GCP Infrastructure Investments Ltd Net Asset Value(s) (9904S)

July 15 2020 - 2:00AM

UK Regulatory

TIDMGCP

RNS Number : 9904S

GCP Infrastructure Investments Ltd

15 July 2020

GCP Infrastructure Investments Limited

("GCP Infra" or the "Company")

LEI 213800W64MNATSIV5Z47

Headline: Net Asset Value(s)

15 July 2020

GCP Infra, the only UK listed fund focused primarily on

investments in UK Infrastructure debt, announces that as at close

of business on 30 June 2020, the unaudited net asset value per

ordinary share of the Company was 107.73 pence, a decrease of 1.9%

on the net asset value per ordinary share of 109.83 pence at the

end of the previous quarter.

The net asset value takes into account cash, other assets,

accrued liabilities and expenses and leverage (if any) of the

Company attributable to the ordinary share class.

The Company's Valuation Agent, Mazars LLP, carries out a fair

market valuation of the Company's investments on behalf of the

Board on a quarterly basis. The valuation principles used by the

Valuation Agent are based on a discounted cash flow methodology. A

fair value of each asset acquired by the Company is calculated by

applying an appropriate discount rate (determined by the Valuation

Agent) to the cash flow expected to arise from each asset

respectively.

A number of the Company's investments rely on projected future

UK electricity market prices for a proportion of their revenues.

Changes in electricity prices may therefore impact on a borrower's

ability to service debt or, in cases where the Company has stepped

into projects and/or has direct exposure through its investment

structure, impact on overall returns. On 29 May 2020 the Company

published an updated portfolio sensitivity to electricity prices as

part of its half-yearly financial report, in which the Directors

noted that in the medium term the Company expects Covid-19 to have

a negative impact on electricity prices resulting from reduced

demand for energy.

At the end of the quarter ended 30 June 2020, the medium-term

electricity price forecasts used by the Company declined by a

further c.5.5%. The impact of these changes in electricity

forecasts has reduced the Company's net asset value per ordinary

share at 30 June by 1.75 pence.

Gravis Capital Management Limited

Philip Kent

Dion Di Miceli +44 (0)20 3405 8500

Stifel Nicolaus Europe Limited

Mark Bloomfield

Nick Donovan +44 (0)20 7710 7600

Buchanan/Quill

Helen Tarbet

Sarah Gibbons-Cook

Henry Wilson +44 (0)20 7466 5000

Notes to the Editor

About GCP Infra

GCP Infra is a closed-ended investment company and FTSE-250

constituent whose shares are traded on the main market of the

London Stock Exchange. Its objective is to provide shareholders

with regular, sustained, long-term distributions and to preserve

capital over the long term by generating exposure to UK

infrastructure debt and related and/or similar assets. The Company

primarily targets investments in infrastructure projects, with long

term, public sector-backed, availability-based revenues. Where

possible, investments are structured to benefit from partial

inflation protection. GCP Infra is advised by Gravis Capital

Management Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVBSGDRSUBDGGS

(END) Dow Jones Newswires

July 15, 2020 02:00 ET (06:00 GMT)

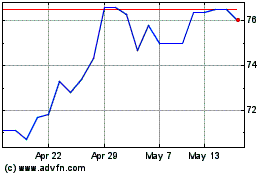

Gcp Infrastructure Inves... (LSE:GCP)

Historical Stock Chart

From Jul 2024 to Aug 2024

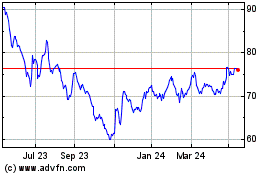

Gcp Infrastructure Inves... (LSE:GCP)

Historical Stock Chart

From Aug 2023 to Aug 2024