FAIRFX Group PLC FairFX unveils card issuance and business lending (8766J)

April 05 2018 - 2:00AM

UK Regulatory

TIDMFFX

RNS Number : 8766J

FAIRFX Group PLC

05 April 2018

5 April 2018

FairFX Group plc

("FairFX" or "the Group" or "the Company")

FairFX Group launches self-issuance of cards and commercial

finance capability

FairFX, the e-banking and international payments group, is

pleased to announce the achievement of two further milestones as

part of its digital banking strategic plans, with the commencement

of self-issuance of Mastercard branded cards and launching a

commercial finance capability to its business banking

customers.

Self-issuance allows the Group to consider multiple options for

issuance of cards across its entire product suite and delivers the

stated objective of achieving increasing economies of scale, whilst

selectively internalising appropriate parts of the value chain.

Developing this facility was made possible through the Group's

e-money licence and its principal membership of Mastercard (as

announced in December last year).

In addition, the Group has launched a commercial finance

capability through a collaboration with Alternative Business

Funding, which connects customers with appropriate and properly

regulated lenders. The Board believes this is a natural extension

of the Group's comprehensive digital banking offering through the

CardOneBanking platform. Customers will be able to access a variety

of funding options online, including loans which can be approved in

hours rather than days. The provision of this service adds a

crucial banking capability and will broaden the appeal of the

Group's offering, whilst improving the ability to add more business

customers without taking on any credit risk.

Ian Strafford-Taylor, CEO of FairFX, said: "Achieving the

milestones of issuing the first cards under our Mastercard license,

and adding a commercial finance capability to our digital Banking

suite are important steps forward for the FairFX Group. The

successful launch of self-issuance is testament to the Group

working as a unified team with the CardOneBanking banking team in

Chester, ably led by CEO and Banking Head Adam Rigler, alongside

other areas in the Group. Together, these successes tie in with our

twin strategies of increasing efficiency whilst adding new

products."

Adam Rigler, Head of Banking for FairFX Group and CEO of

CardOneBanking said: "Self-issuance enables us to better manage the

service levels we can offer to our customers which will further

improve customer satisfaction and thereby retention. Furthermore,

offering quick and simple access to commercial finance is in

response to requests from our current customer base as obtaining

funding for SME's from traditional lenders can be difficult and

time consuming."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Contact:

FairFX Group plc

Ian Strafford-Taylor, CEO +44 (0) 20 7778 9308

Cenkos Securities plc

Max Hartley/Callum Davidson +44 (0) 20 7397 8900

Yellow Jersey

Charles Goodwin +44 (0) 7747 788 221

Katie Bairsto +44 (0) 7946 424 651

About FairFX

FairFX is a leading challenger brand in banking and payments

that disintermediates the incumbent banks with a superior user

experience and low cost operating model. This enables personal and

business customers to make easy, low-cost multi-currency payments

in a broad range of currencies and across a range of FX products

all via one integrated system. The FairFX platform facilitates

payments either direct to Bank Accounts or at 30 million merchants

and over 1 million ATM's in a broad range of countries globally via

Mobile apps, the Internet, SMS, wire transfer and MasterCard/VISA

debit cards.

FairFX provides banking and payment services to both personal

and business customers through four channels: Currency Cards,

Physical Currency, International Payments and Bank Accounts. The

Currency Card and Physical Currency offerings facilitate multiple

overseas payments at points of sale and ATM's whereas the

International Payments channel supports wire transfer foreign

exchange transactions direct to Bank Accounts. For Corporates,

FairFX has a market-leading business-expenses solution based around

its corporate prepaid platform and card that can yield significant

savings on a Corporate's procurement through better controls and

improved transparency and also streamline the procurement process

thus saving administrative costs. Through the recent acquisition of

CardOneBanking, FairFX now has the capability to offer retail and

business Bank Accounts with all the functionality you would expect

from a Bank, namely faster payments, BACs, direct debits,

international payments and a debit card.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBZLLBVZFFBBD

(END) Dow Jones Newswires

April 05, 2018 02:00 ET (06:00 GMT)

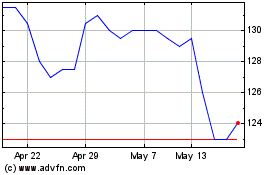

Equals (LSE:EQLS)

Historical Stock Chart

From Jun 2024 to Jul 2024

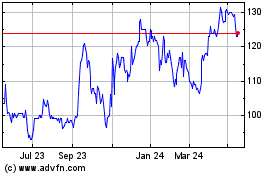

Equals (LSE:EQLS)

Historical Stock Chart

From Jul 2023 to Jul 2024