TIDMCRPR

RNS Number : 7130R

Cropper(James) PLC

09 November 2021

The advanced materials and paper products group is pleased to

announce its

Half-year results to 25 September 2021

Half-year **Half-year Full-year

to 25 September to 26 September to

2021 2020 27 March

2021

GBPm GBPm GBPm

Revenue 49.8 34.0 78.7

Adjusted operating profit * 2.5 1.6 4.5

Operating profit 2.3 0.4 2.4

Adjusted profit before tax * 2.3 1.3 4.0

Impact of IAS 19 (0.4) (0.3) (0.8)

Impact of exceptional items 0.0 (1.1) (1.5)

Profit before tax 1.9 0.0 1.7

Earnings per share - basic and

diluted 16.2p (0.2)p 16.4p

Dividend per share declared 2.5p Nil Nil

Net borrowings (9.6) (5.2) (7.5)

Equity shareholders' funds 32.3 27.3 29.9

Gearing % - before IAS 19 deficit 21% 12% 17%

Gearing % - after IAS 19 deficit 30% 19% 25%

Capital expenditure 2.9 1.4 3.1

* excludes the impact of IAS 19 and exceptional items (per note

8)

** Prior year to 26 Sept 20 restated to reflect GBP2.8m of grant

income reclassified from exceptional items to other income

Highlights

-- Group revenues up 47% on prior period comparative

-- Growth above pre-pandemic levels in TFP and Colourform

-- Adjusted PBT (excluding IAS 19 impact) at GBP2.3m, up 70% on prior period comparative

-- EPS (diluted) at 16.2p compared to 16.4p for the year ended March 2021

-- Reinstatement of interim dividend

-- As at 25 Sept 2021, the Company has liquidity of over GBP15m

including cash and overdraft facilities

-- TFP new non-woven line adding 50% capacity now operational

-- Capital investments for future growth have re-started and ramp-up in the second half

-- New talent to join the Group Board during H2

Mark Cropper, Chairman, commented:

"The Group has experienced a 47% increase in revenues in the

first half, returning to pre-pandemic levels, with both TFP and

Colourform performing above this level, and Paper demonstrating a

strong recovery. Plans are in place to establish an additional

electrolyser line in the US as the hydrogen market surges and the

50% increase in TFP's non-woven lines is now operational. Paper

sales are projected to be ahead of pre-pandemic levels by the start

of 2022, with a strong demand for recycled fibre content and

responsible sourcing. The Colourform ä business attracts brands

seeking plastic-free sustainable packaging across the wines,

spirits, beauty, and fragrance sectors."

"We are committed to being operationally carbon neutral by 2030

and to significantly reducing carbon through our entire supply

chain by 2035. Building on strong foundations, the newly defined

ESG committee is developing targets against all our ESG strategic

intents. We invest significantly in people, innovation and

capability will ensure that over the long term, the Group has the

potential to sustain growth across all its businesses. In the

nearer term, the full-year results are anticipated to show strong

growth from the pandemic."

Enquiries: Isabelle Maddock, Robert Finlay, Henry Willcocks,

Chief Financial Officer John More

James Cropper PLC (AIM:CRPR.L) Shore Capital

Telephone: +44 (0) 1539 Telephone: +44 (0) 20 7408 4090

722002

www.jamescropper.com

Half-year ** Half-year Full-year

to 25 September to 26 September to 27 March

2021 2020 2021

Summary of results GBP '000 GBP'000 GBP'000

Revenue 49,828 34,004 78,768

Adjusted operating profit* 2,474 1,583 4,510

Operating profit 2,310 352 2,445

Adjusted profit before tax * 2,263 1,334 4,023

Impact of IAS19 (350) (293) (802)

Exceptional items (note 8) - (1,057) (1,502)

Profit / (loss) before tax 1,913 (16) 1,719

------------------------------ ----------------- ----------------- -------------

* excludes the impact of IAS 19 and exceptional items (per note

8)

** prior-year reclassification of grant income from exceptional

items to other income

Half-year ** Half-year Full-year

to 25 September to 26 September to 27 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Revenue

Paper division 34,143 20,856 51,376

Colourform division 1,731 1,414 2,822

Technical Fibre Products division 13,954 11,734 24,570

---------------------------------------- ----------------- ----------------- -------------

49,828 34,004 78,768

Adjusted operating profit * 2,474 1,583 4,510

Adjusted net interest (211) (249) (487)

---------------------------------------- ----------------- ----------------- -------------

Adjusted profit before tax * 2,263 1,334 4,023

IAS19 pension adjustments

Net current service charge against

operating profits (164) (174) (563)

Finance costs charged against interest (186) (119) (239)

---------------------------------------- ----------------- ----------------- -------------

(350) (293) (802)

Exceptional items (note 8) - (1,057) (1,502)

---------------------------------------- ----------------- ----------------- -------------

Profit / (loss) before tax 1,913 (16) 1,719

---------------------------------------- ----------------- ----------------- -------------

* excludes the impact of IAS 19 and exceptional items (per note

8)

Balance sheet summary Half-year Half-year Full-year

to 25 September to 26 September to 27 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Non-pension assets - excluding

cash 74,213 69,854 70,780

Non-pension liabilities - excluding

borrowings (19,482) (22,517) (18,444)

54,731 47,337 52,336

Net IAS19 pension deficit (after

deferred tax) (12,835) (14,791) (14.933)

------------------------------------- ----------------- ----------------- -------------

41,896 32,546 37,403

Net borrowings (9,637) (5,220) (7,502)

------------------------------------- ----------------- ----------------- -------------

Equity shareholders' funds 32,259 27,326 29,901

------------------------------------- ----------------- ----------------- -------------

Gearing % - before IAS19 deficit 21% 12% 17%

Gearing % - after IAS19 deficit 30% 19% 25%

Capital expenditure 2,877 1,367 3,127

Dear Shareholders

I am pleased to report that James Cropper PLC recorded a 47%

increase in revenue for the first half, at GBP49.8m (2020: GBP34m)

compared to the prior year comparative, with growth in all

divisions. Adjusted profit before tax (excluding the impact of IAS

19) was GBP2.3m for the first half of the current financial year,

compared to GBP1.3m in the prior comparative period. In the first

half of the previous year GBP2.8m of government support from UK and

US schemes for employment helped the Group to retain trained

employees and protect liquidity during the demand shock from the

pandemic; in the first half of this year, demand returns to

pre-pandemic levels, and the Group is operating without such

support. After the impact of IAS19, profit before tax is GBP1.9m,

up from GBPnil in the prior comparative period.

In TFP, sales grew 19%, including recovery in the aerospace

sector and strong growth continuing in renewable energy. Paper

experienced 64% growth on prior-year sales, with luxury packaging,

publishing, art and photography sectors returning to strength.

Meanwhile, Colourform continues to win new contracts and

experienced 22% growth in all markets.

Technical Fibre Products ("TFP")

Revenues in the TFP division were up by 19% across all market

segments. Strong growth continues in the renewable energy sector,

and demand in the aerospace sector is returning as aircraft build

rates increase. Proton Exchange Membrane (PEM) w ater electrolyser

sectors are growing, and TFP is investing in additional USA

capacity to meet forthcoming demand.

James Cropper Paper ("Paper")

The Paper division, which Covid-19 adversely impacted, is seeing

revenues up by 64% compared to last year's comparable period.

Whilst the division does face a challenging inflationary

environment, significant contracts gained in luxury packaging and

price increases are strengthening the mix. Investment is underway

to deliver additional capability to meet these contract wins and

the increased demand coming on stream for materials with

sustainable and recycled fibres delivered via circular economy

projects.

Colourform(TM) ("Colourform")

Revenues in the Colourform division grew by 22% in the period,

with contracts being fulfilled for the wines, spirits, and beauty

and fragrance sectors. Significant international recognition was

gained across the packaging industry with multiple sustainability

awards won. As a result, Colourform's pipeline continues to grow

with unique, pioneering projects for sustainable coloured packaging

solutions.

Pension

Overall, the combined funding position on an IAS19 measure for

the combined schemes has improved over the 6 month period from a

deficit of GBP18.4 million to a deficit of GBP17.1 million. This

improvement largely came about as a result of stronger asset

performance relative to the discount rate at the end of the year,

which was partially offset by a rise in inflation expectations.

Earnings per share and dividend

Basic and fully diluted earnings per share increased to 16.2

pence, compared to (0.2) pence in the prior year comparative

period.

The Board has declared an interim dividend as trading conditions

have improved and the outlook continues to be favourable. The Board

declared an interim dividend of 2.5p per share (2020: nil).

Group Board changes

As per the announcement on 4 November, James Gravestock will

join the Board on 15 November 2021 as an Executive Director and the

Managing Director for TFP. As Group Managing Director with Hamla

plc, James has demonstrated a career with strong results-driven

business leadership roles. The appointment of James follows a prior

announcement sharing that Martin Thompson, TFP MD, will be leaving

the company after 18 years, following a handover period.

As per the announcement on 9 November 2021, the Group Board

welcomes two additional Non-Executive Directors (NED), Martin Court

and Sarah Miles. Whilst bringing further independence to the Group

Board, both Martin and Sarah bring strong commercial experience,

helping to support the group's growth plans. The Group Board also

wishes to thank Andrew Hosty for his role as a NED during the last

three years and his contribution. Andrew stepped down from the

Board in November.

Outlook

The Group has experienced a 47% increase in revenues in the

first half, returning to pre-pandemic levels, with both TFP and

Colourform performing above this level and Paper demonstrating a

strong recovery.

Adjusted PBT for the Group increased by 70%, with strong growth

across all businesses. It is expected that the Group will continue

to grow in the second half.

Plans are in place to establish an additional electrolyser line

in the US as the hydrogen market expands and the 50% increase in

TFP's non-woven lines is now operational. Paper sales are projected

to be ahead of pre-pandemic levels by the start of 2022, with a

strong demand for recycled fibre content and responsible sourcing.

The Colourform ä business is attracting brands seeking plastic-free

sustainable packaging across the wines, spirits, beauty, and

fragrance sectors.

Through the second half, new talent will be joining the Group

Board, including a successor for the TFP MD role and two additional

Non-Executive Directors. These changes will continue to strengthen

the capabilities of the Group Board.

We are committed to being operationally carbon neutral by 2030

and to significantly reducing carbon through our entire supply

chain by 2035. Building on strong foundations, the newly defined

ESG committee is developing targets against all our ESG strategic

intents. We invest significantly in people, innovation and

capability, and this will ensure that over the long term the Group

has the potential to sustain growth across all its businesses. In

the nearer term, the full-year results are anticipated to show

strong growth from the pandemic.

Mark Cropper

Chairman

UN-AUDITED CONSOLIDATED INCOME STATEMENT

26 week period 26 week period 52 week period

to 25 September to 26 September to 27 March

2021 2020 2021

------------------------------------------ ---------------- ---------------- --------------

GBP'000 GBP'000 GBP'000

Revenue 49,828 34,004 78,768

Provision for impairment - - (431)

Other income 590 2,804 3,036

Changes in inventories 1,772 (1,383) 598

Raw materials and consumables used (19,438) (10,416) (28,290)

Energy costs (3,231) (1,034) (3,078)

Employee benefit costs (15,088) (14,713) (28,417)

Depreciation and amortisation (1,975) (2,158) (4,489)

Other expenses (10,148) (6,752) (15,252)

Operating profit 2,310 352 2,445

Interest payable and similar charges (415) (370) (730)

Interest receivable and similar

income 18 2 4

Profit /(loss) before taxation 1,913 (16) 1,719

Taxation (363) 3 (153)

------------------------------------------ ---------------- ---------------- --------------

Profit / (loss) for the period 1,550 (13) 1,566

Earnings per share - basic and diluted 16.2p (0.2)p 16.4p

UN-AUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME COMPREHENSIVE

INCOME

Profit / (loss) for the period 1,550 (13) 1,566

------------------------------------------ ---------------- ---------------- --------------

Items that are or may be reclassified

to profit or loss

Foreign currency translation 1 (80) (80)

Cash flow hedges - effective portion

of changes in fair value 33 53 258

Pulp hedge fair value adjustment 154 - 501

Items that will never be reclassified

to profit or loss

Retirement benefit liabilities -

actuarial gain / (loss) 955 (8,788) (8,750)

Deferred tax on actuarial (gain)

/ loss on retirement benefit liabilities (239) 1,670 1,663

Other comprehensive income / (expense)

for the period 904 (7,145) (6,408)

------------------------------------------ ---------------- ---------------- --------------

Total comprehensive income / (expense)

for the period attributable to equity

holders of the Company 2,454 (7,158) (4,842)

------------------------------------------ ---------------- ---------------- --------------

UN-AUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

25 September 26 September 27 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ --------------- ----------------

Assets

Intangible assets 1,935 421 1,946

Goodwill 1,264 - 1,264

Property, plant and equipment 31,584 32,438 30,6966

Right of use assets 4,219 3,468 4,160

Deferred tax assets 4,279 3,471 3,729

------------------------------------- ------------ --------------- ----------------

Total non-current assets 43,281 39,798 41,795

------------------------------------- ------------ --------------- ----------------

Inventories 17,807 13,550 15,469

Trade and other receivables 17,536 18,656 16,053

Provision for impairment (901) (536) (961)

Other financial assets 672 - 501

Cash and cash equivalents 7,357 11,064 6,765

Current tax assets 97 1,857 1,425

Total current assets 42,568 44,591 39,252

------------------------------------- ------------ --------------- ----------------

Total assets 85,849 84,389 81,047

------------------------------------- ------------ --------------- ----------------

Liabilities

Trade and other payables 17,061 20,219 15,780

Other financial liabilities - 222 16

Loans and borrowings 8,548 4,774 8,301

------------------------------------- ------------ --------------- ----------------

Total current liabilities 25,609 25,215 24,097

------------------------------------- ------------ --------------- ----------------

Long-term borrowings 8,446 11,510 5,966

Retirement benefit liabilities 17,114 18,262 18,436

Contingent consideration on business

acquisition 401 - 401

Deferred tax liabilities 2,020 2,076 2,246

Total non-current liabilities 27,981 31,848 27,049

------------------------------------- ------------ --------------- ----------------

Total liabilities 53,590 57,063 51,146

------------------------------------- ------------ --------------- ----------------

Equity

------------------------------------- ------------ --------------- ----------------

Share capital 2,389 2,389 2,389

Share premium 1,588 1,588 1,588

Translation reserve 505 504 504

Hedging reserve 655 - 501

Reserve for own shares (1,151) (1,251) (1,151)

Retained earnings 28,273 24,096 26,070

------------------------------------- ------------ --------------- ----------------

Total shareholders' equity 32,259 27,326 29,901

------------------------------------- ------------ --------------- ----------------

Total equity and liabilities 85,849 84,389 81,047

------------------------------------- ------------ --------------- ----------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

26 week period 26 week period 52 week period

to 25 September to 26 September to 27 March

2021 2020 2021

--------------------------------------------- ---------------- -------------------- ------------------------

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Net profit / (loss) 1,550 (13) 1,566

Adjustments for:

Tax 363 (3) 153

Depreciation and amortisation 1,975 2,158 4,489

Transaction costs - - 384

Net IAS 19 pension adjustments within

Statement of comprehensive income 350 293 802

Past service pension deficit payments (717) (201) (498)

Foreign exchange differences (1) 112 783

Loss on disposal of property, plant - 2 -

and equipment

Gains on early termination of rights

of use assets - - (19)

Net bank interest expense 220 249 487

Share based payments (96) 87 245

Changes in working capital:

(Increase) / decrease in inventories (2,326) 386 (1,448)

(Increase) / decrease in trade and other

receivables (1,571) 537 3,401

Increase / (decrease) in trade and other

payables 1,274 3,663 (2,406)

Net cash generated from operating activities 1,021 7,270 7,939

Cash flows from investing activities

Purchase of intangible assets (21) (29) (42)

Purchases of property, plant and equipment (2,856) (1,338) (3,085)

Acquisition of business net of cash

and cash equivalents - - (1,359)

Net cash used in investing activities (2,877) (1,367) (4,486 )

Cash flows from financing activities

Proceeds from issue of new loans 3,321 5,402 6,390

Repayment of borrowings (324) (9,066) (10,313)

Repayment of lease liabilities (419) - (818)

Interest received 18 2 4

Interest paid (156) (160) (353)

Distribution of own shares - - 100

Net cash generated / used in financing

activities financingactactivitiesactivities 2,440 (3,822) (4,990)

--------------------------------------------- ---------------- -------------------- ------------------------

Net increase / ( decrease) in cash

and cash equivalents 584 2,081 (1,537)

Effect of exchange rate fluctuations

on cash held 8 19 (662)

--------------------------------------------- ---------------- -------------------- ------------------------

Net increase / ( decrease) in cash

and cash equivalents 592 2,100 (2,199) 12

Cash and cash equivalents at the start

of the period 6,765 8,964 8,964

Cash and cash equivalents at the end

of the period 7,357 11,064 6,765

--------------------------------------------- ---------------- -------------------- ------------------------

Cash and cash equivalents consists

of:

Cash at bank and in hand 7,357 11,064 6,765

--------------------------------------------- ---------------- -------------------- ------------------------

UN-AUDITED CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Share Share Translation Hedging Retained

capital premium reserve Own shares Reserve earnings Total

--------------------------- --------- -------- ---------------- ---------- ---------- ------------- -----------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 27 March 2021 2,389 1,588 504 (1,151) 501 26,070 29,901

Comprehensive income for

the period - - - - - 1,550 1,550

Total other comprehensive

income - - 1 - 154 749 904

Share based payment charge - - - - - (96) (96)

Total contributions by and

distributions to owners

of the Group - - - - - (96) (96)

--------------------------- --------- -------- ---------------- ---------- ---------- ------------- -----------

At 25 September 2021 2,389 1,588 505 (1,151) 655 28,273 32,259

--------------------------- --------- -------- ---------------- ---------- ---------- ------------- -----------

At 28 March 2020 2,389 1,588 584 (1,251) - 31,087 34,397

Comprehensive (expense)

for the period - - - - - (13) (13)

Total other comprehensive

expense - - (80) - - (7,065) (7,145)

Share based payment charge - - - - - 87 87

Total contributions by and

distributions to owners

of the Group - - - - - 87 87

--------------------------- --------- -------- ---------------- ---------- ---------- ------------- -----------

At 26 September 2020 2,389 1,588 504 (1,251) - 24,096 27,326

--------------------------- --------- -------- ---------------- ---------- ---------- ------------- -----------

NOTES TO THE CONDENSED CONSOLIDATED HALF YEAR STATEMENTS

1 BASIS OF PREPARATION

James Cropper Plc (the Company) is a public limited company

incorporated and domiciled in the United Kingdom and listed on the

Alternative Investment Market (AIM). The condensed consolidated

half year financial statements of the Company for the twenty six

weeks ended 25 September 2021, which have not been audited or

reviewed, comprise the Company and its subsidiaries (together

referred to as the Group).

Basis of preparation

The condensed consolidated financial statements for the 26 week

periods ending 25 September 2021 and 26 September 2020 are

unaudited and were approved by the Directors on 8 November 2021.

They do not constitute statutory accounts as defined in s434 of the

Companies Act 2006. The financial statements for the year ended 27

March 2021 were prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The report of the auditor on those financial

statements was unqualified and did not draw attention to any

matters by way of emphasis of matter. The Group's financial

statements consolidate the financial statements of James Cropper

Plc and its subsidiaries.

Applicable standards

These unaudited consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards as adopted by the European Union, under the historical

cost convention. They have not been prepared in accordance with IAs

34, the application of which is not required to the interim

financial statements of companies trading on the Alternative

Investment Market (AIM companies). The interim financial statements

have been prepared in accordance with the accounting policies

applied in the preparation of the Group's published consolidated

financial statements for the 52 week period ended 27 March

2021.

The consolidated financial statements of the Group for the 52

week period ended 27 March 2021 are available upon request from the

Company's registered office Burneside Mills, Kendal, Cumbria, LA9

6PZ or at www.jamescropper.com .

The half year financial information is presented in Sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except where otherwise indicated.

Going concern

The Directors, at the time of approving these interim

statements, have a reasonable expectation that the Group has

adequate resources to continue in operational existence for at

least 12 months from this reporting date.

For the interim going concern review the Group has a 3 year plan

against which a number of scenarios assess headroom against

facilities and impacts on bank covenants, which showed adequate

headroom and no covenant breaches. GBP7.8m of debt is due for

renewal within the next 12 months, current availability of finance

is good and the Group expects to be able to renew funding on

favourable terms.

Following this review the Directors are satisfied that the

Company and the Group have adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt the going concern basis in preparing the

condensed consolidated financial statements.

Significant accounting policies

The accounting policies applied by the Group in these condensed

consolidated financial statements are the same as those applied by

the Group in its consolidated financial statements as at and for

the 52 week period ended 27 March 2021.

2 Accounting estimates and judgements

The preparation of half year financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the 52 week period ended 27

March 2021.

3 Risks and uncertainties

The principal risks and uncertainties which may have the largest

impact on performance in the second half of the year are the same

as disclosed in the 2021 Annual Report on pages 21-25. The

principal risks set out in the 2021 Annual Report were:

Covid-19 pandemic risk; employee health & safety; energy

price volatility; pulp price volatility and sustainability;

exchange rate volatility; pension and information security and

cyber risk.

The Board considers that all principal risks and uncertainties

set out in the 2021 annual report have not changed and remain

relevant for the second half of the financial year.

4 Alternative performance measures

The Company uses alternative performance measures to allow users

of the financial statements to gain a clearer understanding of the

underlying performance of the business.

Profit before tax represents the Group's overall performance and

financial position, however it contains significant non-operational

items relating to IAS 19 that the directors believe obscure an

understanding of the key performance trend.

Measures used to evaluate business performance are 'Adjusted

operating profit' (operating profit excluding the impact of IAS 19

and exceptional items) and 'Adjusted profit before tax' (profit

before tax excluding the impact of IAS 19 and exceptional items).

The alternative performance measures are reconciled in note 9.

The adjustment, which we refer to in these accounts as the "IAS

19 impact" represents the difference between the pension charge as

calculated under IAS 19 and the cash contributions for the current

service cost only as determined by the latest triennial valuation.

The Directors consider that the adjusted pension charge better

reflects the actual pension costs for ongoing service compared to

the IAS 19 charge. This adjustment is made internally when we

assess performance and is also used in the EBITDA and EPS targets

used in management incentive schemes.

5 Earnings per share

Six months Six months Year ended

ended 25 September ended 26 September 27 March

2021 2020 2021

----------------------------------- -------------------- -------------------- ------------

Earnings per share - basic

and diluted 16.2p (0.2)p 16.4p

Profit / (loss) for the financial

period (GBP'000) 1,550 (16) 1,566

----------------------------------- -------------------- -------------------- ------------

Weighted average number of

shares -

basic and diluted 9,554,803 9,554,803 9,554,803

6 Dividends

The proposed interim dividend of 2.5p (2020: nil) per 25p

ordinary share is payable on 14 January 2022 to those shareholders

on the register of the Company at the close of business on 9

December 2021, with the last day for DRIP elections being 21

December 2021.

7 Retirement benefit obligations

26 week period 26 week period 52 week period

ended 25 September ended 26 September ended 27 March

2021 2020 2021

--------------------------------------- ----------------------- ----------------------- -------------------

GBP'000 GBP'000 GBP'000

Obligation brought forward (18,436) (9,382) (9,382)

Expense recognised in the

income statement (718) (528) (1,273)

Contributions paid to the

schemes 1,085 437 969

Actuarial gains and (losses)

recognised in Other Comprehensive

Income 955 (8,789) (8,750)

--------------------------------------- ----------------------- ----------------------- -------------------

Obligation carried forward (17,114) (18,262) (18,436)

--------------------------------------- ----------------------- ----------------------- -------------------

8 Exceptional items

26 week period 26 week period 52 week period

ended 25 September ended 26 September ended 27 March

2021 2020 2021

------------------------ ------------------------ ----------------------- -------------------

GBP'000 GBP'000 GBP'000

Restructuring costs - (1,057) (1,118)

Transaction costs - - (384)

------------------------ ------------------------ ----------------------- -------------------

Exceptional items - (1,057) (1,502)

------------------------ ------------------------ ----------------------- -------------------

9 Alternative performance measures

26 week period 26 week period 52 week period

ended 25 September ended 26 September ended 27 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Adjusted operating profit 2,474 1,583 4,510

Net IAS 19 pension adjustments

- current service costs (164) (174) (563)

Restructuring costs - (1,057) (1,118)

Transaction costs - - (384)

----------------------------------- ----------------------- ----------------------- -------------------

Operating profit 2,310 352 2,445

----------------------------------- ----------------------- ----------------------- -------------------

26 week period 26 week period 52 week period

ended 25 September ended 26 September ended 27 March

2021 2020 2021

GBP'000 GBP'000 GBP'000

Adjusted profit before tax 2,263 1,334 4,023

Net IAS 19 pension adjustments

- current service

costs (532) (409) (1,034)

- future service

contributions

paid 368 235 471

- finance costs (186) (119) (239)

Restructuring costs - (1,057) (1,118)

Transaction costs - - (384)

----------------------------------------------- ----------------------- ----------------------- -------------------

Profit / (loss) before tax 1,913 (16) 1,719

----------------------------------------------- ----------------------- ----------------------- -------------------

10 Related parties

There have been no significant changes in the nature of related

party transactions in the period ended 25 September 2021 from that

disclosed in the 2021 annual report.

Statement of Directors' responsibilities

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

(i) An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

(ii) Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual report.

The Directors of James Cropper Plc are detailed on our Group

website www.jamescropper.com

Forward-looking statements

Sections of this half-yearly financial report may contain

forward-looking statements with respect to the Group's plans and

expectations relating to its future performance, results, strategic

initiatives, objectives and financial position, including liquidity

and capital resources. These forward-looking statements are not

guarantees of future performance. By their very nature, all

forward-looking statements involve risks and uncertainties because

they relate to events that may or may not occur in the future and

are or may be beyond the Group's control. Accordingly, the Group's

actual results and financial condition may differ materially from

those expressed or implied in any forward-looking statements.

Forward-looking statements in this half-yearly financial report are

current only as of the date on which such statements are made. The

Group undertakes no obligation to update any forward-looking

statements, save in respect of any requirement under applicable law

or regulation. Nothing in this announcement shall be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFDLVLTIIL

(END) Dow Jones Newswires

November 09, 2021 02:00 ET (07:00 GMT)

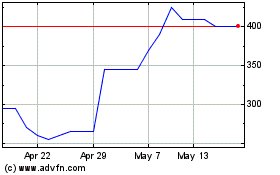

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cropper (james) (LSE:CRPR)

Historical Stock Chart

From Jul 2023 to Jul 2024