TIDMDLN

RNS Number : 2985S

Derwent London PLC

15 May 2009

Derwent London Plc

25 Savile Row

London, W1S 2ER

United Kingdom

www.derwentlondon.com

15th May 2009

Derwent London plc

("Derwent London" / "group")

Interim Management Statement for the QUARTER endED 31 MARCH 2009

Highlights

* Letting activity:

* Lettings in the first quarter of the year totalled 80,100 sq ft (7,400 sq m),

which will generate an income of GBP3.2 million per annum

* Since 31 March 2009, a further 68,000 sq ft (6,300 sq m) of floor space has been

either let or placed under offer, equivalent to future rent of approximately

GBP1.6 million per annum

* Qube offices in Fitzrovia are fully let - EDF, the energy group, leased 31,100

sq ft (2,900 sq m) in one of the largest West End lettings so far this year

* Space available for letting remains low at 4.2%

* Disposals

* Disposals of GBP33.4 million at values in line with the year end valuation

* Financial

* Group's financial position remains sound

* Documentation for new GBP125 million facility signed

* Unutilised, committed facilities of GBP315 million

* GBP400 million of uncharged property

Commenting on the period under review, John Burns, chief executive of Derwent

London, said:

"With the challenging operating conditions, our focus continues to be on

minimising voids, capturing our reversion and careful capital management. Our

balance sheet is strong, and we are well positioned to benefit from the value

creating opportunities which are starting to emerge".

For further information, please contact:

Derwent London John Burns, Chief Executive Officer

Tel: +44 (0)20 7659 3000 Chris Odom, Finance Director

Brunswick Group Andrew Fenwick

Tel: +44 (0)20 7404 5959James Rossiter

Overview

Market conditions continue to be difficult, with central London office

take-up still in decline against the long-term average.Consequently, since the

year end, there has been both a further, sector wide fall in rental levels and

increased tenant incentives. However, whilst demand generally has

slowed, our affordable, well designed space has remained attractive to

occupiers.During the quarter, the group's portfolio, with its limited

development exposure and diverse tenant mix, continued to show its defensive

qualities and, with solid letting progress, maintained a low vacancy rate.

Portfolio management

Letting activity for the first quarter of 2009 totalled 80,100 sq ft (7,400 sq

m), in 21 transactions, which will generate annual rental income of GBP3.2

million. Of this, GBP2.9 million was from space that was vacant at the year end

which included all the remaining office space at Qube. Overall, rental levels

achieved on the lettings were about 7% below the December estimated rental

values.

The principal transactions were:

· Qube, Fitzrovia

· In one of the largest West End lettings so far this year, EDF, the energy

group, leased 31,100 sq ft (2,900 sq m) for 15 years, with rent reviews every

five years, at GBP1,480,000 per annum which equates to GBP47 psf (GBP506 psm).

There are tenant break options after five and ten years. A rent free period of

21 months was granted with a further four months if the fifth year break is not

exercised. If the break is exercised, the tenant will pay a penalty equivalent

to nine months rent.

· ScanSafe, a global provider of security software, leased 6,500 sq ft (600 sq

m) for a term of 10 years at GBP290,000 per annum based on GBP45 psf (GBP484

psm). The rent is subject to annual increases, and rises to GBP355,000 per annum

(GBP55 psf/GBP592 psm) by year five. A rent free period of ten months was

granted with a further five months if the tenant's break clause at year five is

not exercised.

· 1-3 Grosvenor Place, Belgravia

· Jupiter Investment Management Group, an existing tenant in the building, has

taken 8,800 sq ft (800 sq m) on a seven year lease at GBP410,000 per annum

(GBP46 psf / GBP495 psm). There are mutual break options which help retain our

flexibility for future redevelopment.

Across the portfolio, a further 68,000 sq ft (6,300 sq m) of floorspace has been

either let or placed under offer since the March quarter end which equates to an

annual rental income of approximately GBP1.6 million.

The group's vacancy rate (by estimated rental value) is now 4.2%, a slight

increase from 3.8% at the year end.This is predominantly due to the completion

of a number of small refurbishment projects, and some space that became

available following the expiry of a lease at Grosvenor Place.

During the quarter, 18 lease renewals were concluded at an annual rent of GBP1.0

million per annum and 14 rent reviews settled which totalled GBP4.1 million per

annum. Overall, this management activity achieved an uplift of GBP0.9 million

per annum over the previous rents which represented a 22% increase, and

demonstrates the potential rental uplift to be captured. The rents achieved

were, nevertheless, about 6% below the December estimated rental values.

For the March quarter, the group's rent collection was consistent with previous

quarters, with 97% received within 14 days of the quarter day. Tenant defaults

remained low. Only four tenants, with a combined rental income of GBP0.5 million

per annum, are in administration.

Projects

The group has only three schemes underway which, overall, are 57% pre-let:

* Angel Building, Islington - at this 263,000 sq ft (24,400 sq m) office

regeneration project the structural steel frame installation is nearing

completion and the form of the new façade is now visible. Just over half of

the space is pre-let to Cancer Research UK at GBP5.6 million per annum, and the

building is due to be completed in the summer of 2010.

* Arup Phase III, Fitzrovia - the external cladding installation has now commenced

on this 85,000 sq ft (7,900 sq m) office development. Completion is due towards

the end of 2009, and the entire building is pre-let to Arup at GBP3.6 million

per annum on a 25-year lease. The tenant is paying GBP1.2 million per annum

during the construction.

* 16-19 Gresse Street, Noho - the external cladding has now been completed and the

internal fit-out is underway. This 47,000 sq ft (4,400 sq m) office scheme is

due for completion later this year.

At the end of March, the total cost to complete these schemes was approximately

GBP81 million.

Disposals and acquisitions

There have been no further disposals since those announced with the year end

results. The Astoria and 17 Oxford Street, Soho were compulsory purchased as

part of the Crossrail project. To date, we have received interim proceeds of

GBP14.4 million and will receive a further payment once the formal valuation is

agreed. The buildings were multi-let, producing GBP1.0 million per

annum. We continue to be involved with the future plans for this site which

involve the redevelopment of Tottenham Court Road underground interchange, and

have an option to re-purchase it on completion of the works. In addition, we

sold 28 Dorset Square, Marylebone, for GBP16.8 million reflecting a net initial

yield of 6.1% and representing a 5% premium over the December 2008 valuation. No

acquisitions were made during the quarter.

Asset values

Since the year end, there has been some stabilisation in the yields of quality

investments which are let on long term leases to strong covenants. This is

evidenced by the recent sale of the group's property at 28 Dorset Square.

However, with an investment market constrained by limited capital and downward

pressure on rents, values continue to fall across the general market. Our

portfolio was not revalued this quarter. However, as an indication of the

movement in capital values over the first quarter of 2009, the IPD Quarterly

Property Index for Central London Offices showed a decline of 10.0%, with the

main contributor being a 9.6% reduction in rental values. Having consulted our

principal external valuers, CB Richard Ellis Ltd, we believe that, following our

asset management initiatives, our portfolio would have outperformed this index.

Finance

With GBP400 million of uncharged property, a high level of committed but

unutilised bank facilities and flexibility in the management of its banking

covenants, the group's financial position remains sound. This was evidenced at

the end of April when Standard & Poor's published its review of the ratings of

the company and the secured bond. These were both left unchanged, despite the

turmoil in the global economy.

Net debt at 31 March 2009 was GBP840 million, GBP25 million lower than that

reported at the December 2008 year end. This resulted from a net cash inflow

principally due to disposal proceeds of GBP32 million from the sale of The

Astoria, 17 Oxford Street and 28 Dorset Square. Capital expenditure for the

first quarter was just over GBP19 million and there were no acquisitions. The

documentation for the new GBP125 million facility, terms for which were agreed

just before the announcement of the 2008 results, was signed in April, so that

this facility now has an expiry in April 2014. In addition, a small loan in one

of the group's joint ventures was refinanced for a term of twenty years. With

lower debt, the committed, unutilised facilities increased at March 2009 to

GBP315 million. Reduced borrowings and additional hedging meant that at the end

of March 2009, 75% of debt was either fixed or hedged which results in a current

spot weighted average cost of debt of 4.83%.

Outlook

The tough operating conditions look set to continue for some considerable

period, so our focus will remain on income retention, minimising voids and

careful capital management. Our strong balance sheet, low vacancy rate,

affordable passing rents, and diverse tenant base, gives us confidence that we

are well placed to take advantage of the value creating opportunities which are

starting to emerge.

Disclaimer

This document includes statements that are forward-looking in nature.

Forward-looking statements involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or achievements of

Derwent London plc to be materially different from any future results,

performance or achievements expressed or implied by such forward-looking

statements.

Notes to editors

Derwent London plc

Derwent London plc is the largest central London focussed REIT with an

investment portfolio of GBP2.1 billion as at 31 December 2008. The group is one

of London's most innovative office specialist property regenerators and

investors and is well known for its established design-led philosophy and

creative management approach to development. In April, Derwent London was

awarded the Property Week Property Company of the Year 2009.

Derwent London's core strategy is to acquire and own a portfolio of central

London property that has reversionary rents and significant opportunities to

enhance and extract value through refurbishment and redevelopment. The group

owns and manages an investment portfolio, of which 94% is located in central

London, with a specific focus on the West End and the areas bordering the City

of London. Landmark schemes by Derwent London include: Qube W1, Horseferry

House SW1, Johnson Building EC1, Davidson Building WC2 and Tea Building E1.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSBRGDUXBBGGCS

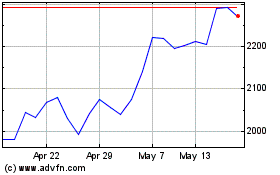

Derwent London (LSE:DLN)

Historical Stock Chart

From Jun 2024 to Jul 2024

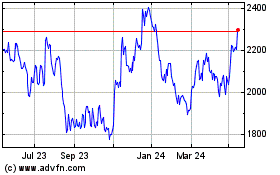

Derwent London (LSE:DLN)

Historical Stock Chart

From Jul 2023 to Jul 2024