Pre-close trading statement

December 14 2007 - 2:02AM

UK Regulatory

RNS Number:9104J

Hikma Pharmaceuticals Plc

14 December 2007

Pre-close trading statement

LONDON, 14 December 2007 - Hikma Pharmaceuticals PLC ("Hikma") (LSE: HIK) (DIFX:

HIK), the multinational pharmaceuticals group, announces that it has seen strong

growth in the year to date and continues to expect to deliver full year revenue

growth of close to 40%. Excluding the acquisitions of Ribosepharm, Thymoorgan

and Alkan Pharma ("Alkan"), we expect to deliver organic revenue growth in the

mid 20% range. We expect gross margin for the Group will be close to 50%.

The Branded business, which is a market leader in the Middle East and North

Africa (MENA), has been performing particularly well and is expected to deliver

revenue growth in the mid 40% range for the full year. This has been driven by

strong organic growth across all the MENA markets, as well as by the full year's

contribution from JPI, the Saudi-based business that became a wholly owned

subsidiary in the second half of 2006, and Alkan, our recent acquisition in

Egypt.

The Injectables business has also maintained a strong performance in the second

half of the year and we currently expect this business to deliver strong organic

sales growth in the mid 20% range and close to 80% growth including

acquisitions. We are very pleased to announce that our new cephalosporin plant

in Portugal has now been accepted by the FDA for exports to the US market.

We expect the Generic business to deliver single digit sales growth in 2007,

compared to 2006, driven by higher volumes and the contribution from new product

launches. As expected this growth has been achieved at lower prices, which

reflect the more competitive market environment. Irrespective of the outcome of

any future solicitation for the supply of the Lisinopril, we expect to maintain

2007 Generic sales levels in 2008 driven by new and recent product launches, but

expect further pressure on margins.

Commenting on the Group's performance, Said Darwazah, CEO said, 'Hikma is

performing well and we expect 2007 will be another year of strong growth,

particularly in the MENA region and in Injectables. We are pleased with the

ongoing development of the Group and are excited about the opportunities that we

have created this year through the acquisitions of APM, our two new oncology

businesses and Alkan, and look forward to continued growth in 2008.'

Hikma will enter its close period on 12 January 2008 ahead of the announcement

of its results for the twelve months ending 31 December 2007, which will be made

on 12 March 2008.

- ENDS -

Enquiries:

Hikma Pharmaceuticals PLC

Susan Ringdal +44 20 7399 2760

Investor Relations Director

Brunswick Group

Jon Coles / Justine McIlroy / Alex Tweed +44 20 7404 5959

About Hikma

Hikma Pharmaceuticals PLC is a fast growing multinational group focused on

developing, manufacturing and marketing a broad range of both branded and

non-branded generic and in-licensed products. Hikma operates through three

businesses: "Branded", "Injectables" and "Generics", based principally in the

Middle East and North Africa ("MENA"), where it is a market leader and sells

across 18 countries, the United States and Europe. In 2006, Hikma achieved

revenues of $317 million (2005 $262 million) and profit attributable to

shareholders was $55 million (2005 $44 million). At 31 December 2006, the Group

had over 2,400 employees. For news and other information, please visit

www.hikma.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTGGMMZLFKGNZM

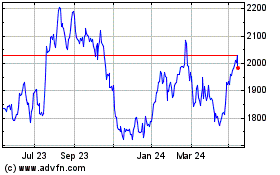

Hikma Pharmaceuticals (LSE:HIK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Hikma Pharmaceuticals (LSE:HIK)

Historical Stock Chart

From Jul 2023 to Jul 2024