TIDMGYM

RNS Number : 4731I

The Gym Group plc

31 August 2016

The Gym Group Plc

('the Company' or 'The Gym')

2016 Interim Results

Continued strong growth in membership numbers and

profitability

The Gym Group Plc, the fast growing, nationwide operator of 80

low cost gyms branded 'The Gym', announces its interim results for

the six month period ended 30 June 2016.

Financial Highlights

-- Revenue of GBP36.1 million, an increase of 25.1% (H1 2015: GBP28.9 million)

-- Group Adjusted EBITDA(1) of GBP11.5 million, an increase of

35.2% (H1 2015: GBP8.5 million)

-- Group Operating Cash Flow(2) of GBP13.5 million, an increase

of 13.6% (H1 2015: GBP11.8 million)

-- Adjusted profit before tax(3) of GBP4.6 million (H1 2015: loss of GBP0.8 million)

-- Adjusted EPS(4) of 2.8 pence (H1 2015: loss of 3.3 pence)

-- Statutory profit before tax of GBP3.4 million (H1 2015: loss of GBP3.3 million)

-- Strong cash generation reduces net debt to GBP2.5 million (December 2015: GBP7.1 million)

-- Maiden interim dividend of 0.25 pence declared

Operational Progress

-- Six new gyms opened in H1 2016 increasing the total estate to 80

-- 19.4% increase in membership numbers versus prior year to 424,000 (H1 2015: 355,000)

-- Maturing sites driving profitability - Site EBITDA up 30.8%

ahead of revenue growth demonstrating the Company's operational

gearing

-- Strong pipeline for H2 2016 and 2017 - expect to meet target of 15-20 new gyms per year

-- Recently exchanged contracts on four sites from another operator

-- 11.2 million visits in the period, up 2.1 million compared to H1 2015

-- Gold Investors in People awarded

John Treharne, CEO of The Gym Group, commented:

"Excellent progress has been achieved so far in 2016 as

demonstrated by the growth in membership. Our rollout is on track

with six sites opened in H1. We remain on target for 15-20 for the

year and have a strong pipeline for 2017. Our existing sites are

performing well which has contributed to the Group's strong growth

in profitability.

We are confident that our low cost, disruptive positioning in

the market place, our well-developed roll out plans and our strong

financial position bode well for further rapid and measured

profitable development and progress, whatever the economic

environment."

An audio webcast of the analyst presentation will be available

from 13:00 today via our website www.tggplc.com

For further information, please contact

The Gym Group via Instinctif Partners

John Treharne, CEO

Richard Darwin, CFO

Numis

Oliver Cardigan

Oliver Hardy

Toby Adcock 020 7260 1000

Instinctif Partners

Matthew Smallwood

Justine Warren 0207 457 2020

(1) Group Adjusted EBITDA is calculated as operating profit

before depreciation, amortisation, long term employee incentive

costs, exceptional items and other income.

(2) Group Operating Cash Flow is calculated as Group Adjusted

EBITDA less working capital less maintenance capital

expenditures.

(3) Adjusted profit before tax is calculated as Group Adjusted

EBITDA less depreciation, net finance costs and long term employee

incentives.

(4) Adjusted EPS is calculated as the Group's profit for the

period before amortisation, exceptional items, other income and the

related tax effect, divided by the basic weighted average number of

shares.

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". By their nature, such

statements involve risk and uncertainty since they relate to future

events and circumstances. Actual results may, and often do, differ

materially from any forward-looking statements.

Any forward-looking statements in this announcement reflect

management's view with respect to future events as at the date of

this announcement. Save as required by law or by the Listing Rules

of the UK Listing Authority, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement following any change in its expectations or to reflect

subsequent events or circumstances following the date of this

announcement.

Chief Executive's Review

Progress in the first half of 2016 has met the Board's

expectations. Revenue of GBP36.1 million increased by 25.1% mainly

as a result of the 22.8% growth of average members in H1 to 420,000

(H1 2015: 342,000). Average revenue per member per month increased

by 1.6% to GBP14.31 (H1 2015: GBP14.08). We now have 80 sites open,

with six openings so far this year and further openings scheduled

for the last four months of the year to meet our 2016 target of

15-20. Our revenue growth is driven by the 2015 and 2016 site

openings together with ongoing maturation of sites opened in 2014.

At June 2016, we had 25 sites that had been open since December

2014, reflecting the relative immaturity and potential of our gym

estate.

The increase in revenues and members is, as anticipated,

translating into growth in profit. Group Adjusted EBITDA grew by

GBP3.0 million to GBP11.5 million, up 35.2% (H1 2015: GBP8.5

million). Site EBITDA(1) increased by 30.8%, ahead of revenue

growth, demonstrating the operational leverage inherent within our

model. Our highly profitable business model aligned with

disciplined site selection is enabling us to generate strong cash

flows which are being invested into new sites. The business is

approaching debt free status at the half year, with just GBP2.5

million of net debt. We have substantial firepower from which to

fund and develop the business, with a total of GBP40.0 million of

available financing facilities.

In light of this strong performance and its confidence in future

cash flows, the Board has declared a maiden interim dividend of

0.25 pence per share.

I set out five key operational initiatives in our last Annual

Report that will drive the future growth of our business. These are

i) to continually improve the performance of our existing sites;

ii) drive efficiencies from our low cost operating model; iii)

continue to enhance the strong customer proposition; iv) rollout

new sites from a strong pipeline; and v) focus on people. At the

half year we are making progress against these priorities:

- Improve performance of existing sites. This involves bringing

the new sites opened in the last two years to maturity and

maintaining the performance and market positioning of the existing

sites. EBITDA per site increased by 2.7% to GBP187,000 (H1 2015:

GBP182,000) as the maturing of recent openings drives up the

overall profitability of the business.

- Efficiencies from low cost operating model. Our operating

discipline is shown in the strong margin performance and tight

control over capital expenditure spent on new sites. Overall Site

EBITDA margin grew to 41.5% (2015: 39.6%). We continue to open

sites at an overall cost of between GBP1.3 million to GBP1.4

million per site, and in some instances where we can take on the

appropriate type of building the cost is being reduced due to cost

re-engineering.

- Strong customer proposition. The Gym originated the low cost

gym concept and we are constantly examining ways to innovate

further. Enhancements are being rolled out to improve classes, free

weights provision and member zones in the gym. We are currently

trialling innovative ways to provide more benefits to our members,

including the creation of an e-shop and affiliate partnerships.

- Rollout new sites delivered from a strong pipeline: We opened

six sites in the first half, of which four are within London. These

are trading encouragingly and in line with our expectations. We

have a strong opening programme for H2 including a number of sites

within the M25 which will extend our presence within Greater

London, including new sites at Sunbury, Lewisham and Dagenham. We

currently expect to meet our target of 15-20 new sites for 2016. As

in previous years, our openings are expected to be weighted towards

Q4. The pipeline in 2017 is also building well and is much more

developed than at the same time last year. As part of our rollout

strategy we have recently exchanged contracts on four sites from

another operator that meet our acquisition criteria and will be

fitted out to our high specifications. The four sites following

assignment of the leases, closure and fit out are likely to open in

Q1 2017. We believe there is a substantial opportunity in the low

cost gym market in which we operate with currently only 450 low

cost Gyms across the UK.

- Focus on people. Considerable progress in the first half has

been made in building the Executive team to support the business in

its rapid growth. I am delighted that Nick Henwood has joined us as

Operations Director having held similar roles at David Lloyd

Leisure, Mothercare and Autoglass. Nick will help to build the

quality of the member proposition. Barney Harrison joins as

Marketing Director from Sky where he had extensive experience in

customer acquisition within their subscription TV business in

Ireland and also at Skybet. I would like to pay tribute to the

enormous contribution to the growth of The Gym Group made by Jim

Graham as COO over the last three years - Jim has decided to return

to the private equity world from which he joined us and we wish him

well. Our investment and commitment to all our people is shown by

the award of the Gold Investors in People and it is key to our

success that we maintain this strong culture and ethos as the

business grows. We were pleased to enable all our employees to

become shareholders in the business through a free shares issue in

April this year.

During the second half of 2016 we will continue to progress,

opening new sites and maturing the gyms that have been opened in

the last two years. If the external environment becomes more

challenging our value proposition will become even more attractive

to consumers - The Gym Group opened its first gym in the wake of

the financial crisis in 2008 and its model is designed to perform

well in all types of economic conditions. I am confident that the

business will continue to execute its strategy and deliver

strongly, disrupting the market in which we operate. After a good

first half we are on track to meet market expectations for profit

for the full year and are confident that we will continue to make

strong progress.

(1) Site EBITDA is calculated as Group Adjusted EBITDA

contributed by the gym portfolio.

John Treharne

Chief Executive Officer

31 August 2016

Financial Review

Six months ended 30 June 2016 Six months ended 30 June 2015 Movement

GBP'000 GBP'000

Revenue 36,079 28,850 25.1%

Group Adjusted EBITDA(1) 11,502 8,507 35.2%

Group Adjusted EBITDA before Pre-Opening

Costs(2) 12,587 9,671 30.2%

Group Operating Cash Flow(3) 13,450 11,839 13.6%

Group Operating Cash Flow Conversion(4) 116.9% 139.2% (16.0)%

Expansionary Capital Expenditure(5) 8,466 12,571 (32.7)%

Net Debt 2,497 55,674 (95.5)%

Total number of gyms 80 63 27.0%

Number of members 424 355 19.4%

Average number of members(6) 420 342 22.8%

Average revenue per member per month

(GBP)(7) 14.31 14.08 1.6%

------------------------------------------- ------------------------------ ------------------------------ ---------

(1) Group Adjusted EBITDA is calculated as operating profit

before depreciation, amortisation, exceptional items, long term

employee incentive costs and other income.

(2) Group Adjusted EBITDA before Pre-Opening Costs is defined as

Group Adjusted EBITDA excluding the costs associated with new site

openings

(3) Group Operating Cash Flow is calculated as Group Adjusted

EBITDA less working capital less maintenance capital

expenditures.

(4) Group Operating Cash Flow Conversion is calculated as Group

Operating Cash Flow as a percentage of Group Adjusted EBITDA.

(5) Expansionary capital expenditure relates to the Group's

investment in the fit-out of new gyms and central IT projects. It

is stated gros

of amounts funded by finance leasing (occurring in the prior

period only) and net of contributions towards landlord building

costs.

(6) Average number of members is calculated as the total number

of members divided by the number of months in the period

(7) Average revenue per member per month is calculated as

revenue divided by the average number of members divided by the

number of months in the period and has been calculated on a

consistent basis for H1 2016 and H1 2015.

Continued focus on the Group's ongoing rollout strategy has

increased the size of the estate to 80 sites, an increase of 17

sites compared to 30 June 2015. Membership numbers increased

significantly to 424,000 compared to 355,000 as at 30 June 2015, an

increase of 19.4%.

Group Adjusted EBITDA increased by 35.2% to GBP11.5 million (H1

2015: GBP8.5 million), with GBP1.1 million of costs incurred in

relation to pre-opening costs during the period (H1 2015: GBP1.2

million).

Revenue

The average number of members for the half year increased by

22.8% to 420,000 (H1 2015: 342,000), driven by the increased size

of the estate. Average revenue per member per month increased from

GBP14.08 to GBP14.31.

As a result, revenue for the half year increased by 25.1% to

GBP36.1 million (H1 2015: GBP28.9 million).

Group Adjusted EBITDA

Group Adjusted EBITDA increased from GBP8.5 million in the six

months ended 30 June 2015 to GBP11.5 million for the six months

ended 30 June 2016. Growth was driven by an increase in the size of

the estate, as well as the average EBITDA per site(7) increasing by

2.7%. On average, each site contributed GBP187,000 to EBITDA,

compared to GBP182,000 in H1 2015.

Group Adjusted EBITDA is adversely affected by pre-opening costs

of GBP1.1 million compared to GBP1.2 million in the first half of

2015. As sites opened during 2014 and 2015 grow to maturity, Group

Adjusted EBITDA before Pre-Opening Costs per site(8) increased from

GBP154,000 in H1 2015 to GBP157,000 in the current period. This

increase, combined with the growth of the overall estate, resulted

in a 30.2% increase in Group Adjusted EBITDA before Pre-Opening

Costs to GBP12.6 million (H1 2015: GBP9.7 million).

(7) Average EBITDA per site is calculated as Site EBITDA divided

by the total number of gyms.

(8) Group Adjusted EBITDA before Pre-Opening Costs per site is

calculated as Group Adjusted EBITDA before Pre-Opening Costs

divided by the total number of gyms.

Result for the period

Six months ended 30 June 2016 Six months ended 30 June 2015

GBP'000 GBP'000

Group Adjusted EBITDA 11,502 8,507

Exceptional items (159) (1,464)

Long term employee incentive costs (471) -

Depreciation (6,079) (4,878)

Amortisation (1,028) (1,069)

Net finance costs (378) (4,416)

Taxation (850) (688)

------------------------------ ------------------------------

Profit / (loss) for the period 2,537 (4,008)

------------------------------ ------------------------------

Significant exceptional costs were incurred in the six months

ended 30 June 2015 in relation to the exploration of strategic

options prior to the Group's IPO in November 2015, and in relation

to the IPO itself. Exceptional costs of GBP0.2 million were

incurred in the six months ended 30 June 2016 in relation to

one-off strategic activities.

During the period the Group implemented the Performance Share

Plan and Share Incentive Plan, which includes the issue of free

shares and a partnership share scheme open to all employees. This

resulted in a charge of GBP0.5 million.

Depreciation charges increased from GBP4.9 million in the prior

period to GBP6.1 million in the six months ended 30 June 2016,

largely as a result of the increased number of sites.

Net finance costs decreased significantly as a result of changes

in the Group's financing structure on IPO.

The Group has incurred an income tax charge for the period of

GBP0.1 million (H1 2015: GBP0.2 million). Taxable profits were

largely offset by the utilisation of taxable losses. A deferred tax

charge of GBP0.7 million (H1 2015: deferred tax credit of GBP0.9

million) has arisen mainly in relation to the same utilisation of

losses.

Earnings

Six months ended 30 June 2016 Six months ended 30 June 2015

GBP'000 GBP'000

Profit / (loss) before tax for the period 3,387 (3,320)

Amortisation of intangible assets 1,028 1,069

Exceptional items 159 1,464

------------------------------ ------------------------------

Adjusted Profit Before Tax 4,574 (787)

Tax charge (850) (688)

Tax effect of adjustment items (167) (201)

------------------------------ ------------------------------

Adjusted Earnings 3,557 (1,676)

------------------------------ ------------------------------

Adjusted Earnings per Share (pence) 2.8 (3.3)

------------------------------------------- ------------------------------ ------------------------------

The tax charge was recognised based on management's best

estimate of the annual income tax rate expected for the full

financial year, applied to the profit before tax for the interim

period. On this basis, the Group's tax charge was GBP0.9 million

(H1 2015: GBP0.7 million). The effective tax rate on Adjusted

Profit Before Tax was 22.2%.

Excluding the tax effect of the amortisation of acquired

intangible assets and exceptional items (GBP167,000) and deferred

tax adjustments in respect of prior years (GBP127,000), the

effective tax rate on Adjusted Profit Before Tax for the half year

ended 30 June 2016 was 25.0%.

Adjusted Earnings for the period increased by GBP5.2 million,

from a loss of GBP1.7 million to a profit for the current period of

GBP3.6 million as a result of the factors discussed above.

Adjusted Earnings per Share was a profit of 2.8 pence (H1 2015:

loss of 3.3 pence). The improvement in Adjusted EPS results from

both an increase in Adjusted Earnings and the dilution arising on

the issue of shares on IPO.

Dividends

The Directors have declared an interim maiden dividend of 0.25

pence. The ex-dividend date is 8 September 2016, with a payment

date of 30 September 2016.

Cash Flow and Net Debt

Six months ended 30 June 2016 Six months ended 30 June 2015

GBP'000 GBP'000

Group Adjusted EBITDA 11,502 8,507

Movement in working capital 2,760 4,034

Maintenance capital expenditure (812) (702)

------------------------------ ------------------------------

Group Operating Cash Flow 13,450 11,839

Expansionary capital expenditure (8,466) (12,571)

Exceptional items (129) (1,464)

Finance costs (212) (4,966)

Repayment of debt - (1,936)

Drawdown of loans - 6,463

------------------------------ ------------------------------

Net cash flow 4,643 (2,635)

------------------------------ ------------------------------

The Group has delivered strong cash generation in the six months

ended 30 June 2016, with Group Operating Cash Flow of GBP13.5

million compared to GBP11.8 million in the prior period due to an

increase in Group Adjusted EBITDA resulting from a greater number

of gyms.

Group Operating Cash Flow Conversion improved from 109.4% for

the year ended 31 December 2015 to 116.9% for the current

period.

Expansionary capital expenditure of GBP8.5 million arises as a

result of the fit-out of new gyms.

30 June 2016 30 June 2015

GBP'000 GBP'000

Net debt at 1 January 7,140 49,205

Group operating cash flow (13,450) (11,839)

Expansionary capital expenditure 8,466 12,571

Other non-operating cash flow 341 1,210

Drawdown of loans - 6,463

Repayment of finance leases - (1,936)

------------- -------------

Net debt at 30 June 2,497 55,674

------------- -------------

Strong cash generation during the half year has resulted in a

decrease in net debt to GBP2.5 million. The Group has drawn GBP10.0

million of its five year bullet repayment facility, with GBP25.0

million of the facility undrawn and available to fund new sites,

working capital and capital expenditure. In addition, the Group has

a GBP5.0 million revolving credit facility which was undrawn at 30

June 2016.

Principal Risks and Uncertainties

The principal risks and uncertainties set out in the last annual

report remain valid at the date of this report. In summary, these

include:

-- the competitive position of the Group;

-- the delivery of the organic rollout plan;

-- providing members with a high quality product and service;

-- retention of key staff;

-- dependency on the performance of IT systems;

-- data security and protection;

-- satisfactory delivery from outsourced services providers; and

-- adherence with regulatory requirements.

Management makes critical judgements in applying the Group's

accounting policies in relation to depreciation and amortisation,

goodwill impairment, provisions, income taxes and share based

payments. A more detailed description of these estimations and

uncertainties is included in the 2015 Annual Report, which can be

obtained from the Company's registered office or from

www.tggplc.com.

Going Concern

As stated in note 2 to the Interim Financial Statements, the

Directors are satisfied that the Group has sufficient resources to

continue in operation for the foreseeable future, a period of at

least 12 months from the date of this report. Accordingly, they

continue to adopt the going concern basis in preparing the Interim

Financial Statements.

Cautionary Statement

This report has been prepared solely to provide additional

information to shareholders to assess the Group's strategies and

the potential for those strategies to succeed. The Interim

Management Report should not be relied on by any other party or for

any other purpose.

In making this report, the Company is not seeking to encourage

any investor to either buy or sell shares in the Company. Any

investor in any doubt about what action to take is recommended to

seek financial advice from an independent financial advisor

authorised by the Financial Services and Markets Act 2000.

Directors' Responsibility Statement

The Directors confirm that, to the best of their knowledge:

-- the Interim Financial Statements have been prepared in

accordance with IAS 34 Interim Financial Reporting;

-- the Interim Management Report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

-- the Interim Management Report includes a fair review of the

information required by DTR 4.2.8R (disclosure of relates parties'

transactions and changes therein).

John Treharne Richard Darwin

Chief Executive Officer Chief Financial Officer

31 August 2016 31 August 2016

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2016

Note Six months ended 30 Six months ended 30 Year ended 31 December

June 2016 June 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Revenue 36,079 28,850 59,979

Cost of sales (419) (518) (1,073)

Gross profit 35,660 28,332 58,906

Administration expenses (31,895) (27,236) (62,712)

Other income - - 1,105

Operating profit / (loss) 3,765 1,096 (2,701)

Finance income 13 233 265

Finance costs (391) (4,649) (9,946)

Profit / (loss) before

tax 3,387 (3,320) (12,382)

Tax (charge) / credit 5 (850) (688) 909

Profit / (loss) for the

period attributable to

equity shareholders 2,537 (4,008) (11,473)

------------------------ ------------------------ -------------------------

Other comprehensive - - -

income for the period

Total comprehensive

income / (loss)

attributable to equity

shareholders 2,537 (4,008) (11,473)

------------------------ ------------------------ -------------------------

Earnings per share 4 pence pence pence

Basic 2.0 (8.0) (19.0)

Diluted 2.0 (8.0) (19.0)

Adjusted earnings per

share 4

Basic 2.8 (3.3) (1.8)

Diluted 2.8 (3.3) (1.8)

------------------------ ------------------------ -------------------------

Reconciliation of GBP'000 GBP'000 GBP'000

operating profit to

Group Adjusted EBITDA

Operating profit / (loss) 3,765 1,096 (2,701)

Depreciation of property,

plant and equipment 6 6,079 4,878 10,907

Amortisation of

intangible assets 1,028 1,069 2,308

Exceptional items 3 159 1,464 7,607

Other income - - (1,105)

Long term employee 471 - -

incentive costs

------------------------ ------------------------ -------------------------

Group Adjusted EBITDA 11,502 8,507 17,016

------------------------ ------------------------ -------------------------

Group Adjusted EBITDA is a non-GAAP metric used by management

and is not an IFRS disclosure

Condensed Consolidated Statement of Financial Position

As at 30 June 2016

Note 30 June 2016 30 June 2015 31 December 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 6 88,837 75,975 85,237

Intangible assets 48,344 49,946 49,137

Deferred tax asset 5 - - 177

Total non-current assets 137,181 125,921 134,551

Current assets

Inventories 167 140 122

Trade and other receivables 7,044 5,971 5,654

Cash and cash equivalents 7,503 2,941 2,860

Total current assets 14,714 9,052 8,636

Total assets 151,895 134,973 143,187

------------- ------------- -----------------

Current liabilities

Trade and other payables 30,520 26,780 25,546

Income taxes payable 116 10 -

Borrowings 7 - 4,039 -

Total current liabilities 30,636 30,829 25,546

Non-current liabilities

Borrowings 7 9,072 74,040 8,966

Provisions 230 226 232

Derivative financial instruments - 811 -

Deferred tax liabilities 5 557 1,482 -

------------- ------------- -----------------

Total non-current liabilities 9,859 76,559 9,198

Total liabilities 40,495 107,388 34,744

------------- ------------- -----------------

Net assets 111,400 27,585 108,443

------------- ------------- -----------------

Capital and reserves

Issued capital 10 12 9 12

Own shares held 48 - 48

Capital redemption reserve 4 - 4

Share premium 136,280 48,982 136,280

Retained deficit (24,944) (21,406) (27,901)

------------- ------------- -----------------

Total equity shareholders' funds 111,400 27,585 108,443

------------- ------------- -----------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2016

Issued Capital Own shares held Capital Share Premium Retained Total

redemption deficit

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2015 (audited) 9 - - 48,974 (17,398) 31,585

Loss for the

period and

total

comprehensive

loss - - - - (4,008) (4,008)

Issue of

Ordinary share

capital - - - 8 - 8

At 30 June 2015

(audited) 9 - - 48,982 (21,406) 27,585

Loss for the

period and

total

comprehensive

loss - - - - (7,465) (7,465)

Share based

payment charge - - - - 1,018 1,018

Conversion of

preference

share capital

into Ordinary

share capital 2 - - - - 2

Cancellation of

share capital (4) - 4 - - -

Issue and

repurchase of

share capital - 48 - - (48) -

Costs associated

with the issue

of share

capital - - - (2,620) - (2,620)

Issue of

Ordinary share

capital 5 - - 89,918 - 89,923

At 31 December

2015 (audited) 12 48 4 136,280 (27,901) 108,443

Profit for the

period and

total

comprehensive

income - - - - 2,537 2,537

Share based

payment charge - - - - 420 420

At 30 June 2016

(unaudited) 12 48 4 136,280 (24,944) 111,400

-------------- --------------- -------------- ------------- --------------- -------

Consolidated Cash Flow Statement

For the six months ended 30 June 2016

Note Six months ended 30 June Six months ended 30 June Year ended 31 December

2016 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from

operations 8 14,262 12,541 21,364

Tax paid - - (73)

Interest paid (225) (4,966) (4,124)

------------------------ ------------------------- -------------------------

Net cash flows from

operating activities

before exceptional items

and other income 14,037 7,575 17,167

Other income - - 1,105

Exceptional items (129) (1,464) (7,001)

------------------------ ------------------------- -------------------------

Net cash flow from

operating activities 13,908 6,111 11,271

------------------------ ------------------------- -------------------------

Cash flows from investing

activities

Purchase of property,

plant and equipment (9,113) (11,273) (27,330)

Purchase of intangible

assets (165) (145) (575)

Interest received 13 - 16

------------------------ ------------------------- -------------------------

Net cash flows used in

investing activities (9,265) (11,418) (27,889)

------------------------ ------------------------- -------------------------

Cash flows from financing

activities

Proceeds of issue of

Ordinary shares - 8 89,931

Drawdown of bank loans - 1,000 17,500

Payment of financing fees - - (1,067)

Costs with IPO - - (2,620)

Repayment of bank loans - - (53,902)

Drawdown / (repayment) of

shareholder loans - 3,600 (22,699)

Repayment of finance

leases - (1,936) (13,241)

------------------------ ------------------------- -------------------------

Net cash flows from

financing activities - 2,672 13,902

------------------------ ------------------------- -------------------------

Net increase / (decrease)

in cash and cash

equivalents 4,643 (2,635) (2,716)

Cash and cash equivalents

at start of period 2,860 5,576 5,576

------------------------ ------------------------- -------------------------

Cash and cash equivalents

at end of period 7,503 2,941 2,860

------------------------ ------------------------- -------------------------

Notes to the Interim Financial Statements

1. General information

The Directors of The Gym Group plc (the "Company") present their

interim report and the unaudited condensed consolidated financial

statements for the six months ended 30 June 2016 ('Interim

Financial Statements').

The Company is a public limited company, incorporated and

domiciled in the UK. Its registered address is Woodbridge House,

Woodbridge Meadows, Guildford, Surrey, GU1 1BA.

The Interim Financial Statements were approved by the Board of

Directors on 30 August 2016.

The Interim Financial Statements have not been audited or

formally reviewed by the auditors.

The information shown for the year ended 31 December 2015 does

not constitute statutory accounts within the meaning of section 434

of the Companies Act 2006 and has been extracted from the Group's

Annual Report and Financial Statements for the year ended 31

December 2015.

The Interim Financial Statements should be read in conjunction

with the Annual Report and Financial Statements for the year ended

31 December 2015, which were prepared in accordance with European

Union endorsed International Financial Reporting Standards ('IFRS')

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The Annual Report and Financial Statements

for 2015 have been filed with the Registrar of Companies. The

Independent Auditors' Report on the Annual Report and Financial

Statements for 2015 was unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under

498(2) or 498(3) of the Companies Act 2006.

Further copies of the Interim Financial Statements and Annual

Report and Financial Statements may be obtained from the address

above.

2. Basis of preparation

The Interim Financial Statements have been prepared in

accordance with IAS 34, 'Interim Financial Reporting' as endorsed

by the European Union and the Disclosure and Transparency Rules of

the United Kingdom's Financial Conduct Authority.

The Interim Financial Statements are presented in Pounds

Sterling, rounded to the nearest thousand Pounds, except where

otherwise indicated; and under the historical cost convention as

modified through the recognition of financial liabilities at fair

value through the profit and loss.

The accounting policies adopted in the preparation of the

Interim Financial Statements are consistent with those applied in

the preparation of the Group's consolidated financial statements

for the year ended 31 December 2015. A number of new European Union

endorsed standards and amendments to existing standards are

effective for periods beginning on or after 1 January 2016.

However, none of these have a material, if any, impact on the

annual or condensed interim consolidated financial statements of

the Group in 2016.

The Group's activities consist solely of the provision of high

quality health and fitness facilities within the United Kingdom. It

is managed as one entity and management have consequently

determined that there is only one operating segment. All revenue

arises in and all non-current assets are located in the United

Kingdom. The Group's operations are not considered to be seasonal

or cyclical in nature.

The Directors have made appropriate enquiries and formed a

judgement at the time of approving the financial statements that

there is a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For this reason the Directors continue to adopt the going

concern basis in preparing the financial statements.

3. Exceptional items

Six months ended 30 June Six months ended 30 June Year ended 31 December

2016 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Costs in relation to IPO - 727 5,731

Share based payment costs

associated with IPO - - 1,018

Exploration of strategic

options 159 689 809

Costs in relation to

aborted merger with Pure

Gym - 48 49

-------------------------- -------------------------- --------------------------

159 1,464 7,607

-------------------------- -------------------------- --------------------------

Other income received in the year ended 31 December 2015 of

GBP1,105,000 (six months ended 30 June 2016: GBPnil, six months

ended 30 June 2015: GBPnil) relates to a payment received on the

surrender of a lease.

An additional GBP2,620,000 of exceptional costs associated with

the issue of share capital as part of the IPO have been recognised

directly in reserves in the year ended 31 December 2015.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit or

loss attributable to equity shareholders by the weighted average

number of Ordinary shares outstanding during the year, excluding

unvested shares held pursuant to The Gym Group plc Share Incentive

Plan and Performance Share Plan (see note 8).

As the Company issued shares and changed its capital structure

on IPO during November 2015, the number of shares in the prior

periods has been adjusted to match the post restructuring position

such that the figures remain comparable.

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary shares outstanding to assume

conversion of all dilutive potential Ordinary shares. During the

six months ended 30 June 2016 the Group had potentially dilutive

shares in the form of share options and unvested shares issued

pursuant to The Gym Group plc Share Incentive Plan and Performance

Share Plan (see note 8).

Six months ended 30 June Six months ended 30 June Year ended 31 December

2016 2015 2015

Unaudited Audited Audited

Basic weighted average

number of shares 128,105,275 50,227,896 60,485,605

Adjustment for share 222,896 - -

awards

-------------------------- -------------------------- --------------------------

Diluted weighted average

number of shares 128,328,171 50,227,896 60,485,605

-------------------------- -------------------------- --------------------------

Basic earnings per share

(p) 2.0 (8.0) (19.0)

Diluted earnings per share

(p) 2.0 (8.0) (19.0)

-------------------------- -------------------------- --------------------------

Adjusted earnings per share is based on profit for the year

before exceptional items, amortisation and their associated tax

effect.

Six months ended 30 June Six months ended 30 June Year ended 31 December

2016 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Profit / (loss) for the

period 2,537 (4,008) (11,473)

Amortisation of intangible

assets 1,028 1,069 2,308

Other income - - (1,105)

Exceptional administration

expenses 159 1,464 7,607

Exceptional finance costs - - 1,623

Tax effect of above items (167) (201) (67)

-------------------------- -------------------------- --------------------------

Adjusted earnings 3,557 (1,676) (1,107)

-------------------------- -------------------------- --------------------------

Basic adjusted earnings per

share (p) 2.8 (3.3) (1.8)

Diluted adjusted earnings

per share (p) 2.8 (3.3) (1.8)

-------------------------- -------------------------- --------------------------

5. Taxation

The major components of taxation are:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2016 June 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Current income tax

Current tax on profits for

the year (116) (236) -

Adjustments in respect of prior

years - - (173)

----------- ----------- -------------

Total current income tax (116) (236) (173)

----------- ----------- -------------

Deferred tax

Origination and reversal of

temporary differences (843) 924 (700)

Change in tax rates (18) - (91)

Adjustments in respect of prior

years 127 - 55

----------- ----------- -------------

Total deferred tax (734) 924 (736)

----------- ----------- -------------

Tax (charge) / credit in the

Income Statement (850) 688 (909)

----------- ----------- -------------

The income tax expense was recognised based on management's best

estimate of the annual income tax rate expected for the full

financial year, applied to the profit before tax for the half year

ended 30 June 2016.

Excluding the tax effect of the amortisation of acquired

intangible assets and exceptional items (GBP167,000) and deferred

tax adjustments in respect of prior years (GBP127,000), the

effective tax rate on Adjusted Profit Before Tax (see note 4) for

the half year ended 30 June 2016 was 25.0%.

The net deferred tax liability recognised at 30 June 2016 was

GBP557,000 (30 June 2015: GBP1,482,000; 31 December 2015:

GBP177,000 deferred tax asset). This comprised deferred tax assets

relating to tax losses and equity settled share-based incentives

totalling GBP176,000 (30 June 2015: GBP632,000; 31 December 2015:

GBP1,006,000) and deferred tax liabilities in relation to

accelerated capital allowances and acquired intangible assets

totalling GBP733,000 (30 June 2015: GBP2,114,000; 31 December 2015:

GBP829,000).

At 30 June 2016 there was a net unrecognised deferred tax asset

of GBPnil (30 June 2015: GBPnil; 31 December 2015: GBPnil) relating

to unrecognised tax losses.

6. Property, plant and equipment

Leasehold Fixtures, Gym and other Computer equipment Total

improvements fittings and equipment

equipment

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 January 2015 56,752 4,033 25,657 533 86,975

Additions 17,364 1,549 9,428 391 28,732

Disposals (89) (13) (298) - (400)

At 31 December 2015 74,027 5,569 34,787 924 115,307

Additions 6,242 505 2,846 135 9,728

Disposals (49) - - - (49)

At 30 June 2016 80,220 6,074 37,633 1,059 124,986

------------------ ----------------- ------------------ ------------------ -------

Accumulated

depreciation

At 1 January 2015 6,606 1,672 10,872 315 19,465

Charge for the year 5,745 656 4,329 177 10,907

Disposals (42) (7) (253) - (302)

At 31 December 2015 12,309 2,321 14,948 492 30,070

Charge for the year 3,065 391 2,506 117 6,079

Disposals - - - - -

At 30 June 2016 15,374 2,712 17,454 609 36,149

------------------ ----------------- ------------------ ------------------ -------

Net book value

At 31 December 2015 61,718 3,248 19,839 432 85,237

At 30 June 2016 64,846 3,362 20,179 450 88,837

------------------ ----------------- ------------------ ------------------ -------

Outstanding capital commitments totalled GBP1,673,000 (30 June

2015: GBP4,917,000; 31 December 2015: GBP2,342,000).

7. Borrowings

30 June 2016 30 June 2015 31 December 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Non-current

Bank facility A 10,000 - 10,000

Former bank facilities - 48,508 -

Finance leases - 6,068 -

Shareholder loans and accrued interest - 21,926 -

Loan arrangement fees (928) (2,462) (1,034)

------------- ------------- -----------------

9,072 74,040 8,966

------------- ------------- -----------------

Current

Finance leases - 4,039 -

------------- ------------- -----------------

The Group's bank borrowings are secured by way of fixed and

floating charges over the Group's assets.

On 12 November 2015 the Group refinanced its former bank

facilities and shareholder loans using the net proceeds of its

IPO.

On 12 November 2015 the Group entered into a new 5 year bullet

repayment facility with HSBC and Barclays. The facility comprises a

GBP10.0 million term loan ('facility A') for the purposes of

refinancing the Group's finance leases, a GBP25.0 million term loan

('facility B') to fund acquisitions and capital expenditure, and a

GBP5.0 million revolving credit facility. Interest is charged at

LIBOR plus a 2.5% margin.

At 30 June 2016, facility A was fully drawn and facility B and

the revolving credit facility were undrawn.

There have been no changes to the valuation techniques used for

financial assets or liabilities held at fair value and no transfers

in the hierarchy of financial assets or liabilities. The carrying

values of all financial assets and liabilities are considered to

represent their fair values.

8. Cash generated from operations

Six months ended 30 June Six months ended 30 June Year ended 31 December

2016 2015 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Operating profit / (loss) 3,765 1,096 (2,701)

Adjustments for:

Other income - - (1,105)

Non-cash long-term 471 - -

employee incentive costs

Exceptional items 159 1,464 7,607

Depreciation of property,

plant and equipment 6,079 4,878 10,907

Amortisation of intangible

assets 1,028 1,069 2,308

Loss on disposal of

property, plant and

equipment 49 19 98

Increase in inventories (45) (66) (47)

Increase in trade and other

receivables (1,389) (1,485) (1,372)

Increase in trade and other

payables 4,145 5,566 5,669

-------------------------- -------------------------- --------------------------

Cash generated from

operations 14,262 12,541 21,364

-------------------------- -------------------------- --------------------------

9. Long term employee incentive costs

The Group operates share based compensation arrangements under

The Gym Group plc Performance Share Plan and The Gym Group plc

Share Incentive Plan. In accordance with IFRS 2 Share Based

Payments, the value of the awards are measured at fair value at the

date of the grant. The fair value is expensed on a straight-line

basis over the vesting period, based on the management's estimate

of the number of shares that will eventually vest.

In the six months ended 30 June 2016, the Group recognised a

total charge of GBP471,000 (six months ended 30 June 2015: GBPnil,

year ended 31 December 2015: GBP1,018,000) in respect of the

Group's share based long term incentive plans and related

employer's national insurance (GBP420,000 and GBP51,000

respectively).

a) Performance Share Plan

During the six months ended 30 June 2016, 528,435 share awards

were granted under the Performance Share Plan ('PSP'). Of these,

134,297 were exercisable at 30 June 2016. The remaining awards will

vest after three years, subject to continued employment and the

achievement of earnings per share and total shareholder return

targets. The fair value of the total shareholder return element of

the award was estimated at the grant date using a Monte Carlo

simulation model, taking into account the terms and conditions upon

which the awards were granted. This model simulates the TSR and

compares it against the group of comparator companies. It takes

into account historic dividends and share price fluctuations to

predict the distribution of relative share price performance.

b) Share Incentive Plan - Free shares

On 26 April 2016, the Company made 79,248 free share awards to

employees of the Group. The awards are subject to continued

employment requirements over a three year period and have no

performance conditions. The shares are held by an employee benefit

trust and are dilutive for the purposes of earnings per share.

c) Share Incentive Plan - Matching shares

During the six months ended 30 June 2016, the Company granted

7,564 matching share awards, whereby for every share purchased by

an employee the Company will award one matching share, up to a

maximum value. The awards are subject to continued employment

requirements over a three year period and have no performance

conditions. The shares are held by an employee benefit trust and

are dilutive for the purposes of earnings per share.

10. Issued capital

During the six months ended 30 June 2016, the Company issued

86,812 Ordinary shares of GBP0.0001 each in relation to free and

matching share awards under The Gym Group Plc Share Incentive Plan.

The shares were then allocated to award holders via an Employee

Benefit Trust, subject to satisfaction of continued employment

conditions, for nil consideration.

11. Related party transactions

Identification of related parties

The Group has related party relationships with major

shareholders, key management personnel and family members of the

Directors.

Phoenix Equity Partners 2010 L.P. and Phoenix Equity Partners

2010 GP L.P. ("the Phoenix Funds"), and Bridges Community

Development Ventures Fund II (which is managed by Bridges Ventures

LLP) are major shareholders in the Company.

Closewall Limited is a company under the control of a family

member of a Director, J Treharne.

C Treharne is a relation of a Director, J Treharne.

Transactions with related parties

The following table provides the total amounts owed to related

parties for the relevant financial period:

Six months ended 30 June Six months ended 30 June Year ended 31 December 2015

2016 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Phoenix Funds - 44,667 -

Bridges Ventures LLP - 22,304 -

Key management - 3,349 -

Closewall Limited 2 9 49

C Treharne - - -

--------------------------- ---------------------------- ----------------------------

The following table provides the total amounts of purchases from

related parties for the relevant financial period:

Six months ended 30 June Six months ended 30 June Year ended 31 December 2015

2016 2015

Unaudited Audited Audited

GBP'000 GBP'000 GBP'000

Phoenix Funds 20 681 -

Bridges Ventures LLP 20 341 -

Key management - - -

Closewall Limited 3,132 3,406 7,627

C Treharne 4 4 8

--------------------------- ---------------------------- ----------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR AKKDQABKDOFN

(END) Dow Jones Newswires

August 31, 2016 02:00 ET (06:00 GMT)

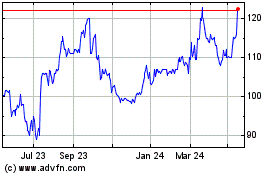

The Gym (LSE:GYM)

Historical Stock Chart

From Jun 2024 to Jul 2024

The Gym (LSE:GYM)

Historical Stock Chart

From Jul 2023 to Jul 2024