Helios Underwriting Plc Syndicate Forecasts (9010H)

December 03 2015 - 6:34AM

UK Regulatory

TIDMHUW

RNS Number : 9010H

Helios Underwriting Plc

03 December 2015

3 December 2015

Helios Underwriting plc

("HUW" or the "Company")

Syndicate Forecasts

Set out below are the aggregated 2013 and 2014 underwriting year

of account (YOA) forecasts of syndicate profits for HUW's portfolio

of syndicate participations:

2013 and 2014 open year of account forecasts

YOA HUW syndicate Previous forecast Current forecast

capacity of syndicate profit of syndicate profit

(GBP000) 30 June 2015 30 September 2015

------ -------------- ----------------------------- -----------------------------

Mid Mid Range Mid Mid Range

point point (%) point point (%)

(GBP000) (%) (GBP000) (%)

------ -------------- ---------- ------ --------- ---------- ------ ---------

7.84 8.24

2013 27,032 2,963 10.96 - 14.09 3,048 11.28 - 14.31

------ -------------- ---------- ------ --------- ---------- ------ ---------

3.28 3.88

2014 29,174 2,168 7.43 - 11.58 2,339 8.02 - 12.16

------ -------------- ---------- ------ --------- ---------- ------ ---------

Source: Syndicate data; Hampden Agencies Limited and HUW

analysis

Explanatory notes:

The table above shows the gross aggregated estimated profits at

syndicate level (before members' agent fees payable by HUW and its

subsidiaries) for the syndicates in which the Company participates

on a three year underwriting year of account (YOA) basis. The

figures are also before HUW's quota share and stop loss reinsurance

arrangements. The forecast YOA syndicate profit for HUW is obtained

by applying the mid-point of the relevant estimated profit range to

each of HUW's syndicate participations. The information presented

above is prepared on a three year YOA basis and should not be

considered as indicative of the Group's annually accounted

financial results prepared in accordance with International

Financial Reporting Standards. Further details, including quarterly

progression for all years and syndicate results for closed years,

will shortly be available on HUW's website at www.huwplc.com.

HUW syndicate participation

HUW's syndicate participations, on which YOA information is

based, is presented below and is also available on the Company's

website:

2013 2014 2015

---------- ----------------- ----------------- -----------------

Syndicate GBP'000 %* GBP'000 %* GBP'000 %*

---------- -------- ------- -------- ------- -------- -------

33 2,121 7.8% 2,276 7.8% 2,277 8.5%

---------- -------- ------- -------- ------- -------- -------

218 1,343 5.0% 1,343 4.6% 1,074 4.0%

---------- -------- ------- -------- ------- -------- -------

308 70 0.3% 85 0.3% 85 0.3%

---------- -------- ------- -------- ------- -------- -------

386 813 3.0% 840 2.9% 717 2.7%

---------- -------- ------- -------- ------- -------- -------

510 4,493 16.6% 4,444 15.2% 4,494 16.8%

---------- -------- ------- -------- ------- -------- -------

557 546 2.0% 516 1.8% 516 1.9%

---------- -------- ------- -------- ------- -------- -------

609 2,528 9.4% 2,533 8.7% 2,586 9.7%

---------- -------- ------- -------- ------- -------- -------

623 2,943 10.9% 3,179 10.9% 2,963 11.1%

---------- -------- ------- -------- ------- -------- -------

727 660 2.4% 661 2.3% 686 2.6%

---------- -------- ------- -------- ------- -------- -------

779 20 0.1% - - - -

---------- -------- ------- -------- ------- -------- -------

958 897 3.3% 714 2.4% 210 0.8%

---------- -------- ------- -------- ------- -------- -------

1176 474 1.8% 476 1.6% 476 1.8%

---------- -------- ------- -------- ------- -------- -------

1200 160 0.6% 160 0.5% 95 0.4%

---------- -------- ------- -------- ------- -------- -------

1729 - - 107 0.4% 69 0.3%

---------- -------- ------- -------- ------- -------- -------

2010 919 3.4% 919 3.1% 804 3.0%

---------- -------- ------- -------- ------- -------- -------

2014 - - 327 1.1% 1,185 4.4%

---------- -------- ------- -------- ------- -------- -------

2121 120 0.4% 160 0.5% 260 1.0%

---------- -------- ------- -------- ------- -------- -------

2525 141 0.5% 141 0.5% 141 0.5%

---------- -------- ------- -------- ------- -------- -------

2526 60 0.2% - 0.0% - 0.0%

---------- -------- ------- -------- ------- -------- -------

2791 4,388 16.2% 3,864 13.2% 3,412 12.7%

---------- -------- ------- -------- ------- -------- -------

4242 177 0.7% 177 0.6% 200 0.7%

---------- -------- ------- -------- ------- -------- -------

5820 224 0.8% 220 0.8% 160 0.6%

---------- -------- ------- -------- ------- -------- -------

6103 550 2.0% 521 1.8% 210 0.8%

---------- -------- ------- -------- ------- -------- -------

6104 611 2.3% 1,088 3.7% 1,088 4.1%

---------- -------- ------- -------- ------- -------- -------

6105 115 0.4% 502 1.7% 517 1.9%

---------- -------- ------- -------- ------- -------- -------

6106 362 1.3% - - - -

---------- -------- ------- -------- ------- -------- -------

6107 33 0.1% 373 1.3% 373 1.4%

---------- -------- ------- -------- ------- -------- -------

6110 1,073 4.0% 925 3.2% - -

---------- -------- ------- -------- ------- -------- -------

6111 1,122 4.2% 1,385 4.7% 1,395 5.2%

---------- -------- ------- -------- ------- -------- -------

6113 67 0.2% 67 0.2% - -

---------- -------- ------- -------- ------- -------- -------

6117 - - 1,171 4.0% 773 2.9%

---------- -------- ------- -------- ------- -------- -------

7227 - - - - 3 0.0%

---------- -------- ------- -------- ------- -------- -------

Total 27,032 100.0% 29,174 100.0% 26,767 100.0%

---------- -------- ------- -------- ------- -------- -------

* Percentage of total syndicate portfolio

For further information please contact:

HUW Nigel Hanbury nigel.hanbury@huwplc.com

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

Westhouse Securities Robert Finlay 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing GBP27 million of capacity for the 2015

account. The portfolio provides a good spread of classes of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGGGWPUPAGGW

(END) Dow Jones Newswires

December 03, 2015 06:34 ET (11:34 GMT)

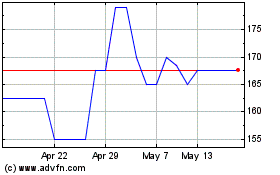

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024