TIDMCYAN

RNS Number : 0182R

Cyan Holdings Plc

23 April 2009

Embargoed Release: Thursday 23 April 2009

Cyan Holdings Plc

("Cyan" or "the Group")

Final Results

Cyan Holdings plc (AIM:CYAN.L), a fabless semiconductor company providing

configurable application software and production ready modules based on feature

rich, low power, microcontroller chips announces its Final Results for the year

ended 31 December 2008.

Summary of 2008

* Substantial progress with Multiple Cy-Solved products and product families

released to market for evaluation

* Cyan achieving increasing levels of interest in products for Automatic Meter

Reading/ Advanced Meter Infrastructure, Wireless Industrial Control and Asset

Tracking markets.

* New Gateway Products (access points to industrial wireless networks) offer

extended features at very competitive prices providing Cyan with products to

access installed networks and support a broader range of international network

standards.

* Cyan secured two very valuable partnerships, the first with Micrel Inc, a

global manufacturer of integrated circuits, and the second with Future

Electronics Inc, a global electronics distributor operating in 41

countries. These partnerships significantly enhance Cyan's credibility with its

customers, while simultaneously providing the Company with a global sales and

support network

* Successfully raised GBP2.8million net of expenses to enable the Company to

deliver revenue growth and profitability in 2009.

* Investment in new product development was completed on plan in 2008 with only

nominal expenditure required for 2009

Post Year end

In the first three months of the year, Cyan received orders for 2009 delivery

with a cumulative value in excess of $1.0 million. The orders, which came from

significant customers in China, were for a range of Cyan products across

automated meter modules and streetlamp controllers, in addition to a Hong Kong

order for microcontrollers in a USB Printer application destined for an end user

OEM. Meanwhile in Europe, orders were for microcontrollers within a jointly

designed gateway for automated metering networks.

Kenn Lamb, CEO of Cyan, commented:

"During 2008 we successfully developed a strong range of products and some key

distribution partners. I am delighted to be able to tell shareholders that

despite the prevailing economic conditions we are now seeing sales coming

through from significant customers who are embracing the benefits of our product

range.

We have a very efficient cost base. The four new sales orders clearly

demonstrate that our products are highly competitive both technically and in

terms of price. The size of the markets our customers address combined with the

margins that we can achieve mean that relatively few such customers are required

to take the company to cash flow break even and profitability. Given the number

of companies already actively engaged in serious evaluation of Cyan products,

the prospects for the second half of 2009 and beyond are exciting."

For further information, please contact:

+-------------------------------------+---------------------------------------+

| Cyan Holdings plc | |

+-------------------------------------+---------------------------------------+

| Kenn Lamb, CEO | Tel: +44 (0) 1954 234 400 |

+-------------------------------------+---------------------------------------+

| | |

+-------------------------------------+---------------------------------------+

| | www.cyantechnology.com |

+-------------------------------------+---------------------------------------+

+-------------------------------------+---------------------------------------+

| Cenkos Securities plc | |

+-------------------------------------+---------------------------------------+

| Stephen Keys / Adrian Hargrave | Tel: +44 (0) 20 7397 8900 |

| | |

+-------------------------------------+---------------------------------------+

| | www.cenkos.com |

+-------------------------------------+---------------------------------------+

Media enquiries:

+-------------------------------------+---------------------------------------+

| Hansard Group | |

+-------------------------------------+---------------------------------------+

| John Bick / Adam Reynolds | Tel: +44 (0) 20 7245 1100 |

+-------------------------------------+---------------------------------------+

| | www.hansardgroup.co.uk |

+-------------------------------------+---------------------------------------+

Chairman's Statement

2008 was another challenging year for Cyan as the management team continued to

reposition the Group. This has successfully led to several customer engagements

moving to pilot production and now in 2009 we have seen the first substantial

orders.

In last year's statement I reported that under Kenn's leadership as CEO the

Group was addressing the twin issues of competing at component level with the

major semiconductor manufacturers and of producing product which was technically

excellent but could not be manufactured at a cost that customers were willing to

pay.

At the outset of the year we were developing a cost-reduced microcontroller

which we felt would be the key to profitable sales penetration in China. This

development was successfully completed in mid-2008. The specification and

performance of the new microcontroller is extremely competitive both technically

and on cost with similarly targeted designs from the major semiconductor

manufacturers.

We also began development of a range of module solutions that demonstrate the

use of Cyan microcontrollers for several specific application areas. These are

to provide ready-made solutions to customers to facilitate rapid prototyping for

their product development programs. The initial take-up of these through our

agreements with catalogue suppliers Farnell and RS in the UK and Mouser in the

US plus our direct sales gave us further insight into some key developing market

segments. This, together with specific customer discussions led us to

improve our range of RF enabled modules together with robust, proprietary

mesh-networking software that has resulted not only directly in the new orders

announced in March but also to a number of other exciting potential engagements.

We have been presented with the opportunity to supply not just low-cost

microcontrollers but modules and larger parts of our customer's systems

requirements together with our mesh-networking software at substantially higher

selling prices than microcontrollers alone. While this approach will still lead

eventually to the higher volumes of chip sales that were the original aim of the

module strategy they should also ease the path to earlier significant revenues

than would otherwise have been the case.

The results of these actions only began to materialize towards the end of the

year and we closed 2008 with a turnover of GBP145,627 (2007:GBP32,596). The loss

for the year was lower at GBP3,999,326 (2007:GBP4,287,626).

We believe that the group has reacted well to the challenges and is now in a

position to grow revenues strongly in 2009.

Board Changes

In the early part of the year David Gutteridge joined the board as a

non-executive with financial background. He also chairs the Audit committee.

David's experience and advice are invaluable and have been particularly so

during the difficult second half of 2008 and early 2009.

Andrew Lee, CFO, was taken ill in late August and terminated his employment in

February. We thank Andy for his contributions since the founding of the Company

and wish him well and to restored health for the future. The position of Finance

Director was terminated and the company hired Heather Peacock as full-time

financial controller.

Placing of New Shares

The company sought and secured a further round of finance in August 2008 with

the support of several major existing shareholders and some new ones and I would

like to take this opportunity to thank them for their support..

We believe that the Company will continue to benefit from the changes that were

put in place during 2008 and indeed we are already seeing orders coming through

as a result of those actions and the continued hard work by everyone at the

Company.

Dr John Read

Chairman

22 April 2009

Chief Executive's Review

Twelve months ago the Cyan team were deeply engaged in executing the new

strategic business plan. Organisational changes had been completed, investment

in enhancements and extensions to the technology were under way, the first

module products had been defined and marketed under the Cy-Solved brand and

significant manufacturing cost reductions had been realised by a new operations

team.

Today Cyan has taken the first steps to becoming a major supplier to the global

Automated/Smart metering market, the global street lamp control market and to

become a leading supplier of gateways (access points) to a wide range of

industrial wireless networks.

Cyan has secured valuable partnerships with Micrel Inc and Future Electronics

Inc providing a global network of sales and support and for the first time

offering Cyan access to worldwide markets through major established players.

Cyan has secured working relationships with established suppliers of meters,

street lamps and wireless networking standards and is actively engaged in

multiple field trials and joint development of customised products.

Cyan has realised a number of key features in our new products that offer prices

and functionality that customers demand and require. These features include the

low power and cost saving capability of our microcontrollers, the system

development capacity of our software tools and the application knowledge of our

engineering teams. Cyan has targeted markets that, even in the current economic

climate, are receiving new investment and benefit from government incentives as

they contribute to reducing energy consumption.

Cyan is inevitably affected by the global slowdown. The first half of 2008 saw

the release of a generation of products that could be rapidly developed and

launched onto the market. These products addressed a broad range of applications

so as to maximise the prospects of early sales. The initial market reaction was

positive but as the slowdown progressed these failed to achieve initial sales

expectations but instead guided us to the metering, street lamp and industrial

control markets. The company then developed proprietary, application specific

software, targeted directly at these markets, including features that customers

had specifically requested. This second generation of products, (only recently

fully released), is rapidly gaining traction, but the delay in realising sales

necessitated a substantial reduction in the cost base of the business, a

reduction that has now been fully implemented.

Looking Forward

Cyan now has the products, partners, customers and prospective customers that

have more than sufficient capacity to drive growth and profitability for the

business. Proprietary application software ensures that good margins can be

consistently realised, our targeted markets demonstrably support annual sales

volumes in tens of millions and our partnerships support a roadmap of product

and technology enhancements that ensures that Cyan can grow market share.

The Cyan team have worked diligently and have developed valuable intellectual

property further enhancing our technology leadership, a process that has

accelerated, as we understand more of the requirements of our target markets.

Once again I wish to acknowledge and thank Cyan employees for their enthusiasm

and dedication.

In developing new products Cyan has delivered all that we set out to achieve.

Customer's reaction to the price, specification and ease of use confirms this

view. Cyan would not have secured its partnerships if we had not developed

attractive and competitive products and together with these partners we now have

our first customer orders, across a range of products, each targeted at a fast

growing global market.

The rate at which customers can fund the purchase and deployment of our products

now determines how soon Cyan will achieve profitability, however we must

recognise that in the current economic climate not even our customers can

predict timing with any certainty. I am nonetheless enormously encouraged by the

announcement on 31st March of four new customers spread across our range of new

products. These four clearly demonstrate the potential that relatively few such

customers are all that is required to take the company into profitability. When

compared with the number of prospective companies where Cyan is currently

actively engaged in product evaluation the prospects for the remainder of 2009

and beyond are exciting.

Kenn Lamb

Chief Executive Officer

22 April 2009

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2008

+----------------------------------+-------+---------------+-------------+----------------+

| | | | 2008 | 2007 |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | GBP | GBP |

+----------------------------------+-------+---------------+-------------+----------------+

| Continuing Operations | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Revenue | | | 145,627 | 32,596 |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Cost of sales | | | (86,321) | (26,934) |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Gross profit | | | 59,306 | 5,662 |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Administrative expenses | | | (2,485,486) | (2,264,076) |

| Research and development costs | | | (1,953,937) | (1,486,619) |

+----------------------------------+-------+---------------+-------------+----------------+

| Restructuring costs | | | (177,800) | (1,047,267) |

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Operating loss | | | (4,557,917) | (4,792,300) |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Investment revenues | | | 92,885 | 144,795 |

+----------------------------------+-------+---------------+-------------+----------------+

| Finance costs | | | (1) | (121) |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Loss before tax | | | (4,465,033) | (4,647,626) |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Tax | | | 465,707 | 360,000 |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Loss for the period attributable | | | (3,999,326) | (4,287,626) |

| to equity holders of the parent | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Loss per share (pence) | | | | |

+----------------------------------+-------+---------------+-------------+----------------+

| Basic | | | (1.7) | (4.0) |

+----------------------------------+-------+---------------+-------------+----------------+

| Diluted | | | (1.7) | (4.0) |

+----------------------------------+-------+---------------+-------------+----------------+

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE

For the year ended 31 December 2008

+--------------------------------------------+--+----------+--------------+--------------+

| | | | 2008 | 2007 |

+--------------------------------------------+--+----------+--------------+--------------+

| | | | GBP | GBP |

+--------------------------------------------+--+----------+--------------+--------------+

| Exchange differences on translation of | | | (373,948) | 31,876 |

| foreign operations | | | | |

+--------------------------------------------+--+----------+--------------+--------------+

| | | | | |

+--------------------------------------------+--+----------+--------------+--------------+

| Net income recognised directly in equity | | | (373,948) | 31,876 |

+--------------------------------------------+--+----------+--------------+--------------+

| | | | | |

+--------------------------------------------+--+----------+--------------+--------------+

| Loss for the period | | | (3,999,326) | (4,287,626) |

+--------------------------------------------+--+----------+--------------+--------------+

| Total recognised income and expense for | | | (4,373,274) | (4,255,750) |

| the period attributable to equity holders | | | | |

| of the parent | | | | |

+--------------------------------------------+--+----------+--------------+--------------+

| | | | | |

+--------------------------------------------+--+----------+--------------+--------------+

CONSOLIDATED BALANCE SHEET

At 31 December 2008

+--------------------------------------+--------+----------+--------------+--------------+

| | | | 2008 | 2007 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | GBP | GBP |

+--------------------------------------+--------+----------+--------------+--------------+

| Non-current assets | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Intangible assets | | | - | 28,792 |

+--------------------------------------+--------+----------+--------------+--------------+

| Property, plant and equipment | | | 99,769 | 96,680 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | 99,769 | 125,472 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Current assets | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Inventories | | | 847,351 | 180,240 |

+--------------------------------------+--------+----------+--------------+--------------+

| Trade and other receivables | | | 617,636 | 503,225 |

+--------------------------------------+--------+----------+--------------+--------------+

| Cash and cash equivalents | | | 1,356,886 | 4,079,534 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | 2,821,873 | 4,762,999 |

+--------------------------------------+--------+----------+--------------+--------------+

| Total assets | | | 2,921,642 | 4,888,471 |

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Current liabilities | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Trade and other payables | | | 274,695 | 704,223 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | 274,695 | 704,223 |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Total liabilities | | | 274,695 | 704,223 |

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Net assets | | | 2,646,947 | 4,184,248 |

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| EQUITY | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| Share capital | | | 954,259 | 279,252 |

+--------------------------------------+--------+----------+--------------+--------------+

| Share premium account | | | 16,391,994 | 13,600,291 |

+--------------------------------------+--------+----------+--------------+--------------+

| Own shares held | | | (690,191) | |

+--------------------------------------+--------+----------+--------------+--------------+

| Share option reserve | | | 268,852 | 209,398 |

+--------------------------------------+--------+----------+--------------+--------------+

| Translation reserve | | | (373,948) | - |

+--------------------------------------+--------+----------+--------------+--------------+

| Retained earnings | | | (13,904,019) | (9,904,693) |

+--------------------------------------+--------+----------+--------------+--------------+

| Total equity being equity | | | 2,646,947 | 4,184,248 |

| attributable to equity holders of | | | | |

| the parent | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

| | | | | |

+--------------------------------------+--------+----------+--------------+--------------+

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2008

+----------------------------------+------+--------------+---------------+---------------+

| | | | 2008 | 2007 |

+----------------------------------+------+--------------+---------------+---------------+

| | | | GBP | GBP |

+----------------------------------+------+--------------+---------------+---------------+

| Net cash from operating | | | (5,609,327) | (3,927,362) |

| activities | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Investing activities | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Interest received | | | 92,885 | 144,795 |

+----------------------------------+------+--------------+---------------+---------------+

| Purchases of property, plant and | | | (30,008) | (73,426) |

| equipment | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Net cash used in investing | | | 62,877 | 71,369 |

| activities | | | | |

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Financing activities | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Interest paid | | | (1) | (121) |

+----------------------------------+------+--------------+---------------+---------------+

| Proceeds on issue of shares | | | 2,776,519 | 5,081,843 |

+----------------------------------+------+--------------+---------------+---------------+

| Net cash from financing | | | 2,776,518 | 5,081,722 |

| activities | | | | |

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Net increase/(decrease) in cash | | | (2,769,932) | 1,225,729 |

| and cash equivalents | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Cash and cash equivalents at | | | 4,079,534 | 2,820,801 |

| beginning of year | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Effect of foreign exchange rate | | | 47,284 | 33,004 |

| changes | | | | |

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| | | | | |

+----------------------------------+------+--------------+---------------+---------------+

| Cash and cash equivalents at end | | | 1,356,886 | 4,079,534 |

| of year | | | | |

+----------------------------------+------+--------------+---------------+---------------+

NOTES TO THE FINANCIAL INFORMATION

For the year ended 31 December 2008

1. Basis of Preparation

The financial information set out in this announcement has been based on the

Company's financial statements which are prepared in accordance with

International Financial Reporting Standards as adopted for use in the EU. The

Company's specific IFRS accounting policies are available in the 2007 Annual

Report. The financial information does not constitute statutory financial

statements within the meaning of section 240 of the Companies Act 1985.

The results for the year ended 31 December 2007 have been extracted from the

statutory financial statements of Cyan Holdings plc. Statutory financial

statements for the year ended 31 December 2007 are available on the Company's

website and have been filed with the Registrar of Companies. The Company's

auditors issued a report on those financial statements that was unqualified and

did not contain a statement under section 237(2) or section 237(3) of the

Companies Act 1985; however the auditor's report was modified to emphasise the

uncertainty around the Company's ability to continue as a going concern.

The statutory accounts for the year ended 31 December 2008 have been finalized

on the basis of the financial information presented by the directors in this

announcement and will be delivered to the Registrar of Companies shortly. The

audit report for the year ended 31 December 2008 was unqualified and did not

contain a statement under section 237(2) or section 237(3) of the Companies Act

1985; however the auditor's report has been modified to reflect uncertainty

around the Company's ability to continue as a going concern. Note 6 to this

announcement contains further information about this uncertainty.

2. Restructuring costs

During the latter half of 2007 the group undertook a radical restructuring of

its senior management and product portfolio. Costs of GBP177,800 relating to

that restructuring only came through in early 2008. In addition the Group

implemented a cost cutting exercise which resulted in a number of redundancies

at the end of 2008, the costs of which are included in the relevant functional

areas on the income statement. Total restructuring costs in 2008 were as

follows:

Restructuring

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | GBP | GBP |

+--------------------------------------------+--------------+--------------+

| Impairment loss recognised in respect of | - | 147,090 |

| assets | | |

+--------------------------------------------+--------------+--------------+

| Compensation for loss of office | - | 350,619 |

+--------------------------------------------+--------------+--------------+

| Cost of senior management time in respect | - | 104,000 |

| of restructuring | | |

+--------------------------------------------+--------------+--------------+

| Costs to commercialise product range | 177,800 | 287,778 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| | 177,800 | 889,487 |

+--------------------------------------------+--------------+--------------+

Non recurring costs

+--------------------------------------------+--------------+--------------+

| Write off of a bad debt | - | 157,780 |

+--------------------------------------------+--------------+--------------+

| | 177,800 | 1,047,267 |

+--------------------------------------------+--------------+--------------+

3. Earnings per share

The calculation of the basic and diluted earnings per share is based on the

following data:

+--------------------------------------------+--------------+--------------+

| Earnings | | |

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | GBP | GBP |

+--------------------------------------------+--------------+--------------+

| Earnings for the purposes of basic | | |

| earnings per share being net loss | | |

| attributable to equity holders of the | | |

| parent | | |

+--------------------------------------------+--------------+--------------+

| | 3,999,326 | 4,287,626 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Number of shares | | |

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Weighted average number of ordinary shares | | |

| for the purposes of basic and diluted | | |

| earnings per share | | |

+--------------------------------------------+--------------+--------------+

| | 239,626,314 | 107,962,482 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

4. Share capital

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | number | number |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Authorised: | | |

+--------------------------------------------+--------------+--------------+

| Ordinary shares of 0.2 pence each | 600,000,000 | 200,000,000 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | GBP | GBP |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Issued and fully paid: | | |

+--------------------------------------------+--------------+--------------+

| 477,129,314 (2007: 139,626,314) ordinary | 954,259 | 279,252 |

| shares of 0.2 pence each | | |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

On 3 September 2008 the Company completed a placing as a result of which

300,000,000 ordinary shares of 0.2 pence each were issued at a price of 1 pence

per share to raise GBP2,774,681 after expenses. The funds were raised to develop

and execute on the group's new strategy. No shares (2007: 1,291,500) were

issued as a result of the exercise of share options.

On 9 April 2008, 3 directors of the Company were awarded interests in 10,200,000

shares under the Cyan Joint Ownership Scheme.

On 18 December 2008, 2 directors and 6 senior staff of the Company were awarded

interests in 27,303,000 shares under the Cyan Joint Ownership Scheme.

The Company has one class of ordinary shares which carry no right to fixed

income.

In August 2008, 25,000,000 warrants were issued to Cenkos, the Company's broker,

the exercise price of which is GBP0.01 per share.

At 5pm on 31 December 2008 the 43,595 outstanding C warrants to buy shares at 20

pence per share lapsed.

5. Notes to the consolidated cash flow statement

+--------------------------------------------+--------------+--------------+

| | 2008 | 2007 |

+--------------------------------------------+--------------+--------------+

| | GBP | GBP |

+--------------------------------------------+--------------+--------------+

| Operating loss for the year | (4,557,917) | (4,792,300) |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Adjustments for: | | |

+--------------------------------------------+--------------+--------------+

| Depreciation of property, plant and | 67,100 | 54,282 |

| equipment | | |

+--------------------------------------------+--------------+--------------+

| Amortisation of intangible assets | 28,793 | 28,794 |

+--------------------------------------------+--------------+--------------+

| Share-based payment expense | 59,454 | 21,903 |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Operating cash flows before movements in | (4,402,570) | (4,687,321) |

| working capital | | |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Increase in inventories | (667,111) | (73,318) |

+--------------------------------------------+--------------+--------------+

| Decrease/(increase) in receivables | (114,411) | 17,716 |

+--------------------------------------------+--------------+--------------+

| Increase/(decrease) in payables | (429,528) | 454,561 |

| | | |

+--------------------------------------------+--------------+--------------+

| Cash reduced by operations | (5,613,620) | (4,287,362) |

+--------------------------------------------+--------------+--------------+

| | | |

+--------------------------------------------+--------------+--------------+

| Income taxes paid | 4,293 | 360,000 |

+--------------------------------------------+--------------+--------------+

| Interest paid | - | - |

| | | |

+--------------------------------------------+--------------+--------------+

| NET CASH FROM OPERATING ACTIVITIES | (5,609,327) | (3,927,362) |

+--------------------------------------------+--------------+--------------+

Cash and cash equivalents (which are presented as a single class of assets on

the face of the balance sheet) comprise cash at bank and other short-term highly

liquid investments with maturity of three months or less.

6. Going Concern

The directors have prepared a business plan and cash flow forecast for the

period to 30 April 2010. The forecast contains certain assumptions about the

level of future sales and the level of gross margins and also identified the

imminent need for additional finance to fund working capital. On this basis, the

directors have assumed that the Company is a going concern. These assumptions

are the directors' best estimate of the future development of the business.

The directors acknowledge that the Group is trading in a difficult economic

environment and in markets that are new to the Group. This may impact both the

Group's ability to generate positive cashflow and to raise new finance. There is

a risk that the level of sales achieved is materially lower than the level

forecast. The directors have taken steps to satisfy themselves about the

robustness of sales forecasts. In addition, the directors have been in

communication with a number of potential investors, including current

shareholders, who have expressed interest in providing the necessary funding.

There does remain a significant risk that the required level of funding will not

be received in the necessary timescale.

There is a material uncertainty related to the assumptions described above which

may cast significant doubt on the company's ability to continue as a going

concern and, therefore, it may be unable to realise its assets and discharge its

liabilities in the normal course of business. The financial statements do not

include the adjustments that would result if the Group was unable to continue as

a going concern. In the event the Group ceased to be a going concern, the

adjustments would include writing down the carrying value of assets to their

recoverable amount and providing for any further liabilities that might arise.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR ITMRTMMMTBJL

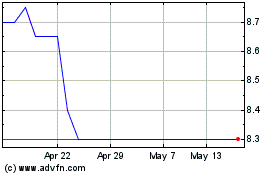

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024