Foresight Slr Fnd Ld Foresight Solar Fund Limited : Net Asset Value, Trading Update And Quarterly Dividends

January 16 2015 - 2:00AM

UK Regulatory

TIDMFSFL

Foresight Solar Fund Limited

NAV Statement, Trading Update and Quarterly Dividends

16 January 2015

NAV UPDATE AS AT 31 DECEMBER 2014

-- Foresight Solar Fund Limited ("The Company") announces that as at 31

December 2014, the unaudited Net Asset Value ("NAV") per ordinary share

was 100.9p (30 September 2014: 101.7).

-- Unaudited NAV of the Company as at 31 December 2014 was GBP209.8m.

-- The market capitalisation of the Company as at close of business on 15

January 2015 was GBP215.5m.

OPERATIONAL STATUS

-- The Company's 231MW, ten asset UK solar portfolio is fully operational

following the recent grid connection and financial completion of the UK's

largest operating solar project, the 46MW Landmead asset in Oxfordshire.

-- All the Company's ten assets have been connected well ahead of the 31

March 2015 date at which the 1.4 Renewable Obligation Certificate (ROC)

regime ends and, being already operational, are all generating income for

the benefit of the Company.

-- The Bournemouth and Spriggs Farm assets achieved financial completion

during the quarter utilising the proceeds of the Placing in October

together with approximately half of the Company's GBP100m acquisition

facility.

-- Financial completion of the Kencot asset (which has a binding agreement

in place for its acquisition) is expected in the first quarter of this

year. The Company has the contractual right to all revenue generated from

Kencot from the start of its operations in September 2014. The remaining

assets owned by the Company all reached financial completion prior to the

end of 2014. The financial completion of the Kencot asset will utilise

the remainder of the GBP100m acquisition facility.

-- There are several further large project acquisitions currently under

consideration by the Company. Additional acquisitions will be funded

utilising debt facilities within the Company's 40% gearing cap, or the

proceeds of any future Placing under the Placing Programme. The current

acquisition facility is being extended by up to a further GBP40m.

-- There is no debt at the underlying project level in line with the

Company's stated strategy.

-- The Company's energy yield for the full quarter under review has

performed in line with expectations.

-- The NAV reflects the recent downward shift in power prices offsetting NAV

increases achieved from financial completions of projects during the

period. In line with the UK listed solar peer group, the Company has also

reduced its average discount rate applied to future cashflows by 0.2% to

7.8%.

DIVIDEND, AND INTENTION TO PAY QUARTERLY DIVIDENDS

-- The Company continues to target a dividend of 6p per ordinary share in

respect of its first financial period ended 31 December 2014. The second

interim dividend in respect of that period will be announced in March

2015.

-- Subject to market conditions and the Company's performance, the

Directors' continued intention is to pay a sustainable, inflation-linked,

dividend to Shareholders. The Directors anticipate being able to increase

the annual dividend in line with inflation for the period commencing 1

January 2015.

-- Following discussions with the Company's advisers, the Directors will

increase the frequency of dividend payments from semi-annually to

quarterly. The payment of dividends will remain subject to market

conditions and the Company's performance, financial position and

financial outlook.

-- The Board expects to pay the first quarterly dividend in respect

of the period from 1 January 2015 to 31 March 2015 in June 2015.

PLACING PROGRAMME

-- The Company has established a Placing Programme under the Prospectus

dated 25 September 2014 in respect of proposed issues of up to 200

million new ordinary shares. The Company raised GBP60 million of gross

proceeds from the issue of 58 million ordinary shares in its initial

fundraising in October 2014 under the Programme.

-- In order to raise further equity funds for financial completion and

repayment of the acquisition facility in respect of existing assets and,

together with debt facilities, to finance future investment opportunities,

the Company intends to carry out a further Placing under the Placing

Programme in the current quarter ending 31 March 2015. The timetable for

the Placing, the Placing Price and the number of any such ordinary shares

to be issued will be announced in due course.

-- The Placing Price is expected to be set at a small premium to the NAV per

ordinary share as at 31 December 2014, such premium being sufficient at

least to cover the costs of the relevant Placing.

RISK PROFILE

-- The Company maintains the lowest risk approach to the sector by seeking

to avoid blind pool, development and construction risk in its acquisition

of assets. This deliberate strategy minimises the exposure of its

investments to changes in regulation such as the accelerated introduction

of a cliff-edge deadline in March 2015 for Renewable Obligation

Certificate (ROC) projects greater than 5MW.

-- The Company's Investment Manager, Foresight Group CI Limited, is seeing

an active secondary market develop for portfolios of operating projects

of over 5MW in addition to large pipelines of sub-5MW projects that will

be connected post-March 2015. On this basis, the Company expects to

continue its growth rate.

SCALE

-- The Company's UK solar portfolio now consists of ten assets with 231MW

capacity, all of which are fully operational.

-- In December 2014, the Company financially completed the acquisition of

the 37MW Bournemouth and the 46MW Landmead assets.

-- The Company now owns and manages 4 of the 6 largest operational UK Solar

plants.

JOINT BROKER APPOINTMENT

-- The Company announces the appointment of J.P Morgan Cazenove as joint

corporate broker alongside Oriel Securities Limited.

ENDS

For further information

Foresight Group

Elena Palasmith epalasmith@foresightgroup.eu

020 3667 8129

Oriel Securities +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

J.P. Morgan Cazenove +44 (0)20 7742 4000

William Simmonds

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013, and a further GBP60.1m through an Initial

Placing and Offer for Subscription in October 2014.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1.3 billion of assets under management. As one of the UK's

leading solar infrastructure investment teams Foresight funds currently

manage over GBP930 million in 44 separate operating Photovoltaic ("PV")

plants in the UK, the USA and southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in the UK, the USA and Italy.

www.foresightgroup.eu

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1887557

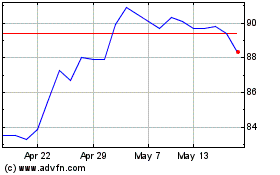

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Sep 2024 to Oct 2024

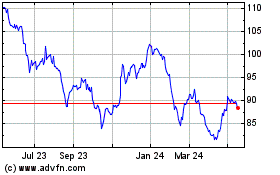

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Oct 2023 to Oct 2024