TIDMEOG

RNS Number : 3626U

Europa Oil & Gas (Holdings) PLC

14 October 2010

Europa Oil and Gas (Holdings) plc

Unaudited preliminary final information for the year ended 31 July 2010

Highlights

Operational highlights

· Drilled Voitinel Gas Discovery - up to 415bcf gas-in-place on-block

(Europa interest 28.75%)

· Seismic 3D dataset being used to define high impact Berenx well - up to

1.5TCF in-place (Europa interest 100%)

· Production site and reserves upgrade at West Firsby

· Drilled Hykeham exploration well

· Acquired 200km of new 2D seismic data in Romania in thrust belt oil play

· Crude oil sales of 64,968 barrels, a decrease of 16% on 2009

Financial performance

· Revenue of GBP3.1 million (2009: GBP2.9 million)

· Two fundraisings raised GBP2,636,000 net of broker commission.

· Relinquished licence in Egypt and took write-off cost of GBP738,000

· Other exploration write-downs totaled GBP270,000

· Impairment charge for Crosby Warren wellsite GBP1,012,000

For further information, please contact:

+---------------------------------+---------------------------------+

| Europa Oil & Gas | |

+---------------------------------+---------------------------------+

| Philip Greenhalgh / Paul | Tel: +44 1235 553 266 |

| Barrett | |

+---------------------------------+---------------------------------+

| | |

+---------------------------------+---------------------------------+

| finnCap | |

+---------------------------------+---------------------------------+

| Sarah Wharry, Corporate Finance | Tel: +44 207 600 1658 |

| | |

+---------------------------------+---------------------------------+

| Henrik Persson, Corporate | Tel: +44 207 600 1658 |

| Finance | |

+---------------------------------+---------------------------------+

| Joanna Weaving, Corporate | Tel: +44 207 600 1658 |

| Broking | |

+---------------------------------+---------------------------------+

Chairman's statement

Dear Shareholders,

In the year to 31st July 2010, the Company participated in two exploration

wells. A notable success was our participation in the Voitinel discovery in

Romania, where dry gas flowed at commercial rates. This discovery opens up an

exciting gas play in the Carpathians where two wells on neighbouring licences

achieved good sustained flow rates. The detail of this discovery is contained in

the Operational Review with the operator estimating a gas in place figure of up

to 415 billion cubic feet (Europa interest 28.75%) leading to appraisal drilling

in 2011. In addition, 200km of new 2D seismic has been acquired in the

promising Romanian thrust belt oil play.

Work continues on the very prospective Berenx area in France (Europa interest

100%) which has discovered gas accumulations. The Company acquired an existing

3D seismic volume which is being incorporated into our modeling in order to

finalise resource numbers prior to securing a drilling partner. The structure,

which has a 500m gas column encountered in a 1969 well, has the potential for

reserves in excess of one trillion cubic feet.

Turning to the UK, the year saw average daily production of 178 barrels, a

decline of 16% on the previous period. Lost production, due to unscheduled well

shut-ins at the producing sites, was the main reason for the decline. This is

being addressed together with a major upgrade of surface facilities at West

Firsby. Workovers on several wells have been undertaken and present daily

production is averaging around 200 barrels. The Company's producing assets

provided a revenue stream of GBP3.1 million in the year.

The exploration well at Hykeham in Lincolnshire is currently suspended, having

encountered live oil but not having produced commercial quantities. It is

thought to have suffered formation damage and the most likely forward plan is to

plug and abandon the well whilst further work is undertaken on the remainder of

the PEDL150 licence area.

In contrast, a thorough technical review of the West Firsby field has led to an

upgrade in 2P reserves of one million barrels, a 250% increase. The drilling of

three development wells on the field would lead to a significant increase in

production if successful. The first of these wells is planned to be drilled in

late 2010 and enables the Company to maintain its production target of 500

barrels of oil per day.

There has been a significant increase in activity in Continental Europe by the

oil majors with regard to unconventional resources. Much of this activity has

focused on gas shales and extensive prospective acreage has now been licenced.

It is clear that the Early Namurian black shales are becoming an interesting

focus for UK shale gas potential. The Humber basin, where Europa has a large

acreage position, is an area that could hold considerable potential. During 2011

the Company will examine its commercial options in relation to this potential.

The Company acquired 2 licences to investigate Underground Coal Gasification

along the UK East coast near to our conventional assets. This exciting

technology has the potential to release up to 80% of the energy contained in the

coal and can be made virtually carbon neutral. Again, the Company will be

examining its commercial options during 2011.

Operating performance for the year has been impacted by the GBP1 million

impairment write down and GBP1 million exploration write-off. This arose from

the decision to write down the carrying value of the Crosby Warren field and

write-off exploration costs incurred primarily in Egypt. At Crosby Warren, the

relatively low incremental production that the CW2 well has produced since its

drilling in 2007 has been a disappointment. Despite several attempts to

stimulate the well it has continued to underperform and for this reason the

Board decided to take the write down. The venture into Egypt was a higher

risk/reward play than our other investments. Though we saw some potential,

ultimately lack of time, resources and influence within the Egyptian General

Petroleum Corporation (EGPC) meant that Europa was unwilling to enter the second

phase of the concession and we relinquished the licence. I believe that the

exiting of Egypt is a positive step for Europa as it ensures a better focus on

the assets in UK, France and Romania.

The lower than expected production and cost of the well workovers has strained

our cash resources and puts a degree of uncertainty over our ability to fund the

2011 work programme. It is anticipated that this will lead to an "Emphasis of

Matter - going concern" comment in the auditor's report of the 2010 Annual

Report and Accounts. Based on latest cash projections and efforts which Europa

is making to raise additional funds, the Directors consider that the Group will

remain a going concern for the foreseeable future.

In April, Sir Michael Oliver retired as Chairman. Dr Erika Syba, co-founder of

the Company, resigned as Operations Director with effect from the end of August

2010. I thank both of them for their contributions to the Company and wish them

well in their future endeavours.

Bill Adamson

Chairman

Operational review

Europa's strategy is to develop a wide range of assets - from production through

to high impact exploration, within the EU. Current core areas are the UK,

France and Romania. Europa operates the majority of its joint ventures from its

headquarters near Oxford, UK. Having acquired three seismic surveys and drilled

as operator some 6 wells to date, the Company has an excellent safety and

environmental record.

Europa holds a varied asset portfolio across three EU jurisdictions and the

Western Sahara. These range from oil producing assets, through exciting

discoveries at the appraisal stage to exploration projects in established oil

and gas plays:

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

|Country | Area | Licence | Field/ | Operator | Equity | Status |

| | | | Prospect | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| | | | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| UK | East | DL003 | West | Europa | 100% | Production |

| | Midlands | | Firsby | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | DL001 | Crosby | Europa | 100% | Production |

| | | | Warren | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | PL199/215 | Whisby-4 | BPEL | 65% | Production |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | PEDL150 | W. | Europa | 75% | Exploration |

| | | | Whisby | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | PEDL180 | Wressle | Europa | 50% | Exploration |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | PEDL222 | | Valhalla | 50% | Exploration |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | PEDL181 | Caister | Europa | 50% | Exploration |

+ +-------------+------------+---------------+--------------+--------------+-----------------------+

| | Weald | PEDL143 | Holmwood | Europa | 40% | Exploration |

+ +-------------+------------+---------------+--------------+--------------+-----------------------+

| | North | Holderness | Offshore | Europa | 90% | Exploration |

| | Sea | | UCG | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | Humber | Offshore | Europa | 90% | Exploration |

| | | South | UCG | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| | | | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| France | Aquitaine | Béarn | Berenx | Europa | 100% | Exploration/Appraisal |

| | | des | | | | |

| | | Gaves | | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | Tarbes | Osmets/Jacque | Europa | 100% | Exploration/Appraisal |

| | | V.d'Adour | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| | | | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

|Romania |Carpathians | EIII-1 | Voitinel | Aurelian | 28.75% | Exploration/Appraisal |

| | | Brodina | | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | EIII-3 | | Aurelian | 17.50% | Exploration |

| | | Cuejdiu | | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | EIII-4 | | Aurelian | 19% | Exploration |

| | | Bacau | | | | |

+ + +------------+---------------+--------------+--------------+-----------------------+

| | | EPI-3 | Barchiz | MND | 20% | Exploration |

| | | Brates | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

| | | | | | | |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

|Western | Tindouf | Bir | | Europa | 100% | Exploration |

| Sahara | | Lehlou | | | | |

+ +-------------+------------+---------------+--------------+--------------+-----------------------+

| | Aaiuun | Hagounia | | Europa | 100% | Exploration |

+---------+-------------+------------+---------------+--------------+--------------+-----------------------+

UK

The core of Europa's portfolio in the UK is in the East Midlands, a basin with a

long history of successful oil exploration and production with potential for

additional reserves and vast unconventional resources.

Production - West Firsby and Crosby Warren (100%), Whisby-4 (65%)

The Company holds interests in three producing oilfields in the East Midlands.

The main operating base is at the West Firsby Field, 15km north of Lincoln. The

production is tankered by road to the refinery at Immingham in North East

Lincolnshire. Current 2P reserves are 1.4 mmbo, having recently been increased

due to the identification of additional Zone 1 reserves at West Firsby. This

resulted from a thorough review of the seismic and well data to calculate

revised oil-in-place figures and a detailed review of production history to

conclude that significant oil remains in the upper Zone 1 reservoir.

West Firsby produces from two wells on a jet pump system at combined rates of up

to 105bopd. A programme of site improvements and production optimisation is

nearing completion and a new Zone 1 production well is expected to be drilled in

late 2010.

At Crosby Warren, in the grounds of the Scunthorpe steelworks, the two

production wells operate on traditional beam pumps or nodding donkeys, producing

up to 40bopd. All producing and exploration assets are tested annually for

possible impairment. In the case of Crosby Warren, the CW2 well, drilled in 2007

has continued to produce relatively small quantities of oil. This led to an

overall carrying value for the site which was not supported by the expected

future cash flows from existing oil production. As a result, the Board took the

decision to write down the book value of the Crosby Warren site from

GBP2,694,000 to GBP1,682,000, an impairment charge in the Statement of

Comprehensive Income of GBP1,012,000.

At Whisby, just to the west of Lincoln, a well drilled by Europa in early 2003

remains on steady production, currently producing around 88bopd gross (55 bopd

net to Europa) on beam pump.

Exploration - NE Lincolnshire (PEDL 180/181 - 50%), Lincoln area (PEDL 150 -

75%), Dorking area (PEDL 143 - 40%)

Europa operates a number of exploration licences in the UK, some with

'ready-to-drill' prospects.

In NE Lincolnshire, PEDL180 and PEDL181 licences contain two prospective areas:

the Wressle Prospect and the Caister Horst. The seismic database over these two

areas, comprising a mixed 2D/3D vintage dataset, has been reprocessed and work

is ongoing to develop drilling locations. Prospect size is in the region of 5

to 8 mmbo recoverable.

Within the PEDL150 concession, the Hykeham well was drilled in the year. Despite

encountering oil pay, the well has failed to flow oil to date, thought to be

principally as a result of formation damage incurred during drilling. Though the

likely forward plan is to plug and abandon the well, the investment has not been

written off as prospectivity within the rest of the block, which includes the

West Whisby feature, is believed to be good. Lessons learnt at Hykeham will be

applied in the drilling of other prospects in the same reservoir interval.

The PEDL222 licence (50%), situated to the north of the Whisby Field, does not

contain any prospects large enough to warrant drilling. The modest investment

to date has been written off and for the remainder of the licence term Europa

will assume operatorship to assess resource potential.

In PEDL 143 in the Weald Basin, Europa and its partners continue to work to

securing planning permission to drill the Holmwood-1 exploration well, south of

Dorking. It is hoped permission will be granted late in 2010.

Unconventional Resources - Underground Coal Gasification and Shale Gas

Europa has been awarded two licences (90%) by the UK Coal Authority to

investigate underground coal gasification of virgin coals along the eastern

coast of England. These licences are situated in areas with deep coal measures

with little structural complexity and a proximity to existing gas and utility

infrastructure.

Underground Coal Gasification (UCG) is a developing technology that recovers up

to 80% of the calorific value of in situ coal by a process of controlled

combustion. UCG, when combined with CO2 storage in the depleted coal seams,

creates a source of energy which rivals nuclear for low emissions and has lower

unit costs than conventional gas-fired power stations.

With only 30% utilisation rate for the coals, the estimated potential UCG energy

resource in these two licence areas is 36x1015 Joules or 6 billion barrels of

oil equivalent.

In addition, the Company's large holding of over 600km2 of the Humber Basin, has

potential for significant shale gas resources from Carboniferous basinal shales.

Whilst this is being evaluated, activities in shale gas exploration elsewhere

in the UK Carboniferous basins are being monitored with interest.

France

Europa holds two exclusive licence in the Aquitaine Basin, adjacent to the

world-class Lacq-Meillon gas developments.

Appraisal - The Berenx Structure (Béarn des Gaves Permit - 100%)

The main focus for Europa is the appraisal of the Berenx gas wells, where a high

pressure high temperature well encountered 500m of gross gas shows and mud gas

kicks in a similar reservoir to the nearby 5TCF Lacq Field. In mid-2010,

Europa took delivery of a reprocessed 3D seismic dataset covering the area

between Berenx and Lacq. The initial mapping indicates that the Berenx wells

were drilled on the western edge of a sizeable structure which could reservoir

in excess of 1 trillion cubic feet of recoverable gas reserve. The proximity

(20km) to the Lacq Field creates a straightforward export route, allowing the

gas to be processed in an existing facility with spare capacity.

The forward programme is for detailed mapping of the structure by experienced

Aquitaine geoscientists followed by securing joint venture partner(s) for the

drilling of an appraisal well for 2011/2012.

Field Re-development and associated Exploration - Tarbes Val d'Adour Licence

(100%)

This licence contains several oil accumulations, previously produced by Elf but

abandoned in 1985 in times of low oil price. Europa commissioned the French

Geological Survey to map the potential field re-development area of Osmets and

Jacque from a reprocessed 2D data set and this work is now complete.

It is hoped that, with a partner, a re-development well can be drilled on one of

these fields in 2011.

Romania

Europa holds interests in 4 Romanian exploration licences, with non-operated

working interests varying from 17.5 to 28.75%. The work programme is moving to

a phase of appraisal of a 2009 gas discovery and exploration in the oil play.

Appraisal - The Voitinel Discovery (EPI-1 Brodina Licence - 28.75%)

The 2009 Voitinel-1 exploration well encountered gas in two sandstone intervals

at around 1400 and 1650m depth. The deeper of these tested dry gas at flow

rates of 3 mmscfpd, but appeared to be close to a reservoir boundary, limiting

the ability to maintain flow for long periods. A fracture stimulation was

undertaken which increased the volume of gas accessed by the well. The

Operator, Aurelian, has assessed that approximately 6bcf will be producible from

each conventional vertical well in this reservoir.

The Voitinel well was drilled close to the northern edge of the structural

trend. However, the play extends far to the south of the well, having been

proven by recent wells drilled by Romgaz at Paltinu. One well sustained gas

flow rates of 5mmscfpd for one week, indicating that the reservoir in the

southern part of the play could be better quality than in the discovery well.

The current resource estimates for the 'Greater Voitinel' play, including the

yet undrilled Solca structure, is that up to 290bcf is recoverable (84 bcf net)

from gross gas-in-place of 415bcf. It is anticipated that two appraisal wells

will be drilled in 2011.

Exploration - the Carpathian Thrust Belt Oil Play

The exploration strategy in the Romanian portfolio is moving away from the small

shallow gas play in the eastern part of the licences to explore in the thrust

belt oil play that is developed in the western part of all four of Europa's

Romanian licences. The US Geological Survey estimates mean undiscovered

potential reserves of over 2.9 billion barrels equivalent in the play and

Europa's first well targeting this play - Barchiz - is due to be spudded in

October 2010.

Barchiz (20%) is situated in the Brates Licence, immediately north of and along

trend from the Geamana oilfield (50 mmbo reserves). It is a relatively shallow

target with a depth of 1,400m and potential for up to 30 mmbo gross reserves.

A further highly prospective area in the same licence, underneath the existing

Tazlaul Mare gas condensate field, is anticipated to be matured for drilling in

2011/12.

In 2010, new seismic data acquisition was undertaken in three of Europa's four

licences and the results from this work will drive the exploration activity into

2011 and beyond.

Other Areas

Egypt

In December 2009, the Company relinquished its interest in the West Darag

concession, onshore Egypt. The decision, driven by the lack of identified

drill-ready prospects needed to commit to phase two of the concession, resulted

in a write-off of the GBP738,000 investment in Egypt.

Western Sahara (100%) - Tindouf Basin and Aiuun Basin Licences

Europa holds interests in Western Sahara through SADR covering almost 80,000km2

of exciting exploration acreage. The Tindouf licence has great potential for

both conventional and unconventional gas resources, being geologically similar

to the prolific Algerian Palaeozoic basins. The Aiuun Basin is an Atlantic

margin basin similar to that developed along the West African margin.

As these license areas remained in force majeure throughout the year, the Board

decided to write-down the intangible asset to nil value. Though the investment

has been written down, Europa retains its 100% interest in the 2 blocks.

Conclusion

The Company's broad asset base in the EU and is a perfect platform for growth -

two projects with Company-making potential will lift off in 2011 and the

management intend to additionally develop a strong exploration-focused new

venture strategy to take the Company to the next level.

Paul Barrett

Managing Director

Unaudited consolidated statement of comprehensive income for the year ended 31

July 2010

+--------------------------------------------+------+---------+---------+

| | | 2010 | 2009 |

+--------------------------------------------+------+---------+---------+

| |Note | GBP000 | GBP000 |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Revenue | | 3,091 | 2,936 |

+--------------------------------------------+------+---------+---------+

| Other cost of sales | | (1,836) | (1,694) |

+--------------------------------------------+------+---------+---------+

| Exploration write-off | 2 | (1,008) | (297) |

+--------------------------------------------+------+---------+---------+

| Impairment of producing fields | 3 | (1,012) | - |

+--------------------------------------------+------+---------+---------+

| Total cost of sales | | (3,856) | (1,991) |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Gross (loss) / profit | | (765) | 945 |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Administrative expenses | | (709) | (545) |

+--------------------------------------------+------+---------+---------+

| Finance income | | 37 | 224 |

+--------------------------------------------+------+---------+---------+

| Finance expense | | (262) | (248) |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| (Loss) / profit before taxation | | (1,699) | 376 |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Taxation | | (263) | (356) |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| (Loss) / profit for the year attributable | | (1,962) | 20 |

| to equity shareholders of the parent | | | |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Other comprehensive income | | | |

+--------------------------------------------+------+---------+---------+

| Exchange gains arising on translation of | | 56 | 373 |

| foreign operations | | | |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

| Total comprehensive (loss) / income for | | (1,906) | 393 |

| the period attributable to the equity | | | |

| shareholders of the parent | | | |

+--------------------------------------------+------+---------+---------+

| | | | |

+--------------------------------------------+------+---------+---------+

+--------------------------------------------+------+---------+---------+

| |Note | Pence | Pence |

| | | per | per |

| | | share | share |

+--------------------------------------------+------+---------+---------+

| (Loss) / earnings per share (eps) | | | |

| attributable to equity shareholders of the | | | |

| parent | | | |

+--------------------------------------------+------+---------+---------+

| Basic eps | 4 | (2.60)p | 0.03p |

+--------------------------------------------+------+---------+---------+

| Diluted eps | 4 | (2.60)p | 0.03p |

+--------------------------------------------+------+---------+---------+

Unaudited consolidated statement of financial position as at 31 July 2010

+--------------------------------------------+----+-----------------------+-----------------------+

| | | 2010 | 2009 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | GBP000 | GBP000 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Assets | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Non-current assets | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Intangible assets | | 9,751 | 7,473 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Property, plant and equipment | | 4,504 | 5,554 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total non-current assets | | 14,255 | 13,027 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Current assets | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Inventories | | 38 | 15 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Trade and other receivables | | 587 | 469 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Current tax asset | | 335 | - |

+--------------------------------------------+----+-----------------------+-----------------------+

| Cash and cash equivalents | | 4 | 4 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total current assets | | 964 | 488 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total assets | | 15,219 | 13,515 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | ===================== | ===================== |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Liabilities | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Current liabilities | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Trade and other payables | | (1,797) | (900) |

+--------------------------------------------+----+-----------------------+-----------------------+

| Current tax liabilities | | (2) | (588) |

+--------------------------------------------+----+-----------------------+-----------------------+

| Derivative | | (55) | (40) |

+--------------------------------------------+----+-----------------------+-----------------------+

| Short-term borrowings | | (900) | (767) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total current liabilities | | (2,754) | (2,295) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Non-current liabilities | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Long-term borrowings | | (352) | (772) |

+--------------------------------------------+----+-----------------------+-----------------------+

| Deferred tax liabilities | | (3,240) | (2,651) |

+--------------------------------------------+----+-----------------------+-----------------------+

| Long-term provisions | | (1,395) | (1,137) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total non-current liabilities | | (4,987) | (4,560) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total liabilities | | (7,741) | (6,855) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Net assets | | 7,478 | 6,660 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | =================== | =================== |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Capital and reserves attributable to | | | |

| equity holders | | | |

| of the parent | | | |

+--------------------------------------------+----+-----------------------+-----------------------+

| Share capital | | 822 | 626 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Share premium | | 7,132 | 4,692 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Merger reserve | | 2,868 | 2,868 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Foreign exchange reserve | | 408 | 352 |

+--------------------------------------------+----+-----------------------+-----------------------+

| Retained deficit | | (3,752) | (1,878) |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+-----------------------+-----------------------+

| Total equity | | 7,478 | 6,660 |

+--------------------------------------------+----+-----------------------+-----------------------+

| | | ================== | ================== |

+--------------------------------------------+----+-----------------------+-----------------------+

Unaudited consolidated statement of changes in equity for the year ended 31 July

2010

Attributable to the equity holders of the parent

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | Share | Share | Merger | Foreign | Retained | Total |

| | capital | premium | reserve | exchange | earnings | equity |

| | | | | reserve | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Balance at 1 | 626 | 4,692 | 2,868 | (21) | (1,994) | 6,171 |

| August 2008 | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Total | | | - | | | |

| comprehensive | - | - | | 373 | 20 | 393 |

| income for the | | | | | | |

| year | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Share based | - | - | - | - | 96 | 96 |

| payment | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | ------------------- | ------------------- | ------------------- | ------------------- | ------------------- | ------------------- |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Balance at 31 | 626 | 4,692 | 2,868 | 352 | (1,878) | 6,660 |

| July 2009 | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | =================== | ================= | ================= | ================= | ================== | ================== |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | Share | Share | Merger | Foreign | Retained | Total |

| | capital | premium | reserve | exchange | earnings | equity |

| | | | | reserve | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Balance at 1 | 626 | 4,692 | 2,868 | 352 | (1,878) | 6,660 |

| August 2009 | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Total | | | - | | | |

| comprehensive | | | | | | |

| income/(loss) | - | - | | 56 | (1,962) | (1,906) |

| for the year | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Share based | - | - | - | - | 88 | 88 |

| payment | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Issue of share | | | | | | |

| capital (net | 196 | 2,440 | - | - | - | 2,636 |

| of issue | | | | | | |

| costs) | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | ------------------- | ------------------- | ------------------- | ------------------- | ------------------- | ------------------- |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| Balance at 31 | 822 | 7,132 | 2,868 | 408 | (3,752) | 7,478 |

| July 2010 | | | | | | |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

| | ================== | ================= | ================= | ================= | =================== | ================= |

+----------------+---------------------+---------------------+---------------------+---------------------+---------------------+---------------------+

Unaudited consolidated statement of cash flows for the year ended 31 July 2010

+--------------------------------------------+----+------------------------+-----------------------+

| | | 2010 | 2009 |

+--------------------------------------------+----+------------------------+-----------------------+

| | | GBP000 | GBP000 |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash flows from operating activities | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| (Loss) / profit after tax | | (1,962) | 20 |

+--------------------------------------------+----+------------------------+-----------------------+

| Adjustments for: | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Share based payments | | 73 | 96 |

+--------------------------------------------+----+------------------------+-----------------------+

| Depreciation | | 498 | 576 |

+--------------------------------------------+----+------------------------+-----------------------+

| Exploration write-off | | 1,008 | 297 |

+--------------------------------------------+----+------------------------+-----------------------+

| Impairment of property, plant & equipment | | 1,012 | - |

+--------------------------------------------+----+------------------------+-----------------------+

| Finance income | | (37) | (224) |

+--------------------------------------------+----+------------------------+-----------------------+

| Finance expense | | 262 | 248 |

+--------------------------------------------+----+------------------------+-----------------------+

| Taxation expense | | 263 | 356 |

+--------------------------------------------+----+------------------------+-----------------------+

| (Increase)/decrease in trade and other | | (66) | 187 |

| receivables | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| (Increase)/decrease in inventories | | (23) | 1 |

+--------------------------------------------+----+------------------------+-----------------------+

| Increase / (decrease) in trade and other | | 592 | 34 |

| payables | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash generated from operations | | 1,620 | 1,591 |

+--------------------------------------------+----+------------------------+-----------------------+

| Income taxes paid | | (597) | (180) |

+--------------------------------------------+----+------------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+------------------------+-----------------------+

| Net cash from operating activities | | 1,023 | 1,411 |

+--------------------------------------------+----+------------------------+-----------------------+

| | | ===================== | ========== |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash flows from investing activities | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Purchase of property, plant and equipment | | (222) | (191) |

+--------------------------------------------+----+------------------------+-----------------------+

| Purchase of intangible assets | | (3,075) | (930) |

+--------------------------------------------+----+------------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+------------------------+-----------------------+

| Net cash used in investing activities | | (3,297) | (1,121) |

+--------------------------------------------+----+------------------------+-----------------------+

| | | ====================== | ===================== |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash flows from financing activities | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Proceeds from issue of share capital (net | | 2,653 | - |

| of issue costs) | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Proceeds from long-term borrowings | | - | 1,000 |

+--------------------------------------------+----+------------------------+-----------------------+

| Repayment of borrowings | | (469) | (585) |

+--------------------------------------------+----+------------------------+-----------------------+

| Finance costs | | (101) | (138) |

+--------------------------------------------+----+------------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+------------------------+-----------------------+

| Net cash from financing activities | | 2,083 | 277 |

+--------------------------------------------+----+------------------------+-----------------------+

| | | ===================== | ==================== |

+--------------------------------------------+----+------------------------+-----------------------+

| | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Net (decrease) /increase in cash and cash | | (191) | 567 |

| equivalents | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| Exchange gain on cash and cash equivalents | | 8 | 160 |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash and cash equivalents at beginning of | | (292) | (1,019) |

| year | | | |

+--------------------------------------------+----+------------------------+-----------------------+

| | | -------------------- | -------------------- |

+--------------------------------------------+----+------------------------+-----------------------+

| Cash and cash equivalents at end of year | | (475) | (292) |

+--------------------------------------------+----+------------------------+-----------------------+

| | | ===================== | ==================== |

+--------------------------------------------+----+------------------------+-----------------------+

Unaudited notes to the financial statements (continued)

1 Basis of preparation

The principal accounting policies adopted in the preparation of the financial

statements are will be set out in the Group's annual report. The policies have

been consistently applied to all the years presented, unless otherwise stated.

Both tThe parent company financial statements and the Group financial statements

have will bebeen prepared and approved by the Directors in accordance with

International Financial Reporting Standards IFRS's and IFRIC interpretations,

issued by the International Accounting Standards Board (ISAB) as endorsed for

use in the EU ("Endorsed IFRSs") and those parts of the Companies Act 2006 that

are applicable to companies that prepare their financial statements under IFRS.

The unaudited financial information presented for the years ended 31 July 2010

and 31 July 2009 does not constitute statutory accounts as defined by section

435 of the Companies Act 2006 but is extracted from the unaudited accounts for

the year ended 31 July 2010 and the audited accounts for the year ended 31 July

2009. The 31 July 2009 accounts have been delivered to the Registrar of

Companies. The 31 July 2010 accounts will be delivered to Companies House within

the statutory filing deadline. The auditors have yet to report on those

accounts; their report is anticipated to be unqualified but contain an emphasis

of matter paragraph in respect of the going concern basis of preparation of the

financial information.

As described in the Chairman's statement, the Directors have considered the cash

position of the Company, and based on latest cash projections and efforts which

Europa is making to raise additional funds, they consider that the Group will

remain a going concern for the foreseeable future.

2 Intangible assets

+---------------------------------------------+-----------------------+----------------------+

| | 2010 | 2009 |

+---------------------------------------------+-----------------------+----------------------+

| | GBP000 | GBP000 |

+---------------------------------------------+-----------------------+----------------------+

| | | |

+---------------------------------------------+-----------------------+----------------------+

| At 1 August | 7,473 | 7,241 |

+---------------------------------------------+-----------------------+----------------------+

| Additions | 3,286 | 529 |

+---------------------------------------------+-----------------------+----------------------+

| Exploration write-off | (1,008) | (297) |

+---------------------------------------------+-----------------------+----------------------+

| | --------------------- | -------------------- |

+---------------------------------------------+-----------------------+----------------------+

| At 31 July | 9,751 | 7,473 |

+---------------------------------------------+-----------------------+----------------------+

| | ==================== | ==================== |

+---------------------------------------------+-----------------------+----------------------+

+--------------------------------------------+----------------------+---------------------+

| | 2010 | 2009 |

| | GBP000 | GBP000 |

| | | |

+--------------------------------------------+----------------------+---------------------+

| Romania | 7,191 | 5,874 |

+--------------------------------------------+----------------------+---------------------+

| Egypt | - | 434 |

+--------------------------------------------+----------------------+---------------------+

| France | 308 | 139 |

+--------------------------------------------+----------------------+---------------------+

| Western Sahara | - | 105 |

+--------------------------------------------+----------------------+---------------------+

| UK PEDL143 (Holmwood) | 186 | 177 |

+--------------------------------------------+----------------------+---------------------+

| UK PEDL150 (SW Lincoln) | 1,904 | 588 |

+--------------------------------------------+----------------------+---------------------+

| UK PEDL180 (NE Lincs) | 63 | 52 |

+--------------------------------------------+----------------------+---------------------+

| UK PEDL181 | 99 | 63 |

+--------------------------------------------+----------------------+---------------------+

| UK PEDL222 (Torksey area) | - | 41 |

+--------------------------------------------+----------------------+---------------------+

| | -------------------- | ------------------- |

+--------------------------------------------+----------------------+---------------------+

| Total | 9,751 | 7,473 |

+--------------------------------------------+----------------------+---------------------+

| | ==================== | =================== |

+--------------------------------------------+----------------------+---------------------+

Intangible assets comprise the Group's pre-production expenditure on licence

interests as follows:

+----------------------------------------------+------------------------+----------------------+

| | 2010 | 2009 |

| | GBP000 | GBP000 |

+----------------------------------------------+------------------------+----------------------+

| Exploration write-off | | |

+----------------------------------------------+------------------------+----------------------+

| Egypt | 738 | - |

+----------------------------------------------+------------------------+----------------------+

| Western Sahara | 184 | - |

+----------------------------------------------+------------------------+----------------------+

| UK - PEDL222 | 55 | - |

+----------------------------------------------+------------------------+----------------------+

| UK - PEDL180/181 pre licence costs | 31 | - |

+----------------------------------------------+------------------------+----------------------+

| UK - East Irish sea block 109/5 | - | 297 |

+----------------------------------------------+------------------------+----------------------+

| | ---------------------- | -------------------- |

+----------------------------------------------+------------------------+----------------------+

| At 31 July | 1,008 | 297 |

+----------------------------------------------+------------------------+----------------------+

| | ===================== | =================== |

+----------------------------------------------+------------------------+----------------------+

In December 2009, the Company relinquished its interest in the West Darag

concession, onshore Egypt. The decision, driven by the lack of identified

drill-ready prospects needed to commit to phase 2 of the concession, resulted in

a write-off of the investment in Egypt.

As the license areas in Western Sahara remained in force majeure throughout the

year, the Board decided to write-down the intangible asset to nil value.

With a lack of identified prospects in the PEDL222 concession, the Board also

decided to write down the investment to nil value.

Within the PEDL150 concession, the Hykeham well was drilled in the year. Though

the likely forward plan is to plug and abandon the well, the investment has not

been written off as prospectivity within the rest of the concession area, which

is considered as one cost pool, is good.

3 Property, plant and equipment

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | Furniture | Leasehold | Producing | Total |

| | & | building | fields | |

| | computers | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | GBP000 | GBP000 | GBP000 | GBP000 |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Cost | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 1 August 2008 | | | | |

| | 27 | 437 | 7,213 | 7,677 |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Additions | 12 | - | 122 | 134 |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ---------------------- | ----------------------- | ------------------------ | ------------------------ |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2009 | | 437 | | 7,811 |

| | 39 | | 7,335 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Additions | 16 | - | 444 | 460 |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Impairment | - | - | (1,331) | (1,331) |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ------------------------- | ------------------------- | ------------------------- | ------------------------- |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2010 | | 437 | | 6,940 |

| | 55 | | 6,448 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ======================== | ======================== | =================== | ======================== |

| | | | === | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Depreciation and | | | | |

| depletion | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 1 August 2008 | | 52 | | 1,681 |

| | 6 | | 1,623 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Charge for year | | 25 | | 576 |

| | 9 | | 542 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ------------------------- | ------------------------- | ------------------------- | ------------------------- |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2009 | | 77 | | 2,257 |

| | 15 | | 2,165 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Charge for year | | 8 | | 498 |

| | 10 | | 480 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Impairment | - | - | (319) | (319) |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ------------------------ | ------------------------- | ------------------------- | ------------------------- |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2010 | | 85 | | 2,436 |

| | 25 | | 2,326 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ========================= | ========================= | ======================= | ========================= |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| Net Book Value | | | | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2010 | | 352 | | 4,504 |

| | 30 | | 4,122 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ========================== | ======================== | ======================== | ======================== |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2009 | | 360 | | 5,554 |

| | 24 | | 5,170 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ========================= | ========================= | ========================= | ======================== |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| At 31 July 2008 | | 385 | | 5,996 |

| | 21 | | 5,590 | |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

| | ======================== | ======================== | ========================= | ======================== |

+-------------------+----------------------------+---------------------------+---------------------------+---------------------------+

The producing fields referred to in the table above are the production assets of

the Group, namely the oilfields at Crosby Warren and West Firsby, and the

Group's interest in the Whisby W4 well.

The carrying value of each producing field was tested for impairment. As a

result, the Board decided to write down value of the Crosby Warren field by

GBP1,012,000 (gross cost of GBP1,331,000 and accumulated depreciation of

GBP319,000).

4 Earnings per share

Basic earnings per share (EPS) has been calculated on the loss or profit after

taxation divided by the weighted average number of shares in issue during the

period. Diluted EPS uses an average number of shares adjusted to allow for the

issue of shares, on the assumed conversion of all in the money options.

The Company's average share price for the year to 31 July 2010 was 14.6p

resulting in a dilution of 26,020 shares.

The Company's average share price for the year to 31 July 2009 was lower than

the exercise price of the share options in issue. Therefore the share options in

issue had no dilutive effect and there is no difference between the basic and

diluted earnings per share.

The calculation of the basic and diluted (loss)/earnings per share is based on

the following:

+---------------------------------------------+------------+------------+

| | 2010 | 2009 |

+---------------------------------------------+------------+------------+

| | GBP000 | GBP000 |

+---------------------------------------------+------------+------------+

| (Losses)/earnings | | |

+---------------------------------------------+------------+------------+

| (Loss)/profit after tax | (1,962) | 20 |

+---------------------------------------------+------------+------------+

| | | |

+---------------------------------------------+------------+------------+

| Weighted average number of shares | | |

+---------------------------------------------+------------+------------+

| for the purposes of basic eps | 75,520,873 | 62,563,730 |

+---------------------------------------------+------------+------------+

| for the purposes of diluted eps | 75,546,893 | 62,563,730 |

+---------------------------------------------+------------+------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR FFEFWDFSSEDS

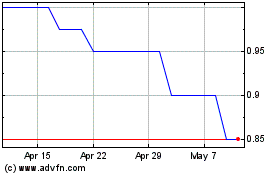

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Jul 2023 to Jul 2024