TIDMDLN

RNS Number : 0755I

Derwent London PLC

10 August 2021

10 August 2021

Derwent London plc ("Derwent London" / "the Group")

INTERIM RESULTS FOR THE HALF YEARED 30 JUNE 2021

INCREASED ACTIVITY AND CONFIDENCE

Financial highlights

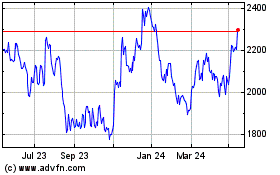

-- Total return of 2.7%, -0.1% in H1 2020, -1.8% in FY 2020

-- EPRA(1) NTA 3,864p per share, up 1.4% from 3,812p at 31 December 2020

-- Net rental income of GBP90.1m, up from GBP84.4m in H1 2020

-- EPRA(1) earnings of GBP60.6m or 54.0p per share, up 10.5% from 48.9p in H1 2020

-- Interim dividend raised 4.5% to 23.0p from 22.0p in 2020

-- Net debt of GBP999.7m (GBP1,049.1m at 31 December 2020)

-- Loan-to-value ratio 17.3% (18.4% at 31 December 2020)

-- Undrawn facilities and cash of GBP527m (GBP476m at 31 December 2020)

Portfolio highlights

-- Portfolio valued at GBP5.4bn, an underlying value increase of 1.4%

-- True equivalent yield of 4.65%, tightening 9bp since December 2020

-- Total property return of 3.2%, outperforming our benchmark index(2) of 2.3%

-- EPRA vacancy rate rose from 1.8% to 3.3% in H1 (subsequently reduced to 2.4%)

-- ERV movement of -0.3% in first half of 2021

-- First half lettings GBP3.9m, 1.6% below December 2020 ERV with offices 0.4% above

-- Raised 2021 ERV guidance to +2% to -2% from 0% to -5%

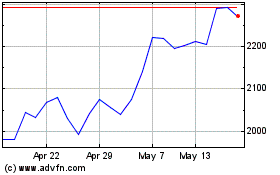

Second half activity to date

-- Exchanged contracts to acquire two freeholds for GBP214.6m

-- Signed memorandum of understanding to form a JV with Lazari

Investments for a major development in Baker Street W1

-- Secured vacant possession of Bush House WC2, accelerating refurbishment opportunity

-- Exchanged contracts to sell Angel Square EC1 for GBP86.5m before costs

-- Resolution to grant consent for the redevelopment of Network Building W1

-- Second half lettings to date GBP3.8m, 2.2% above ERV

-- Potential pipeline now c.2.5m sq ft

(1) Explanations of how EPRA figures are derived from IFRS are

shown in note 23

(2) MSCI IPD Central London Offices Quarterly Index

Paul Williams, Chief Executive, commented:

"Sentiment is improving as the year progresses which has been

reflected in our results and encouraged us to raise our ERV

guidance. We are well positioned to invest and are moving forward

with our next phase of net zero carbon developments and today's

acquisitions have added to our extensive pipeline."

Webcast and conference call

There will be a live webcast together with a conference call for

investors and analysts at 09.30 GMT today. The audio webcast can be

accessed via www.derwentlondon.com

To participate in the call, please register at

www.derwentlondon.com

A recording of the conference call will also be made available

following the conclusion of the call on www.derwentlondon.com

For further information, please contact:

Derwent London Paul Williams, Chief Executive

Tel: +44 (0)20 7659 3000 Damian Wisniewski, Chief Financial Officer

Quentin Freeman, Head of Investor Relations

Brunswick Group Simon Sporborg

Tel: +44 (0)20 7404 5959 Nina Coad

Emily Trapnell

CHIEF EXECUTIVE'S STATEMENT

Improved business confidence

London's business confidence and economy were stronger than

expected in the first six months helped by the successful roll out

of the UK's vaccination programme. In our sector this has been

reflected in increased property activity levels and the tightening

of property yields. We expect these trends to strengthen further in

the second half now that most lockdown restrictions have been

lifted.

Operationally, we have seen higher rent collection with offices,

the bulk of our income, now close to pre-Covid levels. Our letting

activity has picked up as the year has progressed and we have now

let 139,000 sq ft for GBP7.7m of which 50% was in Q3. We continue

to embed our net zero carbon strategies across the business and

support our local communities.

Our average ERV fell only 0.3% in the first six months which was

at the top end of our previous guidance but, as expected, higher

quality buildings are performing better. Our vacancy rate rose

marginally to 3.3% at 30 June 2021 but, following H2 lettings to

date, is now 2.4%.

Our current developments at Soho Place W1 and The Featherstone

Building EC1 are on track to complete in H1 2022. We are commencing

our next major project at 19-35 Baker Street W1 in Q4 this year

which will take our space on site to over 700,000 sq ft.

We have also taken advantage of robust investor demand for

central London office properties by disposing of two older

buildings in the year to date for GBP256.5m and will be investing

the proceeds in new acquisitions and our extended development

pipeline.

Major West End investment

Today we are announcing three transactions with Lazari

Investments.

We have exchanged contracts to acquire two freehold interests in

the West End's Knowledge Quarter(1) :

-- 250 Euston Road NW1 is a 165,900 sq ft office building on a

1.6 acre site. It is let to UCLH until 2039 at a rent of just GBP28

per sq ft, subject to 2.5% fixed annual increases compounded every

five years, coinciding with tenant break options. The consideration

is GBP189.9m including estimated costs.

-- 171-174 Tottenham Court Road W1 is a 16,200 sq ft mixed-use

property acquired for GBP24.7m after estimated costs. This is an

interesting strategic holding, part of a much larger block

including significant UCLH and UCL interests.

In addition, we have signed a memorandum of understanding with

Lazari Investments to form a 50:50 joint venture which is expected

to acquire their leasehold interests in a group of Baker Street

buildings totalling 122,200 sq ft. The consideration for our 50%

interest including costs is GBP64.4m.

It is our intention to apply for planning permission to create a

major c.240,000 sq ft development. This will be almost opposite our

19-35 Baker Street scheme due to commence later this year. Subject

to the necessary approvals this project could begin in 2024. A

further payment of GBP7.25m would be payable to the vendor when

planning and headlease regears are achieved.

The estimated initial financial impacts of these transactions

are disclosed in a separate RNS published today.

(1) London's Knowledge Quarter is defined as the small area

around Euston Road, Kings Cross and Bloomsbury which has a very

high concentration of academic, cultural, research, scientific and

medical organisations

Adding to our next phase of developments

In the second half we have received a resolution to grant

planning consent for either 137,000 sq ft of offices or 112,000 sq

ft of lab-enabled space at Network Building, Fitzrovia W1. We

expect to commence work on site in 2022. Also in the second half,

we have bought in the headlease interest in the South West Wing of

Bush House WC2 for GBP13.5m before costs. The Group already owns

the freehold to this 103,700 sq ft property facing the Strand. As

well as releasing marriage value we are working on plans to

refurbish and extend the building to c.130,000 sq ft, with a

potential start date in 2022, subject to planning. Including the

19-35 Baker Street project these two projects would take our next

phase of developments up to 565,000 sq ft in addition to our

existing 410,000 sq ft on site.

Improved first half results and dividend

The recovery in confidence and activity is reflected in a

significant improvement in our financial results compared to H1

2020 when the first impacts of Covid-19 were being felt.

Gross rental income for the six months to 30 June 2021 increased

modestly to GBP98.1m from GBP97.8m a year earlier, with the GBP9.5m

increase from 80 Charlotte Street W1 being offset by a combined

GBP9.4m of disposals and increased voids. However, the impact of

Covid-related rental waivers and other concessions has been

significantly lower in 2021 so that net property income on an EPRA

basis rose by 10.9% to GBP93.8m from GBP84.6m in H1 2020. EPRA

earnings have benefitted accordingly, rising 10.8% to GBP60.6m from

GBP54.7m in H1 2020. EPRA earnings per share were 10.5% higher at

54.0p from 48.9p in H1 2020 and were also 5.3% above the 51.3p in

H1 2019.

The investment property revaluation surplus for the half year

was GBP57.8m after accounting adjustments, which followed declines

of GBP68.3m in H1 2020 and GBP196.1m for the full year. This has

helped drive EPRA Net Tangible Assets to 3,864p per share, up 1.4%

from 3,812p as at December 2020, and IFRS profit before tax was

GBP121.1m for the first half compared to a loss of GBP14.0m in H1

2020. Adding back dividends paid gave a total return for the first

half of 2021 of 2.7% against -0.1% in H1 2020 and -1.8% for the

whole of 2020.

Our other financial ratios remain very secure with interest

covered 4.8 times and the Group's LTV ratio at 17.3%, the same as a

year earlier and a little lower than the 18.4% at 2020 year end.

All of these aspects have encouraged us to increase the interim

dividend by 4.5% to 23.0p per share, where it remains well

covered.

The London office market

Business activity has been improving as London follows the

roadmap out of lockdown and with the increased level of

vaccinations. We believe it is the strength of the London economy

and its adaptability in attracting new sectors that will ultimately

determine demand and Derwent London's long-term growth. London's

large, relatively young and well-educated labour pool continues to

attract growing businesses. All of this further endorses our

confidence in London.

Office demand has focused on much more than just location and

price for some time. A building's adaptability, amenities, ability

to promote wellbeing, sustainability and 'digital intelligence' are

increasingly important to occupiers. The pandemic has further

highlighted these broader issues. High quality office space is an

important weapon in promoting a business's culture and the 'war for

talent'.

One example of how we are responding is 'DL/78' which is due to

launch next month at our latest completed development 80 Charlotte

Street W1. Located at the heart of our Fitzrovia village it is a

purpose built occupier facility providing drop in space and

refreshments, as well as the opportunity to hire meeting rooms and

event space ranging in capacity from 8 to 100+ persons. We are

encouraged by the positive response to this initiative from our

occupiers.

Many businesses are still considering how changing working

practices will affect them in the future. However, we expect space

requirements to continue to focus on peak occupational demand,

which often requires a significant proportion of the workforce to

be present at one time. Less individual desk space may be replaced

by additional video conferencing facilities. In addition, as more

businesses return to their offices the need to be 'at the centre of

things' will be reinforced.

These views are supported by the results of our third occupier

questionnaire since the start of the Covid pandemic. This survey,

which covers 50% of our income, has consistently shown that

collaboration and social activity have been most missed during the

pandemic. As time has progressed, wellbeing, training and

innovation have become significant additional concerns. In February

we were encouraged to find that 51% of respondents intended to

increase their headcount. That has not changed, but the percentage

seeing no change has increased from 18% to 29%. As a result, 80%

have said they intend in increase or see no change in their

headcount in the next six to 12 months up from 69% in February.

An evolving business

The increasing flight to quality within the central London

office market has led us to take a more nuanced look at our

portfolio and strategy.

We expect to retain more of our larger modern developments where

we see good long-term demand. These will provide asset management

opportunities and a core of high quality income. These properties

will enable the Group to build on its network of established

occupier relationships as well as making meaningful long-term

investments promoting climate resilience, higher levels of customer

services, intelligent buildings and supporting local

communities.

An income producing pipeline of potential projects will remain

at the heart of our business. We will continue to ensure that it is

extensive and offers multiple opportunities where we can continue

to utilise our design skills, proactive management and our brand.

We will advance our active development programme which we expect to

remain a significant contributor to our performance. Our proven

ability to produce high quality product should serve us well in a

market where potential legislation is putting much of central

London's older office stock in need of improvement.

The Lazari transaction announced today involves a classic mix of

income-producing medium and longer-term opportunities in an area we

know well, adding to a major cluster of Derwent London properties.

It adds 243,200 sq ft to our potential development pipeline which

now totals c.2.5m sq ft based on pre-development floor areas.

The strong investment market has given us the opportunity to

dispose of some of those buildings where, on our estimates, we

believe we can find greater returns elsewhere. The proceeds will be

reinvested either into new acquisitions or the development

programme.

All this activity will continue to be based on a financial

structure with modest gearing and sufficient headroom to ensure we

retain the flexibility to deliver all our objectives.

A responsible business

Last year we published our pathway to becoming a net zero carbon

business by 2030. Our focus on sustainability is highlighted by the

delivery of net zero carbon developments and a continuing

investment in our buildings and teams.

The pandemic has increased levels of collaboration with our

stakeholders. We will continue to support our occupiers as they

return to work, as well as offer financial support on a case by

case basis to those whose businesses remain particularly impacted

by the pandemic. In particular we have been supporting many of our

retail and hospitality occupiers.

Our own employees have increasingly been back in the office and

we have benefitted from the increased levels of human interaction.

Feedback on our workplace initiatives has been positive and in the

second half we will be continuing to focus on wellness and mental

health initiatives as well as talent development and cultural

awareness.

The Group continues to enjoy excellent relationships with its

suppliers who have responded well to the challenges presented by

the pandemic. Recognising the importance of cashflow in these

times, our average payment terms to our suppliers remains at 20

days. Looking forward in the next 12 months, we will be awarding a

number of significant new construction contracts covering projects

commencing in 2021 and 2022. We are assuming a higher rate of

construction cost inflation than in recent years with both

materials and labour costs impacted. We have mitigated this in the

past with fixed price contracts and by working closely with our

contractors.

We support local communities around our buildings through our

Community Funds and direct sponsorships and donations. In H1, with

support from our partners AHMM and TTP, we delivered a new

counselling room for the Soup Kitchen in Fitzrovia. In H2 we will

be helping St Monica's Primary School, Hoxton in the Green Schools

Project and Chickenshed in providing two initiatives designed to

help young people get into employment. We are very active and we

continue to engage constructively to ensure outcomes that benefit

the wider community such as our commitment to provide 23 affordable

homes with the development of Network Building in Camden.

Outlook and upgrade in guidance

In the first six months the London office market and our own

portfolio have performed near the upper end of expectations. We are

continuing to see good letting activity and demand. The growth rate

in the London vacancy rate appears to be levelling, new supply

remains constrained and some previously available tenant-controlled

space has been withdrawn from the market. In the light of this

evidence and on the assumption that there is no further lockdown,

we are raising our average portfolio ERV guidance to +2.0% to -2.0%

for the year ending December 2021. This compares to our March 2021

estimate of 0% to -5%.

Our average portfolio investment yields tightened in the first

half as expected. They are still higher than those of comparable

European cities and there is strong demand from a wide range of

sources (estimated at GBP41bn by CBRE). Inflation has begun to rise

from very low levels, but it is not yet clear this will become a

long-term trend and the yield gap between property and many other

assets remains wide. We expect investment demand and property

yields to remain firm in the second half.

We will continue to focus on the pre-letting campaigns for the

offices at The Featherstone Building EC1 and the retail at 1 Oxford

Street (Soho Place) W1 (together 161,000 sq ft); commencing our

next major net zero carbon development at 19-35 Baker Street W1

which totals 298,000 sq ft and continuing the progress to becoming

a net zero carbon business by 2030.

On the back of our strong financial position we have made a

positive start to the second half, and we can now finalise our

plans for Network Building for a 2022 development start, preparing

to submit plans for Bush House and embedding the Lazari

transactions into our portfolio.

As a result, we expect the Group to benefit from London's

continuing economic recovery. Our business model should also gain

from the increasing focus on making cities climate resilient. Risks

remain and international travel is still limited but our strong

activity levels are supported by our skill sets, financial strength

and well established relationships. These should provide additional

impetus ensuring that we can still produce above average long-term

returns and benefits for all our stakeholders.

Board appointments

We recently announced the appointment of Sanjeev Sharma who will

join the board as an independent Non-Executive Director from 1

October 2021. He will become a member of the Risk, Audit and

Nominations Committees. On 31 October Simon Fraser will retire from

the board and his position as Senior Independent Director, a

position that will then be taken by Helen Gordon. We are looking

forward to working with Sanjeev and would like to thank Simon for

his considerable contribution to Derwent London over the last nine

years.

CENTRAL LONDON OFFICE MARKET

The pandemic continues to impact the London office market, but

there are signs that its grip is starting to loosen as the economy

recovers and London's business confidence improves.

Occupier demand

Activity is improving with first half take-up at 3.0m sq ft, 55%

higher than H2 2020 although, in absolute terms, this remains

significantly below pre-Covid levels. Professional and business

services represented 31% of demand, slightly below recent years,

banking and finance increased their share to 23% and creative

industries remained at c.20%.

The overall vacancy rate has risen to 9.3% from 8.0% in the

first six months, with the City vacancy rate at 12.7% rising faster

than the West End's at 6.0%. These levels are above long-term

trends but new space is estimated at under 15% of the total. CBRE

classify the majority as secondhand of which 41% is tenant

controlled. Much of this space is of lower quality which has been a

contributing factor to the two tier market, and the flight to

quality.

The impact on rent has been relatively modest with CBRE

estimating that prime rents have fallen 1.1% overall in the last

year, declining 2.2% in the City and actually rising 1.3% in the

West End. The MSCI IPD central London office index recorded average

rents rising 0.1%. This improving trend is reflected in the amount

of space under offer. This fell steadily from 3.7m sq ft at Q1 2020

to reach its low point at 1.9m sq ft in Q1 this year and has now

recovered to 2.7m sq ft at the end of Q2, its highest level for

five quarters.

The supply of available new space remains constrained despite

lower levels of pre-letting activity. The first half saw 2.9m sq ft

of space delivered leaving 11.2m sq ft under development compared

to 12.1m sq ft in December 2020. This space is 32% pre-let leaving

available new space due for delivery between now and the end of

2023 of 7.6m sq ft. This is in line with recent trends at c.3% of

the total market.

Investment demand

There were GBP3.9bn of investment transactions in the first half

of 2021 as estimated by CBRE, despite the UK being in lockdown for

a major part of the period. Nearly 70% of activity occurred in Q2,

which also represented the highest single quarter's activity since

2018 outside the two very active last quarters in 2019 and 2020.

This demand has seen the MSCI IPD central London office equivalent

yield move in 5bp to 4.85%.

Overall investment activity remains 35% below the pre-Covid

trend but is beginning to recover. There was greater interest from

North American buyers which represented 29% of the total and UK

investors at 28%. Asian and European buyers also remain active and

together amount to 34%. Overall, there seems increased interest in

UK assets not just in the property sector, as UK value growth has

lagged many international peers. These higher levels of interest

may reflect the impact of the UK leaving the EU in January 2021 as

well as the UK's population's relative levels of vaccination. The

largest single transactions were in the City and Whitechapel. CBRE

reports that potential investment demand remains high at

GBP41bn.

VALUATION

The Group's investment portfolio was valued at GBP5.4bn on 30

June 2021. There was a valuation surplus of GBP70.1m for the first

half which, after accounting adjustments of GBP12.0m (see note 10),

produced an uplift of GBP58.1m. This movement represents an

underlying valuation increase of 1.4%, and a reversal of the 2.1%

valuation fall seen over the second half of 2020. By location, our

central London properties, which represent 99% of the portfolio,

increased in value by 1.3% with the West End 1.6% and City Borders

0.7%. The balance of the portfolio, our Scottish holdings, were up

7.4% following a favourable residential planning consent.

Our portfolio's capital growth outperformed the MSCI IPD

Quarterly Index for Central London Offices, at 0.5%, but

underperformed the wider All UK Property Index which increased

2.9%.

Looking at EPRA metrics, with lower leasing activity than

pre-pandemic, our rental values fell marginally by 0.3%. Whilst our

portfolio has limited retail exposure it accounted for the fall, as

rental values in this sector fell by 5.8% compared to the marginal

0.1% increase for offices. The strong investment market, which

continues to see a hunt for yield from well let, quality buildings,

helped drive the portfolio's valuation yields lower. Accordingly,

the true equivalent yield tightened 9bp from 4.74% to 4.65% over

the first half of the year. The initial yield is 3.4%, which after

allowing for the expiry of rent frees and contractual uplifts,

rises to 4.6% on a 'topped-up' basis.

The total property return for the first six months was 3.2%,

which compares to the MSCI IPD Index of 2.3% for Central London

Offices and 5.3% for UK All Property.

We are on site with two major developments: Soho Place W1 and

The Featherstone Building EC1. Further details on their progress

are set out under 'Developments' below. They were valued at

GBP392.3m in June 2021 and delivered a 5.8% uplift. Both are

scheduled for completion in early 2022 and require GBP127m of

additional capex to complete. Their ERV is GBP28.6m, of which 59%

is pre-let by ERV. Excluding these developments, the portfolio

increased by 1.1%.

Portfolio reversion

Turning to our income profile, our contracted annualised cash

rent in June was GBP175.8m, which was a 7% decrease over the 6

months, mainly reflecting the disposal of the Johnson Building EC1

and falling income at our Portman joint venture, ahead of its

restructure and the redevelopment of 19-35 Baker Street W1. With a

portfolio ERV of GBP282.4m there is GBP106.6m of potential

reversion. Within this, GBP60.0m is contracted through rent-frees

and fixed uplifts, which under IFRS accounting treatment is already

mostly incorporated in the income statement. Our on-site

developments and major refurbishments could add GBP31.1m of which

GBP17.0m is pre-let at Soho Place. There is then GBP5.0m of

potential income from several ongoing smaller projects across the

portfolio. Our vacancy rate, whilst low, moved to 3.3% from 1.8%

over the first half. This represents GBP8.4m of reversion. Since

then our letting activity, including at the recently completed 6-8

Greencoat Place refurbishment, would take the level down to 2.4%.

The balance of the potential reversion GBP2.1m comes from future

reviews and expiries.

ASSET MANAGEMENT & INVESTMENT ACTIVITY

Our rent collection has steadily improved since the June 2020

Quarter Day. We have now received 93% of our June 2021 quarter

rents up from 89% when we last reported on 9 July 2021, and we

still have another 3% due to be paid this quarter. Our office rent

collection was 95% with another 2% due later in this quarter, and

we have now received 59% of our retail and hospitality rents

compared to 27% in July. In relation to the previous two quarters,

we have received or have payment plans in place for 96% of March

2021 quarter day rents and 97% of December 2020 rents.

June 2021 quarter(1)

Current position Announced 9 July

------------------------------------------

Office Retail/ Hospitality Total Office Retail/ Hospitality Total

-------------------- --------- --------------------

Rent received to date 95% 59% 93% 93% 27% 89%

Due later in the quarter(2) 2% 12% 3% 3% 31% 5%

Outstanding 2% 23% 3% 3% 36% 5%

Rent free 1% 6% 1% 1% 6% 1%

Total 100% 100% 100% 100% 100% 100%

-----------------------------

GBP38.4m GBP2.7m GBP41.1m GBP38.4m GBP2.7m GBP41.1m

----------------------------- -------------------- --------------------

1 Rent received to date for English quarter days 2 Principally monthly receipts

With a low vacancy rate we continue to have limited amounts of

space to let. The table below shows that Q1 was very quiet in the

market, but our activity and performance has since improved. The

sample size remains relatively low so single deals can have a major

impact. In the first half, our office transactions were 0.4% above

December 2020 ERV, brought down by short-term residential lettings.

However, our overall lettings were 1.6% below ERV on average.

Table 1: Letting activity 2021 to date

Let Performance against

Dec 20 ERV (%)

Area Income Open market Overall(1)

sq ft GBPm pa

Q1 14,400 0.3 (14.4) (16.8)

Q2 64,800 3.6 (0.1) (0.1)

----- -------- ------------ -----------

H1 79,200 3.9 (1.0) (1.6)

----- -------- ------------ -----------

Q3 59,800 3.8 2.2 2.2

----- -------- ------------ -----------

YTD 139,000 7.7 0.6 0.2

----- -------- ------------ -----------

(1) Includes short-term lettings at properties earmarked for

redevelopment

The largest deal in the first half was the letting to Depop who

took the first floor at 20 Farringdon Road EC1. Activity has

continued in the second half. We have let the recently completed

6-8 Greencoat Place SW1 to Fora, and The & Partnership has

chosen the Charlotte Building W1 as its main HQ which has seen them

take additional space as well as extend their existing lease. Our

'furnished & flexible' offer has made an important contribution

letting 20,900 sq ft in total. One of the larger of these deals was

at 3-5 Rathbone Place W1. More details on these transactions can be

seen in the table below.

Table 2: Principal lettings 2021 to date

Total

Office annual Lease Lease

Area rent rent term break Rent-free equivalent

Property Tenant sq ft GBP psf GBPm Years Year Months

H1

20 Farringdon Road 9, plus 4 if no

EC1 Depop 33,500 52.50 1.8 5 3 break

Tea Building E1 Soho House 7,600 50.00 0.4 10 - 24

19-23 Fitzroy Street 5, plus 3 if no

W1 Mission Media 4,500 73.80 0.3 5 3 break

Holden House W1 Envy 5,900 53.00 0.3 5 4 12

Atelier Capital 4, plus 2 if no

3-5 Rathbone Place W1 Partners 3,000 88.00 0.3 5 3 break

H2

6-8 Greencoat Place

SW1 Fora 32,400 68.50 2.2 15 - 34

Charlotte Building W1 The & Partnership 14,900 67.50 1.0 5 - 10

Total 101,800 61.90 6.3

A year ago, our asset management focus was on our 2021 lease

expiries which represented 24% of our rental income. By December

2020 this had reduced to 17% of this year's income. During the

first half we have retained or re-let 78% of all expiries and

completed the disposal of Johnson Building EC1. As a result at 30

June 2021 only 9% of our second half income was subject to expiry.

After adjusting for the disposal of Angel Square, and two buildings

being cleared for development this falls further to 5%. Thereafter

our lease expiry profile follows a more normal pattern.

In the first six months lease events have seen our rental income

increase by GBP1.9m. This activity covered rents on GBP16.5m of

rental income or 9% of our December 2020 annual rent. Overall,

these transactions were 3.5% below ERV. Most of the

underperformance was driven by just two transactions. Our lease

renewal performance was impacted by one letting to a retail

business and the rent review performance was impacted by a

transaction at Angel Square EC1. The performance of lease regears

was more in line with expectations. The aggregate performance of

our activities is shown in the table below.

Table 3: Asset management H1 2021

Area Previous rent New rent Uplift New rent vs

----------------

'000 sq ft GBPm pa GBPm pa % Dec 20 ERV %

---------------- -------------- --------- ------- -------------

Rent reviews 166.2 7.3 9.1 24.6 (4.3)

Lease renewals 31.4 1.9 1.8 (5.0) (6.2)

Lease regears 164.8 7.3 7.5 2.7 (1.8)

---------------- -------------- --------- ------- -------------

Total 362.4 16.5 18.4 11.5 (3.5)

---------------- -------------- --------- ------- -------------

Improving the energy efficiency of the existing portfolio

Our existing portfolio represents a very significant part of our

journey to net zero. In the first half we completed 6-8 Greencoat

Place SW1 improving its EPC rating from an 'E' to 'B'. In addition,

we fitted out 19 Fitzroy Street W1 as 'furnished & flexible'

space which involved upgrading its all-electric heat and power

services. This has seen that building's EPC rating rise from 'C' to

'A'. As a result of our first half actions, we are now fully

compliant with the 2023 EPC legislation, excluding known projects.

Our sights are now set on the potential 2030 legislation which will

require all our portfolio to be EPC 'B' or better.

Investment activity

Our investment team has had an active year to date

notwithstanding the continuing competitiveness of the market. The

majority of this activity relates to the second half and is

included in the table below. This excludes the three Baker Street

properties in joint venture with Lazari Investments, for which we

have signed a detailed memorandum of understanding.

Table 4: Major acquisitions 2021 to date

Net Net

Total after Net rental rental

Area costs yield income income

Property Date sq ft GBPm % GBPm pa GBP psf

250 Euston Road NW1 Q3 165,900 189.9 2.5 4.7 28.30

------ -------- ------------ ------- --------- ---------

171-174 Tottenham Court Road W1 Q3 16,200 24.7 2.6 0.6 57.50

------ -------- ------------ ------- --------- ---------

Holford Works WC1 (long leasehold) Q2 41,600 23.8 6.8 1.6 40.00

------ -------- ------------ ------- --------- ---------

Bush House WC2 (leasehold) Q3 103,700 14.5 - - -

------ -------- ------------ ------- --------- ---------

Total 327,400 252.9

-------- ------------ ------- --------- ---------

We continue to dispose of those assets where we think the

potential returns are less exciting. Recent events have made us

reconsider some of our potential schemes and the current strong

levels of investment demand have allowed us to crystalise these

buildings at good levels.

Table 5: Major disposals 2021

Gross

Area proceeds Net yield to purchaser Rent

Property Date sq ft GBPm % GBPm

Completed

Johnson Building EC1 Q1 192,700 170.0 4.1 7.3

------ -------- ---------- ----------------------- -------

Exchanged

Angel Square EC1 Q3 126,200 86.5 - 0.0(1)

------ -------- ---------- ----------------------- -------

Total 318,900 256.5 - 7.3

-------- ---------- ----------------------- -------

(1) To be sold with vacant possession

DEVELOPMENTS

We have two major developments under construction, both due for

delivery in H1 2022. In the next 18 months we expect to have

commenced our next phase of major schemes incorporating 19-35 Baker

Street W1, Network Building W1 and Bush House WC2. Together these

additional projects could add 565,000 sq ft to our on-site

programme. Beyond that our longer-term pipeline has been increased

by our second half investment transactions so that we have a

potential further 1.7 million sq ft, or 31% of our portfolio by

area, that could form the basis of future regeneration

activity.

On-site projects

At Soho Place W1, the offices and theatre element, in total

249,200 sq ft, is either pre-let or forward-sold. The pre-let

income has an ERV of GBP17.0m. This leaves 36,000 sq ft of retail,

with an ERV of GBP3.1m, still to let.

The Featherstone Building EC1, with an ERV of GBP8.5m, remains

available to pre-let. Following initial interest in a substantial

proportion of the space which has since been satisfied elsewhere,

we continue with the original multi-let strategy similar to our

successful campaign at Brunel Building W2.

Table 6: Major developments pipeline

Property Area Capex to complete Comment

sq ft GBPm(1)

On-site projects completing H1 2022

Soho Place W1 285,000 104(2) 209,000 sq ft offices, 36,000 sq ft retail

and 40,000 sq ft theatre - 87% pre-let /

forward

sold.

The Featherstone Building EC1 125,000 23 110,000 sq ft offices, 13,000 sq ft

workspaces and 2,000 sq ft retail.

----------- ------------------ ---------------------------------------------

410,000 127

----------- ------------------ ---------------------------------------------

Forthcoming projects completing 2025

19-35 Baker Street W1 298,000(3) 271 Consented. 218,000 sq ft offices, 52,000 sq

ft residential and 28,000 sq ft retail.

----------- ------------------ ---------------------------------------------

Planning

Holden House W1 150,000 - Consented. Office and retail scheme.

Network Building W1 137,000 - Dual consent for Office scheme and Life

Science scheme. Existing floorspace 70,000

sq ft.

----------- ------------------ ---------------------------------------------

287,000 -

----------- ------------------ ---------------------------------------------

Under active appraisal

Bush House, South West Wing WC2 130,000 - Existing floorspace 103,700 sq ft.

----------- ------------------ ---------------------------------------------

Total 1,125,000 398

----------- ------------------ ---------------------------------------------

(1) As at 30 June 2021 (2) Includes remaining site acquisition

cost and profit share to Crossrail

(3) Total area - Derwent London currently has a 55% share of the

joint venture

19-35 Baker Street W1

Our next major scheme 19-35 Baker Street, which totals 298,000

sq ft, is expected to commence at the beginning of Q4 2021 when we

exercise our development option with The Portman Estate. Subject to

payment, our 55% interest in a 69-year lease will become a wholly

owned 129-year headlease on the 206,000 sq ft office element. The

ground rent is initially 2.5% rising to 6% in 29 years' time.

The development also includes 45,000 sq ft of residential for

sale at 100 George Street W1, where we are working with Native

Land, and affordable housing. The bulk of the remaining space will

be pre-sold to The Portman Estate as part consideration for the

unwinding of our previous 55:45 joint venture.

We have recently awarded the demolition contract, which was

within budget, and plan to finalise the main building contract in

H1 2022. The total capital expenditure is estimated at GBP271m and

we will draw down monies from the 'green' tranche of our revolving

credit facility. As well as joining our long-life, loose-fit high

quality portfolio the building will be our first NABERS UK

certified scheme and we are targeting BREEAM 'Excellent'. We gave

more details on the building's sustainability aspects in our Report

& Accounts 2020.

Refurbishments

Our two smaller retrofitting projects have progressed well. 6-8

Greencoat Place SW1 was completed in June and totals 32,400 sq ft

(see Table 2 for more details). Work started on the adjacent

Francis House SW1 in March and the completion of this 38,000 sq ft

project is due in H1 2022.

Network Building W1

The Group recently received two resolutions to grant consent at

the Network Building W1. We received consent for either an office

scheme or a lab-enabled project. The former totals 137,000 sq ft

and the latter will comprise 112,000 sq ft of lab-enabled space.

Both projects include 5,000 sq ft of retail. In addition, we are

providing 23 affordable homes in Tottenham Mews W1. Work will start

in H2 2022 for completion in 2025.

Bush House, South West Wing WC2

The recent acquisition of the outstanding 7-year leasehold

interest in Bush House accelerates our refurbishment ambitions for

this 103,700 sq ft building. We are working up plans for a

refurbishment and extension that could, subject to planning,

increase the lettable area to c.130,000 sq ft. If successful, we

could start this scheme in 2022.

Longer term pipeline

In the future we have other projects such as Holden House W1,

Blue Star House SW9 and The White Chapel Building E1 so that at 30

June we had a further 1.7 million sq ft (or 31% of the portfolio)

designated for future development. Our second half activity could

increase this by a further 243,200 sq ft (or 4%).

FINANCIAL REVIEW

Results for the period

Improved confidence among our occupiers and those who invest in

UK real estate has driven stronger results across most aspects of

our business compared to both H1 2020 and the last full year. In

addition, the Group's balance sheet remains lowly geared with

substantial headroom under our financial covenants and with

significant cash and available facilities. These outcomes benefit

all our stakeholders and have encouraged us to recommend a further

4.5% increase in the interim dividend payable to our

shareholders.

Derwent London's total return for the first half of 2021 was

+2.7% following a Covid-19 impacted 0.1% fall in H1 2020 and a 1.8%

decrease over the whole of 2020. EPRA net tangible assets (NTA) per

share increased by 1.4% to 3,864p from 3,812p as at 31 December

2020 and EPRA earnings per share were 54.0p for the first half of

2021, 10.5% higher than in H1 2020.

Gross rental income increased to GBP98.1m from GBP97.8m in H1

2020 after GBP9.7m of additional rent recognised on major lettings,

including GBP9.5m from 80 Charlotte Street W1 alone. This was

largely offset by additional voids which reduced rental income by

GBP4.9m, and disposals, principally the Johnson Building EC1 sold

in January 2021, where GBP4.5m less rent was recognised than in H1

2020. The acquisition of Holford Works WC1 added GBP0.2m and

Covid-related rent waivers took gross rents down by GBP0.6m

compared to H1 2020.

The first half of 2021 has also benefitted from GBP3.6m of net

surrender premiums, largely at 90 Whitfield Street W1.

Net rental income has recovered more significantly as our

occupiers have not needed the same level of support as last year,

reflected in gradually strengthening rent collection figures from

our office occupiers over the last few quarters. The overall

progress in sentiment has been reflected in the unwinding of

GBP1.6m of impairment provisions previously recognised in 2020 but

there remain a few sectors where the recovery has been slower.

Principally in relation to our retail, restaurant and leisure

occupiers, the overall net impairment charges booked in H1 2021

under IFRS 9 against trade and lease incentive receivables were

GBP1.2m. We also added GBP0.2m of service charge provisions to give

an overall first half impact estimated at GBP1.4m. This is

substantially lower than the GBP6.5m recognised in H1 2020 when

impairment charges totalled GBP3.6m, GBP0.8m of receivables were

written off and service charge waivers of GBP2.1m were provided.

Other property costs in H1 2021 totalled GBP6.6m, very similar to

the GBP6.9m in H1 2020.

As a result, net rental income was GBP90.1m in H1 2021, 6.8%

higher than the GBP84.4m in H1 2020, and net property and other

income, which includes the GBP3.6m of net surrender premiums, was

GBP95.1m, up GBP8.6m or 9.9% from H1 2020.

With more difficult letting conditions over the last year or so

and a higher vacancy rate, EPRA like-for-like gross rents fell

compared to H1 2020 by 4.5% and against H2 2020 by 3.4% but

like-for-like net rental income was 0.8% and 4.6% higher,

respectively due to the lower waivers and impairments.

Administrative expenses have increased to GBP19.4m for the half

year with a higher headcount and pay increases driving salaries up

by 9.6%. There was also a substantial rise in the amount accrued

for staff incentives, mainly a result of our higher share price.

Our EPRA cost ratio (including direct vacancy costs) has fallen

back to 25.7% from 28.9% in H1 2020 and 30.5% for the whole of 2020

but remains higher than in previous years. The overhead is impacted

by our investment in digital solutions, ESG, climate change

solutions, additional customer amenity and a growing governance and

assurance programme.

The investment property portfolio carrying value at 30 June 2021

rose slightly to GBP5.1bn after the usual adjustments for leasehold

incentives and headlease liabilities. Including owner-occupied

property (25 Savile Row W1), the assets held for sale (Angel Square

EC1, certain Baker Street properties and part of Soho Place W1) and

the trading properties, the total property portfolio was carried at

GBP5.3bn after a revaluation surplus for the half year of GBP58.8m.

Of this, GBP57.8m passes through the income statement compared to

the deficit in H1 2020 of GBP68.3m, with GBP1.0m of surplus on our

head office included in the statement of comprehensive income.

Profit from operations has accordingly recovered significantly to

GBP134.1m for the half year, against GBP2.8m in H1 2020 and a loss

of GBP49.2m for the full year 2020.

Net finance costs have increased a little to GBP14.2m from

GBP13.6m in H1 2020 mainly due to a lower level of capitalised

interest at GBP5.4m against GBP6.3m in H1 2020 and, as before, we

do not capitalise any overhead costs.

Overall, the IFRS profit before tax for the first half of 2021

was GBP121.1m with the profit for the period, after a small tax

charge, of GBP120.5m. The corresponding figures in H1 2020 were

losses of GBP14.0m and GBP13.2m, respectively.

Cash flow, net debt and financing

In order to provide support for some of our tenants in 2020, we

agreed to defer GBP11.8m of rental income under agreed payment

plans to the following year. Though this reduced our operating cash

flow in H1 2020 to GBP30.1m, it has helped boost cash from

operating activities in H1 2021 to GBP51.3m. Further cash receipts

of GBP166.5m have come from investment property disposals, chiefly

the sale of Johnson Building EC1. After capital expenditure and the

acquisition of Holford Works WC1, net cash received from investing

activities was GBP58.4m.

The cash generation seen has reduced our debt levels from an

already low base to provide a net debt figure of GBP999.7m at 30

June 2021, down from GBP1,049.1m at 31 December 2020. The Group's

loan-to-value ratio was 17.3% at 30 June 2021, the same as a year

earlier and below the 18.4% at December 2020, illustrating our

firepower for new acquisitions. It is also good to see that

interest cover has improved again to 477% or 4.8 times from 435% in

H1 2020 and 446% for the whole of 2020. For many years, this has

been one of our principal financial KPIs. Cash and undrawn

facilities have also risen to GBP527m, against GBP502m at June 2020

and GBP476m at the 2020 year end.

The next loan expiry relates to the GBP28m loan provided by HSBC

against some of our Baker Street properties and, with these

interests due to be reorganised with The Portman Estate in the next

few months, we expect to repay this loan in the second half of the

year. There has been no fresh refinancing in H1 2021 but we do

anticipate raising some new debt over the next twelve months.

As at 30 June 2021, the weighted average maturity of our

borrowings was 6.4 years (December 2020: 6.8 years) and the

interest rate payable on drawn debt was 3.44% (December 2020:

3.34%) on a cash basis and 3.58% (December 2020: 3.48%) on an IFRS

basis after adjusting for the convertible bond.

Qualifying expenditure under the Green Finance Framework

The qualifying 'green' expenditure as at 30 June 2021 for each

project is set out in the table below. The 80 Charlotte Street

scheme commenced in 2015 with Soho Place and The Featherstone

Building both starting on site in 2019.

The cumulative qualifying expenditure on Eligible Green Projects

('EGP's) at the half year was GBP489.7m, with GBP70.0m of this

being incurred in H1 2021.

Table 7: Cumulative spend on each EGP as at 30 June 2021

Project Look back spend Subsequent spend Cumulative spend

------------------------------- -----------------------

Q4 2019 2020 2021

-------------------------------

GBPm GBPm GBPm GBPm GBPm

------------------------------- -------- ------ -----------------

80 Charlotte Street W1 185.6 16.9 16.9 13.8 233.2

Soho Place W1 66.3 13.4 61.5 40.5 181.7

The Featherstone Building EC1 29.1 5.2 24.8 15.7 74.8

281.0 35.5 103.2 70.0 489.7

------

As at 30 June 2021, drawn borrowings on the GBP300m green

tranche of the Group's GBP450m revolving credit facility totalled

GBP83.0m.

The 19-35 Baker Street development, which is targeting BREEAM

excellent, will be elected as the next EGP.

Dividend

The dividend remains well covered by EPRA earnings and our

policy of a sustainable and progressive dividend is unchanged. With

these improved results, we are raising the interim dividend payable

for 2021 by 4.5% to 23.0p per share, all of which will be paid as a

Property Income Distribution on 15 October 2021 to shareholders on

the register as at 10 September 2021.

RISK MANAGEMENT AND INTERNAL CONTROLS

We have identified certain principal risks and uncertainties

that could prevent the Group from achieving its strategic

objectives and have assessed how these risks could best be

mitigated through a combination of internal controls, risk

management and the purchase of insurance cover. These risks are

reviewed and updated on a regular basis and were last formally

assessed by the Board in August 2021. The Board has confirmed that

its risk appetite and key risk indicators remain appropriate. The

Group's approach to the management and mitigation of these risks is

included in the 2020 Annual Report.

Covid-19 has had a considerable impact on the materiality of our

principal risks. As lockdown restrictions have eased, and the

economy re-opened, we expect to see a slow reversal.

As a business we have taken steps to mitigate the threat and

disruption being caused by the virus and have worked proactively

with our occupiers to assist them during this time of difficulty.

The safety and wellbeing of our employees and other key

stakeholders has been consistently at the forefront of our efforts.

Measures introduced at our buildings to reduce transmission remain

in place, including in respect to cleaning regimes, air ventilation

and social distancing in common areas.

Due to the Group's strong financial position and its proactive

response to the pandemic, the risks arising from Covid-19, and the

lockdown restrictions, have been carefully managed. The success of

the UK's vaccination programme has had a positive impact on the

number of Covid-19 cases resulting in serious illness,

hospitalisation and death. There remains a risk that variants

emerge with increased transmissibility, severity or are

vaccine-resistant.

Self-isolation requirements arising from NHS track and trace

'app' notifications, has had an impact on attendance at our

construction sites and for our occupiers. From 16 August 2021, all

adults in England who have received a second dose of a Covid-19

vaccine will be exempt from isolation if they come into contact

with a positive case, which should ease the impact of this

risk.

Beyond Covid-19, the Group has continued to make positive

progress on its Net Zero Carbon Pathway. In response to the

Department for Business, Energy & Industrial Strategy (BEIS)

the 'Future Trajectory to 2030' consultation, we have commissioned

a review of our portfolio to assess the steps we are required to

take to ensure our compliance by 2030.

The principal risks and uncertainties facing the Group for the

remaining six months of the financial year are set out on the

following pages with the potential impact and the mitigating

actions and controls in place.

Strategic risks

That the Group's business model and/or strategy does not create

the anticipated shareholder value or fails to meet investors' and

other stakeholders' expectations.

Risk, effect and progression Controls and mitigation

----------------------------------------------------------- ------------------------------------------------------------------

1. Failure to implement the Group's strategy

The Group's strategy is not met due to poor strategy * The Group's development pipeline has a degree of

implementation or a failure to respond flexibility that enables plans for individual

appropriately to internal or external factors such as: properties to be changed to reflect prevailing

* an economic downturn; economic circumstances.

* the Group's development programme being inconsistent * The Group seeks to maintain income from properties

with the current economic cycle; until development commences and has an ongoing

strategy to extend income through lease renewals and

regears.

* responding to changing work practices and

occupational demand; and/or

* The Group aims to de-risk the development programme

through pre-lets, typically during the construction

* London losing its global appeal with a consequential period.

impact on the property investment or occupational

markets.

* The Group conducts an annual strategic review,

prepares a budget and provides three two-year rolling

Although the Covid-19 pandemic did not stop the Group forecasts.

implementing its strategy, the lockdown

restrictions have marginally extended the project length

for Soho Place and The Featherstone * The Board considers the sensitivity of the Group KPIs

Building, and has caused significant economic disruption. to changes in the assumptions underlying our

Our strategy currently includes forecasts in light of anticipated economic

incorporating a retail element into our buildings to conditions. If considered necessary, modifications

provide amenity to our tenants and the are made.

local community. As Covid-19 has only amplified the

weaknesses within the retail market, this

aspect of our strategy is being reviewed. The impact of a * The Group maintains sufficient headroom in all the

potential recession on our strategy, Group's key ratios and financial covenants with a

and other longer-term consequences of the Covid-19 particular focus on interest cover.

pandemic, is being monitored by the Executive

Committee and the Board.

2. Implications of Brexit

International trade negotiations following Brexit result * Trade negotiations are being monitored and potential

in arrangements which are damaging outcomes discussed with external advisers.

to the London economy. As a London-based Group, we are

particularly impacted by factors which

affect London's growth and demand for office space. * The Group's strong financing and covenant headroom

On 2 June 2021, the UK's application to join the enables it to weather a downturn. In addition, the

Comprehensive and Progressive Trans-Pacific Group's diverse and high-quality tenant base provides

Partnership (CPTPP) was formally approved. The UK resilience against tenant default.

Government stated in its June 2020 Policy

Paper that it hopes that CPTPP membership will increase

trade and investment opportunities * Construction cost risk, with the exception of

for UK businesses and help the UK economy overcome the Government tariffs, sits with our main contractors.

economic effects of the Covid-19 pandemic. Early ordering and off-site holding facilities are in

For London, uncertainty remains until terms are agreed place for our development projects.

with the EU in respect of financial

services. The Group will continue to monitor international

trade negotiations. * The Group focuses on good value properties that are

less susceptible to reductions in tenant demand. The

Group's average 'topped-up' office rent is only

GBP58.35 per sq ft.

* Income is maintained at future development sites for

as long as possible. The Group develops properties in

locations where there is good potential for future

demand, such as near Crossrail stations. We do not

have any properties in the City.

Financial risks

Significant steps have been taken in recent years to reduce or

mitigate the Group's financial risks. The main financial risk is

that the Group becomes unable to meet its financial obligations,

which is not currently a principal risk. Financial risks can arise

from movements in the financial markets in which we operate and

inefficient management of capital resources.

Risk, effect and progression Controls and mitigation

----------------------------- ------------------------

3. Risk of tenants defaulting or tenant failure

The risk that tenants become unable to pay their rents * Detailed reviews of all prospective tenants are

and/or their businesses fail. In the performed.

current environment, this risk has increased to be

classified as a principal risk for the

Group. * A "tenants at risk" register is maintained and

Due to the economic impact of Covid-19, and its regularly reviewed by the Executive Committee and the

potential long-term implications, occupiers Board.

could be facing increased financial difficulty.

Restaurants and hospitality occupiers (who

account for approximately 9% of our portfolio income) * Rent deposits are held where considered appropriate;

are of particular concern. Covid-19 the balance at 30 June 2021 was GBP18.2m.

has only amplified the weaknesses within the retail

market and there is a strong likelihood

that retail rents and values could fall even further. * Active rent collection with regular reports to the

Our occupiers perceive the restaurant, Executive Committee.

retail and leisure aspects within our portfolio as

amenities; hence we feel it is important

that they are retained within our building offerings. * We maintain close and frequent contact with our

tenants.

4. Risks arising from changing macroeconomic factors

A. Income decline

Due to the various risk factors, including: * The Credit Committee performs detailed reviews of all

* future demand for office space; prospective tenants.

* 'grey' market vacancy in office space (i.e. tena * A "tenants at risk" register is maintained and

nt regularly reviewed by the Executive Committee and the

controlled vacant space); Board.

* weaknesses in retail and hospitality businesses; * Ongoing dialogue is held with tenants to understand

their concerns and requirements.

* depth of recession;

* The Group's strong interest cover ratio reduces the

likelihood that income decline has a significant

* increase in homeworking; and impact on our business continuity.

* rising unemployment.

There is a risk that our income could decline which

could lead to lower interest cover under

our debt facility financial covenants. This could also

have an adverse impact upon the property

valuation and future dividend payments. In addition,

depending on how prolonged the adverse

impacts of Covid-19 are on businesses, and how our

occupiers fare during this period, we could

face additional risk of impairment of receivable

balances.

In light of Covid-19, we have been monitoring the

economic outlook, vacancy rates, financial

health of our tenants and the condition of the wider

property market.

B. The potential impact on our business from the

introduction of a new tax to replace or complement * The Executive Committee and Board monitor

business rates macroeconomic factors, including interest rates and

Due to the ongoing weakness of physical retail tax policy.

trading, the cost of supporting the economy

during Covid-19 and the loss of tax revenues, the

government has been reported as considering * The Group has an experienced Head of Tax who advises

measures to increase tax revenues. The government has the Board on the implications of tax policy.

been seeking views on how the business

rates system currently works, issues to be addressed,

ideas for change and a number of alternative

means of taxing non-residential property to either

replace or complement the business rates

system. Derwent London is particularly mindful of

alternatives being discussed which could

impose a tax on the landowner rather than the tenant.

In this respect, Derwent London will

keep abreast of any new developments in this area and

consider the impact of the various proposals

once more detail is published.

Since the publication of our 2020 Annual Report, the

economy has strengthened and has proven

robust. The likelihood of a new tax being introduced

to replace or complement business rates,

which would negatively impact on landlord, is now

deemed less likely.

Operational risks

The Group suffers either a financial loss or adverse

consequences due to processes being inadequate or not operating

correctly, human factors or other external events.

Risk, effect and progression Controls and mitigation

----------------------------- ------------------------

5. Risks arising from our development activities

A. Reduced development returns

The Group's development projects do not produce * Detailed reviews are performed on construction

the targeted financial returns due to one projects to ensure that programme forecasts predicted

or more of the following factors: by our contractors are aligned with our views.

* delay on site

* The procurement process used by the Group includes

* increased construction costs the use of highly regarded firms of quantity

surveyors and is designed to minimise uncertainty

regarding costs.

* adverse letting conditions

* Development costs are benchmarked to ensure that the

* labour storages Group obtains competitive pricing and, where

appropriate, fixed price contracts are negotiated.

Due to restrictions introduced to prevent the

spread of Covid-19, our on-site developments * Post-completion reviews are carried out for all major

have been subject to delays of between one to developments to ensure that improvements to the

three months. During 2020, our Development team Group's procedures are identified, implemented and

liaised and agreed with our principal lessons learned.

contractors in respect to Covid-19-related

liabilities

and cost sharing. * The Group's pre-letting strategy reduces or removes

the letting risk of the development as soon as

possible.

* Procedures carried out before starting work on site,

such as site investigations, historical research of

the property and surveys conducted as part of the

planning application, reduce the risk of unidentified

issues causing delays once on site.

* Investment appraisals, which include contingencies

and inflationary cost increases, are prepared and

sensitivity analysis is undertaken to judge whether

an adequate return is made in all likely

circumstances.

B. 'On-site' risk

Risk of project delays and/or cost overruns * Strict Covid-19 protocols at all of our on-site

caused by unidentified issues e.g. asbestos in developments, in accordance with Site Operating

refurbishments or ground conditions in Procedures (published by the Construction Leadership

developments. For example, our successful Council).

pre-letting

programme means we could face a loss of rental

income and penalties if projects are delayed. * Regular monitoring of our contractors' cash flows.

Due to restrictions introduced to prevent the

spread of Covid-19, our on-site developments

have been subject to minor delays. The * Frequent meetings with key contractors and

Featherstone Building and Soho Place are still subcontractors to review their work programme.

expected

to be completed within their original budgets

under the revised programme. * Off-site inspection of key components to ensure they

Despite strict Covid-19 protocols on-site, there have been completed to the requisite quality.

is a risk of labour and resource shortages,

which could lead to productivity disruption and

project delay. * Prior to construction beginning on site, we conduct

site investigations including the building's history

and various surveys to identify any potential issues.

* Monthly reviews of supply chain issues for each of

our major projects, including in respect to potential

labour shortages.

C. Contractor/subcontractor default

Returns from the Group's developments are reduced * Regular monitoring of our contractors, including

due to delays and cost increases caused their project cash flows, is carried out.

by either a main contractor or major

subcontractor defaulting during the project.

There have * Key construction packages are acquired early in the

been ongoing issues within the construction project's life to reduce the risks associated with

industry in respect of the level of risk and later default.

narrow

profit margins being accepted by contractors. We

regularly monitor our contractors for any * The financial standing of our main contractors is

trading concerns. reviewed prior to awarding the project contract.

There is an increased risk of insolvencies in the

construction industry when the government's

Covid-19 furlough scheme ceases. Due to this * Our main contractors are responsible, and assume the

risk, we have been actively monitoring the immediate risk, for subcontractor default.

financial

health of our main contractors and

subcontractors. * Payments to contractors to incentivise them to

achieve agreed project timescale and damages agreed

in the event of delays/cost overruns.

* Regular on-site supervision by a dedicated Project

Manager who monitors contractor performance and

identifies problems at an early stage, thereby

enabling remedial action to be taken.

* We use known contractors with whom we have

established long-term working relationships.

* Contractors are paid promptly and are encouraged to

pay subcontractors promptly.

6. Risk of business interruption

A. Cyber-attack on our IT systems

The Group is subject to a cyber-attack that * The Group's Business Continuity Plan is regularly

results in it being unable to use its IT systems reviewed and tested.

and/or losing data. This could lead to an

increase in costs whilst a significant diversion

of management time would have a wider impact. * Independent internal and external 'penetration' tests

Considerable time has been spent assessing cyber are regularly conducted to assess the effectiveness

risk and strengthening our controls and of the Group's security.

procedures.

Over the past 12 months, there has been an

increase in cyber-attacks being perpetrated * Multi-Factor Authentication exists for remote access

online to our systems.

as cyber criminals seek to exploit Covid-19. In

response, we identified the key IT risks arising

from home working and implemented additional * Incident response and remediation processes are in

controls. place, which are regularly reviewed and tested.

* The Group's data is regularly backed up and

replicated off-site.

* Our IT systems are protected by anti-virus software,

security anomaly detection and firewalls that are

frequently updated.

* Frequent staff awareness and training programmes.

* Security measures are regularly reviewed by the IT

department.

* The Group has been awarded the 'Cyber Essentials'

badge to demonstrate our commitment to cyber

security.

B. Cyber-attack on our buildings

The Group is subject to a cyber-attack that * Each building has incident management procedures

results in data breaches or significant which are regularly reviewed and tested.

disruption

to IT-enabled tenant services. Buildings are

becoming 'smarter', with an increase in internet * Physical segregation between the building's core IT

enabled devices broadening the cyber security infrastructure and tenants' corporate IT networks.

threat landscape.

The potential impact of a cyber-attack on our

buildings has reduced due to the winding down * Physical segregation of IT infrastructure between

of services and overall low occupancy caused by buildings across the portfolio.

Covid-19. However, the potential risk of this

occurring has subsequently increased due to low

occupancy levels which could provide an * Inclusion of Building Managers in any cyber security

opportunity awareness training and phishing simulations.

for attack. During the lockdown, 24/7 security

was provided by outsourced providers.

C. Significant business interruption (for

example, pandemic, terrorism-related event or * The Group has comprehensive business continuity and

other incident management procedures both at Group level

business interruption) and for each of our managed buildings which are

The risk that a pandemic, terrorism-related event regularly reviewed and tested.

or other business interruption causes significant

business interruption to the Group and/or its

occupiers or supply chain. This could result * Government health guidelines are maintained at all of

in issues such as inability to access or operate our construction sites.

our properties, tenant failures or reduced

rental income, share price volatility, loss of

key suppliers, etc. * Most of our employees are capable of working remotely

Covid-19 has caused significant business and have the necessary IT resources.

interruption for some of our occupiers,

particularly

retail, travel, restaurants or other leisure * Fire protection and access/security procedures are in

services. During 2021, there has been limited place at all of our managed properties.

business interruption for Derwent London;

however, the lockdowns has caused a delay to our

development activities. * Comprehensive property damage and business

interruption insurance which includes terrorism.

* At least annually, a fire risk assessment and health

and safety inspection are performed for each property

in our managed portfolio.

* Robust security at our buildings, including CCTV and

access controls.

7. Reputational damage

The Group's reputation is damaged, for example * Close involvement of senior management in day-to-day

through unauthorised and/or inaccurate media operations and established procedures for approving

coverage or failure to comply with relevant all external announcements.

legislation. We have invested significantly in

developing a well-regarded and respected brand.

Our strong culture, low overall risk tolerance * All new members of staff benefit from an induction

and established procedures and policies mitigate programme and are issued with our Group staff

against the risk of internal wrongdoing. handbook.

How the Group responds to, and manages, the

Covid-19 pandemic could either enhance or damage

our reputation. Feedback on how we have * The Group employs a Head of Investor and Corporate

responded, particularly in respect to our Communications and retains services of an external PR

occupiers, agency, both of whom maintain regular contact with

suppliers, employees and Community Fund, has external media sources.

generally been positive.

* A Group whistleblowing system for staff is maintained

to report wrongdoing anonymously.

* Social media channels are monitored.

* Ongoing engagement with local communities in areas

where the Group operates.

* Staff training and awareness programmes.

8. Our resilience to climate change

The Group fails to respond appropriately, and * The Board and Executive Committee receive regular

sufficiently, to climate change risks or fails updates and presentations on environmental and

to benefit from the potential opportunities. This sustainability performance and management matters as

could lead to damage to our reputation, well as progress against our pathway to becoming net

loss of income and/or property values and loss of zero carbon by 2030.

our licence to operate.

Overall, the climate change agenda continues to

increase in prominence and importance. The * The Sustainability Committee monitors our performance

Government continues to introduce more and management controls.

legislative aspects linked to climate risk e.g.

from

2022 certain listed entities will have to * Strong team led by an experienced Head of

disclose in line with the TCFD. The latest energy Sustainability.

white paper is setting out higher standards for

energy efficiency in commercial and residential

properties. This will mean a shift in our core * The Group monitors its ESG (environmental, social and

market/area of business. governance) reporting against various industry

benchmarks.

* Production of an annual Responsibility Report with

key data and performance points which are externally

assured.

* In 2017 we adopted independently verified

science-based carbon targets which have been approved

by the Science-Based Targets Initiative (SBTi).

9. Non-compliance with regulation

A. Non-compliance with health and safety

legislation * All our properties have the relevant health, safety

The Group's cost base is increased, and and fire management procedures in place which are

management time is diverted through an incident reviewed annually.

or

breach of health, safety and fire legislation

leading to reputational damage and/or loss of * The Group has a qualified Health and Safety team

our licence to operate. whose performance is monitored and managed by the

During 2021, the health and wellbeing of our Health and Safety Committee.

employees, occupiers and other stakeholders has

been a top priority. We have invested additional

resources into health and safety. * Health and safety statutory compliance within our

managed portfolio is managed and monitored using

RiskWise, a software compliance platform. This is

supported by annual property health checks.

* The Managed Portfolio Health and Safety Manager with

the support of internal and external stakeholders

supports our Portfolio and Building Managers to

ensure statutory compliance.

* The Construction Health and Safety Manager, with the

support of internal and external stakeholders,

ensures our CDM Client duties are executed and

monitored and reviews health, safety and welfare on

each construction site on a monthly basis.

* The Board and Executive Committee receive frequent

updates and presentations on key health and safety

matters.

B. Other regulatory non-compliance

The Group's cost base is increased and management * The Board and Risk Committee receive regular reports

time is diverted through a breach of any prepared by the Group's legal advisers identifying

of the legislation that forms the regulatory upcoming legislative/regulatory changes. External

framework within which the Group operates. This advice is taken on any new legislation.

could lead to damage to our reputation and/or

loss of our licence to operate.

During 2021, we followed the UK government's * Staff training and awareness programmes.

regulations in respect of social distancing and

safe working practices. In accordance with

disclosure requirements, we ensured our * Group policies and procedures dealing with all key

stakeholders legislation are available on the Group's intranet.

and the wider investment market were kept

appraised of Derwent London's response to

Covid-19 * A Group whistleblowing system for staff is maintained