TIDMGYM

RNS Number : 2099I

The Gym Group plc

20 March 2018

20 March 2018

The Gym Group plc

('the Company' or 'The Gym')

Full Year Results

Accelerated profitable growth, significant pipeline progress

The Gym Group plc, the fastest growing, nationwide operator of

130 low cost gyms(1) , announces its full year results for the year

ended 31 December 2017.

Financial Highlights

-- Revenue of GBP91.4 million, an increase of 24.3%

(2016: GBP73.5 million)

-- Group Adjusted EBITDA(2) of GBP28.0 million,

an increase of 23.2% (2016: GBP22.7 million)

-- Adjusted earnings per share(3) increased to

7.4p (2016: 5.6p)

-- Adjusted profit before tax(4) increased to GBP12.0

million (2016: GBP8.7 million)

-- Statutory profit before tax of GBP9.2 million

(2016: GBP6.9 million)

-- Proposed final dividend of 0.90p per share,

giving a proposed full year dividend of 1.20p

per share

Operational Progress

-- 21 new gyms opened and 18 acquired from Lifestyle

Fitness in 2017, increasing the total estate

to 128

-- Total year end members at 607,000(5) , an increase

of 35.5% versus prior year (2016: 448,000);

Average member numbers grew by 23.4% to 528,000

(2016: 428,000).

-- Launch of LIVE IT., our premium pricing product,

with rollout on course to complete by May 2018

-- Return on Capital on mature estate maintained

at 32% (2016: 32%)

-- Average Mature Site EBITDA(6) decreased to GBP461,000

(2016: GBP476,000)

Outlook

-- The new financial year has started well and

current trading is in line with the Board's

expectations with 664,000 members at the end

of February, an increase of 9.4% since the year

end

-- Expect to achieve guidance range of 15 to 20

sites openings for 2018.

John Treharne, CEO of The Gym Group, commented:

"We have made considerable progress in 2017 and were the fastest

growing low cost fitness operator, substantially increasing our

market share and rapidly expanding our estate.

We continue to see potential for substantial growth in 2018 as

we plan to open a further 15-20 new gyms and benefit from the

profitability of those sites opened in recent years reaching

maturity.

We have had a strong start to 2018 and are excited about the

future and confident in our team's ability to maximise our

opportunity."

An audio webcast of the analyst presentation will be available

later today via our website www.tggplc.com

A copy of the Annual Report and Accounts will be available later

today via our website.

For further information, please contact

The Gym Group

John Treharne, CEO

Richard Darwin, CFO

via Instinctif

Numis

Oliver Cardigan

Toby Adcock

020 7260 1000

Instinctif

Matthew Smallwood

Justine Warren

0207 457 2020

1 120 sites branded The Gym and 10 sites currently branded

Lifestyle Fitness.

2 Group Adjusted EBITDA is calculated as operating profit before

depreciation, amortisation, long term employee incentive costs and

exceptional items.

3 Adjusted earnings per share is calculated as the Group's

profit for the year before amortisation, exceptional items and the

related tax effect, divided by the diluted weighted average number

of shares.

4 Adjusted profit before tax is calculated as profit before tax

before amortisation, exceptional items.

5 Average members excludes sites not open at the period end.

6 Average Mature Site EBITDA is calculated as Group Adjusted

EBITDA contributed by the mature gym portfolio, divided by the

number of mature sites. Mature sites are defined as gyms that have

been open for 24 months or more measured at the end of the

year.

Chairwoman's Statement

This has been a year of significant success for The Gym Group.

2017 will be remembered for the acceleration of number of sites

from 89 to 128 as a result of 21 organic openings and the

acquisition of 18 sites from Lifestyle Fitness. This is now a

significant business with over 600,000 members enjoying millions of

gym visits a year. We are reporting strong financial results which

has allowed the Board to recommend a final dividend of 0.90p taking

the full year dividend to 1.20p, ahead of the 1p declared in the

prior year. It was also significant that our share register

normalised as our prior Private Equity owners sold their final

tranche of shares and we welcome those new investors who have

joined the register during the year.

This rate of business growth has required us to mature our

capabilities. Our Operations organisational structure has developed

and new talent, particularly in Marketing and Technology, gives

both enhanced capability and also greater resilience. The Board was

impressed that our significant technology investment in our new

Member Management System was successfully launched entirely to

plan. Work progresses on the next phase of our infrastructure

development programme, Enterprise Resource Planning (ERP) system,

which is on schedule to be implemented mid-2018. These are

fundamental milestones to support our future growth potential.

Our approach to property selection is rigorous. We are building

a business with strong capital discipline as a result of a

thoroughly researched approach to site selection, utilising the

skills and experience of our property team supported by the

strength of our covenant. This is an area of significant

competitive advantage. When we can accelerate openings such as in

2017 we will, but our expectation is to maintain good discipline as

we continue to target 15-20 organic openings a year.

My Board colleagues and I continue to enjoy visiting sites to

see first-hand the energy and commitment of our general managers

and just how much our members appreciate their gym. We believe the

quality and fit out of our new sites and refurbishments are a stand

out feature in the market place. This is such an important part of

ensuring that going for a work out is an appealing activity for our

members. We may be growing quickly, but I can still say I have

visited the majority of our gyms! Our work to transform our

acquired sites into The Gym Group's branding is particularly

impressive and member response has been overwhelmingly positive.

Recently, we were delighted to be awarded the prestigious FEEFO

Trusted Service Award.

During the course of the year we have been focused on evolving

our relationship with the Personal Trainers that operate their

businesses out of our sites. It is estimated that 80% plus of

qualified Personal Trainers in the health and fitness industry are

self-employed; in our model to date Personal Trainers have been

wholly self-employed. However, as we wish to further enhance the

service we give our members, we think it is timely to move this

model on. We have commenced a number of trials that will allow some

Personal Trainers to be part time employees, during which time they

will be directly managed to deliver services on the gym floor. We

hope that this change will benefit all stakeholders. Personal

Trainers will have access to an enhanced range of opportunities and

relevant benefits and members will benefit from a more reliable and

committed programme of activities in the gym. These are important

changes that we are trialling to understand the learnings, before a

wider implementation during the course of 2018.

Many businesses are having to reflect on a more uncertain

economic environment and the potential impact of Brexit. We believe

The Gym Group is particularly well positioned, with no material

identifiable impacts from Brexit at this time and the ability to

thrive even if the economy becomes less buoyant as we offer such

good value for money gym membership.

This business has such a positive purpose. To provide affordable

access to exercise facilities and expert help to every person who

wants to improve their wellbeing, whatever their starting point,

whatever their destination.

The impact The Gym Group has had in enabling and encouraging

people from all walks of life - we believe several million over the

last ten years - to commit to becoming more active is a good news

story of which we are incredibly proud because we know that every

new gym that opens can be a force for good in its community. We

actively seek to establish gyms where there may previously have

been no affordable alternatives. We currently have 36 gyms situated

in the top 20% "most inactive" local authority areas and 41 gyms (a

third of all our gyms) situated in the top 20% "most deprived"

local authority areas. The average age of our members is 31 so, if

they can get into fitness and staying healthy while relatively

young, the benefits for them and for society are clear.

We have an engaged and talented Board and I am grateful to my

non-executive colleagues for their willingness to both challenge

and support the business; they bring a wealth of relevant insight

and experience. But most credit must go to the Management team led

by CEO John Treharne and all our colleagues. The Gym Group has a

special culture; we look forward to giving many more members their

best gym experience yet.

Penny Hughes

Chairwoman

20 March 2018

Chief Executive's Review

Introduction

This has been a very significant year of growth for the

business, one where we have substantially increased our market

share in the low cost gym sector through a combination of

acquisition and organic openings.

During the year we expanded our estate by 39 sites, up from 89

in 2016 to 128 at the end of 2017. 21 of these new sites were as a

result of our organic opening programme. In September 2017, the

acquisition of 18 additional sites from Lifestyle Fitness gave us a

strong set of profitable locations to convert into The Gym brand

and develop our geographic footprint.

This expansion substantially grew our membership base with total

year end members up 35.5% to 607,000 (2016: 448,000) and average

members up 23.4% to 528,000 (2016: 428,000). The impact of this

growth is demonstrated by increases in all our key metrics; revenue

up 24.3% to GBP91.4 million (2016: GBP73.5 million) and Group

Adjusted EBITDA up by 23.2% to GBP28.0 million (2016: GBP22.7

million). Adjusted Profit before Tax increased by 38.2% to GBP12.0

million (2016: GBP8.7 million) and Adjusted Earnings per Share up

by 32.1% to 7.4p (2016: 5.6p). Our statutory profit before tax has

increased to GBP9.2 million (2016: GBP6.9 million).

During the year we put in place foundations that will enable us

to support a business of size and substance. A key part of this was

the launch of a new Member Management System in July, an

infrastructure development that gives us the flexibility and

ability to launch new products and react to changes in market

conditions through our pricing structure. It is the backbone of our

technology architecture. To launch such a major technological

change in a 24/7 business without any interruption in member

service was an excellent achievement by our team. The development

effort will continue in 2018 as we plan the launch of a new

Enterprise Resourcing Planning (ERP) platform, a development that

gives the finance team the capability to support the increased

scale of the business.

The low cost gym market is developing and growing rapidly, and

our investment strategy has allowed us to take advantage of these

market trends. The Group achieved 2/3rds of the estimated net site

growth of the low cost market between March 2017 and December 2017.

Overall our market share is up from 17.7% in March 2017 to 22.4% in

December 2017. Our model continues to attract new members,

including first time gym-goers who are new to the market, as well

as taking share from other operators. We have introduced affordable

health and fitness provision for those that previously couldn't

access it. In doing so, we are positively impacting the nation's

collective fitness, a great purpose for a business. Even if the

economic environment becomes more difficult, we believe that our

core proposition of a quality low cost operation will continue to

flourish.

Strategic progress

Delivering performance from gyms

At the year end we had 74 sites that have been operating for

more than two years (2016: 55 sites). We continue to drive

significant increases in overall profitability as sites mature.

Overall Mature Site EBITDA was GBP34.1 million up 30.3% (2016:

GBP26.2 million). Mature Site EBITDA per site was GBP461,000 (2016:

GBP476,000). This is in line with our expectation reflecting recent

moves to relatively smaller sites built at lower capital cost;

these sites can achieve our target returns at lower member numbers

than we have historically achieved. Overall we have maintained the

return on capital in the mature estate at 32% (2016: 32%). The

return on capital for mature sites opened between 2008 and 2013 and

for sites opened in 2014 and 2015 is also consistent at 32%

overall.

The considerable growth in our estate through our organic roll

out and acquisition means that, at the year end 42% of our sites

have been open for less than two years (2016: 38%). This means that

growth from sites that are still to reach maturity is substantial,

and will be a key profit driver over the coming year.

The sites acquired as part of the Lifestyle transaction are a

key part of that growth. We acquired 18 sites for a total

consideration of GBP20.5 million. To date we have converted 8 of

the sites to The Gym brand, and a further two are planned for

conversion. Recently, we decided to convert the remaining 8

Lifestyle sites and expect to conclude the entire programme by

September 2018. Total conversion costs to all 18 sites are expected

to be GBP470,000 per site. We target 20% plus return on capital on

acquisition opportunities such as Lifestyle. This is lower than for

our organic openings, reflecting the acquisition premium incurred

on such sites and the faster timeline on which sites with an

existing membership base will mature, compared to the organic sites

that we open from scratch.

Improving operating efficiencies

Mature EBITDA margin in 2017 was 47.0% (2016: 47.5%), reflecting

our continued ability to apply our operating model across a

business of growing scale. We continue to operate with disciplined

cost control, selecting the right sites and negotiating acceptable

levels of rent and other fixed costs (rates and service charges).

This is assisted by a stronger covenant with landlords through

being a listed company.

Our membership is the beneficiary of the low cost base, as we

pass on the positive impact of disciplined cost control to them.

This means an average headline price of GBP17.50 (2016: GBP17.00)

and a membership fee range (excluding LIVEIT.) of GBP10.99 to

GBP28.99 per month. We do however, endeavor to increase yield

wherever the local market allows and pricing decisions are

intelligently made through a combination of data analytics and

local market intelligence. Average revenue per member per month

increased 0.7% across our estate and we expect further progress in

2018 as sites become more established. Revenue progression will be

enhanced by the integration of the Lifestyle sites into our

operating model and will benefit from the rollout of the LIVE IT.,

our premium pricing initiative, across the estate.

Achieving our rollout strategy

We organically opened 21 sites in 2017. As in recent years there

was a strong London bias, with seven of the sites located within

the M25 and a further five within the South East. Our proposition

goes from strength to strength, and one recent opening saw our

record for the largest number of members on launch (day one)

broken. Small scale acquisitions from previous years contributed to

the strong organic growth as we converted three sites acquired from

Fitness First in 2016. We continue to view the acquisition of

existing gyms as an important element of our growth plan, and at

the end of 2017 we were able to acquire a site in Aylesbury from

another operator.

It is encouraging that the availability of excess space from

retailers is increasing. Sites in Edinburgh, Walthamstow and

Altrincham have arisen from retailers giving up such space. Other

sites we have opened are located in new build developments or were

previously used for alternative leisure activities.

Our new sites continue to trade well, in line with our

expectations. Encouragingly, our pipeline is strong and expanding

rapidly and we entered 2018 with the confidence that we will once

again be able to open between 15-20 sites in the coming year.

The strong returns on capital are now benefiting from the

savings which have been achieved on multiple stages of the fit-out

process, including build costs, gym equipment and fixtures and

fittings. During 2017 our average fit-out cost was GBP1.35 million

compared to a historical average on all mature sites of GBP1.46

million. In the coming year we will once again be tendering our gym

equipment supply contract, using our increased scale to benefit

capital cost.

Developing the customer proposition

Our latest branding means that sites are modern, well-equipped

and well-lit as our members expect. We refurbished 17 sites in 2017

taking advantage of their cyclical five year refurbishment to bring

them in line with our latest specification. By the end of 2018 we

expect all our sites to have been updated to a common and high

quality standard. Our experience is of improved performance levels

on the completion of a refurbishment, giving us the ability to

relaunch the site to prospective members.

During the year we introduced a new system of tracking Net

Promoter Score, which measures customer feedback, enabling us to

introduce member satisfaction as a metric within the incentive

programme at site level. This system is still in its implementation

phase. The previous system, which ran until June 2017, showed an

NPS of 63% - a continuation of the high levels achieved in previous

years. We continue to see member service as a key differentiating

factor in the running of a successful low cost gym and this new

system is a key part of improving the already high standards across

our estate.

The most significant innovation in 2017 was the launch of

LIVEIT. our premium pricing product. The early results from this

were promising, allowing us to expand the initial rollout to the

whole estate. LIVEIT. gives members four specific benefits; the

ability to bring a friend, multi-site access, use of a fitness

measurement machine (Fitquest) and affiliate member offers from

third parties. The rollout is on course to complete by May 2018.

LIVEIT. is just one part of our strategy to drive yield. Price

increases for new members are introduced where applicable, and as

markets mature a discounted joining fee is used as a key

promotional tool to drive volume.

Our people

During the year we announced plans to trial a new operating

model within our estate that would enable some of our Personal

Trainers to take up part time employment. Outside of the contracted

12 hours, they will continue to run their business on a

self-employed basis in our gyms by payment of a rent. The trials

are proceeding according to plan and we are in the process of

extending the trial, with a full scale rollout currently scheduled

in for the summer. The new model is driven by our desire to improve

member satisfaction by exercising control over Personal Trainers in

their contracted hours. We are confident that this significant

change will deliver tangible benefits and importantly retain the

competitive advantage that we have that enables us to have the best

Personal Trainers operating out of our gyms.

During the year the business has recruited new talent to ensure

that our Marketing, Technology and Finance teams have the scope to

operate the business at the scale that is required. The benefits of

this investment have already been seen in the various

value-enhancing projects that have been launched in the year

including the new Member Management System, the Lifestyle

acquisition and the LIVEIT. launch. Enhancing our quality team and

business infrastructure enables us to drive the business forward at

pace. Throughout the business our culture remains to drive

performance at a local level while providing high quality central

support. This is a philosophy that has served the business well in

its first 10 years and will, I am sure, continue to do so in the

coming years. The commitment of all our people remains key to the

success of this business whether it be in supporting new site

openings or in the day to day operations. I was delighted that at

our employee conference in 2017 we were able to recognise 20

employees who have been with us for more than five years and I hope

this number grows exponentially in the coming years.

Our use of technology

With the launch of the new Member Management System now

complete, the business can focus on using its technological edge to

drive performance. Part of this includes using the newly-created

platform to launch functional improvements that enhance the

customer journey. We will continue to research ways in which using

technology will enhance the customer experience for existing

members. We are also seeking to improve conversion levels through

our website. Artificial Intelligence that can drive efficiencies in

our operating processes, dynamic pricing and the development of an

app are also part of the plan. Technology and systems development

such as the ERP project will remain fundamental to the delivery of

our business model and help to facilitate the low cost environment

that we operate in.

2017 was also the year when we started to realise the benefits

of past technology investment. This includes use of the email sales

platform (Salesforce), the new website and a business intelligence

platform that supports the data analytics team. In a data rich

business we increasingly see the potential to enhance performance

and efficiency by using data gathered on member behavior. We

believe this is an area of significant competitive advantage

compared to the traditional market.

During the past 12 months, we have celebrated a number of key

milestones, not least our 10 year anniversary from when I founded

the business. The launch of the 100(th) gym at Feltham by Jonnie

Peacock was a great way to celebrate, and we are well on our way to

the next landmark with site numbers having increased to 128 at the

year end. We also welcomed our 100 millionth member visit in

November. While we celebrate these successes, we remain fiercely

ambitious to establish new milestones as we grow the business.

Outlook

The new financial year has started well and current trading is

in line with the Board's expectations. Membership numbers at the

end of February show an increase to 664,000, a record level, with a

9.4% increase since December 2017. This continued level of member

growth helps to underpin our performance for the rest of the year.

In 2018 we anticipate opening 15 to 20 sites, with 6 openings

expected in the first half of the year. South East openings are

more likely to be geared towards the second half of the year. While

it remains early days in the rollout of LIVEIT., we expect to

continue to see promising levels of take-up as the initiative is

launched across the estate. We expect that it will underpin

increased yield growth and we will give a further update at the

half year once the rollout has been completed.

After a year in which our business has increased in scale more

than at any stage in its history, 2018 will see the realisation of

the benefits of our recent investments. This will assist in

achieving the uplift in profitability built into our plans and in

continuing to expand at a rapid rate. It is an exciting time for

everyone involved with the Company as we look to extract the

inherent value within our business.

John Treharne

Chief Executive Officer

20 March 2018

Financial Review

Summary

We are pleased to have delivered another strong set of financial

results with revenue growth of 24.3% and Group Adjusted EBITDA

growth of 23.2%.

The growth in Group Adjusted EBITDA has been achieved despite

significant pre-opening costs of GBP2.6 million in the opening of

21 new gyms and investment in central services. Overall we consider

that GBP0.3 million of incremental pre-opening cost that has been

incurred in 2017 related to Q1 2018 openings.

Group Operating Cash Flow decreased by 1.1% despite the increase

in Group Adjusted EBITDA offset by a 113.7% increase in maintenance

capital expenditure due to the refurbishment of 17 (2016: 8) sites

under the refurbishment programme.

2017 2016

GBP'000 GBP'000

------------------------------------------ -------- --------

Total Number of Gyms 128 89

Total Number of Members ('000) 607 448

Revenue 91,377 73,539

Group Adjusted EBITDA(1) 27,963 22,691

Group Adjusted EBITDA before Pre-Opening

Costs(2) 30,598 24,888

Statutory Profit before Tax 9,191 6,940

Adjusted Earnings(3) 9,527 7,153

Group Operating Cash Flow(4) 24,677 24,944

------------------------------------------ -------- --------

(1) Group Adjusted EBITDA is calculated as operating profit

before depreciation, amortisation, long term employee incentive

costs, and exceptional items.

(2) Group Adjusted EBITDA before Pre-Opening Costs is defined as

Group Adjusted EBITDA excluding the costs associated with new site

openings.

(3) Adjusted Earnings is calculated as the Group's profit for

the year before amortisation, exceptional items, and the related

tax effect.

(4) Group Operating Cash Flow is calculated as Group Adjusted

EBITDA less working capital less maintenance capital expenditures

and is a non-IFRS GAAP measure.

Result for the year

2017 2016

GBP'000 GBP'000

------------------------------------ --------- ---------

Revenue 91,377 73,539

Cost of sales (982) (830)

------------------------------------ --------- ---------

Gross profit 90,395 72,709

Administration expenses (78,015) (64,153)

Long term employee incentive costs (774) (519)

Exceptional costs (1,664) (321)

------------------------------------ --------- ---------

Operating profit 9,942 7,716

Finance income 12 19

Finance costs (763) (795)

------------------------------------ --------- ---------

Profit before tax 9,191 6,940

Tax charge (2,020) (1,237)

------------------------------------

Profit for the year 7,171 5,703

------------------------------------ --------- ---------

Tax charge 2,020 1,237

Amortisation of intangible assets 1,175 1,442

Exceptional administration expenses 1,664 321

-------------------------------------

Adjusted profit before tax 12,030 8,703

------------------------------------- -------- --------

Tax charge (2,020) (1,237)

Tax effect of above items (483) (313)

-------------------------------------

Adjusted Earnings 9,527 7,153

------------------------------------- -------- --------

Revenue

The 24.3% increase in revenue is as a result of the growth in

Average Member Numbers and a 0.7% increase in the Average Revenue

per Member per Month to GBP14.41 (2016: GBP14.31).

Member satisfaction is one of our key strategic drivers and our

membership numbers reflect the ongoing effectiveness of our

proposition. Member Numbers at the year end grew significantly,

from 448,000 in 2016 to 607,000 in 2017.

Our average member numbers grew by 23.4% to 528,000 (2016:

428,000), largely due to the opening of 21 sites during the year.

Average Revenue per Member per Month increased from GBP14.31 to

GBP14.41 in 2017 as our pricing continues to mature.

As a result, revenue for the year ended 31 December 2017

increased to GBP91.4 million (2016: GBP73.5 million).

Administration expenses

Administration expenses increased by 21.6%, primarily due to the

number of gyms increasing from 89 at 31 December 2016 to 128 at 31

December 2017.

The largest cost within administration expenses is property

lease rentals. These increased from GBP13.5 million in 2016 to

GBP17.3 million in 2017 due to the increase in the number of gyms

and head office. Staff costs also form a significant part of

administration expenses and increased from GBP9.9 million to

GBP13.2 million, excluding a charge of GBP0.8 million (2016: GBP0.5

million) from long term employee incentives. The increase was

driven by both gym openings and a scaling up of head office support

costs to support future growth.

Head office costs increased from GBP7.3 million in 2016 to

GBP9.1 million in 2017. This was largely due to the effect of

headcount increases in 2017 and staff bonuses associated with

improved operating performance.

Depreciation charges increased from GBP12.7 million in 2016 to

GBP14.4 million in 2017, largely as a result of the increased

number of sites. During the year the Group carried out a

re-assessment of the estimated useful lives of gym equipment

resulting in a GBP1.3 million decrease in the depreciation charge.

Depreciation as a percentage of revenue decreased from 17% in 2016

to 16% in 2017, reflecting the growing maturity of our estate.

Amortisation charges decreased from GBP1.4 million to GBP1.2

million due to certain intangible assets recognised on the

acquisition of The Gym Limited becoming fully amortised. This is

offset by three months of amortisation on new intangibles

recognised on the Lifestyle acquisition during the year.

Group Adjusted EBITDA

2017 2016

GBP'000 GBP'000

------------------------------------ -------- --------

Operating profit 9,942 7,716

Depreciation of property, plant

and equipment 14,408 12,693

Amortisation of intangible assets 1,175 1,442

Exceptional items 1,664 321

Long term employee incentive costs 774 519

------------------------------------

Group Adjusted EBITDA 27,963 22,691

------------------------------------ -------- --------

Group Adjusted EBITDA increased by 23.2% to GBP28.0 million

(2016: GBP22.7 million), due to an increase in the number of

existing sites reaching mature profit levels.

Group Adjusted EBITDA is adversely affected by pre-opening costs

incurred in the process of opening new sites. Group Adjusted EBITDA

before Pre-Opening Costs increased by 22.9% to GBP30.6 million.

Pre-opening costs increased from GBP2.2 million to GBP2.6 million,

reflecting 21 site openings in 2017 compared to 15 in 2016. In 2017

GBP0.3 million of the costs related to Q1 2018 openings.

Growth in EBITDA from our mature sites has contributed

significantly towards the growth in Group Adjusted EBITDA. Mature

Site EBITDA(1) contributed by the 74 mature sites increased by

30.3% to GBP34.1 million (2016: GBP26.2 million from 55 sites).

EBITDA from new sites decreased from GBP3.8 million in 2016,

representing 34 sites, to GBP3.0 million in 2017, with 54 sites at

31 December 2017. This is as a result of the timing of gyms

openings in 2017 compared to 2016 and just 3 months contribution

from the 18 Lifestyle sites. The new gyms opened in 2016 and 2017

are performing well.

Exceptional items

Exceptional costs have increased significantly year on year from

GBP0.3 million in 2016 to GBP1.7 million in 2017. In 2017

Exceptional items includes GBP0.5 million of acquisition costs and

GBP0.6 million of integration costs associated with the acquisition

of the Lifestyle Fitness portfolio. A further GBP0.5 million

related to the restructuring costs associated from the

restructuring of the operating model associated with the personal

trainers used within the business.

Long term employee incentives

During the year the Group granted further Performance Share Plan

('PSP') and Share Incentive Plan ('SIP') shares to certain members

of senior management. The Group also introduced Restricted Stock

Option granted to certain members of senior management and Long

Service Awards granted to employees of the Group. The awards vest

in three years providing continuous employment during this period

and in the case of the PSP certain performance conditions are

attained relating to the earnings per share ("EPS") and Total

shareholder returns ("TSR").

The Group continues to operate a matching shares scheme under

the SIP, where for every share purchased by an employee the Group

will award one matching share, up to a maximum value, which vest in

three years subject to continued employment.

The Group recognised a charge of GBP0.8 million (2016: GBP0.5

million) in relation to these share based payment arrangements.

Finance costs

Finance costs were unchanged at GBP0.8 million in 2017 (2016:

GBP0.8 million) despite drawing GBP28.0 million from our facilities

to fund the Lifestyle acquisition, however this occurred in the

final quarter of 2017. The Group currently has undrawn facilities

of GBP12.0 million of its five year bullet repayment facility

having increased the facility available by GBP10.0 million during

the year.

Taxation

The Group has incurred a tax charge of GBP2.0 million for the

year ended 31 December 2017, which represents an effective tax rate

(ETR) on statutory profit before tax of 22.0% (2016: 17.8%). The

increase in ETR was driven by the adjustments in respect of prior

year depressing the ETR for 2016 in addition to which the Group

incurred a greater level of costs in 2017 which were not deductible

for tax purposes relating to the Lifestyle acquisition and fit-out

and refurbishment costs.

The underlying effective tax rate on adjusted profit before tax,

after adjusting for amortisation and exceptional items, is

20.8%.

(1) Mature sites are defined as gyms that have been open for 24

months or more measured at the end of the year. New sites are

defined as gyms that have been open for less than 24 months at the

end of the year, and includes all 18 Lifestyle sites.

Earnings

The statutory profit before tax increased to GBP9.2 million

(2016: GBP6.9 million), largely as a result of the increase in

Group Adjusted EBITDA, offset by increased depreciation due to

increased number of sites and higher exceptional costs. The Group

delivered a profit for the year of GBP7.2 million (2016: GBP5.7

million) as a result of the factors discussed above.

Basic earnings per share ('EPS') was 5.6p (2016: 4.5p). Adjusted

EPS was 7.4p (2016: 5.6p). Adjusted EPS is calculated by excluding

amortisation, exceptional items, and the resultant tax effect from

earnings.

Dividend

The Board expect to continue to adopt a progressive dividend

policy. When making proposals for the payment of dividends, the

Board considers the resources available to the Group.

Due to an oversight interim accounts were inadvertently not

filed at Companies House prior to payment of dividends in 2017,

totalling GBP1,347,000 and hence these distributions were paid in

technical infringement of the Companies Act 2006 ("the Act"). We

are undertaking a series of administrative steps in order to

rectify this issue and put the Company's shareholders and the

Directors, insofar as possible, in the position that was originally

intended. At the Annual General Meeting of the Company's

shareholders to be held on 4 June 2018, a special resolution is

proposed to authorise the appropriation of distributable profits to

the payment of the relevant dividends, to waive any rights of the

Company to pursue shareholders who received the distributions or

past, present or future Directors in respect of payment of the

distributions and to approve entering into deeds of release in

favour of such shareholders and Directors. Entry into the deeds of

release constitutes a smaller related party transaction under

Listing Rule 11.1.10 and a related party transaction under IAS 24

"Related party disclosures". The overall effect of the resolution

being proposed is to return all parties to the position they would

have been in had the relevant dividends been made in full

compliance with the Act. The Directors consider it in the best

interests of the Company to regularise the position since

sufficient distributable reserves were available to make the

payment and it was intended that shareholders should receive the

dividends.

The Group declared an interim dividend of 0.30p per share. The

Board recommends a final dividend of 0.90p per share in respect of

the financial year ending 31 December 2017, resulting in a full

year dividend of 1.20p per share. Shareholders will be asked to

approve the dividend at the AGM on 4 June 2018, for payment on 14

June 2018 to shareholders whose names are on the register on 25 May

2018. This final dividend will be paid by reference to interim

accounts, which will demonstrate that the Company has adequate

distributable reserves to pay the final dividend, to be filed with

Companies House in compliance with the Act.

Cash Flow

2017 2016

GBP'000 GBP'000

------------------------------------- --------- ---------

Group Adjusted EBITDA 27,963 22,691

Movement in working capital 2,981 5,186

Maintenance capital expenditure(1) (6,267) (2,933)

------------------------------------- --------- ---------

Group Operating Cash Flow 24,677 24,944

Expansionary capital expenditure(2) (52,453) (20,922)

Exceptional items (1,147) (944)

Taxation (1,050) (243)

Finance costs (759) (552)

Dividends paid (1,347) (321)

Other net cash flows from financing

activity 27,714 -

-------------------------------------

Net cash flow (4,365) 1,962

------------------------------------- --------- ---------

(1) Maintenance capital expenditure comprises the replacement of

gym equipment and premises refurbishment.

(2) Expansionary capital expenditure relates to the Group's

investment in the fit-out of new gyms, the acquisition of the

Lifestyle portfolio, product enhancements, acquisitions and

technology projects. It is stated net of contributions towards

landlord building costs.

(3) Items 1) & 2) are non-IFRS measures

The Group's increasing Group Adjusted EBITDA and efficient use

of working capital continues to deliver strong cash flows. Group

Operating Cash Flow has declined marginally by 1.1% from GBP24.9

million to GBP24.7 million despite greater cash generation from

mature sites as a result of the continuation of the site

refurbishment programme: in the current year 17 (2016: 8) sites

were refurbished. Total maintenance capital expenditure was GBP6.3

million (2016: GBP2.9 million). Given this our Group Operating Cash

Flow Conversion has fallen significantly to 88.2% for the year

(2016: 109.9%), despite the continuing positive effects of our

negative working capital profile.

Expansionary capital expenditure of GBP52.5 million (2016:

GBP20.9 million) arises as a result of the fit-out of new gyms and

the acquisition of the Lifestyle portfolio.

The funding of the Lifestyle acquisition and expansionary

capital expenditure has resulted in an increase in Net Debt to

GBP37.5 million (2016: GBP5.2 million) and the Net Debt:Group

Adjusted EBITDA to 1.34x (2016: 0.23x). Target threshold under

banking covenants is less than 3.25x.

Balance sheet

2017 2016

GBP'000 GBP'000

------------------------- --------- ---------

Non-current assets 196,253 148,157

Current assets 9,691 10,795

Current liabilities (44,971) (34,257)

Non-current liabilities (40,089) (10,405)

-------------------------

Net assets 120,884 114,290

------------------------- --------- ---------

Our business model and strong conversion from revenue to cash

results in an uncomplicated balance sheet.

Non-current assets have increased by GBP48.1 million to GBP196.3

million (2016: GBP148.2 million). This is largely as a result of

capital expenditure in property, plant and equipment and

intangibles totalling GBP63.3 million, offset by depreciation and

amortisation of GBP15.6 million.

Current assets have decreased due to lower cash balances, as

discussed above mitigated by an increase in prepayments as a result

of the increase in the number of sites. Current liabilities have

increased by GBP10.7 million as a result of lease incentives

associated with new gyms opening in the year, and increases in

trade and other payables as the size of our operations

increases.

The Group has drawn GBP38.0 million of its five year bullet

repayment facility. GBP12.0 million of the facility was undrawn at

31 December 2017 and will be utilised to fund new sites, working

capital and capital expenditure.

Guidance

We reiterate the guidance that we have made previously:

-- We expect 15 to 20 new openings for 2018;

-- Depreciation is expected to be 16% of revenue

in 2018;

-- The charge for long term employee incentives

is anticipated as GBP1.5m in 2018, rising

to GBP1.8m in 2019; and

In addition, in 2018:

-- We expect the new sites fit-out costs to continue

to be between GBP1.3 million and GBP1.4 million

per site, with a further GBP4.0 million to

GBP4.5 million of capital spend on IT, the

ERP platform and other expansionary projects;

-- The 18 Lifestyle conversions are expected

to complete at a total cost in 2017 and 2018

of GBP470,000 per site. A total of GBP1.5m

was spent in 2017 on the 6 conversions;

-- Maintenance capital expenditure is expected

to equate to 5.5% of revenue in 2018;

-- To support the growth of the business we expect

support office costs to be around 8.5% to

9.0% of revenues (2017: 10%).

-- The future effective tax rate, after adjusting

for amortisation and exceptional items, is

estimated to be 23% in 2018 (2017: 20.8%)

Richard Darwin

Chief Financial Officer

20 March 2018

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2017

31 December 31 December

Note 2017 2016

GBP'000 GBP'000

Revenue 91,377 73,539

Cost of sales (982) (830)

Gross profit 90,395 72,709

Administration expenses (80,453) (64,993)

Operating profit 9,942 7,716

Being:

- Group Adjusted EBITDA(1) 27,963 22,691

- Depreciation 7 (14,408) (12,693)

- Amortisation (1,175) (1,442)

- Exceptional items 3 (1,664) (321)

- Long term employee

incentive costs 5 (774) (519)

Finance income 12 19

Finance costs (763) (795)

Profit before tax 9,191 6,940

Tax charge 6 (2,020) (1,237)

Profit for the year attributable

to equity shareholders 7,171 5,703

------------ ------------

Other comprehensive income

for the year - -

Total comprehensive income

attributable to equity

shareholders 7,171 5,703

------------ ------------

Earnings per share 4 pence pence

Basic 5.6 4.5

Diluted 5.6 4.4

1-Group EBITDA is a non-GAAP metric used internally by

management and externally by investors

Consolidated Statement of Financial Position

As at 31 December 2017

31 December 31 December

Note 2017 2016

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 7 133,356 99,037

Intangible assets 62,066 48,717

Trade and other receivables 515 403

Available-for-sale financial

assets 316 -

------------ ------------

Total non-current assets 196,253 148,157

Current assets

Inventories 197 159

Trade and other receivables 9,037 5,814

Cash and cash equivalents 457 4,822

Total current assets 9,691 10,795

Total assets 205,944 158,952

------------ ------------

Current liabilities

Trade and other payables 43,662 34,123

Provisions 487 -

Income taxes payable 822 134

Total current liabilities 44,971 34,257

Non-current liabilities

Borrowings 8 37,113 9,178

Other financial liabilities 184 -

Provisions 700 544

Deferred tax liabilities 6 2,092 683

------------ ------------

Total non-current liabilities 40,089 10,405

Total liabilities 85,060 44,662

------------ ------------

Net assets 120,884 114,290

------------ ------------

Capital and reserves

Issued capital 12 12

Own shares held 48 48

Capital redemption reserve 4 4

Share premium 136,280 136,280

Retained deficit (15,460) (22,054)

Total equity shareholders'

funds 120,884 114,290

------------ ------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2017

Own Capital

Issued shares redemption Share Retained

Capital held reserve Premium deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2016 12 48 4 136,280 (27,901) 108,443

Profit for

the year and

total comprehensive

income - - - - 5,703 5,703

Share based

payments 5 - - - - 465 465

Dividends paid - - - - (321) (321)

At 31 December

2016 12 48 4 136,280 (22,054) 114,290

Profit for

the year and

total comprehensive

income - - - - 7,171 7,171

Share based

payments 5 - - - - 655 655

Deferred tax

on share based

payments - - - - 115 115

Dividends paid - - - - (1,347) (1,347)

At 31 December

2017 12 48 4 136,280 (15,460) 120,884

--------- -------- ------------ --------- --------- --------

Consolidated Cash Flow Statement

For the year ended 31 December 2017

31 December 31 December

Note 2017 2016

GBP'000 GBP'000

Cash flows from operating activities

Operating profit 9,942 7,716

Adjustments for:

Exceptional items 3 1,664 321

Depreciation of property, plant

and equipment 7 14,408 12,693

Amortisation of intangible assets 1,175 1,442

Long term employee incentive

costs 774 519

(Profit) / loss on disposal

of property, plant and equipment (5) 30

Increase in inventories (38) (37)

Increase in trade and other

receivables (3,334) (451)

Increase in trade and other

payables 6,358 5,622

------------ ------------

Cash generated from operations 30,944 27,855

Tax paid (1,050) (243)

Interest paid (771) (571)

------------ ------------

Net cash flows from operating

activities before exceptional

items 29,123 27,041

Exceptional costs (1,147) (944)

Net cash flow from operating

activities 27,976 26,097

------------ ------------

Cash flows from investing activities

Proceeds from disposals of property,

plant and equipment - 22

Purchase of available-for-sale

financial assets (316) -

Business Combinations (21,300) -

Purchase of property, plant

and equipment (35,411) (22,833)

Purchase of intangible assets (1,693) (1,022)

Interest received 12 19

Net cash flows used in investing

activities (58,708) (23,814)

------------ ------------

Cash flows from financing activities

Dividends paid (1,347) (321)

Drawdown of bank loans 28,000 -

Payment of financing fees (286) -

Net cash flows from / (used

in) financing activities 26,367 (321)

------------ ------------

Net (decrease) / increase in

cash and cash equivalents (4,365) 1,962

Cash and cash equivalents at

1 January 4,822 2,860

Cash and cash equivalents at

31 December 457 4,822

------------ ------------

Notes

1. General information

The financial information, comprising the Consolidated Statement

of Comprehensive Income, Consolidated Statement of Financial

Position, Consolidated Statement of Changes in Equity, Consolidated

Cash Flow Statement and related notes, has been extracted from the

Consolidated Financial Statements of The Gym Group plc ('the

Company') for the year ended 31 December 2017, which were approved

by the Board of Directors on 20 March 2018.

The financial information set out above does not constitute

statutory accounts for the years ended 31 December 2017 or 2016

within the meaning of sections 435(1) and (2) of the Companies Act

2006 or contain sufficient information to comply with the

disclosure requirements of International Financial Reporting

Standards ('IFRS'), but is derived from those accounts. An

unqualified report on the Consolidated Financial Statements for

each of the years ended 31 December 2017 and 2016 has been given by

the auditors Ernst & Young LLP. Each year's report did not

include reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain any statement under section 498 (2) or (3) of the

Companies Act 2006.

The Consolidated Financial Statements for the year ended 31

December 2016 have been filed with the Registrar of Companies, and

those for 2017 will be delivered in due course subject to their

approval by the Company's shareholders at the Company's Annual

General Meeting on 4 June 2018.

2. Basis of preparation

The Consolidated Financial Statements for the year ended 31

December 2017, from which the financial information in this

announcement is derived, have been prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted for

use in the EU, International Financial Reporting Interpretations

Committee ('IFRIC') interpretations and with those parts of the

Companies Act 2006 applicable to companies reporting under

IFRS.

The Consolidated Financial Statements have been prepared on a

going concern basis under the historical cost convention as

modified by the recognition of derivative financial instruments and

other financial liabilities at fair value. The Directors have made

appropriate enquiries and formed a judgement at the time of

approving the Financial Statements that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason

the Directors continue to adopt the going concern basis in

preparing the Financial Statements.

3. Exceptional items

2017 2016

GBP'000 GBP'000

Acquisition costs 548 -

Integration costs 525 -

Restructuring costs 543 -

Costs related to post IPO

reorganisation - 149

Costs associated with head

office relocation 48 172

1,664 321

-------- --------

Acquisition and integration costs relate to the acquisition of

the trade and assets from Lifestyle Fitness consisting of 18 sites

located in the Midlands, North of England and Scotland on the 29

September 2017. Restructuring costs relate to the cost associated

with changing the operating model in relation to the use of

Personal Trainers within the business.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit or

loss attributable to equity shareholders by the weighted average

number of Ordinary shares outstanding during the year, excluding

unvested shares held pursuant to The Gym Group plc Share Incentive

Plan, The Gym Group plc Performance Share Plan, The Gym Group plc

Restricted Stock Plan and The Gym Group plc Long Service Award Plan

(see note 5).

2017 2016

Basic weighted average number

of shares 128,105,275 128,105,275

Adjustment for share awards 416,773 172,130

------------ ------------

Diluted weighted average number

of shares 128,522,048 128,277,405

Basic earnings per share (p) 5.6 4.5

Diluted earnings per share

(p) 5.6 4.4

------------ ------------

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary shares outstanding to assume

conversion of all dilutive potential Ordinary shares. During the

year ended 31 December 2017, the Group had potentially dilutive

shares in the form of share options and unvested shares issued

pursuant to The Gym Group plc Share Incentive Plan,The Gym Group

plc Performance Share Plan, The Gym Group plc Restricted Stock Plan

and The Gym Group plc Long Service Award Plan (see note 5).

Adjusted earnings per share is based on profit for the year

before exceptional items, amortisation and their associated tax

effect.

2017 2016

GBP'000 GBP'000

Profit for the year 7,171 5,703

Amortisation of intangible

assets 1,175 1,442

Exceptional administration

expenses 1,664 321

Tax effect of above items (483) (313)

Adjusted earnings 9,527 7,153

-------- --------

Basic adjusted earnings per

share (p) 7.4 5.6

Diluted adjusted earnings per

share (p) 7.4 5.6

-------- --------

5. Share based payments

The Group had the following share-based payment arrangements in

operation during the year:

a) The Gym Group plc Performance Share Plan

b) The Gym Group plc Share Incentive Plan -

Free shares

c) The Gym Group plc Share Incentive Plan -

Matching shares

d) The Gym Group plc Restricted Stock Plan

e) The Gym Group plc Long Service Award Plan

In accordance with IFRS 2 Share Based Payments, the value of the

awards are measured at fair value at the date of the grant. The

fair value is expensed on a straight-line basis over the vesting

period, based on management's estimate of the number of shares that

will eventually vest.

The Group recognised a total charge of GBP655,000 (2016:

GBP465,000) in respect of the Group's share based payment

arrangements and related employer's national insurance of

GBP119,000 (2016: GBP54,000).

6. Taxation

The major components of taxation are:

(a) Tax on profit

2017 2016

GBP'000 GBP'000

Current income tax

Current tax on profits for the

year 1,712 426

Adjustments in respect of prior

years 24 (49)

-------- --------

Total current income tax 1,736 377

Deferred tax

Origination and reversal of

temporary differences 534 1,118

Change in tax rates (78) 18

Adjustments in respect of prior

years (172) (276)

-------- --------

Total deferred tax 284 860

Tax charge in the Consolidated

Statement of Comprehensive Income 2,020 1,237

-------- --------

(b) Reconciliation of tax charge

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the weighted average rate

applicable to profits of the Group as follows:

2017 2016

GBP'000 GBP'000

Profit before tax 9,191 6,940

Tax calculation at standard

rate of corporation tax of 19.25%

(2016: 20.00%) 1,769 1,388

Expenses not deductible for

tax purposes 329 156

Exceptional costs not deductible 148 -

Change in tax rates (78) 18

Adjustments in respect of prior

years (148) (325)

2,020 1,237

-------- --------

(c) Deferred tax

During the year the Group recognised the following deferred tax

assets and liabilities:

Accelerated

capital Intangible Share

allowances Losses assets schemes Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2016 (187) 1,006 (642) - 177

Prior year adjustment 276 - - - 276

Recognised in

income statement (564) (796) 217 25 (1,118)

Change in deferred

tax rate - (50) 32 - (18)

At 31 December

2016 (475) 160 (393) 25 (683)

Prior year adjustment 171 - - 1 172

Acquired in

business combination (921) - (319) - (1,240)

Recognised in

equity - - - 115 115

Recognised in

income statement (777) (20) 137 126 (534)

Change in deferred

tax rate 123 (15) 25 (55) 78

At 31 December

2017 (1,879) 125 (550) 212 (2,092)

------------ -------- ----------- --------- --------

7. Property, plant and equipment

Fixtures, Gym

Assets fittings and

under Leasehold and other Computer

Construction improvements equipment equipment equipment Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January

2016 - 74,027 5,569 34,787 924 115,307

Additions - 16,729 1,178 8,257 381 26,545

Disposals - (100) - (244) - (344)

At 31 December

2016 - 90,656 6,747 42,800 1,305 141,508

Additions 2,368 21,875 2,505 10,608 647 38,003

Business

Combinations - 5,724 208 4,827 - 10,759

Disposals - (180) (8) (522) (2) (712)

At 31 December

2017 2,368 118,075 9,452 57,713 1,950 189,558

-------------- -------------- ----------- ----------- ----------- --------

Accumulated

depreciation

At 1 January

2016 - 12,309 2,321 14,948 492 30,070

Charge for

the year - 6,422 812 5,205 254 12,693

Disposals - (48) - (244) - (292)

At 31 December

2016 - 18,683 3,133 19,909 746 42,471

Charge for

the year - 7,429 1,034 5,575 370 14,408

Disposals - (168) (4) (503) (2) (677)

At 31 December

2017 - 25,944 4,163 24,981 1,114 56,202

-------------- -------------- ----------- ----------- ----------- --------

Net book

value

At 31 December

2016 - 71,973 3,614 22,891 559 99,037

At 31 December

2017 2,368 92,131 5,289 32,732 836 133,356

-------------- -------------- ----------- ----------- ----------- --------

8. Borrowings

2017 2016

GBP'000 GBP'000

Non-current

Facility A 10,000 10,000

Facility B 28,000 -

Loan arrangement fees (887) (822)

37,113 9,178

-------- --------

The Group's bank borrowings are secured by way of fixed and

floating charges over the Group's assets.

HSBC and Barclays bank facility

On 12 November 2015 the Group entered into a five year bullet

repayment facility with HSBC and Barclays. The facility comprises a

GBP10.0 million term loan ('facility A') for the purposes of

refinancing the Group's previous finance leases, a GBP25.0 million

term loan ('facility B') to fund acquisitions and capital

expenditure, and a GBP5.0 million revolving credit facility. On 14

September 2017 the Group agreed a facility amendment increasing

facility B commitment from GBP25.0 million to GBP35.0 million to

enable the acquisition of the Lifestyle Portfolio of gyms. Interest

is charged at LIBOR plus a 2.5% margin.

9. Business Combinations

On the 29 September 2017 the group acquired the trade and assets

of a portfolio of 18 gyms trading under the Lifestyle brand. The

property lease agreements in respect of ten of these gyms were

transferred to the Group and these gyms are being rebranded to

operate under The Gym brand. In respect of the eight other gyms,

the property leases were not transferred to the Group and these

gyms continue to be operated using the Lifestyle Fitness brand

under a concession agreement with the vendor whereby the Group will

pay a royalty based upon a percentage of revenue together with a

recharge equal to the vendor's lease rentals. The concession

agreement also includes an option fee totalling GBP1.25 million for

the Group to terminate the concession agreement in respect of each

gym and transfer the leasehold. In early 2018 the Board has taken

the decision to terminate the concession agreement and convert all

eight gyms to The Gym brand during 2018.

Further on the 24 November 2017 the Group also acquired the

trade and assets of a single gym based in the Aylesbury. The

consideration for the Aylesbury acquisitions includes an element of

contingent consideration which is payable upon the number of

members at the site reaching a predetermined level.

The details of both transactions, the purchase consideration,

the net assets acquired and goodwill are as follows:

Fair value

Lifestyle Aylesbury Total

Net assets

acquired GBP'000 GBP'000 GBP'000

Intangibles 1,880 72 1,952

Property, plant and equipment 10,283 476 10,759

Provisions (295) - (295)

Deferred

tax (1,242) - (1,242)

--------------------------------- ------------------- --------

Net Assets 10,626 548 11,174

-------------------------------- ------------------- ---------- --------

Goodwill 9,874 436 10,310

Total consideration 20,500 984 21,484

-------------------------------- ------------------- ---------- --------

Satisfied by

:

Cash 20,500 800 21,300

Contingent

consideration - 184 184

-------------------------------- ---------- --------

Total consideration 20,500 984 21,484

-------------------------------- ------------------- ---------- --------

Net cash outflow arising

on acquisition

Cash consideration 20,500 800 21,300

Net cash outflow 20,500 800 21,300

-------------------------------- ------------------- ---------- --------

Five year record

2017 2016 2015 2014 2013(1)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 91,377 73,539 59,979 45,480 35,734

Group Adjusted EBITDA 27,963 22,691 17,016 14,688 11,752

Group Adjusted EBITDA

before Pre-Opening

Costs 30,598 24,888 19,681 16,668 12,886

Group Operating Cash

Flow 24,677 24,944 18,616 16,514 14,751

Group Operating Cash

Flow Conversion 88.2% 109.9% 109.4% 112.4% 125.5%

Expansionary Capital

Expenditure 52,453 20,922 28,230 20,335 14,058

Net Debt 37,543 5,178 7,140 49,205 36,743

Net Debt to Group

Adjusted EBITDA 1.34x 0.23x 0.42x 3.35x 3.11x

Group Adjusted Earnings 9,527 7,153 (1,107) (4,452) (3,551)

Adjusted earnings

per share (p) 7.4 5.6 (1.8) (9.1) (13.3)

Total Number of Gyms

(number) 128 89 74 55 40

Total Number of Members

('000) 607 448 376 293 225

Average Revenue per

Member per Month

(GBP) 14.41 14.31 14.08 13.98 14.06

Number of Mature

Gyms in Operation

(number) 74 55 40 32 16

Mature Gym Site EBITDA 34,082 26,161 18,828 16,244 9,505

(1) The Gym Group plc acquired control of The Gym Limited on 13

June 2013. Before this date the Group did not constitute a single

legal group. Prior to the acquisition, combined financial

information has been prepared on a basis that aggregates the

results, cash flows, assets and liabilities of each the companies

constituting the Group.

Responsibilities statement

The following statement will be contained in the 2017 Annual

Report and Accounts:

We confirm that to the best of our knowledge:

-- the Group Financial Statements, which have

been prepared in accordance with IFRSs as

adopted by the EU, give a true and fair view

of the assets, liabilities, financial position

and results of the Group; and

-- the Strategic Report contained in this Annual

Report includes a fair review of the development

and performance of the business and the position

of the Company and the Group, together with

a description of the principal risks and uncertainties

that they face; and

-- the Annual Report and Accounts, taken as a

whole, is fair, balanced and understandable

and provides the information necessary for

shareholders to assess the Company's performance,

business model and strategy.

On behalf of the Board

Richard Darwin

Chief Financial Officer and Company Secretary

20 March 2018

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LLFSTVSIALIT

(END) Dow Jones Newswires

March 20, 2018 03:00 ET (07:00 GMT)

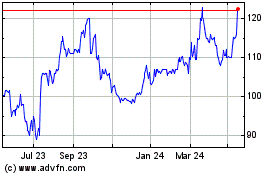

The Gym (LSE:GYM)

Historical Stock Chart

From Jun 2024 to Jul 2024

The Gym (LSE:GYM)

Historical Stock Chart

From Jul 2023 to Jul 2024