TIDMDLN

RNS Number : 4407Y

Derwent London PLC

01 March 2012

1 March 2012

Derwent London plc ("Derwent London" / "the Group")

Results for the year ended 31 December 2011

DERWENT LONDON ANNOUNCES STRONG 2011 RESULTS

Derwent London, the largest real estate investment trust (REIT)

focused on the central London commercial market, announces results

for the year ended 31 December 2011.

HIGHLIGHTS

Continued strong performance in 2011

Financial strength and flexibility retained

-- GBP600m debt facilities refinanced including the issue of a GBP175m 2.75% convertible bond

-- Undrawn bank facilities totalled GBP469m (2010: GBP245m)

-- Loan to value ratio reduced to 32.0% (31 December 2010: 35.7%)

Further significant dividend growth

-- Final dividend increased to 21.90p giving a total of 31.35p, up 8.1% on 2010

Robust demand for our distinctive brand of high quality,

mid-market office space

-- 100 lettings in 2011 totalling 495,700 sq ft (46,050m(2)) at GBP16.7m pa (2010: GBP8.0m)

-- Vacancy rate at 31 December 2011 was 1.3% (31 December 2010: 5.9%)

-- New lettings signed in 2012 include a pre-let to Burberry at

1 Page Street SW1 (127,000 sq ft /11,800m(2))

Further investment in the portfolio

-- Planning permissions secured to create a total of 0.9 million

sq ft (83,600m(2)), a 68% uplift on existing floorspace

-- Seven schemes on site or planned to commence in 2012

totalling over 500,000 sq ft (46,500m(2)) incurring total capital

expenditure of GBP137m

-- Joint venture with Grosvenor announced today at 1-5 Grosvenor

Place SW1 with a view to redevelopment. Grosvenor have granted a

new 150-year lease to replace the Group's existing leases and paid

GBP60m to the Group in return for 50% ownership

-- Headlease at 40 Chancery Lane regeared in 2012, unlocking a

100,000 sq ft (9,300m(2)) development

-- Riverwalk House and nearby property sold, subject to planning permission, for GBP77.3m

Robert Rayne, Chairman, commented:

"Derwent London has proven again that the strategy of focusing

on mid-market central London property is successful. We have

increased and extended our debt facilities to provide us with the

firepower and flexibility to exploit the opportunities open to us.

We are confident that the Group is well positioned to deliver good

returns both in the tough environment we currently face, and when

more sustained economic growth appears."

John Burns, Chief Executive Officer, commented:

"2011 has been another strong year for Derwent London. The

robust leasing activity we experienced in the first half of the

year has continued throughout 2011 and into 2012 and we are

confident that the quality and distinctive space in our portfolio

will continue to attract a diverse mix of tenants.

"We have made significant progress in unlocking the potential

value at a number of our projects, and look forward to advancing

our exciting pipeline. The positive regenerative impact of

Crossrail is increasingly apparent in our villages close to

Tottenham Court Road and Farringdon."

For further information, please contact:

Derwent London Tel: 020 7659 3000

John Burns, Chief Executive Officer

Damian Wisniewski, Finance Director

Louise Rich, Head of Investor Relations

Brunswick Group LLP Tel: 020 7404 5959

Kate Holgate / Elizabeth Adams

There will be a webcast of the results at 9:30am today which can

be accessed at www.derwentlondon.com

CHAIRMAN'S STATEMENT

Overview

Derwent London recorded another strong performance in 2011,

seeing good progress across a range of projects, whilst maximising

flexibility and mitigating key risks. Our business model has again

proved robust in turbulent markets, with the core central London

office market holding up well. We have seen lower than average

supply and continued strong demand both from tenants and a wide

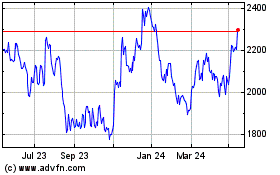

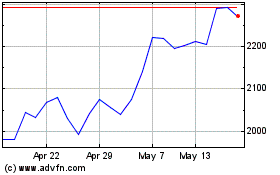

variety of domestic and overseas investors. EPRA net asset value

per share increased by 15.4% to 1,701p from 1,474p at 31 December

2010 and the portfolio generated a revaluation surplus of GBP172.1m

(2010: GBP301.7m).

In a period in which asset management has become ever more

important, 2011 was a record year for lettings at the Group. This

activity produced total rental income of GBP16.7m pa on floorspace

of 495,700 sq ft (46,050m(2)). This surpassed our 2010 performance,

when the lettings totalled GBP8.0m pa. These transactions reduced

the Group's space immediately available for occupation to 1.3% by

estimated rental value, down from 5.9% at the start of the year.

There are a number of projects currently on site which, when

completed, will increase this percentage. However taking account of

pre-lets, including Burberry's expansion into 1 Page Street SW1,

and the continuing receipt of rental income from the Buckley

Building (previously Woodbridge House) EC1, these schemes have been

considerably derisked.

The year was also an important one for the Group in securing

planning permissions at a number of properties which add to our

store of future opportunities. In 2011 we received planning

permission to create a total of 0.9m sq ft (83,600m(2)), an uplift

on the existing floorspace at these properties of 68%. Amongst

these consents, in our core Fitzrovia Estate, 80 Charlotte Street

W1 will provide 367,000 sq ft (34,100m(2)) of development, a

further step in the wider regeneration of the area. The City Road

Estate EC1 scheme also received planning permission during the

year. This 289,000 sq ft (26,800m(2)) office-led development is

located at Old Street roundabout, in the centre of the area

promoted by the Government as 'Tech City'. It will be developed

using our 'White Collar Factory' principles though we would require

a pre-let of a substantial portion before proceeding with this

scheme.

The development of Crossrail will have a significant beneficial

impact on central London, and we intend to take full advantage of

this with projects planned around both the Tottenham Court Road and

Farringdon interchanges. Towards the end of 2011, in collaboration

with Crossrail, we submitted a planning application for major

regeneration at 1 Oxford Street W1. The 275,000 sq ft (25,500m(2))

proposed scheme would be built above the Tottenham Court Road

Crossrail and London Underground station. We have the option to

repurchase this site upon completion of the Crossrail works, around

2017. It is hoped to receive a planning decision shortly.

During the year we also made material progress on our proposed

schemes in the Farringdon area, with Turnmill at 63 Clerkenwell

Road EC1 and the Buckley Building on Clerkenwell Green EC1 both

receiving planning consent. Turnmill is a 70,000 sq ft (6,500m(2))

new-build office development which will occupy a major corner site

close to the Farringdon Crossrail interchange. The development is

expected to start later in 2012. At the nearby Buckley Building we

are now on site, enlarging the existing property to 85,000 sq ft

(7,900m(2)) with works due to complete later this year.

In October 2011, we signed a Memorandum of Understanding with

Grosvenor, our freeholder at 1-5 Grosvenor Place SW1, to consider

redevelopment of the site. We are now pleased to confirm that we

have progressed this relationship into a formal joint venture. The

Group has restructured its headleases into a new 150-year term and

sold 50% of this interest to Grosvenor for GBP60m. The existing

buildings occupy an underutilised flagship site of 1.5 acres (0.6

hectare), at Hyde Park Corner. The transaction offers a unique

opportunity to undertake a substantial mixed-use redevelopment in

such a prominent location. Whilst we progress redevelopment plans,

we are maintaining income through short-term, flexible

lettings.

At 40 Chancery Lane WC2 we have undertaken similar active asset

management. In early 2012 we exchanged conditional contracts with

our freeholder to restructure and extend our interests here into a

new 128-year lease. This has unlocked a redevelopment opportunity

which is due to start in the second half of 2012. It will provide a

new 100,000 sq ft (9,300m(2)) six-storey office building which we

expect to complete by the end of 2014.

Towards the end of 2011, we submitted a planning application for

the redevelopment of Riverwalk House on Millbank SW1. In contrast

to the commercial developments above, this application is for a

148,000 sq ft (13,700m(2)) high-specification residential

redevelopment. We have exchanged contracts to sell this and another

nearby property for GBP77.3m to Ronson Capital Partners, with

completion conditional on receipt of planning permission. This

transaction will provide the Group with valuable experience of a

major residential scheme and a continued interest by way of a

profit overage.

Following the Government's recent decision to proceed with the

HS2 rail link, the Board has given careful consideration to our

proposed 265,000 sq ft (24,600m(2)) office and residential

development at Hampstead Road NW1. The property is now expected to

be compulsorily purchased as part of the construction of HS2.

Despite having reached advanced negotiations on major pre-lets on

this project, in view of the uncertainty as to the future of the

site and the considerable investment needed to complete the

project, we have decided to defer redevelopment. 'Light touch'

refurbishment options are now being considered that will enable us

to let the space on flexible terms and we will keep the situation

under review as the Government's plans progress.

The process of recycling the portfolio continues, disposing of

properties where this appears an attractive option. In 2011 we sold

GBP132.5m of mature and smaller assets, giving rise to a surplus on

disposal of GBP36.1m. Where opportunities arose, we also made

acquisitions, totalling GBP87.5m, either near existing holdings,

such as 1 Page Street SW1, or where we could buy or lengthen

headleases such as at the Network Building W1 and Morelands

Buildings EC1. These purchases give us greater control over the

future of these properties.

Despite a difficult period for UK and European banks when their

cost of funds has been under renewed pressure and access to capital

has been constrained, our covenant remains in demand and we

continue to receive very good support from the banking sector.

Including the issue of a GBP175m unsecured convertible bond in June

2011 we signed up a total of GBP600m of new or extended facilities

in 2011. As well as deferring any bank refinancing risk until 2014,

we have diversified our sources of finance and anticipate that an

increasing proportion of our future debt requirements is likely to

come from non-bank sources.

The Group's performance would not be possible without a highly

committed and experienced team. It was gratifying that this was

recognised when Derwent London was ranked fifth overall among UK

companies in Management Today's 'Britain's Most Admired Companies'

Award, and first in the property sector for the second consecutive

year. In addition, the Angel Building was shortlisted for the

prestigious RIBA Stirling Prize as well as being awarded a number

of other accolades, endorsing the strength of our design

philosophy. Further recognition of the quality of our business came

when we were recently awarded the Estates Gazette 'Property Company

of the Year - Offices'.

Results

The portfolio performed well through the whole of 2011,

increasing in underlying value by 7.6% to GBP2.6bn and driving the

Group's EPRA net asset value to 1,701p per share compared with

1,474p a year earlier and 1,621p at June 2011. This 15.4% increase

over the year was led by the GBP172.1m revaluation movement which

came mainly from rental growth while the GBP301.7m surplus in 2010

also benefited from yield compression.

With strong lettings and new income from properties acquired,

gross property income increased to GBP125.5m from GBP119.4m in 2010

but EPRA earnings per share fell slightly from 52.89p to 51.59p due

mainly to higher finance and administration costs. Profits on

disposals of investment properties, which are not included in the

EPRA earnings, totalled GBP36.1m in 2011 against GBP0.9m in

2010.

The Board continues to pursue a progressive dividend policy and

is proposing an increase in the final dividend of 8.1% to 21.9p per

share to be paid on 15 June 2012 to shareholders on the register at

18 May 2012. Of this amount, 18.10p will be paid as a PID under the

UK REIT regime and there will be a scrip alternative. The total

dividend for the year is therefore 31.35p, an increase of 8.1% on

that in 2010 and a level which remains well covered by recurring

earnings.

Property disposals during 2011 almost matched the combined

investment in new acquisitions and capital expenditure and, with

the valuation increase noted above, this has contributed to another

fall in gearing. The Group's loan to value ratio at 31 December

2011 was 32.0% against 35.7% in December 2010 and undrawn and

available bank facilities totalled GBP469m at December 2011, a

substantial increase over the equivalent figure at December 2010 of

GBP245m. In addition, there was GBP589m of uncharged property at

December 2011 compared with GBP484m at the previous year end.

The Board

As previously announced, Donald Newell stepped down from his

position as non-executive Director at the conclusion of the Annual

General Meeting in May 2011. Don joined the Company when it merged

with London Merchant Securities, where he had been on the Board

since 1998. Again I would like to thank him for his valuable

contribution and sound counsel throughout this period.

Outlook

Whilst we believe that low GDP growth and a paucity of finance

will continue to act as headwinds to the UK economy, including to

the real estate market, we consider Derwent London to be strongly

placed. The London economy continues to show resilience and our

focus on mid-market rentals accords with the somewhat straitened

times in which we currently live. We have, and continue to attract,

a diverse tenant mix, with an emphasis on companies from the

Technology, Media and Telecoms sectors.

Despite the difficult state of the economy, we are encouraged by

the continuing strength of our letting activity. We are on site or

due to commence major capital projects covering over 500,000 sq ft

(46,500m(2)) in 2012 which will involve total capital expenditure

of about GBP137m. We have either pre-let commitments, or continuing

rental income, over almost 50% of these projects.

In the near term, the London economy should receive a boost in

2012 with the Queen's Diamond Jubilee celebrations, the Olympics

and the Paralympics and, in the medium term, our central London

'villages' will greatly benefit from the progress of Crossrail.

We have a vibrant portfolio that is attractive to tenants, a

strong pipeline of development opportunities and a very sound

financial base. As a result we have capacity for further

substantial investment in both new acquisitions and development

expenditure, and we continually assess opportunities, whilst

retaining flexibility over the timing of such commitments. We

believe the Group is well positioned to deliver good returns both

in the tough environment we currently face, and when more sustained

economic growth appears.

R.A. Rayne

1 March 2012

BUSINESS REVIEW

OUR PORTFOLIO

Derwent London provides high quality, innovative contemporary

office space, priced at mid-market rents. We own and manage a 5.4

million sq ft (501,400m(2)) portfolio that was valued at GBP2.6bn

as at 31 December 2011. Of our portfolio, 77% is in the West End,

the main focus of our operations, in villages such as Fitzrovia,

Victoria, Belgravia and Marylebone. The City borders account for

19% and include villages such as Old Street, Clerkenwell, Holborn

and Shoreditch and the remaining 4% is in Scotland, on the northern

outskirts of Glasgow. With over half of the portfolio still to be

worked, we have a wealth of value-creating opportunities in the

portfolio that can be crystallised through asset management or

regeneration. With some major planning approvals in 2011, we have

added to these opportunities.

The portfolio consists of 122 buildings and has over 600 tenants

covering a range of business sectors. Media, TV, marketing and

advertising tenants account for 29% of our net rental income whilst

professional and business services tenants comprise 28% and 13% of

our income is from retail sales outlets.

Our portfolio's annualised net contracted rental income at the

year end was GBP113.1m, compared to an estimated rental value of

GBP160.4m, therefore offering strong reversionary potential. With

passing rent of GBP25.79 per sq ft (GBP277.60 per m(2) ) on our

central London office portfolio, rising to GBP31.10 per sq ft

(GBP334.80 per m(2) ) once 'topped up' for the expiry of rent free

periods and other rental incentives, average rents remain low.

OUR MARKET

See appendix 1

http://www.rns-pdf.londonstockexchange.com/rns/4407Y_-2012-2-29.pdf

Overview

The UK economy grew by an estimated 0.9% in 2011, a weaker level

than anticipated a year ago, with growth of 0.6% in the third

quarter and contraction of 0.2% in the final quarter. UK base rates

stayed at their historic low of 0.5% during the year whilst

unemployment continued to rise and RPI inflation stayed at 5% or

above for every month of 2011 with the exception of December.

Against this backdrop, and with the Government's austerity

measures starting to impact the economy, the outlook for 2012

remains fragile. In addition, the sovereign debt issues in many

parts of the Eurozone add to the economic and political uncertainty

further subduing business sentiment and putting additional pressure

on the cost of borrowing. The Bank of England is predicting that

inflation will fall in 2012 and is hopeful that the further

quantitative easing will help to stimulate the economy. Most

commentators expect interest rates to remain unchanged throughout

2012 whilst the International Monetary Fund in January 2012

predicted that UK GDP growth for the year will be constrained at

around 0.6% before rising to 2% in 2013. With this background,

financial and business services employment in central London is

expected to rise by 1.2% in 2012 before accelerating to 3.7% in

2013 according to Oxford Economics.

London, where 96% of Derwent London's portfolio is located, is a

major centre for international business and commerce and generates

approximately 20% of UK economic output. Its economy is

predominantly service-based and was one of the strongest performing

UK regions in the year. Despite London's significant exposure to

the financial services sector and to Europe, the capital has

remained resilient and continues to attract national and

international occupiers and inward investment.

The year ahead will be a memorable one for London as it hosts

the Olympic and Paralympic Games in the summer and it will play a

major role in the celebrations surrounding the Queen's Diamond

Jubilee. These events are expected to boost sentiment and economic

activity and further enhance London's international profile.

Central London office occupier market

Central London has an office stock of approximately 218 million

sq ft (20.3 million m(2)), making the capital a significant office

centre in both a European and global context. By sub-area, 50% of

London's office stock is in the City, 41% in the West End and 9% in

Docklands. Derwent London focuses on the West End and its surrounds

and tailors its space to the more diverse occupier base here that

mainly comprises companies from the media and professional and

business services sectors. The City and Docklands are very much

dominated by financial and legal occupiers.

As published by surveyors CBRE, central London office take-up

for 2011 was 10.3 million sq ft (0.96 million m(2)). This was lower

than the 14.6 million sq ft (1.36 million m(2)) recorded in 2010

and approximately 10% below the 10-year average. Relative to trend,

and underlining the resilience of our chosen operating market, the

West End was the strongest performing sub-area with annual take-up

of 4.4 million sq ft (409,000m(2)). This was 6% above the 10-year

average and 8% below the 2010 level. The Technology, Media and

Telecommunications (TMT) sectors were particularly active in 2011

and accounted for 24% of West End take-up.

With the lowest level of completed developments since the early

1990s at 1.7 million sq ft (158,000m(2)), the CBRE central London

vacancy rate by floorspace remained stable over the year, and below

the 10-year average. This rate started the year at 5.5%, declined

to 4.9% at the half year and finished at 5.2%. With few development

completions, the West End's vacancy rate was even lower, commencing

the year at 5.2%, falling to 3.8% at the half year before rising to

4.3% at the year end.

With the differing levels of supply and demand across the

central London office sub-areas, the CBRE prime rent index showed

West End rents increasing by 4.8% in 2011 compared to a 0.6% rise

in the City.

Central London investment market

Central London investment volumes, according to CBRE, totalled

GBP8.4bn in 2011, down 14% on 2010 and 17% below the 10-year

average. In the West End, annual transactions totalled GBP3.2bn

with overseas investors accounting for 57% of the total. Over the

year, prime yields in the West End remained at 4.0%, unchanged

since mid 2010 and 150 basis points lower than their maximum during

the downturn in 2009. City prime yields compressed by 35 basis

points over the year and finished at 5.0%.

VALUATION

See appendix 2

http://www.rns-pdf.londonstockexchange.com/rns/4407Y_1-2012-2-29.pdf

In 2011, London continued to be investors' UK location of choice

with strong domestic and international demand. This appetite, in a

market with a scarcity of properties for sale coupled with rental

growth performance, enabled London's commercial property values to

outperform the rest of the UK again.

In the first half of 2011, the investment market saw a marginal

tightening of valuation yields and an improving rental growth

trend. However, with the increased economic uncertainty in the

Eurozone in the second half, sentiment was moderated and this

stabilised yields and limited rental growth.

Within this environment, the Group's investment portfolio was

valued at GBP2.6bn at 31 December 2011. The valuation surplus was

GBP181.7m for the year, before lease incentive adjustments of

GBP9.6m, giving a total movement of GBP172.1m. This valuation

movement was below the GBP301.7m in 2010, a year when yield

compression across the portfolio was more widespread.

The underlying valuation increase over the year was 7.6%, or

8.8% if property sales completed during the year had been retained

and valued at their disposal level. Both were an outperformance

against our comparative benchmark measures, the IPD Capital Growth

Index for Central London Offices at 7.3%, and the IPD All UK

Property Index at 1.7%. Valuation performance was stronger in the

first half of the year with a 4.6% increase, slowing to 2.9% in the

second half as the rate of rental growth eased.

Our London portfolio saw underlying capital values grow by 7.9%

over the year. Within this, West End properties increased by 8.1%

and City border properties rose by 7.1%. The remaining 4% of the

portfolio, our Scottish assets, increased by 1.5% over the

year.

Our projects that are currently on site and encompass the entire

building, namely 1 Page Street, Buckley Building and 4 & 10

Pentonville Road, were valued at GBP96.2m as at December 2011. This

reflects a valuation uplift of 4.8% over their value on 31 December

2010 or date of purchase, if later. These projects are at a

relatively early stage of development and offer the potential for

material valuation uplift in the future.

As shown by our buoyant 2011 letting activity, good tenant

demand moved rents forward and this growth was the principal driver

in valuation performance. Over the year, the underlying estimated

rental value increased by 6.3% (2010: 5.4%). Rental growth in the

first half of the year was 4.1% before moderating to 2.1% in the

second half as economic uncertainty increased.

On an EPRA basis, the portfolio's net initial yield was 4.4%

which would rise to 5.2% on a 'topped-up' basis following the

expiry of rent-free periods and contracted rental uplifts. The net

reversionary yield was 5.8%.

The portfolio's true equivalent yield at 31 December 2011 was

5.61% against 5.65% at the half year and 5.77% at the end of 2010,

reflecting the general yield stabilisation seen across the

investment market, whereas there was a 67 basis point yield

compression in 2010. On a total property return basis, the

portfolio delivered 13.4% in 2011 compared to 21.3% in 2010. The

IPD Total Return Index was 12.5% for Central London Offices and

7.8% for All UK Property.

PORTFOLIO MANAGEMENT

See appendix 3

http://www.rns-pdf.londonstockexchange.com/rns/4407Y_2-2012-2-29.pdf

Overview

Active asset management is a cornerstone of the business and we

made significant achievements in a number of areas during 2011.

Letting activity was strong with a high volume of transactions at

above estimated rental values whilst voids were kept to a minimum.

We saw excellent tenant retention and rent collection remained

prompt. Rent reviews and lease renewals captured portfolio

reversion.

Letting activity

Our well-designed, mid-priced offices continued to prove popular

and 2011 was another exceptional period of leasing activity. In

total, we concluded 100 lettings on a floorspace of 495,700 sq ft

(46,050m(2)) and a rental income of GBP16.7m pa, the highest ever

level achieved by the Group. In 2010, we concluded a similar number

of lettings but at GBP8.0m pa on a floorspace of 347,000 sq ft

(32,200m(2)).

Lettings comprised GBP8.5m pa in the first half of the year and

GBP8.2m pa in the second half. Two thirds of the lettings were 'new

income' as the floorspace concerned was producing a total rent of

GBP5.3m pa at the start of 2011.

Open market transactions for the year accounted for 88% of the

activity and achieved rents 11.2% higher than their December 2010

estimated rental values. The uplift was 8.9% for overall lettings,

which include short-term transactions at our future development

projects. In the second half of the year, open market transactions

were 5.9% above June 2011 estimated rental values whilst overall

transactions were 4.6% above.

Lettings during the year included:

-- Angel Building, 407 St John Street EC1 - this award-winning

263,000 sq ft (24,400m(2)) regeneration project, which completed in

September 2010, became fully let in November 2011 following seven

lettings during the year totalling GBP5.5m pa on 136,500 sq ft

(12,680m(2)). Expedia, the world's largest online travel company,

took 93,400 sq ft (8,680m(2)) of office space at GBP3.8m pa whilst

Sage Pay and NG Bailey took 29,800 sq ft (2,770m(2)) at GBP1.2m pa.

The retail units, totalling 13,300 sq ft (1,230m(2)), attracted

well known names - Jamie's Italian, Busaba Eathai and Hummingbird

Bakery - at a total rent of GBP0.5m pa. During the year the Angel

Building was shortlisted for the RIBA Stirling Prize and won

numerous accolades including RIBA London, the British Council for

Offices and the British Construction Industry awards.

-- 88 Rosebery Avenue EC1 - 49,000 sq ft (4,550m(2)) of offices

were pre-let to City University at GBP1.2m pa at this refurbishment

which involved just under half of the building.

-- 1-5 Grosvenor Place SW1 - whilst we progress the development

plans here, through the recent headlease regear (see 'Activity in

2012'), we continue to optimise income through shorter term

lettings. Nine transactions were concluded in 2011 at a rent of

GBP1.2m pa, covering 26,600 sq ft (2,470m(2)), which was 4.8% above

December 2010 estimated rental values.

-- Tea Building, Shoreditch High Street E1 - nine office

lettings were concluded at this landmark property totalling GBP1.2m

pa, 31% ahead of December 2010 estimated rental values, on a

floorspace of 41,000 sq ft (3,810m(2)). With the ever improving

micro market in the area and our recent environmentally-friendly

'Green Tea' fit out of several units, rents achieved during the

year averaged GBP29 per sq ft (GBP310 per m(2)) with an all-time

high for the building of GBP32.50 per sq ft (GBP350 per m(2)) in

the third quarter. With a total rental income of GBP4.5m pa and an

estimated rental value of GBP6.2m pa, the building remains highly

reversionary. At the year end, this 250,400 sq ft (23,260m(2))

building had an occupancy rate of 97% with the balance of space

under offer.

-- Johnson Building, 77 Hatton Garden EC1 - 22,300 sq ft

(2,070m(2)) was let to Lastminute.com at GBP0.95m pa equating to

GBP42.50 per sq ft (GBP455 per m(2)) and the highest level achieved

in this building.

Through asset management initiatives during the year, we

captured further reversion within the portfolio and concluded 52

rent reviews and lease renewals that increased the Group's income

by GBP0.9m pa, a 14.1% uplift on the previous income.

Tenant retention and rent collection

Although 19% (GBP21.4m) of the Group's 2010 year end income was

subject to lease breaks and expiries during the year, tenant

retention remained strong across the business. Excluding those

where projects were imminent, the total exposure to lease breaks

and expiries was 14% (GBP16.2m). Of this, 72% of income was

retained (2010: 72%), 21% re-let prior to the year end (2010: 17%)

and a further 2% re-let or placed under offer since the year

end.

Rent collection continued to be prompt with on average 98%

collected within 14 days of the due date. This is above the KPI

collection target of 95% and compares with 96% in 2010.

Vacancy rate

With our strong letting activity and active portfolio

management, the portfolio's EPRA vacancy rate by rental value,

measured as space immediately available for occupation, ended the

year at 1.3% or GBP1.9m pa. Half of this space has either been let

subsequently or is under offer. This compared to 5.9% at the start

of the year and 4.0% in June. By available floorspace, the year end

vacancy rate was 1.3%, down from 4.9% a year earlier and 3.5% at

the half-year. This compared favourably to the CBRE central London

rate that decreased from 5.5% to 5.2% during the year.

Our five principal on-site projects have an estimated rental

value of about GBP13m pa and, upon completion, would increase the

Group's vacancy rate to around 9%. However, after adjusting for

pre-lets and space under offer, the rate would reduce to

approximately 5%.

Activity in 2012

Letting activity has continued into 2012 with the completion of

a further 153,100 sq ft (14,220m(2)) of transactions at a rental

income of GBP6.0m pa.

These included 1 Page Street SW1 where we are pleased to

announce that Burberry will be increasing their presence in our

portfolio by pre-letting the entire 127,000 sq ft (11,800m(2))

building for GBP5.3m pa. This reflects a level of GBP50 per sq ft

(GBP540 per m(2)) on the top three floors with GBP45 per sq ft

(GBP485 per m(2)) on a typical mid-level floor. The lease is for a

20-year term with a tenant-only break option in year ten and a

rent-free period equivalent to 22 months. The first review after

five years will be subject to a minimum uplift to GBP5.7m pa. An

amendment to the existing planning consent has been submitted and

approval is anticipated shortly. The completion of the lease is

conditional on obtaining satisfactory consent.

We are also pleased to announce that we have signed a joint

venture agreement with Grosvenor, our freeholder, for the future

redevelopment of 1-5 Grosvenor Place, Belgravia SW1. As part of the

transaction our headleases, that were due to expire in 2063 and

2084, have been regeared into a new 150-year term at a ground rent

of 5% of rental income. Simultaneously, the Group has sold 50% of

its ownership to Grosvenor and received GBP60m before costs. Having

assembled the ownership over many years, this initiative protects

our value through the headlease regear and unlocks the opportunity

for a substantial and prestigious mixed-use scheme, likely to

include a luxury hotel, commercial and residential space. The

existing buildings, totalling 168,000 sq ft (15,600m(2)), are fully

let at a gross income of GBP6.2m pa and occupy a prime 1.5 acre

(0.6 hectare) island site, which overlooks Hyde Park Corner.

Following the transaction our share of the income is GBP2.95m. We

are in the process of selecting architects to work on this

scheme.

PROJECTS

See appendix 4

http://www.rns-pdf.londonstockexchange.com/rns/4407Y_3-2012-2-29.pdf

During the year we made excellent progress with our development

programme through the completion of a range of refurbishments, the

advancement of our on-site projects and the receipt of six major,

value-creating planning consents. These total 0.9 million sq ft

(83,600m(2)) and relate to 80 Charlotte Street W1, City Road Estate

EC1, Turnmill EC1, Buckley Building EC1, 4 & 10 Pentonville

Road N1 and the first phase of Central Cross W1. We await decisions

on a number of other significant planning applications made in 2011

including 1 Oxford Street W1 and Riverwalk House SW1.

Despite the difficult state of the economy, we are encouraged by

the strength of our letting activity and the relatively moderate

level of space available to rent in our key markets. Our current

development programme, which is either on-site or scheduled to

commence in 2012, totals just over 0.5 million sq ft (46,500m(2))

on seven projects. These will have a potential net rental income of

around GBP20m pa and will incur total capital expenditure of

approximately GBP137m.

Review of 2011 activity

In 2011, the Group completed 219,400 sq ft (20,380m(2)) of

projects - 91,400 sq ft (8,490m(2)) in the first half of the year

and 128,000 sq ft (11,890m(2)) in the second. After the disposal of

Victory House, these are now fully let at GBP5.2m pa.

The principal completions were:

-- 33 George Street W1 - Pandora Jewellery pre-let the entire

13,000 sq ft (1,210m(2)) refurbished building for GBP0.7m pa which

was completed in January 2011.

-- Victory House, 170 Tottenham Court Road W1 - following

completion of this 48,000 sq ft (4,460m(2)) mixed-use scheme in

July, the building was sold (see 'Disposals').

-- 88 Rosebery Avenue EC1 - a 49,000 sq ft (4,550m(2))

refurbishment that was completed in December and pre-let to City

University for GBP1.2m pa.

Smaller refurbishments at the Tea Building E1, Holden House W1,

Morelands Buildings EC1 and 55-65 North Wharf Road W2 were also

completed in the year. Overall, excluding capitalised interest,

GBP41.0m of capital expenditure was invested in the portfolio in

2011.

At year end, five principal projects were on site totalling

338,000 sq ft (31,400m(2)) with an estimated net rental value of

GBP13m pa and a capital expenditure to complete of GBP68m. By

estimated income, 50% of these are pre-let or under offer. The

schemes are:

-- 1 Page Street SW1 - this 127,000 sq ft (11,800m(2)) office

building has been pre-let to Burberry (see 'Activity in 2012'). As

part of the agreement with Burberry, as well as internal

refurbishment and extension, the building will be reclad with an

elegant masonry facade. This approach has enabled us to increase

the floor area by 8% from the 118,000 sq ft (10,960m(2)) at the

time of acquisition. We await planning approval for these

amendments. Total capital expenditure to complete is estimated at

GBP30m and it is anticipated that the building will be handed over

to Burberry in mid 2013.

-- Buckley Building (formerly Woodbridge House), 49 Clerkenwell

Green EC1 - planning consent for this scheme was gained in May 2011

to refurbish and extend the existing building by 13% to 85,000 sq

ft (7,900m(2)). Work is due to complete towards the end of 2012. To

improve the building's identity, the office entrance is being

repositioned from Aylesbury Street to the more prominent

Clerkenwell Green. We have received some good early interest on

this building and the Group continues to receive a rental income of

GBP2.5m pa until March 2015 from an agreement with the previous

tenant, which considerably derisks this project.

-- 4 & 10 Pentonville Road N1 - this 55,000 sq ft

(5,110m(2)) office refurbishment, opposite our Angel Building,

gained planning consent in April 2011. The two existing buildings

will be linked and remodelled, increasing the previous floor area

by over 20%. Completion is scheduled for mid 2012.

-- Central Cross W1 (Phases 1 & 2) - planning permission was

obtained in September 2011 for the remodelling and extension of the

main office entrance that will create 23,000 sq ft (2,140m(2)) of

ground floor offices. Strip out work commenced in December on this

first phase of this regeneration, with delivery due in late 2013.

We expect to coincide these works with Phase 2 that will include a

further office refurbishment of 21,000 sq ft (1,950m(2)). We have

placed 15,400 sq ft (1,430m(2)) of Phase 1 under offer and we

intend to rebrand the building going forward as 1-2 Stephen

Street.

-- Morelands Buildings, 5-27 Old Street EC1 - following a

headlease extension, this multi-let building is undergoing a

rolling refurbishment with 27,000 sq ft (2,510m(2)) in the current

phase. This includes a fourth floor refurbishment and new fifth

floor of 17,800 sq ft (1,650m(2)) which have been pre-let at

GBP34.50 per sq ft (GBP370 per m(2)) and GBP37.50 per sq ft (GBP405

per m(2)) respectively and which are due to complete by the end of

2012.

Projects - 2012

In the year ahead, we are due to commence two exciting new-build

projects totalling 170,000 sq ft (15,800m(2)) with a net estimated

rental value of over GBP7m pa:

-- 40 Chancery Lane WC2 - a second half start is proposed at

this 100,000 sq ft (9,300m(2)) six-storey Midtown office scheme. In

February 2012, to enable the redevelopment, we exchanged

conditional contracts to restructure and extend our interests into

a new 128-year lease with our freeholder, the Colville Estate.

Completion will take place on achieving vacant possession, and will

replace a 17-year unexpired headlease held on the majority of the

site, the relinquishing of a minor freehold element and the

extension of our ownership to include an adjacent building where

the Group had no previous interest. The ground rent gearing is 18%

of rental income, with the opportunity for the Group to pay a

premium to reduce this to 10%. The freeholder will receive a share

of the project's profits above a target return. Completion is

anticipated towards the end of 2014 and the project will incur

capital expenditure estimated at GBP44m.

-- Turnmill, 63 Clerkenwell Road EC1 - this 70,000 sq ft

(6,500m(2)) office development was granted planning permission in

September 2011. It offers a substantial regeneration opportunity in

an area that will benefit from the arrival of Crossrail at nearby

Farringdon station in circa 2018. Capital expenditure is

anticipated to be GBP26m with completion due in mid 2014.

At 132-142 Hampstead Road NW1, following the Government's

January 2012 decision to proceed with the HS2 high speed rail link,

we have reluctantly decided to put on hold the 265,000 sq ft

(24,600m(2)) office and residential redevelopment. This decision is

due to the expectation that our ownership will be compulsorily

purchased should HS2 be built. Despite having been in advanced

negotiations for substantial office pre-lets, the considerable

capital expenditure of around GBP90m needed to complete the project

and the uncertainty as to its future leads us to believe that the

risk to proceed with the planned redevelopment is too great. We are

now considering several 'light touch' refurbishment options that

will allow us to offer space on flexible terms.

Projects - 2013 and onwards

During the year, our development team advanced a number of major

future projects that could commence from 2013. These were made up

of planning permissions granted, planning applications submitted

and appraisal studies.

Planning permissions included:

-- 80 Charlotte Street W1 - this 367,000 sq ft (34,100m(2))

mixed-use Fitzrovia development, providing 320,000 sq ft

(29,700m(2)) of offices, together with residential and retail space

and a new public park was granted planning permission by the Mayor

of London in September 2011. This island site, located in the heart

of Fitzrovia, currently comprises 200,000 sq ft (18,600m(2)) of

outdated offices. The new scheme will be a major step in the wider

regeneration of the area. Construction is due to commence after the

existing leases expire in March 2013. Total anticipated capital

expenditure is around GBP125m with delivery expected in 2015.

-- City Road Estate EC1 - this major 289,000 sq ft (26,800m(2))

office-led development, located at Old Street roundabout within the

Government's 'Tech City', was granted planning permission in

October. The proposed scheme reflects a 130% increase on the

existing floorspace and includes a new 16-storey office building,

that incorporates our 'White Collar Factory' concept, together with

retail and residential units. The existing buildings are multi-let

on flexible leases producing GBP0.8m pa. The Group will be looking

to secure a significant pre-let prior to committing an anticipated

GBP100m of capital expenditure.

Planning applications made during the year included:

-- Riverwalk House, 157-166 Millbank SW1 - a planning

application was submitted in October for a 121-unit 148,000 sq ft

(13,700m(2)) high-specification residential redevelopment at this

prestigious riverside location. The building has been sold, subject

to receipt of satisfactory planning permission (see

'Disposals').

-- 1 Oxford Street W1 - a joint planning application with

Crossrail Limited was submitted in October for a 275,000 sq ft

(25,500m(2)) mixed-use scheme at Tottenham Court Road station,

which will become a major transport interchange following the

completion of Crossrail. This comprises 204,000 sq ft (18,900m(2))

of offices, 37,000 sq ft (3,400m(2)) of retail space and a 350-seat

theatre. The site was compulsorily purchased from the Group by

Crossrail in 2009 and we have the option to re-acquire it following

the completion of their station works around 2017.

-- 96-98 Bishop's Bridge Road W2 - planning permission was

granted in February 2012 for a residential-led scheme of 21,400 sq

ft (1,990m(2)), comprising 16 units, at this former 1930s cinema.

It is anticipated that construction will start in early 2013.

We continue to advance a number of appraisal studies across the

portfolio. This year we will be progressing our plans at 1-5

Grosvenor Place SW1 and the retail phase of Central Cross W1 where

planning applications will be submitted in due course.

Acquisitions

Further depth was added to our development pipeline with

acquisitions in 2011 totalling GBP87.5m before costs.

-- 1 Page Street SW1 - this vacant office building, located

close to our Horseferry House holding in Victoria, was acquired in

March for GBP45.0m. As outlined in the 'Activity in 2012' section,

we have pre-let the entire building to Burberry.

-- Network Building, 95-100 Tottenham Court Road W1 - the

headlease of this 64,000 sq ft (5,900m(2)) multi-let Fitzrovia

office and retail property was purchased for GBP31.0m in April. The

Group already owned the freehold and, by merging the interests, we

are able to consider a more substantial redevelopment in the

future. Income from this building is GBP2.1m pa which should rise

to GBP2.7m pa on the letting of the vacant office space.

-- Morelands Buildings, 5-27 Old Street EC1 - the headlease of

this popular, multi-tenanted Clerkenwell property was regeared for

an outlay of GBP5.8m before costs in the first half of the year,

extending our tenure from 45 to 125 years and increasing our

development rights. This regear facilitates a phased refurbishment

and extension of the property with Phase 1, which has been mostly

pre-let, now underway, incurring capital expenditure to complete of

GBP5.6m.

-- 423-425 Caledonian Road N7 - this 18,300 sq ft (1,700m(2))

office building was purchased for GBP5.6m in June and produces an

income of GBP0.3m pa. It is opposite an existing holding, Balmoral

Grove Buildings, where we are formulating a residential planning

application.

Disposals

During the year the Group took the opportunity to recycle

capital through the disposal of a mixture of mature and smaller

assets. Sales totalled GBP132.5m before costs, had an income of

GBP3.2m pa and gave rise to an overall surplus of GBP36.1m, or 38%

above the December 2010 valuation. These included:

-- Covent Garden Estate WC2 - this 71,900 sq ft (6,680m(2))

mixed-use holding of five freehold properties, that produced

GBP2.5m pa, was sold for GBP68.0m.

-- Victory House, 170 Tottenham Court Road W1 - following an

extensive refurbishment, this 48,000 sq ft (4,460m(2)) mixed-used

property was sold for GBP37.2m.

-- 79-89 Pentonville Road N1 - this 35,600 sq ft (3,310m(2)) low

income producing property was sold for GBP11.0m.

-- 18-30 Leonard Street EC2 - the long leasehold interest of

this cleared site, with planning consent for 47 residential units

and 20,000 sq ft (1,860m(2)) of offices, was sold for GBP11.0m.

-- Harp House, 83-86 Farringdon Street EC4 - at the expiry of

the existing lease, this 14,300 sq ft (1,330m(2)) property was sold

for GBP5.0m in December with vacant possession.

In addition, in December 2011 we exchanged conditional contracts

to sell Riverwalk House SW1 and 232-242 Vauxhall Bridge Road SW1

for GBP77.3m to Ronson Capital Partners with completion subject to

receipt of satisfactory planning permission. A planning decision is

expected shortly. The Group will maintain an interest in the

development by way of a profit overage arrangement and will work

closely with the purchasers to enhance our expertise in residential

projects.

Following the year end, at 1-5 Grosvenor Place SW1, we

restructured our ownership and sold a 50% interest in the new

headlease to Grosvenor for GBP60m as part of our joint venture

arrangements for the future redevelopment of this site (see

'Activity in 2012').

FINANCE REVIEW

See appendix 5

http://www.rns-pdf.londonstockexchange.com/rns/4407Y_4-2012-2-29.pdf

Looking back on 2011, the first half of the year showed a

continuation of the relatively strong recovery in sentiment that

characterised 2010 but, from mid-year onwards, the UK's economic

recovery slowed and stresses within the Eurozone came prominently

to the surface. Certain European governments found that the cost of

refinancing their sovereign debt was set to rise dramatically. The

interdependence of banks upon banks, and banks upon sovereign

support, caused market concern and political solutions were not

rapid enough to curtail a substantial loss of confidence. The UK

emerged as something of a 'safe haven', pushing gilt yields to

almost record lows. However, confidence in the UK's domestic

economy weakened in the second half, UK national debt levels also

remain high and domestic consumer demand is under sustained

pressure.

We therefore remain some way from 'normal' market conditions. As

a consequence, our financial initiatives in 2011 focused on

pre-emptive mitigation of refinancing exposures, while also

managing operational risk such as letting voids. At the same time,

we have worked to unlock valuable development opportunities for the

future.

Adjusted net asset value per share

The Group's EPRA adjusted net asset value per share increased by

15.4% to 1,701p per share as at 31 December 2011 from 1,474p a year

earlier. As usual, the main constituent of this increase was the

property portfolio valuation which showed an increase of 168p per

share after allowing for capital expenditure and lease incentives.

Profits arising on disposals of investment properties also

contributed another 35.4p per share compared with 0.9p per share in

2010.

London commercial property values have not yet recovered to

their December 2007 peak levels but, since December 2009, the Group

has seen a cumulative increase of almost 47% in net asset value per

share. Debt and gearing levels have also been reduced further in

the last year and we have been able to enhance the level of undrawn

and available bank facilities.

Due to an increase in the valuation of the part of 25 Savile Row

W1 that the Group occupies as its head office, this part has now

been reclassified from investment properties to 'property, plant

and equipment' in compliance with IAS 16 and IAS 40. Please refer

to note 2 for further details of this minor restatement of the

prior year comparative numbers.

In accordance with IFRS 5, the properties that were expected to

be sold during 2012 have been included in 'assets held for sale' at

the balance sheet date. These are discussed in the 'Disposals'

section of the Property Review and amounted to GBP137.5m.

Group income statement

The last year was characterised by a record level of new

lettings and reviews for the Group which helped gross property

income to grow by 5.1% to GBP125.5m from GBP119.4m for the year

ended 31 December 2010. After taking account of lease breaks and

expiries, new lettings increased gross income by GBP3.3m compared

to 2010. Properties acquired in 2010 and 2011 added GBP7.2m of

rental income when compared with the 2010 calendar year, partly due

to the full year's contribution from Central Cross, while disposals

only reduced rent by GBP1.6m. However, as we progressed schemes at

Riverwalk House, Hampstead Road, 88 Rosebery Avenue and 4 & 10

Pentonville Road, the income generated from those properties fell

by GBP4.4m when compared with the prior year. As noted last year,

the Buckley Building continues to generate rental income of GBP2.5m

pa during the construction period and beyond to 2015.

Premiums received from tenants terminating leases early totalled

GBP1.4m after netting off the related accrued income from

unamortised lease incentives. The largest premium received came

from a tenant who paid GBP1.5m to vacate the Johnson Building in

December 2011; the resulting write-off of unamortised rent accrued

through the rent-free period totalled GBP0.9m. This lease surrender

was supported by a back-to-back letting to Lastminute.com at a

higher rental level.

Property outgoings and ground rents increased from GBP8.1m in

2010 to GBP9.8m due mainly to void costs being higher in 2011

during the post completion period at the Angel Building until it

was fully let and Riverwalk House's office tenant vacating in April

2011. In addition, surrender premiums of GBP1.9m were paid in 2011

of which the largest was a GBP1.3m payment to secure vacant

possession at 210 Old Street. As a result, net property income

increased by 4.2% to GBP117.7m, a slightly lower percentage than

the increase in gross rents. Net rental income took account of a

further recovery of GBP1.6m of commercial rates rebates from prior

years, marginally lower than the GBP1.7m rates credit in 2010.

Excluding the impact of acquisitions, disposals and properties

under development, like-for-like net property income on an EPRA

basis rose by 3.7% from 2010 and an analysis is shown in the table

in Appendix 5.

Administrative expenses increased to GBP22.7m from GBP20.9m in

2010 due mainly to increased staff and office costs. As in the

previous year, we have both increased and strengthened the

management team and we believe this was a contributory factor to

the valuable planning consents won during the year. The Group's

consistently strong performance over recent years has also

contributed to an increase in the provision for long-term

management incentives of GBP0.7m compared to 2010.

Average borrowings during the year were about GBP118m higher

than in 2010. In addition, the impact of higher margins and fees

charged on bank facilities renewed since November 2010 and the

lower level of floating rate debt combined to increase net finance

costs from 2010. Net finance costs, after capitalising GBP2.2m of

interest in 2011, increased to GBP43.2m from GBP37.9m in 2010. The

GBP175m of unsecured convertible bonds issued in June 2011 pay a

cash coupon of 2.75% pa but, in accordance with IFRS accounting

rules, we have recognised the hybrid nature of this instrument by

booking an additional non-cash interest charge of 1.24% pa which

added GBP1.0m to the 2011 finance cost. In future years, the

additional charge will be GBP1.9m pa. In addition, the equity

element of the convertible bond instrument of GBP9.4m, after costs,

was recognised in reserves at the point of issue.

The resulting EPRA recurring profit before tax was GBP52.3m for

the year ended 31 December 2011 compared with GBP55.2m in 2010. Tax

recoveries from historical positions in the UK and USA meant that

EPRA earnings per share fell by less than 3% to 51.59p from 52.89p

in 2010.

The overall profit before taxation for the year was GBP233.0m

compared to GBP352.8m in 2010, the reduction due mainly to the

lower level of property revaluation movements in 2011. The surplus

arising in 2011 from the revaluation of the Group's property

portfolio amounted to GBP172.1m against GBP301.7m in 2010. A

further contribution came from profits on disposals of investment

properties in 2011 of GBP36.1m offset partially by the GBP26.5m

mark-to-market deficit on interest rate swaps referred to below.

The gain on disposals of investment properties came from the sales

of low yielding properties at Covent Garden and 78-79 Pentonville

Road in the first half of the year and Victory House, 18-30 Leonard

Street and Harp House in the second half. In aggregate, these sales

achieved 38% above December 2010 book values, after costs.

Gilt yields and swap rates over the medium and long-term fell

strongly in the second half of 2011 after rising a little in the

first half. This recent decline in rates has been quite exceptional

with the 10-year gilt hovering around 2.0% at the 2011 year end

illustrating a distinct cooling of UK growth and interest rate

expectations. The resulting mark-to-market deficit of GBP26.5m for

2011 compares with a GBP2.4m deficit in 2010. Interest rates have

so far remained low into 2012.

Taxation

The 2011 tax credit relating to the non-REIT part of the

business was GBP1.3m. This comprised a tax charge of GBP0.5m for

the unelected share in our joint venture with the Portman Estate

and a prior year tax credit of GBP1.8m. The latter item benefited

from the resolution of a long-running US tax matter resulting in a

cash receipt of GBP0.4m. In addition, we were able to release

provisions against UK tax enquiries amounting to GBP1.4m. The

deferred tax provision in 2011 fell slightly to GBP5.2m as the

effect of the higher revaluation surplus was more than offset by

previously unrecognised tax losses and the reduced UK corporation

tax rate which falls to 25% on 1 April 2012.

Financing, net debt and cash flow

As the Group entered 2011 it faced GBP32.5m of bank facilities

expiring in 2012 and a further GBP575m due to expire in 2013. We

were also very aware of the deleveraging pressures facing real

estate lending banks. Therefore, a principal strategic aim for the

year was to focus on refinancing the majority of this requirement

before 2012.

We had also previously flagged that we would look to seek out

non-bank sources of debt and, after considering a number of other

options, we decided to launch a GBP175m unsecured convertible bond

in May 2011, the first of its type by a UK REIT. This was well

received and was several times over-subscribed. Pricing settled at

a 2.75% pa coupon with an initial exercise price of GBP22.22, some

50% above the Group's net asset value at December 2010. This issue

provides a source of unsecured debt with no corporate or

asset-specific financial covenants and a low coupon. It also

carries a relatively modest risk of dilution given the high

conversion price relative to net asset value. In documenting the

issue, we were able to include an allowance of up to GBP350m for

other capital markets issues such as private placements and bonds,

together with unlimited access to bank and insurance company debt.

We considered that this combination was unlikely to fetter our

borrowing strategy over the five-year term of the bonds.

We have also taken action to renew and/or extend and refinance

bank facilities during the year. In June 2011, the GBP100m

bilateral revolving facility with The Royal Bank of Scotland was

extended to a renewal date of April 2015; the margin increased to

120bp and steps up again in April 2012 to 175bp for loan to value

("LTV") ratios up to 65% and 200bp in the less likely event that we

draw above 65% LTV.

We were also able to increase the principal amount of our

revolving bilateral loan facility with HSBC that expires in

November 2015 from GBP100m to GBP125m. This GBP25m increase was

executed in December 2011 on the same terms as the original

facility which was arranged in November 2010.

Both of these transactions are indicative of the strong nature

of our valued banking relationships and illustrate the increasingly

binary nature of the bank loan environment. For a small number of

chosen borrowers, funds are available on terms that remain

reasonably attractive while, for others, the facilities are either

all but unavailable or are priced at a significant premium.

In the second half of the year, we approached a number of

potential lenders to refinance part of the GBP375m syndicated loan

facility expiring in March 2013 that was inherited upon the merger

with London Merchant Securities in 2007. Our intention was to

remove the risk in relation to that part of this refinancing which

was to be funded by banks while leaving a further part which could

be replaced with non-bank funding in 2012. Derwent London favours

facilities which are either held by one bank or by a small club of

banks and we therefore preferred to avoid assembling a new large

syndicated facility.

After receiving several offers of funding, in December 2011 we

signed a new GBP150m fully revolving five-year facility provided

equally by The Royal Bank of Scotland and Barclays and a new

GBP150m fully revolving five-year facility provided by Lloyds Bank

to replace and extend their existing GBP100m bilateral facility.

Although signed in 2011, these new facilities did not become

available for drawing until January 2012 and so, as at the 2011

balance sheet date, the GBP375m facility was still in place. In

January 2012, the GBP375m facility was part-cancelled and now

consists of a GBP150m fully revolving facility.

The debt profiles of the bank facilities as at 31 December 2011

and the pro-forma refinanced position are both provided in Appendix

5.

We believe that the pricing on these two new facilities is at

good and sensible levels in the current market, which became

considerably more difficult in the last quarter of 2011. In both

cases, we have agreed a 'ratchet' of margin pricing based on the

amount drawn; at the lower end of the range of LTV ratios where we

tend to operate most of the time, margins of 185bp and 160bp,

respectively, were agreed for the two facilities while we expect to

pay margins between 160bp and 215bp through the life of these

loans. Should we need to draw the full amounts and in a situation

where property security values were also to fall substantially from

current levels, the margins in both facilities could be up to

250bp.

We are not seeking to renew the small GBP32.5m unsecured

facility expiring in June 2012 which was originally arranged in

connection with the loan notes offered at the time of the LMS

merger. The remaining loan notes were repaid in January 2012.

In order to mitigate the effect of an increase in facility

margins, we have taken steps to reduce the weighted average cost of

our interest rate swaps. In January 2012, when the higher margins

started to take effect, we broke two interest rate swaps with a

principal amount of GBP130m and a weighted average rate of about

5.0%, excluding margin, which were due to expire in March 2013. The

cost of breaking these swaps was GBP6.3m, a small discount to the

additional interest charge that we would have incurred through the

remaining life of the swaps. At the same time, we took out a new

GBP70m swap to April 2019 at a rate of just under 2.0%, excluding

margin. The impact of the new facility margins and swap rates is

shown in the table in Appendix 5.

Cash proceeds from the sales of investment properties during

2011 were GBP131.5m which almost matched the GBP134.2m outflow

incurred on capital expenditure and property acquisitions. Cash

generated from operations after payment of the dividend totalled

GBP21.8m for the year leading to an overall reduction in bank and

other loans.

Taking account of amortisation of arrangement fees and other

adjustments, the Group's net debt fell slightly to GBP864.5m at

December 2011 compared to GBP887.8m a year earlier. After allowing

for the cash raised from the issue of the convertible bond in June,

bank loans were repaid by a net amount of GBP186.6m during the year

compared to a net drawing of GBP158.8m in 2010.

Supported by the rise in portfolio values, gearing has fallen

again in 2011 and the Group's overall LTV ratio, after allowing for

unamortised loan arrangement costs, fell from 35.7% at 31 December

2010 to 32.0% at 31 December 2011. Balance sheet gearing fell from

59.4% to 50.4% over the same period. As noted above, our finance

costs have increased in the year and, accordingly, the Group's

overall interest cover ratio for the year fell a little to 307%,

after capitalisation of interest, or 291% excluding capitalised

interest, compared to 328% in 2010. These levels of LTV ratio and

interest cover provide very substantial headroom for our bank

facilities.

The weighted average length of unexpired debt facilities at 31

December 2011 was 4.4 years but, with the new facilities that

became effective in January 2012, the pro-forma figure rises to 5.2

years, which is the same as at 31 December 2010.

The issue of the convertible bonds in June 2011 increased

available headroom under bank facilities but also raised the

proportion of debt that is at fixed rates; at 31 December 2011, the

percentage of debt at fixed rates was 98% though this has fallen to

90% in January 2012 on the termination of the old swaps and the

arrangement of the new swap noted above. This level of fixed rates

provides us with considerable protection against movements in

interest rates but remains a little above our target range. As we

invest further in the portfolio over the medium term, we expect

this proportion to fall back under 85%.

As a result of the higher level of fixed rates and the increased

margins that we pay on recently renewed bank facilities, the

weighted average cost of debt, including the secured bond,

increased from 4.34% at December 2010 to 4.91% in December 2011,

inclusive of the non-cash element of the convertible bond, or 4.65%

if the latter is excluded.

The bond issue increased the level of committed bank facilities

available for drawing at 31 December 2011 to GBP469m compared with

GBP245m the previous year, added to which there was an additional

GBP589m of uncharged property in December 2011; the comparative

figure at December 2010 was GBP484m. The low LTV ratio at December

2011 means that the Group's bank covenants, both for LTV ratio and

interest cover, have significant headroom and we estimate that

property values could fall by around 50% before there was an LTV

ratio breach under any of the facilities.

Dividend

Our dividend remains well covered and, as a result, the Board

has been able to recommend an 8.1% increase in the proposed final

dividend to 21.90p per share. Of the final dividend, 18.10p will be

paid as a PID with the balance of 3.80p as a conventional dividend.

This will bring the total dividend for the year to 31.35p per

share, an increase of 2.35p or 8.1% over 2010. We will again offer

a scrip dividend alternative as this has proved popular with

shareholders with around 17% opting for shares rather than cash so

far since it was introduced.

Directors' responsibilities

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company, for safeguarding the assets of

the Company, for taking reasonable steps for the prevention and

detection of fraud and other irregularities and for the preparation

of a Directors' report and Directors' remuneration report which

comply with the requirements of the Companies Act 2006.

The Directors are responsible for preparing the annual report

and the financial statements in accordance with the Companies Act

2006. The Directors are also required to prepare financial

statements for the Group in accordance with International Financial

Reporting Standards, as adopted by the European Union (IFRSs) and

Article 4 of the IAS Regulation. The Directors have chosen to

prepare financial statements for the Company in accordance with

IFRSs.

Group financial statements

International Accounting Standard 1 requires that financial

statements present fairly for each financial year the Group's and

Company's financial position, financial performance and cash flows.

This requires the faithful representation of the effects of

transactions, other events and conditions in accordance with the

definitions and recognition criteria for assets, liabilities,

income and expenses set out in the International Accounting

Standards Board's "Framework for the preparation and presentation

of financial statements". In virtually all circumstances, a fair

presentation will be achieved by compliance with all applicable

IFRSs. A fair presentation also requires the Directors to:

-- consistently select and apply appropriate accounting policies;

-- present information, including accounting polices, in a

manner that provides relevant, reliable, comparable and

understandable information; and

-- provide additional disclosures when compliance with the

specific requirements in IFRSs is insufficient to enable users to

understand the impact of particular transactions, other events and

conditions on the entity's financial position and financial

performance.

The Directors confirm to the best of their knowledge:

-- they have complied with the above requirements in preparing

the financial statements which give a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company and the undertakings included in the consolidation taken as

a whole;

-- the adoption of a going concern basis for the preparation of

the financial statements continues to be appropriate based on the

foregoing and having reviewed the forecast financial position of

the Group; and

-- the business review includes a fair review of the development

and performance of the business and the position of the Company and

the undertakings included in the consolidation taken as whole,

together with a description of the principal risks and

uncertainties that they face.

-- Financial statements are published on the Group's website in

accordance with legislation in the United Kingdom governing the

preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance and

integrity of the Group's website is the responsibility of the

Directors. The Directors' responsibility also extends to the

ongoing integrity of the financial statements contained

therein.

On behalf of the board

J. D. Burns D.M.A. Wisniewski

Chief Executive Officer Finance Director

1 March 2012

GROUP INCOME STATEMENT

2011 2010

Restated

Note GBPm GBPm

Gross property income 125.5 119.4

Other income 2.0 1.7

---------------------------------------------- ---- ------- --------

Total income 5 127.5 121.1

Property outgoings (9.8) (8.1)

Net property income 117.7 113.0

Administrative expenses 2 (22.7) (20.9)

Revaluation surplus 2 170.1 298.1

Profit on disposal of investment properties 6 36.1 0.9

Profit from operations 301.2 391.1

Finance income 7 1.1 1.9

Finance costs 7 (44.3) (39.8)

Movement in fair value of derivative

financial instruments (26.5) (2.4)

Share of results of joint ventures 8 1.5 2.0

Profit before tax 233.0 352.8

Tax credit 9 1.3 -

Profit for the year 234.3 352.8

Attributable to:

- Equity shareholders 228.3 343.6

- Minority interest 6.0 9.2

234.3 352.8

Earnings per share 10 225.20p 339.68p

Diluted earnings per share 10 217.67p 337.47p

GROUP STATEMENT OF COMPREHENSIVE INCOME

2011 2010

Restated

Note GBPm GBPm

Profit for the year 234.3 352.8

Actuarial losses on defined benefit

pension scheme (3.5) (0.4)

Revaluation surplus of owner-occupied

property 11 2.0 3.6

Deferred tax on revaluation surplus 16 0.7 (1.0)

Foreign currency translation - 0.2

------ --------

Other comprehensive (expense)/income (0.8) 2.4

Total comprehensive income relating to the

year 233.5 355.2

Attributable to:

- Equity shareholders 227.5 346.0

- Minority interest 6.0 9.2

233.5 355.2

GROUP BALANCE SHEET

2011 2010 2009

Restated Restated

Note GBPm GBPm GBPm

Non-current assets

Investment property 2, 11 2,444.9 2,373.3 1,876.9

Property, plant and equipment 2, 12 19.4 16.7 13.1

Investments 9.7 8.4 6.4

Pension scheme surplus - 0.7 0.8

Other receivables 13 55.4 45.8 38.9

2,529.4 2,444.9 1,936.1

Current assets

Trading properties - - 1.0

Trade and other receivables 45.0 37.7 44.0

Cash and cash equivalents 3.5 7.2 19.0

48.5 44.9 64.0

Non-current assets held for

sale 14 137.5 - -

Total assets 2,715.4 2,489.8 2,000.1

Current liabilities

Bank overdraft and loans 15 32.5 5.6 5.9

Trade and other payables 70.9 63.4 59.0

Corporation tax liability 1.3 3.3 5.4

Derivative financial instruments - - 1.6

Provisions 1.6 1.4 2.3

106.3 73.7 74.2

Non-current liabilities

Borrowings 15 835.5 889.4 733.9

Derivative financial instruments 15 51.9 25.4 21.4

Provisions 0.5 0.7 0.8

Pension scheme deficit 1.5 - -

Deferred tax 16 5.2 5.9 5.9

894.6 921.4 762.0

Total liabilities 1,000.9 995.1 836.2

Total net assets 1,714.5 1,494.7 1,163.9

Equity

Share capital 5.0 5.0 5.0

Share premium 162.9 158.2 156.9

Other reserves 936.6 924.0 920.1

Retained earnings 558.2 361.6 45.2

Equity shareholders' funds 1,662.7 1,448.8 1,127.2

Minority interest 51.8 45.9 36.7

Total equity 1,714.5 1,494.7 1,163.9

GROUP STATEMENT OF CHANGES IN EQUITY

Attributable to equity shareholders

-----------------------------------------------

Share Share Other Retained Minority Total

capital premium reserves earnings Total interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2011

(restated) 5.0 158.2 924.0 361.6 1,448.8 45.9 1,494.7

Total comprehensive

income for the

year - - 2.7 224.8 227.5 6.0 233.5

Share-based payments

expense transferred

to

reserves - - 2.4 - 2.4 - 2.4

Transfer between

reserves

in respect of

performance

share plan - - (1.9) 1.9 - - -

Issue of convertible

bonds - - 9.4 - 9.4 - 9.4

Premium on issue

of shares - 4.7 - - 4.7 - 4.7

Dividends paid - - - (30.1) (30.1) (0.1) (30.2)

At 31 December 2011 5.0 162.9 936.6 558.2 1,662.7 51.8 1,714.5

Attributable to equity shareholders

-----------------------------------------------

Share Share Other Retained Minority Total

capital premium reserves earnings Total interest equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January 2010

(as previously

reported) 5.0 156.9 916.8 48.5 1,127.2 36.7 1,163.9

Restatement (see

note 2) - - 3.3 (3.3) - - -

-------- ------- -------- -------- -------- -------- --------

At 1 January 2010

(restated) 5.0 156.9 920.1 45.2 1,127.2 36.7 1,163.9

Total comprehensive

income for the

year - - 2.8 343.2 346.0 9.2 355.2

Share-based payments

expense transferred

to

reserves - - 2.2 - 2.2 - 2.2

Transfer between

reserves in

respect of performance

share plan - - (1.1) 1.1 - - -

Premium on issue

of shares - 1.3 - - 1.3 - 1.3

Dividends paid - - - (27.9) (27.9) - (27.9)

At 31 December 2010 5.0 158.2 924.0 361.6 1,448.8 45.9 1,494.7

(restated)