TIDMHUW

RNS Number : 3804N

Hampden Underwriting Plc

28 September 2012

28 September 2012

Hampden Underwriting plc

("Hampden Underwriting" or the "Company")

Interim results for the six months ended 30 June 2012

Appointment of CEO

Hampden Underwriting plc, which provides investors with a

limited liability direct investment into the Lloyd's insurance

market, announces its unaudited interim results for the six months

ended 30 June 2012 and the appointment of a Chief Executive

Officer.

Highlights

-- Premium written during the period totalled GBP5.0m (an

increase of 10% over the same period last year)

-- Net profit of GBP247,000 (compared to a loss of GBP536,000

over the same period last year)

-- Earnings per share of 3.33p (compared to (7.23)p over the same period last year)

-- Net assets increased to GBP7.7m

-- Nigel Hanbury appointed as CEO and his NameCo 917 to be

acquired by the Company for shares

Commenting upon these results, Sir Michael Oliver, Chairman,

said:

"It gives me great pleasure to be able to report a profit of

GBP247,000 at the half year as opposed to a loss of GBP536,000 over

the same period last year. This is of course largely due to the

lack of catastrophe losses in the first six months of 2012 and it

remains our intention to pay an interim dividend later in the year.

I am also delighted to be able to say that we have appointed Nigel

Hanbury as Chief Executive Officer. Many of our shareholders will

know Nigel well from his time as CEO and then Chairman of Hampden

Agencies and I am sure that his drive and enthusiasm will be

brought to his new role."

For further information please contact:

Hampden Underwriting Jeremy Evans 020 7863 6567

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

Additional information

Nigel John Hanbury (aged 55) currently owns (directly and

indirectly) 147,685 ordinary shares in the Company; on completion

of the proposed acquisition by the Company of Nameco (No. 917)

Limited ("NameCo 917"), it is expected that he will own

(indirectly) a further 1,113,572 ordinary shares. Under the terms

of his service agreement with the Company, he will be entitled to

an annual salary of GBP75,000 and a bonus of 15% of the amount by

which the audited annual net profit of the Company exceeds

GBP500,000. He is currently a director/partner of the following

companies/partnerships: Nomina No.084 LLP; ALM Ltd; NJ Hanbury Ltd;

Upperton Holdings Ltd; Hanbury Trading Ltd; Pooks Ltd; Nameco (No.

917) Ltd; Headwinds Investments plc; PF Hanbury & Son; Capital

Holdings Ltd; Hampden Insurance Protected Cell Company (Guernsey)

Ltd, and has been a director of the following companies in the last

five years: Hampden Agencies Ltd; Hampden Capital plc; Red Squirrel

Survival Trust Ltd; Syndicate 138 Ltd.

NameCo 917 is a corporate member of Lloyd's which the Company

has agreed (subject to regulatory approval) to acquire from

Upperton Holdings Limited (which itself is wholly-owned by Nigel

Hanbury) for a consideration of 1,113,572 new ordinary shares in

the Company. The 2012 underwriting capacity of Nameco 917 is GBP1.7

million; this compares with Hampden Underwriting's 2012 capacity of

GBP9.3 million. Nameco 917 is advised by Hampden Agencies and

participates in a spread of Lloyd's syndicates similar to Hampden

Underwriting's own participation. In the year ended 31 December

2011, Nameco 917 made a profit before tax of GBP0.1 million on

gross premiums written of GBP1.2 million and had net assets of

GBP1.8 million at that date (this is before a post year-end

dividend of GBP0.7 million). Hampden Underwriting will contribute

an estimated further GBP0.5 million in cash to its funds at Lloyd's

to support the Company's enlarged underwriting activities.

Chairman's Statement

It gives me great pleasure to be able to report a profit of

GBP247,000 at the half year as opposed to a loss of GBP536,000 over

the same period last year. This is of course largely due to the

lack of catastrophe losses in the first six months of 2012 and it

remains our intention to pay an interim dividend later in the

year.

In my statement to you in the 2011 annual report and accounts, I

said that we had made a good start and that now was the time for

expansion. Since the Company floated on AIM in 2007, it has

weathered the Lloyd's cycle with the worst year on record in 2011

and some profitable years in 2008 and 2009. The Company has

fulfilled its stated prospectus objective by underwriting though

Hampden MAPAs and also making some very successful acquisitions of

existing NameCos.

The Board is currently comprised of non-executive directors and

we consider that there is a need for a full-time executive to take

the Company to the next steps in its development. I am therefore

very pleased to be able to say that Nigel Hanbury has been

appointed Chief Executive Officer with immediate effect. Nigel has

also agreed to sell his NameCo 917 to the Company in exchange for

shares. The price of this acquisition, which will increase our

underwriting capacity by GBP1.7 million, is based on net asset

value and so there should be no NAV dilution for existing

shareholders. The new shares will rank pari passu in all respects

with existing shares and, when they are issued, Nigel's

shareholding (direct and indirect) in the Company will increase to

approximately 15%.

Many of you will know Nigel from his time as CEO and then

Chairman of Hampden Agencies and I am delighted to welcome him to

the Board as CEO. I am sure that his drive and enthusiasm will be

brought to his new role.

Sir Michael Oliver

Non-executive Chairman

27 September 2012

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2012

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2012 2011 2011

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ----- --------- --------- -------------

Gross premium written 5,043 4,571 7,715

Reinsurance premium ceded (1,201) (1,056) (1,445)

------------------------------------------- ----- --------- --------- -------------

Net premiums written 3,842 3,515 6,270

Change in unearned gross premium

provision (1,337) (840) 238

Change in unearned reinsurance premium

provision 565 423 (17)

------------------------------------------- ----- --------- --------- -------------

(772) (417) 221

Net earned premium 2 3,070 3,098 6,491

------------------------------------------- ----- --------- --------- -------------

Net investment income 4 204 148 247

Other underwriting income - - -

Other income 2 - 17 22

------------------------------------------- ----- --------- --------- -------------

204 165 269

------------------------------------------- ----- --------- --------- -------------

Revenue 3,274 3,263 6,760

------------------------------------------- ----- --------- --------- -------------

Gross claims paid (2,133) (1,940) (4,726)

Reinsurance share of gross claims

paid 416 270 842

------------------------------------------- ----- --------- --------- -------------

Claims paid, net of reinsurance (1,717) (1,670) (3,884)

Change in provision for gross claims 193 (1,671) (1,115)

Reinsurance share of change in provision

for gross claims (179) 543 486

------------------------------------------- ----- --------- --------- -------------

Net change in provision for claims 14 (1,128) (629)

Net insurance claims and loss adjustment

expenses 2 (1,703) (2,798) (4,513)

------------------------------------------- ----- --------- --------- -------------

Expenses incurred in insurance activities 2 (916) (889) (2,277)

Other operating expenses 2 (321) (310) (574)

------------------------------------------- ----- --------- --------- -------------

Operating expenses (1,237) (1,199) (2,851)

Operating profit/(loss) before tax 2 334 (734) (604)

------------------------------------------- ----- --------- --------- -------------

Income tax (expense)/credit 5 (87) 198 217

Profit/(loss) attributable to equity

shareholders 9 247 (536) (387)

------------------------------------------- ----- --------- --------- -------------

Earnings per share attributable to

equity shareholders

Basic and diluted 6 3.33p (7.23)p (5.22)p

------------------------------------------- ----- --------- --------- -------------

The profit/(loss) and earnings per share set out above are in

respect of continuing operations.

The accounting policies and notes are an integral part of these

Interim Financial Statements.

Condensed Consolidated Statement of Financial Position

At 30 June 2012

30 June 30 June 31 December

2012 2011 2011

Note GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- -------- -------- ------------

Assets

Intangible assets 909 1,123 1,052

Deferred income tax assets - 12 -

Reinsurance share of insurance liabilities

- Reinsurers' share of outstanding

claims 3 2,702 2,974 3,044

- Reinsurers' share of unearned

premiums 3 992 884 409

Other receivables, including insurance

receivables 6,598 7,095 6,628

Prepayments and accrued income 1,045 1,026 842

Financial assets at fair value 14,091 13,162 13,675

Cash and cash equivalents 3,526 4,566 3,020

Total assets 29,863 30,842 28,670

-------------------------------------------- ----- -------- -------- ------------

Liabilities

Insurance liabilities

- Claims outstanding 3 12,853 14,068 14,234

- Unearned premiums 3 4,603 4,411 3,137

Deferred income tax liabilities 417 457 415

Other payables, including insurance

payables 3,814 3,843 2,911

Accruals and deferred income 444 727 488

Total liabilities 22,131 23,506 21,185

-------------------------------------------- ----- -------- -------- ------------

Shareholders' equity

Share capital 8 741 741 741

Share premium 8 6,261 6,261 6,261

Retained earnings 9 730 334 483

-------------------------------------------- ----- -------- -------- ------------

Total shareholders' equity 7,732 7,336 7,485

-------------------------------------------- ----- -------- -------- ------------

Total liabilities and shareholders'

equity 29,863 30,842 28,670

-------------------------------------------- ----- -------- -------- ------------

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2012

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Cash flow from operating activities 2012 2011 2011

GBP'000 GBP'000 GBP'000

--------------------------------------------- --------- --------- -------------

Results of operating activities 334 (734) (604)

Interest received (15) (8) (4)

Investment income (177) (118) (275)

Profit on sale of intangible assets - - 11

Amortisation of intangible assets 143 141 270

Change in fair value of investments 2 30 (5)

Changes in working capital:

Increase in other receivables (173) (1,181) (530)

Increase in other payables 772 1,145 3

Net increase in technical provisions (156) 1,157 454

Income tax paid - - (16)

Net cash inflow/(outflow) from operating

activities 730 432 (696)

--------------------------------------------- --------- --------- -------------

Cash flows from investing activities

Interest received 15 8 4

Investment income 177 118 275

Purchase of intangible assets - 9 (49)

Purchase of financial assets at fair value (416) 679 166

Acquisition of subsidiary, net of cash - - -

acquired

Proceeds from disposal of intangible assets - - -

Net cash used in investing activities (224) 814 396

--------------------------------------------- --------- --------- -------------

Cash flows from financing activities

Net proceeds from issue of ordinary share - - -

capital

Net cash used in financing activities - - -

--------------------------------------------- --------- --------- -------------

Net increase/(decrease) in cash and cash

equivalents 506 1,246 (300)

Cash and cash equivalents at beginning

of period 3,020 3,320 3,320

Cash, cash equivalents and bank overdrafts

at end of period 3,526 4,566 3,020

--------------------------------------------- --------- --------- -------------

Condensed Statement of Changes in Shareholders' Equity

Six months ended 30 June 2012

Ordinary Share Retained

share capital Premium Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --------------- --------- ---------- --------

At 1 January 2011 741 6,261 870 7,872

Loss for the year attributable

to equity shareholders - - (387) (387)

------------------------------------ --------------- --------- ---------- --------

At 31 December 2011 741 6,261 483 7,485

------------------------------------ --------------- --------- ---------- --------

At 1 January 2012 741 6,261 483 7,485

Profit for the period attributable

to equity shareholders - - 247 247

At 30 June 2012 741 6,261 730 7,732

------------------------------------ --------------- --------- ---------- --------

Notes to the Interim Financial Statements

Six months ended 30 June 2012

1. Accounting policies

Basis of preparation

The Interim Financial Statements have been prepared using

accounting policies consistent with International Financial

Reporting Standards (IFRSs) and in accordance with International

Accounting Standard (IAS) 34 Interim Financial Reporting.

The Interim Financial Statements are prepared for the six months

ended 30 June 2012.

The Interim Financial Statements incorporate the results of

Hampden Underwriting plc, Hampden Corporate Member Limited, Nameco

(No. 365) Limited, Nameco (No. 605) Limited and Nameco (No. 321)

Limited.

The Interim Financial Statements are unaudited, but have been

subject to review by the Group's auditors. The Interim Financial

Statements have been prepared in accordance with the accounting

policies adopted for the year ended 31 December 2011.

The comparative figures are based upon the Group Financial

Statements for the year ended 31 December 2011, and have been

reported on by the Group's auditors and were delivered to the

Registrar of Companies on 22 June 2012.

The underwriting data on which these Interim Financial

Statements are based upon has been supplied by the managing agents

of those syndicates which the Group supports. The data supplied is

the 100% figures for each syndicate. The Group has applied its

share of the syndicate participations to the gross figures to

derive its share of the syndicates transactions, assets and

liabilities.

Significant accounting policies

The Interim Financial Statements have been prepared under the

historical cost convention. The same accounting policies,

presentation and methods of computation are followed in these

Interim Financial Statements as were applied in the preparation of

the Group Financial Statements for the year ended 31 December

2011.

2. Segmental information

Primary segment information

The Group has three primary segments which represent the primary

way in which the Group is managed:

-- Syndicate participation;

-- Investment management;

-- Other corporate activities.

6 months ended 30 June Syndicate Investment Other corporate

2012 participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------------- ------------ ---------------- --------

Net earned premium 3,070 - - 3,070

Net investment income 141 63 - 204

Net insurance claims and

loss adjustment expenses (1,703) - - (1,703)

Expenses incurred in insurance

activities (916) - - (916)

Amortisation of syndicate

capacity - - (87) (87)

Other operating expenses - - (234) (234)

--------------------------------- --------------- ------------ ---------------- --------

Results of operating activities 592 63 (321) 334

--------------------------------- --------------- ------------ ---------------- --------

6 months ended 30 June Syndicate Investment Other corporate

2011 participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------------- ------------ ---------------- --------

Net earned premium 3,098 - - 3,098

Net investment income 116 32 - 148

Other income - - 17 17

Net insurance claims

and loss adjustment expenses (2,798) - - (2,798)

Expenses incurred in

insurance activities (889) - - (889)

Amortisation of syndicate

capacity - - (213) (213)

Other operating expenses - - (97) (97)

------------------------------- --------------- ------------ ---------------- --------

Results of operating

activities (473) 32 (293) (734)

------------------------------- --------------- ------------ ---------------- --------

12 months ended 31 December Syndicate Investment Other corporate

2011 participation management activities Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- --------------- ------------ ---------------- --------

Net earned premium 6,491 - - 6,491

Net investment income 245 2 - 247

Other income 22 - - 22

Net insurance claims and

loss adjustment expenses (4,513) - - (4,513)

Expenses incurred in insurance

activities (2,277) - - (2,277)

Amortisation of syndicate

capacity - - (158) (158)

Other operating expenses (192) - (224) (416)

--------------------------------- --------------- ------------ ---------------- --------

Results of operating activities (224) 2 (382) (604)

--------------------------------- --------------- ------------ ---------------- --------

Secondary segment information

The Group does not have any secondary segments as it considers

all of its activities to arise from trading within the UK.

3. Insurance liabilities and reinsurance balances

Movement in claims outstanding

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- -------- ------------ --------

At 1 January 2012 14,234 3,044 11,190

Movement of reserves (193) (179) (14)

Net exchange differences and changes in syndicate participation (1,188) (163) (1,025)

----------------------------------------------------------------- -------- ------------ --------

At 30 June 2012 12,853 2,702 10,151

----------------------------------------------------------------- -------- ------------ --------

Movement in unearned premium

Gross Reinsurance Net

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- -------- ------------ --------

At 1 January 2012 3,137 409 2,728

Movement in premiums earned in the year 1,337 565 772

Net exchange difference and changes in syndicate participation 129 18 111

---------------------------------------------------------------- -------- ------------ --------

At 30 June 2012 4,603 992 3,611

---------------------------------------------------------------- -------- ------------ --------

4. Net investment income

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2012 2011 2011

GBP'000 GBP'000 GBP'000

------------------------------------------- --------- --------- -------------

Investment income at fair value through

income statement 177 118 275

Realised gains on financial investments

at fair value through income statement - - 74

Unrealised gains/(losses) on financial

investments at fair value through income

statement 20 22 5

Investment management expenses (8) - (111)

Bank interest 15 8 4

------------------------------------------- --------- --------- -------------

Net investment income 204 148 247

------------------------------------------- --------- --------- -------------

5. Income tax expense

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2012 2011 2011

GBP'000 GBP'000 GBP'000

----------------------------- --------- --------- -------------

Income tax (expense)/credit (87) 198 217

----------------------------- --------- --------- -------------

The income tax credit/(expense) is recognised based on

management's best estimate of the weighted average annual income

tax rate expected for the full financial year. The estimated

average annual tax rate used is 26% (2011: 27%). Material

disallowed items have been adjusted for in the income tax

calculation.

6. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS

33.

Reconciliation of the earnings and weighted average number of

shares used in the calculation is set out below.

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2012 2011 2011

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- ---------- -------------

Profit/(loss) for the period 247,000 (536,000) (387,000)

-------------------------------------- ---------- ---------- -------------

Weighted average number of shares in

issue 7,413,376 7,413,376 7,413,376

-------------------------------------- ---------- ---------- -------------

Basic and diluted earnings per share

(p) 3.33p (7.23)p (5.22)p

-------------------------------------- ---------- ---------- -------------

7. Dividends

No equity dividends were proposed, declared or paid in the

period (2011 - GBPNil).

8. Share capital and share premium

Ordinary

Share Share

Capital Premium Total

Allotted, called up and fully paid GBP'000 GBP'000 GBP'000

------------------------------------------------- --------- --------- ---------

7,413,376 ordinary shares of 10p each and share

premium at 1 January 2012 741 6,261 7,002

7,413,376 ordinary shares of 10p each and share

premium at 30 June 2012 741 6,261 7,002

------------------------------------------------- --------- --------- ---------

9. Retained earnings

30 June 30 June 31 December

2012 2011 2011

GBP'000 GBP'000 GBP'000

Group

At 1 January 2012 483 870 870

Profit/(loss) attributable to equity shareholders 247 (536) (387)

-------- -------- ------------

At 30 June 2012 730 334 483

-------- -------- ------------

10. Related party transactions

Hampden Underwriting plc has provided inter-company loans to

Hampden Corporate Member Limited, Nameco (No.365) Limited, Nameco

(No.605) Limited and Nameco (No. 321) Limited, all 100%

subsidiaries of the Company. Interest is charged on the loans at

base rate plus 0.125%. The loans are repayable on three months'

notice provided it does not jeopardise the ability of Hampden

Corporate Member Limited, Nameco (No.365) Limited, Nameco (No.605)

Limited and Nameco (No.321) Limited to meet their liabilities as

they fall due. The amounts outstanding as at 30 June are set out

below:

30 June 30 June 31 December

2012 2011 2011

Company GBP'000 GBP'000 GBP'000

-------------------------------------- -------- -------- ------------

Balances due from Group companies at

the period end:

Hampden Corporate Member Limited 3,111 3,715 2,637

Nameco (No. 365) Limited 346 134 345

Nameco (No. 605) Limited 1,100 1,024 1,097

Nameco (No. 321) Limited 319 12 318

-------------------------------------- -------- -------- ------------

Total 4,876 4,885 4,397

-------------------------------------- -------- -------- ------------

Hampden Corporate Member Limited, Nameco (No.365) Limited,

Nameco (No.605) Limited and Nameco (No.321) Limited ("Corporate

Members") are 100% subsidiaries of the Company and have entered

into a management agreement with Nomina plc. Jeremy Richard Holt

Evans, a Director of Hampden Underwriting plc and the Corporate

Members is also a Director of Nomina plc. Under the agreement,

Nomina plc provides management and administration, financial tax

and accounting services to the Group for an annual fee of GBP2,750

(2011: GBP2,750) per Corporate Member.

The Corporate Members are100% subsidiaries of the Company and

have entered into a member's agent agreement with Hampden Agencies

Limited. Jeremy Richard Holt Evans, a Director of Hampden

Underwriting plc and the Corporate Members and Sir James Michael

Yorrick Oliver, a Director of Hampden Underwriting plc, are also

Directors of Hampden Capital plc which controls Hampden Agencies

Limited. Under the agreement the Corporate Members will pay Hampden

Agencies Limited a fee based on a fixed amount, which will vary

depending upon the number of syndicates the Corporate Members

underwrites on a bespoke basis, and a variable amount depending on

the level of underwriting through the members' agent pooling

arrangements. In addition, the Corporate Members will pay profit

commission on a sliding scale from 1% of the net profit up to a

maximum of 10%. The total fees payable are set out below:

30 June 30 June 31 December

2012 2011 2011

Company GBP'000 GBP'000 GBP'000

---------------------------------- -------- -------- ------------

Hampden Corporate Member Limited 51 44 41

Nameco (No. 365) Limited 9 8 10

Nameco (No. 605) Limited 50 21 11

Nameco (No. 321) Limited 16 10 14

---------------------------------- -------- -------- ------------

Total 126 83 76

---------------------------------- -------- -------- ------------

Hampden Underwriting plc has entered into a company secretarial

agreement with Hampden Legal plc. Under the agreement, Hampden

Legal plc provides company secretarial services to the Group for an

annual fee of GBP42,000. During the period, company secretarial

fees of GBP17,500 (2011: GBP35,000) were charged to Hampden

Underwriting plc. Hampden Holdings Limited has a controlling

interest in both Hampden Legal plc and Hampden Capital plc.

11. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA")

in which the Company's subsidiaries participate as corporate

members of Lloyd's as are follows:

Allocated capacity

Period of account

Syndicate

or Managing or Members'

MAPA Number Agent 2010 2011 2012

------------- ------------------------------- ---------- ---------- ----------

33 Hiscox Syndicates Limited 138,067 124,261 131,164

Equity Syndicates Management

218 Limited 220,092 220,092 198,084

386 QBE Underwriting Limited 26,968 26,968 30,515

510 RJ Kiln & Co. Limited 172,115 172,115 203,247

557 RJ Kiln & Co. Limited 205,000 102,868 102,868

Atrium Underwriters

570 Limited 56,931 56,931 -

Atrium Underwriters

609 Limited 57,431 57,431 114,362

623 Beazley Furlonge Limited 190,841 190,841 190,841

S.A. Meacock & Company

727 Limited 43,348 43,348 43,348

807 R.J. Kiln & Co Limited 39,225 39,225 -

Omega Underwriting Agency

958 Limited 118,428 118,428 118,428

Argo Managing Agency

1200 Limited 118,915 118,915 118,915

Argenta Syndicate Management

2121 Limited 100,000 114,286 114,286

Managing Agency Partners

2791 Limited 309,577 309,577 309,577

4040 HCC Underwriting Agency - - -

Limited

Managing Agency Partners

6103 Limited 235,000 100,000 100,000

6104 Hiscox Syndicates Limited 225,000 100,000 100,000

Ark Syndicate Management

6105 Limited - 87,549 87,549

6106 Amlin Underwriting Limited 175,000 125,000 125,000

6107 Beazley Furlonge Limited 15,000 15,000 15,000

Pembroke Managing Agency

6110 Limited - - 225,768

Catlin Underwriting

6111 Agencies Limited - - 180,616

Members' Agents Pooling

7200 Arrangement 245,501 237,453 244,223

Members' Agents Pooling

7201 Arrangement 1,278,668 1,240,909 1,260,967

Members' Agents Pooling

7202 Arrangement 458,211 435,303 443,745

Members' Agents Pooling

7203 Arrangement 44,288 42,859 43,509

Members' Agents Pooling

7208 Arrangement 5,086,898 4,627,855 4,751,602

7211 Members' Agents Pooling - - -

Arrangement

Members' Agents Pooling

7217 Arrangement 70,235 53,477 53,477

Total 9,630,739 8,760,691 9,307,091

------------- ------------------------------- ---------- ---------- ----------

12. Group owned net assets

The Group balance sheet includes the following assets and

liabilities held by the syndicates on which the Group participates.

These assets are subject to trust deeds for the benefit of the

relevant syndicates' insurance creditors. The table below shows the

split of the Group balance sheet between group and syndicate assets

and liabilities.

30 June 2012 30 June 2011 31 December 2011

Group Syndicate Total Group Syndicate Total Group Syndicate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Assets

Intangible assets 909 - 909 1,123 - 1,123 1,052 - 1,052

Deferred income tax

assets - - - 12 - 12 - - -

Reinsurance share

of insurance

liabilities

- Reinsurers' share

of outstanding

claims - 2,702 2,702 - 2,974 2,974 - 3,044 3,044

- Reinsurers' share

of unearned

premiums - 992 992 - 884 884 - 409 409

Other receivables,

including insurance

receivables 704 5,894 6,598 321 6,774 7,095 421 6,207 6,628

Prepayments and

accrued

income 27 1,018 1,045 31 995 1,026 41 801 842

Financial assets

at fair value 5,562 8,529 14,091 3,674 9,488 13,162 4,090 9,585 13,675

Cash and cash

equivalents 2,080 1,446 3,526 3,072 1,494 4,566 2,483 537 3,020

Total assets 9,281 20,582 29,863 8,233 22,609 30,842 8,087 20,583 28,670

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Liabilities

Insurance liabilities

- Claims outstanding - 12,853 12,853 - 14,068 14,068 - 14,234 14,234

- Unearned premiums - 4,603 4,603 - 4,411 4,411 - 3,137 3,137

Deferred income tax

liabilities 417 - 417 655 - 655 415 - 415

Other payables,

including

insurance payables 737 3,077 3,814 74 3,542 3,616 126 2,785 2,911

Accruals and deferred

income 346 98 444 633 94 727 862 (374) 488

Current income tax

liabilities - - - 29 - 29 - - -

Total liabilities 1,500 20,631 22,131 1,391 22,115 23,506 1,403 19,782 21,185

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Shareholders' equity

Share capital 741 - 741 741 - 741 741 - 741

Share premium 6,261 - 6,261 6,261 - 6,261 6,261 - 6,261

Retained earnings 779 (49) 730 (160) 494 334 (318) 801 483

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Total shareholders'

equity 7,781 (49) 7,732 6,842 494 7,336 6,684 801 7,485

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

Total liabilities

and shareholders'

equity 9,828 20,581 29,863 8,233 22,609 30,842 8,087 20,583 28,670

---------------------- -------- ---------- -------- -------- ---------- -------- -------- ---------- --------

13. Announcement

A copy of this announcement will be available on the Company's

website, www.hampdenplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUMGBUPPGQM

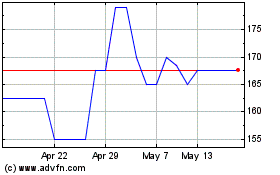

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024