company's Annual Report in full. Page numbers and cross references

in the extracted information refer to page numbers and cross

references in the 2021 Annual Report.

APPIX

The principal risks set out below are extracted from pages 47 to

53 of the Annual Report and are repeated here solely for the

purpose of complying with DTR 6.3.5.

Risk Taxonomy and Management

We have developed a Risk Taxonomy to ensure that we consider the

full range of risks faced by the business, and to create a

consensus for classifying all risk management activities. The

taxonomy categorises the principal risks faced by IG into five

areas:

1. Regulatory environment risk

2. Commercial risk

3. Business model risk

4. Operational risk

5. Conduct risk

Principal risks/Taxonomy Taxonomy level 2 Overview

level 1

------------------------------- ---------------------------------------- ------------------------------------

Regulatory environment We actively monitor and

risk * Regulatory risk manage the outlook for

regulatory environment

The risk we face enhanced risk across all countries

regulatory scrutiny, * Regulatory change and territories where

or the risk that the we operate. The regulatory

regulatory environment landscape has remained

in any of the jurisdictions * Tax stable in the UK and Europe.

in which we currently In Australia, the Australian

operate, or may wish Securities and Investments

to operate, changes Commission (ASIC) published

in a way that has an final product intervention

adverse effect on our measures in FY21 that

business or operations, were in line with expectation.

through reduction in Changes were easily embedded,

revenue, increases in given the similarity with

costs, or increases the rules in force in

in capital and liquidity the UK and EU since 2019.

requirements.

As regulation of all forms

continues to evolve, further

changes are anticipated

in the normal course of

business. When changes

occur, we will have plans

in place to ensure a smooth

transition to meet new

requirements.

------------------------------- ---------------------------------------- ------------------------------------

Commercial risk Sustained levels of increased

The risk that our performance * Strategic delivery risk market volatility, with

is affected by client occasional spikes, led

sensitivity to adverse to a strong business performance

market conditions, failure * Market conditions risk in FY21. We continue to

to adopt or implement make significant progress

an effective business on our strategic initiatives,

strategy, failure to * Competitor risk despite the ongoing circumstances

provide the expected related to the Covid-19

levels of client service, pandemic. The Group continues

new or existing competitors * Client service risk to monitor and assess

offering more attractive market volatility, client

products or services service level and the

or client dissatisfaction. competitor environment,

and to respond to changes.

------------------------------- ---------------------------------------- ------------------------------------

Business model risk News surrounding the global

The risk we face arising * Market risk Covid-19 pandemic and

from the nature of our events such as the US

business and our business election and positive

model, including market * Credit risk vaccine news drove market

risk, credit risk, liquidity volatility throughout

risk, and capital adequacy the year, resulting in

risk. * Liquidity risk increased trading volumes

Concentration risk exists as clients looked to benefit

and is managed within from all-time index highs

credit, market, liquidity * Capital adequacy risk and other opportunities.

and capital adequacy The Group's mature and

risk. embedded systems and controls

enabled us to manage the

increased business model

risk we faced during this

extraordinary year.

------------------------------- ---------------------------------------- ------------------------------------

Operational risk Sustained client demand

The risk of loss resulting * Technology risk continues to place additional

from inadequate or failed stress on systems, people

internal processes, and processes through

people, systems or external * People risk unprecedented levels of

events. trading volumes. Strengthening

our control environment

* Process risk and ensuring the scalability

of our processes continue

to be key focus areas,

* External risk with operational and technological

resilience programmes

in flight.

------------------------------- ---------------------------------------- ------------------------------------

Conduct risk We continue to invest

The risk that our conduct * Our clients in systems, people and

poses to the achievement training to ensure our

of fair outcomes for management of conduct

consumers, or to the * The markets and financial crime risk meets the very highest

sound, stable, resilient standards. This includes

and transparent operation ensuring we further embed

of the financial markets. * Culture our client-first culture,

The risk arising from while continuing to work

the Group's failure closely with all our regulators

to adequately assess to protect the integrity

and manage obligations of the financial markets.

and wider stakeholder We manage our ESG profile

expectations regarding by assessing and managing

environmental, social our obligations and wider

and governance (ESG)-related stakeholder expectations

matters. regarding the Group's

approach to being a responsible

and sustainable business

Regulatory environment risk

Regulatory risk

The risk that IG is subject to enhanced regulatory scrutiny, and

that we therefore face a higher chance of investigation,

enforcement or sanction by financial services regulators, through

non-compliance. This may be driven by internal factors, such as the

strength of our control framework or its interpretation, awareness,

understanding, or the implementation of relevant regulatory

requirements. This risk can also arise from external factors, such

as the current and changing priorities of both policy and

supervision departments within the Group's regulators

Regulatory change

IG operates in a highly regulated environment that is

continually evolving.

Governments or regulators may introduce legislation or new

regulations and requirements in any of the jurisdictions in which

we currently operate. We face the risk that this could result in an

adverse effect on our business or operations, reducing our revenue,

raising costs or increasing our capital and liquidity requirements.

We operate to the highest regulatory standards and believe that we

lead the industry in the way in which we deal with our clients. We

maintain constructive relationships with our key regulators and

actively seek to converse with them in an effort to keep abreast of

emerging regulatory trends or developments

Tax

Within regulatory environment risk, we also include the risk of

significant adverse changes in the way that the Group as a whole,

or our individual businesses, are taxed. Examples of the tax risk

we face include the risk that a financial transactions tax is

imposed, which could severely impact the economics of trading, and

the risk that the basis under which we're taxed, in any of the

jurisdictions in which we operate, is adversely affected.

Commercial risk

We define commercial risk as the risk that our performance is

affected by:

-- Client sensitivity to adverse market conditions

-- Failure to adopt or implement an effective business strategy

-- Failure to provide the expected levels of client service

-- New or existing competitors offering more attractive products or services

-- Risk to third-party supply of services

-- Client dissatisfaction

Strategic delivery risk

We work to mitigate our strategic delivery risk through the

Board's regular and thorough review and challenge of our strategy,

and the performance of current strategic initiatives. The Board

holds a number of strategy sessions during the year to consider and

agree the strategic priorities for the business. Planning processes

are extensive, with stakeholders across our business being

involved, and may include external assistance. We undertake

external consultation and extensive market research before

committing to any strategy, in order to test and validate a

concept. Projects are managed via a phased investment process, with

regular review periods, in order to assess performance and

determine if further investment is justified. The Board also

considers specific strategic actions and initiatives during its

normal schedule of Board meetings.

Market conditions risk

IG's trading revenue reflects the transaction fees paid by

clients, less the transaction costs incurred in hedging market

exposures. The extent of client trading activity and the number of

active clients in any period are the key determinants of revenue in

that period. The ability to attract new clients, and the

willingness of clients to trade, depends on the level of

opportunity that clients perceive to be available in the markets.

Our revenue is therefore partly dependent on market conditions.

We seek to mitigate the impact of adverse market conditions and

client sensitivity towards those conditions through detailed review

of daily revenue analysis, monthly financial information, Key

Performance Indicators (KPIs) and regular reforecasts of our

expected financial performance, reflecting the latest and expected

market conditions. We use these forecasts to determine actions

necessary to manage performance, with consideration given to

changes in market conditions.

We regularly update our investors and market analysts on our

revenue performance, including quarterly updates and pre-close

statements, and engage with investors and market analysts to

mitigate the risk that the impact of market conditions is not

reflected in performance expectations

Competitor risk

IG operates in a highly competitive environment, which includes

some unregulated and unethical operators. We work to mitigate

competitor risk by maintaining a clear distinction in the market in

terms of product, service and ethics, and by closely monitoring the

activity and performance of our competitors, including detailed

comparison of the terms of product offers.

We consider ourselves the leader in our market and, given our

strong ethical values, we never deploy questionable practices,

regardless of whether they would prove to be commercially

attractive to clients. We do, however, aim to ensure that our

product offering remains attractive, taking into account the other

benefits that we offer our clients. These include brand, strength

of technology and client service quality. This allows our business

to provide a competitive offering overall and manage competitor

risk without compromising our values.

Client service risk

The risk of client dissatisfaction arising from the expected

service level not being met, resulting in reduced trading and

account closures. This risk may stem from business stretch in times

of high financial market volatility and increased client

contact.

The service IG provides clients is supported by client-facing

teams that interact with clients directly, and specific operational

teams that support client account activity.

Business model risk

We define business model risk as the risks we face arising from

the nature of our business and our business model. These include

market risk, credit risk, liquidity risk and capital adequacy

risk.

Market risk

We do not seek to generate returns from actively taking market

risk. We don't take proprietary trading positions, and our revenue

isn't dependent on the direction of market movements.

We accept some market risk to facilitate instant execution of

client trades. We manage this market risk by internalising client

flow - netting the exposure created through clients' trades so as

to offset it - and external hedging when the residual exposures

reach defined limits. Our real-time market position-monitoring

system allows us to constantly manage our market exposures against

our market risk limits. If exposures exceed predetermined limits,

we execute hedges to bring the exposure back within the limits.

We have a Market Risk Policy which sets out how our business

manages its market risk exposures. The market risk policy

incorporates a methodology for setting market risk limits,

consistent with our risk appetite, for each financial market in

which our clients can trade, as well as for certain groups of

markets or assets which we consider to be correlated. We determine

these limits with reference to the expected liquidity and

volatility of the underlying financial product or asset class, and

represent the maximum (long or short) net exposure IG will hold

without hedging.

We set our market risk limits with the objective of achieving

the optimal efficiency between allowing client trades to be

internalised, the cost of external hedging, and the variability of

daily revenue. We work to manage market risk so that our trading

revenue predominantly reflects client transaction fees net of

hedging costs and is not driven by market risk gains or losses.

Residual market risk can crystallise if a market 'gaps' or

fluctuates sharply, which occurs when a price changes suddenly in a

single large movement - sometimes at the opening of a trading day,

rather than in small incremental steps. This can mean we're unable

to execute or adjust our hedging in a timely manner, resulting in

potential market risk exposure. This may create a gain or a

loss.

We monitor our market risk exposures through regular

scenario-based stress tests which analyse the impact of potential

stress and market gap events. We use the results to take

appropriate action to reduce our risk exposures and those of our

clients.

Credit risk

IG faces the risk that either a client or a financial

counterparty fails to meet their obligations to us, resulting in a

financial loss.

As a result of offering leveraged trading products, we accept

that client credit losses can arise as a cost of our business

model. Client credit risk principally arises when a client's total

funds deposited with IG are insufficient to cover any trading

losses incurred. In addition, a small number of clients are granted

credit limits to cover running losses on open trades and margin

requirements.

We manage client credit risk through the application of our

Client Credit Risk Policy.

We set client margin requirements that reflect the market price

risk for each instrument and use tiered margining so that larger

positions are subject to proportionately higher margin

requirements. We offer training and education to clients covering

all aspects of trading and risk management, which encourages them

to collateralise their accounts at an appropriate level in excess

of the minimum requirement. In addition to cash funding by clients,

we may also accept collateral in the form of shares from

professional clients held in their IG stock trading account.

We further mitigate client credit risk by monitoring client

positions in real time via the close-out monitor (COM), and by

giving clients the ability to set a level at which an individual

deal will be closed (the 'stop' level or 'guaranteed stop'

level).

The COM automatically identifies accounts that have insufficient

margin and triggers an automated process to close positions on

those accounts. Where client losses are such that their total

equity falls below the specified liquidation level, positions will

be liquidated to bring the account back to within margin

requirements, resulting in reduced credit risk exposure for IG.

In some jurisdictions, IG provides negative balance protection

for retail clients, which is a guarantee that clients can't lose

more than the total amount of equity held on their account. This,

together with COM and client-initiated 'stops', results in the

transfer of an element of the market risk from the client to IG.

This market risk arises following the closure of a client position,

as IG may hold a corresponding hedging position that will, assuming

sufficient market liquidity, be unwound.

We have significant financial exposure to a number of financial

institutions, owing to our placement of financial assets at banks

and our hedging of market risk in the wholesale markets, which

requires us to place margin with our hedging brokers.

We manage financial institution credit risk by applying our

Financial Institution Counterparty Credit Risk Policy.

Financial institutional counterparties are subject to a credit

review when we enter into a new relationship, and this is updated

semi-annually (or more frequently as required, for example on

changes to the financial institution's corporate structure).

Proposed maximum exposure limits for these financial institutions,

reflecting their credit rating and systemic position, are reviewed

and approved by the Executive Risk Committee.

We actively manage our credit exposure to each of our broking

counterparties, settling or recalling balances at each broker on a

daily basis in line with the collateral requirements. As part of

our management of concentration risk, we're also committed to

maintaining multiple brokers for each asset class.

We're responsible, under various regulatory regimes, for the

stewardship of client money and assets. These responsibilities

include the appointment and periodic review of institutions where

client money is deposited. Our general policy is that all financial

institution counterparties holding client money accounts must have

a minimum long-term credit rating of BBB-, with limits set

depending on strength of credit rating. In a small number of

operating jurisdictions where we maintain accounts to provide local

banking facilities for clients, it can be problematic to find a

banking counterparty satisfying these minimum rating requirements.

In such cases, we may use a locally systemically important

institution. These criteria also apply to IG's own bank accounts

held with financial institutions.

In addition, the majority of our deposits are made on an

overnight or breakable-term basis, which enables us to react

immediately to any deterioration in credit quality. We only hold

deposits of an unbreakable nature, or requiring notice, with a

subset of counterparties that have been approved by the Executive

Risk Committee.

Liquidity risk

Liquidity risk is the risk that we are unable to meet our

financial obligations as they fall due. We manage this by applying

our Liquidity Risk Management Policy.

Our approach to managing liquidity is to ensure that we have

sufficient liquidity to meet our broker margin requirements and

other financial liabilities when due, under both normal

circumstances and stressed conditions. These liquidity requirements

must be met from our own liquidity resources, as we do not use

client money to fund our operations.

We hold liquid assets to:

1. Enable the funding of broker margin requirements

2. Ensure sufficient funds are held in non-UK entities

3. lace appropriate prudent margins and buffers in segregated client money accounts

4. Maintain a liquid assets buffer

5. Make dividend payments to shareholders

6. over profits and losses on client trading and hedging positions

7. Make tax and other payments

We manage liquidity within the UK Defined Liquidity Group (UK

DLG) comprising IGM and IGI. The UK DLG includes IGM, IG's primary

market risk management vehicle, which internalises and hedges

market risk on behalf of the other entities in the Group. Key

liquidity decisions are discussed at the Executive Risk Committee

and then the Executive Committee, as necessary.

The UK DLG carries out an Individual Liquidity Adequacy

Assessment (ILAA) each year. This assesses the key drivers of

liquidity for the UK DLG and whether it has sufficient liquidity to

continue in operation, including under liquidity stress. The

Contingency Funding Plan (CFP), contained within the ILAA,

identifies mitigation options and steps to improve the liquidity

position in a stress scenario, through the implementation of

management actions.

We use a number of KRIs for managing liquidity risk, including

G3 cash (GBP, EURand USD) held in UK DLG bank accounts, forecasted

UK DLG available liquidity and UK DLG stressed liquidity after

management actions.

We're required to fund initial margin payments to brokers on

demand. Broker initial margin requirements are dependent on client

trading positions, the level of internalisation IG can achieve from

client trading, the product mix in our hedging positions and any

natural offset in correlated products within our hedging

positions.

In addition to our liquid assets, we mitigate liquidity risk

through access to committed, unsecured bank facilities. We reassess

annually the appropriate level of committed facilities we have

available and draw down on the facility at least once during each

year to test the process for accessing that liquidity.

The Group successfully managed its liquidity needs during the

2021 financial year, throughout the increased levels of client

trading activity driven by the heightened and sustained levels of

market volatility triggered by the Covid-19 pandemic. Liquidity is

anticipated to remain strong.

We produce short-term liquidity forecasts and stress tests so

that appropriate management actions, including facility draw-down,

can be taken ahead of a period of expected liquidity demands.

IG is exposed to interest rate risk through our debt and our

holdings of cash and investments. The interest costs incurred on

debt, and interest income received through cash and investments,

are not material in respect of our overall costs and income. We

consider the liquidity risk related to these instruments in the

Group Liquidity Risk Management Policy.

Capital adequacy risk

IG operates authorised and regulated businesses worldwide,

supervised by the FCA in the UK and by various regulators across

other jurisdictions. As a result of this supervision, we are

required to hold sufficient regulatory capital at both Group and

individual entity levels to cover our risk exposures, valued

according to applicable rules, and any additional regulatory

financial obligations imposed.

We're supervised on a consolidated basis by the FCA. In addition

to our two UK FCA-regulated entities, our operations in Australia,

Japan, Singapore, South Africa, Bermuda, the United States of

America, Cyprus, Germany, Switzerland and United Arab Emirates

(Dubai International Financial Centre) are directly authorised by

the respective local regulators. Individual capital requirements in

each regulated entity are taken into account, among other factors,

when managing the global distribution and level of our capital

resources, as part of the Group Capital Management Framework.

IG manages capital adequacy risk through our Regulatory Capital

Policy, and we work to ensure that at all times we hold sufficient

capital to operate our business successfully and to satisfy all

regulatory requirements. We manage our capital resources with the

objectives of facilitating business growth, maintaining our

dividend policy, and complying with the regulatory capital

resources requirements set by our regulators around the world.

We undertake an annual Internal Capital Adequacy Assessment

Process (ICAAP) through which we assess our capital requirements,

by applying a series of stress-testing scenarios to our baseline

financial projections. This assessment is reviewed and challenged

by the ICAAPand ILAA Committee as well as the Board Risk Committee,

which recommends the result to the Board for review and

approval.

We operate a monitoring framework over our capital resources and

minimum capital requirements daily, calculating the credit and

market risk requirements arising on the exposures at the end of

each business day. We also monitor internal warning indicators as a

component of our Board Risk Dashboard. Any breaches are escalated

to the Board as they occur, with a recommendation for appropriate

remedial action.

Entity-level capital requirements monitoring and management is

carried out locally according to each jurisdiction's

requirements.

Operational risk

Operational risk is defined as the risk of loss resulting from

inadequate or failed internal processes, people activities,

technology or other operations, or external events.

Operational risk is managed by applying our Operational Risk

Management Framework. We continuously develop this framework to

ensure visibility of risks and controls. We focus on clear

accountability for controls, escalation and reporting mechanisms -

through which risk events are identified and managed, and

appropriate action is taken to improve controls.

We recognise that operational risk arises in the execution of

all activities we undertake. We identify and manage operational

risk in four categories: technology, people, process and external

events. We recognise the growing risks associated with climate

change and a warming planet. These include physical risks from

changing weather patterns, and the transition risks arising from

movement towards a less polluting, greener economy.

Our Risk and Control Self-Assessment (RCSA) methodology focuses

on areas of the business identified as a priority. We use an

operational risk event self-reporting process which provides

increased visibility over events and control actions to be taken.

These are monitored through a consolidated Control Action List.

Technology risk

Technology risk is the risk of loss caused by breakdown or other

disruption to technology performance and service availability, or

by information security incidents. It also includes new technology

and technology that fails to meet business requirements.

We manage our technology risk through our Technology Risk

Framework, which is overseen by the Technology Risk Committee.

KPIs, incidents and outages are raised to this forum, comprising

technology, information security, operations and risk experts. To

manage cyber risk and external threats to our systems and data, we

have the Information Security Forum, through which senior

management is made aware of ongoing and potential threats, with

policies and processes continuously being refreshed to ensure their

validity within the evolving landscape. We have a 24/7 Security

Operations Centre to review and triage information security

incidents and employ mitigation services for threats such as

denial-of-service (DOS) attacks.

We undertake regular performance and stress-testing to ensure

our platforms have sufficient headroom and resilience to perform in

times of heightened financial market volatility and increased

demand. We also test our disaster recovery capability regularly to

ensure that standby services are effective and minimise the impact

to our services.

People risk

People risk is considered as the risk of a loss intentionally or

unintentionally caused by an employee, such as employee error or

misdeeds, or involving employees, such as in the area of employment

disputes. It includes risks relating to employment law, health and

safety, and HR practices. People risk includes the risk that IG is

unable to attract and retain the staff it requires to operate its

business successfully. In addition, we monitor for any strain on

resources, ensuring sufficient staffing levels are in place for key

business teams, so that processes are run effectively with controls

maintained.

Process risk

Process risk relates to the design, execution and maintenance of

key processes - such as client onboarding, trade execution or

financial reporting - including process governance, clarity of

roles, process design and execution. It also covers record-keeping,

regulatory compliance failures and reporting failures.

External risk

External risk is the risk of loss due to third-party

relationships and outsourcing, damage to physical and non-physical

property or assets from natural or non-natural external causes, and

external fraud.

The Group Business Continuity Policy, and the framework to that

document, provide a clear statement of our commitment to ensure

that critical IG business activities can be maintained during a

disruption.

Conduct risk

IG recognises and manages the risk that our conduct may pose to

the achievement of fair outcomes for clients, and to the sound,

stable, resilient, and transparent operation of the financial

markets. We have a Conduct Risk Framework and have implemented a

Conduct Risk Strategy that aims to analyse the conduct risks that

may arise and sets out how those risks are managed and mitigated.

It also sets out specific controls used to manage conduct risk. We

work to promote a positive, company-wide culture of good conduct as

a competitive advantage and a means to differentiate our business

clearly from companies conducting themselves poorly or unethically.

We also aim to ensure, through training and awareness, that all

employees are aware of the importance of managing conduct risk.

Our clients

We manage and monitor the risk of clients failing to understand

the functionality of our products and suffering poor outcomes. We

recognise that some of our products are not appropriate for certain

clients and operate a process to identify potential new clients for

whom the product may not be suitable. We support clients with

education and training and offer account types that limit clients'

risk. Client outcomes are monitored and reported to the Board.

Across the Group, IG employs a Vulnerable Client Policy. The

policy places responsibility on first-line client-facing staff to

monitor for signs of vulnerability in clients (eg the type of

language used by clients in their communications to us). If a

client is deemed vulnerable their account will be closed. The

number of clients who have closed accounts due to deemed

vulnerability is tracked and monitored by the compliance team as

part of a product governance management information suite.

Compliance monitoring helps to identify lack of policy adherence,

as well as any sudden increases in closures which may point to an

issue with the way our products are being designed, marketed and

sold.

In addition, the compliance team monitors the funding of client

accounts in tandem with information held on clients regarding their

financial position. This is done with the intention of identifying

scenarios where affordability of losses may be called into

question.

Markets and financial crime

We recognise the risk of causing poor market outcomes if proper

controls are not in place to, for example, detect instances of

market abuse which must then be reported on. Clients may also

attempt to use IG to commit fraud or launder money, and we've

designed our systems, controls and monitoring programmes with the

aim of preventing and detecting such issues.

Culture

We recognise the risk that the actions of our staff or IG's

culture can result in poor outcomes for clients, or for the

financial markets. We work to ensure that our staff are

appropriately trained, managed and incentivised to ensure that

their behaviour and activities don't inadvertently result in poor

outcomes for clients or the markets. We also review remuneration

policies and incentive schemes to ensure that they are appropriate

and conducive to good conduct by staff. We recognise the risks

arising from a failure to adequately assess and manage obligations

and wider stakeholder expectations regarding the Group's approach

to being a responsible and sustainable business. An environmental,

social and governance strategy is in place to manage these

risks.

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE

FINANCIAL STATEMENTS

The following statement is extracted from The Statement of

Directors' Responsibilities on page 117 of the Annual Report and is

repeated here solely for the purpose of complying with DTR 6.3.5.

The Statement relates to the full Annual Report and not the

extracted information presented in this announcement of Full Year

Results announcement.

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

have prepared the Group and the Company Financial Statements in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. Additionally, the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules require the Directors to prepare the Group Financial

Statements in accordance with International Financial Reporting

Standards adopted pursuant to Regulation (EC) No 1606/2002 as it

applies in the European Union.

Under company law, Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of the

profit or loss of the Group for that period. In preparing the

Financial Statements, the Directors are required to:

-- Select suitable accounting policies and then apply them consistently

-- State whether, for the Group and Company, international

accounting standards in conformity with the requirements of the

Companies Act 2006 and, for the Group, International Financial

Reporting Standards adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the European Union have been followed,

subject to any material departures disclosed and explained in the

Financial Statements

-- Make judgements and accounting estimates that are reasonable and prudent

-- Prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Group and Company

will continue in business

The Directors are also responsible for safeguarding the assets

of the Group and Company and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's and

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Group and Company and enable

them to ensure that the Financial Statements and the Directors'

Remuneration Report comply with the Companies Act 2006.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of Financial Statements

may differ from legislation in other jurisdictions.

Directors' confirmations

The Directors consider that the Annual Report and Financial

Statements, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Group's and Company's position and performance, business model

and strategy.

Each of the Directors, whose names and functions are listed in

the Corporate Governance section confirm that, to the best of their

knowledge:

-- The Group and Company Financial Statements, which have been

prepared in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006 and, for

the Group, International Financial Reporting Standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union give a true and fair view of the assets,

liabilities, financial position and profit of the Group and profit

of the Company

-- The Strategic Report includes a fair review of the

development and performance of the business and the position of the

Group and Company, together with a description of the principal

risks and uncertainties that it faces

In the case of each Director in office at the date the

Directors' Report is approved:

-- So far as the Director is aware, there is no relevant audit

information of which the Group's and Company's Auditors are

unaware

-- They have taken all the steps that they ought to have taken

as a Director in order to make themselves aware of any relevant

audit information and to establish that the Group's and Company's

Auditors are aware of that information

On behalf of the Board

JUNE FELIX

CHIEF EXECUTIVE OFFICER

9 AUGUST 2021

IG Group:

Business Company Secretary

Aurelia Gibbs +44 20 7896 0011

Investors contact

Liz Scorer, Head of Investor Relations +44 20 7573 0727

investors@ig.com

Press contact

Ramon Kaur, Head of Communications +44 20 7573 0060

press@ig.com

FTI Consulting:

Ed Berry +44 20 3727 1141 / 1046

About IG

IG Group has been at the forefront of trading innovation since

1974. Since then, we've evolved into a global fintech company

incorporating the IG, tastytrade, IG Prime, Spectrum, Nadex and

DailyFX brands, with a presence in Europe, North America, Africa,

Asia-Pacific and the Middle East.

Our award-winning products and platforms empower ambitious

people the world over to unlock opportunities around the clock,

giving them access to over 19,000 financial markets. Today, more

than 400,000 clients call IG Group home.

IG Group Holdings plc is an established member of the FTSE 250

and holds a long-term investment grade credit rating of BBB- with a

stable outlook from Fitch Ratings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSUPUWGRUPGGAQ

(END) Dow Jones Newswires

August 09, 2021 13:15 ET (17:15 GMT)

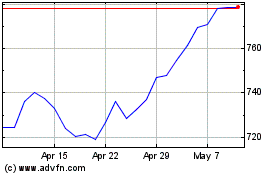

Ig (LSE:IGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ig (LSE:IGG)

Historical Stock Chart

From Apr 2023 to Apr 2024