Interim Results

April 05 2006 - 3:02AM

UK Regulatory

RNS Number:0042B

GruppeM Investments PLC

05 April 2006

Embargoed until 7.00am 5 April 2006

GRUPPEM INVESTMENTS PLC

(LSE: GRP, 'GruppeM' or the 'Company')

Interim results for the six month period ended 31 January 2006 and board change

GruppeM Investments PLC today announces its unaudited interim results for the

six month period ended 31 January 2006.

In addition, the Company announces that Marvin Tien has today resigned from his

position as Non-executive Director.

The Board would like to take this opportunity to thank Marvin for his

contribution to the Company, and to wish him well for the future.

For more information please contact:

GruppeM Investments PLC

Kenny Chen/Paul McIlwaine

Tel: +44 (0) 207 233 2952

Shore Capital and Corporate Limited

Alex Borrelli

Tel: +44 (0) 207 408 4090

Further information on GruppeM Investments PLC can be found on the Company's

website: www.gruppemplc.com

CHAIRMAN'S STATEMENT

Overview

This six month period has been a time of increased activity within the Company.

Unfortunately this activity has yet to result in the Company implementing its

investing strategy. However, we have identified two possible acquisitions in

line with our investing strategy and are confident of executing a significant

transaction in the near future.

Financial results

In the six months ended 31 January 2006, the Company made a loss of #427,385,

after exceptional costs of #310,299. This compares to a loss of #168,777, after

exceptional costs of #142,512, in the period ended 31 July 2005. The

exceptional costs are in relation to the legal and professional costs billed,

and accrued, in advance of the proposed transactions mentioned above.

Working capital

The proposed transactions are expected to be accompanied by a fundraising in

order to raise sufficient funds to finance the Company's ongoing working capital

requirements.

Strategy

The Board remains committed to creating value for shareholders through

high-quality, selective acquisitions that have the capacity to earn returns

above the cost of capital.

Market prospects

China, the world's fastest-growing major economy, has experienced average GDP

growth of 9.2% a year over the past decade, driving up land prices to such an

extent that property values in the major cities almost tripled in six years.

The average growth rate of the Chinese car market as a whole is estimated to be

at least 15% per year in the future and forecasts suggest that China will become

the world's second-largest automotive market by 2013. Therefore, the Board

believes that the market for motor retailing and property development will

remain extremely attractive as its economy continues to forge ahead.

I would like to take this opportunity to thank all our employees and

professional advisors for their commitment and support as we work together

towards our first significant reverse takeover transaction.

Lord Marsh

Chairman, on behalf of the Board

PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTH PERIOD ENDED 31 JANUARY 2006

Notes Period

Six months ended

ended 31 July

31 January 2006 2005

(Unaudited) (Audited)

# #

Administrative expenses

- exceptional items 310,299 142,512

- other 116,603 26,265

________ ________

OPERATING LOSS (426,902) (168,777)

Interest received 23 156

Interest paid (506) -

________ ________

LOSS FOR THE PERIOD (427,385) (168,621)

-------- --------

Loss per share

Basic and fully diluted 2 (2.14p) (0.17p)

-------- --------

All activities are classed as continuing.

There are no recognised gains or losses other than the loss for the financial

period.

BALANCE SHEET

AS AT 31 JANUARY 2006

Notes 31 January 31 July

2006 2005

(Unaudited) (Audited)

# #

Fixed assets

Tangible assets 1,566 -

Current assets

Debtors 5,091 8,185

Cash at bank 145 94,746

________ ________

5,236 102,931

Creditors

Amounts falling due within one year 402,808 71,552

________ ________

NET (LIABILITIES)/ASSETS (396,006) 31,379

-------- --------

EQUITY AND LIABILITIES

Capital and Reserves

Share capital 200,000 200,000

Profit and loss account 3 (596,006) (168,621)

________ ________

Equity shareholders' funds (396,006) 31,379

-------- --------

CASH FLOW STATEMENT

FOR THE SIX MONTH PERIOD ENDED 31 JANUARY 2006

Six months Period

ended ended

31 January 31 July

2006 2005

(Unaudited) (Audited)

# #

Operating loss (426,902) (168,777)

Depreciation on tangible fixed assets 169

Decrease/(increase) in debtors 3,094 (8,185)

Increase in creditors 331,256 71,552

________ ________

Cash outflow from operating activities (92,383) (105,410)

Return on investment and servicing of finance

Interest received 23 156

Interest paid (506) -

Capital expenditure

Payment to acquire tangible fixed asset (1,735) -

________ ________

Net cash outflow before financing (94,601) (105,254)

Financing

Proceeds on issue of shares - 200,000

________ ________

NET (DECREASE)/INCREASE IN CASH FOR THE PERIOD (94,601) 94,746

-------- --------

RECONCILIATION OF NET CASH INFLOW TO MOVEMENT IN NET FUNDS

(Decrease)/increase in cash for the period (94,601) 94,746

________ ________

Net funds brought forward 94,746 -

________ ________

Net funds carried forward 145 94,746

-------- --------

ANALYSIS OF NET FUNDS

Cash at bank 145 94,746

-------- --------

NOTES

1. ACCOUNTING POLICIES

BASIS OF PREPARATION

These interim statements have been prepared on a consistent basis with the

financial statements for the period ended 31 July 2005.

These interim statements do not constitute statutory financial statements within

the meaning of Section 240 of the Companies Act 1985. Results for the six month

period ended 31 January 2006 have not been audited. The results for the period

ended 31 July 2005 have been extracted from the statutory financial statements

that have been filed with the Registrar of Companies and upon which the auditors

reported without qualification.

The financial statements have been prepared under the historical cost convention

and the principal accounting policies adopted are set out below.

Tangible fixed assets

Tangible fixed assets are carried at cost and are depreciated over their useful

economic lives on a straight-line basis as follows:

Office equipment: 3 years

Going concern

The Company suffered a loss of #427,385 for the six month period ended 31

January 2006 and had net liabilities of #396,006 at that date.

The directors have identified suitable investment opportunities and will seek to

raise sufficient funds to finance the Company's working capital requirements for

the foreseeable future.

In view of this, the directors consider it appropriate to prepare the financial

statements on the going concern basis.

Exceptional Costs

Exceptional administrative costs totalling #310,299 were incurred in relation to

a proposed investment transaction which did not proceed before the period end.

Financial instruments

The Company's financial instruments comprise only cash at bank. Trade creditors

have been excluded from the following disclosure, as permitted by Financial

Reporting Standard 13.

The Company's policy is to obtain the highest possible rate of return on its

cash balances, subject to having sufficient resources to manage the business on

a day to day basis and not exposing the Company to unnecessary risk of default.

The Company had no undrawn borrowing facilities at 31 January 2006.

2. LOSS PER SHARE

The calculation of loss per share is based upon the loss of #427,835 and on

20,000,000 being the weighted average number of shares in issue during the

period.

There were no share options in issue during the period.

3. PROFIT AND LOSS ACCOUNT

31 January 2006 31 July 2005

# #

Loss brought forward (168,621) -

Loss for the period (427,385) (168,621)

Loss carried forward (596,006) (168,621)

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ILFLASVISIIR

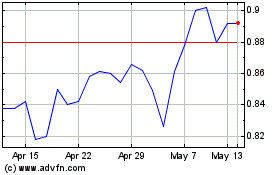

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

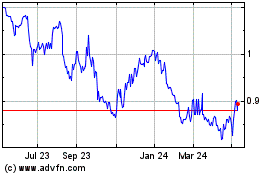

Greencoat Renewables (LSE:GRP)

Historical Stock Chart

From Jul 2023 to Jul 2024