TIDMHEIQ

RNS Number : 0824O

HeiQ PLC

29 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596) which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

29 September 2023

HeiQ Plc

("HeiQ" or the "Company" or the "Group")

Accounts update

Further to its AGM Statement announced on 29 June 2023, the

Company provides the following update on the progress of its

audited accounts for the year ended 31 December 2022 ("2022

Accounts") alongside an update on current trading for the six

months ended 30 June 2023.

Accounts update

The Company is concluding its annual report and audit in

conjunction with its auditor, Deloitte LLP and expects to publish

its Full Year 2022 Accounts shortly, together with its interim

results, following which the Company expects trading in its shares

to recommence.

Following the completion of several acquisitions, the Group has

grown significantly in terms of capabilities and technology

platforms but also in terms of organizational complexity. The

Company has seen a number of businesses with different systems,

processes and cultures join the Group since 2017 and, in

particular, during 2021. To integrate the different businesses, the

Group commenced the harmonization of processes, systems, and

operating practices across the organization in 2022. While this is

a challenging project for any organization, the significant changes

in market conditions in the year have made this process more

onerous. All of these factors contributed to a significantly

extended year end reporting timetable for 2022, with a related

impact on the timing of the external audit work.

Previous announcements detailed the challenging market

conditions that HeiQ has been enduring, which have impacted top

line performance and Group profitability. Whilst management

considers the Company to be performing better than many of its

peers, the significant disruption in market demand across HeiQ's

value chains has impacted the Company's financial performance for

FY2022. HeiQ expects to report FY2022 revenue in line with the most

recently published guidance but gross profit and loss from

operations for FY 2022 are expected to be materially below previous

market guidance as the significant drop in market demand has

required HeiQ to review aspects of the accounting processes which

rely on significant judgement. Key factors impacting profitability

are set out below:

-- Goodwill from acquisitions: The challenging market dynamics

impaired the ability of its recently acquired businesses to achieve

their initial business plans. Reviewing key judgements inherent in

the Company's impairment review, including operating margins and

long-term growth rates, has caused significant goodwill impairments

in the period.

-- Inventory valuation: Judgements surrounding allowances

required for inventory have also been reassessed to reflect

management's updated views on recoverability and caused the

recording of significant allowances on inventory.

Furthermore, in the process of reviewing significant judgements

with the auditors also for the prior year, the Company has had to

record prior year restatements. Specifically, restatements have

been recorded around impairment of goodwill from acquisitions as

well as in relation to the accounting treatment of a significant

take-or-pay contract. This contract has been renegotiated in 2023

and accounts receivable have been waived in exchange for a right of

first refusal on the supply of a wide product range to a large

industry player. While the Group is confident that the amendment to

this contract will be beneficial going forward, the historical

accounting treatment of this contract has been reviewed and it was

determined that a restatement of prior year reported revenue and

profits is appropriate, as recognition criteria had not been

met.

The cash balance as of 31 December 2022 was US$8.5 million, in

line with market guidance. To manage its cash balance, the Group

has access to credit facilities totalling CHF9 million

(approximately US$9.8 million). The facilities are in place with

two different banks and both contracts have materially the same

conditions. The facilities are not limited in time, can be

terminated by either party at any time and allow overdrafts and

fixed cash advances with a duration of up to twelve months. In case

one or the other party terminates the agreement, fixed cash

advances become due upon their defined maturity date. While the

facilities are not committed, the Board has not received any

indication from financing partners that the facilities are at risk

of being terminated. Nevertheless, the Board acknowledges the

uncommitted status of the facilities which could be terminated

requiring the refinancing of debts, and which casts material

uncertainty on the going concern assessment. The Board therefore

expects the auditor to make reference to this material uncertainty

in their audit opinion. The Board is in discussions with financial

institutions to replace the currently uncommitted credit facilities

by committed, long-term facilities, but the outcome of these

discussions remain uncertain.

As at June 30, 2023, the Company had cash balances amounting to

US$7.3 million with a total of CHF6.3 million drawn under the

facilities.

Current trading and outlook

Since the start of FY 2023, HeiQ has focused on reducing its

cost base and reorganizing the business, and the Company is pleased

to report that it is already seeing the benefits of this. Whilst

the Board has not yet seen the challenges abate in H1 2023, the

action taken since the start of the year means the Company is

expected to be in a better position in H2 2023 to manage the

ongoing challenging macro-economic environment, continue building

value in core innovations and preserve the Company's ability to

deliver when the market demand turns.

For H1 2023, the Company expects to report sales of US$21

million (H1 2022: US$30 million) and a decrease in margins in a

buyers-market, driven by current overcapacity. For H2 2023, the

Company expects a stabilization of the financial performance and

operating cashflows based on implemented cost measures becoming

effective.

The Board believes that the medium and long-term opportunities

for the Company's technology offering remain strong and the

leadership team is focused on gaining market share for the

commercialized core businesses, while also prioritizing innovation

projects which have near-term market potential or significant

long-term value creation potential. Each of HeiQ's key technology

development projects has a significant market opportunity, and the

Company's business infrastructure has been established to ensure

effective rollout globally once market conditions change.

Further detail will be included in the Company's audited results

for FY 2022 as well as its interim results. Financial reporting on

H1 2023 performance will be published together with the Annual

Accounts 2022.

PDMR Notifications

The Company also announces that, on 26 September 2022, options

over 224,000 new ordinary shares in HeiQ ("Options") were made to

each of Carlo Centonze and Xaver Hangartner pursuant to the

Company's 2022 Option Plan. The Options have a strike price of

70.2p per share, being the trailing 5-day mid-market share price at

the time of grant, a vesting period of three years and are subject

to performance criteria as set out below.

--Vesting of 65% of the Options are conditional upon sales

growth targets. Performance is measured over the years 2022-2024

and the performance target is 7.5% for each individual year or

24.2% compound sales growth over the three years 2022-2024.

--Vesting of 35% of the remaining Options are conditional upon

annual operating margin targets. Performance is measured each year

2022-2024 and the performance target is 25%.

Further information is set out below pursuant to the

requirements of the UK Market Abuse Regulation.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Mr. Carlo Centonze

-------------------------- ---------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------- ---------------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- ---------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name HeiQ plc

-------------------------- ---------------------------------------------

b) LEI 213800IGT65IMJDO4S03

-------------------------- ---------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------

a) Description of the Options over new ordinary shares of 30 pence

financial instrument, each in the Company

type of instrument

Identification code GB00BN2CJ299

-------------------------- ---------------------------------------------

b) Nature of the transaction Grant of options pursuant to 2022 Company

Share Option Plan

-------------------------- ---------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Exercise price of

70.2p per share 224,000

----------

-------------------------- ---------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ---------------------------------------------

e) Date of the transaction 26 September 2022

-------------------------- ---------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ---------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Xaver Hangartner

-------------------------- ---------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------------

a) Position/status Chief Financial Officer

-------------------------- ---------------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------- ---------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------

a) Name HeiQ plc

-------------------------- ---------------------------------------------

b) LEI 213800IGT65IMJDO4S03

-------------------------- ---------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------

a) Description of the Options over new ordinary shares of 30 pence

financial instrument, each in the Company

type of instrument

Identification code GB00BN2CJ299

-------------------------- ---------------------------------------------

b) Nature of the transaction Grant of options pursuant to 2022 Company

Share Option Plan

-------------------------- ---------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Exercise price of

70.2p per share 224,000

----------

-------------------------- ---------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ---------------------------------------------

e) Date of the transaction 26 September 2022

-------------------------- ---------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ---------------------------------------------

For further information, please contact:

HeiQ Plc

Carlo Centonze (CEO) +41 56 250 68 50

Cavendish Securities plc (Broker) +44 (0) 207 397

Stephen Keys / Callum Davidson 8900

------------------

SEC Newgate (Media Enquiries) +44 (0) 20 3757

Elisabeth Cowell / Molly Gretton / Tom 6882

Carnegie HeiQ@s ecnewgate

.co.uk

------------------

About HeiQ

HeiQ is a Swiss-based international company that innovates

pioneering and differentiating materials in partnership with

established global brands. We bridge the academic and commercial

worlds to conceive performance-enhancing materials and

technologies, working with aligned brands to research, manufacture

and bring products to market, aiming for lab to consumer in months.

Our goal is to improve the lives of billions by innovating the

materials that go into everyday products, making them more

hygienic, comfortable, protective, and sustainable.

Our strong IP portfolio positions us as an innovation leader for

niche, premium and high-margin products in the textile chemicals,

man-made fibers, paints and coatings, antimicrobial plastics,

probiotics and household cleaner markets. We have also expanded

into healthcare facilities, probiotic cleaning, and hygiene

coatings markets to help make hospitals and healthcare environments

more hygienic.

We have developed over 200 technologies in partnership with 300

major brands. With a substantial research and development pipeline,

including key technology development projects HeiQ AeoniQ, HeiQ

ECOS, HeiQ GrapheneX, and HeiQ Synbio, HeiQ aims to deliver

shareholder value through sales growth and entry into new lucrative

markets through disruptive innovation and M&A.

We have built a strong reputation for ESG & sustainable

innovation, having won multiple awards including the Swiss

Technology Award twice and the Swiss Environmental Award. Under

experienced leadership, we are committed to driving our profit in

close connection with people and the planet. For more information,

please visit www.heiq.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSEDESAEDSEFU

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

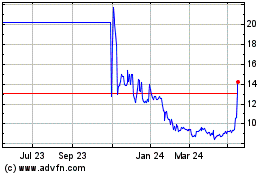

Heiq (LSE:HEIQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

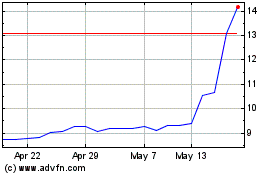

Heiq (LSE:HEIQ)

Historical Stock Chart

From Dec 2023 to Dec 2024