TIDMHUW

RNS Number : 5586J

Helios Underwriting Plc

13 December 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

13 December 2022

Helios Underwriting plc

("Helios" or the "Company")

Result of General Meeting

Total Voting Rights

and

Directors' Participation

Result of General Meeting

Further to its announcements of 23 November, 24 November and 12

December 2022 (the "Announcements"), Helios, the unique investment

vehicle which acquires and consolidates underwriting capacity at

Lloyd's, is pleased to announce that each of the Resolutions put to

Shareholders at the General Meeting held earlier today were duly

passed.

Application has therefore been made for, in aggregate, 8,196,195

New Ordinary Shares to be admitted to trading on AIM, comprising

7,843,927 Placing Shares, 200,000 Subscription Shares and the

152,268 Open Offer Shares for which valid applications were

received under the Open Offer. Admission is expected to occur at

8.00 am on 14 December 2022.

Total Voting Rights

Following Admission, the Company will have 77,082,407 Ordinary

Shares in issue admitted to trading on AIM (excluding the 419,169

Ordinary Shares held in treasury and which do not carry voting

rights). This figure may be used by Shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

Directors' Participation

The Directors' resulting shareholdings immediately following

Admission are detailed below:

Participation

in the

Placing or Participation

At the Latest Practicable Date Subscription in Open Offer Immediately following Admission

Number of

Percentage of Placing

Number of Existing Shares or Number of Percentage of

Ordinary Ordinary Subscription Number of Open Ordinary Enlarged Share

Name Shares Shares Shares Offer Shares Shares Capital

----------------- --------------- --------------- -------------- --------------- --------------- ---------------

Michael

Cunningham 86,848 0.13% 200,000 - 286,848 0.37%

--------------- --------------- -------------- --------------- --------------- ---------------

Nigel Hanbury* 9,549,794 13.86% 12,564 - 9,562,358 12.41%

--------------- --------------- -------------- --------------- --------------- ---------------

Arthur Manners** 1,187,368 1.72% - 10,141 1,197,509 1.55%

--------------- --------------- -------------- --------------- --------------- ---------------

Andrew Christie 34,317 0.05% - 234 34,551 0.04%

--------------- --------------- -------------- --------------- --------------- ---------------

Edward

Fitzalan-Howard 382,864 0.56% - - 382,864 0.50%

--------------- --------------- -------------- --------------- --------------- ---------------

Martin Reith 130,161 0.19% 127,566 - 257,727 0.33%

--------------- --------------- -------------- --------------- --------------- ---------------

Tom Libassi*** 13,407,000 19.46% - - 13,407,000 17.39%

--------------- --------------- -------------- --------------- --------------- ---------------

(* 622,500 of Nigel Hanbury's Ordinary Shares are jointly owned

in accordance with the Company's Joint Share Ownership Plan -

300,000 of which are detailed in the announcement made by the

Company on 14 December 2017 and 322,500 of which are detailed in

the announcement made by the Company on 17 August 2021.)

(** 477,500 of Arthur Manner's shares are jointly owned in

accordance with the Company's Joint Share Ownership Plan, 200,000

of which are detailed in the announcement made by the Company on 14

December 2017 and 277,500 of which are detailed in the announcement

made by the Company on 17 August 2021.)

(*** Tom Libassi does not hold Ordinary Shares in the Company

but is the Co-founder and Managing Partner of Resolute Global

Partners Limited, which funds under management of, or associated

with, holds 13,407,000 Ordinary Shares.)

This announcement should be read in conjunction with the

Announcements and the full text of the Company's circular dated 24

November 2022 ("Circular"), copies of which are available on the

Company's website at www.huwplc.com. Capitalised terms in this

announcement have the same meaning as given in the Circular.

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

For further information please contact:

Helios Underwriting plc

Nigel Hanbury - Chief Executive +44 (0)7787 530 404 / nigel.hanbury@huwplc.com

Arthur Manners - Chief Financial Officer +44 (0)7754 965 917

Shore Capital (Nomad and Broker)

Robert Finlay +44 (0)20 7408 4080

David Coaten

Henry Willcocks

Gallagher (Financial Adviser) +44 (0)20 3124 6033

Deepon Sen Gupta

Alastair Rodger

Buchanan

Helen Tarbet / Henry Wilson / George Beale +44 (0)7872 604 453

+44 (0) 20 7466 5111

About Helios

Helios provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). Helios trades within the

Lloyd's insurance market writing approximately GBP232 million of

underwriting capacity for the 2022 year of account. The portfolio

provides a good spread of business being concentrated in property

insurance and reinsurance. For further information please visit

www.huwplc.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMFXLFFLLLLFBZ

(END) Dow Jones Newswires

December 13, 2022 06:29 ET (11:29 GMT)

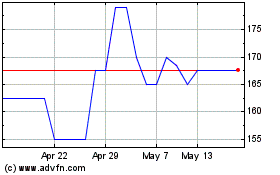

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024