TIDMHEIQ

RNS Number : 1856Z

HeiQ PLC

13 September 2022

September 13, 2022

HeiQ Plc

("HeiQ" or "the Company")

Interim Results for six months to June 30, 2022

Resilient trading and bringing life enhancing technology to

market

HeiQ Plc (LSE:HEIQ), an established global brand in materials

and textile innovation which operates in high-growth markets, is

pleased to announce its interim results for six months to June 30,

2022.

Financial highlights:

-- Revenue increase of 17% to US$ 30.3m (H1 2021: US$ 25.8m),

showing resilience and continued demand

-- Investment by HUGO BOSS (MDAX: BOSS) into HeiQ AeoniQ, the

world's first climate positive fiber to replace polyester (US$

135bn market). A total investment of US$ 10m, structured as

technology milestones & 2.5% equity into HeiQ's Austrian tech

subsidiary at an implied valuation of US$ 200m

-- Sales from HeiQ's ESG-focused "Resource Efficiency" products

increased by 83% compared to H1 2021 and has now become the second

largest functionality in the Group's portfolio

-- Gross margin uplift of 3% to 46.7% compared to previous half

year (H2 2021: 43.7%), reflecting stabilization of underlying

product margins as well as the favorable impact of the product

mix

-- Operating expenditure ("Opex") (respectively selling &

general administration costs) grew to US$ 3.3m or +31% over H1 2021

to US$ 13.9m, in line with the Company's investment budget and

growth strategy

-- Adjusted EBITDA of US$3.5m (1HY 2021: US$4.8m) achieved in

challenging market conditions during a phase of significant

investment in technology

Operational highlights:

-- Completed HeiQ AeoniQ pilot commercialization production

plant in time and on budget; Gained the LYCRA Company as exclusive

distributor

-- Made significant progress with blockbuster tech HeiQ

GrapheneX, demonstrated solid state battery prototype over 1300

cycles, filed a fourth patent & ordered the world's first pilot

commercialization plant

-- Publication of an independent study by Charité University

Hospital Berlin and the Robert Koch-Institute, proving symbiotic

cleaners - like the HeiQ Synbio cleaners - are far more effective

than disinfectants alone, a publication that is now driving

favourable change at regulators for probiotic cleaners in

healthcare

-- Gained Engie, a multibillion player in facility management,

as customer for HeiQ Synbio & Sanpure with the objective to

enter manifold channels at large scale swiftly

-- Launched HeiQ Mint - a durable botanical odour control for

textiles, capable to substitute textile antimicrobial technologies

globally.

Post period-end highlights:

-- Further strengthening of our cash position as significant

amounts of receivables have been collected after balance sheet

date

-- Additional EUR 2.2m paid in into equity of HeiQ AeoniQ LLC by

minority shareholder HUGO BOSS as contractual milestones have been

met

-- Strong H2 2022 performance expected and cautiously optimistic

to meet analyst expectations for the full year

-- Strong US Dollar continues to have a positive impact on the Company's cost structure

Carlo Centonze, co-founder and CEO, HeiQ plc, said:

"Despite the continuing challenging global market conditions and

a 3-month lockdown in our main market China in Q1 2022, we remain

cautiously optimistic and have plans in place to address those

challenges and continue making fast progress with commercialisation

of our disruptive innovative technologies.

HeiQ is very well-positioned to spearhead the decarbonization of

textile, the second most polluting industry in the world. HeiQ

AeoniQ, the world's first climate positive fiber, has made

significant steps towards full market launch in 1HY 2022, and we

remain confident that by the end of the year, first yarns can be

delivered to customers for capsule collections of truly climate

positive bio-degradable or circular apparel items. As such, HeiQ

AeoniQ remains one of our key focus areas for the months and years

ahead. Our ambition remains unchanged to build and operate one or

more full-scale Gigafactories at the beginning of 2025.

We are excited to continue delivering growth and bringing life

enhancing technology to market. The demand for our current and

future technology offering remains sound and we are executing our

long-term growth strategy and strengthening our innovation and

differentiation capabilities as planned. We are actively following

market environment changes and will remain agile to address them

swiftly. "

Analyst Briefing

Carlo Centonze, CEO, and Xaver Hangartner, CFO will host a

webinar for equity analysts at 09:30am BST today. Any equity

analysts wishing to register should contact SEC Newgate at

HeiQ@secnewgate.co.uk where further details will be provided.

This announcement contains inside information.

For further information, please contact:

HeiQ Plc

Carlo Centonze (CEO) +41 56 250 68 50

Cenkos Securities plc (Joint Broker)

Stephen Keys / Callum Davidson +44 (0) 207 397 8900

-------------------------

SEC Newgate (Media Enquiries) +44 (0) 20 3757 6882

Elisabeth Cowell / Axaule Shukanayeva / HeiQ@s ecnewgate .co.uk

Molly Gretton

-------------------------

About HeiQ

HeiQ is focused on improving the lives of billions of people

world-wide by innovating the materials people use every day. HeiQ

has strong IP which is at the forefront of global technology in the

$10 billion antimicrobial fabrics market, $24 billion textile

chemicals market, the $50 billion probiotics market and the $150

billion man-made fibers market. It has also moved into the medical

device, healthcare and hygiene coatings markets, to help make

hospitals and healthcare environments more hygienic. HeiQ aims to

deliver growth for its shareholders through a combination of

increased sales of its core products and by entering additional

lucrative markets through disruptive innovations and M&A.

HeiQ has created some of the most effective, durable and

high-performance technologies in the market today, which cool,

warm, dry, repel, purify, and destroy viruses. Since 2005, HeiQ has

developed over 200 technologies in partnership with 300 major

brands and it has a significant R&D pipeline containing over 50

projects. The Company has won multiple awards and gained a strong

reputation for the ESG & sustainable downstream effect of its

innovations. HeiQ is the only company to have won the Swiss

Technology award twice. It has also won the Swiss Environmental

award with an innovation that saves energy and water consumption

during the textile manufacturing process.

Led by an experienced leadership team, HeiQ researches new

solutions for partners, delivers scaled up manufacturing from its

sites across the world and helps partners market the product to end

consumers - aiming for lab to consumer in months.

Chairwoman's Statement

I am pleased to report that HeiQ continued to demonstrate

resilience during difficult market conditions and made solid

progress in delivering on its growth strategy during the six-month

period ending 30 June 2022 ("H1 2022").

HeiQ's revenues for H1 2022 grew by 17% year on year, and we

were pleased to have increased our overall gross margin compared to

the second half of the 2021 financial year (H2 2021). This was

achieved even though global economies have experienced new

significant turmoil in early 2022, just as things started to

normalize after two years of pandemic. On top of the energy crisis,

pressure on raw material prices continued, and inflation and energy

price rises significantly impacted the markets we operate in.

HeiQ's business from commercialized innovations demonstrated

robustness. While the strengthening of the US Dollar against the

Euro, Swiss Franc and Sterling negatively impacted our sales

(denominated in EUR) the positive effect on our costs outweighed

the topline impact.

As an IP innovator, the development of our innovation pipeline

is a significant growth driver for our business. In this regard, H1

2022 was very successful as we delivered substantial progress on

our four most promising innovation platforms, particularly HeiQ

AeoniQ and HeiQ Synbio.

HeiQ AeoniQ

HeiQ AeoniQ aims to replace oil-based textiles, namely Polyester

which accounts for over 60% of the textile market, with a climate

positive, circular filament yarn made of cellulosic. Having already

proved the concept of the HeiQ AeoniQ yarn in 2021, we achieved

several key commercialization milestones during the period by

installing a pilot production plant, securing investment from HUGO

BOSS, and signing up The LYCRA Company as exclusive

distributor.

In H2 2022, we will optimize the product and proprietary

production process for the pilot plant whilst also gearing up

towards delivery of the first large-scale production plant. This is

likely to be located in Portugal and is expected to come on-stream

in 2025. Unlike polyester or other textile yarns, HeiQ AeoniQ is

designed to have a positive carbon balance and as such we are also

progressing in getting the carbon credits certified.

HeiQ Synbio

HeiQ Synbio allows detergents to become much more effective than

disinfectants used today. It significantly reduces surface

pathogens and antimicrobial resistance which is particularly

important for detergents used in hospitals. In H1 2022, we achieved

significant milestones on the way to establish symbiotic detergents

as a new standard in hospital cleaning. An independent study by the

opinion leading Charité University Hospital Berlin, and the Robert

Koch-Institute proved symbiotic cleaners far more effective than

disinfectants alone. This positions the HeiQ Synbio platform well

given that we are seeing that upcoming European Union regulations

are expected to favor symbiotic cleaners. With this is mind, we

have entered negotiations with major players in the cleaning supply

chain with the objective to enter various channels at large scale

swiftly.

Financial Review

Revenues

Total revenues in H1 2022 increased by 17% to US$ 30.3m compared

to the prior year period (H1 2021: US$ 25.8m). Our "Hygiene"

functionality continues to be our largest, comprising 43% of total

revenues (US$ 12.9m in H1 2022), despite the 6% year on year

decline in this area mainly due to further reduced sales in masks

and lockdowns in China.

With US$10.2m in revenue in H1 2022, "Resource Efficiency" has

grown an impressive +83% compared to H1 2021 and has now become the

second largest functionality in the Group. Driven by revenues from

HeiQ AeoniQ and Innovation Services as well as existing process

chemicals, it now represents 34% of total revenues.

In line with our strategy to increase the share of revenue from

services, license, and royalties, H1 2022 saw revenues of this

nature increase from US$1.2m in H1 2021 to US$ 3.9m in H1 2022.

Gross margin

At 46.7%, gross margin for H1 2022 has improved since the

previous half year (H2 2021: 43.7%). The uplift of 3% reflects

stabilization of underlying product margins as well as the

favorable impact of the product mix (including higher share of

Services & Licensing/TechFee revenues). Compared to H1 2021,

the gross margin is still down 3.5% points (H1 2021: 50.2%) but we

remain optimistic that price increases delivered during the period

can narrow the gap in the coming months.

Opex

Our operating expenditure ("Opex") (respectively selling &

general administration costs) grew US$ 3.3m or 31% over H1 2021 to

US$13.9m. Opex located in acquired entities account for an increase

of US$ 1.9m. The remaining increase is driven by higher personnel

expense, investments in building up the HeiQ AeoniQ team as well as

in the organizational structure and systems in general.

Cash

Our cash position as of June 30 2022 is US$ 9.5m, down from US$

14.5m as at December 31, 2021. About 60% of this decrease is

related to investing and financing activities as well as exchange

rate effects on cash balances. Investments totaled US$ 4.6m

including US$1.6m installment payments for prior period

acquisitions. At the same time, we raised US$ 2.3m (net) through

financing activities (mainly the sale of a minority stake in HeiQ

AeoniQ LLC).

Cash generated from operations (before tax payments) was US$

-1.5m. This decrease was primarily due to investments in working

capital of US$ 4.2m. Compared to December 31, 2021, we increased

our inventories by US$ 2.4m after strong sales towards the end of

2021 and build-up of inventories for key items. With US$ +1.4m,

receivables also show a significant increase as of June 30 2022,

compared to December 31 2021. This is mainly driven by two

circumstances: At the end of H1 22, after achievement of

contractual agreed milestones, we invoiced HUGO BOSS US$ 3m, which

was collected in July 2022. Also, due to lockdowns, we faced delays

of payments into H2 2022 from certain Chinese distributors.

Results

Six months Six months

to to Year ended

December

June 30, June 30, 31,

2022 2021 2021

Comprehensive income US$'000 US$'000 US$'000

------------------------------------ ---------- ---------- ----------

Revenue 30,280 25,795 57,874

Cost of sales (16,127) (12,840) (30,898)

Gross profit 14,153 12,955 26,976

Other operating income 2,671 3,166 6,426

Selling and general administrative

expenses (13,878) (10,576) (24,465)

Other operating expenses (1,706) (2,238) (5,820)

------------------------------------ ---------- ---------- ------------

Operating profit 1,240 3,307 3,117

------------------------------------ ---------- ---------- ------------

Depreciation of property, plant and

equipment 644 591 1,255

Amortization of intangible assets 535 205 758

Depreciation of right-of-use assets 576 279 855

Share options and rights granted

to Directors and employees 486 387 498

Adjusted EBITDA 3,481 4,769 6,483

EBITDA Margin (adjusted) 11.5% 18.5% 11.2%

------------------------------------ ---------- ---------- ------------

Outlook

Despite the continued challenging global market conditions, we

remain cautiously optimistic that market expectations will be met

for the full year 2022.

The demand for our current and future technology offering

remains sound. We are executing our long-term growth strategy and

strengthening our innovation and differentiation capabilities as

planned. Our sales are traditionally stronger in the second half of

the year. We expect several projects to start adding sales in the

remaining months as well as securing additional revenues from

milestone achievements related to HeiQ AeoniQ. Now that lockdowns

in China have ceased, we expect sales in China to gain momentum in

H2 2022.

Having already executed price increases during the period to

combat inflationary pressures, we are confident that gross margins

will continue to recover.

If we look to the mid-term, HeiQ is very well positioned to

spearhead the decarbonization of the textile industry. The

development of HeiQ AeoniQ is progressing as planned and we remain

confident that by the end of the year, yarn can be delivered to

customers for first capsule collections of truly carbon negative

apparel items. As such, HeiQ AeoniQ remains one of our key focus

areas for the months and years ahead. Our ambition remains

unchanged to commission, a full-scale production site at the

beginning of 2025.

We are excited to continue delivering growth and bringing life

enhancing IP to market and thank our shareholders, customers, team

and advisers for their support.

Esther Dale-Kolb

Chairwoman

September 13, 2022

Condensed consolidated statement of comprehensive income

For the six months ended June 30, 2022

Six months Six months

to to Year ended

December

June 30, June 30, 31,

2022 2021 2021

Comprehensive income Note US$'000 US$'000 US$'000

------------------------------------ ---- ---------- ----------- ----------

Revenue 6 30,280 25,795 57,874

Cost of sales 7 (16,127) (12,840) (30,898)

------------------------------------ ---- ---------- ----------- ------------

Gross profit 14,153 12,955 26,976

------------------------------------ ---- ---------- ----------- ------------

Other operating income 6 2,671 3,166 6,426

Selling and general administrative

expenses 7 (13,878) (10,576) (24,465)

Other operating expenses 7 (1,706) (2,238) (5,820)

------------------------------------ ---- ---------- ----------- ------------

Operating profit 1,240 3,307 3,117

------------------------------------ ---- ---------- ----------- ------------

Other income 77 38 199

Other costs (29) (213) (361)

Finance income 442 520 534

Finance costs 17 (537) (282) (597)

Income before taxation 1,193 3,370 2,686

Taxation 8 (287) (522) (212)

------------------------------------ ---- ---------- ----------- ------------

Income after taxation 906 2,848 2,474

------------------------------------ ---- ---------- ----------- ------------

Earnings per share (cents) -

basic 9 0.84 2.46 2.07

Earnings per share (cents) -

diluted 9 0.81 2.38 2.01

------------------------------------ ---- ---------- ----------- ------------

Other comprehensive income

Exchange differences on translation

of foreign operations (1,970) (1 , 723) (1,662)

------------------------------------ ---- ---------- ----------- ------------

Items that may be reclassified

to profit or loss in subsequent

periods (1,970) (1,723) (1,662)

Actuarial gains / (losses) from

defined benefit pension plans - - 899

------------------------------------ ---- ---------- ----------- ------------

Items that will not be reclassified

to profit or loss in subsequent

periods - - 899

------------------------------------ ---- ---------- ----------- ------------

Total comprehensive income for

the period/year (1,064) 1,125 1,711

------------------------------------ ---- ---------- ----------- ------------

Income attributable to:

Equity holders of HeiQ 1,112 3,126 2,676

Non-controlling interests (206) (278) (202)

------------------------------------ ---- ---------- ----------- ------------

906 2,848 2,474

------------------------------------ ---- ---------- ----------- ------------

Comprehensive income / (loss)

attributable to:

Equity holders of the Company (858) 1,403 1,913

Non-controlling interests (206) (278) (202)

------------------------------------ ---- ---------- ----------- ------------

(1,064) 1,125 1,711

------------------------------------ ---- ---------- ----------- ------------

Condensed consolidated statement of financial position

As at June 30, 2022

As at As at

June 30, December

31,

2022 2021

Assets Note US$'000 US$'000

----------------------------------- ----- ---------- -----------

Intangible assets 10 33,448 32,212

Property, plant and equipment 11 6,823 6,865

Right-of-use assets 12 9,114 9,079

Deferred tax assets 8 874 701

Other non-current assets 153 333

----------------------------------- ----- ---------- -----------

Non-current assets 50,412 49,190

----------------------------------- ----- ---------- -----------

Inventories 16,184 13,770

Trade receivables 13 21,512 18,050

Other receivables and prepayments 5,143 6,275

Cash and cash equivalents 9,488 14,560

----------------------------------- ----- ---------- -----------

Current assets 52,327 52,655

----------------------------------- ----- ---------- -----------

Total assets 102,739 101,845

----------------------------------- ----- ---------- -----------

Equity and Liabilities

----------------------------------- ----- ---------- -----------

Share capital 14 53,023 51,523

Capital reserve 14 147,583 144,191

Other reserve (1,144) (1,144)

Share-based payment reserve 14 889 474

Merger reserve (126,912) (126,912)

Currency translation reserve (695) 1,275

Retained deficit (2,249) (5,823)

----------------------------------- ----- ---------- -----------

Equity attributable to owners

of the parent 70,495 63,584

Non-controlling interests 601 1,053

----------------------------------- ----- ---------- -----------

Total equity 71,096 64,637

----------------------------------- ----- ---------- -----------

Lease liabilities 12 7,977 8,176

Long-term borrowings 17 668 670

Deferred tax liability 8 1,737 1,894

Other non-current liabilities 16 2,293 2,619

----------------------------------- ----- ---------- -----------

Total non-current liabilities 12,675 13,359

----------------------------------- ----- ---------- -----------

Trade and other payables 7,928 9,359

Accrued liabilities 4,100 4,538

Income tax liability 8 111 51

Deferred revenue 3,972 1,774

Short-term borrowings 17 1,503 1,004

Lease liabilities 12 1,262 1,054

Other current liabilities 18 92 6,069

----------------------------------- ----- ---------- -----------

Total current liabilities 18,968 23,849

----------------------------------- ----- ---------- -----------

Total liabilities 31,643 37,208

----------------------------------- ----- ---------- -----------

Total liabilities and equity 102,739 101,845

----------------------------------- ----- ---------- -----------

The Notes form an integral part of these Condensed Consolidated

Financial Statements. The Financial Statements were approved and

authorized for issue by the Board of Directors on September 12,

2022 and signed on its behalf by:

Xaver Hangartner

Chief Financial Officer

September 12, 2022

Condensed consolidated statement of changes in shareholders'

equity

For the six months ended June 30, 2022

Share-

based Currency Non-

Share Capital Other payment Merger translation Retained controlling Total

capital reserve reserve reserve reserve reserve deficit interests equity

Note US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

-------------- ----- -------- -------- -------- -------- ---------- ----------- -------- ----------- -------

Balance at January 1,

2021 49,559 134,537 (2,043) 50 (126,912) 2,937 (8,499) (20) 49,609

Income after taxation - - - - - 2,676 (202) 2,474

Other comprehensive

(loss)/income - - 899 - - (1,662) - - (763)

Total comprehensive

(loss)/income for

the year - - 899 - - (1,662) 2,676 (202) 1,711

--------------------- -------- -------- -------- -------- ---------- ----------- -------- ----------- -------

Issuance of shares 1,964 9,654 - - - - - - 11,618

Share-based payment

charges - - - 424 - - - - 424

Amounts arising on

business

combinations - - - - - - - 1,275 1,275

--------------------- -------- -------- -------- -------- ---------- ----------- -------- ----------- -------

Transactions with

owners 1,964 9,654 - 424 - - - 1,275 13,317

--------------------- -------- -------- -------- -------- ---------- ----------- -------- ----------- -------

Balance at December

31, 2021 51,523 144,191 (1,144) 474 (126,912) 1,275 (5,823) 1,053 64,637

--------------------- -------- -------- -------- -------- ---------- ----------- -------- ----------- -------

Income after taxation - - - - - - 1,112 (206) 906

Other comprehensive

(loss)/income - - - - - (1,970) - - (1,970)

Total comprehensive

(loss)/income for the year - - - - - (1,970) 1,112 (206) (1,064)

----------------------------- ------- -------- -------- ---- ---------- -------- -------- ------ --------

Issuance of shares 14 1,500 3,392 - - - - - - 4,892

Share-based payment charges 14 - - - 415 - - - - 415

Dividends paid to minority

shareholders 15 - - - - - - - (243) (243)

Transfer on disposal of

non-controlling interest 4 - - - - - - 2,462 (3) 2,459

Transactions with owners 1,500 3,392 - 415 - - 2,462 (246) 7,523

Balance at June 30, 2022 53,023 147,583 (1,144) 889 (126,912) (695) (2,249) 601 71,096

----------------------------- ------- -------- -------- ---- ---------- -------- -------- ------ --------

Condensed consolidated statement of cash flows

For the six months ended June 30, 2022

Six months Six months

to to Year ended

December

June 30, June 30, 31,

2022 2021 2021

US$'000 US$'000 US$'000

------------------------------------------- ----------- ----------- -----------

Cash flows from operating activities

Income before taxation 1,193 3,370 2,686

Cash flow from operations reconciliation:

Depreciation and amortization 1,755 1,075 2,868

Impairment expense - - 144

Gain on disposal of property,

plant and equipment (9) - (54)

Loss on disposal of property,

plant and equipment 12 - 20

Gain on earnout consideration - - (80)

Finance costs 54 160 221

Finance income (1) (5) (18)

Pension expense 117 132 156

Non-cash equity compensation 486 387 498

Gain from lease modification (68) - -

Foreign exchange differences (860) (118) (877)

Working capital adjustments:

Decrease (Increase) in inventories (2,414) 2,369 2,028

Decrease (Increase) in trade and

other receivables (1,397) 455 (4,741)

Increase (decrease) in trade and

other payables

, accrued liabilities and deferred

revenue (342) (3,489) 3,092

------------------------------------------- ----------- ----------- -----------

Cash generated from operations (1,474) 4,336 5,943

------------------------------------------- ----------- ----------- -----------

Taxes paid (529) (1,442) (2,462)

------------------------------------------- ----------- ----------- -----------

Net cash generated from operating

activities (2,003) 2,894 3,481

------------------------------------------- ----------- ----------- -----------

Cash flows from investing activities

Consideration paid for acquisitions

of businesses (1,587) (8,444) (10,994)

Cash assumed on acquisitions of

businesses - 2,121 2,137

Purchase of property, plant and

equipment (1,060) (284) (994)

Proceeds from the disposal of

property, plant and equipment 37 66 138

Development and acquisition of

intangible assets (1,946) (1,329) (2,969)

Finance income 1 5 18

------------------------------------------- ----------- ----------- -----------

Net cash from / (used in) investing

activities (4,555) (7,865) (12,664)

------------------------------------------- ----------- ----------- -----------

Cash flows from financing activities

Finance costs (54) (160) (221)

Repayment of leases (521) (263) (790)

Proceeds from disposals of minority 2,459 - -

interests

Proceeds from borrowings 818 472 472

Repayment of borrowings (163) (113) (803)

Dividends paid to minority shareholders (243) - -

------------------------------------------- ----------- ----------- -----------

Net cash (used in) / from financing

activities 2,296 (64) (1,342)

------------------------------------------- ----------- ----------- -----------

Net increase (decrease) in cash

and cash equivalents (4,262) (5,035) (10,525)

Cash and cash equivalents - beginning

of the year 14,560 25,695 25,695

Effects of exchange rate changes

on the balance of cash held in

foreign currencies (810) (750) (610)

------------------------------------------- ----------- ----------- -----------

Cash and cash equivalents - end

of the period/year 9,488 19,910 14,560

------------------------------------------- ----------- ----------- -----------

Note: Non-cash transactions: Certain shares were issued during

the year for a non-cash consideration as described in Note 14.

Notes to the Consolidated Financial Statements for the six

months ended June 30, 2022

1. General information

HeiQ PLC (the "Company") and its subsidiaries (together, the

"Group") is an IP innovator and established global brand in

materials and textile innovation, adding hygiene, comfort,

protection and sustainability to the products we use every day.

Active in multiple markets: textiles, carpets, antimicrobial

plastics, conductive coatings, medical devices, probiotic household

cleaners, personal care and hospital hygiene, HeiQ has created some

of the most effective, durable and high-performance technologies in

these markets today. The principal activity of the Company is that

of a holding company for the Group, as well as performing all

administrative, corporate finance, strategic and governance

functions of the Group.

The Company was incorporated on May 14, 2014 as Auctus Growth

Limited, in England and Wales under the Companies Act 2006 with

company number 09040064. The Company was re-registered as a public

company on July 24, 2014. On December 4, 2020, following a reverse

takeover of Swiss-based HeiQ Materials AG, the Company's name was

changed to HeiQ PLC. The Company's registered office is 5th Floor,

15 Whitehall, London, SW1A 2DD.

After the reverse takeover, the Company's enlarged share capital

was Re-admitted to the standard segment of the Official List and

initiation of trading on the London Stock Exchange's Main Market

commenced on December 7, 2020 under the ticker "HEIQ". The ISIN of

the Ordinary Shares is GB00BN2CJ299 and the SEDOL Code is

BN2CJ29.

2. Basis of preparation and measurement

a. Basis of preparation

The unaudited condensed consolidated interim financial

statements have been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Conduct Authority and

International Accounting Standard 34 "Interim Financial Reporting"

(IAS 34). Other than as noted below, the accounting policies

applied by the Group in the preparation of these interim financial

statements are the same as those set out in the Company's audited

financial statements for the year ended December 31, 2021. These

financial statements have been prepared under the historical cost

convention except for certain financial and equity instruments that

have been measured at fair value.

These condensed financial statements do not include all of the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Company's financial position

and performance since the audited financial statements for the year

ended December 31, 2021.

Statutory accounts for the year ended December 31, 2021 have

been filed with the Registrar of Companies and the auditor's report

was unqualified, did not contain any statement under Section 498(2)

or 498(3) of the Companies Act 2006 and did not contain any matters

to which the auditors drew attention without qualifying their

report.

The condensed interim financial statements are unaudited and

have not been reviewed by the auditors and were approved by the

Board of Directors on September 9, 2022.

Unless otherwise stated, the Condensed Consolidated Financial

Statements are presented in United States Dollars ($) which is the

presentational currency of the Group, and all values are rounded to

the nearest thousand dollars except where otherwise indicated.

b. Going concern

The Interim Financial Statements have been prepared on the going

concern basis, which contemplates the continuity of normal business

activity and the realization of assets and the settlement of

liabilities in the normal course of business. The Directors have

reviewed the Group's overall position and outlook and are of the

opinion that the Group is sufficiently well funded to be able to

operate as a going concern for at least the next twelve months from

the date of signing these financial statements.

c. Basis of consolidation

The Condensed Consolidated Financial Statements comprise the

financial statements of the Company and its subsidiaries.

On December 7, 2020, HeiQ Plc became the legal parent of HeiQ

Materials AG by way of reverse acquisition. The cost of the

acquisition is deemed to have been incurred by HeiQ Materials AG,

the legal subsidiary, in the form of equity instruments issued to

the owners of the legal parent. This acquisition has been accounted

for as a reverse acquisition.

Business combinations other than reverse acquisitions are

accounted for under the acquisition method.

d. New standards, interpretations and amendments effective for the current period

The following new standards and amendments were effective for

the first time in these financial statements but did not have a

material effect on the Group:

- Annual Improvements to IFRS: 2018-2020 Cycle

- Conceptual Framework for Financial Reporting (Amendments to IFRS 3)

- IAS 37 Provisions, Contingent Liabilities and Contingent

Assets (Amendment - Onerous Contracts - Cost of Fulfilling a

Contract)

- IAS 16 Property, Plant and Equipment (Amendment - Proceeds before Intended Use)

3. Significant accounting policies

The Company has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2021 financial statements.

New and amended standards and Interpretations issued by the IASB

that will apply for the first time in the next annual financial

statements are not expected to impact the Group as they are either

not relevant to the Group's activities or require accounting which

is consistent with the Group's current accounting policies.

Use of estimates and judgements

There have been no material revisions to the nature and amounts

of estimates of amounts reported in prior periods.

4. Significant events and transactions

Disposal of non-controlling interest in HeiQ AeoniQ LLC

On February 11, 2022, HeiQ Materials AG reached an agreement

with Hugo Boss AG to dispose of 2.5% of its shareholding in HeiQ

AeoniQ LLC.

HeiQ AeoniQ LLC is the exclusive licensee of the AeoniQ

technology under an intragroup license agreement (the "HeiQ AeoniQ

License") between HeiQ and HeiQ AeoniQ LLC dated February 4,

2022.

The consideration for the transfer of such shares to Hugo Boss

was EUR875 (approximately US$1,000). Additionally, Hugo Boss agreed

to pay an amount of EUR2,229,125 into the capital reserves of HeiQ

AeoniQ LLC.

The sale and transfer of the shares in HeiQ AeoniQ LLC was

agreed on February 11, 2022 and the payment into the capital

reserves of HeiQ Aeonic LLC was collected in March 2022.

Furthermore, after HeiQ fulfilled certain contractually agreed

milestones, Hugo Boss paid an additional amount of EUR2,200,000

(approx. US$ 2,459,000) into the capital reserves of HeiQ AeoniQ

LLC in July 2022.

The effect of the disposal on the Group's financial statements

is summarized as follows:

Condensed consolidated statement of changes in shareholders'

equity US$'000

--------------------------------------------------------------- -------

Retained deficit 2,462

Non-controlling interests (3)

Equity 2,459

--------------------------------------------------------------- -------

Condensed consolidated statement of cash flows US$'000

--------------------------------------------------------------- -------

Proceeds from disposals of

non-controlling interests 2,459

Net cash (used in) / from

financing activities 2,459

--------------------------------------------------------------- -------

The net liabilities of HeiQ AeoniQ LLC were valued at US$136,000

as at February 11, 2022. Therefore, the value of the 2.5%

shareholding disposed was valued at US$3,000.

5. Segmental reporting

The Directors consider that the Group has one reportable

segment, that of materials innovation which focuses on scientific

research, manufacturing and consumer ingredient branding.

Accordingly, all revenues, operating results, assets and

liabilities are allocated to this activity.

The Group also analyses and measures its performance into

geographic regions, specifically Europe, North & South America

and Asia.

6. Revenue and other operating income

The Group's activities are materials innovation which focuses on

scientific research, manufacturing and consumer ingredient

branding. The primary source of revenue is the production and sale

of functional ingredients, materials, and finished goods. Other

sources of revenues include research and development services as

well as laboratory work.

The Group classifies the functionalities of the different type

of products into the functionalities of Comfort, Hygiene,

Protection and Resource efficiency.

Revenues were mainly generated in regions Europe, North &

South America and Asia. The following table reconciles HeiQ Group's

revenue for the periods presented:

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Revenue by type of product US$'000 US$'000 US$'000

------------------------------- ------------- ---------- -------------

Revenue recognized at point

in time

Functional ingredients 21,156 19,890* 43,661

Functional materials 434 249 850

Functional consumer goods 4,803 4,469* 10,069

Services, royalties and others 3,179 1,187 2,692

Revenue recognized over time

Licenses 707 - 602

Total revenue 30,280 25,795 57,874

------------------------------- ------------- ---------- -------------

*The comparative analysis of revenue for the six months ended

June 30, 2021 has been restated to more fairly reflect the revenues

from each product consistent with the analysis presented in the

audited financial statements for the year ended December 31,

2021.

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Revenue by functionality US$'000 US$'000 US$'000

------------------------- ------------- ---------- -------------

Comfort 5,689 5,419 12,979

Hygiene 12,912 13,790 29,314

Protection 1,439 997 2,076

Resource efficiency 10,241 5,589 13,505

Total revenue 30,280 25,795 57,874

------------------------- ------------- ---------- -------------

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Revenue by territory US$'000 US$'000 US$'000

------------------------- ------------- ---------- -------------

North & South America 11,820 9,551 21,689

Asia 8,955 8,880 19,636

Europe 9,327 7,093 16,237

Others 177 271 312

Total revenue 30,280 25,795 57,874

------------------------- ------------- ---------- -------------

During the period ended June 30, 2022, no customer individually

totaled more than 10% of total revenues (2021: one customer).

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Other operating income US$'000 US$'000 US$'000

----------------------------- ------------- ---------- -------------

Foreign exchange gains 2,334 2,030 5,032

Other 337 1,136 1,934

Total other operating income 2,671 3,166 6,426

----------------------------- ------------- ---------- -------------

7. Expenses by nature

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Cost of goods sold US$'000 US$'000 US$'000

-------------------------- ------------- ---------- -------------

Material expenses 12,114 10,033 24,581

Personnel expenses 1,477 1,070 2,164

Depreciation of property,

plant and equipment 342 280 706

Other costs of goods 2,194 1,457 3,447

-------------

Total cost of goods sold 16,127 12,840 30,898

-------------------------- ------------- ---------- -------------

Six months Six months

to to Year ended

June 30, June 30, December 31,

Selling and general administration 2022 2021 2021

expenses US$'000 US$'000 US$'000

----------------------------------------- ---------- ---------- -------------

Personnel expenses 7,808 5,468 13,074

Depreciation of property, plant

and equipment 302 311 549

Amortization of intangible assets 535 205 758

Depreciation of right-of-use assets 576 279 855

Other 4,657 4,313 9,229

Total selling and general administration

expenses 13,878 10,576 24,465

----------------------------------------- ---------- ---------- -------------

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Personnel expenses US$'000 US$'000 US$'000

-------------------------- ------------- ---------- -------------

Wages and salaries 7,930 5,363 12,708

Social security and other

payroll taxes 624 471 1,387

Pension costs 244 317 645

Share-based payments 486 387 498

Total personnel expenses 9,285 6,538 15,238

-------------------------- ------------- ---------- -------------

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Other operating expenses US$'000 US$'000 US$'000

------------------------------- ------------- ---------- -------------

Foreign exchange losses 1,620 1,583 4,671

Impairment expense - - 144

Other 86 655 1,005

Total other operating expenses 1,706 2,238 5,820

------------------------------- ------------- ---------- -------------

8. Taxation

The components of the provision for taxation on income included

in the "Condensed Consolidated Statement of Other Comprehensive

Income" are summarized below:

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Current income tax expense US$'000 US$'000 US$'000

--------------------------------- ------------- ---------- -------------

Swiss corporate income taxes 30 (6) (282)

United States state and federal

taxes 383 314 (33)

Taiwan corporate income taxes 78 83 200

Belgium corporate income taxes 76 176 186

Germany corporate income taxes (17) 127 301

Others 79 4 39

Total current income tax expense 629 698 411

--------------------------------- ------------- ---------- -------------

Six months

Six months to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Deferred income tax expense US$'000 US$'000 US$'000

---------------------------- ------------- ---------- -------------

Switzerland (69) (78) (190)

China (128) - (146)

United States (71) - 138

Spain - (38) 108

Others (74) (60) (109)

Total deferred income tax

expense (income) (342) (176) (199)

---------------------------- ------------- ---------- -------------

Total income tax expense 287 522 212

------------------------- --- --- ---

Six months

ended Year ended

June 30, December 31,

2022 2021

Tax liability US$'000 US$'000

--------------------------- ---------- -------------

Opening balance 51 1,495

Tax liability acquired in

business combinations - 638

Income tax expense for the

period / year 629 411

Taxes paid (529) (2,462)

Foreign currency movements (40) (31)

Closing balance 111 51

--------------------------- ---------- -------------

The Group had net deferred tax liabilities of US$863,000 as at

June 30, 2022 (Net deferred tax liabilities of US$ 1,193,000 at

December 31, 2021).

The components of the net deferred income tax assets and

liabilities are as follows:

Period ended Year ended

June 30, December 31,

2022 2021

Deferred taxes US$'000 US$'000

-------------------------------------- ------------ -------------

Deferred tax assets

Pension fund obligations 433 429

Tax losses recognized 285 178

Share-based payment expense 136 88

Others 16 6

Total deferred tax assets 874 701

-------------------------------------- ------------ -------------

Deferred tax liabilities

Capital allowances and depreciation (1,737) (1,894)

Total deferred tax liabilities (1,737) (1,894)

-------------------------------------- ------------ -------------

Net deferred tax assets (liabilities) (863) (1,193)

-------------------------------------- ------------ -------------

As at June 30, 2022, the Group had approximately US$285,000 of

tax losses available to be carried forward against future profits

(December 31, 2021: US$178,000; June 30, 2021: US$327,000).

In applying judgement in recognizing deferred tax assets,

management has critically assessed all available information,

including future business profit projections and the track record

of meeting forecasts. Management expects the deferred tax asset to

be substantially recovered in 2022.

9. Earnings per share

The calculation of earnings per share is based on the following

earnings and number of shares:

Six months Six months

to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Earnings per share US$'000 US$'000 US$'000

----------------------------------- ----------- ----------- -------------

Profit after tax attributable

to owners of the Company 1,112 3,126 2,676

Basic earnings per share (cents) 0.84 2.46 2.07

Diluted earnings per share (cents) 0.81 2.38 2.01

Basic weighted average number

of shares in issue 131,781,726 127,214,811 128,871,639

Diluted weighted average number

of shares in issue 136,936,164 131,222,146 132,718,333

10. Intangible assets

Brands

Internally & Customer Acquired Other intangible

Goodwill developed assets relations technologies assets Total

Cost US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at January 1,

2021 3,516 1,851 295 - 491 6,153

Reclasses - (725) - - 725 -

Additions through

business

combinations 18,599 3,226 2,501 580 24,906

Additions arising

from internal

development - 2,390 - - - 2,390

Other

acquisitions - - - - 579 579

Currency

translation

differences - (7) - - (43) (50)

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at December

31, 2021 22,115 3,509 3,521 2,501 2,332 33,978

Additions arising

from internal

development - 1,840 - - 106 1,946

Currency

translation

differences - (171) - - (50) (222)

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at June 30,

2022 22,115 5,177 3,521 2,501 2,388 35,702

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

Amortization

As at January 1,

2021 - 432 107 - 350 889

Reclasses - (19) - - 19 -

Amortization for

the year - 50 367 177 164 758

Impairment

expense 123 21 - - - 144

Currency

translation

differences - (10) - - (15) (25)

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at December

31, 2021 123 474 474 177 518 1,766

Amortization for

the period - 50 259 125 101 535

Currency

translation

differences - (23) - - (24) (47)

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at June 30,

2022 123 501 733 302 595 2,254

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

Net book value

As at December

31, 2021 21,992 3,035 3,047 2,324 1,814 32,212

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

As at June 30,

2022 21,992 4,676 2,788 2,199 1,793 33,448

------------------ ----------- ----------------- ----------------- ----------------- ----------------- ---------

11. Property, plant and equipment

Machinery and Motor vehicles Computers and Furniture and Land and

equipment software fixtures buildings Total

Cost US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at January 1,

2021 6,779 492 810 132 - 8,213

Additions

through

business

combinations 191 19 24 171 1,675 2,080

Additions 596 67 104 213 14 994

Disposals (30) (37) - (15) (68) (150)

Currency

translation

differences (248) (5) (24) (27) (98) (402)

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at December

31, 2021 7,288 536 914 474 1,523 10,735

Additions 950 2 74 27 7 1,060

Disposals (62) (6) - - - (68)

Currency

translation

differences (394) (6) (45) (30) (123) (598)

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at June 30,

2022 7,782 526 943 471 1,407 11,129

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

Depreciation

As at January 1,

2021 2,002 242 464 38 - 2,746

Charge for the

year 797 118 168 55 117 1,255

Eliminated on

disposal (13) (26) - (7) - (46)

Currency

translation

differences (63) (4) (13) (5) (85)

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at December

31, 2021 2,723 330 619 86 112 3,870

Charge for the

period 380 52 91 57 64 644

Eliminated on

disposal (25) (3) - - - (28)

Currency

translation

differences (125) (3) (32) (7) (13) (179)

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at June 30,

2022 2,953 376 678 136 163 4,306

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

Net book value

As at December

31, 2021 4,565 206 295 388 1,411 6,865

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

As at June 30,

2022 4,829 150 265 335 1,244 6,823

----------------- ---------------- --------------- ---------------- ----------------- ----------------- --------

12. Right-of-use assets

Land and Motor Machinery

buildings vehicles and equipment Total

Cost US$'000 US$'000 US$'000 US$'000

---------------------------------- ----------- ----------- --------------- ---------

As at January 1, 2021 3,701 76 41 3,818

Additions through business

combinations 1,186 300 150 1,636

Additions 5,147 289 393 5,829

Disposals due to expiry

of lease - (33) (9) (42)

Currency translation differences (120) (21) 2 (139)

---------------------------------- ----------- ----------- --------------- ---------

As at December 31, 2021 9,914 611 577 11,102

Additions 7 102 1,572 1,681

Disposals due to expiry

of lease - (36) - (36)

Modification to lease terms* (1,199) - - (1,199)

Currency translation differences (575) (49) (51) (675)

---------------------------------- ----------- ----------- --------------- ---------

As at June 30, 2022 8,147 628 2,098 10,874

---------------------------------- ----------- ----------- --------------- ---------

Depreciation

As at January 1, 2021 1,182 60 12 1,254

Charge for the year 655 89 111 855

Disposals due to expiry

of lease - (32) (9) (41)

Currency translation differences (34) (8) (3) (45)

---------------------------------- ----------- ----------- --------------- ---------

As at December 31, 2021 1,803 109 111 2,023

Charge for the period 442 70 64 576

Disposals due to expiry

of lease - (36) - (36)

Modification to lease terms* (693) - - (693)

Currency translation differences (82) (13) (17) (111)

---------------------------------- ----------- ----------- --------------- ---------

As at June 30, 2022 1,470 131 158 1,760

---------------------------------- ----------- ----------- --------------- ---------

Net book value

As at December 31, 2021 8,111 502 466 9,079

---------------------------------- ----------- ----------- --------------- ---------

As at June 30, 2022 6,677 497 1,940 9,114

---------------------------------- ----------- ----------- --------------- ---------

*The Group agreed to shorten the agreed lease terms of two

existing leases from 2032 to 2027. These modifications have

resulted in a reduction in the total amounts payable under the

leases and a reduction to both of the right-of-use assets and lease

liabilities with effect from the date of modification as

follows:

Before revaluation After revaluation Revaluation

Revaluation US$'000 US$'000

--------------------- ------------------ ----------------- -----------

Right-of-use assets 1,385 879 (506)

Lease liabilities (1,453) (879) 574

Impact on net assets 68 - 68

The impact on net assets was recognized as non-operating

income.

Future minimum lease payments associated with these leases were

as follows:

Six months

ended Year ended

June 30, December 31,

2022 2021

Lease liabilities US$'000 US$'000

------------------------------- ---------- -------------

Not later than one year 1,373 1,115

Later than one year and not

later than five years 4,796 3,689

Later than five years 3,949 5,525

------------------------------- ---------- -------------

Total minimum lease payments 10,118 10,329

Less: Future finance charges (879) (1,099)

Present value of minimum lease

payments 9,239 9,230

------------------------------- ---------- -------------

Six months

ended Year ended

June 30, December 31,

2022 2021

Lease liabilities US$'000 US$'000

------------------------------- ---------- -------------

Current liability 1,262 1,054

Non-current liability 7,977 8,176

------------------------------- ---------- -------------

Present value of minimum lease

payments 9,239 9,230

------------------------------- ---------- -------------

13. Trade receivables

The majority of trade receivables are current, and the Directors

believe these receivables are collectible. The Directors

consistently assess the collectability of these receivables. As at

June 30, 2022, the Directors considered a portion of these

receivables uncollectable and recorded a provision in the amount of

US$1.3 million (June 30, 2021: US$716,000; December 31, 2021:

US$1.5 million).

As at As at

June 30, December 31,

2022 2021

Trade receivables US$'000 US$'000

------------------------------ --------- -------------

Trade receivables 22,784 19,523

Provision for expected credit

loss (1,272) (1,473)

------------------------------ --------- -------------

Total trade receivables 21,512 18,050

------------------------------ --------- -------------

14. Share capital and share options

Movements in the Company's share capital were as follows:

Number Share Capital Totals

of shares capital reserve

No. US$'000 US$'000 US$'000

------------------------------ ----------- -------- -------- -------

Balance as of January 1, 2021 125,891,904 49,559 134,537 184,096

Issue of shares to acquire

Chrisal NV 1,101,928 456 2,526 2,982

Issue of shares to acquire

RAS AG 1,701,821 710 3,946 4,656

Issue of shares to acquire

Life Materials 1,887,883 798 3,182 3,980

Balance as at December 31,

2021 130,583,536 51,523 144,191 195,714

------------------------------- ----------- -------- -------- -------

Issue of shares to vendors

of Life Materials (a) 347,552 141 471 612

Issue of shares as deferred

consideration (b) 3,461,615 1,359 2,921 4,280

Balance as at June 30, 2022 134,392,703 53,023 147,583 200,606

------------------------------- ----------- -------- -------- -------

The par value of all shares is GBP0.30. All shares in issue were

allotted, called up and fully paid.

During the six-month period ended June 30, 2022, the Company

made the following issues of shares:

a) On February 25, 2022, HeiQ Plc issued 347,552 new ordinary

shares of GBP0.30 each in the Company. These shares were allotted

to the vendors of Life Material Technologies Limited to satisfy a

closing working capital adjustment in the amount of US$ 612,000 in

connection with the Company's acquisition of Life in June 2021.

b) On May 12, 2022, HeiQ Plc issued a total of 3,461,615 ordinary shares as part of the deferred consideration paid pursuant to the acquisitions of RAS AG, Regensburg, Germany ("RAS AG") and Life Material Technologies Limited ("LIFE").

- In relation to the acquisition of RAS AG, the Company made a

payment of EUR2.6 million (approximately US$2.88 million), based on

RAS AG's performance for the year ended December 31, 2021. The

deferred consideration was settled entirely through the issue of

2,743,941 ordinary shares in the capital of the Company.

- In relation to the acquisition of LIFE, the Company made a

payment of US$2.8 million, based on LIFE's financial performance

for the year ended December 31, 2021. The deferred consideration

was settled equally in cash (US$1.4 million) and through the issue

of 717,674 ordinary shares (US$1.4 million) in the capital of the

Company. The share issue satisfied earnout payments as part of the

purchase consideration of US$640,000 as well as share-based

payments made as remuneration of US$764,000 which were not part of

the purchase consideration.

Share-based payment expense

Part of the US$764,000 remuneration mentioned above had

previously been accrued for as deferred consideration in relation

to the acquisition of Life Materials AG (year ended December 31,

2021: US$74,000). An additional expense of US$71,000 was recognized

in the period ended June 30, 2022. The remainder of approximately

US$619,000 is expected to be expensed over the period from July 1,

2023 to June 30, 2026.

Share Option Scheme

The Company has adopted the HeiQ plc Option Scheme.

Under the Option Scheme, awards may be made only to employees

and executive directors. The Board will administer the Option

Scheme with all decisions relating to awards made to executive

directors taken by the Remuneration Committee.

A total of 6,260,000 awards were made under the Option Scheme

pursuant to re-admission on December 7, 2020. On October 19, 2021,

a total of 2,447,658 share options were issued, with service

periods covering January 2022 to December 2024 and an exercise

price of GBP0.903 per share option. On June 15, 2022, a total of

1,472,725 share options were issued, with service periods covering

January 2022 to December 2024 and an exercise price of GBP1.002 per

share option.

398,872 options were forfeited during the period ended June 30,

2022 (December 31, 2021: nil). No options were exercised or lapsed

during the period ended June 30, 2022. Accordingly, as at June 30,

2022 9,781,511 options remained in place (December 31, 2021:

8,707,658).

The share-based payment expense arising from these share-based

payment transactions recognized in the period ended June 30, 2022

was US$415,000 ( year ended December 31, 2021: US$424,000).

15. Dividends paid by subsidiary

In June 2022, Chrisal NV declared and paid out a dividend in the

amount of EUR470,000 (approximately US$496,000) of which 49% or

US$243,000 was paid to minority shareholders.

16. Other non-current liabilities

As at As at

June 30, December 31,

2022 2021

Other non-current liabilities US$'000 US$'000

------------------------------------ --------- -------------

Defined benefit obligation IAS

19 2,293 2,281

Deferred consideration in relation

Chemtex acquisition - 88

Other - 250

Total other non-current liabilities 2,293 2,619

------------------------------------ --------- -------------

17. Borrowings and finance costs

The principal changes in borrowings during the period ended June

30, 2022 were as follows:

- a bank loan taken out in May 2022 which incurs interest at

1.05%. It is repayable by April 2023. As at June 30, 2021,

EUR208,515 (US$218,000) is outstanding; and

- a bank loan taken out in April 2022 which incurs interest at

2.45%. It is repayable by March 2023. As at June 30, 2022,

EUR408,000 (US$427,000) is outstanding.

The following table provides a reconciliation of the Group's

future maturities of its total borrowings for each period

presented:

As at As at

June 30, December 31,

2022 2021

Borrowings US$'000 US$'000

---------------------------------- --------- -------------

Not later than one year 1,503 1,004

Later than one year but less than

five years 538 457

After more than five years 130 213

Total borrowings 2,171 1,674

---------------------------------- --------- -------------

The following table represents the Group's finance costs for

each period presented:

Six months Six months

to to Year ended

June 30, June 30, December 31,

2022 2021 2021

Finance costs US$'000 US$'000 US$'000

-------------------------------------- ---------- ---------- -------------

Amortization of deferred finance

costs - acquisition costs - 71 58

Lease finance expense 95 42 145

Interest on borrowings 42 58 108

Bank fees 32 31 55

Loss on foreign currency transactions 368 80 231

-------------

Total finance costs 537 282 597

-------------------------------------- ---------- ---------- -------------

18. Other current liabilities

As at As at

June 30, December 31,

2022 2021

Other current liabilities US$'000 US$'000

----------------------------------- --------- -------------

Deferred consideration in relation

to acquisitions 92 5,995

Deferred consideration in relation

to share-based payments - 74

Total other current liabilities 92 6,069

----------------------------------- --------- -------------

As more fully described in Note 14, the Company settled a total

of US$5.5 million of deferred consideration relating to the

acquisition of RAS AG and Life Materials by way of cash and share

issues. A further US$187,000 in cash payments related to the

Chemtex acquisition in 2017.

The deferred consideration and related financing expense are

summarized below:

As at As at

June 30, December 31,

2022 2021

Deferred consideration US$'000 US$'000

------------------------------------ --------- -------------

Balance brought forward 6,083 1,116

Additions from acquisitions - 5,884

Amortization of fair value discount - 58

Gain on earnout calculation - (80)

Consideration settled in cash (1,587) (908)

Consideration settled through share

issue (4,132) -

Foreign exchange revaluation (272) 13

Deferred consideration carried

forward 92 6,083

------------------------------------ --------- -------------

Current liability 92 5,995

Non-current liability - 88

Total 92 6,083

------------------------------------ --------- -------------

19. Notes to the statements of cash flows

Net debt reconciliation:

Assumed Foreign

Opening on acquisition exchange Closing

balances New agreements Modi-fications of subsidiaries Cash movements differences balances

Six months ended

June 30, 2022 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------- -------------- -------------- ---------------- -------------- ------------ ---------

Cash and cash

equivalents 14,560 - - - (4,262) (810) 9,488

Leases (9,230) (1,681) 574 - 521 577 (9,239)

Borrowings (1,674) (818) - - 163 158 (2,171)

Totals 3,656 (2,499) 574 - (3,578) (75) (1,922)

---------------- --------- -------------- -------------- ---------------- -------------- ------------ ---------

Assumed Foreign

Opening on acquisition exchange Closing

balances New agreements Modi-fications of subsidiaries Cash movements differences balances

Year ended

December

31, 2021 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------- -------------- -------------- ---------------- -------------- ------------ ---------

Cash and cash

equivalents 25,695 - - - (10,525) (610) 14,560

Leases (2,652) (5,829) - (1,636) 790 97 (9,230)

Borrowings (1,573) (472) - (579) 803 147 (1,674)

Totals 21,470 (6,301) (6,301) (2,215) (8,932) (366) 3,656

---------------- --------- -------------- -------------- ---------------- -------------- ------------ ---------

Reconciliation of cash movements on business combinations:

Consideration payment for acquisition of

RAS AG 1,400

Consideration payment for acquisition of

Chemtex 187

Consideration payment for acquisitions of

businesses 1,587

-----

20. Contingencies and provisions

The Group is, from time to time, involved in claims and legal

proceedings.

As at June 30, 2022, there is a potential claim with regards to

a customer contract in the amount of up to US$ 175,000. As at June

30, 2022, no amounts had been accrued related to that matter (31

December, 2021: $nil).

As disclosed in the annual report for the year ended 2021, the

Group was contacted by the United States Environmental Protection

Agency ("EPA") in connection with potential alleged violations of

the Federal Insecticide, Fungicide and Rodenticide Act ("FIFRA")

pertaining to alleged mislabelling. As at June 30, 2022, the

Company has assessed the claim and made a provision for US$200,000

(31 December, 2021: $nil).

21. Related party transactions

In the six months ended June 30, 2022 goods that were in stock

as of December 31, 2021 have been sold to a company controlled by a

minority shareholder at cost value. However, the minority

shareholder is not considered a related party to the Group. The

value of the transaction amounts to US$900,000.

22. Material subsequent events

On July 26, 2022 the Company received an additional cash amount

of EUR2,200,000 (approx. US$ 2,459,000) from Hugo Boss as capital

contribution referred to in Note 4.

On August 9, 2022, the Company issued 164,721 new ordinary

shares for a consideration of GBP173,000 (approximately US$

208,000) to satisfy certain share payments due to the Company's

Innovation Advisory Board, as well as for consultancy and other

services provided by third parties.

23. Ultimate controlling party

As at June 30, 2022, the Company did not have any single

identifiable controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFFIATIFLIF

(END) Dow Jones Newswires

September 13, 2022 02:01 ET (06:01 GMT)

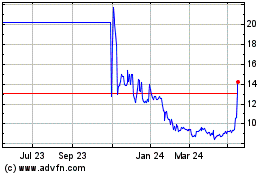

Heiq (LSE:HEIQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

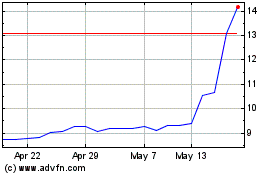

Heiq (LSE:HEIQ)

Historical Stock Chart

From Dec 2023 to Dec 2024