RNS Number : 1372E

Cyan Holdings Plc

24 September 2008

Embargoed Release: 07:00hrs Wednesday 24 September 2008

Cyan Holdings plc

("Cyan" or "the Group")

Interim Results

Cyan Holdings plc (AIM:CYAN.L), the fabless semiconductor company specializing in the development of applications solutions collectively

known as "Cy Solved (TM)" which are built upon the company's low powered, configurable eCOG microcontroller chips announces its Interim

Results for the six months to 30 June 2008.

Highlights

* Substantial cost reductions achieved in the manufacture of all products

* Multiple Cy-Solved products and product families released to market

* Initial orders and customer feedback indicate that Cyan now has attractive products and prices for Automatic Meter Reading/

Advanced Meter Infrastructure, Wireless Industrial Control and Asset Tracking markets.

* New Gateway Products offer extended features at very competitive prices and are expected to be primary drivers of revenue growth.

* New office in Shenzhen (PRC) now working with multiple prospects and customers on customised products.

* Post period end, successfully raised �2.8million net of expenses so as to enable the Company to deliver revenue growth and

profitability in 2009.

Kenn Lamb, CEO of Cyan, commented: "The final phase of our 18 month restructuring plan is nearing completion and we are developing

substantial traction with our new suite of products focusing on Automated Utility Metering, Wireless Industrial Control and the Asset

Tracking markets. For the first time Cyan has the products that customers want at attractive prices and with the recent fund raising we have

the resources to ensure that we can modify and manufacture to our customers exact requirements. Based on visible customers and prospective

customers, the Board remains confident that in the 15 months to the end of 2009, Cyan will see accelerating revenue growth and a transition

into sustainable profitability."

For further information:

Cyan Holdings plc

Kenn Lamb, CEO Tel: +44 (0) 1954 234 400

www.cyantechnology.com

Cenkos Securities plc

Stephen Keys/Adrian Hargrave Tel: +44 (0)20 7397 8900

www.cenkos.com

Media enquiries:

HansardGroup

John Bick/Adam Reynolds Tel: +44 (0)20 7245 1100

Notes to Editors

Based in Cambridge in the UK, Cyan Holdings plc is a fabless semiconductor company specializing in the development of applications

solutions collectively known as "Cy Solved(TM)" which are built upon the company's low powered, configurable eCOG1k and eCOG1x

microcontroller chips.

Cy-Solved incorporates ready to go solutions, software stacks, applications examples, modular software based on easy to use APIs,

evaluation boards and production hardware modules from partners, all pulled together through Cyan's free integrated development environment

CyanIDE(TM). Cy-Solved can be incorporated as-is into an application but also supports an ability to be easily customised - either way,

giving users a head start on the road to market. Currently available Cy-Solved applications include RF-Solved, USB-Solved, Ethernet-Solved

and Motor Control-Solved.

The Company was founded in 2002 and listed on AIM in 2005. Cyan Holdings plc operates through the brand 'Cyan'.

Cyan Holdings plc

Interim Statement

It is 18 months since I joined Cyan and we are now 15 months into the 18 month program that we outlined to implement and deploy our new

strategy. I would like to thank the entire Cyan team for the hard work and dedication that they have put into the transformation of the

company. We remain on course to achieve the targets that we have set ourselves and the first half of 2008 has seen Cyan successfully start

to deploy key elements of this strategy.

The first half of 2008 has seen the introduction of two completely new products which have focused and accelerated Cyan's penetration

into three new markets that Cyan has identified and which each have the potential to take Cyan into sustainable profitability in 2009.

The combination of all three markets presents Cyan with a visible revenue opportunity both from multiple prospective clients and

customers who have already engaged with Cyan that is expected to comfortably meet the higher end of revenue expectations set for the new

strategy. The challenge for Cyan has now shifted from developing attractive and competitively priced products to how to prioritise between

prospective customers and markets to grow Cyan's revenues and achieve sustainable profitability.

Cyan's restructuring set out to reduce the cost of our products, develop a new entry level chip for the Chinese market, to extend the

CyanIDE software tool to system level and then to define design and build production ready modules that embodied the Cyan value proposition

of ease of use coupled with reduced cost and power. Over the year we have

* built an operations team that has halved the manufacturing cost of our products:

* ported CyanIDE to the industry standard Eclipse environment:

* developed a library of drivers and dramatically extended CyanIDE's capability to program the multiple devices required for a

complete system:

* developed a new ultra low cost chip that takes state of the art 16-bit flash MCU's below the $2 threshold:

* developed a new 16-bit MCU core which we expect to demonstrate is amongst the best 16-bit coreS available from any vendor:

* Cyan has developed Application Software for self configuring ad hoc networks and embedded Web Servers that we believe are as good

or better as any comparable products on the market, yet these run on Cyan low cost 16-bit MCU's and not the expensive 32-bit MCU's commonly

used.

We have then taken all these elements and manufactured a number of development and production ready modules that embody all these

features, and delivered these to the market in an easy to use format, even batteries included, to provide an exceptional 'out of the box'

experience.

Cyan's go-to-market strategy is now based around the CY-Solved product brand that delivers the cost and power saving features of the

eCOG chip families in a pre-packaged module, together with the ease of use of the CyanIDE development tool, all enhanced by application

software that does the tricky bits. Uniquely these module reference designs are easily extended via the CyanIDE tool to add functionality

specified by the customer. The modules are designed to simply plug into the customers system and are marketed as cheaper than the customer

could build themselves. Our sourcing of components and manufacturing partners in China, coupled with the reduced component count enabled by

the eCOG MCU makes this claim realistic, for all but the highest production volumes, for many customers not currently using Cyan. For the

remainder, Cyan modules enable exceptionally fast market entry and our design schematics are available under license to incorporate or

extend our module to become a production product. In China every customer wants something different and our engineering teams in Hong Kong and our new office in Shenzhen undertake the work (using a

Chinese Language version of CyanIDE) offering an unrivalled ability to modify functionality and/or reduce cost.

Cyan's RF-Solved product was introduced early in Q1 and took Cyan straight into the AMR/AMI (Automatic Meter Reading / Advanced Metering

Infrastructure) markets and in just 6 months Cyan has engaged with prospective clients in all three Global geographies (Asia, EMEA, USA).

Modifications of RF-Solved by the Cyan Asia team produced a gas meter design that is now in volume production for South West Computer and is

either accepted, in trials, or under evaluation at a number of other prospective customers. RF-Solved is currently in field trials with

multiple prospective customers in EMEA in both AMR and industrial wireless control (IWC) applications. At a major Chinese metering show in

October, Cyan will be demonstrating new application software that makes robust self-configuring networking software available to RF-Solved

customers combined with a new RF-Device from Micrel Inc that has been co-developed with Cyan specifically for the Chinese electricity

metering market.

At the end of Q2 Cyan launched USB/Ethernet-Solved incorporating easy to use drivers in what may prove to be the industry's lowest cost

USB & Ethernet module. Cyan's eCOG MCU enables this price point to be reached without compromise on functionality with both USB & Ethernet

supported concurrently and, unusually for a 16-bit MCU, Cyan incorporates an embedded web server. Prototypes of the USB drivers have

successfully completed field trials with a Korean customer and production orders are forecast for Q4.

In Q4 Cyan will launch a third new family of Gateway products. These combine both RF-Solved and USB/Ethernet-Solved to produce what Cyan

believe will prove to be the company's main driver of revenue growth for a number of years. A Gateway is the interface between any radio

network and the entity controlling or monitoring the network. In each of the Industrial Control, Automated Metering and Home Automation

markets, a Gateway is required to concentrate pre-process and present the information carried over that network. Cyan's customers and

prospective customers tell us that we have a unique Gateway solution that offers prices and features not previously available in the

marketplace.

Cyan is currently working on three Gateway family members each for a different radio protocol and radio partner. At Metering Europe, a

major show in Amsterdam this week, Cyan and Radiocrafts will be demonstrating the first complete Wireless-M-Bus AMR solution available in

Europe, which incorporates a Cyan Gateway. Cyan and Radiocrafts are already engaged with several prospective customers for this solution in

Europe. Cyan will announce further Gateway family members and radio partners in Q4.

RF-Solved and the Gateway products provide Cyan with the products that will accelerate penetration into the AMR/AMI and IWC markets. Our

third area of focus for these products is Asset Tracking, for which an early stage customer was announced in May, but the level of activity

in AMR/AMI and the market reception of the Gateway products currently limits the resource available to Cyan to develop new products for the

Asset Tracking market, and the rate of penetration is for the immediate future primarily determined by end customers own development

resource.

The recent placing, against the background of very challenging market conditions, was completed raising �3 million for the Company and I

would like to thank Cenkos Securities for their management of the placing and the existing and new investors for their support. The Cyan

team in the UK and China is excited and highly motivated. For the first time Cyan has the products that customers want at attractive prices

and we now have the funds to ensure that we can modify and manufacture to our customers' exact requirements. Whilst it is still difficult to

accurately quantify how quickly our growing customer list can deploy their new Cyan powered products into their end markets, based on

visible customers and prospective customers, the Board remains confident that in the 15 months to the end of 2009, Cyan will see

accelerating revenue growth and a transition into sustainable profitability.

Condensed Consolidated Income Statement

Six months ended 30 June 2008

Unaudited six months Unaudited six months Year ended 31

ended ended December 2007

30 June 2008 30 June 2007

Notes � � �

Revenue 52,750 22,496 32,596

Cost of sales (30,217) (18,603) (26,934)

Gross Profit 22,533 3,893 5,662

Administrative expenses

Share based compensation (26,189) (5,757) (21,903)

Other (2,524,820) (1,831,600) (4,776,059)

(2,551,009) (1,837,357) (4,797,962)

Operating loss (2,528,476) (1,833,464) (4,792,300)

Investment revenues 139,239 52,771 144,795

Finance costs (51,340) (53,565) (121)

Loss on ordinary activities before taxation (2,440,577) (1,834,258) (4,647,626)

Tax on loss on ordinary activities 176,789 - 360,000

Loss for the period from

continuing operations (2,263,788) (1,834,258) (4,287,626)

Loss per share (pence)

Basic and diluted 3 (1.6) (2.1) (4.0)

Condensed Consolidated Balance Sheet

At 30 June 2008

Unaudited Unaudited

30 June 30 June 31 December 2007

2008 2007

� � �

Non current assets

Intangible assets 14,396 43,190 28,792

Property, plant and equipment 109,103 92,275 96,680

123,499 135,465 125,472

Current Assets

Inventories 916,274 146,677 180,240

Trade and other receivables 318,195 506,744 503,225

Cash and cash equivalents 1,418,143 1,099,726 4,079,534

2,652,612 1,753,147 4,762,999

Total assets 2,776,111 1,888,612 4,888,471

Current liabilities (859,298) (271,142) (704,223)

Net current assets 1,793,314 1,482,005 4,058,776

Net assets 1,916,813 1,617,470 4,184,248

Equity

Share capital 299,653 171,853 279,252

Share premium account 14,102,640 8,719,997 13,600,291

Own shares held (522,750) - -

Retained loss (12,198,317) (7,427,250) (9,904,693)

Share option reserves 235,587 152,870 209,398

Total Equity 1,916,813 1,617,470 4,184,248

Condensed Consolidated Statements of

Recognised Income and Expense

Six months ended 30 June 2008

Unaudited six months Unaudited six months Year ended 31

ended ended December 2007

30 June 2008 30 June 2007

� � �

Exchange differences on translating foreign

operations recognised directly in equity (29,386) 15,569 31,876

Net income (expense) recognised directly in equity (29,386) 15,569 31,876

Loss for period (2,263,788) (1,834,258) (4,287,626)

Total recognised income and expense for the period

attributable to equity holders of the parent (2,293,174) (1,818,689) (4,255,750)

Condensed Consolidated Cash Flow

Statement

Six months ended 30 June 2008

Unaudited six months Unaudited six months Year ended 31

ended ended December 2007

30 June 2008 30 June 2007

Notes � � �

Net cash outflow from operating activities 4 (2,706,149) (1,773,779) (3,894,358)

Investing activities 5 44,758 (41,446) 71,369

Financing 5 - 94,150 5,081,722

Net (decrease)/increase in cash and cash equivalents (2,661,391) (1,721,075) 1,258,733

Cash and cash equivalents at beginning

of period 4,079,534 2,820,801 2,820,801

Cash and cash equivalents at end of period 1,418,143 1,099,726 4,079,534

Notes to Accounts

Six months ended 30 June 2008

1. Basis of preparation

The interim financial information has been prepared in accordance with the IFRS accounting policies used in the statutory financial

statements for the year ended 31 December 2007.

These interim financial statements do not constitute statutory financial statements within the meaning of section 240 of the Companies

Act 1985. Results for the six month periods ending 30 June 2008 and 30 June 2007 have not been audited. The result for the year ended 31

December 2007 have been extracted from the statutory financial statements of Cyan Holdings plc.

Statutory financial statements for the year ended 31 December 2007 are available on the Company's website www.cyantechnology.com and

have been filed with the Registrar of Companies. The Company's auditors issued a report on those financial statements that was unqualified

and did not contain a statement under section 237(2) or section 237(3) of the Companies Act 1985; however the auditor's report was modified

to emphasise the uncertainty around the company's ability to continue as a going concern.

2. Post balance sheet event

Since the end of the period, the Group has raised additional equity funding of �2.8m through a placing of new ordinary shares. The

placing was authorised by existing shareholders on 3 September 2008.

3. Loss per share

Basic and diluted loss per ordinary share has been calculated by dividing the loss after taxation for the periods as shown in the table

below.

Unaudited Unaudited six

months Year ended

six months ended ended

31 December

30 June 30 June

2007 2007

2008

�

� �

Losses (�) 2,263,788

1,834,258 4,287,626

Weighted average number of shares 139,626,315

85,398,648 107,962,482

IAS33 "Earnings per share" requires presentation of diluted EPS when a company could be called upon to issue shares that would decrease net

profit or

increase net loss per share. For a loss making company with outstanding share options, net loss per share would only be increased by the

exercise of out

of the money options. Since it seems inappropriate to assume that option holders would act irrationally and there are no other diluting

future share

issues, diluted EPS equals basic EPS.

4. Reconciliation of operating loss to operating cash flows

Unaudited six months Unaudited six months Year ended

ended ended 31 December

30 June 2008 30 June 2007 2007

� � �

Operating loss (2,528,476) (1,833,464) (4,792,300)

Currency translation difference (29,836) 15,569 33,004

Depreciation and amortisation 45,114 41,436 83,076

Share based payment expense 26,189 5,757 21,903

Income tax credit 176,789 - 360,000

Increase in inventories (736,034) (38,755) (72,318)

Decrease/ (increase) in trade and other receivables 185,030 14,198 17,716

Increase/ (decrease) in payables 155,075 21,480 454,561

Net cash outflow from operating activities (2,706,149) (1,773,779) (3,894,358)

5. Analysis of cash flows

Unaudited six months Unaudited six months Year ended

ended ended 31 December

30 June 2008 30 June 2007 2007

� � �

Investing activities

Interest receivable and similar income 139,239 52,771 144,795

Interest payable and similar charges (51,340) (53,565) (121)

Purchase of property, plant and equipment (43,141) (40,652) (73,426)

Net cash (outflow)/inflow 44,758 (41,446) 71,248

Financing activites

Proceeds on issue of shares - - 5,081,843

Exercise of share options - 94,150 -

Net cash inflow - 94,150 5,081,843

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FKNKQABKDKCB

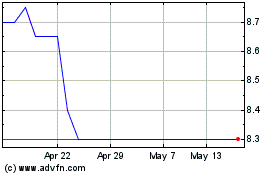

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cyanconnode (LSE:CYAN)

Historical Stock Chart

From Jul 2023 to Jul 2024