Placing

October 12 2009 - 2:00AM

UK Regulatory

TIDMCYAN

RNS Number : 5797A

Cyan Holdings Plc

12 October 2009

Cyan Holdings plc

("Cyan" or "the Company")

Proposed Placings

Notice of General Meeting

Cyan Holdings Plc (AIM:CYAN.L), announces details of proposed placings

("Placings") by Cenkos Securities plc to raise approximately GBP2 million before

expenses (approximately GBP1.84 million after expenses) and a General Meeting

("GM"), to be held at 10.30am on 30 October 2009. It is intended that the net

proceeds from the Placings will be used for general working capital requirements

and will provide the Company with the resources to execute its strategy and to

take it through to profitability. A document containing the Notice of the GM has

been posted to all shareholders in the Company and is available to view on the

Company's website at: www.cyantechnology.com.

Background to and reasons for the Placings

Cyan is a fabless semiconductor company focusing on the design, sale and support

of a range of low power, richly featured 16-bit general-purpose microcontroller

chips ("MCU"). Through 2007 and early 2008 Cyan developed a range of products

that demonstrated the cost and power reduction capabilities of these MCUs in

wireless communication. These products enabled the Company to enter a

partnership with Micrel Inc which has now resulted in Cyan offering wireless

products across the full range of frequencies required to address the global

industrial control market. Later in 2008, in response to customer demand, Cyan

further developed these products for wireless monitoring of utility meters and

control of streetlights. In 2009 these metering and lighting products enabled

the Company to enter a partnershipship with Future Electronics, one of the three

largest electronic component distributors in the world with 169 offices in 44

countries and a focus on both lighting and metering markets.

During 2009 Cyan has taken the first steps in its aim of becoming a major

supplier to the global automated/smart metering market and the global street

lamp control market and becoming a leading supplier of gateways (access points)

in these markets as well as a supplier of a wide range of industrial wireless

networks. In addition, Cyan has in place contract manufacturing partners capable

of supporting a rapid increase in orders and shipments of these products.

Cyan has already secured working relationships with established suppliers of

meters and street lamps and has actively engaged in multiple field trials across

a range of applications. One such trial with an established gas meter

manufacturer in China has led to a performance breakthrough that has had

significant impact on the competitiveness of Cyan's wireless metering solutions.

Cyan had been asked to develop a battery operated mesh networking gas meter that

uses conventional AA batteries rather than very expensive lithium batteries.

Through a series of design modifications implemented in July 2009 and August

2009 the battery life has been increased to 60 months with western alkaline

batteries which comfortably exceeds the 12-month target even using the lower

performance and lower cost batteries available in China. Cyan believes that this

is the only such meter where networking and metering functions are carried out

by a single 16bit MCU. As a result, in the Board's opinion, Cyan now has the

lowest power, wireless mesh networking, metering solution currently available

anywhere in the world. Low power operation is a common requirement globally and

the combination of lowest power, lowest cost and robust wireless networking

makes this a very competitive product.

In September 2009 Cyan demonstrated the first 470MHz version of this meter,

based on a new product from Micrel that completes coverage of all global

metering bands. This frequency has been specified as a future requirement for

all meters in China. Cyan now has a 470MHz product to address electricity

metering opportunities in China as well as gas and water meter opportunities in

all Chinese provinces. The availability of 470MHz versions increases the size of

the Chinese gas meter market for Cyan products, and then doubles this again by

providing access to the Chinese electricity meter market.

In July 2009 Cyan revisited prospective customers in India, first visited in

January 2009, and demonstrated metering products, developed with Micrel to meet

the frequency requirements of the Indian market. One such prospect has already

progressed to a trial and a further four visited in September this year have

indicated their intention to commence trials using this product.

In the lighting markets Cyan has had similar experiences with one trial nearing

completion in China and a second Chinese trial successfully completed in July

this year. Three other prospects in China have tested Cyan products and

indicated an intention to move to field trials in the near future. These

lighting projects are all for outdoor installations including street and tunnel

lighting where the Cyan product uses a single 16bit MCU to implement both

wireless control and dimming functions. These functions are required to realise

energy savings, such energy saving reducing running costs but also triggering

incentive payments by the Chinese government intended to stimulate rapid

deployment.

Future Electronics already supply a substantial portion of the global

in-building LED lighting market through their Future Lighting Solutions ("FLS")

division. As a result of the relationship with Future Electronics, Cyan is

currently working on wireless lighting control to be incorporated into a new

product that is expected to be released to production early in 2010 and offered

to current and prospective customers of FLS.

In 2009 Cyan has engaged in six field trials and is in the process of scheduling

five further trials. On a monthly basis new prospects are entering the sales

pipeline that leads to such trials. None of these trials has resulted in Cyan

being rejected or the customer selecting another supplier, some have triggered

requests for incremental features and some have completed successfully, others

are ongoing. Cyan's customers incorporate Cyan products into their own to offer

new features to their target markets. Successful trials lead to incorporation of

Cyan products but substantial orders on Cyan depend on the demand subsequently

generated from our customers target markets. Timing of these orders is difficult

for Cyan to predict.

Current trading and prospects

The breadth and range of customer engagements has increased significantly in the

last quarter helped by the recently established partnerships with Future

Electronics and Micrel. The Directors believe that the nature of the customers

with which Cyan is engaged is encouraging, and that Future Electronics is able

to add financial and operational credibility, as the majority of the prospective

customers are corporations substantially larger than Cyan.

The Directors believe that Cyan has now entered a phase where it has delivered

what its potential customers have asked for in terms of cost and performance.

These customers have either confirmed, or are conducting trials to confirm, that

Cyan's products meet their requirements. Every month more customers start this

process and the Board believes that the Company will start to see the fruits of

its endeavours with evidence of firm volume orders although the exact timing of

such remains difficult to predict.

The rate at which customers can fund the purchase and deployment of the

Company's products determines how soon Cyan will achieve profitability and the

Directors remain mindful that in the current economic climate customers cannot

predict timing with any certainty.

The prospects for 2010 are exciting particularly given the number of companies

where Cyan is currently actively engaged in product evaluation and since the

Company's AGM statement made in May this year the number of such prospects has

increased and none have been lost. Cyan has a readily identifiable market for

its products and an existing and new product range that, the Directors believe,

has key attractions for customers. With a strong sales pipeline and the fact

that, following the Placing the Directors expect the Company to have sufficient

funds to support the business through the period required to secure orders from

many of the prospective customers, the Directors are excited about Cyan's

prospects and view the future with confidence.

Details of the Placings

The Company intends to raise approximately GBP1.84 million, net of expenses,

through the issue of 95,238,095 new Ordinary Shares at the Placing Price

pursuant to the Placings.

The Placing Price represents a discount of approximately 10.7 per cent. to the

closing mid-market price of 2.33 pence per Ordinary Share as at October 2009,

the latest practicable date prior to the announcement of the Placings. The

Placing Shares will, when issued, rank pari passu in all respects with the

Existing Ordinary Shares, including the right to receive dividends and other

distributions declared following Admission.

The Placing Shares will represent approximately 14.6 per cent. of the Enlarged

Share Capital.

The Placings are being made on a non pre-emptive basis as the time and costs

associated with a pre-emptive offer are considered by the Directors to be

excessive. The making of a pre-emptive offer would require the production of a

prospectus which would have to comply with the Prospectus Rules and be

pre-vetted and approved by the FSA.

Application will be made by the Company for the Placing Shares to be admitted to

trading on AIM. Subject to completion of the Placings, it is expected that the

Placing Shares will be admitted to trading on AIM and that dealings will

commence at 8.00 a.m. on 2 November 2009 in respect of the Placing Shares.

The issue of the Placing Shares, is conditional, inter alia, upon:

(a) the approval of the Resolutions at the GM;

(b) the Placing Agreement becoming unconditional in all respects and not having

been terminated in accordance with its terms; and

(c) Admission,

in each case by no later than 8.00 a.m. on 2 November 2009 (or such time and

date as the Company and Cenkos Securities plc may agree, being not later than 16

November 2009).

Pursuant to the terms of the Placing Agreement, Cenkos Securities plc has

conditionally agreed to use its reasonable endeavours, as agent to the Company,

to place the Placing Shares at the Placing Price with certain institutional and

other investors. The above obligations are subject to certain conditions

including those listed above. The Placings are not underwritten.

The Placing Agreement contains warranties given by the Company with respect to

its business and certain matters connected with the Placings. In addition, the

Company has given certain indemnities to Cenkos Securities plc in connection

with the Placings and Cenkos Securities plc's performance of services in

relation to the Placings. Cenkos Securities plc is entitled to terminate the

Placing Agreement in specified circumstances.

Directors' Shareholdings

The beneficial and non-beneficial interests of the Directors in Ordinary Shares

(not including Ordinary Shares held by the Cyan Employee Benefit Trust) on the

date of this document and following the Placings are set out below:

+---------------+------------+--------------+------------+--------------+

| | Existing | Following the Placings |

+---------------+---------------------------+---------------------------+

| | Existing | Percentage | Number of | Percentage |

| | Number | of Ordinary | Ordinary | of Ordinary |

| | of | Issued Share | Shares | Issued Share |

| | Ordinary | Capital | | Capital |

| | Shares | | | |

+---------------+------------+--------------+------------+--------------+

| Director | | | | |

+---------------+------------+--------------+------------+--------------+

| David | 1,250,000 | 0.22% | 1,250,000 | 0.19% |

| Gutteridge | | | | |

+---------------+------------+--------------+------------+--------------+

| Kenneth Lamb | 7,000,000 | 1.25% | 7,476,000 | 1.14% |

+---------------+------------+--------------+------------+--------------+

| Dr. John | 4,113,636 | 0.74% | 4,351,636 | 0.67% |

| Read | | | | |

+---------------+------------+--------------+------------+--------------+

The following Ordinary Shares held by the Cyan Employee Benefit Trust are

beneficially owned by the following Directors to the extent the share price

exceeds 2.5p per Ordinary Share:

+----------------------------+---------------------------------------+

| Director | Number of Ordinary Shares |

+----------------------------+---------------------------------------+

| Kenneth Lamb | 30,000,000 |

+----------------------------+---------------------------------------+

| Dr. John Read | 1,000,000 |

+----------------------------+---------------------------------------+

Save as stated above, the Directors have no interest in the share capital of the

Company.

Expected Timetable of Events

Latest time for receipt of Forms of Proxy 10:30 a.m. on 28 October 2009

General Meeting 10:30 a.m. on 30 October 2009

Admission and commencement of dealings in the Placing Shares 8:00 a.m. on 2

November 2009

Enquiries:

+--------------------------------------+--------------------------------------+

| Cyan Holdings plc | www.cyantechnology.com |

+--------------------------------------+--------------------------------------+

| Kenn Lamb, CEO | Tel: +44 (0) 1954 234 400 |

+--------------------------------------+--------------------------------------+

| Cenkos Securities plc | |

+--------------------------------------+--------------------------------------+

| Stephen Keys / Adrian Hargrave | Tel: +44 (0) 20 7397 8900 |

+--------------------------------------+--------------------------------------+

| Media - Hansard Group | |

+--------------------------------------+--------------------------------------+

| John Bick | Tel: +44(0) 20 7245 1100 |

+--------------------------------------+--------------------------------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEILFEDIRLAIIA

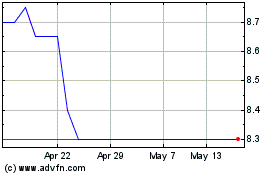

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024