Halma PLC Interim Management Statement (1641N)

July 24 2014 - 2:00AM

UK Regulatory

TIDMHLMA

RNS Number : 1641N

Halma PLC

24 July 2014

Halma plc

AGM/Interim Management Statement

24 July 2014

Halma, the leading safety, health and environmental technology

group is holding its 120(th) AGM later today and makes the

following Interim Management Statement relating to the period 30

March 2014 to date, with comments on trading relating to the first

quarter ended 28 June 2014.

Market conditions have remained varied within our four sectors

and the major geographic regions, while the increasing strength of

sterling continues to provide a translation headwind. However,

Halma has continued to achieve organic revenue growth at constant

currency with order intake at 103% of revenue. This, together with

the acquisitions completed in the first quarter, has positioned

Halma to make further progress in the year ahead in line with the

Board's expectations.

Process Safety performed well with growth from the USA, Mainland

Europe, Middle East and South America offsetting lower revenue from

Asia Pacific. The integration of RCS, the pipeline corrosion

monitoring business acquired in May 2014, has started well and

collaboration with Halma's other Process Safety companies is

already underway.

The Infrastructure Safety sector made solid progress with

encouraging growth in the UK and Mainland Europe. The integration

into Halma of Advanced Electronics, the fire safety company

acquired in May 2014, is also proceeding well.

Our Medical sector had a slow start to the year but is gaining

momentum with good underlying growth in the USA and South America.

Plasticspritzerei, acquired in May 2014, has been fully integrated

into Medicel, the Halma company which manufactures devices for

cataract surgery procedures.

The Environmental & Analysis sector delivered a mixed

performance. Revenue growth in Mainland Europe and Asia Pacific has

been encouraging although trading in the USA and UK has been more

challenging. UK revenue has been affected by lower spending by

water utilities which are now in the final year of their 5-year

investment cycle.

As reported previously, since the start of the period we have

completed three acquisitions and one disposal with a net cash cost

of GBP78m. There have been no other material events or transactions

during the period impacting upon the Group's financial position,

which remains strong. We continue to identify potential acquisition

opportunities which meet our strategic and financial criteria.

The half yearly results for the period ending 27 September 2014

are expected to be released on 18 November 2014.

For further information, please contact:

Halma plc Tel: +44 (0)1494 721111

Andrew Williams, Chief Executive

Kevin Thompson, Finance Director

MHP Communications Tel: +44 (0)20 3128 8100

Rachel Hirst/Andrew Jaques

NOTE TO EDITORS

1. Halma develops and markets products used worldwide to protect

life and improve the quality of life. The Group comprises four

business sectors:

-- Process Safety Products which protect assets and people at

work.

Products which detect hazards to protect assets

* Infrastructure Safety and people in public spaces and commercial

buildings.

-- Medical Products used to improve personal and public

health.

Products and technologies for analysis in

* Environmental & Analysis safety, life sciences and environmental markets.

The key characteristics of Halma's businesses are that they

are based on specialist technology and application knowledge,

offering strong growth potential. Many Group businesses are

market leaders in their specialist field.

2. High resolution photos of Halma senior management, including

Chief Executive Andrew Williams, and images illustrating Halma

business activities can be downloaded from its website: www.halma.com.

Click on the 'News & Media' link, then 'Image Library'. Photo

queries: David Waller +44 (0)1494 721111, e-mail: dwaller@halmapr.com.

3. This Interim Management Statement has been prepared solely

to provide additional information to the shareholders of Halma

plc, in order to meet the requirements of the UK Listing Authority's

Disclosure and Transparency Rules. It should not be relied

on by any other party, for other purposes. Forward-looking

statements have been made by the Directors in good faith using

information available up until the date that they approved

this statement. Forward-looking statements should be regarded

with caution because of the inherent uncertainties in economic

trends and business risks.

4. A copy of this announcement, together with other information

about Halma, may be viewed on its website: www.halma.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSZMGZNVFMGDZM

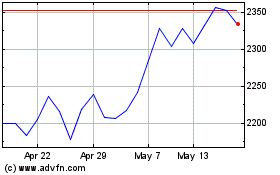

Halma (LSE:HLMA)

Historical Stock Chart

From Jun 2024 to Jul 2024

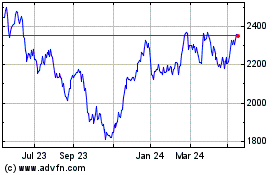

Halma (LSE:HLMA)

Historical Stock Chart

From Jul 2023 to Jul 2024