TIDMCYAN

RNS Number : 4507A

Cyan Holdings Plc

29 September 2015

Cyan Holdings plc

("Cyan" or "the Company")

Interim results for the six months ended 30 June 2015

Cyan Holdings plc (AIM:CYAN.L), the integrated system and

software design company delivering mesh based flexible wireless

solutions for utility metering and lighting control, announces its

interim results for the six months ended 30 June 2015.

Financial Highlights

-- Turnover of GBP157,328 (H1 2014: GBP65,510)

-- Operating loss of GBP2,289,523 (H1 2014: GBP1,273,333)

-- Basic and diluted loss per share of 0.05p (H1 2014: 0.03p)

-- Cash and cash equivalents at 30 June 2015 of GBP628,069 (H1 2014: GBP716,786)

Operational Highlights

-- GBP1m smart metering order from Enzen Global Solutions

-- Letter of Intent from El Sewedy for prospective US$3m order

-- Successfully deployed over 4,000 smart meters for Tata Power Mumbai

-- Strategic agreements in South Africa with Adenco and XLink

-- Sales and marketing, software and customer delivery teams strengthened

-- Increased investment in research and development of Cyan solutions

-- Indian subsidiary established and commenced trading

Post Period Highlights

-- GBP4.6m (gross) raised via two equity placings to fund

staffing costs for the delivery of customer projects won in India,

development and delivery of managed services solutions, business

development, customer pilot/project deployments in other regions

and further product research and development work

-- This round of funding was substantially supported by

institutional investors, adding Herald Investment Management to the

shareholder base as well as a further investment from Legal &

General

John Cronin, Executive Chairman, commented:

"Having won the GBP1m smart metering contract with Enzen in

January, announced the successful deployment of Cyan's solution for

Tata Power Mumbai in April, the $3M Letter of Intent from El Sewedy

in May and the new funding of GBP4.6m in June, it has been six

months of strong progress for Cyan.

The Company remains well placed to add new customers across

India, Brazil, Africa and China and to develop existing commercial

relationships with utilities through to large scale commercial

rollout. The Company has a pipeline of potential orders for the

remainder of this year and going into 2016 across multiple regions

and I look forward to reporting further progress to shareholders in

due course."

Enquiries:

Cyan Holdings plc Tel: +44 (0) 1954

John Cronin, Executive Chairman 234 400

www.cyantechnology.com

Allenby Capital Limited Tel: +44 (0)20 3328

Nominated Adviser and Joint 5656

Broker

Jeremy Porter / Alex Brearley

Beaufort Securities Limited Tel: +44 (0)20 7382

Joint Broker 8300

Jon Belliss

Walbrook PR Tel: +44 (0)20 7933

Financial PR 8780

Paul Cornelius / Nick Rome cyan@walbrookpr.com

CHAIRMAN'S STATEMENT

This was a busy period for the Company as we focused on

strengthening our geographic reach, balance sheet and marketing

initiatives whilst further commercialising our smart metering

solutions. As such, we believe that we are well placed to further

grow existing relationships and to expand our pipeline of

opportunities via our strong ecosystem of partners.

Commercial Deployments

A key milestone for the Company during the period was the

successful deployment of over 4,000 meters with Tata Power Mumbai

("Tata Power"), which the Directors believe is the first 865MHz

Advanced Metering Infrastructure ("AMI") commercial project in

India. The meters that Tata Power has installed are already

providing data to generate customer bills, real-time information on

electricity outages and other factors related to the quality and

cost of power delivery. In July, Tata Power announced the

successful deployment of this project and this is a strong

endorsement of the quality of the Cyan solution as well as the

commercial benefits achieved to date.

In addition to the commercial deployment with Tata Power, the

Company received a GBP1m purchase order from Enzen Global Solutions

Pvt Ltd ("Enzen") for a large smart metering project being

implemented for the Chamundeshwari Electricity Supply Corporation,

Mysore, Karnataka in southwest India. In addition to supplying over

21,000 smart meters, Cyan is managing the end to end solution

delivery for smart metering, highlighting the strength and

potential scalability of the Company's offering. The Directors

believe that this is the first commercial implementation of AMI

technology by a public utility for consumers in India. The project

is now in the delivery phase (first 500 meters installed in

customer homes and in the process of being commissioned), with both

procurement and invoicing taking place through Cyan's recently

established Indian subsidiary.

Eco-system of Partners

We further extended our geographic reach during the period and

were delighted to be selected by Adenco Construction (Pty) Ltd

("Adenco") as its preferred supplier of smart metering and lighting

solutions as well as related Internet of Things ("IoT")

applications across South Africa. Given the scope and scale of

expected grid modernization in South Africa, we believe this

partnership will help to further boost our presence in this

exciting region.

This relationship builds on the 100 unit proof of concept

project and distribution agreement with XLink Communications (Pty)

Ltd, announced in March, for the distribution of our metering and

lighting solutions and related IoT applications in South

Africa.

The Company also received a Letter of Intent ("LOI") from El

Sewedy Electrometer Group EMG ("El Sewedy") for a prospective US$3

million order to be delivered in Ghana, Western Africa. The LOI

outlines plans for Cyan to provide a full AMI solution for up to

200,000 consumers. We are obviously excited by the potential scale

of this opportunity and to be working with El Sewedy which has a

solid presence in a number of growing geographies and will act as a

channel to market for Cyan in these regions.

Strengthened Team

We were delighted to welcome Vikas Kashyap as Vice President

Asia in January 2015. His focus is on business development across

Asia and managing the Company's strategic relationships in this key

region. His experience and contact base in the region will help us

to further develop our pipeline of opportunities and continue to

grow our ecosystem of partners. Given the number of opportunities,

his near term focus is on converting prospects in India into

commercial orders.

In order to build on the strong momentum achieved in India we

set up a local subsidiary, Cyan Technology India Private Limited,

during the period and have since been building out the customer

delivery team employed by this company. Recruitment in India has

continued post the period end as we continue to grow our sales and

delivery teams on the ground to allow the Company to pursue and

deliver the numerous smart grid opportunities around the

country.

Martin Collar joined Cyan as VP Operations & Development in

August to oversee operations and development and specifically meet

the increasing demands in order fulfilment around the smart energy,

emerging smart city and IoT markets. Martin has significant

experience in managing complex development programs across a wide

range of industries including energy, mobile devices and

telecoms.

Financial Review

For the six months ended 30 June 2015 turnover was GBP157,328

(H1 2014: GBP65,510). Operating loss for the period was

GBP2,289,523 (H1 2014 GBP1,273,333) and net loss after tax

increased to GBP2,019,773 (H1 2014: GBP1,131,589). The increased

operating loss was as a result of our strategic investment in

building out the Cyan team, in order to capture the significant

global opportunity for our solutions, as well as additional

investment in research and development (which was GBP1,455,377 in

the period, H1 2014: GBP833,218) to accelerate the product

development required to deliver on customer orders and extend

Cyan's competitive advantage in the marketplace. Cash as at 30 June

2015 was GBP628,069 (H1 2014: GBP716,786).

During June 2015, Cyan announced it had raised a total of

GBP4,590,000, before expenses, from two equity placings issuing a

total of 2,305,000,000 ordinary shares at a price of 0.2 pence per

share. Given the growing levels of commercialisation, the new

monies will be used to fund staffing costs for the delivery of

customer projects won in India, development and delivery of managed

services solutions, business development, customer deployments and

further product development work. This round of funding was

substantially supported by institutional investors and we welcome

Herald Investment Management to our shareholder base as well as a

further investment from Legal & General.

I would like to take this opportunity to welcome the new

shareholders and thank our existing shareholders for their

continued support.

Outlook

The Company remains well placed to add new utility customers

across India, Brazil, Africa and China and to develop existing

commercial relationships with utilities through to large-scale

commercial rollout of our smart metering solutions.

Myself, the other Board members and the strengthened Cyan

management team firmly believe that Cyan is now in a stronger

position than my last report to shareholders after having

successfully demonstrated the value of our solution at Tata Power,

won the new GBP1M order from Enzen and continued our expansion into

new markets. We also firmly believe this strong position will

deliver considerable value for our shareholders.

John Cronin

Executive Chairman

29 September 2015

Consolidated Income Statement

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:00 ET (06:00 GMT)

Six months ended 30 June 2015

Unaudited

six Unaudited

months six months

ended ended Year ended

30 June 30 June 31 December

2015 2014 2014

Notes GBP GBP GBP

Continuing operations

Revenue 157,328 65,510 193,550

Cost of sales (93,126) (30,170) (123,099)

Gross profit 64,202 35,340 70,451

Operating costs (2,353,726) (1,308,673) (3,330,514)

Operating loss (2,289,523) (1,273,333) (3,260,063)

Investment

revenue 2,485 1,856 5,157

Finance costs (657) (112) (391)

------------------------ --- ------ ------------ ------------ -------------

Loss before tax (2,287,695) (1,271,589) (3,255,297)

Tax 267,922 140,000 401,334

Loss for the period (2,019,773) (1,131,589) (2,853,963)

Loss per share

(pence)

Basic 3 (0.05) (0.03) (0.01)

Diluted 3 (0.05) (0.03) (0.01)

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2015

Unaudited Unaudited

six months six months

ended ended Year ended

30 June 30 June 31 December

2015 2014 2014

GBP GBP GBP

Loss for period (2,019,773) (1,131,589) (2,853,963)

Exchange differences on

translation of foreign

operations (3,316) - -

------------------------------ ------------ ------------ -------------

Total comprehensive income

for the period (2,023,089) (1,131,589) (2,853,963)

------------------------------ ------------ ------------ -------------

Consolidated Balance Sheet

At 30 June 2015

Unaudited Unaudited

30 June 30 June 31 December

2015 2014 2014

GBP GBP GBP

Non-current

assets

Leasehold Improvements 7,669 - -

Property, plant and

equipment 29,694 11,901 23,726

37,363 11,901 23,726

--- --- ----------------------------- ------------- ------------------------ --------------------

Current Assets

Inventories 528,298 593,967 574,530

Trade and other receivables 466,103 210,181 574,248

Cash and cash equivalents 628,069 716,786 2,344,344

--------------------------------------- ------------- ------------------------ --------------------

1,622,470 1,520,934 3,493,122

--- --- ----------------------------- ------------- ------------------------ --------------------

Total assets 1,659,833 1,532,835 3,516,848

---------------------------------- --- ------------- ------------------------ --------------------

Current liabilities

Trade and

other payables (649,675) (318,630) (508,290)

---------------------------------- --- ------------- ------------------------ --------------------

Total liabilities (649,675) (318,630) (508,290)

---------------------------------- --- ------------- ------------------------ --------------------

Net current

assets 972,795 1,202,304 2,984,832

---------------------------------- --- ------------- ------------------------ --------------------

Net assets 1,010,158 1,214,205 3,008,558

---------------------------------- --- ------------- ------------------------ --------------------

Equity

Share capital 447,662 345,126 446,493

Share premium account 33,935,138 30,642,130 33,911,618

Own shares

held (808,856) (808,856) (808,856)

Share option

reserve 522,562 376,690 522,562

Translation

reserve (153,058) (149,742) (149,742)

Retained loss (32,933,290) (29,191,143) (30,913,517)

--------------------------------------- ------------- ------------------------ --------------------

Total equity being

attributable to

owners of the Company 1,010,158 1,214,205 3,008,558

----------------------------------- ------------- ------------------------ --------------------

Consolidated Statement of Changes in Equity

At 30 June 2015

Own Share

Share Share shares Option Translation Retained Total

Capital Premium held Reserve Reserve Losses Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at

30 June 2014 345,126 30,642,130 (808,856) 376,690 (149,742) (29,191,143) 1,214,205

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Loss for

the period - - - - - (1,722,374) (1,722,374)

Other

comprehensive

income for

the period - - - - - - -

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Total

comprehensive

income for

the period - - - - - (1,722,374) (1,722,374)

Issue of

share capital 101,367 3,269,488 - - - - 3,370,855

Debit to

equity for

share options - - - 145,872 - - 145,872

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Balance at

31 December

2014 446,493 33,911,618 (808,856) 522,562 (149,742) (30,913,517) 3,008,558

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Loss for

the period - - - - - (2,019,773) (2,019,773)

Other

comprehensive

income for

the period - - - - (3,316) - (3,316)

--------------- ------------------------------------------- -------------------------- ------------- ---------------- ------------- ------------

Total

comprehensive

income for

the period (3,316) (2,019,773) (2,023,089)

Issue of

share capital 1,169 23,520 - - - - 24,689

Balance at

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:00 ET (06:00 GMT)

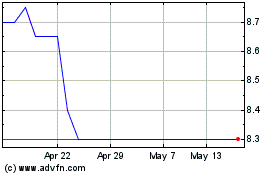

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024