TIDMFAB

RNS Number : 0741I

Fusion Antibodies PLC

10 August 2021

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Article 7 under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). With the publication of this

announcement, this information is now considered to be in the

public domain.

Fusion Antibodies plc

("Fusion" or the "Company")

Final results

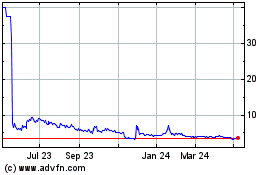

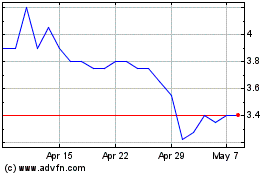

Fusion Antibodies plc (AIM: FAB), specialists in pre-clinical

antibody discovery, engineering and supply for both therapeutic

drug and diagnostic applications, announces its final results for

the year ended 31 March 2021.

Commercial and operational highlights

-- Commercial roll out and revenues from Rational Affinity Maturation Platform ("RAMP(TM) ")

-- Investment in R&D increased by 57% from prior year

-- Full year revenues increased by 7% to GBP4.2m (2020: GBP3.9m)

-- Deferred tax asset of GBP1.8m derecognised, but tax losses of

GBP9.0m remain available to offset future profits

-- Loss for the year of GBP2.9m (2020: loss GBP0.7m)

-- GBP3.0m equity fundraise

-- Cash position at the year-end GBP2.7m (31 March 2020: GBP1.5m)

Post period end highlights

-- Receipt of first success milestone payment of GBP150,000 from a key client

Presentation on the results

Fusion will host an online live presentation open to all

investors on Monday, 23 August at 11am, delivered by Richard Jones,

CEO and James Fair, CFO. The presentation is open to all existing

and potential shareholders. Questions can be submitted pre-event

via your Investor Meet Company dashboard up until 9am the day

before the meeting or at any time during the meeting. The Company

is committed to providing an opportunity for all existing and

potential investors to hear directly from management on its results

whilst additionally providing an update on the business and current

trading.

Investors can sign up to Investor Meet Company for free and add

to meet Fusion Antibodies plc via the following link:

https://www.investormeetcompany.com/fusion-antibodies-plc/register-investor

Richard Jones, CEO of Fusion Antibodies commented: "We are

pleased with our performance in what has been a challenging year

for everyone. We have made significant progress with sustained

revenue growth, progress on the R&D pipeline, and continue to

expand our range of services.

"On behalf of the Board, I would like to thank our shareholders

for their continued support and we hope to be able to provide

further positive updates as we go through the year."

Enquiries:

Fusion Antibodies plc www.fusionantibodies.com

Richard Jones, Chief Executive Officer Via Walbrook PR

James Fair, Chief Financial Officer

Allenby Capital Limited Tel: +44 (0)20 3328

5656

James Reeve (Corporate Finance)

Tony Quirke (Sales and Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780 or fusion@walbrookpr.com

Anna Dunphy Mob: +44 (0)7876 741

001

Paul McManus Mob: +44 (0)7980 541

893

About Fusion Antibodies plc

Fusion is a Belfast based contract research organisation ("CRO")

providing a range of antibody engineering services for the

development of antibodies for both therapeutic drug and diagnostic

applications.

The Company's ordinary shares were admitted to trading on AIM on

18 December 2017. Fusion provides a broad range of services in

antibody generation, development, production, characterisation and

optimisation. These services include antigen expression, antibody

production, purification and sequencing, antibody humanisation

using Fusion's proprietary CDRx (TM) platform and the production of

antibody generating stable cell lines to provide material for use

in clinical trials. Since 2012, the Company has successfully

sequenced and expressed over 250 antibodies and successfully

completed over 200 humanisation projects and has an international,

blue-chip client base, which has included eight of the top 10

global pharmaceutical companies by revenue.

The Company was established in 2001 as a spin out from Queen's

University Belfast. The Company's mission is to enable

pharmaceutical and diagnostic companies to develop innovative

products in a timely and cost-effective manner for the benefit of

the global healthcare industry. Fusion Antibodies provides a broad

range of services in antibody generation, development, production,

characterisation and optimisation.

Fusion Antibodies growth strategy is based on combining the

latest technological advances with cutting edge science to deliver

new platforms that will enable Pharma and Biotech companies get to

the clinic faster, with the optimal drug candidate and ultimately

speed up the drug development process.

The global monoclonal antibody therapeutics market was valued at

$135.4 billion in 2018 and is forecast to surpass $212.6 billion in

2022, an increase at a CAGR of 12.0 per cent. for the period 2018

to 2022. In 2017, seven of the world's ten top selling drugs were

antibody-based therapeutics with the combined annual sales of these

drugs exceeding $63.2 billion.

Chairman's Statement

Due to the pandemic, this year has been a difficult year for the

Company, our staff and many of our customers. However, our staff

have been flexible, committed and dedicated to continue to grow our

services and deliver a positive year, something for which I would

like to thank them. Where possible, staff have worked from home and

in the case of the Technical and R&D teams good social

distancing and control has allowed a challenging but safe working

environment. Overall, the Board believes that Company was able to

meet the challenges presented as a result of the pandemic which

affected the whole financial year.

Revenues increased in both H1 and H2 to deliver year on year

revenue growth of 7% with revenue of GBP4.2m for FY2021 marginally

above market expectation. This growth came from good performance

across all of the business areas with our humanisation service

significantly outperforming the previous year. The l oss for the

year was GBP2.9m (FY2020: GBP0.7m loss) as is explained in the

Chief Executive Officer's report.

Earlier in the year the Company continued with its strategy to

invest for growth and raised a further GBP3.0 million (gross

proceeds) via a placing of new ordinary shares in order to expand

the ongoing programme to develop a Mammalian Antibody Library

Discovery Platform (OptiMAL(TM) ). The Covid-19 pandemic presented

us with an opportunity to add this new target to the already

planned oncology targets and validate OptiMAL(TM) in a real-world

setting. This proof-of-concept project is ongoing with the control

models demonstrated. The next steps to optimise the screening and

selection of antibodies are in progress with the selection of

validation partners and the generation of a body of data from the

range of targets expected towards the end of the current financial

year and initial revenues from OptiMAL(TM) in 2022.

The scientific approach behind RAMP(TM) , our affinity

maturation platform, has been expanded and being marketed under the

OptiMAS(TM) brand. We now offer an exciting broader service which

encompasses the potential to improve the antibody yield from cell

culture, optimizing the manufacturing efficiency and reducing the

overall cost of goods. Additionally, in many cases the overall

stability of the antibody can be improved and the immunogenicity

reduced, with the opportunity to maximize the efficiency of a

client's therapeutic antibody drug.

As we grow our range of services, which are underpinned by world

class scientific expertise, we are attracting more new clients

looking for the ideal development partner with the flexibility and

skills to meet all of their needs. We will be targeting companies

at the earlier stage of their journey who are committed to

outsourcing much of their drug development program and we are

positioning ourselves as a partner who works and acts as an

extension of their business. To identify and attract companies at

the earlier stage of development we are also looking at extending

our global reach over the coming year through working with new

partners and distributors who can offer our services to a wider

audience.

This year has seen a change in our leadership and I am delighted

to welcome our new CEO, Dr Richard Jones, who joined the Company in

February this year. Richard Jones is an accomplished life sciences

executive with 25 years' experience in the pharmaceutical industry

both in big pharma and biotech companies as well as running a

contract development and manufacturing organisation ("CDMO"). He

replaces Dr Paul Kerr who I would like to thank for his

contribution to the business over the last 10 years and his

enthusiastic attitude in taking the business to where it is today.

I am looking forward to working with Richard for the next phase of

our exciting journey in creating a world class service company and

adding value both to customers and to you as shareholders.

Corporate governance

The long-term success of the business and delivery on strategy

depends on good governance. The Company complies with the Quoted

Companies Alliance Corporate Governance Code.

Current trading

Despite a uniquely challenging year we continued to see growth

and invest further in our core scientific based services. Our

commitment to new R&D projects was maintained and OptiMAL(TM)

remains on track to deliver initial revenues in 2022. The Covid-19

pandemic did not have a material impact on operations as the

Company implemented procedures to protect our laboratory services.

Again, our thanks to all the staff who, as a team, were committed

to maintaining the full operations of the Company though either

working from home or, for those in the laboratories, working

flexible hours.in controlled conditions. I would also like to thank

the shareholders for their continued support.

Post year end trading has been in line with expectations. While

conditions in the UK have improved significantly over the past few

months, there remains considerable uncertainty around the world as

countries ease or increase restrictions to manage the global

Covid-19 pandemic. Challenges remain for much of our international

customer base, but the Board believe the Company has the expertise

to meet these challenges and capitalise on opportunities as we have

done over the past year.

Dr Simon Douglas

Chairman

10 August 2021

Business model - milestone and royalty payments

Payment for current services is primarily by way of "fee for

service" revenue model. In certain circumstances, particularly when

there is a significant contribution to the client's intellectual

property, the Company will also obtain a commercial interest in the

client project. This may take the form of a milestone based success

payment or it may be by way of a royalty on future income streams.

The number and potential value of such interest increases

periodically as the Company enters into new agreements and reduces

either when a milestone is realised or when a project is ceased

before a payment milestone is reached.

At the reporting date the Company had an interest in fifteen

such client projects which it understands its clients to be

actively developing: six projects have fixed success payments with

a maximum potential income of GBP1,525,000 and nine projects carry

royalty agreements. Such payments would be expected a number of

years after the service is performed and would depend on the

successful further progression of the project by the client. Due to

the uncertainty of the success of such development programmes and

the commercial sensitivities for our clients, the Company will not

be fully aware of a project's status at any given point in time,

and therefore does not intend to regularly update the market on the

above figures nor does it estimate a potential value of future

revenues or include such a value in its Statement of Financial

Position.

After the reporting date, the Company announced in July that it

had received GBP150,000 milestone payment as a result of a

humanised antibody project which was successfully commercialised by

a key client. This was the first such payment received by the

Company and is in line with our strategic objectives of unlocking

the intrinsic value that our service offerings represent to our

clients where we have access to the downstream value of successful

projects.

Chief Executive Officer's Statement

FY 2021 was a remarkable and challenging year for all of us due

to the COVID-19 pandemic. Despite these head winds, the Company

continued to make progress on multiple fronts with continued

revenue growth and progress on the R&D pipeline. As a result of

our ongoing investment for growth and in R&D, the Company

continues to return losses which increased this year to GBP2.9m

(FY2020: GBP0.7m loss for the year). I am delighted to have joined

the Company as the CEO, building on the Company's strong

foundations and generating shareholder value from its current and

future technology platform and services. I am also proud of how,

despite the challenges throughout the year, the Company staff were

able to work diligently, delivering on the financial performance,

enabling our clients to advance their discovery and development

projects and progressing our pipeline of projects.

In addition, the Company has been well placed to deal with the

uncertainties which arose as companies and governments around the

world took steps to control the spread of the Coronavirus pandemic.

Early in the financial year, the Company successfully raised

additional capital funds of GBP3m to continue its strategy of

investment in revenue growth and R&D over the short to medium

term, and particularly in the development of the Mammalian Antibody

Library, now branded as OptiMAL(TM) .

Business review

The Company's revenue performance for the financial year to 31

March 2021 grew by 7% vs FY2020 to GBP4.2m which was marginally

ahead of market expectations. Growth was seen in both H1 and H2 of

FY2021 compared to the comparable periods in FY2020, although

growth in H2 was modest as the effects of the worldwide pandemic

continued.

The majority of this growth has come from the expansion of our

existing services such as discovery, engineering and supply, as

well as increasing interest and uptake of our new RAMP(TM)

technology service platform which represents a key driver of growth

for the business. Over the course of the year, Fusion has initiated

and successfully completed a number of RAMP(TM) client projects

which further affirms the value contribution of this new service

offering to both the Company and to our customers. I am pleased to

report that the Company saw continued growth in our key

geographical markets, in particular in North America which

represented 41% of revenues and with an increasing number of key

client accounts. Our main Asia Pacific markets such as Japan, India

and Korea, where we have appointed distributors, continue to be

impacted by the global pandemic, although client relationships and

opportunities are increasing. However, I am pleased to report that

progress is being made with Biotickle, our distributor in India,

with the successful initiation of client projects as well as with

Bizcom, our distributor in Japan, who successfully secured a client

humanisation project.

In addition to the current 'Fee for Service' revenue model, and

where this significant contribution to the client's intellectual

property we will look to enter into a collaboration agreement

structure which will enable Fusion to access the downstream value

of the services and share in the commercial success. This will

further enable Fusion to unlock the intrinsic value that our

service platforms provide to our clients and generate additional

shareholder value.

We continued to drive investment and innovation into the R&D

pipeline of new service offerings. In the financial year, we made

further progress on the development work of OptiMAL(TM) with the

successful production of control models having been achieved and

work commencing on two further oncology targets to be developed in

addition to the SARS-CoV-2 work. I strongly believe that

OptiMAL(TM) represents a key future driver of growth for the

business and will enable the Company to access a sizeable

addressable market which will generate significant shareholder

value.

I am also pleased to report that as part of our commitment and

drive into R&D, Dr Richard Buick will assume the role of Chief

Scientific Officer, overseeing and managing the R&D platform

and pipeline. Dr Buick will be fully focused on driving the Library

and B-Cell Cloning programs as well as exploring early stage

R&D pipeline experimental work which can be further developed

into exciting new service offerings. As part of this focus on

R&D, Dr Buick will be establishing a Scientific Advisory Panel

of industry experts and thought leaders in the field of antibody

discovery and services.

As reported in October 2020, the Company received grants from

Invest Northern Ireland to support Fusion's COVID-19 Discovery

programme as part of the NI COVID-19 Antibody Development Alliance

(NICADA) a collaboration between Fusion and Queen's University

Belfast with an aim to develop and test antibodies to assist in

tackling the COVID-19 pandemic. A portion of the grant was used to

support the OptiMAL(TM) programme and to reinforce the work being

performed at Fusion to produce fully human antibodies targeting the

SARS-CoV-2 virus which could be used in therapeutic and diagnostic

applications.

Inventory of consumables was increased at the year end to allow

for any supply chain disruption from the UK's planned departure

from the European Union and the Coronavirus outbreak reaching

Europe in the final quarter of the financial year. In the year, 27%

of the Company's revenues arose from exports to the EU countries.

The Company continues to monitor potential risks and opportunities

arising as the future EU trade deal is negotiated. We also continue

to develop other export markets to mitigate risks of overexposure

to any one geographical market.

I am very grateful for the commitment, dedication and resilience

shown both by those staff who continued to come into work each day

throughout the lockdown and those who adjusted their working

arrangements to work remotely. I also want to thank our

collaborators and partners who also had to adjust to the challenges

and enabled us to continue to operate throughout the year.

The Company held current net assets of GBP3.7m at 31 March 2021

(2020: GBP1.8m) which mainly comprised inventories and cash and

cash equivalents.

The Company ended the year with GBP2.7m of cash and cash

equivalents, having used GBP1.1m of cash in operations during the

year, invested GBP0.4m in property, plant and equipment and GBP0.2m

servicing asset-based borrowings. This cash level put the Company

in a strong position to progress plans for growth in existing

services in FY2022.

Post year end events

-- Receipt of first success milestone payment of GBP150,000 from a key client

Financial Results

The Company has continued to build on the revenue growth in the

second half of FY2020 with revenue growth seen in both H1 and H2.

Full year revenues for the year in total were up 7% to GBP4.2m

(FY2020: GBP3.9m).

The EBITDA loss for the year was GBP0.5m (FY2020: GBP0.4m loss)

(see note 27). Continued losses are a result of ongoing investment

in operations and research which are expected to contribute towards

future revenue growth. The loss before tax increased to GBP1.3m

(FY2020: GBP1.1m loss).

An additional tax charge was incurred upon the decision to

derecognise the deferred tax asset, which has resulted in an

additional tax charge of GBP1.8m in the year. IAS12 requires that a

deferred tax asset relating to unused tax losses is carried forward

to the extent that it is probable that future taxable profits will

be available. The Company raised GBP2.8m to continue investment in

R&D and business development. After the investment period the

Board expects the Company to generate healthy profits but

considering the immediate outlook for the business, it is difficult

at this stage to reliably estimate the period over which profits

many arise in the future. The Board has therefore determined that

derecognising the asset in the current year is the most appropriate

course of action. This approach does not affect the future

availability of the tax losses for offset against future

profits.

The Company used GBP1.1m of cash in operations (2020: GBP0.2m)

and invested GBP0.4m in expenditure on capital equipment and a

further GBP0.2m servicing asset-based borrowings. Cash and cash

equivalents as at 31 March 2021 totaled GBP2.7m (2020:

GBP1.5m).

Key performance indicators

The key performance indicators (KPIs) regularly reviewed by the

Board are:

KPI FY2021 FY2020

----------------------------- ---------- ----------

Revenue change year on year 7% 79%

EBITDA (GBP0.5m) (GBP0.4m)

Cash used in operations (GBP1.1m) (GBP0.2m)

----------------------------- ---------- ----------

Corporate strategy

The Company continues to grow by following the existing

Corporate Strategy of investing for growth through market

development and the introduction of new services developed

in-house.

Fusion is at a key value inflection point in its evolution. The

Company has world class and cutting-edge Antibody Discovery,

Engineering and Supply technology platforms with the potential to

generate significant future shareholder value.

The Company's vision is to move into the next phase of its

evolution as a commercially successful antibody service provider

with a diversified range of technology platforms to enable our

customers in pharma and biotech to identify and commercialise

antibodies more cost effectively, more rapidly, with a higher

probability of success and with a more competitive profile.

Outlook

There continues to be a level of uncertainty around the world as

countries ease or increase restrictions to manage the global

COVID-19 pandemic though we are seeing the situation improving.

The Board believes that the Company has the expertise to meet

these challenges and capitalise on opportunities and, having raised

capital in the year, that it also has the financial resources to

face the coming months with confidence. We will continue to build

on our current commercial performance accessing additional value

generating opportunities, advancing the OptiMAL R&D program in

preparation for commercialisation and growing the value from our

current proprietary service platforms.

Dr Richard Jones

Chief Executive Officer

10 August 2021

Statement of Comprehensive Income

Notes 2021 2020

GBP'000 GBP'000

------------------------------ ------ --------- ---------

Revenue 4 4,165 3,895

Cost of sales (2,141) (2,123)

------------------------------ ------ --------- ---------

Gross profit 2,024 1,772

Other operating income 194 56

Administrative expenses (3,467) (2,887)

Operating loss 5 (1,249) (1,059)

------------------------------ ------ --------- ---------

Finance income 8 3 6

Finance expense 8 (18) (20)

------------------------------ ------ --------- ---------

Loss before tax (1,264) (1,073)

Income tax (charge)/credit 10 (1,635) 376

------------------------------ ------ --------- ---------

Loss for the financial year (2,899) (697)

------------------------------ ------ --------- ---------

Total comprehensive expense

for the year (2,899) (697)

Pence Pence

Loss per share

Basic 11 (11.4) (3.2)

The statement of comprehensive income has been prepared on the

basis that all operations are continuing operations.

Statement of Financial Position

Notes 2021 2020

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 12 2 4

Property, plant and equipment 13 1,123 1,470

Deferred tax assets 15 - 1,764

---------------------------------- ------ --------- ---------

1,125 3,238

---------------------------------- ------ --------- ---------

Current assets

Inventories 16 480 340

Trade and other receivables 17 1,440 887

Current tax receivable 99 38

Cash and cash equivalents 2,686 1,537

---------------------------------- ------ --------- ---------

4,705 2,802

---------------------------------- ------ --------- ---------

Total assets 5,830 6,040

Liabilities

---------------------------------- ------ --------- ---------

Current liabilities

Trade and other payables 18 833 828

Borrowings 19 163 161

---------------------------------- ------ --------- ---------

996 989

---------------------------------- ------ --------- ---------

Net current assets 3,709 1,813

---------------------------------- ------ --------- ---------

Non-current liabilities

Borrowings 19 67 219

Provisions for other liabilities

and charges 20 20 20

---------------------------------- ------ --------- ---------

87 239

---------------------------------- ------ --------- ---------

Total liabilities 1,083 1,228

Net assets 4,747 4,812

---------------------------------- ------ --------- ---------

Equity

Called up share capital 22 1,024 884

Share premium reserve 7,547 4,872

Accumulated losses (3,824) (944)

---------------------------------- ------ --------- ---------

Total equity 4,747 4,812

---------------------------------- ------ --------- ---------

Statement of Changes in Equity

Called Share premium Accumulated Total

up share reserve losses equity

capital GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ ----------- --------------- ------------- ----------

At 1 April 2019 884 4,872 (402) 5,354

Loss and total comprehensive

expense for the year - - (697) (697)

------------------------------ ----------- --------------- ------------- ----------

Share options - value

of employee services - - 72 72

Tax charge relating

to share option scheme - - 83 83

------------------------------ ----------- --------------- ------------- ----------

Total transactions

with owners, recognised

directly in equity - - 155 155

------------------------------ ----------- --------------- ------------- ----------

At 31 March 2020 884 4,872 (944) 4,812

------------------------------ ----------- --------------- ------------- ----------

At 1 April 2020 884 4,872 (944) 4,812

Loss and total comprehensive

expense for the year - - (2,899) (2,899)

------------------------------ ----------- --------------- ------------- ----------

Issue of share capital 140 2,879 - 3,019

Cost of issuing share

capital - (204) - (204)

Share options - value

of employee services - - 19 19

------------------------------ ----------- --------------- ------------- ----------

Total transactions

with owners, recognised

directly in equity 140 2,675 19 2,834

------------------------------ ----------- --------------- ------------- ----------

At 31 March 2021 1,024 7,547 (3,824) 4,747

------------------------------ ----------- --------------- ------------- ----------

Statement of Cash Flows

2021 2020

GBP'000 GBP'000

---------------------------------------------------- --------- ---------

Cash flows from operating activities

Loss for the year (2,899) (697)

Adjustments for:

Share based payment expense 19 83

Depreciation 712 620

Amortisation of intangible assets 2 2

Finance income (3) (6)

Finance costs 18 20

Income tax charge/(credit) 1,635 (376)

Increase in inventories (140) (97)

(Increase)/decrease in trade and other receivables (553) 169

Increase in trade and other payables 5 99

---------------------------------------------------- --------- ---------

Cash used in operations (1,204) (183)

Income tax received 68 23

---------------------------------------------------- --------- ---------

Net cash used in operating activities (1,136) (160)

Cash flows from investing activities

Purchase of property, plant and equipment (365) (109)

Finance income - interest received 3 6

---------------------------------------------------- --------- ---------

Net cash used in investing activities (362) (103)

Cash flows from financing activities

Proceeds from issue of share capital net 2,815 -

of transaction costs

Proceeds from new borrowings 14 -

Repayment of borrowings (164) (172)

Finance costs - interest paid (18) (12)

---------------------------------------------------- --------- ---------

Net cash generated from/(used in) financing

activities 2,647 (184)

Net increase/(decrease) in cash and cash

equivalents 1,149 (447)

Cash and cash equivalents at the beginning

of the year 1,537 1,984

---------------------------------------------------- --------- ---------

Cash and cash equivalents at the end of the

year 2,686 1,537

---------------------------------------------------- --------- ---------

Notes to the Financial Statements

1 General information

Fusion Antibodies plc is a company incorporated and domiciled in

the UK, having its registered office at Marlborough House, 30

Victoria Street, Belfast BT1 3GG.

The principal activity of the Company is the research,

development and manufacture of recombinant proteins and antibodies,

particularly in the areas of cancer and infectious diseases.

2 Significant accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below. These policies have

been consistently applied to all years presented unless otherwise

stated.

Basis of preparation

The financial information included in this preliminary

announcement does not constitute statutory accounts of the Company

for the years ended 31 March 2021 and 31 March 2020 but is derived

from those accounts. Statutory accounts for the year ended 31 March

2020 have been delivered to the Registrar of Companies and those

for 2021 will be delivered following the Company's Annual General

Meeting. The auditors have reported on those accounts: their

reports were (i) unqualified, (ii) did not include a reference to

any matters to which the auditors drew attention by way of emphasis

without qualifying their report, and (iii) did not contain a

statement under section 498(2) or (3) of the Companies Act

2006.

The financial statements have been prepared on the historical

cost convention, modified to include certain financial instruments

at fair value.

The financial statements are prepared in sterling, which is the

functional currency of the Company. Monetary amounts in these

financial statements are rounded to the nearest GBP1.

The financial statements have been prepared in accordance with

international accounting standards in conformity with the Companies

Act 2006.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise its judgement in the process of

applying the Company's accounting policies. The areas involving a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the financial

statements are disclosed in note 3.

Going concern

The Company has returned a loss of GBP2,899,000 for the year and

at the year-end had net current assets of GBP3,709,000 including

GBP2,686,000 of cash and cash equivalents. The impact of the

Covid-19 pandemic has had limited impact on trading and the Company

was able to remain open and operational throughout the period of

most stringent Government restrictions. The Company continues to

expend cash in a planned manner to both grow the trading aspects of

the business and to develop new services through research and

development projects. The directors have, at the time of approving

the financial statements, a reasonable expectation that the Company

has adequate resources to continue in operational existence for 12

months from the reporting date. Thus, they continue to adopt the

going concern basis of accounting in preparing the financial

statements. In arriving at this conclusion, the directors have

reviewed detailed forecast models for the Company. These models are

based on best estimates of future performance and have been

adjusted to reflect various scenarios and outcomes that could

potentially impact the forecasts.

Revenue recognition

Revenue comprises the fair value of the consideration received

or receivable for the provision of services in the ordinary course

of the Company's activities. Revenue is shown net of value added

tax.

The Company's performance obligations for its revenue streams

are deemed to be the provision of specific services or materials to

the customer. Revenue billed to the customer is allocated to the

various performance obligations, based on the relative fair value

of those obligations, and is then recognised as follows:

-- Where a contractual right to receive payment exists, revenue

is recognised over the period services are provided using the

percentage of completion method, based on the input method using

time spent; and

-- Where no contractual right to receive payment exists, revenue

is recognised upon completion of each separate performance

obligation, which is typically when implementation services are

complete or data has been provided to the customer.

Grant income

Revenue grants received by the Company are recognised in a

manner consistent with the grant conditions. Once conditions have

been met, grant income is recognised in the Statement of

Comprehensive Income as other operating income.

Research and development

Research expenditure is written off as incurred. Development

expenditure is recognised in the Statement of Comprehensive Income

as an expense until it can be demonstrated that the following

conditions for capitalisation apply:

-- it is technically feasible to complete the scientific product

so that it will be available for use;

-- management intends to complete the product and use or sell it;

-- there is an ability to use or sell the product;

-- it can be demonstrated how the product will generate probable future economic benefits;

-- adequate technical, financial and other resources to complete

the development and to use or sell the product are available;

and

-- the expenditure attributable to the product during its

development can be reliably measured.

Intangible assets

Software

Software developed for use in the business is initially

recognised at historical costs, net of amortisation and provision

for impairment. Subsequent development costs are included in the

asset's carrying amount or recognised as a separate asset, as

appropriate, only when it is probable that future economic benefits

associated with the item will flow to the Company and the cost of

the item can be measured reliably.

Software is amortised over its expected useful economic life,

which is currently estimated to be 4 years. Amortisation expense is

included within administrative expenses in the Statement of

Comprehensive Income.

Property, plant and equipment

Property, plant and equipment are initially recognised at

historical cost, net of depreciation and any impairment losses.

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Company and the cost of the item can be measured

reliably. The carrying amount of the replaced part is

de-recognised. All other repairs and maintenance are charged to the

statement of comprehensive income during the financial year in

which they are incurred.

Subsequently, property plant and equipment are measured at cost

or valuation net of depreciation and any impairment losses.

Costs associated with maintaining computer software programmes

are recognised as an expense as incurred. Software acquired with

hardware is considered to be integral to the operation of that

hardware and is capitalised with that equipment. Software acquired

separately from hardware is recognised as an intangible asset and

amortised over its estimated useful life.

Depreciation is provided on all property, plant and equipment at

rates calculated to write off the cost less estimated residual

value of each asset on a straight line basis over its expected

economic useful life as follows:

Right of use assets The remaining length of the lease

Leasehold improvements The lesser of the asset life and the

remaining length of the lease

Plant and machinery 4 years

Fixtures, fittings & equipment 4 years

Leases

Leases in which a significant portion of the risks and rewards

of ownership remain with the lessor are deemed to give the Company

the right-of-use and accordingly are recognised as property, plant

and equipment in the statement of financial position. Depreciation

is calculated on the same basis as a similar asset purchased

outright and is charged to profit or loss over the term of the

lease. A corresponding liability is recognised as borrowings in the

statement of financial position and lease payments deducted from

the liability. The difference between remaining lease payments and

the liability is treated as a finance cost and taken to profit or

loss in the appropriate accounting period.

Impairment of non-financial assets

For the purposes of assessing impairment, assets are grouped at

the lowest levels for which there are largely independent cash

inflows (cash-generating units). As a result, some assets are

tested individually for impairment and some are tested at

cash-generating unit level.

All individual assets or cash-generating units are tested

whenever events or changes in circumstances indicate that the

carrying amount may not be recoverable.

An impairment loss is recognised for the amount by which the

asset's or cash-generating unit's amount exceeds its recoverable

amount. The recoverable amount is the higher of fair value,

reflecting market conditions less costs to sell, and value in use.

Value in use is based on estimated future cash flows from each

cash-generating unit or individual asset, discounted at a suitable

rate in order to calculate the present value of those cash flows.

The data used for impairment testing procedures is directly linked

to the Company's latest approved budgets, adjusted as necessary to

exclude any restructuring to which the Company is not yet

committed. Discount rates are determined individually for each

cash-generating unit or individual asset and reflect their

respective risk profiles as assessed by the directors. Impairment

losses for cash-generating units are charged pro rata to the assets

in the cash-generating unit. Cash generating units and individual

assets are subsequently reassessed for indications that an

impairment loss previously recognised may no longer exist.

Impairment charges are included in administrative expenses in the

Statement of Comprehensive Income. An impairment charge that has

been recognised is reversed if the recoverable amount of the

cash-generating unit or individual asset exceeds the carrying

amount.

Current tax and deferred tax

The tax expense for the year comprises current and deferred tax.

Tax is recognised in the statement of comprehensive income, except

to the extent that it relates to items recognised directly in

equity.

The current tax charge is calculated on the basis of the tax

laws enacted or substantively enacted at the reporting date in the

UK, where the Company operates and generates taxable income.

Management periodically evaluates positions taken in tax returns

with respect to situations in which applicable tax regulation is

subject to interpretation. It establishes provisions where

appropriate on the basis of amounts expected to be paid to the tax

authorities.

Deferred tax is recognised on temporary differences arising

between the carrying amounts of assets and liabilities and their

tax bases. Deferred tax is determined using tax rates (and laws)

that have been enacted, or substantively enacted, by the reporting

date and are expected to apply when the related deferred tax asset

is realised or the deferred tax liability is settled.

Deferred tax assets are recognised only to the extent that it is

probable that future taxable profit will be available against which

the temporary differences can be utilised.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to offset current tax assets against

current tax liabilities.

Share based employee compensation

The Company operates equity-settled share-based compensation

plans for remuneration of its directors and employees.

All employee services received in exchange for the grant of any

share-based compensation are measured at their fair values. The

fair value is appraised at the grant date and excludes the impact

of any non-market vesting conditions (e.g. profitability and

remaining an employee of the Company over a specified time

period).

Share based compensation is recognised as an expense in the

Statement of Comprehensive Income with a corresponding credit to

equity. If vesting periods or other vesting conditions apply, the

expense is allocated over the vesting period, based on the best

available estimate of the number of share options expected to

vest.

Non-market vesting conditions are included in assumptions about

the number of options that are expected to become exercisable.

Estimates are subsequently revised if there is any indication that

the number of share options expected to vest differs from previous

estimates.

The proceeds received net of any directly attributable

transaction costs are credited to share capital and share premium

when the options are exercised.

Financial assets

Classification

The Company classifies its financial assets in the following

measurement categories:

-- Those to be measured at amortised costs; and

-- Those to be measured subsequently at fair value (either

through Other Comprehensive Income of through profit and loss).

The classification depends on the Company's business model for

managing the financial assets and the contractual terms of the cash

flows. The Company reclassifies its financial assets when and only

when its business model for managing those assets changes.

Recognition and measurement

At initial recognition, the Company measures a financial assets

at its fair value plus transaction costs that are directly

attributable to the acquisition of the financial asset.

Subsequent measurement of financial assets depends on the

Company's business model for managing those financial assets and

the cash flow characteristics of those financial assets. The

Company only has financial assets classified at amortised cost.

These assets are those held for contractual collection of cash

flows, where those cash flows represent solely payments of

principal and interest and are held at amortised cost. Any gains or

losses arising on derecognition is recognised directly in profit or

loss. Impairment losses are presented as a separate line in the

profit and loss account.

Impairment

The Company assesses on a forward looking basis, the expected

credit losses associated with its debt instruments carried at

amortised cost. For trade receivables the Company applies the

simplified approach permitted by IFRS 9, which requires expected

lifetime losses to be recognised from the initial recognition of

the receivables. For other receivables the Company applies the

three stage model to determine expected credit losses.

Inventories

Inventories comprise consumables. Consumables inventory is

stated at the lower of cost and net realisable value. Cost is

determined using the first-in, first-out (FIFO) method. Cost

represents the amounts payable on the acquisition of materials. Net

realisable value represents the estimated selling price less all

estimated costs of completion and costs to be incurred in selling

and distribution.

Financial liabilities

Financial liabilities comprise Trade and other payables and

borrowings due within one year end after one year, which are

recognised initially at fair value and subsequently carried at

amortised cost using the effective interest method. The company

does not use derivative financial instruments or hedge account for

any transactions. Trade payables represent obligations to pay for

goods or services that have been acquired in the ordinary course of

business from suppliers. Trade payables are classified as current

liabilities if payment is due within one year. If not, they are

presented as non-current liabilities.

Provisions

A provision is recognised in the Statement of Financial Position

when the Company has a present legal or constructive obligation as

a result of a past event, that can be reliably measured and it is

probable that an outflow of economic benefits will be required to

settle the obligation. Provisions are determined by discounting the

expected future cash flows at a pre-tax rate that reflects risks

specific to the liability. The increase in the provision due to the

passage of time is recognised as a finance cost. Provisions for

dilapidation charges that will crystallise at the end of the period

of occupancy are provided for in full.

Employee benefits - Defined contribution plan

The Company operates a defined contribution pension scheme which

is open to all employees and directors. The assets of the schemes

are held by investment managers separately from those of the

Company. The contributions payable to these schemes are recorded in

the Statement of Comprehensive Income in the accounting year to

which they relate.

Foreign currency translation

The Company's functional currency is the pound sterling.

Transactions in foreign currencies are translated at the exchange

rate ruling at the date of transaction. Monetary assets and

liabilities in foreign currencies are translated at the rates of

exchange ruling at the reporting date. Exchange differences arising

on the settlement or on translating monetary items at rates

different from those at which they were initially recorded are

recognised in administrative expenses in the Statement of

Comprehensive Income in the year in which they arise.

Equity

Equity comprises the following;

Called up share capital

Share capital represents the nominal value of equity shares.

Share premium

Share premium represents the excess over nominal value of the

fair value of consideration received of equity shares, net of

expenses of the share issue.

Accumulated losses

Accumulated losses represents retained profits and losses.

3 Critical accounting estimates and judgements

Many of the amounts included in the financial statements invoice

the use of judgement and/or estimates. These judgements and

estimates are based on management's best knowledge of the relevant

facts and circumstances, having regard to prior experience, but

actual results may differ from the amounts included in the

financial statements. Information about such judgements and

estimation is contained in the accounting policy and/or the notes

to the financial statements and the key areas are summarised

below:

Critical judgements in applying accounting policies

The directors do not consider there are any critical judgements

in applying accounting policies.

Critical accounting estimates and assumptions

-- Deferred Taxation. The Company has accumulated tax losses of

GBP9,042,000. In principle these losses would support a deferred

tax asset of approximately GBP2,000,000. IAS 12 requires that a

deferred tax asset relating to unused tax losses is carried forward

to the extent that future taxable profits will be available. In the

year the Company raised GBP2,800,000 of capital (net of costs) and

the company is in an investment phase, expecting to have an

increase in expenditure on R&D and business development over

the next two years which will increase the tax losses. After the

investment period the Board expects the Company to generate healthy

profits but it is difficult at this stage to reliably estimate the

period over which profits may arise in the future. The Board has

therefore determined that derecognising the asset in the current

year is the most appropriate course of action. This approach does

not affect the future availability of the tax losses for offset

against future profits.

4 Revenue

All of the activities of the Company fall within one business

segment, that of research, development and manufacture of

recombinant proteins and antibodies.

Geographic analysis 2021 2020

GBP'000 GBP'000

---------------------- --------- ---------

UK 711 561

Rest of Europe 1,125 1,246

North America 1,714 1,435

Rest of World 615 653

4,165 3,895

---------------------- --------- ---------

In the year there were no customers (2020: none) to whom sales

exceeded 10% of revenues.

5 Operating loss is stated after charging/(crediting):

2021 2020

GBP'000 GBP'000

-------------------------------------------------- --------- ---------

Employee benefit costs

-wages and salaries 2,005 1,748

-social security costs 194 169

-other pension costs 113 76

-share based payments 18 72

-------------------------------------------------- --------- ---------

2,330 2,065

-------------------------------------------------- --------- ---------

Depreciation of property, plant and

equipment 712 620

Other operating expenses

Rates, utilities and property maintenance 66 64

IT costs 23 25

Fees payable to the Company's auditors

* for the audit of the financial statements 30 19

* non-audit assurance services - 7

30 26

-------------------------------------------------- --------- ---------

Raw materials and consumables used 1,245 1,337

Increase in inventories (140) (97)

Patent costs 2 20

Marketing costs 143 134

Loss on foreign exchange 64 1

Other expenses 1,133 815

Total cost of sales and administrative

expenses 5,608 5,010

-------------------------------------------------- --------- ---------

Included in the costs above is expenditure on research and

development totalling GBP613,000 (2020: GBP391,000).

6 Average staff numbers

2021 2020

---------------------------------- ----- -----

Employed in UK No. No.

(including executive directors) 49 42

Non-executive directors 5 5

---------------------------------- ----- -----

54 47

---------------------------------- ----- -----

7 Remuneration of directors and key senior management

Directors

2021 2020

GBP'000 GBP'000

----------------------- --------- ---------

Emoluments 562 486

Pension contributions 23 19

585 505

----------------------- --------- ---------

Highest paid director

The highest paid director received the following emoluments:

2021 2020

GBP'000 GBP'000

--------------------------------- --------- ---------

Emoluments 151 121

Compensation for loss of office 30 -

Pension contributions 9 6

190 127

--------------------------------- --------- ---------

During the year the highest paid director exercised options over

125,000 ordinary shares at an exercise price of GBP0.04 per

share.

Key senior management

Key senior management is considered to comprise the directors of

the Company with total remuneration for the year of GBP586,000

(2020: GBP505,000). Share based payments for the year attributable

to key senior management totalled GBP5,000 (2020: GBP38,000).

8 Finance income and expense

Income 2021 2020

GBP'000 GBP'000

-------------------------- --------- ---------

Bank interest receivable 3 6

-------------------------- --------- ---------

Expense 2021 2020

GBP'000 GBP'000

-------------------------------------- --------- ---------

Interest expense on other borrowings 18 20

-------------------------------------- --------- ---------

9 Share based payments

At the reporting date the Company had three share based reward

schemes: two schemes under which options were previously granted

and are now closed to future grants and a third scheme in place in

which grants were made in the current year:

-- A United Kingdom tax authority approved scheme for executive directors and senior staff;

-- An unapproved scheme for awards to those, such as

non-executive directors, not qualifying for the approved scheme;

and

-- A United Kingdom tax authority approved scheme for executive

directors and senior staff which incorporates unapproved options

for grants to be made following listing of the Company shares,

"2017 EMI and Unapproved Employee Share Option Scheme".

9 Share based payments continued

Options awarded during the year under the 2017 EMI and

Unapproved Employee Share Option Scheme have no performance

conditions other than the continued employment within the Company.

Options vest one, two and three years from the date of grant, which

may accelerate for a change of control. Options lapse if not

exercised within ten years of grant, or if the individual leaves

the Company prior to the vesting date, except under certain

circumstances such as leaving by reason of redundancy.

The total share-based remuneration recognised in the Statement

of Comprehensive Income was GBP18,000 (2020: GBP72,000). The most

recent options granted in the year were valued using the

Black-Scholes method. The share price on grant used the share price

of open market value, expected volatility of 35.0% and a compound

risk free rate assumed of 0.88%.

2021 2021 2020 2020

Weighted Number Weighted Number

average average

exercise exercise

price price

GBP GBP

--------------------------- ---------- ---------- ---------- ----------

Outstanding at beginning

of the year 0.400 1,685,417 0.0401 1,718,750

--------------------------- ---------- ---------- ---------- ----------

Granted during the year - - - -

Exercised during the year 0.510 (185,834) - -

Lapsed during the year 0.103 (232,917) 0.545 (33,333)

--------------------------- ---------- ---------- ---------- ----------

Outstanding at the end

of the year 0.421 1,266,666 0.400 1,685,417

--------------------------- ---------- ---------- ---------- ----------

The options outstanding at the end of each year were as

follows:

Expiry Nominal Exercise 2021 2020

share price Number Number

value GBP

--------------- --------- --------- ---------- ----------

May 2027 GBP0.04 0.040 310,000 488,750

December 2028 GBP0.04 0.545 956,666 1,196,667

--------------- --------- --------- ---------- ----------

Total 1,266,666 1,685,417

-------------------------- --------- ---------- ----------

Of the total number outstanding 939,996 (2020: 895,416) had

vested at the reporting date.

10 Income tax credit

2021 2020

GBP'000 GBP'000

----------------------------------- --------- ---------

Current tax - UK corporation tax (129) (38)

Deferred tax - origination

and reversal of temporary

differences - (338)

Deferred tax asset written 1,764 -

off

Income tax charge/(credit) 1,635 (376)

----------------------------------- --------- ---------

The difference between loss before tax multiplied by the

standard rate of 19% (2020: 19%) and the income tax credit is

explained in the reconciliation below:

2021 2020

GBP'000 GBP'000

Factors affecting the tax credit for the

year

Loss before tax (1,264) (1,073)

------------------------------------------- --------- ---------

Loss before tax multiplied by standard

rate of UK corporation tax of 19% (2020:

19%) (240) (204)

------------------------------------------- --------- ---------

Provisions and expenditure not deductible

for tax purposes - permanent - 23

Provisions and expenditure not deductible

for tax purposes - temporary - (2)

Deferred tax not recognised on current 240 -

year losses

Deferred tax not recognised on prior year

losses 1,764

Increase in deferred tax asset due to

increase in the enacted rate - (155)

RDEC/R&D tax credit (99) (38)

RDEC/R&D tax credit - adjustment relating (30) -

to prior year

Total income tax charge/(credit) 1,635 (376)

------------------------------------------- --------- ---------

11 Loss per share

2021 2020

GBP'000 GBP'000

----------------------------- --------- ---------

Loss for the financial year (2,899) (697)

Loss per share pence Pence

Basic (11.4) (3.2)

----------------------------- --------- ---------

Number Number

----------------------------------- ----------- -----------

Issued ordinary shares at the end

of the year 25,610,359 22,091,192

Weighted average number of shares

in issue during the year 25,458,761 22,091,192

----------------------------------- ----------- -----------

Basic earnings per share is calculated by dividing the basic

earnings for the year by the weighted average number of shares in

issue during the year.

12 Intangible assets

2021 2020

Software Software

GBP'000 GBP'000

-------------------------- ---------- ----------

Cost

At 1 April 2020 8 8

At 31 March 2021 8 8

----------------------------- ---------- ----------

Accumulated amortisation

At 1 April 2020 4 2

Amortisation charged

in the year 2 2

At 31 March 2021 6 4

----------------------------- ---------- ----------

Net book value

At 31 March 2 4

----------------------------- ---------- ----------

At 1 April 4 6

----------------------------- ---------- ----------

The amortisation expense is included in administrative expenses

in the statement of comprehensive income in each of the financial

years shown.

13 Property, plant and equipment

Right of Leasehold Plant Fixtures, Total

use assets improvements & fittings GBP'000

GBP'000 GBP'000 machinery & equipment

GBP'000 GBP'000

-------------------------- ------------- --------------- ------------ ------------- ----------

Cost

At 1 April 2020 226 725 1,916 220 3,087

Additions 14 59 265 27 365

At 31 March 2021 240 784 2,181 247 3,452

-------------------------- ------------- --------------- ------------ ------------- ----------

Accumulated depreciation

At 1 April 2020 68 425 1,015 109 1,617

Depreciation

charged in the

year 71 158 431 52 712

At 31 March 2021 139 583 1,446 161 2,329

-------------------------- ------------- --------------- ------------ ------------- ----------

Net book value

At 31 March 2021 101 201 735 86 1,123

-------------------------- ------------- --------------- ------------ ------------- ----------

At 31 March 2020 158 300 901 111 1,470

-------------------------- ------------- --------------- ------------ ------------- ----------

Right Leasehold Plant Fixtures, Total

of use improve-ments & fittings GBP'000

assets GBP'000 machinery & equipment

GBP'000 GBP'000 GBP'000

-------------------------- ---------- --------------- ------------ ------------- ----------

Cost

At 1 April 2019 - 712 1,707 202 2,621

Adoption of IFRS

16 226 - - - 226

--------------------------- ---------- --------------- ------------ ------------- ----------

Additions - 13 245 18 276

Disposals - - (36) - (36)

--------------------------- ---------- --------------- ------------ ------------- ----------

At 31 March 2020 226 725 1,916 220 3,087

--------------------------- ---------- --------------- ------------ ------------- ----------

Accumulated depreciation

At 1 April 2019 - 283 691 59 1,033

Depreciation charged

in the year 68 142 360 50 620

Disposals - - (36) - (36)

--------------------------- ---------- --------------- ------------ ------------- ----------

At 31 March 2020 68 425 1,015 109 1,617

--------------------------- ---------- --------------- ------------ ------------- ----------

Net book value

At 31 March 2020 158 300 901 111 1,470

--------------------------- ---------- --------------- ------------ ------------- ----------

At 31 March 2019 - 429 1,016 143 1,588

--------------------------- ---------- --------------- ------------ ------------- ----------

Plant & machinery with a net book value of GBP216,000 is

held under hire purchase agreements or finance leases (2020:

GBP331,000).

The depreciation expense is included in administrative expenses

in the statement of comprehensive income in each of the financial

years shown.

14 Investment in subsidiary

The Company has the following investment in a subsidiary:

2021 2020

GBP GBP

---------------------------------------- ----- -----

Fusion Contract Services Limited 1 1

100% subsidiary

Dormant company

Marlborough House, 30 Victoria Street,

Belfast BT1 3GG

---------------------------------------- ----- -----

Group financial statements are not prepared on the basis that

the subsidiary company is dormant and not material to the financial

statements.

15 Deferred tax assets

GBP'000 GBP'000

-------------------------------------- --------- --------

At 1 April 2020/2019 1,764 1,343

(Charged)/credited to the statement

of comprehensive income in the year (1,764) 338

Credited to equity in the year on

share based payments - 83

At 31 March 2121/2020 - 1,764

-------------------------------------- --------- --------

The movement in deferred tax assets and liabilities during the

financial year, without taking into consideration the offsetting of

balances within the same tax jurisdiction, is as follows:

Deferred tax Accelerated Tax losses Share RDEC Total

assets and liabilities tax depreciation GBP'000 based tax GBP'000

GBP'000 payments credit

GBP'000 GBP'000

-------------------------- ------------------ ------------ ---------- --------- ----------

At 1 April 2019 (72) 1,388 20 7 1,343

Credited to Statement

of Comprehensive

Income 66 226 37 9 338

Credited to equity - - 83 - 83

-------------------------- ------------------ ------------ ---------- --------- ----------

At 31 March 2020 (6) 1,614 140 16 1,764

(Charged)/credited

to Statement

of Comprehensive

Income 6 (1,614) (140) (16) (1,764)

-------------------------- ------------------ ------------ ---------- --------- ----------

At 31 March 2021 - - - - -

-------------------------- ------------------ ------------ ---------- --------- ----------

16 Inventories

2021 2020

GBP'000 GBP'000

------------------------------- --------- ---------

Raw materials and consumables 480 340

------------------------------- --------- ---------

The cost of inventories recognised as an expense for the year

was GBP1,105,000 (2020: GBP1,240,000).

17 Trade and other receivables

2021 2020

GBP'000 GBP'000

-------------------------------- --------- ---------

Trade receivables 673 542

Loss allowance (81) (1)

-------------------------------- --------- ---------

Trade receivables - net 592 541

Other receivables 90 49

Prepayments and accrued income 758 297

-------------------------------- --------- ---------

1,440 887

-------------------------------- --------- ---------

The fair value of trade and other receivables approximates to

their carrying value.

At the reporting date trade receivables loss

allowance/impairment as follows:

2021 2020

GBP'000 GBP'000

-------------------------------- --------- ---------

Individually impaired 71 -

Expected credit loss allowance 10 1

-------------------------------- --------- ---------

81 1

-------------------------------- --------- ---------

The carrying amount of trade and other receivables are

denominated in the following currencies:

2021 2020

GBP'000 GBP'000

----------- --------- ---------

UK pound 418 497

Euros - 12

US dollar 264 81

682 590

----------- --------- ---------

The expected credit loss allowance has been calculated as

follows:

Current More than More More More than Total

30 days than than 120 days

past due 60 days 90 days past due

past past

due due

---------------- --------- ----------- ---------- --------- ----------- -------

Expected

loss rate 1% 1.1% 1.4% 2.5% 13.8%

Gross carrying

amount

(GBP'000) 373 68 118 - 28 587

Loss allowance

(GBP'000) 4 1 1 - 4 10

---------------- --------- ----------- ---------- --------- ----------- -------

Movements on trade receivables loss allowance is as follows:

GBP'000 GBP'000

---------------------------- -------- --------

At 1 April 2020/2019 1 2

Movement in loss allowance 9 (1)

At 31 March 2021/2020 10 1

---------------------------- -------- --------

The creation and release of the loss allowance for trade

receivables has been included in administrative expenses in the

Statement of Comprehensive Income. Other receivables are considered

to have low credit risk and the loss allowance recognised during

the year was therefore limited to trade receivables.

The maximum exposure to credit risk at the reporting date is the

carrying value of each class of receivables mentioned above. The

Company does not hold any collateral as security.

18 Trade and other payables

2021 2020

GBP'000 GBP'000

--------------------------------- --------- ---------

Trade payables 344 415

Social security and other taxes 71 73

Other payables 45 22

Accruals and deferred income 373 318

833 828

--------------------------------- --------- ---------

The fair value of trade and other payables approximates to their

carrying value.

Invest Northern Ireland hold a mortgage dated 9 December 2009

for securing all monies due or to become due from the Company on

any account. At the reporting date a balance of GBP23,000 (2020:

GBPnil) was due to Invest Northern Ireland.

19 Borrowings

Lease liabilities Hire Purchase Total

GBP'000 Contracts GBP'000

GBP'000

-------------------------- ------------------ -------------- ----------

At 1 April 2020 155 225 380

Additions in year 14 - 14

Interest charged in year 8 10 18

Repayments (77) (105) (182)

-------------------------- ------------------ -------------- ----------

At 31 March 2021 100 130 230

-------------------------- ------------------ -------------- ----------

Amounts due in less than

1 year 75 88 163

Amounts due after more

than 1 year 25 42 67

-------------------------- ------------------ -------------- ----------

100 130 230

-------------------------- ------------------ -------------- ----------

Lease Hire Purchase Total

liabilities Contracts GBP'000

GBP'000 GBP'000

-------------------------- ------------- -------------- ----------

At 1 April 2019 - 140 140

Adoption of IFRS 16 226 - 226

Additions in year 166 166

Interest charged in year 11 9 20

Repayments (82) (90) (172)

-------------------------- ------------- -------------- ----------

At 31 March 2020 155 225 380

-------------------------- ------------- -------------- ----------

Amounts due in less than

1 year 67 94 161

Amounts due after more

than 1 year 88 131 219

-------------------------- ------------- -------------- ----------

155 225 380

-------------------------- ------------- -------------- ----------

All borrowings are denominated in UK pounds. Using a discount

rate of 5.5% per annum the fair value of borrowings at the

reporting date is GBP219,000 (2020: GBP359,000 discounted at

5.5%).

Borrowings are secured by a fixed and floating charge over the

whole undertaking of the Company, its property, assets and rights

in favour of Northern Bank Ltd trading as Danske Bank.

20 Provisions for other liabilities and charges

2021 2020

GBP'000 GBP'000

---------------------------- --------- ---------

Due after more than 1 year 20 20

---------------------------- --------- ---------

Leasehold dilapidations relate to the estimated cost of

returning a leasehold property to its original state at the end of

the lease in accordance with the lease terms. The Company's

premises are held under a lease expiring 31 July 2022. The costs of

dilapidations would be incurred on vacating the premises.

21 Financial instruments

The Company is exposed to risks that arise from its use of

financial instruments. This note describes the Company's

objectives, policies and processes for managing those risks and

methods used to measure them. There have been no substantive

changes in the Company's exposure to financial instrument risks and

the methods used to measure them from previous years unless

otherwise stated in this note.

The principal financial instruments used by the Company, from

which the financial instrument risk arises, are trade receivables,

cash and cash equivalents and trade and other payables. The fair

values of all the Company's financial instruments are the same as

their carrying values.

Financial instruments by category

Financial instruments categories are as follows:

As at 31 March 2021 Amortised

cost

GBP'000

--------------------------- ----------

Trade receivables 592

Other receivables 90

Accrued income 504

Cash and cash equivalents 2,686

------------------------------ ----------

Total 3,872

------------------------------ ----------

As at 31 March 2020 Amortised

Cost

GBP'000

--------------------------- -----------

Trade receivables 541

Other receivables 49

Accrued income 9

Cash and cash equivalents 1,537

--------------------------- -----------

Total 2,136

--------------------------- -----------

As at 31 March 2021 Other financial

liabilities

at amortised

cost

GBP'000

---------------------- ----------------

Trade payables 344

Other payables 116

Accruals 252

Borrowings 230

---------------------- ----------------

Total 942

---------------------- ----------------

As at 31 March 2020 Other financial

liabilities

at amortised

cost

GBP'000

---------------------- ----------------

Trade payables 415

Other payables 95

Accruals 318

Borrowings 380

------------------------ ----------------

Total 1,208

------------------------ ----------------

Capital management

The Company's objectives when managing capital are to safeguard

its ability to continue as a going concern in order to provide

returns for shareholders and benefits for other stakeholders and to

maintain an optimal capital structure to reduce the cost of

capital.

In order to maintain or adjust the capital structure, the

Company may issue new shares or sell assets to provide working

capital.

Consistent with others in the industry at this stage of

development, the Company has relied on issuing new shares and cash

generated from operations.

General objectives, policies and processes - risk management

The Company is exposed through its operations to the following

financial instrument risks: credit risk; liquidity risk and foreign

currency risk. The policy for managing these risks is set by the

Board following recommendations from the Chief Financial Officer.

The overall objective of the Board is to set policies that seek to

reduce risk as far as possible without unduly affecting the

Company's competitiveness and flexibility. The policy for each of

the above risks is described in more detail below.

Credit risk

Credit risk arises from the Company's trade and other

receivables, and from cash at bank. It is the risk that the

counterparty fails to discharge their obligation in respect of the

instrument.

The Company is mainly exposed to credit risk from credit sales.

It is Company policy to assess the credit risk of new customers

before entering contracts. Also, for certain new customers the

Company will seek payment at each stage of a project to reduce the

amount of the receivable the Company has outstanding for that

customer.

At the year end the Company's bank balances were all held with

Northern Bank Ltd trading as Danske Bank (Moody's rating P-1).

Liquidity risk

Liquidity risk arises from the Company's management of working

capital, and is the risk that the Company will encounter difficulty

in meeting its financial obligations as they fall due.

At each Board meeting, and at the reporting date, the cash flow

projections are considered by the Board to confirm that the Company

has sufficient funds and available funding facilities to meet its

obligations as they fall due.