Digital Payments plc Acquisition

August 07 2014 - 11:29AM

UK Regulatory

TIDMDPP

Acquisition

Digital Payments PLC

Summary: Digital Payments PLC is extending its global processing footprint by joining forces with the

Muscato Group Inc. to build the entire vertical chain of services ranging from provision of free

middleware to its clients, to issuing, processing and acquiring for on-line and real time card

businesses and transactions.

Acquisition of Muscato Group Inc

The Board of Digital Payments Plc ("Digital Payments" or the "Company"), the GXG Main Quote investing

company focusing on investment and acquisition opportunities in payment transaction and message

processing services is pleased to announce that it has acquired 100% of the issued share capital of

Muscato Group Inc. ("MGI") a USA, Florida based company (the "Acquisition"), which includes M2 Payment

Solutions Inc. ("M2") and all of its affiliates.

MGI and M2 provide financial institutions, companies, and government agencies in the United States,

Latin America and Europe with the technology, transaction processing and infrastructure needed to

launch innovative payment products and services.

Indicative figures arising from due diligence indicate that in the year ended December 2013 the

companies subject to the Acquisition recorded revenues of approximately USD 2m.

The Acquisition enables Digital Payments PLC to complete another step in their stated ambition of

being a global vertically-integrated payment company with worldwide processing capability.

M2 Payment Solutions will continue to operate under its current brand and business structure; adding

more functionality and resources to build on its global market presence. Digital Payments PLC will

enable M2 to increase its investment in technology, infrastructure, payment and global expansion. Over

the past 12 months M2 has released new products in both multi-currency and loyalty management and

expects to continue the path of new market products and services to deliver to its customer base.

The consideration for the Acquisition is USD 14.6 million, which is to be satisfied by the payment of

USD 4,600,000 in cash to the two shareholders in MGI and the allotment and issue, credited as fully

paid, of 118,694,362 new ordinary shares of 1p each in the Company at an effective price per share of

5 pence (together the "Consideration Shares"). The Consideration Shares will rank pari passu in all

respects with the existing ordinary shares of the Company.

Following the Acquisition and the issue of the Consideration Shares, the vendors of MGI have the

following interest in the Company's issued ordinary share capital:

Name Number of shares Percentage

Mr. Michael Muscato 79,169,139 14.15%

Mr. Joseph Adams 39,525,223 7.06%

The enlarged issued share capital of Digital Payments with voting rights attached consists of

559,619,362 ordinary shares of 1p each with one vote per ordinary share. The total number of voting

rights in Digital Payments is therefore 559,619,361 which figure may be used by shareholders (and

others with notification obligations) as the denominator for the calculations by which they will

determine whether they are required to notify their interest, or a change to their interest, in

Digital Payments under the UK Financial Conduct Authority's Disclosure and Transparency Rules.

The Directors of the Issuer accept responsibility for the contents of this announcement.

For further information please contact:

David Carr - CEO

Digital Payments Plc

Telephone: +44 207493 0387

Email: press@digitalpaymentsplc.com

GXG Corporate Advisor

Nick Michaels and Jon Isaacs

Alfred Henry Corporate Finance Limited

www.alfredhenry.com

Tel: +44 207251 3762

Digital Payments plc

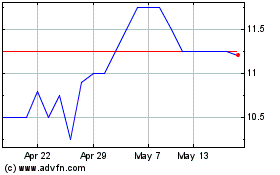

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jul 2023 to Jul 2024