RNS Number:0934I

Christie Group PLC

29 March 2000

Christie Group plc

Preliminary Results for the year to 31 December 1999

Overview of 1999

1999 was a successful year for the Group, which saw both

strong financial performance and improved returns to our

Shareholders. Both divisions of the Group traded strongly,

whilst we continued to invest in future expansion

opportunities both in the UK and overseas. Our core

businesses are businesses of excellence and Christie & Co,

Venners and Venners Computer Systems have each achieved record

results.

Profit before tax of #3.5 million was achieved on turnover of

#35.2 million. This compares with profit of #2.1 million and

turnover #24.5 million for the nine months to 31 December

1998.

Strategy for Growth

The Group has always had a strong commitment to "adding value"

to the services it offers its clients. To this end, recent

years have seen us adding a logical sequence of businesses to

the original business agency activity of Christie & Co.

These included stock audit (Venners), mortgage and insurance

services (RCC) and professional property services (Pinders and

Christie & Co Valuation Services).

In the early 1990's, we identified the growth of Information

Technology as an essential component of our clients' future

businesses. In 1992 we acquired the start-up business that

has since developed into Venners Computer Systems (VCS), a

leading supplier of EPoS and software solutions to the retail,

leisure and hospitality industries in the UK, Europe and

Northern America, and a key driver of the Group's growth today

and in the future.

Professional Business Services

The Professional Business Services division achieved operating

profits of #2.6 million (9 months to 31 December 1998 - #1.3

million) on turnover of #23.3 million (9 months to 31 December

1998 - #16.0 million.

Christie & Co, as the UK's market leader, is now expanding

into Europe and we have established a substantial presence

with offices in Frankfurt and Paris, with Barcelona to follow.

The business model for our European roll-out will be closely

aligned to our internet strategy and we were encouraged that

the Estates Gazette judged Christie & Co's website the best of

the top agents' sites they reviewed in their 4th March 2000

edition.

Information Systems and Services

This division achieved operating profits of #0.9 million (9

months to 31 December 1998 - #0.8 million) on turnover of

#11.9 million (9 months to 31 December 1998 - #8.6 million).

VCS now has international offices in Germany, Canada and Spain

as well as representation in Poland, Japan and Brazil.

In September 1999 we added to Venners Computers Systems (VCS)

with the acquisition of Vision Associates (renamed Venners

Touch Systems), a provider of multimedia software for

touchscreen internet kiosks. Since the year end we have

further strengthened the position of VCS as a leading European

supplier of EPoS solutions to the retail and leisure trades

with the #7.2 million acquisition in March of the French

software business, Groupe Timeless SA. The acquisition of

Timeless, based in Paris and Montpellier, which provides its

own software with internet capability to fashion and other

retailers, substantially extends the reach of both businesses.

We are delighted to welcome Yves Doukhan Chief Executive of

Timeless and his eighty colleagues to the Christie Group.

The draft results for Timeless for the year ended 31

December 1999 shows turnover and profit before tax of FFR 89.2

million and FFR 9.67 million respectively. Net assets at that date

were FFR 13.7 million.

Dividend

Your board proposes a final dividend of 1.5p per share (9

months to 31 December 1998 - 2.0p), which is in addition to

the interim dividend of 1.0p (1998 - nil), bringing the

dividend for the year to 2.5p per share (1998 - 2.0p).

People

I would also like to pay a special tribute to our senior non-

executive Director, Charles Wilson, who has announced his

intention to retire from the Board at the forthcoming AGM.

Charles Wilson joined the Group, then a private company, in

1980. Over all the ensuing years, he has been a source of

wisdom, support and enthusiasm.

I would also like to welcome Amanda Street who joined the

Group Board as a non-executive director on 3 March this year.

Amanda, a senior executive with Hewlett-Packard, was based in

Europe throughout the 90's. She has extensive experience of

sales, marketing and global operations and I am sure will make

a marked contribution.

As ever, thanks are due to all our staff for their continued

hard work and commitment to excellence which has produced

these significantly improved results.

Outlook

Christie Group has an interesting and exciting portfolio of

businesses, which are well positioned both in terms of

products and services and, more importantly, in terms of

established and experienced management with the ability to

take advantage of the opportunities which the new economy will

offer them.

Trading across the Group is currently strong and we expect another

good years performance, although a slow start from VCS in January and

February of this year will affect the first half performance.

Enquiries

Christie Group 020 7227 0707 Philip Gwyn, Chairman

David Rugg, Chief Executive

Robert Zenker, Finance Director

Brunswick 020 7404 5959 Charlotte Elston

PRELIMINARY STATEMENT OF UNAUDITED RESULTS

UNAUDITED CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 1999

Year to 9 months to

31 Dec 31 Dec

1999 1998

#000 #000

Turnover 35,161 24,534

Staff costs (14,625) (9,452)

Other operating charges (17,092) (13,009)

Operating profit 3,444 2,073

Interest receivable 90 93

Interest payable (37) (34)

Profit on ordinary activities before taxation 3,497 2,132

Tax on profit on ordinary activities (1,218) (720)

Profit on ordinary activities after taxation 2,279 1,412

Dividends paid and proposed (608 (481)

Retained profit for the financial year 1,671 931

Earnings per share 9.42p 5.87p

Earnings per share - fully diluted 9.28p 5.87p

All amounts derive from continuing activities.

UNAUDITED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

FOR THE YEAR ENDED 31 DECEMBER 1999

Year to 9 months to

31 Dec 31 Dec

1999 1998

#000 #000

Profit on ordinary activities after taxation 2,279 1,412

Gain on foreign currency translation 14 14

Total recognised gains and

losses relating to the year 2,293 1,426

UNAUDITED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 1999

31 Dec 31 Dec

1999 1998

#000 #000

Fixed assets

Tangible assets 2,778 2,579

Intangible assets 247 -

------- ------

3,025 2,579

Current assets

Stock 207 220

Debtors 7,785 6,581

Cash at bank and in hand 3,318 2,416

------- ------

11,310 9,217

Creditors

- amounts falling due within one year (7,969) (7,135)

Net current assets 3,341 2,082

Total assets less current liabilities 6,366 4,661

Creditors - amounts falling due after

more than one year (150) (285)

Net assets 6,216 4,376

Capital and Reserves

Called up share capital 487 481

Share premium account 3,653 3,504

Profit and Loss Account 2,076 391

Shareholders' funds - equity interests 6,216 4,376

UNAUDITED CONSOLIDATED CASHFLOW STATEMENT

FOR THE YEAR ENDED 31 DECEMBER 1999

Year to 9 months to

31 Dec 31 Dec

1999 1998

#000 #000

Net cash inflow from operating activities 4,273 2,653

Returns on investments and servicing of finance 53 59

Taxation paid (1,240) (390)

Capital expenditure (1,094) (845)

Acquisitions and disposals (331) -

Equity dividends paid (724) (361)

Cash inflow before financing 937 1,116

Financing (35) (107)

Increase in cash in the year 902 1,009

Notes to the preliminary statement of unaudited results:

1. Segmental Information (Unaudited)

Year to Year to 9 months to 9 months to

31 Dec 1999 31 Dec 1999 31 Dec 1998 31 Dec 1998

Turnover Operating Turnover Operating

Profit Profit

#000 #000 #000 #000

Professional

Business Services 23,275 2,587 15,957 1,308

Information Systems

and Services 11,886 857 8,577 765

-------- ------ ------- ------

Total 35,161 3,444 24,534 2,073

A final dividend of 1.5p (December 1998: 2.0p) per Ordinary Share

has been proposed, which is in addition to the interim

dividend of 1.0p (1998 nil). The ex-dividend date is 10

April, the record date 14 April and the date payable 16 June

2000.

Earnings per share is based on the profit attributable to

shareholders of #2,279,000 (9 months to 31 December 1998:

#1,412,000) and 24,195,511 (31 December 1998: 24,057,569)

ordinary shares of 2 pence each being the average number of

shares in issue during the year. Fully diluted earnings

per share is based on the profit attributable to shareholders

of #2,279,000 (9 months to 31 December 1998: #1,412,000) and

24,558,493 (31 December 1998: 24,057,569) ordinary shares of 2

pence each being the average number of shares in issue during

the year after allowing for the exercise of outstanding

share options.

The financial information set out above does not comprise the

Company's statutory accounts. The Company's auditors have

not as yet reported on the accounts for the year ended 31

December 1999 nor have such accounts been delivered to the

Registrar of Companies. The results for the period ended 31

December 1998 have been abridged from the published group

accounts for which an unqualified audit report was issued and

did not contain any statements under Section 237 (2) or (3) of

the Companies Act 1985 and which have been filed with the

Registrar of Companies.

The Report and Accounts are scheduled to be posted to

shareholders in early May. The Annual General Meeting of the

Company is scheduled to take place at 10.00 am on Thursday 8

June 2000 at:

50 Victoria Street

London, SW1H 0NW

Christie Group plc

Professional Business Services

Christie & Co Surveyors, Valuers & Agents

The Leading Firm of Independent Surveyors, Valuers and Agents

serving the hotel, leisure, licensed, healthcare and retail

sectors. Its international operations are based in London and

Paris and it has a linked network of 14 offices in the UK,

each of which has valuation and agency teams that focus on

these business sectors.

Christie Consulting International Hotels, Tourism and Leisure

Provides (to clients with interests in the hotel, tourism,

leisure and healthcare sectors) Advisory Services including

feasibility studies, market trend analysis, operational

reviews and market entry strategy and tactics. With no

geographic limitations, projects include provision of expert

opinion, analysis of under-performing businesses, negotiation

of management agreements and the like.

Quest for Quality

A Quality Assurance Company. It provides externally

accredited quality assurance for the long-term care sector,

and risk assessment through its Performance Evaluation Reports

for banks, local authorities, charitable trusts and business

owners.

Rcc

The Market Leader in the provision of finance and insurance

for the hospitality, healthcare and retail sectors. Business

purchase finance or re-financing are arranged through

committed lines of funds from major financial institutions.

Tailor-made insurance packages are also provided in its

specialist sectors of the market.

Pinders

The UK's Leading Specialist Business Appraisal Company

undertaking valuations in the healthcare, retail, licensed and

leisure sectors.

Information Systems and Services

Venners

A Leading Supplier of stocktaking and inventory services to

the licensed and retail sectors using the latest on-site

technology. This enables immediate investigation by the stock

auditor and branch management of any problems, and provides

valuable data for inclusion in Venners "Vision 2000"

Management Information System which is made available to all

corporate clients for head office use.

Venners Computer Systems

Venners Computer Systems ("VCS") is the Software and Computer

Services arm of Christie Group plc. VCS specialises in the

provision of EPoS systems (including touchscreen, cashless and

loyalty systems) and site management software. Through its

Venners Touch Systems division, VCS provides e-business

solutions, including the design and manufacture of interactive

kiosks, and the creation and touch-enabling of Internet and

Intranet sites. VCS is focused on the retail, hospitality and

leisure markets in the UK, Continental Europe and North

America. Clients include Forte Hotels, Greggs plc, Thornton's

and UCI Worldwide. In September 1999, VCS acquired Vision

Associates, and in March 2000 it announced the acquisition of

Group Timeless SA, a Paris-based retail systems supplier, for

#7.8 million.

END

FR UWOKRROROUAR

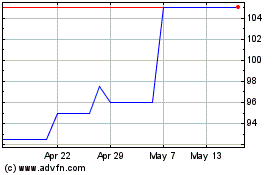

Christie (LSE:CTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Christie (LSE:CTG)

Historical Stock Chart

From Jul 2023 to Jul 2024