Custodian REIT plc : Custodian REIT sells North-East Shopping Centre for GBP9.3 million, ahead of 2021 purchase price (1468135)

October 21 2022 - 2:00AM

UK Regulatory

Custodian REIT plc (CREI) Custodian REIT plc : Custodian REIT

sells North-East Shopping Centre for GBP9.3 million, ahead of 2021

purchase price 21-Oct-2022 / 07:00 GMT/BST Dissemination of a

Regulatory Announcement that contains inside information in

accordance with the Market Abuse Regulation (MAR), transmitted by

EQS Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

21 October 2022

Custodian REIT plc

("Custodian REIT" or the "Company")

Custodian REIT sells North-East Shopping Centre for GBP9.3

million, ahead of 2021 purchase price

Custodian REIT (LSE: CREI), which seeks to deliver a strong

income return by investing in a diversified portfolio of smaller

regional properties across the UK, is pleased to announce the

disposal of its only high street shopping centre for GBP9.3

million1. The Company purchased the 73,367 sq ft shopping centre in

Gosforth as part of its acquisition of DRUM Income Plus REIT plc in

November 2021 and the price reflects a 3.5% premium to the GBP8.975

million apportioned value of the asset at that time.

Since acquisition, the Company has completed a number of asset

management activities which have increased occupancy from 93.6% to

95.7% and grown the rent roll by GBP78k (8.5%), with the asset

producing GBP0.9 million of rental income over the period of

ownership.

The Company intends to invest the sale proceeds in its ongoing

pipeline of building refurbishments, which is expected to enhance

rents and improve the environmental performance of the Company's

portfolio.

Commenting on the disposal, Richard Shepherd-Cross, Managing

Director of Custodian Capital Limited (the Company's external fund

manager), said: "Shopping centres as a sector have not performed

well since the COVID-19 pandemic and do not fit comfortably within

our investment objectives of selecting high quality, well located

regional properties in areas where future rental growth is

underpinned by strong supply/demand fundamentals. The asset

management work completed since acquisition and the accretive terms

of the DRUM Income Plus REIT plc purchase have allowed us to

achieve a profitable sale despite current market uncertainty. This

disposal provides additional capital for our programme of improving

assets we feel will better capture tenant demand over the long term

as well as enhancing their environmental credentials."

1 Adjusted for rental top-ups on vacant units.

- Ends -

For further information, please contact:

Custodian Capital Limited

Richard Shepherd-Cross / Ed Moore / Ian Mattioli MBE Tel: +44 (0)116 240 8740

www.custodiancapital.com

Numis Securities Limited

Hugh Jonathan / Nathan Brown Tel: +44 (0)20 7260 1000

www.numiscorp.com

FTI Consulting

Richard Sunderland / Ellie Sweeney Tel: +44 (0)20 3727 1000

custodianreit@fticonsulting.com

Notes to Editors

Custodian REIT plc is a UK real estate investment trust, listed

on the main market of the London Stock Exchange. Its portfolio

comprises properties predominantly let to institutional grade

tenants on long leases throughout the UK and is principally

characterised by properties with individual values of less than

GBP15 million at acquisition.

The Company offers investors the opportunity to access a

diversified portfolio of UK commercial real estate through a

closed-ended fund. By targeting sub GBP15 million lot size,

regional properties, the Company intends to provide investors with

an attractive level of income with the potential for capital

growth.

Custodian Capital Limited is the discretionary investment

manager of the Company.

For more information visit www.custodianreit.com and

www.custodiancapital.com.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BJFLFT45

Category Code: MSCH

TIDM: CREI

LEI Code: 2138001BOD1J5XK1CX76

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 195679

EQS News ID: 1468135

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1468135&application_name=news

(END) Dow Jones Newswires

October 21, 2022 02:00 ET (06:00 GMT)

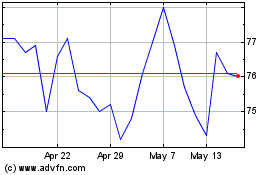

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jun 2024 to Jul 2024

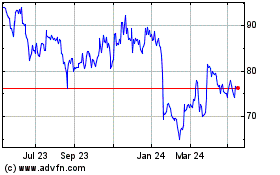

Custodian Property Incom... (LSE:CREI)

Historical Stock Chart

From Jul 2023 to Jul 2024