TIDMHAT

RNS Number : 8278M

H&T Group PLC

23 August 2011

H&T Group plc

("H&T" or "the Group" or "the Company")

UNAUDITED INTERIM CONDENSED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED 30 JUNE 2011

H&T ANNOUNCES STRONG RESULTS

H&T Group plc, which trades under the H&T Pawnbrokers

brand, today announces its interim results, for the six months

ended 30 June, 2011.

John Nichols, Chief Executive, commented: "We are delighted to

report another excellent set of results, with profit before tax of

GBP10.3m for the first six months of 2011. Trading has been

especially strong in the Group's core pawnbroking operations with

year on year increases in the key performance indicators of both

lending and redemption. As a result, the gross pledge book has

risen to GBP41.2m as at 30 June 2011 and the Group has delivered a

14% increase in its key revenue stream, the Pawn Service

Charge.

"Performance of the stores added in recent years continues to be

excellent and supports the Board's view of the growth potential

they offer. We have opened 15 new stores year to date, including

the achievement of a significant milestone for the Group with the

recent opening of our 150(th) store. In addition the Group

currently has 45 Gold Bar retail mall units.

"The outlook remains positive and on the basis of the current

gold price we are pleased to announce our expectation for full year

results to be above the top end of current market forecasts. The

Board has approved an interim dividend of 3.75 pence, which itself

represents compound growth of 23% per annum since flotation."

FINANCIAL HIGHLIGHTS

-- Profit before tax of GBP10.3m (H1 2010: GBP9.6m, excluding

working capital gain of GBP4.9m)

-- Net debt of GBP31.3m (30 Jun 2010: GBP30.4m). Interest

charges of GBP0.8m (H1 10: GBP1.7m)

-- Pledge book increased by 10.5% to GBP41.2m (30 Jun 2010:

GBP37.3m)

-- Pawn Service Charge increased 14.3% to GBP13.2m (H1 10:

GBP11.5m)

-- Basic EPS of 21.21p (H1 10: 19.52p, excluding working capital

gain)

-- Increase in interim dividend to 3.75p (2010 interim: 2.50p +

1.00p special)

OPERATIONAL HIGHLIGHTS

-- 11 new stores opened taking the total store estate to 146 as

at 30 June 2010 (H1 2010: 128 stores); 4 additional stores opened

post 30 June and provisional lease terms are agreed on a further

6stores

-- Converted 6 retail mall units into new style 'Gold shops' or

'H&T Lite' stores

-- Launched an on-line pay day loans product and deployed

H&T's new underwriting model in store thus accessing a wider

customer base

-- Enhanced central pricing and central distribution

capabilities

Enquiries:

H&T Group plc Tel: 0870 9022 600

John Nichols, Chief Executive

Alex Maby, Finance Director

Hawkpoint Partners Ltd (Nominated adviser) Tel: 020 7665 4500

Lawrence Guthrie / Sunil Duggal

Numis Securities (Broker) Tel: 020 7260 1000

Mark Lander

Pelham Bell Pottinger (Public Relations) Mob: 07950 481 795

Damian Beeley Tel: 020 7861 3139

Report of the Chief Executive Officer and Finance Director

We are pleased to report another excellent trading performance

for the period to 30 June 2011. The Group has retained its position

as a leading UK pawnbroker through further new store expansion,

improved brand recognition and a continued focus on delivering

excellent customer service. The pawnbroking industry itself also

continues to benefit from the rising gold price and a wider

recognition in the UK of gold as a source of value, particularly in

these times of economic uncertainty.

Taking advantage of these conditions and the strong cash

generation from the Group's gold purchasing activities, the Group

has achieved continued expansion in the store estate. Eleven stores

were opened during H1 11, with a further four year to date,

including the opening of the Group's 150(th) store on 6 August

2011. Of the combined fifteen store openings, fourteen were

greenfield sites and one was an acquisition for a total

consideration of GBP0.18m.

Financial Performance

The Group delivered GBP10.0m of profit before tax pre swap fair

value movement in H1 11. This compares to GBP15.2m in H1 10 when

trading and results during this period benefited from 'one-off'

factors, as disclosed in the Group's 2010 annual report and interim

statement. The primary factor enhancing the prior year result was

the inclusion of GBP4.9m of gross profit delivered via working

capital gains in H1 10. Of this gain, GBP2.8m was delivered via

shortening the time to process gold and was recorded in gold

purchasing profits, and a further GBP2.1m was recorded in

pawnbroking scrap as the Group reduced its aged pledge

balances.

The underlying financial performance in H1 11 has exceeded both

the Board and market expectations set at the beginning of the year.

Gross profit derived from the Group's pawnbroking operations (Pawn

Service Charge, Retail and Pawnbroking Scrap) rose to GBP20.1m (H1

10: GBP19.8m excluding GBP2.1m realised via delayed auctions) and

now accounts for 66% of gross profits. The key component, the Pawn

Service Charge grew 14% year on year to GBP13.2m (H1 10:

GBP11.5m).

The Group's disposition activities continue to benefit from both

the higher absolute gold price and the rising price environment.

Gold purchasing profits contributed GBP7.5m in the period (H1 10:

GBP12.6 including GBP2.9m working capital gain).

The Group's financial position remains strong with net debt of

GBP31.3m as at 30 June 2011 (30 Jun 10: GBP30.4m). Interest costs

are also substantially reduced year on year, from GBP1.7m in H1 10

to GBP0.8m in H1 11, benefiting from both a lower average debt

level and a lower margin. Cashflow in the period was impacted by an

increase in inventory, as shown on the Group balance sheet, due to

stock build for both new stores and an improved central

distribution capability. The Group has adequate liquidity to fund

both the capital expenditure and working capital requirements of

its new store opening programme, as it currently has available a

GBP50m revolving facility.

Pre-working capital gains made in H1 10, basic earnings per

share increased by 8.7% to 21.21p (H1 10: 29.37p actual, 19.52p

excluding GBP4.9m working capital gain).

Dividend

The directors have approved an interim dividend of 3.75 pence

(2010 interim: 3.50 pence, including 1.00 pence special dividend).

This will be payable on 14 October 2011 to all shareholders on the

register at the close of business on 16 September 2011. During the

last twelve months, the Group's dividend has been covered 4.1x by

earnings.

Review of Operations

Pawn Service Charge and Pawnbroking Scrap:

- The Pawn Service Charge grew 14% year on year to GBP13.2m (H1

10: GBP11.5m), driven by both a period of record lending and an

improved redemption ratio year on year.

- Continued strong demand for our services and an increased

average loan, supported by the current gold price, has resulted in

the Group's pledge book increasing by 10% to GBP41.2m (30 Jun 10:

GBP37.3m).

- Despite the continued competitive environment, whether from

other pawnbrokers or the continued availability of gold purchasing

as a choice for the consumer, like-for-like lending grew by 8%.

- The performance of the Group's store openings over the last 12

months continues to be ahead of the original forecasts approved by

the Board.

- Pawnbroking scrap profits realised were GBP2.6m (H1 10:

GBP6.4m, including GBP2.1m profits realised from delayed 2009

auctions).

Retail:

- In a challenging retail environment, and given the underlying

price and therefore affordability of gold, the Board is pleased to

report a 7% increase in retail gross profits from GBP4.0m in H1 10

to GBP4.3m in H1 11.

- Like-for-like sales were down 12% year on year, but a gross

margin improvement from 46% to 50% has recovered much of this

shortfall.

- As in 2010, the retail sales trend leading into H2 is

positive, and the Group believe that with improved pricing,

distribution and management information that this trend can be

maintained into the important Christmas trading period.

- Retail remains a key disposition route for unredeemed stock,

while the option to scrap surplus stock remains a viable

alternative. H&T's stock balance, of which the vast majority is

second hand gold, is held at cost to the Group, which in turn is

substantially less than the current spot price of gold.

Gold Purchasing:

- H&T became one of the first companies with a nationwide

high street presence to take advantage of the significant spike in

gold purchasing volumes in late 2009 / early 2010. During this

period, the Group demonstrated speed and flexibility in rolling out

its innovative Gold Bar retail mall units, and was able to benefit

both financially and operationally, from this first mover

advantage.

- Gold purchasing trends since mid-2010 have remained steady

with customer numbers being broadly consistent over the last 12

months. The Group continues to see gold purchasing as a steady

source of cashflow and profitability for the Group, albeit at

levels lower than the 'exceptional' period in H1 10.

- Gross profits from the Group's gold purchasing operations

contributed GBP7.5m in H1 11, (H1 10: GBP9.7m excluding GBP2.9m of

working capital gain).

- The Group's Gold Bar retail mall unit operation continues to

be a success, with regard both profitability and as a means of

testing the local market for further expansion. As at 30 June 2011,

the Group had 45 Gold Bar units.

- This business segment continues to benefit from the higher

absolute price of sterling gold and the rising price environment.

On average the gold price per troy ounce was GBP894 during H1 11

(H1 10: GBP757) and has risen by an average of 1.8% per month from

January 2011 to June 2011.

Financial services:

- In H1 2011 the Group's financial services activities

contributed GBP2.8m (H1 10: GBP2.6m) or 9.2% of Group gross profit

(H1 10: 7.0%). The increase was driven evenly across the Group's

three key products: Third Party Cheque Cashing, Pay Day Loans and

the longer term, KwikLoan product.

- Gross commission earned from third party cheque cashing was

broadly stable year on year, reversing the years of decline in this

product. The Group is also pleased to report on the major decision

taken by the Payments Council recently in having decided to

withdraw its target end date to close the centralised cheque

clearing system in the UK.

- Revenues generated by the Group's pay day advance product have

been impacted by the gradual withdrawal of the cheque guarantee

card, but net revenues have increased year on year due to

improvements in debt recovery.

- Further underwriting improvements will allow the Group to

widen its distribution of the pay day advance product, and the

Group has recently launched an on-line pay day loans product,

charging on average, half the interest cost of its competitors in

this market.

Trading outlook

The outlook for the Group continues to be positive. For the

current financial year, the Board believes that the overall trading

performance will result in full year profits being above the top

end of current market expectations. Looking further forward, the

Group still holds excellent prospects for organic growth in

pawnbroking as the store estate is still relatively immature. The

average size of a pledge book for the Group's pre-2005 stores is

over 3.5x greater than the average of the post 2005 greenfield

stores, demonstrating the considerable growth potential existing in

these newer stores as their pledge books continue to grow to a size

more consistent with the estate average.

Depending on market conditions, future growth is also likely to

be driven via expansion of the Group's geographical footprint,

either via development of greenfield sites or acquisitions. The

Board currently expect to open a total of 25 stores in the current

financial year.

Interim Condensed Financial Statements

Unaudited statement of comprehensive income

For the 6 months ended 30 June 2011

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 Dec

2011 2010 2010

Note Total Total Total

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Revenue 2 55,604 70,991 126,397

Cost of sales 2 (25,290) (33,901) (59,637)

______ ______ ______

Gross profit 30,314 37, 090 66,760

Other direct expenses (14,470) (14,814) (29,790)

Administrative expenses (4,965) (5,370) (8,329)

______ ______ ______

Operating profit 3 10,879 16,906 28,641

Investment revenues 1 2 1

Finance costs 5 (832) (1,664) (2,606)

Movement in fair value of

interest rate swap 237 (763) (533)

_______ ______ ______

Profit before taxation 10,285 14,481 25,503

Tax on profit 6 (2,777) (4,073) (8,316)

______ ______ ______

Total comprehensive income

for the period 7,508 10,408 17,187

______ ______ ______

Pence Pence Pence

Earnings per ordinary share

- basic 7 21.21 29.37 48.77

Earnings per ordinary share

- diluted 7 20.71 29.12 47.52

All results derive from continuing operations.

Unaudited condensed consolidated statement of changes in

equity

For the 6 months ended 30 June 2011

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2011 2010 2010

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Opening total equity 61,681 47,055 47,055

Total comprehensive

income for the period 7,508 10,408 17,187

Issue of share capital 212 130 486

Share option credit taken

directly to equity 125 100 149

Deferred Tax on share

options taken directly

to equity 213 31

Dividends paid 9 (2,136) (1,985) (3,227)

Employee Benefit Trust

shares (12) - -

Closing total equity 67,591 55,708 61,681

Unaudited condensed consolidated balance sheet

At 30 June 2011

At 30 June At 30 June At 31 December

2011 2010 2010

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 16,825 16,806 16,825

Other intangible assets 873 915 978

Property, plant and equipment 11,906 10,653 10,751

Deferred tax assets 550 1,238 281

30,154 29,612 28,835

Current assets

Inventories 28,118 21,211 24,100

Trade and other receivables 52,812 50,491 50,159

Cash and cash equivalents 2,664 2,631 4,029

83,594 74,333 78,288

Total assets 113,748 103,945 107,123

Current liabilities

Trade and other payables (7,592) (8,836) (8,623)

Current tax liabilities (3,283) (4,927) (4,361)

Borrowings - - -

Derivative financial instruments (735) (1,201) (972)

(11,610) (14,964) (13,956)

Net current assets 71,984 59,369 64,332

Non-current liabilities

Borrowings 4 (34,000) (33,000) (31,000)

Deferred tax liabilities - - -

Provisions (547) (273) (486)

(34,547) (33,273) (31,486)

Total liabilities (46,157) (48,237) (45,442)

Net assets 67,591 55,708 61,681

EQUITY

Share capital 8 1,799 1,773 1,782

Share premium account 24,751 24,209 24,556

Employee Benefit Trust share

reserve (25) (13) (13)

Retained earnings 41,066 29,739 35,356

Total equity attributable to

equity holders of the parent 67,591 55,708 61,681

Unaudited condensed consolidated cash flow statement

For the 6 months ended 30 June 2011

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

Note 2011 2010 2010

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 7,508 10,408 17,187

Adjustments for:

Investment revenues (1) (2) (1)

Finance costs 832 1,664 2,606

Movement in fair value of interest

rate swap (237) 763 533

Movement in provisions 61 105 318

Income tax expense 2,777 4,073 8,316

Depreciation of property, plant

and equipment 1,154 1,148 2,350

Amortisation of intangible assets 105 132 244

Share based payment expense 125 144 149

Loss on disposal of fixed assets 66 96 207

Operating cash inflows before

movements in working capital 12,390 18,531 31,909

(Increase)/decrease in inventories (4,018) 1,818 (1,035)

Increase in receivables (2,653) (1,859) (1,411)

(Decrease)/increase in payables (1,674) 1,551 1,838

Cash generated from operations 4,045 20,041 31,301

Income taxes paid (3,913) (3,076) (6,852)

Interest paid (861) (1,088) (2,033)

Net cash used in/(from) operating

activities (729) 15,877 22,416

Investing activities

Interest received 1 2 1

Purchases of property, plant and equipment (1,701) (2,114) (3,970)

Purchase of intangible assets - - (115)

Acquisition of trade and assets of

business - - (283)

Net cash used in investing activities (1,700) (2,112) (4,367)

Financing activities

Dividends paid 9 (2,136) (1,985) (3,227)

Proceeds on issue of shares 212 130 486

Net increase / (decrease) in borrowings 3,000 (11,500) (13,500)

Loan to the Employee Benefit Trust

for acquisition of own shares (12) - -

Net cash from financing activities 1,064 (13,355) (16,241)

Net increase / (decrease) in cash and

cash equivalents (1,365) 410 1,808

Cash and cash equivalents at beginning

of period 4,029 2,221 2,221

Cash and cash equivalents at end of

period 2,664 2,631 4,029

Unaudited notes to the condensed interim financial

statements

For the 6 months ended 30 June 2011

Note 1 Basis of preparation

The interim financial statements of the Group for the six months

ended 30 June 2011, which are unaudited, have been prepared in

accordance with the International Financial Reporting Standards

('IFRS') accounting policies adopted by the Group and set out in

the annual report and accounts for the year ended 31 December 2010.

The Group does not anticipate any change in these accounting

policies for the year ended 31 December 2011. As permitted, this

interim report has been prepared in accordance with the AIM rules

and not in accordance with IAS 34 "Interim financial reporting".

While the financial figures included in this preliminary interim

earnings announcement have been computed in accordance with IFRSs

applicable to interim periods, this announcement does not contain

sufficient information to constitute an interim financial report as

that term is defined in IFRSs.

The financial information contained in the interim report also

does not constitute statutory accounts for the purposes of section

434 of the Companies Act 2006. The financial information for the

year ended 31 December 2010 is based on the statutory accounts for

the year ended 31 December 2010. The auditors reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

After conducting a further review of the Group's forecasts of

earnings and cash over the next twelve months and after making

appropriate enquiries as considered necessary, the directors have a

reasonable expectation that the Company and Group have adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the half yearly condensed financial statements.

Note 2 Segmental Reporting

Year ended

Revenue 6 months ended 6 months ended 31 December

6 months ended 30 June 2011 30 June 2011 30 June 2010 2010

Unaudited Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Pawn Service Charge 13,168 11,516 23,181

Retail 8,512 8,636 19,558

Pawnbroking Scrap 8,484 14,000 22,301

Gold Purchasing 22,655 34,244 55,712

Cheque Cashing 2,500 2,364 5,120

Other Financial Services 285 231 525

Total Revenue 55,604 70,991 126,397

Year ended

Gross Profit 6 months ended 6 months ended 31 December

6 months ended 30 June 2011 30 June 2011 30 June 2010 2010

Unaudited Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Pawn Service Charge 13,168 11,516 23,181

Retail 4,262 3,980 8,785

Pawnbroking Scrap 2,643 6,413 9,042

Gold Purchasing 7,456 12,586 20,107

Cheque Cashing 2,500 2,364 5,120

Other Financial Services 285 231 525

Total Gross Profit 30,314 37,090 66,760

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2011

Note 3 Operating profit and EBITDA

EBITDA

The Board considers EBITDA as a key measure of the Group's

financial performance.

EBITDA is defined as Earnings Before Interest, Taxation,

Depreciation and Amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

Year ended

6 months ended 6 months ended 31 December

6 months ended 30 June 2011 30 June 2011 30 June 2010 2010

Unaudited Unaudited Unaudited Audited

Total Total Total

GBP'000 GBP'000 GBP'000

Operating profit 10,879 16,906 28,641

Depreciation 1,154 1,148 2,350

Amortisation 105 132 244

EBITDA 12,138 18,186 31,235

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2011

Note 4 Borrowings

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2011 2010 2010

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Secured borrowing at amortised

cost

Bank loans 34,000 33,000 31,000

Unamortised issue costs - - -

Total borrowings 34,000 33,000 31,000

Short term portion of bank loan - - -

Unamortised issue costs - - -

Amount due for settlement within one year

- - -

Long term portion of bank loan 34,000 33,000 31,000

Unamortised issue costs - - -

Amount due for settlement after

more than one year 34,000 33,000 31,000

Note 5 Finance costs

6 months 6 months Year

ended ended ended

30 June 30 June 31 December

2011 2010 2010

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Interest payable on bank

loans and overdraft 832 1,123 2,069

Other interest - 4 -

Amortisation of debt

issue costs - - -

Write off of loan issue

costs - 537 537

Total finance costs 832 1,664 2,606

Note 6 Tax on profit

The taxation charge for the 6 months ended 30 June 2011 has been

calculated by reference to the expected effective corporation tax

and deferred tax rates for the full financial year to end on 31

December 2011. The underlying effective full year tax charge is

estimated to be 26.6% (year ended 31 December 2010: 28.1%).

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2011

Note 7 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options granted to employees where the exercise

price is less than the average market price of the Company's

ordinary shares during the period.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Unaudited Unaudited Audited

6 months ended 30 June 2011 6 months ended 30 June 2010 Year ended 31 December 2010

Weighted Weighted Weighted

average Per-share average Per-share average Per-share

Earnings number of amount Earnings number of amount Earnings number of amount

GBP'000 shares pence GBP'000 shares pence GBP'000 shares pence

Earnings

per share

- basic 7,508 35,393,625 21.21 10,408 35,439,612 29.37 17,187 35,240,321 48.77

Effect of

dilutive

securities

Options - 857,520 (0.50) - 298,193 (0.25) - 928,658 (1.25)

Earnings

per share

diluted 7,508 36,251,145 20.71 10,408 35,737,805 29.12 17,187 36,168,979 47.52

Unaudited notes to the condensed interim financial statements

(continued)

For the 6 months ended 30 June 2011

Note 8 Share capital

At 30 June At 30 June At 31 December

2011 2010 2010

Unaudited Unaudited Audited

Allotted, called up and fully

paid

(Ordinary Shares of GBP0.05

each)

GBP'000 Sterling 1,799 1,773 1,782

Number 35,973,032 35,461,168 35,631,827

Note 9 Dividends

On 18 August 2011, the directors approved a 3.75 pence interim

dividend (30 June 2010: 3.50 pence, including a 1.00 pence special

dividend) which equates to a dividend payment of GBP1,349,000 (30

June 2010: GBP1,242,000). The dividend will be paid on 14 October

2011 to shareholders on the share register at the close of business

on 16 September 2011 and has not been provided for in the 2011

interim results.

On 21 April 2011, the shareholders approved the payment of a

6.00 pence final dividend for 2011 which equates to a dividend

payment of GBP2,136,000 (2010: GBP1,985,000). The dividend was paid

on the 2 June 2011.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UURBRAVAWUAR

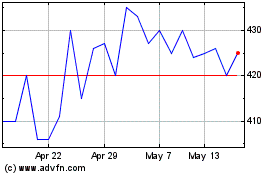

H&t (LSE:HAT)

Historical Stock Chart

From Sep 2024 to Oct 2024

H&t (LSE:HAT)

Historical Stock Chart

From Oct 2023 to Oct 2024