TIDMCYAN

RNS Number : 7191Z

Cyan Holdings Plc

28 September 2009

Embargoed Release: 07:00hrs, Monday 28 September 2009

Cyan Holdings Plc

("Cyan" or "the Group")

Half Year Report

for the six months ended 30 June 2009

Cyan Holdings plc (AIM:CYAN.L), a fabless semiconductor company providing

configurable application software and production ready modules based on feature

rich, low power, microcontroller chips announces its half year results for the

six months ended 30 June 2009.

Summary

* Partnerships in place with Micrel Inc, a global manufacturer of integrated

circuits, and Future Electronics Inc, a global electronics distributor operating

in 41 countries giving Cyan access to major distribution networks into the

global smart metering market.

* Good progress with a range of field trials underway and completed with metering

manufacturers.

* Raised GBP1.2 million, net of expenses, in a placing to provide additional

working capital.

* Tight management of costs.

Kenn Lamb, CEO of Cyan, commented:

"Cyan has now entered a phase where it has delivered what its potential

customers have asked for in terms of cost and performance. We have been pleased

that these customers have either confirmed, or are well into the process of

confirming, that Cyan's products meet their requirements. The prospects for 2010

are exciting particularly given the number of prospective companies where Cyan

is currently actively engaged in product evaluation."

Enquiries:

+--------------------------------------------------+--------------------------------------------------+

| Cyan Holdings plc | www.cyantechnology.com |

+--------------------------------------------------+--------------------------------------------------+

| Kenn Lamb, CEO | Tel: +44 (0) 1954 234 400 |

+--------------------------------------------------+--------------------------------------------------+

| Cenkos Securities plc | |

+--------------------------------------------------+--------------------------------------------------+

| Stephen Keys / Adrian Hargrave | Tel: +44 (0) 20 7397 8900 |

+--------------------------------------------------+--------------------------------------------------+

| Media - Hansard Group | |

+--------------------------------------------------+--------------------------------------------------+

| John Bick / Vikki Krause | Tel: +44(0) 20 7245 1100 |

+--------------------------------------------------+--------------------------------------------------+

Interim Statement

At our AGM on 27 May I reported that Cyan had taken the first steps to becoming

a major supplier to the global automated/smart metering market, the global

street lamp control market and to become a leading supplier of gateways (access

points) to a wide range of industrial wireless networks.

I am delighted to report that Cyan now has partnerships in place, including

Future Electronics and Micrel Inc. that provide a global network offering access

to worldwide markets through major established players. Cyan has already secured

working relationships with established suppliers of meters and street lamps

and has actively engaged in multiple field trials across a range of

applications. In addition, Cyan has in place contract manufacturing partners

capable of supporting a rapid increase in orders and shipments of our solutions.

One such trial has led to a performance breakthrough that has had profound

impact on the competitiveness of Cyan's wireless metering solutions. Cyan had

been asked to develop a battery operated mesh networking gas meter that uses

conventional AA batteries rather than the very expensive Lithium batteries that

until now have had to be fitted and replaced by the meter manufacturer.

Replacing a Lithium battery requires a visit to the residential property by an

engineer. Frequency of such visits could be minimised by increasing the size

(and cost) of the Lithium battery, but use of AA batteries fitted by the

resident would eliminate the requirement entirely, substantially reducing the

cost of the meter and the need and cost of engineer visits. Cyan was given a

requirement for 12 months operation on AA batteries, and we delivered over 100

of our existing meters for a test at the meter manufacturers premises in June.

Through a series of design modifications implemented in July and August the

battery life has been increased to 60 months with Western alkaline batteries

which comfortably exceeds the 12-month target even using the lower performance

and lower cost batteries available in China.

As a result of this latest innovation from our technical team we believe that we

now have the lowest power, wireless mesh networking, metering solution currently

available anywhere in the World. Low power operation is a common requirement

globally and the combination of lowest power, lowest cost and robust wireless

networking makes this a very competitive product.

In September Cyan demonstrated the first 470MHz version of this meter, based on

a new product from Micrel that completes coverage of all global metering bands.

This frequency has been specified as a future requirement for all meters in

China. Cyan now has a 470MHz product to address electricity metering

opportunities in China as well as gas and water meter opportunities in all

Chinese provinces. The availability of 470MHz versions approximately doubles the

size of the (already substantial) Chinese gas meter market for Cyan products,

and then more than doubles this again by providing access to the Chinese

Electricity meter market.

In the intervening months since the AGM the breadth and range of customer

engagements has increased significantly. Some field trials have been

successfully completed and we are awaiting the first production orders, others

have delayed start dates, arising from issues unrelated to Cyan products. Some

customers have simply purchased Cyan products and are undertaking their own

trials without our support, and in one case detailed above; the customer

requirements were successfully exceeded during the trial.

We are confident that Cyan has very competitive pricing across its product range

and the technical performance continues to drive demand for field trials across

a number of large scale applications. Field trials require significant

commitment and expenditure by customers; our view is that the majority of such

trials are for performance confirmation and not for vendor selection.

Following the period end on 27 July the Company announced its agreement with

Future Electronics, one of the three largest electronics distributors in the

world, with 169 offices in 41 countries. The agreement provides Cyan with access

to a leading distributor with customer support and fulfilment organisation that

has a global presence and the ability to secure business that would not

otherwise be available to Cyan. Through this agreement, Cyan can supply its

range of wireless metering and lighting control products available to the global

market.

Financials

For the six months ended 30 June 2009 turnover was GBP42,575 (2008:GBP52,750).

The loss for the period was substantially reduced to GBP1,612,050

(2008:GBP2,263,788), primarily due to the restructuring of the business that was

undertaken last year, creating cost efficiencies in addition to a significant

reduction in research and development costs. Cash balances at the period end

were GBP1,504,783 (2008: GBP1,418,143).

In order to fund the growth of the business and its resulting additional working

capital requirements the Company on 27 May 2009 announced that it had secured a

further round of finance, successfully raising GBP1.2 million (net of expenses)

as a result of a placing of shares with [existing] shareholders and the Board

would like to take this opportunity to thank shareholders for their continuing

support.

Outlook

Cyan has now entered a phase where it has delivered what its potential customers

have asked for in terms of cost and performance. We have been pleased that these

customers have either confirmed, or are well into the process of confirming,

that Cyan's products meet their requirements. Every month more customers start

this process and we believe that we will start to see the fruits of our

endeavours with evidence of firm volume orders although the exact timing of such

remains difficult to predict.

As I reported previously, the rate at which customers can fund the purchase and

deployment of our products now determines how soon Cyan will achieve

profitability. We must recognise that in the current economic climate not even

our customers can predict timing with any certainty.

The prospects for 2010 are exciting particularly given the number of prospective

companies where Cyan is currently actively engaged in product evaluation and

since the Company's AGM statement made in May the number of such prospects has

increased and none have been lost.

Kenn Lamb

Chief Executive Officer

28 September 2009

Consolidated Income Statement

Six months ended 30 June 2009

+----------+--------+--------------------+--+--+--------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended 31 |

| | | | | months | months | December |

| | | | | ended | ended | 2008 |

| | | | | 30 | 30 June | |

| | | | | June 2009 | 2008 | |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| | | | Notes | GBP | GBP | GBP |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| Continuing operations | | | |

+-------------------------------------------------------+-------------+-------------+-------------+

| Revenue | 42,575 | 52,750 | 145,627 |

+-------------------------------------------------------+-------------+-------------+-------------+

| Cost of sales | | | (27,313) | (30,217) | (86,321) |

+-------------------+--------------------------+--------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+--------------------------+--------+-------------+-------------+-------------+

| Gross Profit | | | 15,262 | 22,533 | 59,306 |

+-------------------+--------------------------+--------+-------------+-------------+-------------+

| | | | | |

+----------------------------------------------+--------+-------------+-------------+-------------+

| Operating costs | | (1,243,185) | (1,440,152) | (2,485,486) |

+----------------------------------------------+--------+-------------+-------------+-------------+

| Research and development costs | | (528,289) | (933,057) | (1,953,937) |

+----------------------------------------------+--------+-------------+-------------+-------------+

| Restructuring costs | | | | - | (177,800) | (177,800) |

+----------------------------------------+--+--+--------+-------------+-------------+-------------+

| | | | | | | |

+----------------------------------------+--+--+--------+-------------+-------------+-------------+

| | | | | (1,771,474) | (2,551,009) | (4,617,223) |

+----------------------------------------+--+--+--------+-------------+-------------+-------------+

| | | | | | | |

+----------------------------------------+--+--+--------+-------------+-------------+-------------+

| Operating loss | (1,756,212) | (2,528,476) | (4,557,917) |

+-------------------------------------------------------+-------------+-------------+-------------+

| Investment | | | 1,085 | 139,239 | 92,885 |

| revenue | | | | | |

+-------------------+-----------------------+-----------+-------------+-------------+-------------+

| Finance costs | | | (11) | (51,340) | (1) |

+-------------------+-----------------------+-----------+-------------+-------------+-------------+

| Loss before tax | (1,755,138) | (2,440,577) | (4,465,033) |

+-------------------------------------------------------+-------------+-------------+-------------+

| Tax | 143,088 | 176,789 | 465,707 |

+-------------------------------------------------------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| Loss for the period | | (1,612,050) | (2,263,788) | (3,999,326) |

+-------------------------------------------+-----------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| Loss per share (pence) | | | | |

+-------------------------------------------+-----------+-------------+-------------+-------------+

| Basic and diluted | | 2 | (0.3) | (1.6) | (1.7) |

+-------------------+-----------------------+-----------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+-----------------------+-----------+-------------+-------------+-------------+

| | | | | | | |

+----------+--------+--------------------+--+--+--------+-------------+-------------+-------------+

Consolidated Balance Sheet

At 30 June 2009

+-------------+-----------+-------------------------+--+--+--------------+--------------+--------------+

| | | | | Unaudited | Unaudited | 31 |

| | | | | | 30 June | December |

| | | | | 30 | 2008 | 2008 |

| | | | | June 2009 | | |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| | | | | GBP | GBP | GBP |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Non-current assets | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Intangible assets | | | - | 14,396 | - |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Property, plant and equipment | | 48,680 | 109,103 | 99,769 |

+------------------------------------------------------+--+--------------+--------------+--------------+

| | | | | | | |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| | | | | 48,680 | 123,499 | 99,769 |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Current Assets | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Inventories | | | | 902,658 | 916,274 | 847,351 |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Trade and other receivables | | 242,840 | 318,195 | 617,636 |

+------------------------------------------------------+--+--------------+--------------+--------------+

| Cash and cash equivalents | | 1,504,783 | 1,418,143 | 1,356,886 |

+------------------------------------------------------+--+--------------+--------------+--------------+

| | | | | 2,650,281 | 2,652,612 | 2,821,873 |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Total assets | | | 2,698,961 | 2,776,111 | 2,921,642 |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Current liabilities | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Trade and other | | | 331,937 | 859,298 | 274,695 |

| payables | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| | | | 331,937 | 859,298 | 274,695 |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Non-current | | | - | - | - |

| liabilities | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Total liabilities | | | 331,937 | 859,298 | 274,695 |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Net assets | | | 2,367,024 | 1,916,813 | 2,646,947 |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| | | | | | | |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Equity | | | | | | |

+-------------+-----------+----------------------------+--+--------------+--------------+--------------+

| Share capital | | | 1,118,259 | 299,653 | 954,259 |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Share premium account | | 17,353,068 | 14,102,640 | 16,391,994 |

+------------------------------------------------------+--+--------------+--------------+--------------+

| Own shares held | | | (690,191) | (522,750) | (690,191) |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Share option | | | 316,537 | 235,587 | 268,852 |

| reserve | | | | | |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Translation reserve | | | (214,580) | - | (373,948) |

+-------------------------+----------------------------+--+--------------+--------------+--------------+

| Retained loss | | (15,516,069) | (12,198,317) | (13,904,019) |

+------------------------------------------------------+--+--------------+--------------+--------------+

| | | | | | | |

+-------------+-------------------------------------+--+--+--------------+--------------+--------------+

| Total equity being attributable to equity | | | 2,367,024 | 1,916,813 | 2,646,947 |

| holders of the parent | | | | | |

+-------------+-----------+-------------------------+--+--+--------------+--------------+--------------+

Consolidated Statement of Recognised Income and Expense

Six months ended 30 June 2009

+--------+--------+-------------------------+--+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended 31 |

| | | | | months | months | December |

| | | | | ended | ended | 2008 |

| | | | | 30 June | 30 June | |

| | | | | 2009 | 2008 | |

+--------+--------+-------------------------+--+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+--------+--------+-------------------------+--+-------------+-------------+-------------+

| | | | | |

+-------------------------------------------+--+-------------+-------------+-------------+

| Exchange differences on translation of | | 159,368 | (29,386) | (373,948) |

| foreign operations | | | | |

+-------------------------------------------+--+-------------+-------------+-------------+

| Net income (expense) recognised directly | | 159,368 | (29,386) | (373,948) |

| in equity | | | | |

+-------------------------------------------+--+-------------+-------------+-------------+

| Loss for period | | | (1,612,050) | (2,263,788) | (3,999,326) |

+-----------------+-------------------------+--+-------------+-------------+-------------+

| Total recognised income and expense for | | | | |

| the period | | | | |

+-------------------------------------------+--+-------------+-------------+-------------+

| attributable to equity holders of the | | (1,452,682) | (2,293,174) | (4,373,274) |

| parent | | | | |

+--------+--------+-------------------------+--+-------------+-------------+-------------+

Consolidated Cash Flow Statement

Six months ended 30 June 2009

+--------+--------+-----+-----------+------+------+--+--+---+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended 31 |

| | | | | months | months | December |

| | | | | ended | ended | 2008 |

| | | | | 30 June | 30 June | |

| | | | | 2009 | 2008 | |

+--------+--------+------------------------+----------------+-------------+-------------+-------------+

| | | | Notes | GBP | GBP | GBP |

+--------+--------+------------------------+----------------+-------------+-------------+-------------+

| Net cash outflow from operating | 3 | (1,287,671) | (2,676,313) | (5,609,327) |

| activities | | | | |

+------------------------------------------+----------------+-------------+-------------+-------------+

| Investing | | 4 | (1,200) | 44,758 | 62,877 |

| activities | | | | | |

+-----------------+------------------------+----------------+-------------+-------------+-------------+

| Financing | | | 4 | 1,125,062 | - | 2,776,518 |

| activities | | | | | | |

+-----------------+-----+-----------+-----------------------+-------------+-------------+-------------+

| Net (decrease)/increase in cash and cash equivalents | (163,809) | (2,631,555) | (2,769,932) |

+-----------------------------------------------------------+-------------+-------------+-------------+

| Cash and cash equivalents at beginning of period | | 1,356,886 | 4,079,534 | 4,079,534 |

+-------------------------------------------------------+---+-------------+-------------+-------------+

| Effect of foreign exchange rate changes | | | | 311,706 | (29,836) | 47,284 |

+-------------------------------------------------+--+--+---+-------------+-------------+-------------+

| Cash and cash equivalents at end of period | 1,504,783 | 1,418,143 | 1,356,886 |

+-----------------------------------------------------------+-------------+-------------+-------------+

| | | | | | | |

+--------+--------+-----+-----------+------+------+--+--+---+-------------+-------------+-------------+

Notes to Accounts

Six months ended 30 June 2009

1. Basis of preparation

The interim financial information has been prepared in accordance with the

IFRS accounting policies used in the statutory financial statements for the year

ended 31 December 2008.

These interim financial statements do not constitute statutory financial

statements within the meaning of section 435 of the Companies Act 2006. Results

for the six month periods ending 30 June 2009 and 30 June 2008 have not been

audited. The results for the year ended 31 December 2008 have been extracted

from the statutory financial statements of Cyan Holdings plc.

Statutory financial statements for the year ended 31 December 2008 are available

on the Company's website www.cyantechnology.com and have been filed with the

Registrar of Companies. The Company's auditors issued a report on those

financial statements that was unqualified and did not contain a statement under

section 498(2) or section 498(3) of the Companies Act 2006; however the

auditor's report was modified to emphasise the uncertainty around the company's

ability to continue as a going concern.

2.Loss per share

Basic and diluted loss per ordinary share has been calculated by dividing the

loss after taxation for the periods as shown in the table below.

+--------+--------+----------------+--------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six months | | ended |

| | | | | ended | six | 31 |

| | | | | 30 June | months | December |

| | | | | 2009 | ended | 2008 |

| | | | | | 30 June | |

| | | | | | 2008 | |

+--------+--------+----------------+--------+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+--------+--------+----------------+--------+-------------+-------------+-------------+

| | | | | | | |

+--------+--------+----------------+--------+-------------+-------------+-------------+

| Losses (GBP) | | | 1,612,050 | 2,263,788 | 3,999,326 |

+-----------------+----------------+--------+-------------+-------------+-------------+

| Weighted average number of | | 597,095,436 | 139,626,315 | 239,626,314 |

| shares | | | | |

+----------------------------------+--------+-------------+-------------+-------------+

| |

| IAS33 "Earnings per share" requires presentation of diluted EPS when a company |

| could be called upon to issue shares that would decrease net profit or |

| increase net loss per share. For a loss making company with outstanding share |

| options, net loss per share would only be increased by the exercise of out of |

| the money options. Since it seems inappropriate to assume that option holders |

| would act irrationally and there are no other diluting future share issues, |

| diluted EPS equals basic EPS. |

+-------------------------------------------------------------------------------------+

| | | | | | | |

+--------+--------+----------------+--------+-------------+-------------+-------------+

3.Reconciliation of operating loss to operating cash flows

+---------+--------+----------------+--------------+--+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended |

| | | | | months | months | 31 |

| | | | | ended | ended | December |

| | | | | 30 June | 30 June | 2008 |

| | | | | 2009 | 2008 | |

+---------+--------+-------------------------------+--+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+---------+--------+-------------------------------+--+-------------+-------------+-------------+

| Operating loss | | | (1,756,212) | (2,528,476) | (4,557,917) |

+------------------+-------------------------------+--+-------------+-------------+-------------+

| Adjustments for: | | | | | |

+------------------+-------------------------------+--+-------------+-------------+-------------+

| Depreciation of property, plant and equipment | | 44,520 | 30,718 | 67,100 |

+--------------------------------------------------+--+-------------+-------------+-------------+

| Amortisation of intangible assets | | - | 14,396 | 28,793 |

+--------------------------------------------------+--+-------------+-------------+-------------+

| Share-based payment expense | | 47,685 | 26,189 | 59,454 |

+--------------------------------------------------+--+-------------+-------------+-------------+

| Operating cash flows before movements in working | | (1,664,007) | (2,457,173) | (4,402,570) |

| capital | | | | |

+--------------------------------------------------+--+-------------+-------------+-------------+

| Increase in inventories | | (55,308) | (736,034) | (667,111) |

+--------------------------------------------------+--+-------------+-------------+-------------+

| Decrease/ (increase) in trade and other receivables | 374,734 | 185,030 | (114,411) |

+-----------------------------------------------------+-------------+-------------+-------------+

| Increase/ (decrease) in payables | | 56,921 | 155,075 | (429,528) |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Cash reduced by operations | | (1,287,660) | (2,853,102) | (5,613,620) |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Income taxes refunded | | - | 176,789 | 4,293 |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Interest paid | | (11) | - | - |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Net cash outflow from operating | | (1,287,671) | (2,676,313) | (5,609,327 |

| activities | | | | |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| | | | | | | |

+---------+--------+----------------+-----------------+-------------+-------------+-------------+

| | | | | | | |

+---------+--------+----------------+-----------------+-------------+-------------+-------------+

| 4.Analysis of cash flows | | | | |

| | | | | |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| | | | | Unaudited | Unaudited | Year |

| | | | | six | six | ended |

| | | | | months | months | 31 |

| | | | | ended | ended | December |

| | | | | 30 June | 30 June | 2008 |

| | | | | 2009 | 2008 | |

+---------+--------+----------------+-----------------+-------------+-------------+-------------+

| | | | | GBP | GBP | GBP |

+---------+--------+----------------+-----------------+-------------+-------------+-------------+

| Investing | | | | | |

| activities | | | | | |

+------------------+----------------+-----------------+-------------+-------------+-------------+

| Interest receivable and similar | | 1,085 | 139,239 | 92,885 |

| income | | | | |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Purchase of property, plant and | | (2,285) | (43,141) | (30,008) |

| equipment | | | | |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Net cash (outflow)/inflow | | (1,200) | 96,098 | 62,877 |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Financing | | | | | |

| activities | | | | | |

+------------------+----------------+-----------------+-------------+-------------+-------------+

| Proceeds on issue of shares | | 1,125,073 | - | 2,776,519 |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Interest paid | | (11) | (51,340) | (1) |

+-----------------------------------+-----------------+-------------+-------------+-------------+

| Net cash inflow | | | 1,125,062 | (51,340) | 2,776,518 |

+---------+--------+----------------+--------------+--+-------------+-------------+-------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR QELFLKKBLBBB

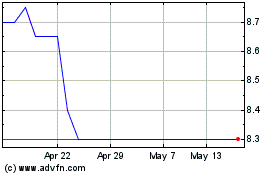

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024